When it comes to forex trading, the choice between scalping vs swing trading is a crucial decision that can significantly impact your success and trading lifestyle. Both strategies have their merits, but understanding their nuances is essential for aligning your trading approach with your goals, risk tolerance, and available time commitment.

Scalping involves making numerous short-term trades within a single day to profit from small price movements, while swing trading focuses on capturing larger “swings” in asset prices over periods ranging from a few days to several weeks. In this comprehensive guide, we’ll explore the key differences between scalping vs swing trading, delving into their pros and cons, and providing valuable insights to help you determine which strategy best suits your trading style.

Whether you’re considering forex scalping vs swing trading or looking to refine your existing approach, this article will equip you with the knowledge to make an informed decision. We’ll cover essential topics such as time commitment, profit potential, risk management, and the psychological factors involved in each strategy. We’ll also discuss how to choose the right online forex broker to support your preferred trading style, ensuring you have the tools and resources needed for success in the dynamic world of forex trading.

Understanding Scalping and Swing Trading

What is Scalping?

Scalping is a high-frequency trading strategy that aims to profit from small price movements in the forex market. Scalpers typically hold positions for very short periods, often just a few seconds to minutes. The goal is to make many small profits throughout the day, which can add up to significant gains.

What is Swing Trading?

Swing trading is a strategy that aims to capture medium-term price movements or “swings” in the forex market. Swing traders typically hold positions for several days to weeks, looking to profit from larger price movements compared to scalping.

Key Characteristics and Advantages

Scalping Characteristics

- Rapid-fire trades: Scalpers may execute dozens or even hundreds of trades per day.

- Minimal price movements: Profits are typically measured in pips, with traders aiming for 5-10 pips per trade.

- Short holding periods: Positions are rarely held overnight, reducing exposure to overnight risks.

- High leverage: Scalpers often use high leverage to magnify small price movements.

- Intense focus: Requires constant monitoring of charts and quick decision-making.

Swing Trading Characteristics

- Longer holding periods: Trades can last from a few days to several weeks.

- Larger price movements: Swing traders aim for more significant profits, often 50-200 pips or more per trade.

- Less frequent trades: Typically involves fewer trades compared to scalping, often just a few per week.

- Technical and fundamental analysis: Incorporates both chart patterns and economic factors.

- Lower time commitment: Doesn’t require constant monitoring of the markets.

Advantages of Scalping

- Frequent opportunities: Market volatility creates numerous trading chances throughout the day.

- Reduced exposure: Short holding periods limit the risk of significant adverse price movements.

- Quick feedback: Traders can quickly assess the effectiveness of their strategies.

- Potential for consistent profits: Small gains can accumulate into substantial returns over time.

Advantages of Swing Trading

- Larger profit potential: Targeting bigger price movements can lead to more substantial gains per trade.

- Lower stress: Less frequent trades and longer holding periods reduce day-to-day pressure.

- Better work-life balance: Suitable for part-time traders or those with full-time jobs.

- Lower transaction costs: Fewer trades mean lower overall commissions and spreads.

Challenges and Risks

Challenges of Scalping

- High stress: The fast-paced nature of scalping can be mentally and emotionally demanding.

- Transaction costs: Frequent trades can lead to higher commission and spread costs.

- Technology dependence: Requires reliable, high-speed internet and advanced trading platforms.

- Discipline: Strict adherence to stop-loss and take-profit levels is crucial.

Challenges of Swing Trading

- Overnight and weekend risk: Holding positions for longer periods exposes traders to gap risks.

- Requires patience: Traders must be comfortable waiting for setups and letting profits run.

- Larger stop-losses: Wider stops are necessary to accommodate larger price swings.

- Fewer opportunities: Compared to scalping, there are fewer trade setups available.

Scalping vs Swing Trading: A Detailed Comparison

Time Commitment

Scalping: Demands full-time attention during trading hours, often requiring traders to be glued to their screens for extended periods. It’s not uncommon for scalpers to spend 6-8 hours per day actively trading.

