The Bollinger Bands scalping strategy is a powerful technique that combines the versatility of Bollinger Bands with the fast-paced approach of scalping to capture quick profits in the forex market. This strategy involves using Bollinger Bands settings optimized for short-term trading to identify potential entry and exit points, allowing traders to make multiple small profits throughout the day. Whether you’re using an online forex broker or a regulated forex broker, mastering this strategy can significantly enhance your trading performance.

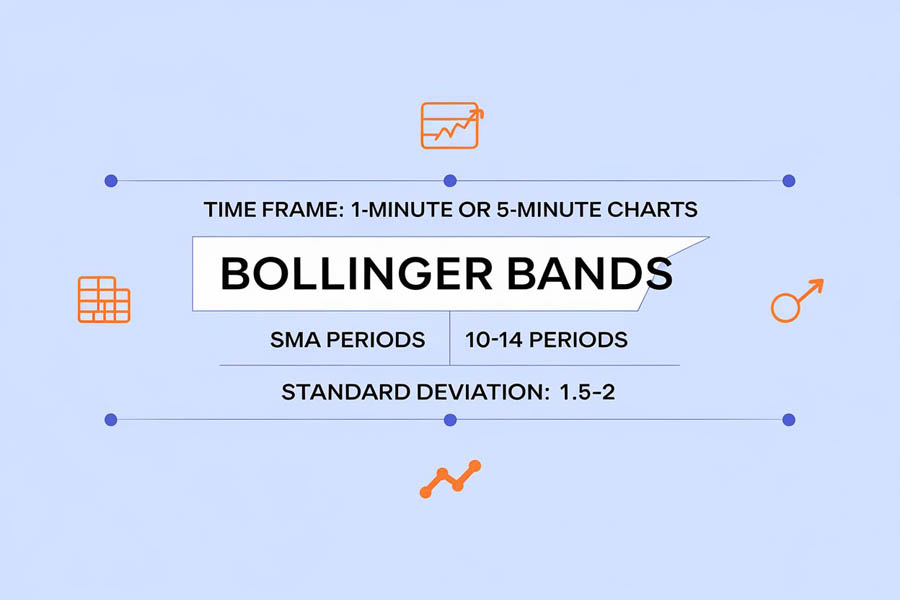

Bollinger Bands, developed by John Bollinger in the 1980s, consist of a middle band (typically a 20-period simple moving average) and two outer bands set at two standard deviations above and below the middle band. When applied to scalping, traders often adjust these settings to suit shorter timeframes, such as using a 10-14 period SMA and 1.5-2 standard deviations on 1-minute or 5-minute charts.

In this comprehensive guide, we’ll reveal seven powerful secrets to mastering the Bollinger Bands scalping strategy, including optimal Bollinger Bands settings for scalping and advanced techniques to maximize your trading success. By the end of this article, you’ll have a thorough understanding of how to implement this strategy effectively and boost your forex trading results.

Understanding Bollinger Bands

What Are Bollinger Bands?

Bollinger Bands are a versatile technical indicator consisting of three lines:

- The middle band: A simple moving average (SMA)

- The upper band: Typically set at 2 standard deviations above the middle band

- The lower band: Typically set at 2 standard deviations below the middle band

These bands expand and contract based on market volatility, providing traders with valuable insights into potential price reversals and breakouts.

How Bollinger Bands Work in Scalping

When it comes to scalping, Bollinger Bands offer several key advantages:

- Volatility measurement: The width of the bands indicates market volatility, helping scalpers identify optimal entry and exit points.

- Trend identification: The direction of the middle band can signal short-term trends.

- Overbought/oversold conditions: Price touches on the upper or lower bands can indicate potential reversal points.

7 Powerful Bollinger Bands Scalping Secrets

1. Master the Optimal Bollinger Bands Settings for Scalping

Finding the right Bollinger Bands settings is crucial for successful scalping. While the standard 20-period SMA with 2 standard deviations works well for many traders, scalpers often benefit from tighter settings:

- Time frame: 1-minute or 5-minute charts

- SMA period: 10-14 periods

- Standard deviation: 1.5-2

Experiment with these settings to find the perfect balance between sensitivity and reliability for your trading style.

2. The Bollinger Band Squeeze Strategy

The Bollinger Band squeeze occurs when volatility decreases, causing the bands to contract. This often precedes significant price movements, making it an excellent opportunity for scalpers.

