The ICT New York Open Strategy, also known as the New York Killzone, is a sophisticated forex trading approach designed to exploit liquidity and fair value gaps that typically occur during the opening of the New York trading session. Traders utilizing this strategy aim to capitalize on the increased volatility and significant market movements often observed during this time. By focusing on specific “kill zones” where price action is expected to be most pronounced, traders can enhance their chances of successful trades. This strategy leverages the overlap between the New York and London trading sessions, a period known for its heightened trading activity and dynamic price fluctuations. For those looking to implement this strategy, partnering with a reliable online forex broker is essential to ensure optimal execution and access to real-time market data.

Understanding the New York Forex Session and ICT New York Killzone

The Importance of the New York Session in the ICT New York Killzone

The New York forex session is a pivotal trading period due to several key factors:

- High Liquidity: The New York session, beginning at 7:00 AM EST, experiences high liquidity due to its overlap with the London session. This overlap creates an ideal environment for trading as both major forex markets are active, providing ample trading opportunities.

- Major Currency Pairs: Currency pairs involving the US dollar, such as EUR/USD, GBP/USD, and USD/JPY, are particularly active during this session. These pairs often see significant price movements, making them prime candidates for the ICT New York Killzone strategy.

- Increased Volatility: The overlap between the London and New York sessions results in increased volatility, which can lead to substantial price movements. This volatility presents opportunities for traders to profit from rapid price changes.

- Institutional Activity: Major financial institutions are actively trading during this period, which increases market activity and provides further opportunities for traders to align their strategies with institutional movements.

Characteristics of the ICT New York Killzone

The ICT New York Killzone strategy focuses on trading during a specific timeframe characterized by high volatility and liquidity. Here are the essential characteristics of this strategy:

- Timing: The ICT New York Killzone occurs between 7:00 AM and 9:00 AM EST. This timeframe marks the beginning of the New York session and is known for its heightened market activity.

- Price Action: During the Killzone, the market often experiences price movements that retrace back to the London trading range. This retracement creates opportunities for traders to enter trades at favorable levels.

- Trade Potential: The New York session typically offers opportunities for trades with potential gains of 30 to 40 pips due to the increased volatility and trading volume during this period.

- Volatility and Liquidity: The overlap between the London and New York sessions results in high trading volume and volatility, creating favorable conditions for the ICT New York Killzone strategy.

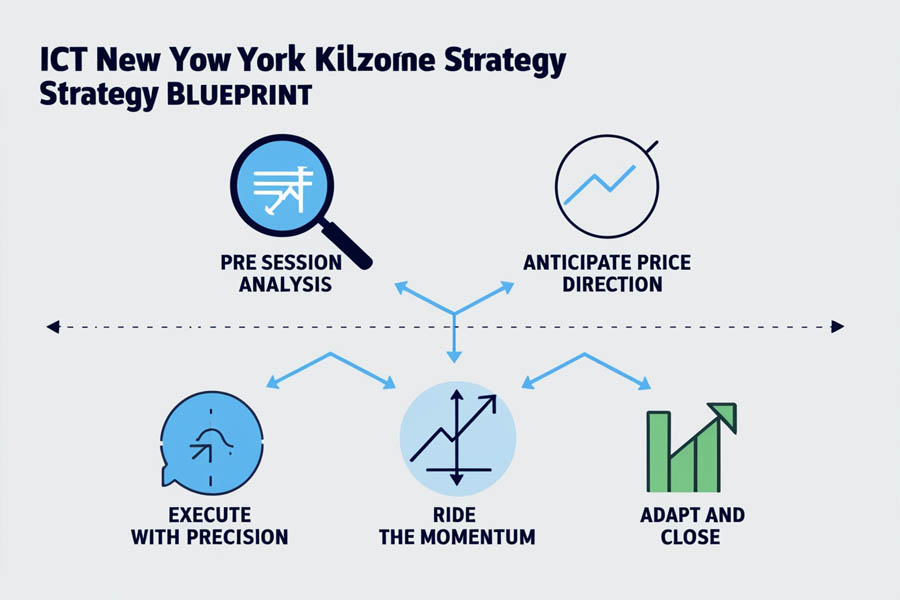

The 5-Step ICT New York Killzone Strategy Blueprint

To successfully implement the ICT New York Killzone strategy and align with institutional movements, follow these five crucial steps:

1. Pre-Session Analysis for ICT New York Killzone

Before the New York session opens and the ICT New York Killzone begins, it’s crucial to conduct thorough pre-session analysis:

- Identify Key Levels: Mark key support and resistance levels on daily and 4-hour timeframes relevant to the Killzone. This includes identifying previous day’s high and low points as they often serve as significant levels during the Killzone.

