In the ever-evolving landscape of forex trading, Fibonacci retracement in forex stands out as a pivotal tool for traders aiming to enhance their market analysis and trading precision. Originating from Leonardo Fibonacci’s renowned sequence, this technique leverages mathematical ratios to predict potential support and resistance levels in currency pairs. Its popularity among forex traders stems from its effectiveness in identifying possible reversal points, thereby providing strategic entry and exit signals that can significantly improve trading outcomes.

Understanding how to use Fibonacci retracement in forex trading not only empowers traders with a robust analytical framework but also aligns with the best practices advocated by leading regulated forex brokers. This comprehensive guide delves deep into the essence of Fibonacci retracement, exploring its key levels, practical application on forex charts, and advanced strategies to refine your trading approach. Whether you’re partnering with a broker for forex trading or fine-tuning your fib retracement strategy, this article offers invaluable insights to navigate the complexities of the forex market with confidence.

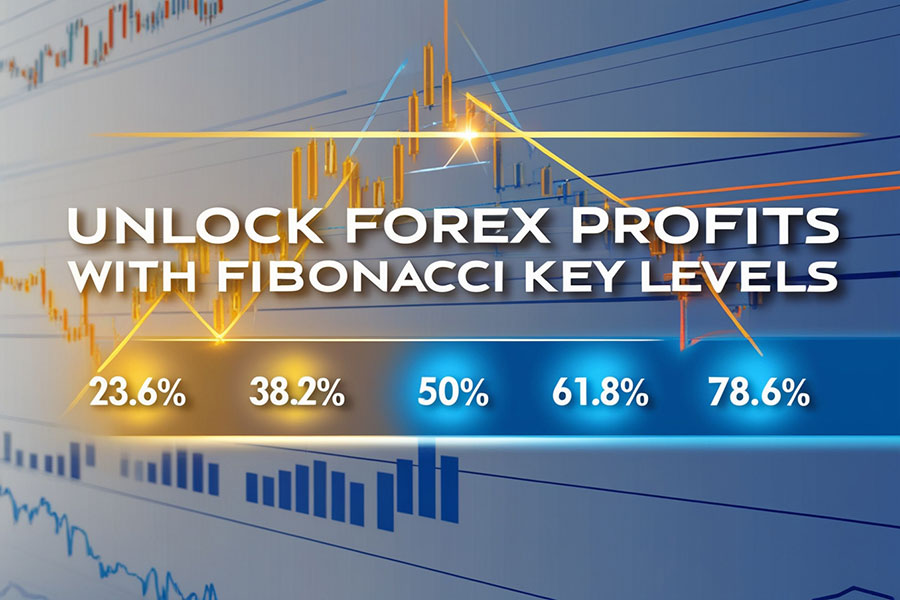

Key Fibonacci Retracement Levels in Forex

Fibonacci retracement levels are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones. In forex trading, the most significant Fibonacci levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels act as potential indicators of where the price of a currency pair might reverse or continue its trend.

23.6% Level

The 23.6% retracement level is considered a minor correction point. It often indicates a shallow pullback in the trend, suggesting that the prevailing trend is likely to continue with minimal interruption. Traders may use this level to identify quick entry points with tight stop-loss orders.

38.2% Level

At the 38.2% level, traders observe a more substantial retracement. This level frequently acts as a strong support or resistance zone where significant price reversals can occur. It is often used to gauge the strength of the current trend and potential continuation.

50% Level

Although not a true Fibonacci ratio, the 50% retracement level is widely used due to its psychological significance among traders. It represents a significant correction point where the price may reverse or consolidate, providing strategic opportunities for entry or exit.

61.8% Level

Known as the “golden ratio,” the 61.8% retracement level is one of the most critical Fibonacci levels in forex trading. It signifies a deep retracement where the trend is likely to resume with strong momentum, making it a key level for setting stop-loss and take-profit orders.

78.6% Level

The 78.6% retracement level marks an extensive pullback, often signaling the end of a correction phase. At this level, traders anticipate the resumption of the original trend, making it a strategic point for re-entering trades with high confidence.

