In the realm of financial trading, understanding various methodologies can significantly enhance a trader’s success. Among the most discussed approaches are the Inner Circle Trader (ICT) methodology and Smart Money Concepts (SMC). The difference between ICT and SMC trading can often be subtle yet impactful, influencing how traders interpret market data and make strategic decisions.

This article aims to provide a comprehensive analysis of these two methodologies, highlighting their unique aspects and comparing their effectiveness. If you’re searching for a broker for forex trading or interested in integrating these concepts into your trading strategy, understanding the core differences between ICT and SMC will be crucial. By exploring these methodologies in detail, you’ll gain valuable insights that can inform your trading decisions and strategies.

Understanding the Basics of ICT and SMC

To effectively compare and contrast ICT and SMC, it’s crucial to first understand the foundational principles behind these methodologies.

What Is Inner Circle Trader (ICT)?

The Inner Circle Trader (ICT) methodology, developed by Michael Huddleston, focuses on market structure, liquidity, and institutional order flow. Huddleston’s approach centers around the idea that understanding the manipulative tactics of large institutional players can give retail traders a significant edge.

What Is Smart Money Concepts (SMC)?

Smart Money Concepts (SMC) focus on the behavior of institutional traders, known as the “smart money,” to predict market movements. SMC emphasizes following these large players to gain insights into potential price actions.

Read More: Understanding Smart Money Concepts Terminology

Key Components of SMC:

- Institutional Order Flow: Tracking the activities of large financial institutions.

- Liquidity Zones: Identifying areas with high liquidity targeted by institutions.

- Market Manipulation: Recognizing patterns of manipulation by smart money to deceive retail traders.

- Risk Management: Effective techniques for managing risk in trading decisions.

Both ICT and SMC stress the importance of liquidity and institutional influence but approach market analysis from different angles.

The Foundation of ICT: A Deep Dive into the Inner Circle Trader Methodology

The ICT methodology is more than just a trading technique; it’s a comprehensive approach to understanding market behavior. By focusing on the actions of institutional traders, ICT aims to provide traders with a deeper insight into market movements.

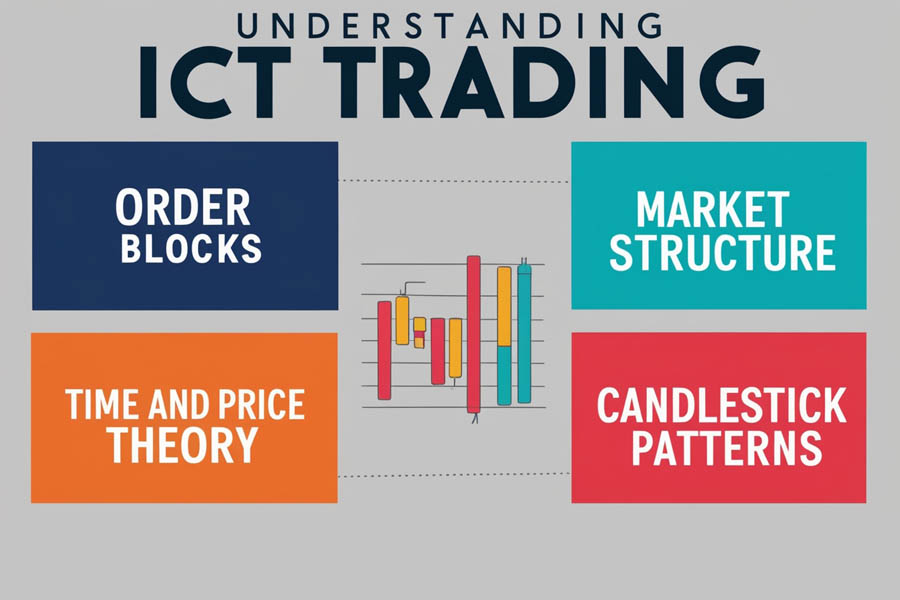

Key Concepts in ICT

- Liquidity Pools: ICT traders identify liquidity pools as critical areas where institutional traders execute their trades. These pools, concentrated with stop orders, often become targets for price manipulation.

- Order Blocks: These are areas where significant buying or selling has occurred. Recognizing order blocks helps traders predict future price movements based on historical trading activity.

- Market Structure: Analyzing market structure involves understanding trends, support, and resistance levels. ICT traders use this analysis to identify potential trading opportunities and reversal points.

- Time and Price: ICT emphasizes understanding the timing of market movements. By correlating specific times of day with price changes, traders can better predict when significant price shifts are likely to occur.

ICT requires a meticulous analysis of technical factors and market patterns, demanding a deep understanding of market dynamics.

The Core of SMC: Leveraging Smart Money Concepts for Better Trading

Smart Money Concepts (SMC) offer a broader view of trading strategies by focusing on the actions and behaviors of institutional traders. SMC provides tools to align retail trading strategies with those of the smart money.

