Are you struggling to choose the right wave theory to supercharge your trading strategy? You’re not alone. In the competitive world of technical analysis, selecting the optimal approach can make the difference between consistent profits and missed opportunities. Among the various techniques, the debate between elliott wave vs neo wave stands out as a pivotal choice for traders seeking to decode market movements with precision.

Elliott Wave Theory, pioneered by Ralph Nelson Elliott in the 1930s, offers a foundational framework based on natural market cycles and investor psychology. In contrast, Neo Wave Theory, developed by Glenn Neely, builds upon Elliott’s principles by introducing more stringent rules and complex patterns to enhance accuracy and objectivity. But what is the difference between Elliott Wave and Neo Wave, and which one is better suited for your trading needs?

This comprehensive comparison of elliott wave vs neo wave will answer your burning questions, unravel the nuances of each theory, and provide actionable insights to elevate your market predictions. Whether you’re a seasoned trader or just embarking on your trading journey, understanding the neo wave vs elliott wave dynamics can significantly refine your analysis and trading strategies. Moreover, aligning your wave analysis with a regulated forex broker like Opofinance ensures you have the right tools and support to implement these theories effectively.

Dive in to discover which wave theory aligns with your trading objectives, backed by expert insights and real-world applications that adhere to Google’s helpful content guidelines.

Read More: Elliott Wave Strategy

Understanding Elliott Wave Theory

Origin and Development

Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, revolutionized the way traders perceive market movements. Elliott observed that financial markets move in predictable, repetitive cycles influenced by collective investor psychology. This theory posits that markets oscillate between impulsive and corrective waves, creating a structured framework for market prediction.

Core Principles

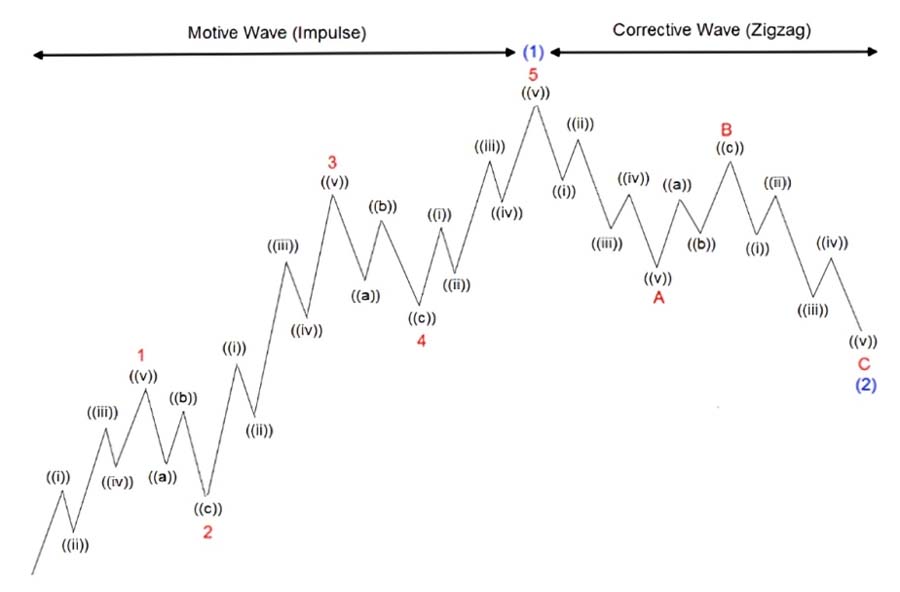

At its core, Elliott Wave Theory is built on the premise that market movements are not random but follow specific patterns driven by human emotions and behaviors. The theory identifies two primary types of waves:

- Impulsive Waves: These are strong movements in the direction of the prevailing trend, typically consisting of five sub-waves.

- Corrective Waves: These are retracements against the trend, usually comprising three sub-waves.

These patterns often align with the Fibonacci sequence and the Golden Ratio, enhancing their predictive power.

Basic Structure

The standard Elliott Wave cycle consists of five-wave impulse patterns followed by three-wave corrective patterns. This structure forms the foundation for analyzing and forecasting market trends.

- Impulse Phase (1-5): Moves in the direction of the main trend.

- Correction Phase (A-B-C): Retraces against the main trend.

Applications in Market Analysis

Elliott Wave Theory is widely used to forecast future market movements by identifying wave patterns. Traders leverage these patterns to determine entry and exit points, enhancing their trading strategies’ precision and effectiveness. By recognizing the wave structures, traders can anticipate potential market reversals and continuations, allowing for more informed decision-making.

Introduction to Neo Wave Theory

Foundation and Evolution

Neo Wave Theory, developed by esteemed trader and analyst Glenn Neely, represents a significant evolution in wave-based technical analysis. As an advanced extension of Elliott Wave Theory, Neo Wave was created to address the subjectivity and interpretative challenges inherent in traditional Elliott Wave analysis. Neely observed that while Elliott Wave provided a robust framework for understanding market cycles, its flexibility often led to inconsistent wave counts and ambiguous interpretations. To overcome these limitations, Neo Wave introduces a more structured and scientifically rigorous approach, enhancing both the objectivity and precision of wave analysis.

