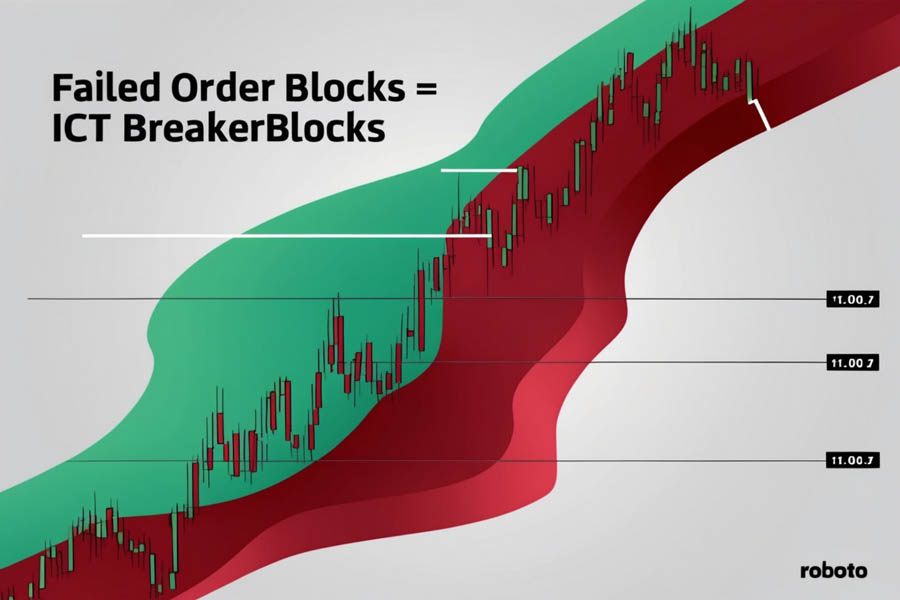

In the intricate world of forex trading, the ICT Breaker Block stands out as a pivotal concept for identifying potential market reversals and shifts in liquidity. Developed by the Inner Circle Trader (ICT), the ICT Breaker Block represents a failed order block that can offer traders critical insights into upcoming market movements. Understanding how to identify and trade these blocks can significantly enhance your trading strategy and improve your market predictions.

The ICT Breaker Block concept is rooted in the idea that markets are constantly searching for liquidity. When an order block fails—meaning the market does not sustain its initial direction—it often transforms into a new area of interest. This transformation can signal a reversal point where significant price action is likely to occur. For traders, recognizing these failed order blocks and understanding their implications can provide valuable opportunities for entering or exiting trades with greater precision.

In this guide, we will delve into the intricacies of ICT Breaker Blocks, exploring their role in market structure, how to effectively use them in trading strategies, and their benefits and limitations. By mastering this concept, you can align your trading decisions with the shifting dynamics of the forex market and improve your overall trading performance.

What is an ICT Breaker Block in Forex?

An ICT Breaker Block in forex trading is essentially a failed order block that has resulted in a significant shift in market liquidity and structure. According to the Inner Circle Trader (ICT), when an order block fails, it doesn’t become irrelevant. Instead, it transforms into a new area of interest for traders, indicating a potential reversal in market direction. This concept is critical for traders who seek to capitalize on these shifts to predict future market movements.

The Role of ICT Breaker Blocks in Market Structure

The concept of ICT Breaker Blocks revolves around the idea that markets are constantly searching for liquidity. When an order block fails, it often signifies that the market is preparing for a reversal. This failed block then serves as a key zone where traders can anticipate significant price action. These zones, known as ICT Breaker Blocks, can act as new levels of support or resistance, depending on the direction of the market shift.