Essential Elements of SMC

- Institutional Order Flow: SMC traders track the buying and selling activities of large institutions to align their trades with the smart money. Tools like the Commitment of Traders (COT) report are often used to gauge institutional activity.

- Liquidity Zones: Identifying liquidity zones helps traders understand where large orders might be executed, providing insights into potential price movements.

- Market Manipulation: Recognizing market manipulation tactics used by large players helps traders avoid common pitfalls and take advantage of market movements that deviate from the prevailing trend.

- Risk Management: SMC emphasizes managing risk effectively, including setting appropriate stop-loss levels and controlling trade sizes to prevent significant losses.

SMC offers a more generalized approach to trading, allowing for greater flexibility and adaptation across various market conditions.

Comparing ICT and SMC: Similarities and Differences

When analyzing trading methodologies, it is essential to understand both their shared principles and their distinct characteristics. The Inner Circle Trader (ICT) methodology and Smart Money Concepts (SMC) offer unique perspectives on trading that cater to different aspects of market analysis. Here’s a detailed comparison to help you discern the difference between ICT and SMC trading and make an informed decision about which approach aligns best with your trading strategy.

Similarities Between ICT and SMC

Both ICT and SMC methodologies share several foundational similarities, reflecting their common goal of improving trading outcomes through a better understanding of market dynamics.

- Focus on Institutional Traders:

- Both methodologies emphasize the importance of institutional traders and their influence on the market. ICT looks at the market behavior of large players to anticipate price movements, while SMC directly tracks institutional order flows and market manipulations.

- By understanding how these large players operate, traders can gain insights into potential market shifts and align their strategies accordingly.

- Importance of Liquidity:

- Liquidity is a central theme in both ICT and SMC. ICT identifies liquidity pools as critical areas where institutional traders may influence the market, while SMC focuses on identifying high liquidity zones where smart money is likely to be active.

- Recognizing these liquidity zones helps traders anticipate where significant market moves might occur, allowing them to position their trades more effectively.

- Market Structure Analysis:

- Both methodologies involve a detailed analysis of market structure. ICT uses concepts like market highs, lows, and order blocks to predict market behavior, while SMC examines price action and liquidity zones to identify trading opportunities.

- Understanding market structure is crucial for both approaches, as it provides context for evaluating price movements and making informed trading decisions.

- Risk Management Principles:

- Effective risk management is essential in both ICT and SMC strategies. ICT traders employ risk management techniques to protect their capital while trading based on technical signals, and SMC traders use similar principles to mitigate risks associated with institutional behavior and market manipulation.

- Strategies such as setting stop-loss orders and adjusting trade sizes are common practices in both methodologies, ensuring that traders can manage potential losses effectively.

Differences Between ICT and SMC

While ICT and SMC share common goals, their methodologies diverge in several key aspects, reflecting their unique approaches to trading.

- Technical Focus vs. Institutional Behavior:

- ICT: The ICT methodology is more focused on technical aspects of trading. It involves analyzing market structure, identifying order blocks, and applying time and price theories to predict price movements. ICT traders rely heavily on technical analysis tools and indicators.

- SMC: SMC, on the other hand, emphasizes understanding the behavior of institutional traders and their impact on the market. It involves tracking institutional order flows, recognizing liquidity zones, and identifying market manipulations. SMC is less technical and more oriented towards understanding the broader market context.

- Specific Techniques vs. General Mindset:

- ICT: ICT provides specific techniques and theories for analyzing market conditions. Traders use precise methods to identify order blocks and liquidity pools, and apply them to their trading strategies.

- SMC: SMC offers a broader mindset and framework for trading, allowing traders to adapt to various market conditions based on institutional behavior and market manipulations. It provides a general approach to aligning with smart money, rather than detailed technical signals.

- Market Manipulation Awareness:

- ICT: While ICT recognizes market manipulation, its primary focus is on technical patterns and order flow. Manipulation is seen as a factor to consider but is not the central focus of the methodology.

- SMC: SMC places a greater emphasis on identifying and capitalizing on market manipulation tactics employed by institutional players. Recognizing these manipulations is a key component of SMC, as it helps traders avoid traps and take advantage of deviations from the prevailing trend.

- Complexity and Learning Curve:

- ICT: The ICT methodology tends to be more complex, requiring a deep understanding of technical analysis and market theories. It has a steeper learning curve, as traders need to grasp various concepts and apply them effectively.

- SMC: SMC is generally more accessible and adaptable, with a focus on understanding institutional behavior rather than mastering intricate technical details. It may be easier for traders to grasp and apply SMC principles compared to the more detailed ICT strategies.

By evaluating these similarities and differences, traders can better understand how each methodology aligns with their trading style and objectives. Whether you choose to focus on ICT, SMC, or a combination of both, having a clear understanding of these approaches will enhance your ability to make informed trading decisions.