- Assess Market Conditions: Review any overnight news and potential market-moving events that could impact the dynamics of the Killzone. Economic data releases, geopolitical events, and other news can influence price movements.

- Analyze Price Action: Study the price action from the Asian session to understand its context leading into the New York session. The Asian session’s movements can provide clues about potential price behavior during the Killzone.

- Spot Institutional Zones: Look for potential institutional accumulation or distribution zones using ICT concepts like order blocks and fair value gaps. Identifying these zones can help you anticipate potential price movements.

- Define Breaker Zones: Identify potential “Breaker” zones where price might exhibit significant movement. These zones are areas where price action could break out or reverse, creating trading opportunities.

2. Anticipate Price Direction in the ICT New York Killzone

Based on your pre-session analysis, form a hypothesis about potential price movements within the ICT New York Killzone:

- Market Sentiment: Determine the overall market sentiment (bullish, bearish, or neutral) and how it might influence the Killzone. Understanding market sentiment can help you predict price direction.

- Economic Releases: Evaluate the potential impact of upcoming economic releases on the Killzone. Economic data can influence market sentiment and drive significant price movements.

- Technical Indicators: Analyze technical indicators to assess overbought or oversold conditions as the Killzone approaches. Indicators like RSI, MACD, and moving averages can provide additional insights.

- Institutional Positioning: Look for signs of institutional positioning, such as stop hunts or liquidity grabs, using ICT’s Optimal Trade Entry (OTE) concept. These signs can indicate where major players are placing their trades.

- Mitigation Zones: Identify potential “Mitigation” zones where price might return before continuing its trend. Mitigation zones are areas where price could retrace to before resuming its direction.

Read more: Mastering the ICT Market Maker Sell Model

3. Execute with Precision in the ICT New York Killzone

As the New York session opens at 7:00 AM EST and the ICT New York Killzone begins, be prepared to enter trades swiftly and precisely:

- Entry Orders: Use limit orders to enter at predetermined levels within the Killzone or market orders for fast-moving breakouts. This approach ensures you get the best possible entry prices.

- Risk Management: Implement tight stop-losses to manage risk in the volatile Killzone conditions. Proper risk management is crucial to protect your capital from unexpected price movements.

- Institutional Signals: Look for signals of institutional order flow to confirm entry points. These signals can help you align your trades with the actions of major market players.

- Market Structure: Utilize ICT’s Market Structure Liquid Grab (MSLG) to identify potential entry points. Understanding market structure helps you spot key levels and trends.

- Liquidity Voids: Pay attention to areas of low liquidity where price might move rapidly. Liquidity voids can lead to significant price jumps and create trading opportunities.

4. Ride the Momentum of the ICT New York Killzone

If your trade moves in your favor within the ICT New York Killzone, actively manage it to maximize profits:

- Scale Out: Scale out partial positions at predetermined profit targets within the Killzone. This strategy allows you to lock in profits while keeping a portion of your position open.

- Trail Stops: Trail your stop-loss to lock in gains as the price advances through the Killzone. Trailing stops help you protect profits while allowing for potential further gains.

- Add to Positions: Consider adding to winning positions if the momentum remains strong. Adding to positions can increase your exposure to favorable price movements.

- Reversal Points: Monitor for potential institutional reversal points using ICT’s Institutional Candle Pattern concept. Recognizing reversal patterns can help you adjust your trades accordingly.

- Fair Value Gaps: Watch for Fair Value Gaps that might get filled during the price movement. Fair Value Gaps can indicate areas where price is likely to return before continuing its trend.

