Are you searching for the best trading strategy for GBP/JPY? Look no further. In this comprehensive guide, we’ll unveil seven powerful strategies to help you conquer the volatile GBP/JPY pair and maximize your profits in the forex market. The British Pound/Japanese Yen (GBP/JPY) currency pair, often called “the dragon” due to its rapid price movements, offers lucrative opportunities for savvy traders. The best trading strategy for GBP/JPY combines technical analysis, fundamental understanding, and risk management techniques tailored to this unique pair’s characteristics. Whether you’re a seasoned trader or just starting, these strategies will equip you with the tools to navigate the GBP/JPY market with confidence and precision.

Understanding GBP/JPY

Before diving into specific trading strategies, it’s crucial to understand the nature of the GBP/JPY pair and the factors that influence its movements.

GBP/JPY as a Cross-Currency Pair

GBP/JPY is a cross-currency pair, meaning it doesn’t involve the US dollar. This characteristic gives it some unique properties:

- High Volatility: Cross pairs like GBP/JPY often experience more volatility than major pairs, offering potentially higher profits but also increased risk.

- Derived Value: The GBP/JPY rate is derived from the GBP/USD and USD/JPY rates, which can sometimes lead to complex price dynamics.

- Liquidity: While not as liquid as major pairs involving the USD, GBP/JPY still offers sufficient liquidity for most traders.

- Carry Trade Potential: Due to interest rate differentials between the UK and Japan, GBP/JPY is sometimes used for carry trades.

Factors Influencing GBP/JPY Movement

Several key factors drive the movement of the GBP/JPY pair:

- Economic Indicators:

- UK indicators: GDP growth, inflation rates, employment figures, and retail sales data

- Japanese indicators: Industrial production, trade balance, and consumer price index

- Monetary Policy:

- Bank of England (BoE) decisions on interest rates and quantitative easing

- Bank of Japan (BoJ) policy changes, particularly regarding their yield curve control and asset purchase programs

- Geopolitical Events:

- Brexit developments and UK political stability

- East Asian geopolitical tensions affecting Japan

- Global risk sentiment, as JPY is often seen as a safe-haven currency

- Market Sentiment:

- Risk-on/Risk-off movements in global markets

- Shifts in global investment flows

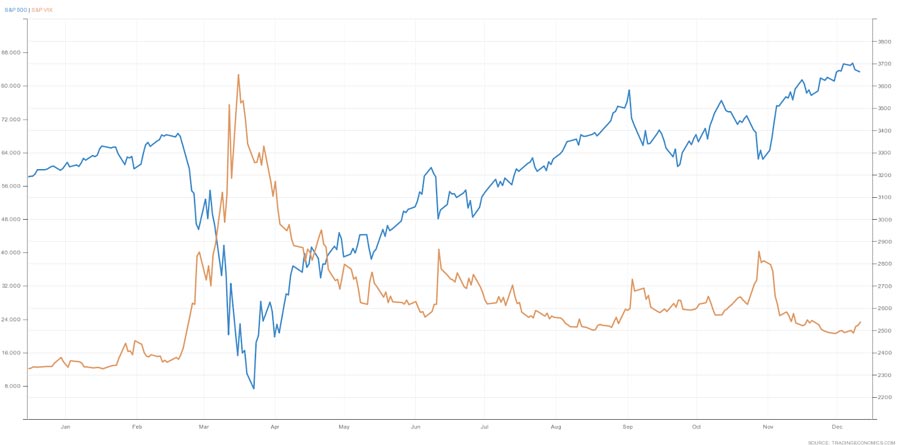

- Correlation with Other Markets:

- Stock market performance, especially the FTSE 100 and Nikkei 225

- Commodity prices, particularly oil, due to its impact on both economies

- Technical Factors:

- Key support and resistance levels

- Trend lines and chart patterns

Understanding these factors and how they interact is crucial for developing effective trading strategies for the GBP/JPY pair. Traders should stay informed about economic releases, central bank decisions, and global events that could impact either currency.