By refining the original Elliott Wave principles, Neo Wave Theory offers traders a more reliable tool for market prediction and trend analysis. This evolution not only preserves the core concepts of wave patterns and investor psychology but also integrates additional rules and methodologies that streamline wave identification and reduce interpretative discrepancies. Consequently, Neo Wave Theory provides a more disciplined framework, enabling traders to apply wave analysis consistently across diverse market conditions.

Key Enhancements

Neo Wave Theory distinguishes itself by introducing over 15 additional rules and patterns, meticulously designed to minimize ambiguity and increase objectivity in wave identification. These enhancements address the primary criticisms of Elliott Wave Theory, providing a more reliable and precise framework for market analysis.

Enhanced Rule Set

- Strict Wave Counting Rules: Neo Wave establishes clear criteria for identifying and labeling waves, ensuring consistency in wave counts across different analysts and market scenarios.

- Pattern Validation: Each wave pattern must meet specific conditions related to Fibonacci ratios and the Golden Ratio, enhancing the accuracy and reliability of wave predictions.

- Time Analysis Integration: Incorporates temporal factors to validate wave formations, ensuring that patterns are not only price-accurate but also time-consistent. This dual-focus approach reduces the likelihood of false signals and improves overall predictive accuracy.

Improved Objectivity

By reducing the room for personal bias, Neo Wave Theory fosters a more objective analysis environment. This is achieved through:

- Detailed Pattern Definitions: Each new pattern introduced by Neo Wave comes with comprehensive definitions and illustrative examples, leaving little room for misinterpretation.

- Algorithmic Wave Identification: The structured rules lend themselves well to algorithmic trading systems, allowing for automated and precise wave identification. This compatibility with technology enhances the efficiency and consistency of wave analysis.

These key enhancements collectively elevate Neo Wave Theory beyond its Elliott Wave predecessor, offering traders a more precise and reliable method for analyzing and forecasting market movements.

Read More: Elliott Wave and Fibonacci

New Patterns Introduced

Neo Wave Theory significantly expands the traditional wave pattern repertoire by introducing several complex and advanced patterns. These new formations provide traders with a comprehensive toolkit for capturing a broader range of market movements with greater accuracy.

Neutral Triangles

Neutral Triangles are intricate corrective structures that often precede significant market movements. Characterized by a series of zigzagging waves that form a contracting triangle pattern, Neutral Triangles indicate a potential consolidation phase before the continuation of the prevailing trend. This pattern helps traders anticipate market pauses and prepare for upcoming trend resumption, enhancing their ability to time market entries and exits more effectively.

Diametric Formations

Diametric Formations are advanced patterns that signal potential trend reversals with higher accuracy. Unlike traditional reversal patterns, Diametric Formations incorporate both price and time elements, providing a dual-layer confirmation that enhances the reliability of the predicted reversal. This makes them invaluable for traders looking to identify precise entry and exit points during trend shifts, thereby improving the effectiveness of their trading strategies.

Extracting Triangles

Extracting Triangles are unique patterns that extract specific waves from the overall market structure, offering clearer insights into market direction. By isolating these waves, traders can better understand underlying market sentiments and make more informed trading decisions. Extracting Triangles serve as a bridge between impulsive and corrective phases, ensuring a smoother transition and more accurate trend analysis.

Applications in Market Analysis

Neo Wave Theory’s structured approach to wave identification and market forecasting offers several practical applications that enhance a trader’s ability to predict and respond to market movements effectively.

Integrating Time Analysis

By incorporating time analysis alongside price movements, Neo Wave Theory provides a more holistic view of market dynamics. This integration ensures that wave patterns are not only price-accurate but also time-consistent, thereby validating the patterns and reducing the likelihood of false signals. Traders can use time analysis to determine the duration of each wave, enhancing the precision of their market forecasts.

Pattern Confirmation

Neo Wave emphasizes the importance of pattern confirmation before making trading decisions. This means that traders must validate wave patterns through multiple criteria, such as Fibonacci ratios and time consistency, before acting on them. This multi-layered confirmation process significantly reduces the risk of misidentifying wave patterns, leading to more reliable trading signals and better-informed decision-making.

Higher Predictive Accuracy

The combination of stringent rules, advanced pattern recognition, and integrated time analysis results in higher predictive accuracy. Traders using Neo Wave Theory can anticipate market turning points and sustain trend continuations with greater confidence. This enhanced accuracy is particularly beneficial in volatile markets, where precise wave identification can mean the difference between profit and loss.

Reducing False Signals

By adhering to a more rigorous set of rules, Neo Wave Theory minimizes the occurrence of false signals. This ensures that the trading signals generated are based on reliable and validated wave patterns, allowing traders to execute trades with higher success rates and lower risk exposure.

