Swing trading is a dynamic trading strategy that capitalizes on short- to medium-term price movements in financial markets. For traders looking to maximize their profits while minimizing risks, discovering the highest win rate swing trading strategy is essential. This article provides actionable insights into effective swing trading techniques, backed by statistics and proven methodologies.

In this comprehensive guide, we will explore various swing trading strategies, answer frequently asked questions, and provide valuable insights into how to implement these strategies effectively. Whether you are a novice trader looking to enhance your skills or an experienced trader seeking new approaches, this article is tailored for you.

Additionally, we will highlight the benefits of using a regulated forex broker, such as Opofinance, which offers robust trading services and social trading options that can complement your swing trading journey.

Understanding Swing Trading

Swing trading involves holding positions for several days to capture short-term market movements. Unlike day trading, which requires constant monitoring of the markets, swing trading allows traders to capitalize on price fluctuations without the need for minute-by-minute tracking.

Key Characteristics of Swing Trading

- Time Frame: Positions are typically held for a few days to weeks, allowing traders to take advantage of market volatility without the need for constant oversight. This approach helps to avoid the intense pressures of day trading and allows traders to take breaks while still participating in the market.

- Market Analysis: Swing traders rely heavily on technical analysis to identify potential entry and exit points. This includes chart patterns, indicators, and volume analysis, which are crucial to determining whether market conditions are favorable. Swing traders often use tools like Fibonacci retracement levels, trendlines, and moving averages to predict future price movements.

- Risk Management: Effective risk management strategies are crucial for maintaining profitability. This includes setting stop-loss orders and determining position sizes based on risk tolerance. Traders often adhere to strict rules regarding how much of their capital they are willing to risk on each trade.

The ultimate goal of swing trading is to identify trends and capitalize on price swings within those trends. Whether these trends last several days or weeks, traders aim to capture the most significant moves during the life of the trend.

Read More: xauusd swing trading strategy

The Highest Win Rate Swing Trading Strategies

To achieve a high win rate in swing trading, traders must adopt specific strategies that have proven successful over time. Here are some of the most effective approaches:

1. Momentum Trading

Momentum trading involves identifying stocks that are moving significantly in one direction and entering trades in the same direction. Traders look for stocks with high volume and volatility, which can provide opportunities for substantial gains.

- Key Indicators: Moving averages (such as the 50-day and 200-day), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify momentum. These indicators signal whether a stock is overbought or oversold, helping traders determine the best entry points.

- Entry Point: Enter when the price breaks above resistance levels or shows strong upward momentum. Traders often look for confirmation through volume spikes or other technical indicators to avoid false breakouts.

- Win Rate: Momentum trading can yield win rates between 60% to 80%, depending on market conditions and trader experience. This strategy thrives in trending markets where price action continues in one direction for an extended period.

Momentum trading leverages existing market trends to maximize gains. However, it requires vigilance and the ability to exit trades before the momentum fades.

Advantages of Momentum Trading

- Quick Profits: Momentum trades can lead to quick profits due to rapid price movements. The speed of these trades makes it ideal for those looking to capitalize on short-term opportunities.

- Clear Signals: The use of technical indicators provides clear entry and exit signals, reducing the guesswork involved in identifying trades.

- Market Psychology: Momentum traders capitalize on market psychology, riding trends until signs of reversal appear. By understanding the behavior of market participants, momentum traders can better time their trades for maximum effect.

2. Reversal Trading

Reversal trading focuses on identifying potential reversals in price trends. Traders look for signs that a stock may be about to change direction, providing opportunities to enter the market at the beginning of a new trend.

- Key Indicators: Candlestick patterns (such as hammers or shooting stars), divergence in RSI or MACD, and Fibonacci retracement levels can signal potential reversals. These patterns indicate that the prevailing trend is losing strength, suggesting a reversal may be imminent.

- Entry Point: Enter when there is confirmation of a reversal pattern through volume spikes or price action. It’s essential to wait for confirmation instead of jumping in too early, as premature entries can lead to losses.