Swing Trading: Offers more flexibility, allowing traders to analyze markets and place trades during off-hours. Typically requires 1-2 hours per day for analysis and trade management.

Profit Potential

Scalping: Relies on accumulating many small profits. A successful scalper might aim for 10-20 pips per trade, executing 20-30 trades per day. With proper risk management, this can lead to consistent daily profits.

Swing Trading: Targets larger moves, with potential profits of 100-300 pips per trade. While there are fewer trades, each successful position can significantly impact the overall portfolio.

Risk Management

Scalping: Requires tight stop-losses, often just a few pips away from entry. The risk per trade is typically small, but the frequent trading can lead to higher overall risk if not managed properly.

Swing Trading: Uses wider stop-losses to accommodate market volatility. While the risk per trade is higher, the lower frequency of trades can make overall risk management more manageable.

Market Analysis

Scalping: Focuses primarily on technical analysis, with an emphasis on short-term chart patterns, support and resistance levels, and momentum indicators.

Swing Trading: Incorporates both technical and fundamental analysis. Traders consider longer-term trends, economic data releases, and geopolitical events in addition to chart patterns.

Psychological Factors

Scalping: Requires quick decision-making and the ability to handle high-stress situations. Emotional control is crucial, as losses can accumulate quickly if a trader hesitates or second-guesses their strategy.

Swing Trading: Demands patience and discipline to hold positions through market fluctuations. Traders must be comfortable with larger paper gains and losses as positions develop over time.

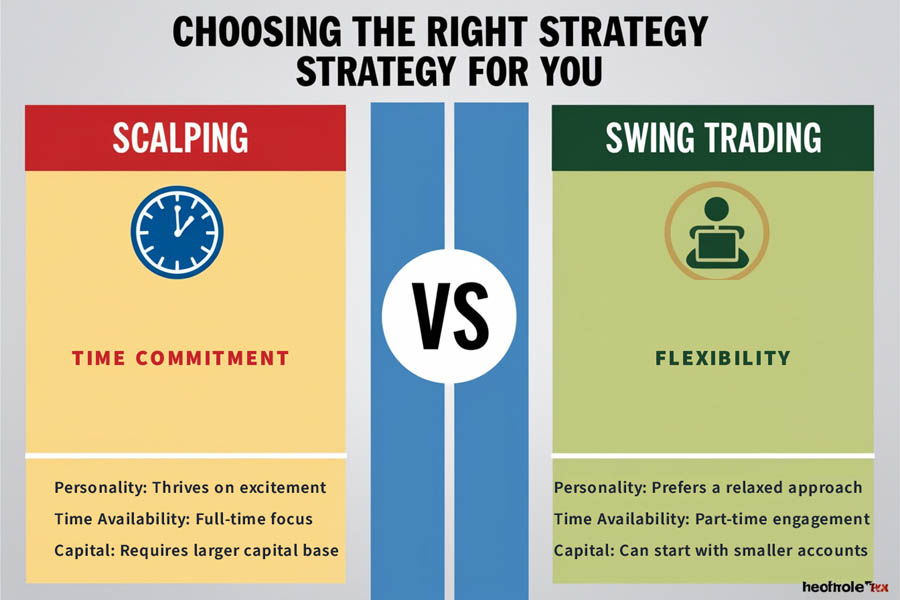

Choosing the Right Strategy for You

Personality Traits

- Scalping suits: Those who thrive on excitement, can make quick decisions, and handle stress well.

- Swing trading suits: Patient individuals who prefer a more relaxed approach and can detach emotionally from short-term market movements.

Time Availability

- Full-time traders: May find scalping more suitable, as it allows for maximum engagement with the markets.

- Part-time traders: Often gravitate towards swing trading due to its lower time commitment and flexibility.

Capital Requirements

- Scalping: Generally requires a larger capital base to withstand the impact of transaction costs and to meet minimum position size requirements for frequent trades.

