In the dynamic world of forex trading, finding the best forex strategy for ranging markets can be the key to unlocking consistent profits. A ranging market, characterized by price movements within a defined upper and lower boundary, presents unique challenges and opportunities for traders. The most effective forex range trading strategy capitalizes on these horizontal price movements, allowing traders to profit from the market’s predictable oscillations.

This comprehensive guide will delve into ten proven strategies that excel in ranging market conditions. We’ll explore techniques that leverage support and resistance levels, utilize oscillators, and employ channeling tactics to maximize your trading potential. Whether you’re a novice trader looking to understand ranging markets or an experienced professional seeking to refine your approach, this article will equip you with the knowledge and tools to thrive in sideways market conditions.

Understanding Ranging Markets

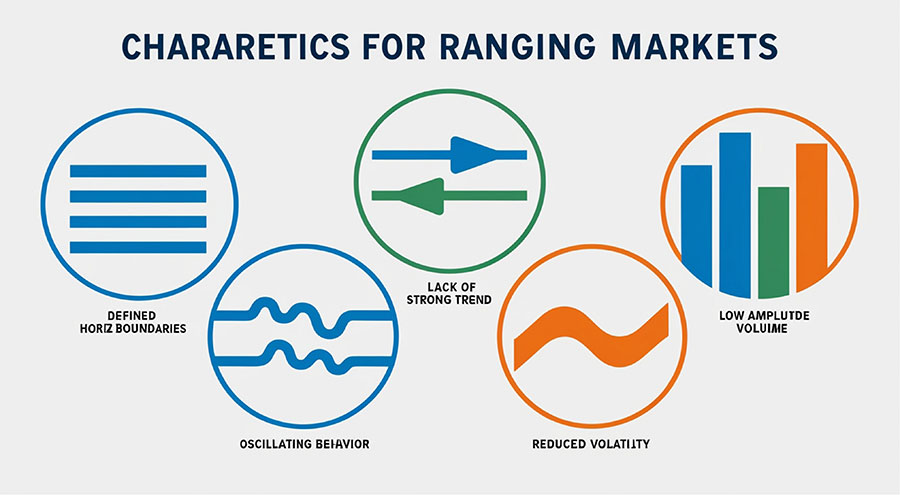

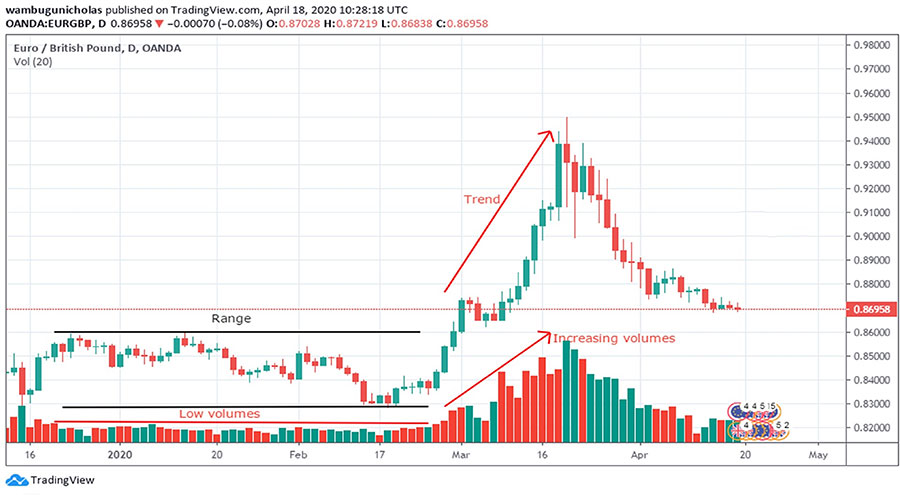

Before diving into specific strategies, it’s crucial to understand what constitutes a ranging market:

- Defined boundaries: Prices fluctuate between clear support and resistance levels

- Lack of strong trends: No significant upward or downward momentum

- Oscillating behavior: Price tends to bounce between upper and lower limits

- Reduced volatility: Price movements are typically less dramatic than in trending markets

- Trading volume: Often lower than during trending periods, but can spike near range boundaries

Identifying these characteristics is the first step in implementing a successful forex range trading strategy. Traders must also be aware that ranges can occur on various timeframes, from intraday charts to weekly and monthly views.