5. Adapt and Close as the ICT New York Killzone Progresses

As the initial volatility of the ICT New York Killzone subsides, usually within the first couple of hours, reassess your positions:

- Close Non-Performers: Close trades that haven’t performed as expected within the Killzone. This approach helps you avoid further losses on underperforming trades.

- Adjust Stops: Adjust stop-losses on winning trades to secure profits gained. Ensuring your stop-loss is in a favorable position helps protect your profits.

- Trend Continuation: Consider holding a portion of your position if a strong trend is established beyond the Killzone. Holding positions in strong trends can lead to additional gains.

- Institutional Analysis: Look for signs of institutional distribution or accumulation to anticipate potential reversals. Institutional movements can signal shifts in market direction.

- Timing Windows: Use ICT’s Timing Windows concept to identify potential reversal points in time. Timing Windows help you pinpoint key moments for potential market reversals.

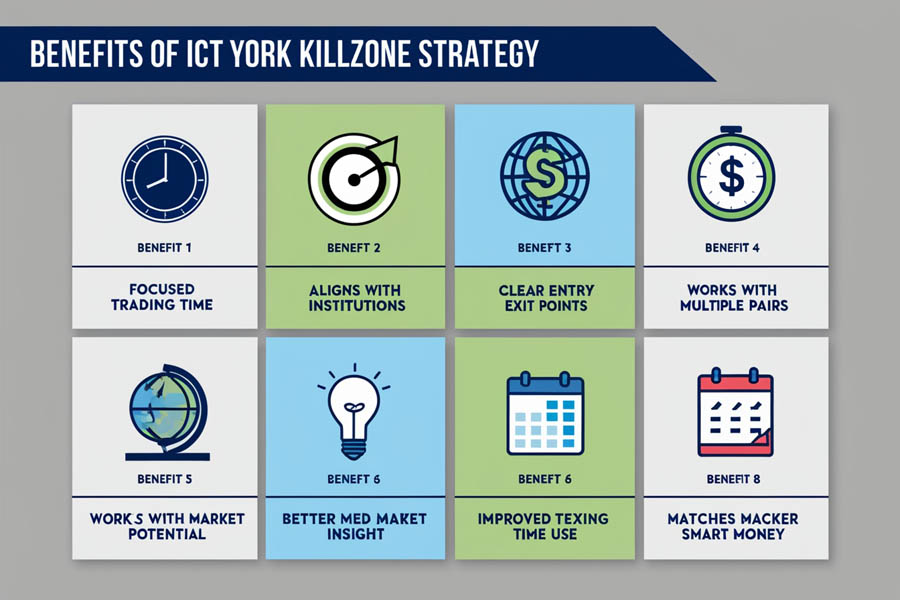

The Benefits of Using the ICT New York Killzone Strategy

The ICT New York Killzone strategy offers several key benefits that can enhance your trading performance:

- Enhanced Trading Opportunities: The strategy focuses on a specific timeframe known for its increased volatility and liquidity, providing traders with ample trading opportunities.

- Alignment with Institutional Movements: By following institutional trading patterns, traders can align their strategies with major market players, improving their chances of success.

- Structured Approach: The ICT New York Killzone strategy provides a clear, structured approach to trading, helping traders make informed decisions and manage their trades effectively.

- Risk Management: The strategy emphasizes robust risk management practices, including tight stop-losses and trade planning, to protect capital and minimize losses.

Read more: Mastering the ICT Market Maker Buy Model

Common Pitfalls to Avoid with the ICT New York Killzone Strategy

Even with a well-defined strategy like the ICT New York Killzone, traders can encounter several common pitfalls that may hinder their success. Here’s a look at some of these pitfalls and how to avoid them:

1. Overtrading During the Killzone

Pitfall: One of the most common mistakes is overtrading during the Killzone. Due to the high volatility and rapid price movements, traders might be tempted to enter multiple trades in quick succession, leading to overexposure and potential losses.

Solution: Focus on quality rather than quantity. Set clear criteria for trade entry and only take trades that meet your predefined conditions. Avoid the temptation to trade impulsively, and ensure each trade aligns with your strategy.

