A Dow Jones scalping strategy is a high-frequency trading approach that aims to profit from small price movements in the Dow Jones Industrial Average (DJIA) index. This method involves making numerous quick trades throughout the day, capitalizing on minor fluctuations in the market. By mastering a Dow Jones scalping strategy, day traders can potentially generate consistent profits through rapid buying and selling of US30 futures or CFDs.

This comprehensive guide will walk you through the best US30 scalping strategies, equipping you with the knowledge and tools to navigate this fast-paced trading style. We’ll explore various techniques, from momentum-based approaches to range trading, all tailored specifically for the Dow Jones index. Whether you’re a seasoned trader looking to refine your skills or a newcomer eager to explore index scalping, this article provides valuable insights to enhance your trading performance.

As we delve into the intricacies of Dow Jones scalping, it’s crucial to emphasize the importance of choosing a reputable online forex broker. A reliable, regulated forex broker can provide the necessary tools, execution speed, and market access essential for successful scalping. Throughout this guide, we’ll discuss how to leverage these broker services to implement effective scalping strategies and maximize your trading potential in the dynamic world of the Dow Jones Industrial Average.

From understanding the unique characteristics of the Dow Jones to implementing advanced technical analysis and risk management techniques, this article covers everything you need to know to develop a robust scalping strategy. Let’s embark on this journey to master the art of quick profits in one of the world’s most watched financial indices.

Understanding the Dow Jones and Scalping

What is the Dow Jones Industrial Average?

The Dow Jones Industrial Average, often referred to as “the Dow,” is one of the most widely recognized stock market indices in the world. Comprised of 30 large, publicly-owned companies listed on the New York Stock Exchange (NYSE) and NASDAQ, the Dow serves as a barometer for the overall health of the U.S. stock market and economy.

The Dow is a price-weighted index, meaning that higher-priced stocks have a greater impact on its value. This unique characteristic sets it apart from other major indices like the S&P 500, which is market-cap weighted. Understanding this distinction is crucial for scalpers, as it can influence how individual stock movements affect the overall index.

The Concept of Scalping

Scalping is a trading strategy that aims to profit from small price changes in a security. Traders who employ this method, known as scalpers, make numerous trades within a single day, holding positions for very short periods—often just a few minutes or even seconds.

The philosophy behind scalping is that small moves in price are easier to catch than large ones, and that smaller moves occur more frequently than larger ones. Scalpers aim to take advantage of the market’s natural noise and volatility to make quick, small profits repeatedly throughout the day.

Why Scalp the Dow Jones?

- High Liquidity: The Dow Jones index is highly liquid, meaning trades can be executed quickly and with minimal slippage. This is crucial for scalpers who need to enter and exit positions rapidly.

- Volatility: The index often experiences small but frequent price movements, ideal for scalping. These movements are influenced by various factors, including economic data releases, corporate earnings reports, and global events.

- Popularity: As a widely followed index, there’s no shortage of news and analysis to inform trading decisions. This abundance of information can help scalpers make more informed decisions.

- Extended Trading Hours: Many brokers offer trading on Dow Jones futures nearly 24 hours a day, providing ample opportunities for scalpers in different time zones.

- Technical Analysis Applicability: The Dow Jones tends to respect technical levels and patterns, making it suitable for scalpers who rely heavily on technical analysis.

Key Components of a Successful Dow Jones Scalping Strategy

1. Technical Analysis Tools

To effectively scalp the Dow Jones, traders must become proficient in using various technical analysis tools:

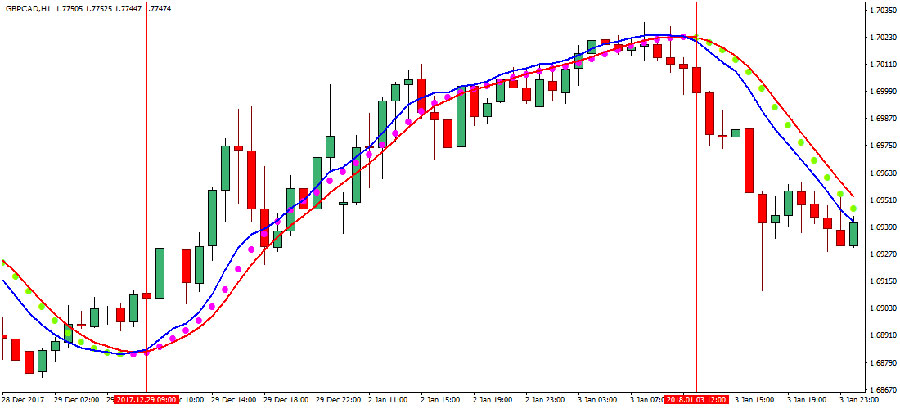

- Moving Averages: Use short-term moving averages (e.g., 5, 10, and 20 periods) to identify trend direction and potential entry/exit points. The crossover of these moving averages can signal potential trend changes.

- Bollinger Bands: These can help identify overbought or oversold conditions, as well as potential breakouts. When the price touches the upper or lower band, it may indicate a potential reversal.

- Relative Strength Index (RSI): This momentum oscillator can signal when the index might be ready for a reversal. Readings above 70 typically indicate overbought conditions, while readings below 30 suggest oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator can help identify momentum changes and potential trend reversals. Look for MACD line crossovers with the signal line for entry and exit signals.

- Stochastic Oscillator: This momentum indicator compares a closing price to its price range over a specific period. It can be particularly useful for identifying potential reversal points in ranging markets.

2. Price Action Analysis

Understanding price action is crucial for any scalping strategy, especially when trading the Dow Jones. Look for patterns such as:

- Support and Resistance Levels: Identify key price levels where the index tends to bounce or reverse. These levels can be used to set entry points, stop losses, and take profit targets.

- Candlestick Patterns: Recognizing patterns like doji, engulfing, and hammer candles can provide valuable insights into short-term price movements. For example, a bullish engulfing pattern at a support level could signal a potential upward move.

- Trend Lines: Drawing trend lines can help you visualize the overall direction of the market. Look for bounces off trend lines as potential entry points, and breaks of trend lines as possible trend reversal signals.

- Chart Patterns: Familiarize yourself with common chart patterns such as triangles, flags, and head and shoulders. These patterns can offer insights into potential price movements and breakouts.

3. News and Economic Calendar Awareness

While technical analysis forms the backbone of most scalping strategies, staying informed about relevant news and economic events is equally important:

- Economic Releases: Be aware of major economic indicators that can affect the Dow, such as GDP reports, employment data, and Federal Reserve announcements. These releases can cause significant short-term volatility.

- Company Earnings: Since the Dow consists of 30 major companies, their earnings reports can significantly impact the index. Pay attention to earnings calendars and be prepared for increased volatility around these events.

- Geopolitical Events: Global events can cause rapid fluctuations in the Dow, creating both opportunities and risks for scalpers. Stay informed about international trade relations, political developments, and global economic trends.

- Market Sentiment: Keep an eye on overall market sentiment indicators, such as the VIX (Volatility Index) or the Put/Call ratio. These can provide insights into potential market direction and volatility.

Scalping Strategies for the Dow Jones

1. Momentum Scalping

Momentum scalping involves identifying and capitalizing on strong, short-term price movements.

Key Elements:

- Use momentum indicators like RSI or MACD to identify overbought or oversold conditions.

- Look for breakouts above resistance or below support levels.

- Enter trades in the direction of the momentum.

- Set tight stop-losses and take-profit levels.

2. Range Scalping

Range scalping is effective when the Dow Jones is trading within a defined range.

Key Elements:

- Identify clear support and resistance levels.

- Enter long positions near support and short positions near resistance.

- Use oscillators like Stochastic or RSI to confirm overbought/oversold conditions.

