Divergence scalping is a powerful forex trading strategy that can help you capitalize on short-term price movements and maximize profits in the fast-paced world of currency markets. This technique combines technical analysis with quick decision-making to exploit brief market inefficiencies, making it an essential tool for traders looking to enhance their forex broker selection and trading performance. By identifying discrepancies between price action and technical indicators, divergence scalping allows traders to enter and exit positions rapidly, often within minutes. As we delve into this strategy, you’ll discover how to leverage divergence scalping to potentially boost your trading success and navigate the complexities of forex markets with confidence.

What is Divergence Scalping?

Divergence scalping is a short-term trading strategy that focuses on identifying and exploiting discrepancies between price action and technical indicators. This approach is particularly popular among forex traders due to the high liquidity and volatility of currency markets. Here’s a breakdown of the key components:

- Divergence: This occurs when the price of an asset moves in the opposite direction of a technical indicator, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD).

- Scalping: A trading style that aims to profit from small price changes, with positions held for very short periods, typically minutes or even seconds.

- Technical Analysis: The use of charts, indicators, and patterns to predict future price movements based on historical data.

By combining these elements, traders can spot potential reversals or continuations in price trends, allowing them to enter and exit trades quickly for small but frequent profits.

Types of Divergences

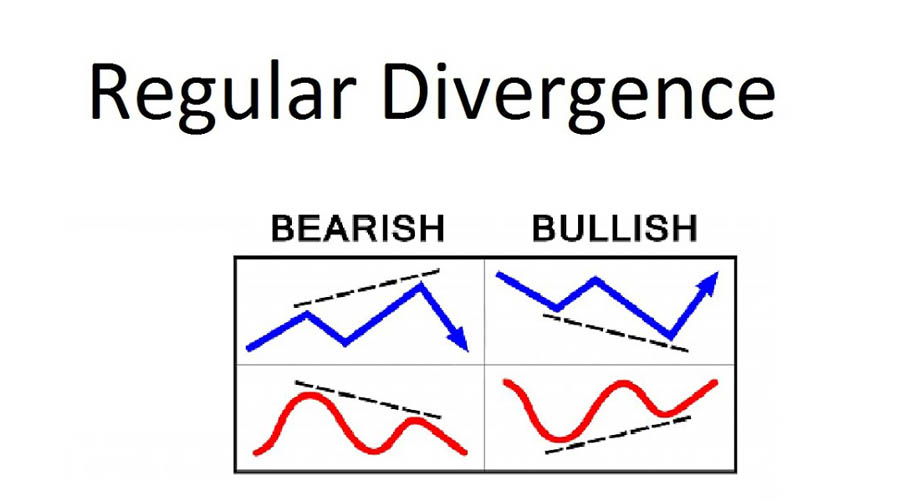

Divergences occur when the price of an asset moves in the opposite direction of a technical indicator. In the context of divergence scalping, recognizing the different types of divergences can provide significant trading opportunities. Each type of divergence signals either a potential reversal or continuation of the trend, which helps scalpers make quick trading decisions. There are four main types of divergences, each offering different insights into market behavior: regular bullish divergence, regular bearish divergence, hidden bullish divergence, and hidden bearish divergence.

1. Regular Bullish Divergence

A regular bullish divergence occurs when the price of a currency pair or asset makes a lower low, while the corresponding technical indicator—such as RSI, MACD, or Stochastic—forms a higher low. This mismatch indicates that the selling pressure is weakening, even though the price is making new lows. Regular bullish divergence is often interpreted as a signal of a potential upward reversal, meaning that the price may soon begin to rise.

Example:

Imagine the EUR/USD pair is in a downtrend, and the price creates a new lower low. However, at the same time, the RSI indicator makes a higher low, suggesting that the momentum behind the downtrend is weakening. Traders would take this as an opportunity to place buy orders in anticipation of a price reversal to the upside.

How to Trade:

- Confirm the divergence with a candlestick reversal pattern like a hammer or bullish engulfing.

- Set stop-loss orders below the most recent low to minimize risk.

- Target nearby resistance levels for potential take profits.

2. Regular Bearish Divergence

A regular bearish divergence occurs when the price makes a higher high, but the technical indicator makes a lower high. This signals that while the price is rising, the underlying strength of the market is fading. The reduced buying momentum implies that a bearish reversal may be imminent. This type of divergence is particularly useful for identifying selling opportunities during a rising market.