Read More: Mastering ICT Market Structure

Practical Application: How to Implement ICT and SMC in Your Trading Strategy

Successfully applying ICT and SMC methodologies involves understanding their core principles and integrating them into your trading strategy. Here’s a step-by-step guide to implementing these strategies effectively.

Step 1: Master the Basics

Ensure you have a strong foundation in:

- Market Structure: Understand how to identify trends, support, and resistance levels.

- Liquidity: Learn to spot liquidity pools and zones.

- Risk Management: Develop a robust risk management plan.

Step 2: Choose Your Focus

Decide whether to emphasize ICT, SMC, or a combination of both based on your trading style and goals.

- ICT-Focused Traders: Focus on technical analysis, order blocks, and market timing.

- SMC-Focused Traders: Track institutional order flow and liquidity zones, and recognize market manipulations.

Step 3: Practice and Backtest

Engage in:

- Paper Trading: Use demo accounts to practice without financial risk.

- Backtesting: Analyze historical data to refine your strategies.

Step 4: Start Small and Scale Up

Begin with small positions in real trading to test your strategies and gradually increase trade sizes as you gain confidence.

Step 5: Continuously Learn and Adapt

Stay updated with market developments and be ready to adapt your strategies as needed.

Implementing these steps will help you integrate ICT and SMC into your trading practice effectively.

Opofinance Services: The ASIC Regulated Broker Advantage

When choosing a regulated forex broker, it’s crucial to select one that aligns with your trading needs and provides a secure trading environment. Opofinance, an ASIC-regulated broker, stands out for its robust regulatory framework, ensuring a high level of transparency and security for its clients.

Why Choose Opofinance?

- ASIC Regulation: Opofinance is regulated by the Australian Securities and Investments Commission (ASIC), providing assurance of regulatory compliance and protection for your trading activities.

- Comprehensive Services: From competitive spreads and advanced trading platforms to a range of forex pairs and financial instruments, Opofinance caters to diverse trading needs.

- Social Trading Services: Opofinance also offers innovative social trading services, allowing you to follow and copy the trades of successful traders. This feature is particularly beneficial for those new to trading or looking to diversify their strategies by leveraging the expertise of experienced traders.

Choosing a reputable broker like Opofinance not only enhances your trading experience but also ensures a secure and reliable trading environment.

Read More: The Smart Money Concept (SMC) Explained

Conclusion

Understanding the difference between ICT and SMC trading is pivotal for traders looking to refine their strategies and achieve better trading outcomes. Both methodologies offer valuable insights into market dynamics, but they approach trading from distinct perspectives. ICT provides a technically detailed approach, focusing on market structure, order blocks, and specific technical indicators. In contrast, SMC offers a broader framework centered around institutional behavior, liquidity zones, and market manipulation.

Choosing between ICT and SMC depends on your trading style, objectives, and preferences. If you prefer a methodical, technically focused approach, ICT might be more suitable. On the other hand, if you are interested in understanding institutional behavior and aligning your trades with smart money, SMC could be a better fit. Many traders find that combining elements from both methodologies provides a more comprehensive trading strategy.

Additionally, selecting the right broker for forex trading can further enhance your trading experience. For instance, Opofinance, an ASIC-regulated broker, offers a secure trading environment and innovative features such as social trading services. By choosing a reputable broker and integrating effective trading methodologies, you can optimize your trading performance and work towards achieving your financial goals.

By understanding and applying the principles of ICT and SMC, and leveraging the support of a trusted broker, you can navigate the complexities of trading with greater confidence and success.

How do ICT and SMC methodologies influence trading decisions?

ICT methodologies influence trading decisions by providing technical tools and theories to analyze market structure, liquidity, and institutional order flow. This approach helps traders predict price movements and identify trading opportunities based on detailed technical analysis. SMC methodologies, on the other hand, focus on understanding and tracking the behavior of institutional traders. By following smart money and recognizing market manipulation patterns, traders can make informed decisions that align with institutional trends and market shifts.

What are some common pitfalls when applying ICT and SMC strategies?

Common pitfalls when applying ICT strategies include overcomplicating technical analysis and relying too heavily on specific indicators without considering broader market context. Traders might also struggle with the steep learning curve of ICT’s detailed techniques. For SMC, pitfalls include misinterpreting institutional behavior or liquidity zones, which can lead to incorrect assumptions about market trends. Both methodologies require a nuanced understanding and careful application to avoid these pitfalls and achieve successful trading outcomes.

How can traders measure the effectiveness of ICT and SMC strategies?

Traders can measure the effectiveness of ICT and SMC strategies by tracking their trading performance over time. Key metrics include win/loss ratios, profitability, and consistency of trade execution. Regularly reviewing and analyzing trade results, conducting backtests, and comparing outcomes with market conditions can provide insights into the effectiveness of these strategies. Additionally, using performance analytics tools offered by brokers like Opofinance can help in assessing and refining trading strategies.