To capitalize on the squeeze:

- Identify periods of low volatility when the bands narrow

- Watch for a breakout above the upper band or below the lower band

- Enter a trade in the direction of the breakout

- Set a tight stop-loss just inside the opposite band

- Take profits quickly as the price moves in your favor

3. Bollinger Bands Bounce Trading

The Bollinger Bands bounce strategy involves trading price reversals from the outer bands. Here’s how to implement it:

- Wait for the price to touch or slightly penetrate an outer band

- Look for confirmation of a reversal (e.g., candlestick patterns, momentum indicators)

- Enter a trade in the opposite direction of the initial move

- Set a stop-loss beyond the recent extreme

- Target the middle band or the opposite outer band for profit-taking

4. Combining Bollinger Bands with Other Indicators

Enhance your scalping strategy by pairing Bollinger Bands with complementary indicators:

- Relative Strength Index (RSI): Use RSI to confirm overbought/oversold conditions when price touches the outer bands.

- Moving Average Convergence Divergence (MACD): Look for MACD crossovers to confirm trend direction and potential entry points.

- Stochastic Oscillator: Use this indicator to identify potential reversal points in conjunction with Bollinger Band touches.

5. The Bollinger Bands Breakout Strategy

Breakouts can offer excellent scalping opportunities. Here’s how to trade them:

- Identify a strong trend or a period of consolidation

- Wait for the price to break decisively above the upper band or below the lower band

- Enter a trade in the direction of the breakout

- Set a stop-loss at the middle band

- Take profits at 1-2 times the initial risk, or use a trailing stop to capture extended moves

6. Mastering Bollinger Bands Double Bottoms and Double Tops

Double bottoms and double tops forming near the Bollinger Bands can signal potent reversal opportunities:

- Look for two consecutive touches of the lower band (double bottom) or upper band (double top)

- Confirm the pattern with a price move towards the middle band

- Enter a trade as the price crosses the middle band in the direction of the potential reversal

- Set a stop-loss below the recent low (for double bottoms) or above the recent high (for double tops)

- Target the opposite band for profit-taking

7. The Bollinger Bands Trend-Following Strategy

While scalping often focuses on reversals, trending markets can offer lucrative opportunities:

- Identify a strong trend using the direction of the middle band

- Look for pullbacks to the middle band in an uptrend, or rallies to the middle band in a downtrend

- Enter trades in the direction of the overall trend when price bounces off the middle band

- Set a stop-loss at the opposite band

- Take profits at the outer band in the trend direction, or use a trailing stop to capture larger moves

Risk Management in Bollinger Bands Scalping

Effective risk management is crucial for long-term success in scalping. Consider these tips:

- Always use stop-losses: Set a stop-loss for every trade, typically just beyond the opposite Bollinger Band.

- Maintain a favorable risk-reward ratio: Aim for a minimum 1:1.5 risk-reward ratio, preferably 1:2 or higher.

- Limit position sizes: Never risk more than 1-2% of your trading account on a single trade.

- Use proper leverage: While scalping may tempt you to use high leverage, keep it reasonable to avoid excessive risk.

- Implement a daily stop-loss: Set a maximum daily loss limit to protect your account from significant drawdowns.

Common Pitfalls to Avoid in Bollinger Bands Scalping

Be aware of these potential pitfalls when using Bollinger Bands for scalping:

- Overtrading: Don’t feel compelled to take every signal; wait for high-probability setups.

- Ignoring the broader market context: Always consider the larger timeframe trends and key support/resistance levels.

- Neglecting fundamentals: Be aware of major economic news events that can impact your trades.

- Emotional trading: Stick to your strategy and avoid making impulsive decisions based on fear or greed.

- Failing to adapt: Markets change, so be prepared to adjust your strategy when necessary.

Advanced Bollinger Bands Scalping Techniques

To further refine your Bollinger Bands scalping strategy, consider incorporating these advanced techniques:

1. Multiple Timeframe Analysis

While scalping focuses on short-term price movements, incorporating multiple timeframe analysis can provide valuable context:

- Use a higher timeframe (e.g., 15-minute or 1-hour) to identify the overall trend

- Switch to your scalping timeframe (1-minute or 5-minute) to pinpoint precise entry and exit points

- Align your trades with the higher timeframe trend for increased probability of success

2. Bollinger Bands Width Indicator

The Bollinger Bands Width indicator measures the percentage difference between the upper and lower bands:

- Add the Bollinger Bands Width indicator to your chart

- Look for periods of low width, indicating potential squeeze setups

- Use width expansion as a confirmation of breakout strength

3. Fibonacci Retracement with Bollinger Bands

Combining Fibonacci retracement levels with Bollinger Bands can enhance your scalping accuracy:

- Draw Fibonacci retracement levels on recent price swings

- Look for confluences between Fibonacci levels and Bollinger Bands

- Use these confluence zones as potential entry or exit points

4. Volume Analysis

Incorporating volume analysis can help validate Bollinger Bands signals:

- Add a volume indicator to your chart

- Look for increasing volume on breakouts or band touches to confirm the move’s strength

- Be cautious of signals occurring on low volume, as they may lack follow-through

Backtesting and Optimizing Your Bollinger Bands Scalping Strategy

To ensure the effectiveness of your Bollinger Bands scalping strategy, it’s crucial to backtest and optimize it:

- Use historical data: Test your strategy on a significant amount of historical price data to gauge its performance across various market conditions.

- Track key metrics: Monitor win rate, average win/loss size, maximum drawdown, and overall profitability.

- Optimize parameters: Experiment with different Bollinger Bands settings, entry/exit criteria, and risk management rules to find the optimal combination for your trading style.

- Forward testing: After backtesting, implement your strategy in a demo account to validate its performance in real-time market conditions.

- Continuous improvement: Regularly review and refine your strategy based on its performance and changing market dynamics.

The Psychology of Successful Bollinger Bands Scalping

Mastering the psychological aspects of scalping is just as important as perfecting your technical skills:

- Maintain discipline: Stick to your predefined strategy and risk management rules, even during losing streaks.

- Manage stress: Scalping can be intense. Take regular breaks and practice stress-management techniques to maintain peak performance.

- Avoid revenge trading: Don’t try to immediately recover losses by taking unplanned trades.

- Stay focused: Minimize distractions and create a conducive trading environment to maintain concentration during scalping sessions.

- Embrace continuous learning: Stay open to new ideas and regularly analyze your trades to identify areas for improvement.

OpoFinance Services: Your Trusted ASIC-Regulated Forex Broker

When it comes to implementing your Bollinger Bands scalping strategy, choosing the right forex broker is crucial. OpoFinance stands out as an ASIC-regulated broker, offering a secure and reliable trading environment for forex traders of all levels. With competitive spreads, fast execution, and a user-friendly platform, OpoFinance provides the tools you need to succeed in your scalping endeavors.

One of OpoFinance’s standout features is its innovative social trading service. This allows you to connect with experienced traders, observe their strategies, and even automatically copy their trades. For those looking to refine their Bollinger Bands scalping technique, this feature can be invaluable, providing insights from successful traders and helping you accelerate your learning curve.

Conclusion

Mastering the Bollinger Bands scalping strategy can significantly enhance your forex trading performance. By understanding the nuances of this powerful indicator and implementing the seven secrets we’ve explored, you’ll be well-equipped to capitalize on short-term price movements in the forex market.

Remember, successful scalping requires discipline, practice, and continuous learning. Start by paper trading to familiarize yourself with the strategy, then gradually implement it with small position sizes in live markets. As you gain confidence and experience, you can scale up your trading while always maintaining proper risk management.

With the right approach and a reliable broker like OpoFinance by your side, you’re well on your way to unlocking the potential of Bollinger Bands scalping. Happy trading!

How does the Bollinger Bands scalping strategy differ from traditional Bollinger Bands trading?

The Bollinger Bands scalping strategy focuses on much shorter time frames and quicker profits compared to traditional Bollinger Bands trading. Scalpers typically use 1-minute or 5-minute charts and aim to capture small price movements, often entering and exiting trades within minutes. This approach requires faster decision-making and tighter stop-losses than longer-term Bollinger Bands strategies.

Can the Bollinger Bands scalping strategy be applied to cryptocurrencies?

Yes, the Bollinger Bands scalping strategy can be effectively applied to cryptocurrency trading. However, it’s important to note that crypto markets can be more volatile than traditional forex pairs. When scalping cryptocurrencies with Bollinger Bands, you may need to adjust your settings to account for higher volatility, potentially using wider bands or shorter time frames to filter out noise.

How do I handle false breakouts when scalping with Bollinger Bands?

False breakouts can be challenging when scalping with Bollinger Bands. To mitigate this risk, consider implementing additional confirmation signals before entering a trade. This could include waiting for a candle to close beyond the band, using volume analysis to confirm the strength of a move, or incorporating momentum indicators like RSI or MACD. Additionally, using a time-based exit strategy can help limit losses on false breakouts by exiting trades that don’t move in your favor within a predetermined timeframe.