- Swing trading: Can be started with smaller accounts, as the lower frequency of trades reduces the impact of transaction costs.

Market Conditions

- Scalping: Thrives in volatile markets with high liquidity, making major currency pairs ideal.

- Swing trading: Can be applied to a wider range of markets and can capitalize on both trending and ranging conditions.

Tools and Techniques for Success

Essential Tools for Scalping

- Real-time charting software: With 1-minute and 5-minute timeframes for quick analysis.

- Level 2 market depth: To gauge order flow and potential price movements.

- Hot keys: For rapid order execution and position management.

- Momentum indicators: Such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD).

Key Techniques for Scalping

- Breakout trading: Capitalizing on sudden price movements beyond support or resistance levels.

- Range trading: Profiting from oscillations between established price boundaries.

- News trading: Exploiting short-term volatility following economic data releases.

Essential Tools for Swing Trading

- Multi-timeframe analysis: Combining daily, 4-hour, and 1-hour charts for a comprehensive view.

- Trend indicators: Such as moving averages and the Average Directional Index (ADX).

- Economic calendar: To track important news events and data releases.

- Fibonacci retracement tools: For identifying potential reversal levels.

Key Techniques for Swing Trading

- Trend following: Aligning trades with the prevailing market direction.

- Counter-trend trading: Identifying potential reversal points in established trends.

- Chart pattern recognition: Using classic patterns like head and shoulders, triangles, and flags.

Risk Management Strategies

For Scalping

- Use tight stop-losses: Typically 5-10 pips from entry.

- Implement a risk-per-trade limit: Often 0.5% to 1% of account balance.

- Set daily loss limits: To prevent overtrading and protect capital.

- Use trailing stops: To lock in profits as the trade moves in your favor.

For Swing Trading

- Set wider stop-losses: Often 50-100 pips, depending on market volatility.

- Use a lower risk-per-trade: Typically 1-2% of account balance.

- Implement partial profit-taking: To secure gains while letting winners run.

- Consider options for hedging: To protect against overnight gaps or weekend risk.

Adapting Your Strategy to Market Conditions

Successful traders often find that a blend of scalping and swing trading techniques can be advantageous, allowing them to adapt to changing market conditions. Here are some scenarios where you might consider adjusting your approach:

High Volatility Markets

- Scalping: Can be highly effective during volatile periods, as price movements are more pronounced.

- Swing Trading: May require tighter stop-losses and more frequent position monitoring.

Low Volatility Markets

- Scalping: Can become challenging due to limited price movements.

- Swing Trading: Often thrives in range-bound markets, allowing traders to capitalize on predictable price oscillations.

Trending Markets

- Scalping: Can be profitable when trading in the direction of the trend.

- Swing Trading: Ideal for capturing larger moves within the overall trend.

News-Driven Markets

- Scalping: Can capitalize on short-term volatility following news releases.

- Swing Trading: May require adjusting stop-losses or temporarily exiting positions to avoid news-related gaps.

By understanding how different market conditions affect each strategy, you can develop a more flexible and resilient trading approach.

OpoFinance Services

For traders looking to implement either scalping or swing trading strategies, choosing the right broker is crucial. OpoFinance, an ASIC-regulated forex broker, offers a comprehensive platform that caters to both scalpers and swing traders. Their advanced trading technology ensures fast execution speeds, essential for scalping, while their robust analytical tools support the in-depth analysis required for swing trading.

One standout feature of OpoFinance is their social trading service, which can be particularly beneficial for those new to forex trading or looking to diversify their strategies. This service allows traders to follow and automatically copy the trades of experienced professionals, providing an opportunity to learn from successful traders and potentially enhance returns.

OpoFinance’s commitment to regulatory compliance and transparent trading conditions makes it a reliable choice for traders of all experience levels. Whether you’re a high-frequency scalper or a patient swing trader, their platform offers the tools and support needed to execute your chosen strategy effectively.