Understanding these key Fibonacci retracement levels is essential for identifying potential reversal points and enhancing your trading strategy.

How to Draw Fibonacci Retracement on Forex Charts

Effectively applying Fibonacci retracement in forex trading requires precise plotting on charts. Here’s a step-by-step guide to drawing Fibonacci retracement levels:

Step 1: Identify the Trend

Determine whether the market is in an uptrend or a downtrend. This foundational step ensures accurate placement of Fibonacci levels.

Step 2: Select Significant High and Low Points

Choose the most significant swing high and swing low points within the selected timeframe. These points serve as the anchors for plotting Fibonacci levels.

Step 3: Plot the Retracement Levels

Using your charting tool, draw the Fibonacci retracement from the swing low to swing high in an uptrend, or from swing high to swing low in a downtrend. The tool will automatically display the key retracement levels.

Step 4: Analyze Price Behavior

Monitor how the price interacts with each Fibonacci level. A bounce or reversal at these levels can indicate potential entry or exit points for your trades.

Practical Example: EUR/USD

Consider the EUR/USD pair in an uptrend. Identify the swing low at 1.1000 and the swing high at 1.2000. Plotting Fibonacci retracement from 1.1000 to 1.2000 will display levels at 23.6% (1.1236), 38.2% (1.1382), 50% (1.1500), 61.8% (1.1618), and 78.6% (1.1786). Traders can use these levels to anticipate potential support zones where the price might reverse and continue the uptrend.

Mastering the art of drawing Fibonacci retracement levels is crucial for precise market analysis and strategic trading decisions.

Trading Strategies Using Fibonacci Retracement

Integrating Fibonacci retracement into your trading strategy can significantly enhance your ability to predict market movements and optimize your trades. Here are some effective and practical strategies to leverage Fibonacci retracement in forex trading:

1. Trend Reversal Strategy

Objective: Identify potential reversal points within a prevailing trend to enter trades with higher probability.

Steps:

- Identify the Trend:

- Determine whether the market is in an uptrend or a downtrend by analyzing higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend).

- Plot Fibonacci Retracement Levels:

- In an uptrend, draw the Fibonacci retracement from the swing low to the swing high.

- In a downtrend, draw from the swing high to the swing low.

- Look for Reversal Signals at Key Levels:

- Focus on the 38.2% and 61.8% retracement levels as potential reversal zones.

- Wait for confirmation signals such as candlestick patterns (e.g., Hammer, Doji) or bullish/bearish divergence on indicators like RSI or MACD.

- Enter the Trade:

- For an uptrend reversal, enter a long position when the price bounces off a Fibonacci support level with a confirming signal.

- For a downtrend reversal, enter a short position when the price rejects a Fibonacci resistance level with a confirming signal.

- Set Stop-Loss and Take-Profit:

- Place a stop-loss order just below the Fibonacci support level for long positions or above the resistance level for short positions.

- Set take-profit targets near the next Fibonacci level or based on a favorable risk-to-reward ratio (e.g., 1:2).

Practical Example:

- Currency Pair: EUR/USD

- Trend: Uptrend

- Swing Low: 1.1000

- Swing High: 1.2000

- Fibonacci Levels Plotted: 23.6% (1.1236), 38.2% (1.1382), 50% (1.1500), 61.8% (1.1618), 78.6% (1.1786)

Suppose the price retraces to the 61.8% level (1.1618) and forms a Hammer candlestick, indicating a potential reversal. A trader might enter a long position at 1.1620 with a stop-loss at 1.1550 and a take-profit at 1.1800.

2. Continuation Strategy

Objective: Capitalize on minor pullbacks within a strong trend to enter trades in the direction of the prevailing trend.

Steps:

- Identify a Strong Trend:

- Confirm a robust uptrend or downtrend using trend indicators like Moving Averages or trendlines.

- Plot Fibonacci Retracement Levels:

- In an uptrend, draw from swing low to swing high.

- In a downtrend, draw from swing high to swing low.