Example:

Consider the USD/JPY pair in an uptrend, where the price reaches a new high. However, the MACD or RSI forms a lower high during this time, signaling weakening bullish momentum. Traders can use this divergence as an indication to prepare for a downturn in price.

How to Trade:

- Look for confirmation with bearish candlestick patterns like the shooting star or bearish engulfing.

- Place a stop loss above the most recent high to manage risk.

- Aim for support levels or previous swing lows for setting take profit targets.

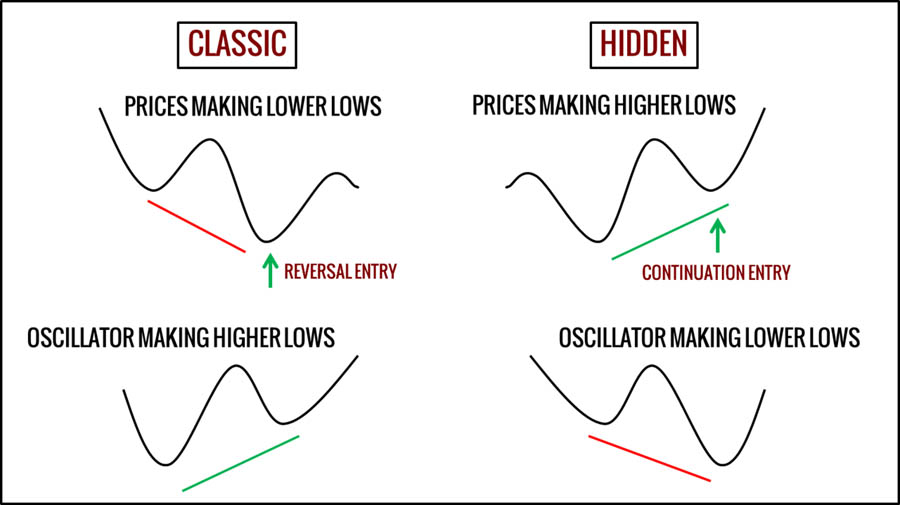

3. Hidden Bullish Divergence

A hidden bullish divergence is often a continuation pattern that occurs within an ongoing uptrend. It forms when the price makes a higher low, but the technical indicator makes a lower low. This signals that, despite the indicator’s reading, the overall bullish trend remains intact, and the market is likely to resume its upward trajectory. Hidden divergences are valuable for identifying pullback entries in a trending market, allowing traders to join the trend at a more favorable price.

Example:

During an uptrend in the GBP/USD pair, the price makes a higher low, but the RSI forms a lower low, suggesting that the pullback may be losing strength and the uptrend could continue. Traders may see this as a buying opportunity to enter the market in the direction of the prevailing trend.

How to Trade:

- Confirm the divergence by identifying key support levels or bullish candlestick formations like a bullish engulfing pattern.

- Set stop-loss orders below the recent swing low to protect against a deeper correction.

- Ride the trend by aiming for higher resistance levels or previous highs as potential profit targets.

4. Hidden Bearish Divergence

A hidden bearish divergence signals a continuation of a downtrend. It occurs when the price makes a lower high, but the technical indicator forms a higher high. This suggests that, while the indicator is showing strength, the underlying market trend is still bearish. Hidden bearish divergence helps traders spot opportunities to enter short positions during retracements in a downtrend.

Example:

Consider the AUD/USD pair in a downtrend, where the price creates a lower high, but the Stochastic Oscillator forms a higher high. This signals that the corrective upward movement is likely temporary, and the broader downtrend may soon resume, providing an opportunity for traders to sell.

How to Trade:

- Look for bearish reversal patterns like a bearish engulfing or dark cloud cover to confirm the divergence.

- Place a stop loss above the recent swing high to limit potential losses.

- Set take profits at recent lows or support levels, aiming to capitalize on the continuation of the downtrend.

Key Technical Indicators for Divergence Scalping

To effectively implement divergence scalping, traders rely on various technical indicators. Here are some of the most popular ones:

- Relative Strength Index (RSI)

- Measures the speed and change of price movements

- Oscillates between 0 and 100

- Divergence is often spotted when RSI doesn’t confirm new highs or lows in price

- Moving Average Convergence Divergence (MACD)

- Shows the relationship between two moving averages

- Divergence occurs when MACD lines don’t confirm price action

- Stochastic Oscillator

- Compares a closing price to its price range over a specific period

- Useful for identifying overbought and oversold conditions

- Commodity Channel Index (CCI)

- Measures the current price level relative to an average price level over a given period

- Helps in identifying cyclical trends and divergences

- Fibonacci Retracement

- Used in conjunction with divergence to identify potential support and resistance levels

- Helps in setting precise entry and exit points

By mastering these indicators, traders can enhance their ability to spot and capitalize on divergences in the forex market.