1. Trend-Following Strategy: Riding the Dragon’s Momentum

When it comes to trading GBP/JPY, one of the most effective approaches is to follow the trend. This pair is known for its strong directional movements, making trend-following an ideal strategy.

Key components:

- Identify the overall trend using higher timeframes (daily or weekly charts)

- Use moving averages (50-day and 200-day) to confirm trend direction

- Look for pullbacks to enter trades in the direction of the main trend

- Set stop-losses below recent swing lows for long positions or above swing highs for short positions

Advanced Trend-Following Techniques

- Moving Average Convergence Divergence (MACD): Use the MACD indicator to confirm trend strength and potential reversals.

- Parabolic SAR: Implement the Parabolic SAR indicator to determine trend direction and potential exit points.

- Trend Channel Analysis: Draw trend channels to identify potential support and resistance levels within the overall trend.

- Volume Analysis: Incorporate volume indicators to confirm trend strength.

2. Breakout Trading: Capitalizing on Volatility

GBP/JPY is notorious for its explosive breakouts, making breakout trading a potentially profitable strategy.

How to execute:

- Identify key support and resistance levels on the chart

- Watch for price consolidation near these levels

- Enter trades when the price breaks above resistance or below support

- Use volatility-based stop-losses to account for the pair’s wide price swings

- Set profit targets at the next significant support/resistance level

Refining Your Breakout Strategy

- False Breakout Filter: Wait for a retest of the broken level before entering a trade.

- Volume Confirmation: Look for a surge in volume during the breakout to confirm its validity.

- Time-Based Filters: Be aware that breakouts occurring during specific times may have a higher probability of success.

- Multiple Timeframe Confirmation: Confirm breakouts on multiple timeframes to increase the likelihood of a sustained move.

- Volatility-Based Position Sizing: Adjust your position size based on current market volatility.

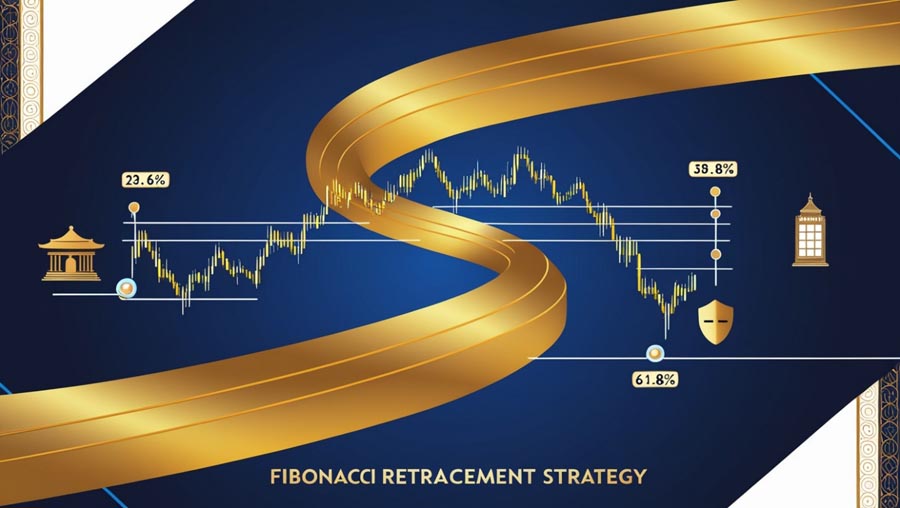

3. Fibonacci Retracement Strategy: Precision Entry and Exit Points

Fibonacci retracements are particularly effective for trading GBP/JPY due to the pair’s tendency to respect these levels.

Steps to implement:

- Draw Fibonacci retracement levels on the chart during strong trends

- Look for price retracements to key Fibonacci levels (38.2%, 50%, and 61.8%)

- Enter trades when price action confirms a reversal at these levels

- Place stop-losses below the nearest swing low/high

- Set profit targets at the next Fibonacci extension level

Advanced Fibonacci Techniques

- Fibonacci Extensions: Use Fibonacci extension levels to set precise profit targets during strong trends.