- Wait for a Pullback to a Fibonacci Level:

- In an uptrend, wait for the price to pull back to the 38.2% or 50% retracement level.

- In a downtrend, wait for the price to rally to the 38.2% or 50% retracement level.

- Confirm with Additional Indicators:

- Use indicators like RSI to ensure the asset is not overbought or oversold.

- Look for bullish or bearish divergence to confirm the continuation of the trend.

- Enter the Trade:

- For an uptrend, enter a long position as the price starts to move upward from the retracement level.

- For a downtrend, enter a short position as the price begins to decline from the retracement level.

- Set Stop-Loss and Take-Profit:

- Place a stop-loss order below the retracement level for long positions or above for short positions.

- Set take-profit targets at the next significant Fibonacci level or based on a predefined risk-to-reward ratio.

Practical Example:

- Currency Pair: GBP/JPY

- Trend: Downtrend

- Swing High: 150.00

- Swing Low: 140.00

- Fibonacci Levels Plotted: 23.6% (143.64), 38.2% (145.82), 50% (145.00), 61.8% (144.18), 78.6% (141.42)

If GBP/JPY rallies to the 50% retracement level (145.00) and the RSI indicates overbought conditions but the price begins to show bearish candlestick patterns, a trader might enter a short position at 144.80 with a stop-loss at 145.50 and a take-profit at 142.00.

3. Breakout Strategy

Objective: Exploit breakouts beyond key Fibonacci levels to enter trades in the direction of the breakout.

Steps:

- Identify Key Fibonacci Levels:

- Plot Fibonacci retracement levels on a significant swing high and low.

- Monitor Price Action Near Fibonacci Levels:

- Observe how the price behaves as it approaches key retracement levels, particularly the 61.8% and 78.6% levels.

- Look for Breakout Signals:

- A breakout occurs when the price decisively moves beyond a Fibonacci level with increased volume.

- Confirm the breakout with indicators like MACD crossover or a surge in trading volume.

- Enter the Trade:

- For an upward breakout, enter a long position once the price closes above the Fibonacci resistance level.

- For a downward breakout, enter a short position once the price closes below the Fibonacci support level.

- Set Stop-Loss and Take-Profit:

- Place a stop-loss order just below the broken Fibonacci level for long positions or above for short positions.

- Use Fibonacci extensions to determine potential take-profit targets, ensuring a favorable risk-to-reward ratio.

Practical Example:

- Currency Pair: USD/CHF

- Trend: Sideways with potential for breakout

- Swing Low: 0.9000

- Swing High: 0.9500

- Fibonacci Levels Plotted: 23.6% (0.9236), 38.2% (0.8862), 50% (0.9250), 61.8% (0.9618), 78.6% (0.9786)

If USD/CHF approaches the 78.6% retracement level (0.9786) and breaks above it with significant volume, a trader might enter a long position at 0.9800 with a stop-loss at 0.9750 and a take-profit at 0.9900, using Fibonacci extensions to identify further price targets.

4. Fibonacci Fan Strategy

Objective: Utilize diagonal Fibonacci lines to identify dynamic support and resistance levels, aiding in the prediction of price movements in trending markets.

Steps:

- Identify the Trend:

- Determine whether the market is trending upwards or downwards.

- Plot the Fibonacci Fan:

- In an uptrend, draw the fan from the swing low to the swing high.

- In a downtrend, draw from the swing high to the swing low.

- The Fibonacci fan consists of diagonal lines representing different Fibonacci ratios (e.g., 38.2%, 50%, 61.8%).

- Identify Support and Resistance Zones:

- The diagonal lines act as dynamic support and resistance levels.

- Monitor how the price interacts with these lines to anticipate potential reversals or continuation of the trend.

- Combine with Price Action:

- Look for confirmation through price action signals like candlestick patterns or trendline breaks when the price touches a Fibonacci fan line.

- Enter the Trade:

- For an uptrend, enter a long position when the price bounces off a fan support line with confirming signals.

- For a downtrend, enter a short position when the price rejects a fan resistance line with confirming signals.