- Set stop-losses outside the range and take-profits within the range.

3. News Scalping

News scalping involves taking advantage of short-term price movements caused by economic releases or breaking news.

Key Elements:

- Stay informed about upcoming economic releases and potential market-moving events.

- Be prepared to enter trades quickly as news breaks.

- Use wide stop-losses to account for increased volatility.

- Exit trades rapidly as the initial news-driven move often retraces.

4. Trend-Following Scalping

This strategy involves identifying and trading in the direction of the short-term trend.

Key Elements:

- Use multiple timeframes to confirm the trend (e.g., 5-minute and 15-minute charts).

- Enter trades on pullbacks in the direction of the trend.

- Use moving averages to identify trend direction and potential entry points.

- Trail your stop-loss to protect profits as the trend progresses.

5. Breakout Scalping

Breakout scalping involves entering trades when the price breaks out of a established range or pattern.

Key Elements:

- Identify key levels of support and resistance or chart patterns like triangles and flags.

- Enter trades when the price breaks out of these levels or patterns with increased volume.

- Set stop-losses just inside the broken level or pattern.

- Use measured moves or nearby resistance/support levels for take-profit targets.

Developing Your Dow Jones Scalping Strategy

Step 1: Choose Your Timeframe

For Dow Jones scalping, most traders focus on 1-minute to 5-minute charts. The timeframe you choose will depend on your trading style and risk tolerance:

- 1-Minute Charts: Offer the most trading opportunities but require quick decision-making and execution. These charts are suitable for very short-term scalping strategies and traders who can handle high-stress environments.

- 3-Minute Charts: Provide a balance between frequency of trades and signal reliability. This timeframe can help filter out some of the noise present in 1-minute charts while still offering numerous trading opportunities.

- 5-Minute Charts: May offer fewer but potentially more reliable trading signals. This timeframe is often preferred by beginners or those who want a slightly longer-term perspective on price movements.

Consider using multiple timeframes in your analysis. For example, you might use a 15-minute chart to identify the overall trend, and then switch to a 1-minute or 3-minute chart for precise entry and exit points.

Step 2: Set Clear Entry and Exit Rules

Successful scalping requires disciplined entry and exit strategies:

- Entry Rules:

- Look for price action confirming a short-term trend, such as a series of higher highs and higher lows for an uptrend.

- Use momentum indicators like RSI to confirm overbought or oversold conditions. For example, an RSI reading below 30 might signal a potential long entry in an overall uptrend.

- Wait for a break of key support or resistance levels, especially when accompanied by increased volume.

- Consider using multiple confirming factors before entering a trade. For instance, a breakout above resistance, with strong volume and a bullish candlestick pattern.

- Exit Rules:

- Set tight stop-loss orders to minimize potential losses. A common approach is to place stops just beyond recent swing highs or lows.

- Use a fixed take-profit level or trailing stop to secure gains. For example, you might aim for a 1:2 risk-reward ratio on each trade.

- Exit trades based on reversal signals from your chosen indicators, such as a bearish divergence on RSI for a long trade.

- Consider partial profit-taking. For instance, close half the position at your initial target and move the stop-loss to breakeven for the remainder.

Step 3: Implement Proper Risk Management

Risk management is paramount in scalping due to the high frequency of trades and the potential for quick losses. Consider the following:

- Position Sizing: Never risk more than 1-2% of your trading capital on a single trade. For example, if your account balance is $10,000, you shouldn’t risk more than $100-$200 per trade.

- Stop-Loss Placement: Place stops just beyond key support or resistance levels. For instance, if you’re going long at a support level of 34,000, you might place your stop-loss at 33,980.

- Risk-Reward Ratio: Aim for a minimum risk-reward ratio of 1:1.5 to ensure profitability over time. This means if you’re risking $100 on a trade, your potential profit should be at least $150.

