Are you ready to supercharge your forex trading strategy? Look no further than the Stochastic oscillator for scalping. This powerful technical indicator can be your secret weapon in the fast-paced world of forex trading. The Stochastic oscillator is a momentum indicator that compares a closing price of a currency pair to its price range over a specific period, making it an invaluable tool for scalpers seeking quick profits in short-term market fluctuations.

In this comprehensive guide, we’ll dive deep into the world of Stochastic oscillator strategies for scalping, exploring the best Stochastic indicator settings for scalping and how to leverage this versatile tool to maximize your trading potential. Whether you’re a seasoned trader or just starting with a regulated forex broker, mastering the Stochastic oscillator can give you the edge you need to succeed in the dynamic forex market.

Understanding the Stochastic Oscillator

What is the Stochastic Oscillator?

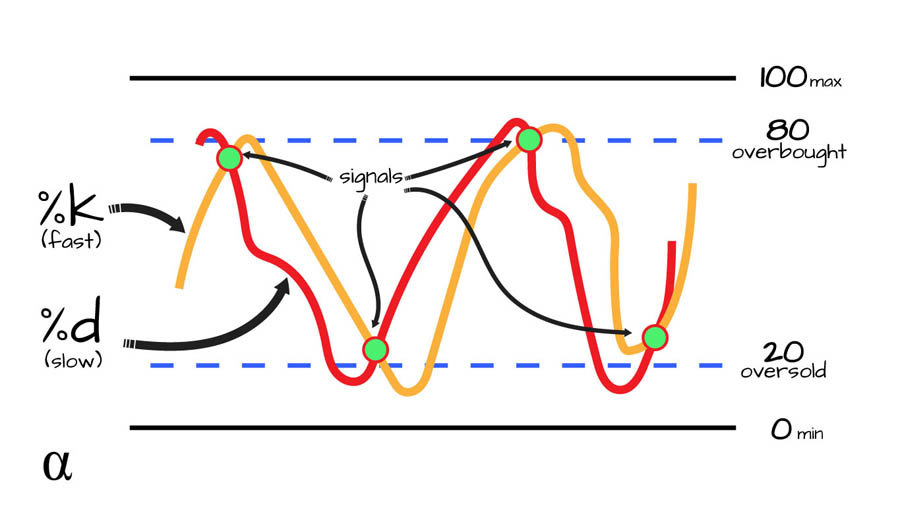

The Stochastic oscillator, developed by George Lane in the 1950s, is a momentum indicator that measures the relationship between an asset’s closing price and its price range over a set period. This indicator consists of two lines:

- %K line: The main line that measures the current price relative to the high-low range over a specific period.

- %D line: A moving average of the %K line, typically over 3 periods.

How Does the Stochastic Oscillator Work?

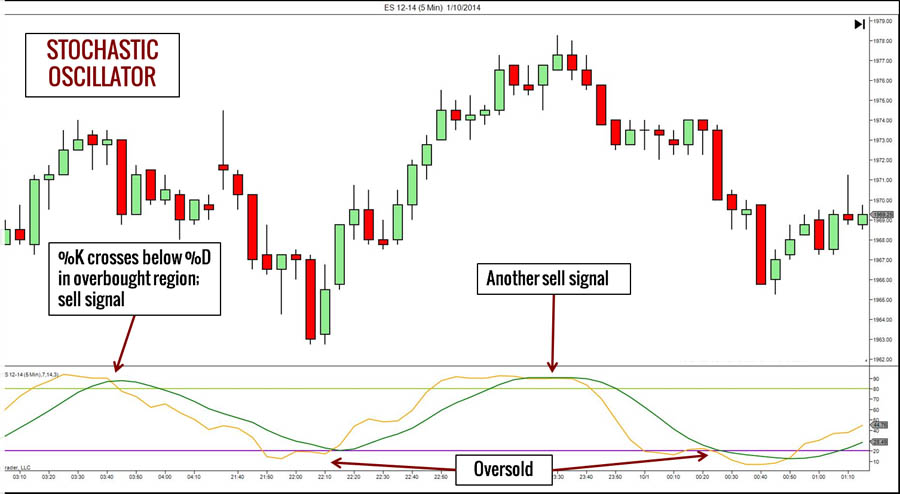

The Stochastic oscillator operates on a scale of 0 to 100, with readings above 80 generally considered overbought and below 20 oversold. The indicator’s effectiveness lies in its ability to identify potential trend reversals and price momentum shifts, making it particularly useful for scalpers looking to capitalize on short-term price movements.

