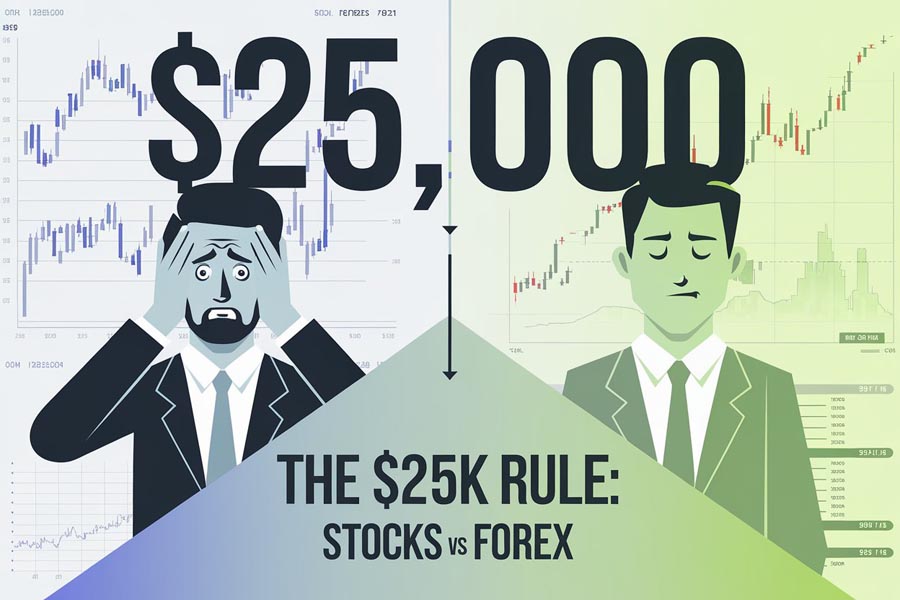

Day trading forex has gained immense popularity among aspiring traders seeking financial independence and lucrative returns. However, a common misconception persists that you need $25,000 to day trade forex. The reality is that you don’t need $25,000 to day trade forex. Unlike the stock market, which has specific capital requirements for day trading, the forex market offers more flexibility for traders with varying account sizes. This article will explore the actual capital requirements for forex day trading, debunk the day trading 25k rule myth, and provide valuable insights for both novice and experienced traders. We’ll also discuss how to choose a reputable online forex broker to start your trading journey with confidence, addressing the question: “Do you need 25,000 to day trade?” in the context of forex trading. It’s important to note that while forex trading has more lenient capital requirements, it is still subject to regulatory rules that vary by country and jurisdiction.

Understanding the $25,000 Rule in Trading

The Day Trading 25k Rule Explained

The $25,000 rule, also known as the Pattern Day Trader (PDT) rule, is a regulation set by the Financial Industry Regulatory Authority (FINRA) for stock trading in the United States. This rule requires traders who execute four or more day trades within five business days to maintain a minimum account balance of $25,000. However, it’s crucial to understand that this day trading 25k rule does not apply to forex trading.

Origins and Purpose of the $25,000 Limit

The PDT rule was implemented in 2001 to protect inexperienced traders from excessive risk. The rationale behind the $25,000 limit was to ensure that day traders had sufficient capital to withstand potential losses. While this rule applies to stock trading, forex trading operates under different regulations, and you don’t need 25,000 to day trade forex.

Day Trading Limits with $25,000 in Stocks

In stock trading, having $25,000 or more in your account allows you to make unlimited day trades. However, forex trading doesn’t impose such restrictions. Forex traders can execute multiple trades per day regardless of their account balance, as long as they have sufficient margin to cover their positions.

What Happens if You’re Flagged as a PDT with Over $25,000?

For stock traders flagged as Pattern Day Traders with over $25,000 in their accounts, they can continue day trading without restrictions. However, if their balance falls below $25,000, they may face limitations on day trades until they replenish their account. Again, these rules don’t apply to forex trading, providing more flexibility for traders with varying account sizes.

How Many Day Trades Can You Make Without $25,000?