- Set Stop-Loss and Take-Profit:

- Place stop-loss orders beyond the Fibonacci fan lines to protect against false breakouts.

- Use the next Fibonacci fan line as a take-profit target or employ Fibonacci extensions for higher targets.

Practical Example:

- Currency Pair: AUD/USD

- Trend: Uptrend

- Swing Low: 0.7000

- Swing High: 0.8000

- Fibonacci Fan Lines Plotted: 38.2% (0.7382), 50% (0.7500), 61.8% (0.7618)

If AUD/USD retraces to the 50% fan line (0.7500) and forms a bullish Engulfing pattern, a trader might enter a long position at 0.7520 with a stop-loss at 0.7450 and a take-profit at 0.7600, anticipating the continuation of the uptrend.

Employing these Fibonacci retracement strategies can provide a structured approach to trading, enhancing your decision-making process and increasing profitability. By integrating practical techniques with robust risk management, traders can effectively navigate the complexities of the forex market.

Combining Fibonacci Retracement with Other Tools

Enhancing the effectiveness of Fibonacci retracement involves integrating it with other technical analysis tools. This combination provides a more comprehensive view of the market and increases the reliability of your trading signals.

Candlestick Patterns

Utilize candlestick patterns such as Doji, Hammer, or Engulfing patterns in conjunction with Fibonacci levels. For instance, a Hammer candlestick forming near the 61.8% retracement level can confirm a potential reversal, providing a stronger signal to enter a trade.

Technical Indicators

Integrate Fibonacci retracement with indicators like Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). For example:

- Moving Averages: Use moving averages to confirm the trend direction and strengthen Fibonacci retracement signals.

- RSI: An RSI divergence at a Fibonacci level can indicate a potential reversal, enhancing the reliability of the signal.

- MACD: The MACD histogram crossing above or below the signal line near a Fibonacci level can provide additional confirmation for trade entries or exits.

Combining Fibonacci retracement with other technical tools creates a robust analytical framework, improving the accuracy of your trading decisions.

Risk Management and Fibonacci Retracement

Effective risk management is paramount in forex trading, and Fibonacci retracement can play a vital role in planning your risk-to-reward ratios and setting stop-loss and take-profit levels.

Planning Risk-to-Reward Ratios

Use Fibonacci levels to determine optimal entry points and set realistic profit targets. By analyzing potential retracement levels, you can calculate a favorable risk-to-reward ratio, ensuring that potential profits justify the risks taken.

Setting Stop-Loss and Take-Profit Levels

Place stop-loss orders just beyond a significant Fibonacci level to minimize potential losses. For example, if entering a trade at the 38.2% retracement level, set a stop-loss slightly below this level. Similarly, set take-profit orders near the next Fibonacci level to secure profits.

Specific Strategies

- Stop-Loss Beyond 61.8% Level: Placing stop-loss orders beyond the 61.8% retracement level provides a buffer against unexpected price movements, ensuring that trades are protected even if the market becomes volatile.

- Fibonacci Extensions for Profit Targets: Use Fibonacci extensions to identify potential profit targets beyond the standard retracement levels. This technique helps in setting realistic and achievable profit goals, enhancing overall trading performance.

Incorporating Fibonacci retracement into your risk management strategy ensures that your trades are well-protected and that your potential rewards justify the risks involved.

Advanced Techniques: Extensions and Fibonacci Confluence

For seasoned traders, advanced Fibonacci retracement techniques can provide deeper insights and enhance trading precision.

Fibonacci Extensions

Fibonacci extensions are used to identify potential price targets beyond the standard retracement levels. By plotting extensions at 161.8%, 261.8%, and 423.6%, traders can determine where the price might reach after completing a retracement, allowing for more accurate profit-taking strategies.

Fibonacci Confluence

Fibonacci confluence occurs when multiple Fibonacci levels from different swings or different timeframes intersect. This convergence creates stronger support or resistance zones, increasing the likelihood of a price reversal or continuation. For example, if the 38.2% retracement level from one swing aligns with the 61.8% level from another swing, it forms a Fibonacci confluence, providing a highly reliable trading signal.