Strategy 1: The Classic Support and Resistance Play

One of the most fundamental approaches to trading ranging markets is the support and resistance strategy:

- Identify clear support and resistance levels

- Enter long positions near support

- Enter short positions near resistance

- Set stop-losses just beyond the range boundaries

- Take profits as price approaches the opposite boundary

This strategy capitalizes on the market’s tendency to respect established price levels in a range. To enhance this approach:

- Use multiple timeframes to confirm support and resistance levels

- Look for price action confirmation, such as candlestick patterns, at these levels

- Consider using limit orders to enter trades at predetermined levels

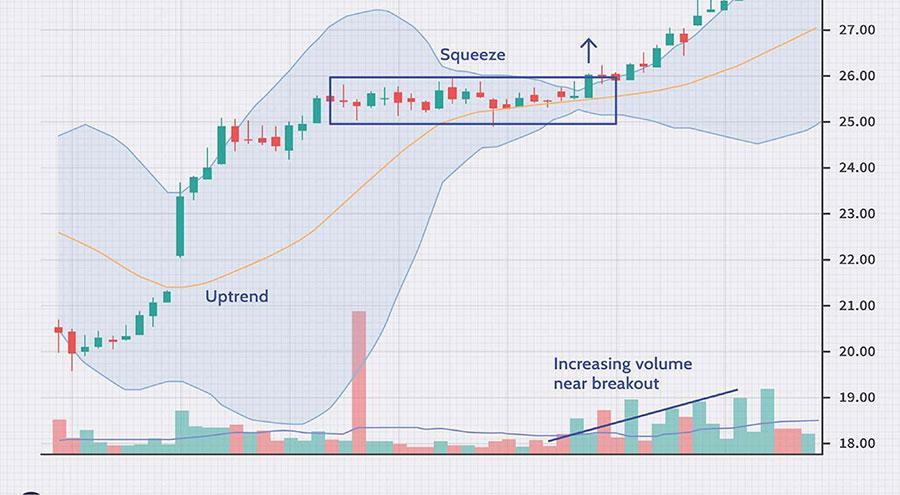

Strategy 2: Bollinger Band Squeeze

Bollinger Bands are excellent indicators for range-bound markets:

- Wait for the bands to narrow, indicating low volatility

- Look for price to touch or break the upper or lower band

- Enter trades in the direction of the breakout

- Set stop-losses beyond the opposite band

- Take profits when price reaches the middle band or opposite band

This strategy takes advantage of the increased volatility that often follows periods of consolidation. To refine this strategy:

- Use the Bollinger Band width indicator to quantify the squeeze

- Combine with volume analysis to confirm potential breakouts

- Consider using multiple timeframes to identify longer-term range boundaries

Strategy 3: RSI Divergence Trading

The Relative Strength Index (RSI) can reveal hidden momentum in ranging markets:

- Identify divergences between price action and RSI readings

- Look for bullish divergence (price making lower lows, RSI making higher lows) near support

- Look for bearish divergence (price making higher highs, RSI making lower highs) near resistance

- Enter trades in the direction of the divergence

- Set stop-losses beyond recent swing points

RSI divergence can signal potential reversals within the range, offering high-probability trade setups. To enhance this strategy:

- Use multiple timeframe analysis to confirm divergences

- Look for additional confirmation from other indicators or price action

- Consider using RSI overbought/oversold levels in conjunction with divergence signals

Strategy 4: Channel Trading

Channel trading is tailor-made for ranging markets:

- Draw parallel trendlines connecting highs and lows

- Enter long trades at the lower channel line

- Enter short trades at the upper channel line

- Place stop-losses just outside the channel

- Take profits as price approaches the opposite channel line

This strategy provides a visual framework for trading within the range, making it easier to identify entry and exit points. To refine your channel trading:

- Use different channel types (e.g., horizontal, ascending, descending) depending on the range characteristics

- Incorporate Fibonacci levels within the channel for more precise entry and exit points

- Be prepared for false breakouts by using confirmation signals before entering trades

Strategy 5: Moving Average Ribbon

Multiple moving averages can create a “ribbon” effect that’s useful in ranging markets:

- Apply several moving averages of different periods (e.g., 10, 20, 30, 40, 50)

- Look for the ribbon to flatten, indicating a ranging market

- Enter long trades when price bounces off the lower part of the ribbon

- Enter short trades when price rejects from the upper part of the ribbon

- Set stop-losses beyond the opposite side of the ribbon

The moving average ribbon acts as a dynamic support and resistance zone, helping to identify high-probability trades. To enhance this strategy:

- Experiment with different moving average combinations to find what works best for your trading style

- Use the ribbon’s slope to gauge the range’s overall bias (slightly bullish, bearish, or neutral)

- Combine with momentum indicators for additional confirmation

Strategy 6: Stochastic Oscillator Overbought/Oversold

The Stochastic Oscillator is particularly effective in ranging markets:

- Look for overbought conditions (above 80) near resistance

- Look for oversold conditions (below 20) near support

- Enter short trades when Stochastic crosses down from overbought territory

- Enter long trades when Stochastic crosses up from oversold territory

- Set stop-losses above recent highs for shorts and below recent lows for longs

This strategy capitalizes on the tendency for price to reverse from extreme levels in a ranging market. To refine your Stochastic trading:

- Use the Stochastic’s signal line crossovers for additional confirmation

- Combine with other oscillators like RSI for stronger signals

- Be cautious of potential false signals during strong moves within the range

Strategy 7: Fibonacci Retracement

Fibonacci levels can provide precise entry and exit points in a range:

- Draw Fibonacci retracement from the range’s high to low

- Look for price reactions at key Fibonacci levels (23.6%, 38.2%, 50%, 61.8%)

- Enter long trades at Fibonacci support levels

- Enter short trades at Fibonacci resistance levels

- Set stop-losses beyond the next Fibonacci level

Fibonacci retracements offer a mathematical approach to identifying potential reversal points within the range. To enhance this strategy:

- Use Fibonacci extension levels for potential profit targets

- Combine with price action patterns for stronger confirmation

- Consider using Fibonacci time zones to anticipate potential reversal points

Strategy 8: Volume Profile Trading

Volume Profile analysis can reveal key price levels within a range:

- Apply the Volume Profile indicator to your chart

- Identify the Point of Control (POC) – the price level with the highest trading volume

- Look for Value Area High (VAH) and Value Area Low (VAL)

- Enter long trades near VAL and short trades near VAH

- Use the POC as a potential profit target or stop-loss level

This strategy leverages volume data to identify the most significant price levels within the range. To refine your Volume Profile trading:

- Use multiple timeframes to identify longer-term volume nodes

- Combine with price action analysis for more precise entry points

- Pay attention to developing volume patterns that may signal range expansion or contraction

Strategy 9: Ichimoku Cloud Range Trading

The Ichimoku Cloud system can be adapted for range trading:

- Identify when the Tenkan-sen and Kijun-sen lines are flattening and intertwining

- Look for price to bounce between the cloud’s upper and lower boundaries

- Enter long trades when price touches the cloud’s lower boundary

- Enter short trades when price touches the cloud’s upper boundary

- Use the Chikou Span for additional confirmation of range-bound conditions

This strategy uses the Ichimoku Cloud’s multiple components to identify range boundaries and potential reversal points. To enhance your Ichimoku range trading:

- Pay attention to the cloud’s thickness as an indicator of range strength

- Use the cloud’s future projections to anticipate potential breakouts

- Combine with classic support and resistance levels for added confirmation

Strategy 10: Range-Bound Momentum Strategy

This strategy combines momentum indicators with range-bound price action:

- Identify the range using price action or indicators like Bollinger Bands

- Apply a momentum indicator like the Commodity Channel Index (CCI)

- Look for overbought CCI readings near range resistance

- Look for oversold CCI readings near range support

- Enter trades when CCI begins to reverse from extreme levels

- Set stop-losses beyond recent swing points

This approach combines the benefits of range trading with momentum analysis. To refine this strategy:

- Experiment with different momentum indicators to find the best fit for your trading style

- Use multiple timeframe analysis to confirm range boundaries and momentum signals

- Consider using trailing stops to maximize profits during strong moves within the range

Implementing Your Ranging Market Strategy

To effectively use these strategies:

- Confirm the ranging market: Ensure the market is truly range-bound before applying these techniques.

- Use multiple timeframes: Analyze higher timeframes to confirm the range and lower timeframes for precise entries.

- Practice risk management: Always use appropriate position sizing and stop-losses.

- Be patient: Ranging markets require discipline and the ability to wait for high-probability setups.

- Combine strategies: Use multiple indicators and techniques to confirm trade signals.

- Backtest and forward test: Validate your strategy on historical data and in real-time market conditions.

- Keep a trading journal: Record your trades and analyze your performance to continuously improve.

Common Pitfalls to Avoid

Even with the best forex strategy for ranging markets, traders can fall into traps:

- Overtrading: Resist the urge to take every potential setup within the range.

- Ignoring breakouts: Be prepared for when the market eventually breaks out of the range.

- Neglecting fundamentals: Keep an eye on economic events that could disrupt the range.

- Tight stop-losses: Allow for some wiggle room in your stops to account for false breakouts.

- Emotional trading: Stick to your strategy and avoid impulsive decisions based on short-term fluctuations.

- Failing to adapt: Be ready to switch strategies if market conditions change.

- Overlooking correlation: Be aware of correlated pairs that might affect your chosen range.

Conclusion

Mastering the best forex strategy for ranging markets can significantly enhance your trading performance and consistency. By understanding the unique characteristics of sideways markets and implementing the ten strategies outlined in this guide, you’ll be well-equipped to navigate and profit from these challenging conditions.

Remember, success in forex trading comes from continuous learning, practice, and adaptation. Experiment with these strategies in a demo account, refine your approach based on your results, and always prioritize risk management. With patience and discipline, you can turn ranging markets from frustrating periods of stagnation into lucrative opportunities for steady profits.

Whether you’re employing the classic support and resistance play, leveraging the power of Bollinger Bands, or utilizing advanced techniques like Volume Profile and Ichimoku Cloud analysis, the key is to remain flexible and attuned to the market’s rhythm. By doing so, you’ll be able to dance with the range, capitalizing on its predictable swings while staying prepared for eventual breakouts.

Embrace the sideways game, and watch as your forex trading reaches new heights of consistency and profitability. The ranging market, once a trader’s nemesis, can become your greatest ally with the right strategy and mindset. As you continue to refine your skills and expand your trading toolkit, you’ll find that ranging markets offer some of the most reliable and repeatable trading opportunities in the forex world.

How long do ranging markets typically last?

Ranging markets can persist for varying lengths of time, from a few days to several months. The duration depends on various factors, including economic conditions, market sentiment, and the absence of significant trend-driving events. It’s essential to remain vigilant for signs of a potential breakout, as all ranges eventually come to an end.

Can I use leverage when trading ranging markets?

While leverage can amplify profits in ranging markets, it also increases risk. If you choose to use leverage, do so cautiously and ensure your risk management is robust. A general rule of thumb is to risk no more than 1-2% of your account on any single trade, regardless of leverage used.

Are there specific currency pairs that tend to range more often?

Some currency pairs are known for exhibiting ranging behavior more frequently than others. Pairs like EUR/CHF and AUD/NZD often experience extended periods of consolidation due to their economic similarities and correlations. However, it’s important to note that any pair can enter a ranging phase, so always analyze current market conditions rather than relying solely on historical tendencies.