A range trading strategy is one of the most reliable methods for profiting in forex markets, especially in range-bound conditions where prices fluctuate between consistent highs and lows. By buying at support and selling at resistance, traders can repeatedly take advantage of predictable price movements. Many traders prefer this strategy because it provides numerous trading opportunities, particularly when market trends are unclear.

Whether you’re using a regulated forex broker or exploring different platforms, mastering the range trading strategy can significantly improve your trading results. In this article, we’ll cover key aspects of range trading, from price action tools to advanced techniques and the psychological skills required to be successful. These insights will help both beginner and seasoned traders enhance their strategies in 2024.

What is Range Trading?

Range trading is a strategy where traders identify and capitalize on securities that trade within a defined range. The price moves between two horizontal levels: support (the lower boundary) and resistance (the upper boundary). Traders buy near the support level and sell near the resistance level, repeatedly profiting as the price fluctuates between these points.

Key Elements of Range Trading

- Support: This is the price level where demand is strong enough to prevent the price from falling further. It acts as a floor for the range, and traders often buy when the price is near this level.

- Resistance: This is the price level where selling pressure prevents the price from rising further. It acts as a ceiling for the range, and traders typically sell when the price nears this level.

- Range-bound Markets: These are periods where the market lacks a clear upward or downward trend, making it ideal for range trading.

The key to successful range trading is identifying stable trading ranges and executing trades at optimal points within those ranges.

Read More: Breakout Trading Strategy

Why Use Range Trading?

Range trading is especially effective in sideways markets where there is no clear trend direction. During these periods, traders can make profits by repeatedly entering and exiting trades based on predictable price oscillations. This strategy also allows for greater precision in trade execution, as prices tend to follow well-established patterns within the range.

Key Components of Successful Range Trading

1. Understanding Trading Ranges

Understanding how to identify and interpret trading ranges is critical for success in this strategy. When prices move within a specific range, traders can make calculated decisions about when to enter and exit trades. The reliability of a trading range depends on several factors, including its duration and volatility.

- Duration: The longer a range remains intact, the more reliable it becomes. A well-established range gives traders confidence that the price will continue to oscillate between support and resistance.

- Volatility: Higher volatility within the range offers more trading opportunities but also increases the risk of sudden breakouts. Lower volatility ranges provide more consistent and predictable trading environments.

- Risk Considerations: Range trading can become risky when the price shows signs of breaking out of the range. Traders must be vigilant in monitoring potential breakout signals to avoid unexpected losses.

Understanding the characteristics of a trading range is essential for effectively implementing a range trading strategy.

2. Price Action Tools for Range Identification

When employing a range trading strategy, traders often rely on price action rather than just technical indicators. Price action tools provide real-time insights into how prices are behaving within the range, allowing traders to make informed decisions.

Support and Resistance Levels

Support and resistance levels are the backbone of range trading. Identifying these levels is critical to the strategy’s success.

- Support: The support level represents a price floor where buyers are willing to step in and purchase the asset, preventing further declines. Traders should enter buy positions when prices approach this level, as the market is expected to rebound.

- Resistance: The resistance level acts as a price ceiling where selling pressure outweighs buying interest. Traders typically sell when prices near this level, as the market is likely to retreat.

By consistently trading between these two levels, traders can exploit price oscillations for profit. Support and resistance levels give traders a roadmap for entering and exiting trades within a range.

Read More: Trend Reversal Trading Strategy

Candlestick Patterns

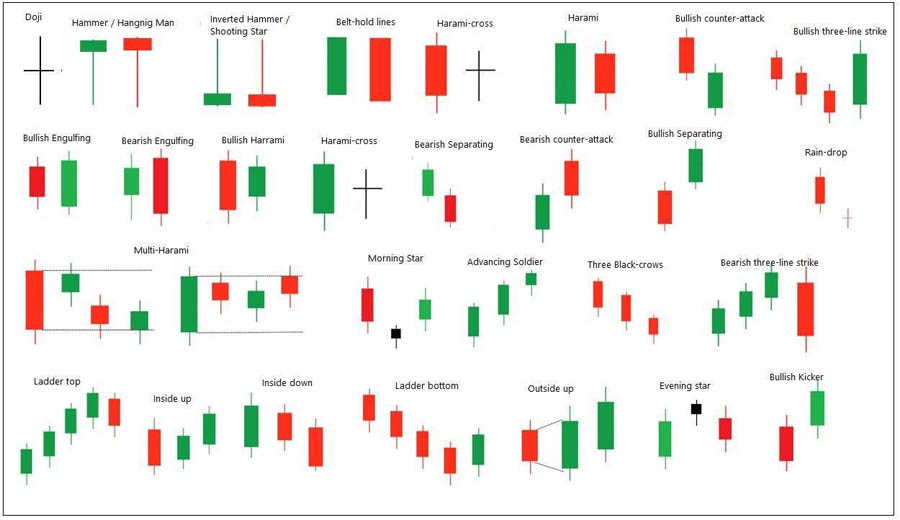

Candlestick patterns are widely used in range trading to identify potential price reversals within the range. These patterns provide visual cues that indicate whether the price is likely to reverse direction at support or resistance.

