The Head and Shoulders pattern is one of the most reliable and widely recognized chart patterns in forex trading. This formation plays a crucial role in helping traders identify potential market reversals, offering signals that allow them to enter or exit trades at optimal points. It’s used by traders to recognize when an uptrend is losing momentum and a downtrend is beginning. The formation itself visually resembles a head flanked by two shoulders, which is how it gets its name. Mastering how to trade head and shoulders in forex can drastically improve your trading results by enabling you to recognize key market shifts before they happen.

This article will provide you with an in-depth guide on how to effectively use this pattern in the forex market. We’ll explore the components and structure of the pattern, explain the head and shoulders pattern rules, and outline essential strategies for entering and exiting trades. Additionally, we’ll discuss risk management tactics, common pitfalls to avoid, and the importance of using proper forex trading brokers to execute trades successfully.

Working with a reliable, regulated forex broker, such as Opofinance, enhances the chances of maximizing your trading profits while ensuring a secure and transparent trading environment.

What Is the Head and Shoulders Pattern?

Definition of the Head and Shoulders Pattern

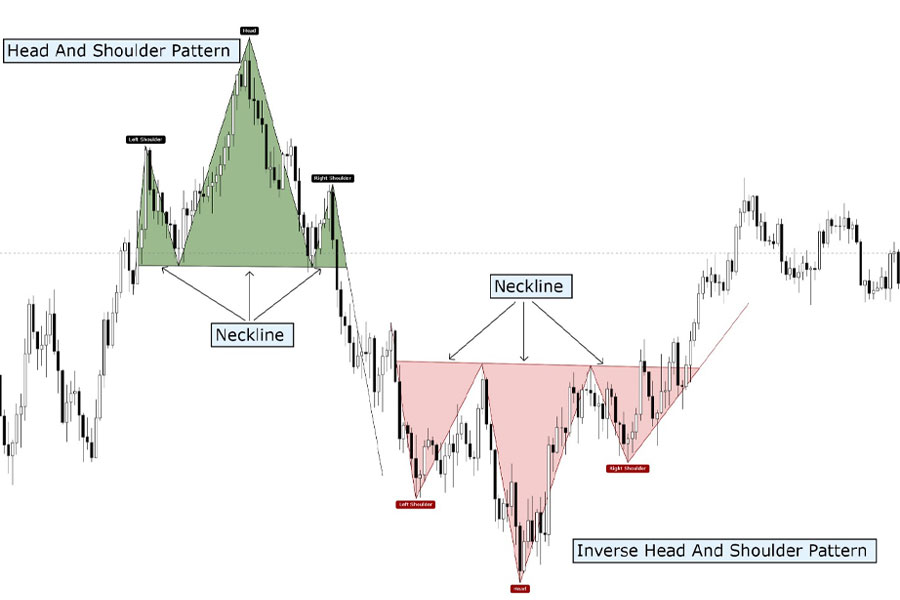

The head and shoulders pattern is a technical analysis tool that signals a trend reversal, which can be either bearish or bullish depending on the specific variation of the pattern. This pattern can be broken down into three main sections: the left shoulder, the head, and the right shoulder. It’s a classic reversal pattern used to indicate a change in trend direction, commonly seen after a significant uptrend or downtrend.

There are two types of head and shoulders patterns:

- Traditional Head and Shoulders: This pattern forms during an uptrend and signals a bearish reversal, suggesting that the price will drop after completing the formation.

- Inverse Head and Shoulders: This pattern occurs during a downtrend and indicates a bullish reversal, showing that the price is likely to rise after the pattern finishes forming.

Importance in Identifying Market Reversals

For forex traders, identifying market reversals is critical to managing risk and seizing profitable opportunities. The head and shoulders pattern is a robust tool in identifying these reversals, making it easier to anticipate when a currency pair’s price is likely to change direction. Recognizing a market reversal early allows traders to exit a position before a trend shifts or enter a trade at a more advantageous price.

The ability to spot reversals gives traders several advantages:

- Better Timing: Knowing when a trend is likely to reverse allows traders to time their entries and exits with greater accuracy.

- Capital Preservation: By recognizing reversal patterns early, traders can reduce the risk of holding onto losing trades.

- Profit Maximization: Entering or exiting trades at optimal points maximizes the potential for profit, as traders can catch trends early on.

By incorporating the head and shoulders pattern into your trading strategy, you increase your ability to capitalize on key market moments.

Read More: Elliott Wave Strategy

Structure of the Head and Shoulders Pattern

Components: Left Shoulder, Head, Right Shoulder

The head and shoulders pattern consists of three key components that work together to signal a reversal:

- Left Shoulder: The price rises, reaches a peak, and then retraces to form the left shoulder. This initial peak often aligns with previous levels of resistance in the market.

- Head: The price increases again, creating a higher peak (the “head”) before retracing once more. This is the highest point in the pattern and represents the final push of bullish momentum before the reversal starts to take shape.

- Right Shoulder: The price rises a third time but doesn’t reach the height of the head. This smaller peak forms the right shoulder and signifies that buyers are losing strength.