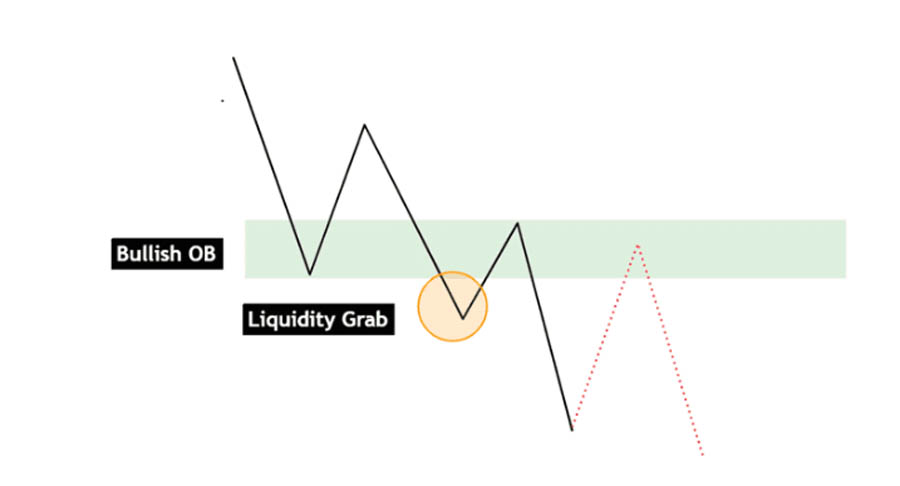

- Bullish ICT Breaker Block: When a bullish order block fails, it can turn into a bearish ICT Breaker Block, serving as a potential resistance or supply zone. This indicates that the market may be preparing to move lower.

- Bearish ICT Breaker Block: Conversely, when a bearish order block fails, it becomes a bullish ICT Breaker Block, potentially acting as a support or demand zone. This suggests that the market could be setting up for an upward move.

Understanding these transformations is essential for effectively incorporating ICT Breaker Blocks into your trading strategy. Recognizing when an order block has failed and identifying the subsequent ICT Breaker Block can provide traders with valuable insights into future price movements and potential entry or exit points.

How to Use ICT Breaker Blocks in Trading?

To successfully trade using ICT Breaker Blocks, traders must develop a methodical approach to identifying and leveraging these key market zones. Here’s a step-by-step guide on how to effectively incorporate ICT Breaker Blocks into your trading strategy:

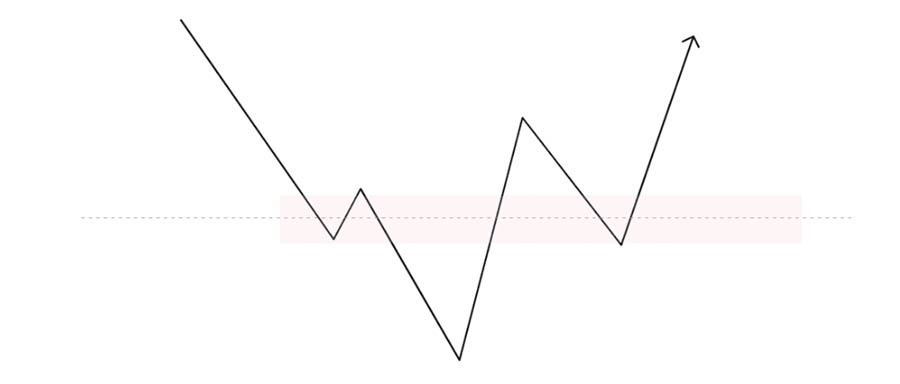

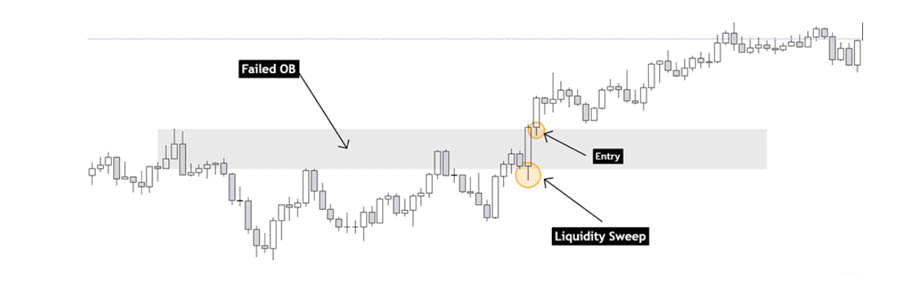

- Identify a Market Structure Shift: The first step in utilizing ICT Breaker Blocks is to identify when the market structure has shifted. This shift is typically evident when a previous order block is broken, signaling a change in the market’s direction. For example, if a bullish order block is breached, it may indicate a shift towards a bearish market. Recognizing this shift is crucial as it sets the foundation for identifying potential ICT Breaker Blocks that align with the new market dynamics.