- Doji Candlestick: A doji candlestick indicates indecision in the market and often signals a reversal when it forms at support or resistance. Traders can use the doji as a cue to enter or exit trades when prices approach key levels.

- Engulfing Pattern: This pattern occurs when a large candle engulfs the previous smaller one, suggesting a strong reversal. An engulfing pattern at resistance signals a potential sell opportunity, while an engulfing pattern at support suggests a buying opportunity.

Candlestick patterns enhance range trading by providing confirmation of potential reversals, giving traders more confidence in their entry and exit decisions.

Trendlines

Trendlines are used to visualize price movements and help traders recognize the boundaries of a range. By drawing horizontal lines at the support and resistance levels, traders can clearly see where price reversals are likely to occur.

- Horizontal Trendlines: These are drawn across the highs and lows of the range to mark the boundaries.

- Diagonal Trendlines: Occasionally, a diagonal trendline may help identify a shift in momentum, signaling that the range could be coming to an end.

Trendlines simplify the process of identifying a range, helping traders quickly recognize entry and exit points.

Volume Analysis in Range Trading

Volume is a crucial factor in identifying and confirming price movements within a range. It provides valuable insight into the strength and sustainability of a price action. Traders can use volume analysis to validate whether price movements, particularly near support and resistance levels, are likely to continue or reverse.

The Role of Volume in Confirming Trends

An increase in volume typically signifies stronger interest and commitment from market participants, confirming the direction of a price movement. Conversely, low volume may indicate weak momentum, potentially signaling a lack of conviction in the price trend.

Volume and Rising Prices

- Increasing Volume with Rising Prices: When prices rise and volume simultaneously increases, it suggests strong demand and trader confidence in the upward movement. This alignment between price and volume confirms that buyers are driving the market higher, increasing the likelihood of sustained gains.

- Decreasing Volume with Rising Prices: If prices rise but volume starts to decline, it may indicate that fewer participants are buying at the higher price levels. This divergence often signals waning demand and a potential reversal or weakening of the upward trend. In this case, traders may look for other signs, like candlestick patterns at resistance, to anticipate a possible downturn.

Volume and Falling Prices

- Increasing Volume with Falling Prices: When prices fall and volume rises, it indicates that sellers are becoming more active, driving the market lower. This often signals the beginning of a downtrend and may confirm a breakout below support if the volume continues to grow.

- Decreasing Volume with Falling Prices: Falling prices accompanied by decreasing volume may suggest that selling pressure is weakening. This often leads to a reversal or a consolidation phase, where the price could stabilize or bounce back toward the range’s resistance.

Incorporating volume analysis into your range trading strategy provides additional context to price movements, helping you make more informed decisions about when to enter or exit trades.

Implementing Your Range Trading Strategy

A well-planned range trading strategy allows traders to capitalize on price oscillations within defined support and resistance levels. Implementing this strategy effectively involves setting up trades, recognizing market conditions, and adhering to strict entry and exit rules. Let’s break down the key components of putting this approach into action.

Recognizing Market Conditions

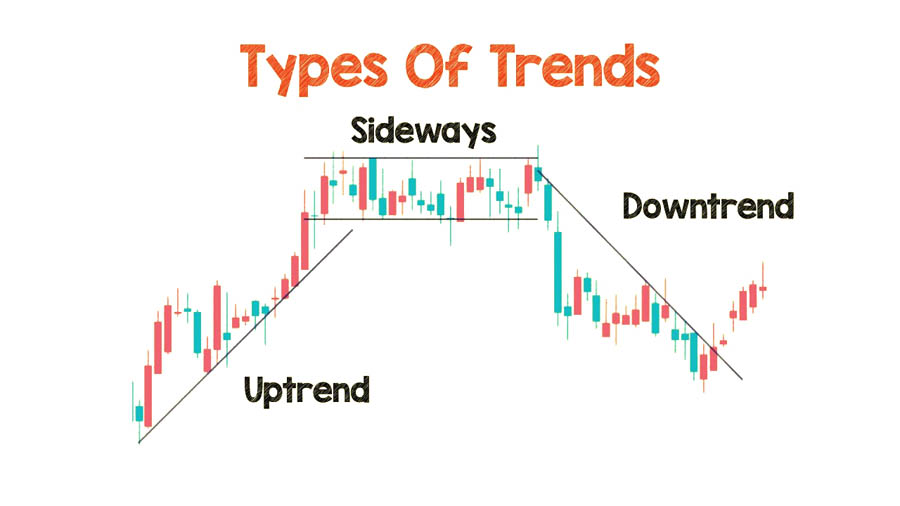

Before executing a range trading strategy forex, it is crucial to determine whether the market is in a trending or non-trending phase.