- Win Rate: Reversal strategies can achieve win rates of around 55% to 70%, but they often require precise timing and risk management. The ability to identify and act on reversal signals is crucial to success with this approach.

Reversal trading can yield high rewards if executed correctly, as traders can catch significant price movements from the beginning of a new trend.

Challenges of Reversal Trading

- Timing Issues: Accurately timing reversals can be challenging; entering too early can lead to losses. Traders must be patient and wait for confirmation of a reversal before entering the trade.

- Market Noise: False signals can occur frequently in volatile markets, making it crucial to confirm signals before entering trades. This reduces the chances of being caught in a false reversal and incurring unnecessary losses.

Read More: Weekly Swing Trading

3. Breakout Trading

Breakout trading seeks to capitalize on stocks that break through established support or resistance levels. These breakouts can lead to significant price movements, providing traders with opportunities for large gains.

- Key Indicators: Volume spikes accompanying price breaks, Bollinger Bands, and Average True Range (ATR) for volatility assessment are essential tools for breakout traders. These indicators help confirm that a breakout is genuine and not just a temporary fluctuation in price.

- Entry Point: Enter after a breakout occurs with confirmation from volume; consider waiting for a retest of the breakout level for added confirmation. This helps ensure that the breakout is valid rather than a false move.

- Win Rate: Breakout strategies can yield win rates ranging from 65% to 75%, especially when combined with proper risk management techniques. Traders who carefully manage their risk can achieve consistent success with this approach.

Breakouts can often lead to large price movements, especially when they occur after a period of consolidation. Traders who can identify and act on breakouts can benefit from these significant price shifts.

Benefits of Breakout Trading

- Potential for Large Moves: Breakouts often lead to substantial price movements, allowing traders to capture significant profits from relatively short-term trades.

- Trend Confirmation: Breakouts confirm existing trends, providing confidence in trade direction. This gives traders a higher probability of success, as they are trading with the prevailing trend.

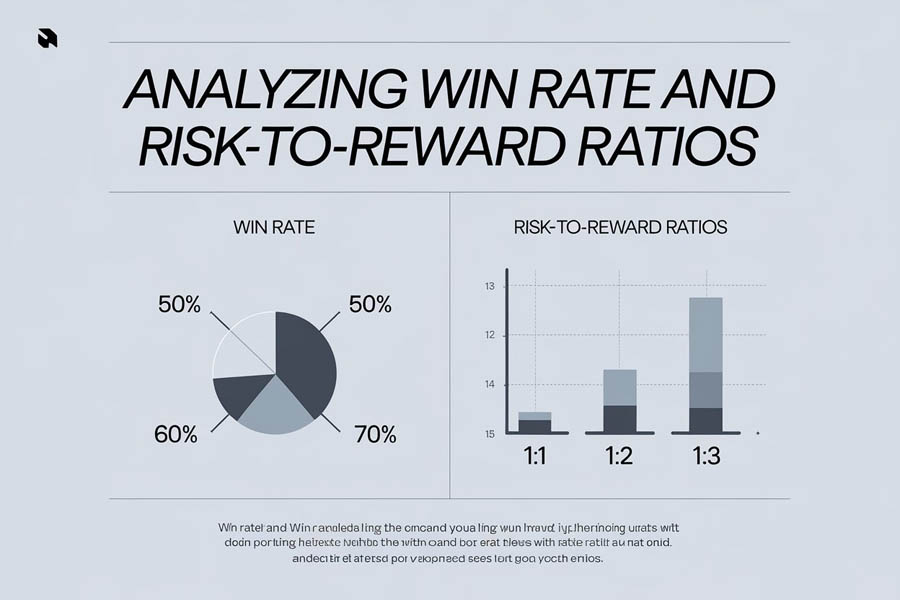

Analyzing Win Rate and Risk-to-Reward Ratios

Understanding the relationship between win rate and risk-to-reward ratios is essential for successful swing trading. While a high win rate is desirable, it’s important to also focus on the potential reward relative to the risk taken on each trade.

The Importance of Win Rate

The win rate is simply the percentage of trades that result in profit compared to total trades taken. A higher win rate typically indicates a more successful strategy; however, it’s not the only metric that matters. Traders should also consider the average size of their winning trades relative to their losses.