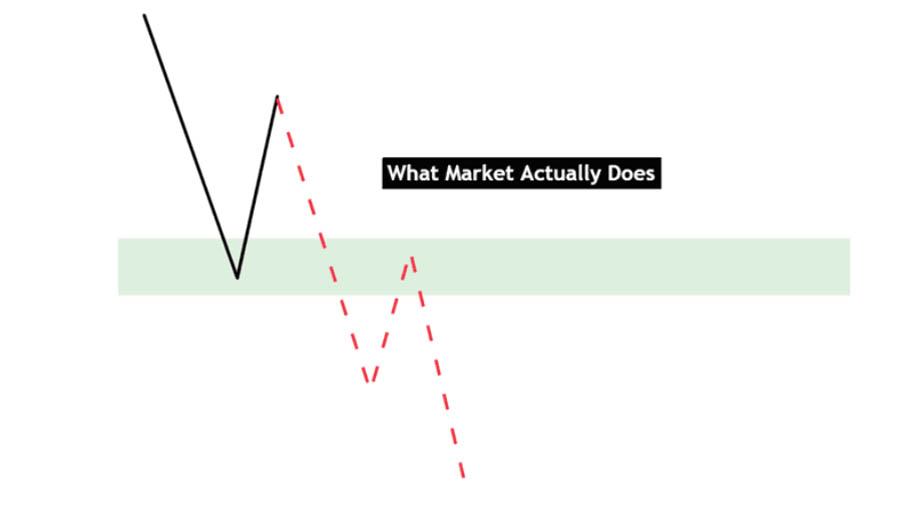

- Identifying the ICT Breaker Block: Once a market structure shift has been identified, the next step is to pinpoint the ICT Breaker Block. An ICT Breaker Block is usually recognized after a significant price movement where the market fails to sustain its initial direction, leading to a reversal. This failed order block now takes on an opposite role after the trend has changed, similar to how support levels can become resistance levels after being breached.

- Expecting Price Return to the ICT Breaker Block: After identifying the ICT Breaker Block, traders should anticipate a price return to this level. This return is often a critical phase where the market consolidates before making its next move. The ICT Breaker Block serves as a potential reversal zone where traders can prepare to take action based on how the price behaves upon reaching this level.

- Wait for Confirmation Before Entering a Position: Before entering a position, it’s important to wait for confirmation within the ICT Breaker Block. Confirmation can come in various forms, such as specific candlestick patterns, a change in market character at the ICT Breaker Block level, or alignment with other technical indicators. Once confirmation is received, traders can confidently enter a position that aligns with the new market trend, whether that be going long or short.

Using ICT Breaker Blocks effectively requires a blend of patience, discipline, and technical analysis. By following these steps, traders can increase their chances of success when trading with ICT Breaker Blocks.

Benefits and Limitations of ICT Breaker Block Trading

Like any trading concept, the use of ICT Breaker Blocks comes with its own set of benefits and limitations. Understanding these can help traders make more informed decisions about when and how to use ICT Breaker Blocks in their trading strategies.

Benefits

- Enhanced Market Prediction: Despite being classified as failed order blocks, ICT Breaker Blocks are highly valuable for predicting future price directions. They provide traders with insights into the actions of market makers and the potential next moves in the market.

- Applicability Across Markets: ICT Breaker Blocks are not limited to forex trading alone; they are relevant in other financial markets, including stocks, futures, and commodities. This universality makes them a versatile tool for traders operating in various markets.