Setting Up Your Charts for Divergence Scalping

To effectively implement divergence scalping, proper chart setup is crucial. Follow these steps:

- Choose the Right Timeframe

- Most scalpers prefer 1-minute to 15-minute charts

- Consider using multiple timeframes for confirmation

- Select Your Indicators

- Add RSI, MACD, or Stochastic Oscillator to your chart

- Adjust indicator settings to suit your trading style

- Apply Price Action Tools

- Add support and resistance lines

- Include trend lines to identify overall market direction

- Use Candlestick Patterns

- Familiarize yourself with key reversal patterns like pin bars and engulfing candles

- Implement Volume Indicators

- Add volume bars or On-Balance Volume (OBV) to confirm divergences

- Set Up Alerts

- Configure your trading platform to notify you of potential divergences

By optimizing your chart layout and tools, you’ll be better equipped to spot and act on divergence opportunities quickly and efficiently.

Step-by-Step Guide to Executing a Divergence Scalp Trade

Follow these steps to implement a divergence scalping strategy:

- Identify the Divergence

- Look for discrepancies between price action and your chosen indicator

- Confirm the type of divergence (regular or hidden, bullish or bearish)

- Wait for Confirmation

- Look for candlestick patterns or price action that supports the divergence

- Check for confluence with other technical factors (e.g., support/resistance levels)

- Set Entry Order

- Place a market or limit order when confirmation is received

- Consider using a stop entry order to avoid false breakouts

- Determine Stop Loss

- Set a tight stop loss based on recent price swings or indicator levels

- Typically, stops are placed just beyond the divergence swing point

- Define Take Profit Levels

- Use a risk-reward ratio of at least 1:1, preferably 1:2 or higher

- Consider using multiple take profit levels to secure partial gains

- Monitor and Manage the Trade

- Watch for new divergences or reversal signals

- Be prepared to exit quickly if the trade doesn’t develop as expected

- Record and Analyze

- Keep a detailed trading journal of each divergence scalp

- Regularly review your trades to refine your strategy

By following this systematic approach, you can improve your consistency and potentially increase your success rate in divergence scalping.

Risk Management in Divergence Scalping

Effective risk management is crucial for long-term success in divergence scalping. Consider these key principles:

- Position Sizing

- Never risk more than 1-2% of your trading account on a single trade

- Adjust position size based on the distance to your stop loss

- Use of Stop Losses

- Always set a stop loss for every trade

- Place stops at levels that invalidate the divergence setup

- Implement a Risk-Reward Ratio

- Aim for a minimum risk-reward ratio of 1:1.5 or higher

- Be willing to let winners run while cutting losses short

- Manage Leverage Carefully

- Use leverage conservatively to avoid excessive risk

- Remember that high leverage can amplify losses as well as gains

- Set Daily Loss Limits

- Establish a maximum daily loss threshold

- Stop trading if you reach this limit to prevent emotional decisions

- Use Proper Account Management

- Diversify your trades across different currency pairs

- Avoid overexposure to correlated pairs

- Implement a Trading Plan

- Develop and stick to a well-defined trading plan

- Include entry, exit, and risk management rules

By incorporating these risk management strategies, you can protect your capital and maintain a sustainable approach to divergence scalping in the volatile forex market.