Each part of the pattern reveals a story of market psychology, showing the weakening momentum of buyers and the eventual takeover by sellers (or vice versa in the case of an inverse head and shoulders).

Role of the Neckline in Determining Entry Points

The neckline is a trendline that connects the lows (in the case of a traditional pattern) or the highs (in an inverse pattern) between the left and right shoulders. The neckline plays a crucial role in determining entry points. A break below the neckline in a traditional head and shoulders pattern is a strong indication that a bearish reversal is about to occur. Similarly, a break above the neckline in an inverse head and shoulders pattern signals a bullish reversal.

The neckline can be horizontal, slanted, or curved, depending on the price movement, and its angle can influence the strength of the breakout. A steeper neckline often indicates a stronger breakout, while a flat neckline may suggest a more gradual shift.

Important Tip: The neckline is the critical point for entry. Wait for a confirmed break of the neckline before entering a trade to avoid false signals.

In the inverse head and shoulders pattern, the neckline signals a bullish trend shift when it breaks upward.

How to Trade the Head and Shoulders Pattern

Importance of Waiting for Pattern Completion Before Trading

One of the biggest mistakes traders make is entering trades too early, before the pattern has fully completed. Patience is essential when trading the head and shoulders pattern, as entering before the pattern confirms can lead to false breakouts and significant losses. Wait until the neckline is decisively broken before initiating a trade.

For a traditional head and shoulders pattern, this means waiting for the price to break below the neckline. For the inverse pattern, you should wait for the price to break above the neckline, signaling a bullish trend reversal.

Entry Points: Traditional vs. Inverse Patterns

The head and shoulders pattern offers clear entry points based on the break of the neckline:

- Traditional Head and Shoulders: Enter a short position when the price breaks below the neckline, confirming the bearish reversal.

- Inverse Head and Shoulders: Enter a long position after the price breaks above the neckline, confirming the bullish reversal.

Pending Orders vs. Candle Closures

When trading this pattern, traders have two options: using pending orders or waiting for candle closures.

- Pending Orders: Traders can set a pending order just below (or above for inverse patterns) the neckline, so the trade automatically triggers once the price breaks through.

- Candle Closures: Waiting for a candle to close below or above the neckline provides further confirmation that the breakout is legitimate.

Read More: Long Term Forex Trading Strategy

Risk Management: Setting Stop Losses

Placement Above the Right Shoulder or Neckline

Risk management is essential for successful trading, and one of the best tools for managing risk is the stop-loss order. When trading the head and shoulders pattern, a stop-loss should be placed just above the right shoulder in a traditional pattern or just below the right shoulder in an inverse pattern. This placement ensures that if the pattern fails and the price moves against your position, your losses are limited.

Setting your stop-loss correctly can mean the difference between a minor loss and a catastrophic one.

Considerations for Different Timeframes and Instruments

The head and shoulders pattern can appear on any timeframe, from short-term intraday charts to long-term weekly or monthly charts. The timeframe you trade will influence your risk management approach:

- Short-Term Traders: For traders using hourly or minute charts, tighter stop-losses are necessary to avoid being stopped out by minor price fluctuations.

- Long-Term Traders: For those trading on daily or weekly charts, wider stop-losses give the trade room to develop and account for larger price movements.

Different currency pairs also exhibit varying levels of volatility. Major currency pairs like EUR/USD tend to be less volatile than exotic pairs like USD/ZAR, so your stop-loss should reflect the volatility of the pair you are trading.

Profit Targets: Maximizing Your Gains

Calculating Targets Based on the Height of the Head to the Neckline

Setting profit targets based on the head and shoulders pattern is a straightforward process. The most common method is to measure the distance from the top of the head to the neckline and then project that distance downward (or upward in an inverse pattern) from the breakout point. This projected distance serves as your first profit target.

For example:

- If the distance from the head to the neckline is 150 pips, you can set your first target 150 pips below the neckline for a traditional head and shoulders pattern.

This method provides a simple yet effective way to estimate how far the price might move after the pattern completes.

Adjusting Targets Based on Market Conditions

While the height of the pattern gives a good estimate of where the price might go, it’s important to remain flexible. Market conditions can change rapidly, and factors such as overall market sentiment, news events, or economic data releases can impact price movement. In some cases, you might need to adjust your target to reflect the current state of the market.

Consider the following when adjusting your targets:

- Trend Strength: If the overall trend is strong, you may want to aim for a higher profit target.

- Volatility: In highly volatile markets, consider setting more conservative profit targets to lock in gains.

Adjusting your profit targets based on current market conditions can help you capture the maximum possible profit.

Confirmation Techniques: Reducing False Breakouts

Utilizing Technical Indicators (MACD, RSI, etc.)

While the head and shoulders pattern can provide reliable signals, it’s always wise to use additional confirmation tools to enhance the accuracy of your trades. Technical indicators such as the MACD (Moving Average Convergence Divergence) or RSI (Relative Strength Index) can help confirm whether the breakout is valid.

For instance:

- MACD: A bearish crossover in a traditional pattern or a bullish crossover in an inverse pattern adds confirmation that the reversal is likely to continue.