Stochastic Oscillator Strategy for Scalping

1. Choose the Right Timeframe

For effective scalping with the Stochastic oscillator, selecting the appropriate timeframe is crucial. Most scalpers prefer shorter timeframes such as 1-minute, 5-minute, or 15-minute charts. These timeframes allow for quick entry and exit points, essential for the rapid-fire nature of scalping.

When choosing your timeframe, consider the following factors:

- Your trading style and personal preferences

- The volatility of the currency pair you’re trading

- Your ability to monitor and execute trades quickly

- The typical duration of price movements in your chosen market

2. Optimize Your Stochastic Indicator Settings

The default settings for the Stochastic oscillator (14, 3, 3) may not always be ideal for scalping. Experiment with different settings to find what works best for your trading style. Many scalpers find success with faster settings such as (5, 3, 3) or (8, 3, 3), which provide more frequent signals.

Consider these tips when optimizing your settings:

- Shorter periods (e.g., 5 or 8) will generate more signals but may be noisier

- Longer periods (e.g., 14 or 21) will provide fewer, potentially more reliable signals

- Adjust the smoothing factor (the second and third numbers) to fine-tune sensitivity

3. Identify Overbought and Oversold Conditions

Use the Stochastic oscillator to spot potential reversal points by identifying overbought (above 80) and oversold (below 20) conditions. However, remember that in strong trends, the indicator can remain in these extreme zones for extended periods, so always consider the broader market context.

To enhance your analysis of overbought and oversold conditions:

- Look for divergences between price action and the Stochastic readings

- Consider adjusting the overbought/oversold levels based on market conditions (e.g., 70/30 instead of 80/20)

- Use multiple timeframes to confirm signals and reduce false positives

4. Look for Crossovers

Pay attention to crossovers between the %K and %D lines. A bullish signal occurs when the %K line crosses above the %D line, while a bearish signal happens when the %K line crosses below the %D line. These crossovers can indicate potential entry points for scalping trades.

To maximize the effectiveness of crossover signals:

- Look for crossovers that occur near overbought or oversold levels

- Consider the angle and speed of the crossover for additional insight into momentum

- Use crossovers in conjunction with other technical indicators or chart patterns for confirmation

5. Confirm with Price Action

Don’t rely solely on the Stochastic oscillator. Confirm its signals with price action on your charts. Look for candlestick patterns, support and resistance levels, and trend lines to increase the probability of successful trades.

Key price action elements to consider:

- Candlestick patterns (e.g., doji, engulfing patterns, pin bars)

- Chart patterns (e.g., triangles, flags, head and shoulders)

- Support and resistance levels, including dynamic levels like moving averages

- Trend strength and direction

6. Implement Strict Risk Management

Scalping involves frequent trades with small profit targets. As such, implementing strict risk management is crucial. Use tight stop-losses and aim for a favorable risk-reward ratio, typically at least 1:1.5 or higher.

Essential risk management practices for scalping:

- Set a maximum loss per trade and per day

- Use proper position sizing based on your account balance and risk tolerance

- Consider using trailing stops to protect profits on winning trades

- Be prepared to exit trades quickly if market conditions change

7. Practice and Refine

Like any trading strategy, mastering the Stochastic oscillator for scalping takes time and practice. Start with a demo account to hone your skills and refine your strategy before risking real capital.

Tips for effective practice:

- Keep a detailed trading journal to track your progress and identify areas for improvement

- Backtest your strategy on historical data to gauge its effectiveness

- Regularly review and analyze your trades to refine your approach

- Stay informed about market news and events that could impact your trades

Advanced Techniques for Stochastic Oscillator Scalping

Combining with Other Indicators

Enhance your scalping strategy by combining the Stochastic oscillator with other technical indicators. Popular combinations include:

- Stochastic + Moving Averages: Use moving averages to confirm the overall trend direction while using Stochastic for entry timing.

- Stochastic + RSI: Combine these two momentum indicators for stronger confirmation of potential reversal points.

- Stochastic + Bollinger Bands: Use Bollinger Bands to identify volatility and potential breakouts, while Stochastic confirms momentum.