Integrating with Elliott Wave Theory

Combining Fibonacci retracement with Elliott Wave Theory can enhance your ability to predict market cycles and identify significant price movements. By aligning Fibonacci levels with Elliott Wave counts, traders can gain a deeper understanding of market dynamics and improve their trading accuracy.

Automated Fibonacci Tools

Leverage automated trading tools and software that can plot Fibonacci retracement levels in real-time. These tools save time, increase precision, and allow for timely adjustments based on market volatility and changing trend conditions.

Advanced Fibonacci retracement techniques offer deeper market insights and enhance the precision of your trading strategies, providing a competitive edge in the forex market.

Pro Tips for Advanced Traders

Elevate your trading strategy with these expert Fibonacci retracement techniques:

- Use Fibonacci Extensions for Target Setting: Go beyond standard retracement levels by applying Fibonacci extensions to identify additional profit targets, ensuring you capture maximum market movements.

- Combine with Elliott Wave Theory: Integrate Fibonacci retracement with Elliott Wave principles to better anticipate market cycles and enhance the accuracy of your predictions.

- Dynamic Adjustment of Fibonacci Levels: Adapt Fibonacci levels dynamically based on real-time market volatility and trend changes to maintain their relevance and effectiveness.

- Leverage Automated Tools: Utilize advanced trading software that automatically plots Fibonacci retracement levels, saving time and increasing precision in your analysis.

- Regular Backtesting: Consistently backtest your Fibonacci retracement strategies against historical data to refine your approach and improve future trading performance.

Implementing these pro tips can significantly enhance your trading strategy, providing advanced traders with the tools needed to navigate complex market conditions effectively.

Opofinance: Your Trusted Forex Trading Partner

When it comes to executing your fib retracement strategy, partnering with a reliable regulated forex broker is paramount. Opofinance stands out as an ASIC regulated broker, offering a suite of services tailored to meet the needs of both novice and advanced traders.

Why Choose Opofinance?

- Social Trading Services: Connect with a community of experienced traders, share strategies, and replicate successful trades effortlessly.

- Featured on MT5 Brokers List: Enjoy the robust features and reliability of the MetaTrader 5 platform, trusted by traders worldwide.

- Safe and Convenient Deposits and Withdrawals: Experience seamless financial transactions with multiple secure payment options, ensuring your funds are always protected.

Choose Opofinance for a superior trading experience that aligns with your Fibonacci retracement strategies and overall trading goals.

Key Takeaways

- Fibonacci retracement in forex is a vital tool for identifying potential support and resistance levels.

- Understanding and effectively applying Fibonacci levels can enhance your trading strategy and profitability.

- Combining Fibonacci retracement with other technical indicators and strategies leads to more informed trading decisions.

- Advanced techniques like Fibonacci extensions and integration with Elliott Wave Theory can further refine your trading approach.

- Partnering with a reputable regulated forex broker like Opofinance ensures a secure and efficient trading environment.

Mastering Fibonacci retracement can transform your forex trading strategy, providing a structured approach to market analysis and risk management.

How do Fibonacci retracement levels differ between various currency pairs?

Fibonacci retracement levels are universal and can be applied to any currency pair. However, the significance of each level may vary based on the volatility and trading behavior of the specific pair. It’s essential to analyze each currency pair individually and consider historical price movements to determine the most relevant retracement levels.

Can Fibonacci retracement be automated in trading platforms?

Yes, many trading platforms, including MetaTrader 5, offer automated Fibonacci retracement tools. These tools can automatically plot retracement levels based on predefined parameters, saving traders time and ensuring accuracy in their analysis. Additionally, some platforms allow for the customization of Fibonacci tools to suit individual trading strategies.

How can I validate Fibonacci retracement signals before entering a trade?

To validate Fibonacci retracement signals, combine them with other technical indicators such as RSI, MACD, or moving averages. Additionally, look for confirmation through candlestick patterns or trend analysis. Ensuring that multiple indicators align at a specific Fibonacci level increases the reliability of the signal and reduces the likelihood of false positives.