Common Pitfalls and How to Avoid Them

Even experienced traders can fall into traps when using divergence scalping. Here are some common pitfalls and tips to avoid them:

- Overtrading

- Pitfall: Taking too many trades, leading to increased transaction costs and potential losses

- Solution: Set strict criteria for trade entry and stick to your trading plan

- Ignoring the Broader Market Context

- Pitfall: Focusing solely on divergences without considering overall market trends

- Solution: Always analyze multiple timeframes and be aware of key economic events

- Chasing False Divergences

- Pitfall: Mistaking normal price fluctuations for meaningful divergences

- Solution: Wait for clear confirmation before entering trades and use multiple indicators

- Holding Positions Too Long

- Pitfall: Turning scalps into longer-term trades, increasing risk exposure

- Solution: Set clear time limits for trades and stick to your exit strategy

- Neglecting Proper Risk Management

- Pitfall: Risking too much on individual trades or overall account exposure

- Solution: Strictly adhere to position sizing rules and use appropriate stop losses

- Emotional Trading

- Pitfall: Making decisions based on fear or greed rather than analysis

- Solution: Develop and follow a mechanical trading system to reduce emotional influence

- Failing to Adapt to Market Conditions

- Pitfall: Using the same strategy in all market conditions

- Solution: Be flexible and adjust your approach based on market volatility and trends

By being aware of these common mistakes and implementing the suggested solutions, you can significantly improve your divergence scalping performance and overall trading results.

Advanced Techniques for Experienced Traders

As you become more proficient in divergence scalping, consider incorporating these advanced techniques to refine your strategy:

- Multiple Timeframe Analysis

- Use higher timeframes to identify the overall trend

- Confirm divergences on lower timeframes for more precise entries

- Divergence Strength Assessment

- Evaluate the steepness and duration of divergences

- Prioritize trades with stronger, more pronounced divergences

- Indicator Combination

- Combine multiple indicators (e.g., RSI and MACD) for confirmation

- Look for confluences between different technical tools

- Price Action Integration

- Use candlestick patterns in conjunction with divergences

- Identify key support and resistance levels for better trade management

- Volatility-Based Position Sizing

- Adjust position sizes based on market volatility

- Use tools like Average True Range (ATR) to gauge volatility

- Algorithmic Trading Implementation

- Develop and backtest automated strategies for divergence scalping

- Use Expert Advisors (EAs) to execute trades based on predefined criteria

- Sentiment Analysis

- Incorporate market sentiment indicators into your decision-making process

- Use tools like the Commitment of Traders (COT) report for additional insights

By mastering these advanced techniques, experienced traders can potentially enhance their edge in the competitive world of forex scalping.

OpoFinance Services: A Trusted Partner for Divergence Scalping

When implementing a divergence scalping strategy, choosing the right broker is crucial for success. OpoFinance, an ASIC-regulated forex broker, offers a range of services tailored to meet the needs of scalpers and short-term traders. With their advanced trading platforms, tight spreads, and fast execution speeds, OpoFinance provides an ideal environment for implementing divergence scalping strategies effectively.

One standout feature of OpoFinance is their social trading service, which allows traders to connect with and learn from experienced professionals. This can be particularly beneficial for those new to divergence scalping, as it provides an opportunity to observe how skilled traders implement this strategy in real-time market conditions. Additionally, OpoFinance’s commitment to regulatory compliance ensures a secure trading environment, giving you peace of mind as you focus on perfecting your divergence scalping technique.

Conclusion

Divergence scalping is a powerful strategy that can help forex traders capitalize on short-term market inefficiencies and potentially generate consistent profits. By mastering the identification of various divergence types, utilizing key technical indicators, and implementing robust risk management practices, traders can enhance their chances of success in the fast-paced world of forex scalping.

Remember that successful divergence scalping requires discipline, continuous learning, and adaptation to changing market conditions. As you gain experience, don’t hesitate to explore advanced techniques and refine your approach. With dedication and practice, divergence scalping can become a valuable addition to your forex trading toolkit, potentially leading to improved performance and profitability in your trading endeavors.

How does divergence scalping differ from other scalping strategies?

Divergence scalping focuses specifically on identifying and exploiting discrepancies between price action and technical indicators, whereas other scalping strategies may rely solely on price movements or patterns. This approach allows traders to potentially predict reversals or continuations with greater accuracy, giving them an edge in short-term trading.

Can divergence scalping be applied to markets other than forex?

Yes, divergence scalping can be applied to various financial markets, including stocks, commodities, and cryptocurrencies. However, it’s most commonly used in forex due to the market’s high liquidity and 24-hour trading cycle, which provides ample opportunities for short-term trades.

How important is the choice of timeframe in divergence scalping?

Timeframe selection is crucial in divergence scalping. While most scalpers prefer shorter timeframes (1-15 minutes), the optimal timeframe can vary depending on individual trading style, market conditions, and the specific currency pair being traded. It’s often beneficial to use multiple timeframes to confirm divergences and improve trade accuracy.