- Key Liquidity Zones: ICT Breaker Blocks help traders identify critical liquidity zones, offering opportunities for more precise entries and exits based on the anticipated price reversals or continuations.

Limitations

- Risk of False Signals: Not all ICT Breaker Blocks are genuine. Some may simply be traps set by market makers to lure traders into positions that ultimately result in losses. Traders must be cautious and seek confirmation before making any trading decisions based on an ICT Breaker Block.

- Inconsistent Market Respect: In some cases, the price may not respect the ICT Breaker Block, meaning it could breach the level without any significant reaction. This inconsistency can lead to potential losses if traders are not adequately prepared.

- Complexity for Beginners: The concept of ICT Breaker Blocks can be complex for novice traders to grasp fully. Misidentifying these zones or misunderstanding their implications can lead to poor trading decisions.

Recognizing both the benefits and limitations of ICT Breaker Blocks is crucial for integrating them effectively into your overall trading strategy.

Read More: ICT Breaker Block Vs Mitigation Block

ICT Breaker Blocks and Its Role in Smart Money Concepts Strategy

ICT Breaker Blocks are an integral part of Smart Money Concepts (SMC), a trading approach that focuses on understanding and following the actions of large institutional traders, often referred to as “smart money.” By recognizing the patterns and movements created by these entities, retail traders can gain insights into potential market directions and capitalize on significant price movements.

How ICT Breaker Blocks Fit into Smart Money Concepts

- Liquidity and Market Manipulation: Smart Money Concepts are heavily focused on the idea of liquidity. Institutions need liquidity to execute large trades, and they often manipulate the market to create this liquidity. ICT Breaker Blocks come into play when these institutions push the market past certain levels (such as order blocks), creating false signals and trapping retail traders in losing positions. These failed order blocks, which then become ICT Breaker Blocks, can indicate where smart money has intentionally reversed the market direction to take advantage of liquidity.

- The Role of ICT Breaker Blocks in Market Reversals: In the context of SMC, ICT Breaker Blocks are not just random occurrences but deliberate actions by institutional traders to reverse the market. When a bullish order block fails and turns into a bearish ICT Breaker Block, it often signals that smart money has finished accumulating positions and is now driving the market in the opposite direction. Understanding this behavior can help traders align their strategies with the actions of smart money, improving their odds of success.

- Combining ICT Breaker Blocks with Other SMC Tools: ICT Breaker Blocks should not be used in isolation but rather in conjunction with other Smart Money Concepts like Fair Value Gaps (FVG), Mitigation Blocks, and Optimal Trade Entries (OTE). For example, an ICT Breaker Block that aligns with a Fair Value Gap can be a strong indicator of a high-probability trade setup. Similarly, identifying an Optimal Trade Entry within the zone of an ICT Breaker Block can provide a precise point for entering a trade, enhancing the accuracy and profitability of the strategy.

- Developing a Confluence-Based Trading System: The most successful traders using Smart Money Concepts often rely on confluence, which means aligning multiple signals from different tools and indicators. ICT Breaker Blocks play a crucial role in this by acting as a key indicator of market reversals or continuations. When an ICT Breaker Block is confirmed by other SMC tools or traditional technical analysis, it can form the basis of a robust, confluence-based trading system that significantly improves trading accuracy.

Read More: Mastering ICT Change In State Of Delivery

Is the ICT Breaker Block Trading Strategy Good or Bad?

The effectiveness of the ICT Breaker Block trading strategy depends largely on the trader’s experience, skill level, and approach. While many traders have found success using this strategy, others may find it challenging to apply consistently.

Why It’s Good

- Strategic Analysis: The ICT Breaker Block strategy provides a structured way to analyze potential market reversals and capitalize on these opportunities. It encourages traders to think critically about market structure and liquidity.

- Adaptability: The strategy can be adapted to various trading styles and timeframes. Whether you are a day trader, swing trader, or position trader, ICT Breaker Blocks can be integrated into your approach.