Risk-to-Reward Ratio Explained

The risk-to-reward ratio measures how much you stand to gain versus how much you risk losing on a trade. For example, if you risk $1 to potentially gain $3, your risk-to-reward ratio is 1:3. Traders should aim for a favorable risk-to-reward ratio to ensure that their winning trades more than compensate for any losses.

Relationship Between Win Rate and Risk-to-Reward

- Balancing Act: A high win rate does not always equate to profitability if the risk-to-reward ratio is unfavorable. For instance, a trader with a win rate of 80% but a risk-to-reward ratio of 1:2 may still incur losses over time if they encounter several losing trades.

- Optimal Ratios: Many successful traders aim for a balance where their win rate is around 50% with a risk-to-reward ratio of at least 1:2 or higher. This means that even with half their trades losing, they can remain profitable due to larger gains from winning trades.

- Strategic Adjustments: Traders should continuously analyze their performance metrics and adjust their strategies accordingly—whether that means tightening stop-loss orders or seeking higher reward targets.

- Psychological Impact: Understanding this relationship helps traders maintain discipline during losing streaks by focusing on overall profitability rather than individual trade outcomes. By focusing on the bigger picture, traders can avoid emotional decision-making and stick to their plan.

Essential Tips for Maximizing Your Win Rate

Achieving a high win rate requires discipline and strategic planning. Here are some tips:

- Set Clear Goals: Define your profit targets and risk tolerance before entering any trade. Having clear objectives will help you make more informed decisions.

- Utilize Stop-Loss Orders: Protect your capital by setting stop-loss orders based on technical analysis levels or percentage loss thresholds.

- Stay Informed: Keep abreast of market news and economic indicators that could impact your trades—this includes earnings reports, economic data releases, and geopolitical events.

- Backtest Your Strategies: Use historical data to test the effectiveness of your strategies before applying them in real-time scenarios; this helps refine your approach based on past performance.

- Review Performance Regularly: Analyze past trades to identify patterns of success and failure. By regularly reviewing your trading history, you can fine-tune your strategies and eliminate tactics that aren’t yielding the desired results.

- Avoid Overtrading: Overtrading can lead to burnout and poor decision-making. Stick to your strategy, avoid chasing the market, and only trade when the conditions align with your plan.

- Adapt to Market Conditions: Market conditions are constantly changing, and the best swing traders know how to adapt. Whether it’s increasing your stop-loss levels during volatile periods or adjusting your profit targets, flexibility is key to maintaining a high win rate.

Read More: ichimoku cloud swing trading strategy

Case Study: Successful Swing Trading Using Breakout Strategy

Let’s explore a case study of a swing trader who employed a breakout strategy and achieved a high win rate:

Background

John, an experienced swing trader, focuses on stocks with significant volatility and volume spikes. His preferred strategy involves identifying stocks that are consolidating near major resistance levels and entering trades once the price breaks out above these levels.

Approach

John uses a combination of technical analysis tools such as Bollinger Bands and the 50-day moving average to identify potential breakout candidates. He also monitors the volume to confirm that the breakout is supported by strong buying pressure.

- Entry Point: John enters trades as soon as the price breaks above a key resistance level with a noticeable increase in volume.

- Risk Management: He places stop-loss orders just below the breakout level to minimize potential losses in case of a false breakout.

- Exit Strategy: John targets a profit level of 2x his risk, ensuring that his risk-to-reward ratio remains favorable.

Results

Over a six-month period, John executed 50 trades using this breakout strategy. He achieved a win rate of 68%, with an average risk-to-reward ratio of 1:2. This meant that even though he lost on 32% of his trades, his winning trades were large enough to result in consistent profitability.

Key Takeaways

- Risk Management: John’s success was heavily dependent on his disciplined use of stop-loss orders and his ability to manage risk.

- Patience: John only entered trades when all of his conditions were met, avoiding the temptation to jump in early or chase the market.

- Consistency: By sticking to a clear strategy and avoiding impulsive trades, John was able to achieve consistent returns over time.