In stock trading, if you have less than $25,000 in your account, you’re limited to three day trades within a five-day rolling period. Exceeding this limit can result in your account being flagged as a Pattern Day Trader. However, in forex trading, there are no such restrictions, regardless of your account balance.

Forex Trading: A Different Playing Field

Do You Need $25,000 to Day Trade Forex?

No, you don’t need $25,000 to day trade forex. This is one of the key differences between forex and stock trading. The forex market operates under different regulations and doesn’t impose the same capital requirements as the stock market.

Minimum Amount to Day Trade Forex

Unlike stock trading where you need 25,000 to day trade freely, forex doesn’t have a universally set minimum amount required to start day trading. The minimum amount to day trade forex largely depends on your chosen broker and account type. Some key points to consider:

- Micro accounts: Can start with as little as $50-$100

- Mini accounts: Typically require $250-$500

- Standard accounts: Often require $1,000-$2,000 or more

Read more: How Much do You Need to Start Trading Forex

It’s important to note that while you can technically start with these minimums, having a larger capital base provides more flexibility and better risk management options.

Micro and Mini Accounts: Starting Small in Forex

Many brokers offer micro and mini accounts that allow traders to start with smaller capital:

- Micro accounts: Trade in 0.01 lot sizes (1,000 units of currency)

- Mini accounts: Trade in 0.1 lot sizes (10,000 units of currency)

These account types make it possible to start day trading forex with as little as $100 to $500, debunking the myth that you need 25,000 to day trade forex.

Understanding Leverage in Forex Trading

Leverage plays a crucial role in forex trading, especially for those starting with smaller accounts:

- Common leverage ratios range from 50:1 to 500:1

- Higher leverage allows control of larger positions with less capital

- However, leverage is a double-edged sword and can magnify losses

It’s essential to use leverage responsibly and understand its implications on your trading.

Day Trading Other Financial Instruments

Do You Need $25,000 to Trade Futures?

No, you don’t need $25,000 to trade futures. Futures trading has its own set of requirements, which can vary depending on the specific contract and broker. While some futures contracts might require substantial capital, others can be traded with much less. Day trading margins for futures are often lower than overnight margins, making it possible to start with less capital.

Can You Day Trade Futures Without $25k?

Yes, you can day trade futures without $25k. The exact amount needed depends on the specific contracts you’re trading and your broker’s requirements. Some brokers offer “day trading margins” which can be as low as 25% of the standard margin, making it more accessible for traders with smaller accounts.

Do You Need $25,000 to Trade Options?

No, you don’t need $25,000 to trade options. Options trading, like forex, doesn’t have a strict $25,000 requirement. Many brokers allow traders to open options accounts with as little as $2,000. However, the capital needed can vary based on several factors:

- Type of options strategy employed

- Underlying asset’s price and volatility

- Broker-specific requirements

Risk Management Strategies for Smaller Accounts

When trading with a smaller account, effective risk management is paramount:

- Use stop-loss orders religiously

- Limit risk per trade to 1-2% of your account balance

- Avoid overtrading or chasing losses

- Focus on one or two currency pairs initially

Choosing the Right Broker

Selecting an appropriate broker is crucial for success:

- Look for regulated brokers with a good reputation

- Compare minimum deposit requirements and account types

- Evaluate trading platforms and tools offered

- Consider customer support and educational resources

The Psychology of Trading with a Small Account

Trading with a smaller account can be psychologically challenging. Here are some tips to maintain a healthy mindset:

- Focus on percentage gains rather than dollar amounts

- Set realistic expectations for growth

- Avoid the temptation to overtrade or take excessive risks

- Celebrate small wins and learn from losses

- Develop a long-term perspective on your trading career

Leveraging Technology for Successful Day Trading

In today’s digital age, technology plays a crucial role in forex day trading:

- Advanced charting software for technical analysis

- Automated trading systems and algorithms

- Mobile trading apps for on-the-go market access

- Economic calendars and news feeds for fundamental analysis

- Risk management tools and position calculators

Utilizing these technologies can help level the playing field, even for traders starting with smaller accounts.