- Fibonacci Time Zones: Apply Fibonacci ratios to time analysis to predict potential reversal points.

- Fibonacci Fan Lines: Draw fan lines from significant highs or lows to identify potential support and resistance levels.

- Multiple Fibonacci Retracements: Apply Fibonacci retracements to different swing highs and lows to find confluence areas.

- Combining Fibonacci with Other Indicators: Use Fibonacci levels in conjunction with other technical indicators for confirmation.

4. News Trading: Leveraging Economic Events

Given the economic significance of both the UK and Japan, news trading can be a powerful strategy for GBP/JPY.

Key aspects:

- Stay informed about major economic releases from both countries

- Focus on high-impact events like interest rate decisions, GDP reports, and inflation data

- Use a news calendar to plan your trades in advance

- Implement a straddle strategy by placing pending orders above and below the current price before news releases

- Be prepared for increased volatility and adjust your position sizes accordingly

Maximizing News Trading Effectiveness

- Pre-News Analysis: Study market sentiment and positioning before major news releases.

- Correlation Analysis: Monitor correlated pairs to gauge overall market sentiment during news events.

- Volatility-Based Exit Strategies: Use volatility indicators to set dynamic take-profit and stop-loss levels.

- Post-News Trend Trading: Look for opportunities to enter trades in the direction of the initial news-driven move.

- News Trading with Options: Consider using options strategies to limit risk during highly volatile news events.

5. Range Trading: Profiting from Consolidation

Despite its reputation for volatility, GBP/JPY also experiences periods of consolidation, making range trading viable.

How to apply:

- Identify clear support and resistance levels forming a range

- Enter long positions near support and short positions near resistance

- Use oscillators like RSI or Stochastic to confirm overbought/oversold conditions

- Set tight stop-losses outside the range

- Take profits before price reaches the opposite end of the range

Enhancing Your Range Trading Approach

- Bollinger Bands Squeeze: Use Bollinger Bands to identify periods of low volatility, which often precede range breakouts.

- Multiple Timeframe Range Analysis: Confirm range-bound conditions across multiple timeframes.

- Range-to-Breakout Strategy: Be prepared to switch from range trading to breakout trading when necessary.

- Volume Profile Analysis: Use volume profile tools to identify high-volume nodes within the range.

- Harmonic Patterns: Look for harmonic patterns forming within the range to identify potential reversal points.

6. Multi-Timeframe Analysis: Combining Short and Long-Term Views

A multi-timeframe approach helps you align your trades with both short-term opportunities and long-term trends in GBP/JPY.

Implementation steps:

- Start with a higher timeframe (weekly or daily) to identify the overall trend

- Move to a lower timeframe (4-hour or 1-hour) to fine-tune entry points

- Use the lowest timeframe (15-minute or 5-minute) for precise entry and exit timing

- Ensure that your trades on lower timeframes align with the higher timeframe trend

- Adjust your position sizes based on the confluence of signals across timeframes

Advanced Multi-Timeframe Techniques

- Timeframe Alignment Indicator: Develop or use an indicator that shows trend alignment across multiple timeframes.

- Fractal Analysis: Study price patterns and structures that repeat across different timeframes.

- Timeframe-Specific Indicators: Use different technical indicators optimized for specific timeframes.

- Multi-Timeframe Momentum Analysis: Compare momentum indicators across different timeframes.

- Timeframe Transition Strategy: Develop a strategy for transitioning your analysis as price action moves from one timeframe to another.

7. Correlation Trading: Leveraging Relationships with Other Pairs

GBP/JPY often exhibits strong correlations with other currency pairs, which can be exploited for trading opportunities.