The Role of Psychology in Swing Trading Success

Trading psychology plays a vital role in maintaining a high win rate. The emotional ups and downs of trading can affect decision-making, often leading to mistakes like holding onto losing trades for too long or exiting winning trades prematurely. Here’s how to stay emotionally balanced:

1. Stick to Your Plan

One of the best ways to avoid emotional trading decisions is to create and stick to a detailed trading plan. This plan should include your strategy, risk tolerance, entry and exit rules, and criteria for assessing your performance. Having a well-defined plan can help you avoid making impulsive decisions when market conditions become unpredictable.

2. Manage Expectations

It’s easy to get swept up in the idea of quick profits, but successful swing traders know that not every trade will be a winner. By managing your expectations and focusing on long-term success rather than immediate results, you can maintain a calm and rational approach to your trades.

3. Control Your Emotions

Fear and greed are two emotions that can severely impact trading performance. Fear of losing can lead to exiting trades too early, while greed can cause traders to hold onto positions for too long, hoping for more profit. The key is to keep emotions in check by adhering to your strategy and using risk management tools like stop-loss orders to protect your capital.

4. Stay Focused on the Big Picture

Swing trading is about capturing price movements over several days or weeks. It’s essential to avoid getting caught up in short-term fluctuations or small losses that can occur in the daily grind of trading. Instead, keep your focus on the bigger picture and trust your strategy to deliver results over time.

Leveraging Opofinance for Swing Trading Success

When selecting a broker for swing trading, it’s essential to choose one that offers the tools, support, and security needed for success. Opofinance, a regulated broker by ASIC, provides traders with access to the popular MT5 trading platform, advanced charting tools, and robust social trading services. Social trading allows you to follow and replicate the trades of successful traders, which can be particularly useful for beginners or those looking to diversify their strategies.

Additionally, Opofinance offers competitive spreads, low trading fees, and secure deposit and withdrawal methods, ensuring that your capital is protected. For traders looking to optimize their swing trading strategy, Opofinance is a reliable partner on the path to success.

Conclusion: Achieving Consistency with the Highest Win Rate Swing Trading Strategy

Achieving a high win rate in swing trading requires discipline, strategy, and a clear understanding of market dynamics. By implementing proven techniques like momentum, breakout, and reversal strategies, you can increase your chances of success. It’s also crucial to understand the importance of risk management and the psychology of trading to maintain consistency over time.

Remember that the highest win rate swing trading strategy isn’t just about winning every trade; it’s about maximizing your gains while minimizing your losses. By focusing on long-term profitability and sticking to a well-defined plan, you can build a successful swing trading career.

For those seeking a trusted broker to support their swing trading journey, Opofinance offers the tools and services needed to excel in today’s fast-paced markets.

What is the highest win rate swing trading strategy?

The highest win rate swing trading strategy typically involves a combination of momentum, breakout, and reversal strategies. Momentum strategies tend to offer high win rates when the market is trending, while breakout strategies work well in volatile conditions. Reversal strategies can provide good opportunities during trend shifts.

How much capital is needed for swing trading?

The amount of capital required for swing trading depends on the trader’s goals, risk tolerance, and the assets being traded. Some traders start with as little as $1,000, while others prefer to begin with $10,000 or more. It’s essential to only risk capital that you can afford to lose.

What is a good risk-to-reward ratio for swing trading?

A good risk-to-reward ratio for swing trading is typically 1:2 or higher. This means that for every $1 risked, the potential profit should be at least $2. A favorable risk-to-reward ratio ensures that even if some trades are unsuccessful, the winning trades can compensate for the losses.

How long should you hold a swing trade?

The duration of a swing trade varies based on the strategy and market conditions. Generally, swing traders hold positions for a few days to several weeks. The key is to remain flexible and adapt to the market, exiting when the desired profit target is reached or when the trade starts moving against you.

Can swing trading be automated?

Yes, swing trading can be automated through the use of trading bots or algorithms. Automated systems can execute trades based on predetermined criteria, removing emotional decision-making from the process. However, it’s essential to test any automated system thoroughly before relying on it in live market conditions.