- Daily Loss Limit: Set a maximum daily loss limit, such as 3-5% of your account balance. If you hit this limit, stop trading for the day to prevent emotional decision-making.

- Profit Target: Similarly, consider setting a daily profit target. Once reached, you might choose to stop trading to protect your gains.

Step 4: Practice and Refine

Before trading with real money, extensively backtest and paper trade your strategy:

- Use historical data to simulate your strategy and analyze its performance. Many trading platforms offer backtesting capabilities.

- Practice on a demo account to refine your execution without risking capital. This allows you to get comfortable with your chosen broker’s platform and to test your strategy in real-time market conditions.

- Keep a detailed trading journal to track your progress and identify areas for improvement. Record not just your trades, but also your thought process, market conditions, and any relevant news or events.

- Regularly review and analyze your trading performance. Look for patterns in your winning and losing trades, and adjust your strategy accordingly.

- Stay educated and informed about market developments and new trading techniques. The financial markets are constantly evolving, and successful traders evolve with them.

OpoFinance Services: Your Partner in Dow Jones Scalping

When it comes to executing a successful Dow Jones scalping strategy, having a reliable and regulated forex broker is essential. OpoFinance stands out as an ASIC-regulated broker, offering traders a secure and efficient platform for their scalping endeavors. With its advanced trading tools, competitive spreads, and fast execution speeds, OpoFinance provides the ideal environment for implementing your US30 scalping strategy.

One of the standout features of OpoFinance is its innovative social trading service. This feature allows novice traders to follow and automatically copy the trades of experienced Dow Jones scalpers, providing an excellent opportunity to learn and potentially profit from expert strategies. Whether you’re a seasoned trader looking to optimize your scalping technique or a beginner seeking to enter the world of index trading, OpoFinance’s comprehensive suite of services and regulatory compliance make it an excellent choice for your trading journey.

Conclusion

Mastering a Dow Jones scalping strategy requires dedication, discipline, and continuous learning. By understanding the intricacies of the index, employing robust technical analysis, and maintaining strict risk management practices, traders can potentially capitalize on the frequent price movements of this iconic market barometer. Remember that scalping is a high-intensity trading style that may not be suitable for everyone. It’s crucial to thoroughly test your strategy, manage your risks carefully, and stay informed about market conditions.

As you embark on your Dow Jones scalping journey, keep refining your approach, stay adaptable to changing market conditions, and never stop educating yourself about new trading techniques and market dynamics. With patience, practice, and perseverance, you can develop a profitable Dow Jones scalping strategy that aligns with your trading goals and risk tolerance.

How much capital do I need to start scalping the Dow Jones?

While there’s no set minimum, it’s generally recommended to have at least $5,000 to $10,000 to start scalping the Dow Jones effectively. This amount allows for proper position sizing and risk management. Remember, scalping involves frequent trades, so you need enough capital to withstand potential drawdowns and cover transaction costs. Always start with an amount you can afford to lose and consider using a demo account first to practice your strategy without risking real money.

Can I scalp the Dow Jones using CFDs instead of futures contracts?

Yes, you can scalp the Dow Jones using Contracts for Difference (CFDs). Many forex and CFD brokers offer Dow Jones CFDs, which can be advantageous for scalpers due to their lower capital requirements and the ability to go long or short easily. However, be aware that CFDs come with their own risks, including potential overnight financing charges for positions held beyond the trading day. Always understand the terms and conditions of your chosen instrument and broker before trading.

How do I handle news releases when scalping the Dow Jones?

Handling news releases while scalping the Dow Jones requires caution and preparation. It’s often advisable to avoid trading immediately before and during major economic announcements, as these can cause extreme volatility and price gaps. If you do choose to trade during news events, consider widening your stop-loss orders to account for increased volatility. Alternatively, some scalpers prefer to take advantage of the increased volatility by waiting for a clear trend to emerge shortly after the news release before entering a trade. Always prioritize risk management and be prepared for rapid market movements during these periods.