- Synergy with Other Concepts: ICT Breaker Blocks work well when combined with other trading strategies and technical indicators. This synergy can help create a more robust and reliable trading system.

Why It’s Bad

- High Skill Requirement: Successfully identifying and trading ICT Breaker Blocks requires a deep understanding of market structure and liquidity. This level of skill may be challenging for less experienced traders.

- Not Foolproof: Like all trading strategies, the ICT Breaker Block strategy is not infallible. There will be times when the market behaves unpredictably, leading to potential losses if the strategy is not executed with precision.

- Potential Over-Reliance: Traders who rely too heavily on ICT Breaker Blocks without considering other market factors may find themselves caught off guard by unexpected price movements.

Ultimately, the success of the ICT Breaker Block strategy hinges on how well it is integrated with other trading concepts and tools. It is most effective when used as part of a comprehensive trading plan that accounts for various market conditions.

OpoFinance Services: Elevate Your Trading with a Trusted Broker

To maximize the effectiveness of the ICT Breaker Block strategy, it’s essential to trade with a broker that provides the right tools, security, and support. OpoFinance, an ASIC-regulated broker, offers a comprehensive trading platform designed to meet the needs of both novice and experienced traders.

Why Choose OpoFinance?

- Regulation and Trust: OpoFinance is regulated by the Australian Securities and Investments Commission (ASIC), one of the most reputable financial regulatory bodies. This ensures a secure trading environment, giving you peace of mind as you trade.

- Advanced Trading Tools: OpoFinance provides state-of-the-art charting tools, real-time market data, and a wealth of educational resources. These tools are essential for effectively applying strategies like ICT Breaker Blocks in your trading.

- Social Trading Platform: OpoFinance’s social trading feature allows you to follow and replicate the trades of successful traders. This can be particularly beneficial if you’re new to the ICT Breaker Block strategy and want to see how experienced traders are applying it in real-time.

- Comprehensive Support: OpoFinance offers robust customer support, ensuring that any issues or questions you have are addressed promptly. This level of support is crucial for traders who want to focus on trading rather than navigating technical difficulties.

OpoFinance: Your Partner in ICT Breaker Block Trading

OpoFinance’s platform is ideally suited for traders looking to implement the ICT Breaker Block strategy. With its advanced tools, reliable regulation, and supportive community, OpoFinance provides everything you need to trade confidently and effectively.

By choosing OpoFinance, you can enhance your trading strategy and increase your chances of success in the forex market.

Read More: Mastering The ICT 30 Second Model

Conclusion

ICT Breaker Blocks are a powerful trading concept that, when used correctly, can provide significant insights into market movements and enhance trading strategies. By understanding the role of ICT Breaker Blocks in market structure, learning how to identify and use them effectively, and combining them with other technical analysis tools, traders can increase their chances of success in the forex market.

However, it’s important to remember that no strategy is foolproof. The key to successful trading lies in continuous learning, disciplined execution, and a well-rounded approach that considers multiple market factors. With the right tools and a reliable broker like OpoFinance, you can confidently navigate the complexities of forex trading and make informed decisions that align with your trading goals.

What is the difference between an ICT Breaker Block and a Mitigation Block?

The primary difference between an ICT Breaker Block and a Mitigation Block lies in their formation and role in market structure. An ICT Breaker Block forms after a higher high or lower low is broken, signaling a reversal in market direction. A Mitigation Block, on the other hand, is a tool used by traders to mitigate potential losses after a price movement but does not necessarily indicate a complete reversal.

What is the best time frame for trading ICT Breaker Blocks in Forex?

The ideal time frame for trading ICT Breaker Blocks depends on your trading style and strategy. However, many traders find success using multiple time frame analyses to confirm trends and identify optimal entry points.

What are the risks of trading with ICT Breaker Blocks?

The main risks include false breakouts, overtrading, and poor risk management. These can lead to significant losses if not properly managed, emphasizing the importance of discipline and careful analysis when using this strategy.