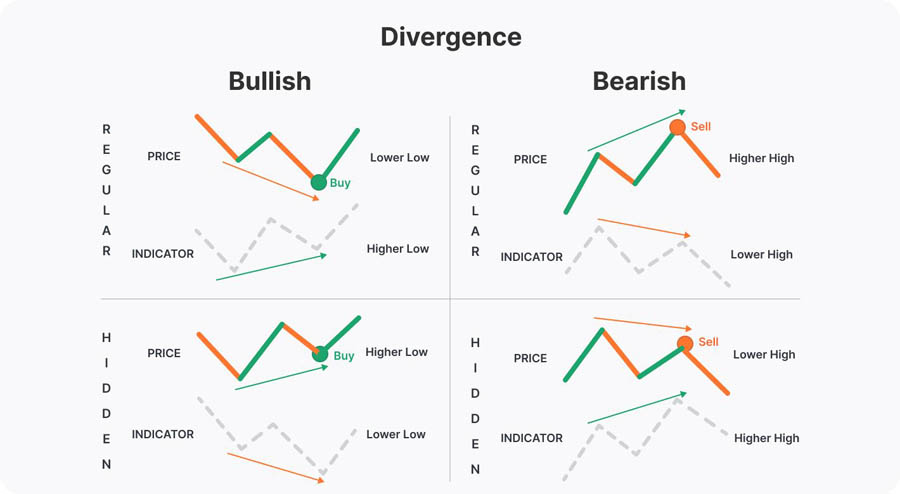

Trading Divergences

Stochastic divergences can be powerful signals for potential trend reversals. Look for instances where price makes higher highs or lower lows, but the Stochastic oscillator fails to confirm these moves. This divergence often indicates weakening momentum and a possible trend change, providing excellent scalping opportunities.

Types of divergences to watch for:

- Regular bullish divergence: Price makes lower lows, but Stochastic makes higher lows

- Regular bearish divergence: Price makes higher highs, but Stochastic makes lower highs

- Hidden bullish divergence: Price makes higher lows, but Stochastic makes lower lows

- Hidden bearish divergence: Price makes lower highs, but Stochastic makes higher highs

Stochastic Oscillator in Range-Bound Markets

The Stochastic oscillator truly shines in range-bound markets. In these conditions, use the indicator to identify potential bounces off support and resistance levels. Enter long trades when the Stochastic moves out of oversold territory near support, and short trades when it exits overbought territory near resistance.

Tips for trading range-bound markets:

- Identify clear support and resistance levels on higher timeframes

- Look for multiple timeframe confirmation of range-bound conditions

- Use limit orders to enter trades at key levels

- Be prepared for potential breakouts from the range

Common Pitfalls to Avoid

- Overtrading: The frequent signals generated by the Stochastic oscillator can lead to overtrading. Be selective and only take the highest probability setups.

- Ignoring the Broader Trend: While scalping focuses on short-term movements, always be aware of the larger market trend to avoid trading against strong momentum.

- Neglecting Risk Management: The fast-paced nature of scalping can lead to emotional decision-making. Stick to your predefined risk parameters at all times.

- Relying Solely on Indicators: Remember that the Stochastic oscillator is just one tool in your trading arsenal. Always use it in conjunction with other analysis methods and market context.

Stochastic Oscillator Settings for Different Market Conditions

Fast Markets

In highly volatile or trending markets, consider using faster Stochastic settings such as (5, 3, 3) or (8, 3, 3). These settings will provide more frequent signals, allowing you to capitalize on rapid price movements.

Slow Markets

For ranging or less volatile markets, slower settings like (21, 7, 7) or even the default (14, 3, 3) can help filter out noise and provide more reliable signals.

Finding Your Sweet Spot

The key to successful Stochastic oscillator scalping lies in finding the settings that work best for your trading style and the specific currency pairs you trade. Don’t be afraid to experiment with different parameters and backtest your results to optimize your strategy.

Using the Stochastic Oscillator Scalping Strategy for Trading S&P 500, Gold, and U.S. Dollar

When employing Stochastic Oscillator Scalping, it’s important to recognize that each financial instrument—whether it’s the S&P 500, gold, or the U.S. dollar—demonstrates unique price behavior. Understanding these nuances is essential for improving trading success. Below, we’ll explore how to use the Stochastic Oscillator scalping strategy for each of these assets.

Stochastic Oscillator Scalping for S&P 500 Trading

The S&P 500 has a distinct pattern in response to stochastic signals. Historical price movements show that the price doesn’t always drop when the oscillator moves into the overbought zone. Conversely, when the indicator enters the oversold zone, there is a higher probability that the market will soon rally.