Conclusion

The debate between scalping vs swing trading ultimately comes down to personal preference, trading style, and individual circumstances. Both strategies have proven successful for many traders, but each requires a different set of skills, tools, and mindset.

Scalping offers the allure of frequent action and the potential for consistent small gains, but demands intense focus and a high tolerance for stress. Swing trading, on the other hand, provides a more relaxed approach with the opportunity for larger profits per trade, but requires patience and the ability to weather short-term market fluctuations.

As you consider which strategy to adopt, remember that success in forex trading comes not just from choosing the right approach, but from developing a deep understanding of market dynamics, implementing robust risk management, and continuously refining your skills. Whether you opt for the rapid-fire world of scalping or the more measured pace of swing trading, commitment to education and disciplined execution will be key to your long-term success in the forex market.

Ultimately, the best strategy is one that aligns with your personal goals, risk tolerance, and lifestyle. Many successful traders find value in incorporating elements of both scalping and swing trading into their overall approach, allowing them to adapt to different market conditions and capitalize on a wider range of opportunities.

As you embark on your trading journey, consider starting with a demo account to practice your chosen strategy without risking real capital. This will allow you to refine your techniques, test your risk management strategies, and gain confidence in your ability to execute trades effectively.

Remember, becoming a successful trader is a journey that requires patience, dedication, and continuous learning. Whether you choose scalping, swing trading, or a combination of both, stay committed to your education, remain disciplined in your approach, and always prioritize risk management. With time and experience, you’ll develop the skills and intuition needed to navigate the exciting and challenging world of forex trading successfully.

How does leverage differ in scalping vs swing trading?

Leverage usage typically differs significantly between scalping and swing trading. Scalpers often use higher leverage ratios, sometimes up to 50:1 or even 100:1, to magnify small price movements into meaningful profits. This is because scalp trades aim for small pip movements, and higher leverage allows for larger position sizes relative to account balance.

Swing traders, on the other hand, generally use lower leverage ratios, often around 10:1 to 20:1. This is because swing trades are held for longer periods and are exposed to larger price movements. Lower leverage helps manage risk and prevents large drawdowns during adverse price swings.

It’s crucial to note that while higher leverage can amplify profits, it also increases the risk of significant losses. Traders should always use leverage cautiously and in line with their risk tolerance and trading strategy.

Can scalping and swing trading be combined effectively?

Yes, scalping and swing trading can be combined effectively, creating a hybrid approach that some traders find beneficial. This strategy, sometimes called “multi-timeframe trading,” involves using shorter-term scalping techniques within the context of a larger swing trade.

For example, a trader might identify a swing trade opportunity on a daily chart and enter a position. While holding this swing trade, they might use scalping techniques on shorter timeframes (like 5-minute or 15-minute charts) to fine-tune entries and exits or to capture additional profits within the larger price swing.

This combined approach can potentially enhance overall profitability and provide more trading opportunities. However, it requires a deep understanding of both strategies and the ability to manage multiple positions across different timeframes effectively.

How do market conditions affect the choice between scalping and swing trading?

Market conditions play a crucial role in determining the effectiveness of scalping versus swing trading strategies. Scalping tends to perform best in highly liquid markets with tight spreads and high volatility. These conditions are often found in major currency pairs during peak trading hours.

Swing trading, conversely, can be effective in a wider range of market conditions. It can capitalize on both trending and ranging markets, and can be applied to less liquid currency pairs or other financial instruments.

During periods of low volatility or ranging markets, scalping may become challenging due to the lack of price movement. In such conditions, swing trading might be more suitable as it allows traders to capture larger moves over time.

Conversely, in extremely volatile markets or during major news events, swing traders might find it difficult to hold positions due to large price swings. Scalpers, however, might thrive in such environments, capitalizing on the increased short-term trading opportunities.

Ultimately, successful traders often adapt their strategy based on prevailing market conditions, switching between scalping and swing trading as appropriate.