- Trending Markets: In trending markets, prices move in a consistent direction (upward or downward) rather than oscillating between support and resistance. Range trading may be less effective in such conditions, as breakouts or sustained trends often invalidate the range’s boundaries.

- Non-Trending Markets: Range trading is most effective in non-trending or sideways markets, where prices move between defined support and resistance levels without breaking out in either direction. Identifying a stable, range-bound market is key to profiting from this strategy.

Recognizing the right market conditions helps traders avoid unprofitable trades in trending markets, ensuring they only employ the strategy when the market is conducive to range trading.

Setting Up Trades

One of the primary steps in range trading is to identify the support and resistance levels that define the range. These levels form the boundaries of the price fluctuations, and traders need to ensure they are working within a clearly established range.

Steps to set up range trades:

- Identify Support and Resistance Levels: Traders need to analyze historical price data to pinpoint the price levels where the market tends to reverse. Support represents the lower boundary where prices usually rebound, while resistance is the upper boundary where prices tend to fall back. Using price charts with daily or weekly time frames helps in accurately identifying these levels.

Read More: 200 EMA Swing Trading

Entry and Exit Rules

Discipline is the cornerstone of any successful range trading strategy. By adhering to strict entry and exit rules, traders can avoid being swayed by market noise or false breakouts. This helps in capturing consistent profits while minimizing risk.

Entry Strategies

- Buying Near Support: Traders should look to enter a buy position when the price approaches the lower boundary of the range, or the support level. However, it’s essential to wait for confirmation through price action tools or indicators, such as bullish candlestick patterns, before pulling the trigger. Entering a trade prematurely, without clear signals, could result in losses if the price breaks through support.

- Selling Near Resistance: Conversely, traders should sell when the price nears the upper boundary of the range (resistance). Similar to buying near support, traders should wait for confirmation signals, such as a bearish reversal pattern or weakening momentum, to ensure that the price is likely to decline from the resistance level.

Strict entry strategies reduce the risk of false signals and help traders execute their trades with greater confidence.

Exit Rules

- Stop-Loss Placement: A stop-loss order is a protective measure that automatically closes a trade if the price moves unfavorably. For range trading, stop-loss orders should be placed just outside the range’s boundaries—above resistance for a sell trade and below support for a buy trade. This prevents excessive losses in the event of a breakout that invalidates the range.

- Take Profit: Take-profit orders are placed near the opposite end of the range to lock in profits. For example, if a trader buys near the support level, the take-profit should be set just below the resistance level. This ensures that profits are secured before the price reverses within the range.

Following clear exit rules not only protects traders from large losses but also ensures that profits are taken at optimal points.

Handling Breakouts and Breakdowns

Although range trading relies on prices remaining within a defined range, traders must be prepared for potential breakouts (above resistance) or breakdowns (below support). These events often occur when a market transitions from a non-trending phase to a trending phase, signaling that the range has been invalidated.

Tips for handling breakouts and breakdowns:

- Volume Confirmation: Breakouts or breakdowns accompanied by increasing volume are more likely to be genuine. Traders should wait for a significant increase in volume to confirm that the price is moving decisively out of the range.

- Waiting for Retests: After a breakout or breakdown, the price often retraces to retest the previous support or resistance level. Traders can wait for this retest before entering a position to increase the probability of success.

Being prepared for breakouts and breakdowns allows traders to adjust their strategies and minimize losses if the range fails to hold.

Risk Management in Range Trading

Risk management is crucial when using the range trading strategy forex, especially in unpredictable market conditions. Proper risk management ensures that traders protect their capital even when trades don’t go as planned.

Key Risk Management Techniques

- Position Sizing: Traders should size their positions relative to the size of the range. Narrower ranges call for smaller positions, as the potential profit is limited, while wider ranges allow for larger positions.

- Stop-Loss Orders: Stop-loss orders are critical for limiting risk in case of a breakout. Always place stop-losses just beyond the support or resistance levels to avoid being prematurely stopped out by normal price fluctuations.