- RSI: If the RSI shows overbought conditions in a traditional head and shoulders pattern, it supports the bearish reversal. Conversely, oversold conditions in an inverse pattern support a bullish reversal.

Combining the head and shoulders pattern with technical indicators helps reduce the risk of false breakouts and enhances trade accuracy.

Importance of Avoiding False Breakouts

False breakouts are one of the biggest risks when trading head and shoulders patterns. These occur when the price briefly breaks the neckline but then reverses back, failing to follow through on the expected trend.

To avoid falling victim to false breakouts, consider these strategies:

- Wait for Confirmation: Always wait for a confirmed break of the neckline before entering a trade. A candle close below (or above for inverse) the neckline is often a reliable signal.

- Use Indicators: As mentioned above, indicators like MACD and RSI can help confirm the legitimacy of the breakout.

- Use Pending Orders: If you’re not comfortable manually entering trades, consider using a pending order just below or above the neckline to automatically execute your trade if the breakout is confirmed.

Read More: What Is The Ichimoku Cloud

Common Pitfalls When Trading Head and Shoulders

Risks Associated with Premature Entries and False Signals

Entering trades too early is a common pitfall that traders fall into when trading the head and shoulders pattern. Premature entries can lead to significant losses if the pattern hasn’t fully formed or if the neckline fails to break convincingly. Always be patient and wait for the complete formation of the pattern and the confirmation of the neckline break before entering a trade.

Additionally, false signals can occur, particularly in volatile markets. A break of the neckline does not always guarantee a reversal, especially if other market factors are at play. Using additional confirmation techniques can help mitigate the risk of false signals.

Strategies for Managing Failed Patterns

Even the most reliable patterns can fail, and the head and shoulders is no exception. When a pattern fails, the price reverses against your position, leading to potential losses. Here are a few strategies for managing failed patterns:

- Tight Stop-Loss: Always use a tight stop-loss when trading the head and shoulders pattern. If the price reverses after a breakout, your stop-loss will limit your losses.

- Reversal Confirmation: If the pattern fails, consider entering a trade in the opposite direction, especially if other indicators or market conditions support a reversal.

Opofinance: Your ASIC-Regulated Broker

When trading complex patterns like the head and shoulders, it’s essential to work with a trustworthy broker. Opofinance is an ASIC-regulated forex broker, ensuring that your trading experience is both secure and transparent. As a regulated entity, Opofinance complies with strict financial standards, safeguarding your funds and providing a reliable trading environment.

Opofinance also offers a social trading service, allowing you to follow and copy successful traders in real-time. This feature is ideal for both beginners looking to learn from experienced traders and seasoned traders looking to diversify their strategies.

Additionally, Opofinance is officially featured on the MT5 brokers list, ensuring you have access to one of the most advanced trading platforms available. With safe and convenient deposit and withdrawal methods, you can focus on trading without worrying about the security of your funds.

Conclusion

The head and shoulders pattern serves as a critical tool in the arsenal of forex traders, offering insights into potential market reversals that can significantly enhance trading outcomes. By mastering this pattern, traders can position themselves to identify key shifts in market momentum, allowing for more informed decision-making and strategic entries and exits. Understanding the components of the head and shoulders, including the left shoulder, head, right shoulder, and neckline, is vital for recognizing its formation and implications.

Moreover, the importance of waiting for confirmation before acting cannot be overstated. Premature entries can lead to unnecessary losses, particularly in volatile markets where false breakouts are common. Utilizing confirmation techniques such as technical indicators—like MACD and RSI—can further bolster the reliability of trades based on this pattern. Incorporating these strategies not only enhances accuracy but also mitigates risks associated with trading.

Risk management remains an essential aspect of trading the head and shoulders pattern. Setting appropriate stop-loss orders and profit targets ensures that traders protect their capital while maximizing potential gains. The flexibility to adjust targets based on current market conditions is crucial for adapting to the ever-changing forex landscape.

Ultimately, patience and discipline are key to successfully implementing the head and shoulders pattern in trading strategies. As traders gain experience and refine their skills in recognizing and executing trades based on this powerful pattern, it will undoubtedly become an invaluable component of their trading toolkit. By leveraging the insights provided by the head and shoulders pattern alongside robust risk management practices, traders can navigate the complexities of the forex market with greater confidence and success.

What timeframe is best for trading the head and shoulders pattern?

The head and shoulders pattern can be applied to any timeframe, but it tends to be more reliable on longer timeframes such as the 4-hour, daily, or weekly charts. The longer the timeframe, the more significant the pattern, as it indicates a more substantial market shift.

Can I use the head and shoulders pattern in combination with other strategies?

Yes, the head and shoulders pattern works well in conjunction with other technical analysis tools, such as support and resistance levels, Fibonacci retracements, and technical indicators like MACD and RSI. Using multiple strategies increases the accuracy of your trades.

What is the difference between a head and shoulders and a double top pattern?

Both patterns signal a trend reversal, but the key difference is in their structure. The head and shoulders pattern has three peaks (two shoulders and a head), while the double top pattern consists of two peaks at roughly the same level. The head and shoulders is considered a more reliable pattern due to its more complex structure.