When scalping the S&P 500 using the Stochastic Oscillator, traders should focus on bullish reversal signals that are effective when the market is temporarily oversold during an uptrend. Additionally, if the market is in a downtrend and enters the overbought zone, there’s a good chance a bullish correction could occur, presenting opportunities for short-term trades.

Stochastic Oscillator Scalping for Gold Trading

Gold behaves differently from the S&P 500 when trading with the Stochastic Oscillator. In the case of gold, overbought and oversold signals tend to be less reliable. Specifically, when the market is oversold during an uptrend, a bullish reversal signal is often ineffective. However, when the market is overbought during a downtrend, there is a higher likelihood of a bearish reversal.

For scalping gold using the Stochastic Oscillator Scalping technique, it’s crucial to avoid relying solely on overbought or oversold signals. Instead, traders should look for additional confirmations, such as trend continuation or momentum signals, to increase the chances of a successful trade.

Stochastic Oscillator Scalping for U.S. Dollar Trading

When trading the U.S. dollar, the Stochastic Oscillator Scalping strategy reveals that price momentum often continues even after the curves enter the overbought or oversold zones. This behavior indicates that the U.S. dollar may not reverse immediately after these signals appear. Instead, traders should focus on entering the market when a price reversal is more apparent, as relying solely on overbought/oversold conditions during uptrends or downtrends may not be effective.

In summary, Stochastic Oscillator Scalping can be a valuable tool for trading the S&P 500, gold, and the U.S. dollar, but it must be adapted to the unique behaviors of each instrument.

Opofinance Services: Your Trusted Partner in Forex Trading

When it comes to executing your Stochastic oscillator scalping strategy, choosing the right broker is crucial. Opofinance, an ASIC-regulated forex broker, offers a comprehensive suite of services tailored to both novice and experienced traders. With its cutting-edge trading platform, competitive spreads, and robust risk management tools, Opofinance provides the ideal environment for implementing your scalping strategies.

One standout feature of Opofinance is its innovative social trading service, allowing you to learn from and copy the trades of successful traders. This can be particularly beneficial for those new to Stochastic oscillator scalping, providing valuable insights and real-world examples of effective trading strategies.

Opofinance’s commitment to trader success is further evidenced by its official inclusion in the MT5 brokers list, ensuring you have access to one of the most powerful and widely-used trading platforms in the industry. With safe and convenient deposit and withdrawal methods, you can focus on your trading without worrying about the security of your funds.

Conclusion

Mastering the Stochastic oscillator for scalping can significantly enhance your forex trading success. By understanding its mechanics, implementing effective strategies, and avoiding common pitfalls, you can harness the power of this versatile indicator to identify profitable trading opportunities in the fast-paced world of scalping.

Remember, successful trading is not just about indicators and strategies – it’s also about discipline, continuous learning, and adapting to changing market conditions. As you refine your Stochastic oscillator scalping technique, always prioritize risk management and stay informed about broader market trends.

With practice and persistence, the Stochastic oscillator can become an invaluable tool in your trading arsenal, helping you navigate the forex markets with greater confidence and precision. So, start exploring the possibilities today and take your scalping game to the next level!

Can the Stochastic oscillator be used for long-term trading strategies?

While the Stochastic oscillator is particularly popular among scalpers and short-term traders, it can also be valuable for longer-term strategies. When applied to higher timeframes like daily or weekly charts, the Stochastic can help identify potential trend reversals or entry points for swing trades. However, it’s important to adjust your interpretation and possibly use slower settings for these longer-term applications.

How does the Stochastic oscillator perform in different market conditions?

The Stochastic oscillator tends to perform best in ranging or sideways markets, where it can effectively identify overbought and oversold conditions. In strongly trending markets, the indicator may generate false signals as it can remain in overbought or oversold territory for extended periods. That’s why it’s crucial to use the Stochastic in conjunction with other technical analysis tools and always consider the broader market context.

Are there any specific currency pairs that work particularly well with Stochastic oscillator scalping?

While the Stochastic oscillator can be applied to any currency pair, it tends to work especially well with pairs that exhibit regular ranging behavior or have clear support and resistance levels. Pairs like EUR/USD, GBP/USD, and USD/JPY are often favored by scalpers using the Stochastic due to their liquidity and tendency to respect technical levels. However, the effectiveness can vary depending on market conditions, so it’s essential to test the indicator on different pairs and timeframes to find the best fit for your trading style.