- Risk-Reward Ratio: A favorable risk-reward ratio is essential in range trading. Ideally, traders should aim for a risk-reward ratio of at least 1:2, meaning the potential profit is double the risk taken on each trade.

Effective risk management protects your trading account from large losses, ensuring long-term success in range trading.

Psychological Aspects of Range Trading

Importance of Discipline and Patience

In range trading, discipline and patience are essential for long-term success. Without these qualities, traders are likely to make impulsive decisions that lead to unnecessary losses.

- Patience: Traders must wait for prices to approach support or resistance before entering trades. Entering too early or late can result in missed opportunities or increased risk.

- Discipline: It’s critical to follow your trading plan. Traders who act on emotion rather than sticking to their strategy are more likely to lose money.

Discipline and patience separate successful traders from those who struggle to maintain profitability.

Handling Emotions in Range Trading

Emotions play a significant role in trading success. Fear and greed can cloud judgment and lead to poor decision-making, especially in range-bound markets.

- Fear: Fear can cause traders to exit trades too early, missing out on potential profits.

- Greed: Greed can lead traders to stay in trades too long, risking a reversal and giving back profits.

By managing emotions, traders can stay focused on their strategy and achieve consistent results.

Experience the Advantage with Opofinance

If you’re looking for a reliable online forex broker to enhance your trading experience, look no further than Opofinance. Regulated by ASIC, Opofinance offers traders a secure and compliant trading environment, ensuring peace of mind while you navigate the forex markets.

Key Features of Opofinance:

- Advanced Trading Tools: Gain access to a comprehensive suite of technical indicators and charting tools designed to help you identify trading opportunities with precision. Whether you are using a range trading strategy or exploring other techniques, our platform equips you with everything you need for success.

- Social Trading Services: Join a vibrant community of traders through our innovative social trading features. Learn from experienced traders and replicate their successful strategies, making your journey in the forex market even more rewarding.

- Safe Deposit and Withdrawal Methods: Enjoy hassle-free transactions with a variety of secure deposit and withdrawal options. At Opofinance, your funds are safe, allowing you to focus on what truly matters—trading.

- Inclusion in MT5 Brokers List: Opofinance is proudly featured on the official MT5 brokers list, providing you with access to a state-of-the-art trading platform known for its speed and reliability.

Unlock your potential with Opofinance today and take your trading to the next level! Visit our website to learn more and start trading smarter.

Conclusion

Range trading is a reliable and time-tested strategy that can yield consistent profits in forex markets, especially during periods of low volatility or when the market lacks a clear trend. Traders who master essential elements like identifying support and resistance levels, effectively utilizing price action tools, and maintaining strict discipline are well-positioned to take advantage of predictable price movements within a defined range.

Whether you are trading with a regulated forex broker or utilizing another platform, implementing these range trading strategies equips you with the tools necessary to navigate 2024’s forex markets confidently. With a focus on proper risk management, recognition of breakouts and breakdowns, and an emphasis on maintaining psychological discipline, range trading strategy forex provides a powerful approach for successful trading.

Traders who commit to learning these strategies and staying patient will unlock the potential for consistent gains while minimizing the risks of false signals and market noise.

By applying this approach, traders can leverage market opportunities, manage their risk effectively, and capitalize on profitable trades in a range-bound market environment.

Can range trading be applied to all currency pairs in the forex market?

Yes, range trading can be applied to various currency pairs, but its effectiveness may vary depending on the pair’s volatility and liquidity. Major currency pairs like EUR/USD or GBP/USD often exhibit more stable ranges due to their high liquidity, making them ideal for range trading. However, less liquid or more volatile pairs, such as exotic currencies, might present unpredictable movements, making range trading riskier. It’s essential to assess each currency pair individually and determine whether it exhibits clear support and resistance levels before applying the strategy.

How does news impact range trading strategies?

News events can significantly impact the success of a range trading strategy. Sudden, unexpected economic or political news can lead to sharp price movements, breaking the established range and invalidating the support and resistance levels. Traders must remain vigilant about upcoming news events, such as central bank announcements or major economic data releases, as these can cause breakouts or breakdowns. It’s often recommended to avoid trading during highly volatile news periods or, at the very least, tighten risk management protocols, such as using tighter stop-loss orders.

Is range trading suitable for beginners in the forex market?

Range trading can be a suitable strategy for beginners because it allows for clear identification of entry and exit points, reducing the complexity of trading decisions. However, beginners must first learn how to properly identify support and resistance levels and practice patience and discipline. Starting with small positions and using a demo account to practice the strategy in real-time market conditions is advisable. Understanding basic technical analysis and risk management is also crucial for beginners who want to succeed with range trading.