Building a Sustainable Trading Career

Regardless of your starting capital, building a sustainable trading career requires:

- Continuous education and skill development

- Adapting to changing market conditions

- Networking with other traders and joining trading communities

- Regularly reviewing and adjusting your trading plan

- Maintaining a healthy work-life balance to avoid burnout

Remember, successful traders often view their journey as a marathon, not a sprint.

The Future of Forex Day Trading

As technology advances and markets evolve, the landscape of forex day trading continues to change:

- Increased accessibility through mobile platforms

- Integration of artificial intelligence and machine learning

- Growing importance of social trading and copy trading

- Potential regulatory changes affecting leverage and capital requirements

- Emergence of new trading instruments and strategies

Staying informed about these trends can help traders, regardless of account size, position themselves for future success.

OpoFinance Services: A Trusted ASIC-Regulated Broker

For traders seeking a reliable and regulated forex broker, OpoFinance stands out as an excellent choice. As an ASIC-regulated broker, OpoFinance offers a secure trading environment with competitive spreads and advanced trading platforms. Their commitment to transparency and customer satisfaction makes them an ideal partner for both novice and experienced forex traders.

One of OpoFinance’s standout features is their social trading service. This innovative platform allows traders to connect, share strategies, and even copy trades from successful traders. For those starting with smaller account sizes, this can be an invaluable learning tool, providing insights into professional trading techniques and potentially boosting returns.

OpoFinance’s social trading service also aligns perfectly with the needs of traders who may not have $25,000 to start. It offers an opportunity to learn from experienced traders, diversify strategies, and potentially achieve better results even with a smaller initial investment. This feature, combined with their robust educational resources and customer support, makes OpoFinance an attractive option for traders at all levels.

Conclusion

In conclusion, the notion that you need $25,000 to day trade forex is a misconception. While having more capital can provide certain advantages, it’s entirely possible to start forex day trading with a much smaller investment. The key to success lies in choosing the right broker, managing your risk effectively, and continuously educating yourself about the market.

Remember, successful forex day trading is not about how much money you start with, but how well you manage your capital and trades. By starting small, practicing diligently, and gradually increasing your account size, you can potentially achieve success in forex day trading without the need for a $25,000 initial investment.

As you embark on your forex day trading journey, focus on developing a solid trading strategy, maintaining discipline, and staying informed about market trends. With dedication and the right approach, you can navigate the exciting world of forex trading, regardless of your initial capital.

The forex market offers unparalleled opportunities for traders of all levels. Unlike the stock market with its $25,000 Pattern Day Trader rule, forex allows you to start with much less capital. Whether you’re trading with $500 or $50,000, the principles of successful trading remain the same: proper education, disciplined risk management, and a well-thought-out strategy.

As you progress in your trading career, remember that the goal is not just to make quick profits, but to build a sustainable and profitable trading business. This requires patience, persistence, and a commitment to continuous learning. The forex market is dynamic and ever-changing, offering new opportunities and challenges every day.

In the end, your success in forex day trading will be determined not by the size of your initial investment, but by your dedication to mastering the craft, your ability to adapt to market conditions, and your commitment to responsible trading practices. So, don’t let the myth of needing $25,000 hold you back. With the right approach and mindset, you can start your forex trading journey today and work towards achieving your financial goals.

Is forex day trading legal with less than $25,000?

Yes, forex day trading is legal with less than $25,000 in most countries. Unlike the stock market, which has the Pattern Day Trader (PDT) rule requiring a minimum of $25,000 for day trading, the forex market doesn’t have such restrictions. However, always check local regulations and choose a reputable, regulated broker.

How much leverage should I use when starting with a small account?

When starting with a small account, it’s advisable to use leverage conservatively. While high leverage like 500:1 might be available, consider starting with lower ratios such as 50:1 or 100:1. This approach helps manage risk more effectively while you gain experience. Remember, higher leverage amplifies both profits and losses.

Can I make a living day trading forex with a small account?

While it’s possible to make a living day trading forex, starting with a small account makes it challenging. It requires exceptional skill, discipline, and risk management. Most successful traders build their accounts over time. Focus on consistent growth and learning rather than expecting to make a full-time income immediately. Consider supplementing your income from other sources while you develop your trading skills.