2. Ignoring Risk Management

Pitfall: Neglecting proper risk management can be detrimental. High volatility during the Killzone means price can move quickly, and without adequate risk management, losses can accumulate rapidly.

Solution: Implement strict risk management rules, including setting tight stop-losses and limiting the size of each trade. Ensure your risk per trade is consistent with your overall trading plan and capital allocation.

3. Failing to Adapt to Market Conditions

Pitfall: The forex market is dynamic, and failing to adapt to changing market conditions can lead to missed opportunities or losses. Traders might stick to their strategy rigidly without considering new information or market changes.

Solution: Stay informed about market news and events that could impact the Killzone. Be flexible in your approach and adjust your strategy based on current market conditions and new data.

4. Overlooking Institutional Signals

Pitfall: Ignoring institutional signals and focusing solely on technical indicators can lead to suboptimal trading decisions. Institutional movements often drive significant price changes, and not recognizing these can result in missed opportunities.

Solution: Incorporate analysis of institutional order flow and price patterns into your strategy. Look for signs of institutional activity and align your trades with these movements to improve your chances of success.

5. Lack of Post-Trade Analysis

Pitfall: Many traders neglect post-trade analysis, missing out on valuable insights for improving their strategy. Without reviewing past trades, it’s challenging to identify mistakes and areas for improvement.

Solution: Conduct thorough post-trade analysis to evaluate the performance of your trades. Review your trade entries, exits, and overall strategy to identify areas for improvement and refine your approach for future trades.

Read more: Mastering the ICT London Open Strategy

Elevate Your Trading with OpoFinance

Are you ready to take your trading to the next level? OpoFinance is here to empower you with the tools and resources you need to excel in the forex market. Our advanced trading solutions are designed to help you navigate the complexities of trading with confidence and precision.

Why Choose OpoFinance?

- Real-Time Data Analysis: Stay ahead of the market with our cutting-edge data analytics tools. Access real-time insights and trends to make informed trading decisions and seize opportunities as they arise.

- Advanced Trading Platforms: Experience seamless trading with our state-of-the-art platforms, offering advanced charting tools, automated trading features, and customizable interfaces to suit your trading style.

- Expert Resources and Support: Benefit from our extensive educational resources and dedicated support team. Whether you’re a seasoned trader or just starting, our expert guidance will help you master strategies and enhance your skills.

Unlock your trading potential with OpoFinance. Visit OpoFinance to explore our solutions and see how we can support your trading journey. Let us be your trusted partner in achieving trading success!

Conclusion: Maximizing Your Success with the ICT New York Killzone Strategy

The ICT New York Open Strategy, or New York Killzone, is a powerful trading approach designed to exploit the unique opportunities presented during the New York session’s opening hours. By focusing on the specific characteristics of the Killzone and following a structured approach, traders can enhance their chances of capturing profitable trades. Success with this strategy requires careful preparation, precise execution, and continuous adaptation to market conditions. With disciplined trading practices, effective risk management, and a commitment to ongoing learning, traders can make the most of the ICT New York Killzone strategy and achieve their trading goals.

What are the key characteristics of the ICT New York Killzone?

The ICT New York Killzone is characterized by its trading window from 7:00 AM to 9:00 AM EST, focusing on USD-related currency pairs. It is marked by high volatility and liquidity due to the overlap with the London session, providing optimal trading conditions. The strategy often involves trading retracements back to the London trading range and capitalizing on significant price movements within this period.

How does the New York Killzone strategy benefit from institutional trading patterns?

The New York Killzone strategy benefits from institutional trading patterns by aligning with the significant price movements driven by major financial institutions. These institutions execute large trades that impact market prices, and by focusing on the Killzone, traders can anticipate and align their trades with these movements, enhancing their chances of success.

Can the ICT New York Killzone strategy be applied to other markets?

While the ICT New York Killzone strategy is specifically tailored for the forex market during the New York session, its core principles—timing, volatility, and alignment with institutional movements—can be adapted to other markets with similar characteristics. Traders should adjust their approach based on the specific dynamics, trading hours, and market conditions of the market they are targeting.