Strategy details:

- Monitor correlations between GBP/JPY and pairs like EUR/JPY or GBP/USD

- Look for divergences in correlated pairs as potential trade signals

- Use correlation coefficients to quantify the strength of relationships

- Enter trades when a lagging pair starts to catch up with its correlated counterpart

- Set stop-losses based on the historical volatility of the correlation

Advanced Correlation Trading Techniques

- Dynamic Correlation Analysis: Use rolling correlation calculations to identify changes in pair relationships over time.

- Correlation Divergence Trading: Develop a system to trade divergences between correlated pairs.

- Basket Trading: Create a basket of correlated currencies to trade against GBP/JPY.

- Correlation-Based Portfolio Management: Use pair correlations to balance your overall forex portfolio.

- Machine Learning for Correlation Prediction: Implement machine learning algorithms to predict future correlations.

Risk Management: The Cornerstone of Successful GBP/JPY Trading

Effective risk management is crucial when trading GBP/JPY due to its high volatility.

Essential risk management techniques:

- Never risk more than 1-2% of your trading capital on a single trade

- Use stop-losses consistently to protect against unexpected market moves

- Consider using options or guaranteed stops for additional protection

- Adjust your position sizes based on market volatility

- Implement a positive risk-reward ratio (aim for at least 1:2)

- Be prepared to cut losses quickly if a trade moves against you

Advanced Risk Management Strategies

- Dynamic Position Sizing: Adjust your position size based on the pair’s current Average True Range (ATR).

- Correlation-Based Risk Assessment: Monitor correlations between GBP/JPY and other assets in your portfolio.

- Monte Carlo Simulations: Use statistical simulations to stress-test your trading strategy.

- Risk-Adjusted Performance Metrics: Utilize measures like the Sharpe ratio or Sortino ratio to evaluate your trading performance.

- Hedging Strategies: Implement advanced hedging techniques using options or correlated pairs.

Conclusion

Mastering the best trading strategy for GBP/JPY requires a combination of technical skill, market knowledge, and disciplined risk management. By incorporating these seven proven strategies into your trading arsenal, you’ll be well-equipped to navigate the challenges and opportunities presented by this dynamic currency pair.

Remember, successful trading is not just about choosing the right strategy but also about consistent execution and continuous learning. Stay informed about economic developments in both the UK and Japan, refine your technical analysis skills, and always prioritize risk management.

As you implement these strategies, be prepared to adapt to changing market conditions. Regularly review and refine your approach, keeping detailed trading journals to track your performance and identify areas for improvement.

With dedication, practice, and a commitment to ongoing education, you can harness the power of GBP/JPY to achieve your forex trading goals and potentially secure significant profits in the ever-evolving currency market.

How does the Bank of Japan’s monetary policy affect GBP/JPY trading?

The Bank of Japan’s monetary policy plays a crucial role in GBP/JPY trading. When the BOJ maintains an ultra-loose monetary policy, it tends to weaken the Yen, potentially driving GBP/JPY higher. Conversely, any hints of policy tightening can strengthen the Yen and push the pair lower. Traders should closely monitor BOJ statements and policy decisions, as sudden changes can lead to significant volatility in GBP/JPY.

What are the best times to trade GBP/JPY?

The optimal times to trade GBP/JPY are when both the London and Tokyo markets are active. This typically occurs between 8:00 AM and 9:00 AM GMT (3:00 AM to 4:00 AM EST). During this overlap, liquidity is high, and volatility often increases, providing more trading opportunities. Additionally, the London session (8:00 AM to 4:00 PM GMT) is generally active for GBP/JPY due to the release of key UK economic data.

How can I adjust my trading strategy during Brexit-related events?

During Brexit-related events, it’s crucial to adapt your GBP/JPY trading strategy. First, increase your focus on fundamental analysis, as political developments can overshadow technical indicators. Second, be prepared for increased volatility by widening your stop-losses and reducing position sizes. Third, consider using options or guaranteed stops to limit potential losses. Lastly, stay informed about Brexit negotiations and UK economic indicators, as these will significantly impact GBP/JPY movements during this period.