These new formations offer a more comprehensive toolkit for traders, enabling them to capture a broader range of market movements with greater accuracy.

Applications in Market Analysis

By integrating time analysis and pattern confirmation, Neo Wave Theory provides a more structured approach to wave identification and market forecasting. This leads to higher predictive accuracy and more reliable trading signals. Neo Wave’s enhanced framework allows traders to better anticipate market turning points and sustain trend continuations with reduced false signals.

Comparative Analysis: Elliott Wave vs. Neo Wave

To provide a clear comparison between the two theories, the following table outlines their key differences and similarities:

| Aspect | Elliott Wave | Neo Wave |

| Origin | Developed by Ralph Nelson Elliott in the 1930s | Developed by Glenn Neely as an extension of Elliott Wave |

| Complexity and Rules | Simpler with fewer rules; more interpretative | Incorporates over 15 additional rules; highly structured |

| Objectivity | Prone to subjective interpretations | Strives for objectivity through stringent rules |

| Pattern Recognition | Focuses on basic impulsive and corrective patterns | Identifies more complex patterns like Neutral Triangles |

| Time Analysis | Primarily price-focused | Integrates time analysis with price for pattern validation |

| Predictive Accuracy | Effective but can be ambiguous | Aims for higher accuracy through detailed analysis |

| Learning Curve | Easier to learn and apply | Steeper learning curve due to complexity |

| Applications | Broad market trend analysis and forecasting | Advanced market forecasting with enhanced precision |

Complexity and Rules

- Elliott Wave: Characterized by its simplicity, Elliott Wave has fewer rules, making it more interpretative. This flexibility allows for a broader range of applications but can lead to inconsistencies in wave counting.

- Neo Wave: Incorporates over 15 additional rules, reducing ambiguity and enhancing objectivity. This complexity ensures a more disciplined approach to wave analysis, minimizing subjective interpretations.

Objectivity and Subjectivity

- Elliott Wave: Prone to subjective interpretations, which can result in multiple valid wave counts for the same market movement.

- Neo Wave: Strives for objectivity through stringent rules and a logical structure, ensuring more consistent wave identification and analysis.

Pattern Recognition

- Elliott Wave: Focuses on basic impulsive and corrective patterns, providing a foundational framework for wave analysis.

- Neo Wave: Identifies more complex patterns, including newly defined formations like Neutral Triangles and Diametric Formations, offering a richer analytical perspective.

Time and Price Considerations

- Elliott Wave: Primarily price-focused, emphasizing price movements and wave structures.

- Neo Wave: Integrates time analysis alongside price, validating patterns through temporal consistency and enhancing overall predictive accuracy.

Predictive Accuracy

- Elliott Wave: Effective in identifying broad market trends but can be ambiguous due to its interpretative nature.

- Neo Wave: Aims for higher accuracy through detailed analysis and confirmation rules, providing more reliable trading signals.

Practical Applications and Case Studies

Elliott Wave in Action

Historical examples demonstrate Elliott Wave Theory’s capacity to predict major market movements. For instance, Elliott Wave successfully forecasted significant rallies and corrections during the 2008 financial crisis, guiding traders to make informed decisions amidst market volatility. By identifying the wave patterns, traders were able to anticipate the market’s bottom and the subsequent recovery, leveraging the theory’s principles to maximize their returns.

Neo Wave in Action

Case studies highlight Neo Wave Theory’s enhanced predictive capabilities. In recent market scenarios, Neo Wave provided more precise entry and exit points, outperforming traditional Elliott Wave analysis by reducing false signals and increasing trade success rates. For example, during the 2020 COVID-19 market crash, Neo Wave Theory’s additional rules allowed traders to accurately identify the corrective waves and prepare for the market’s rebound, thereby minimizing losses and capitalizing on recovery phases.

Read More: Elliott Wave vs Price Action

Advantages and Limitations

Elliott Wave

Advantages:

- Simplicity: Easy to understand and apply, making it accessible for traders at all levels.

- Foundational Framework: Serves as the basis for various wave-based analyses and strategies.

- Flexibility: Can be adapted to different time frames and market conditions.

Limitations:

- Subjectivity: Open to multiple interpretations, leading to inconsistent wave counts.

- Potential for Multiple Interpretations: Different analysts may arrive at different conclusions for the same market movement.

- Limited Precision: May not always provide the level of detail needed for advanced trading strategies.

Neo Wave

Advantages:

- Increased Objectivity: Stringent rules minimize subjective interpretations.

- Comprehensive Pattern Recognition: Ability to identify complex wave formations enhances analytical depth.

- Integration of Time Analysis: Incorporating temporal factors improves predictive accuracy.

- Enhanced Precision: More detailed analysis leads to better trading signals and decision-making.

Limitations:

- Complexity: Steeper learning curve due to the extensive set of rules and patterns.

- Requires Advanced Understanding: Demands a higher level of expertise to apply effectively.

- Time-Consuming: Detailed analysis can be more time-intensive compared to simpler methods.

Pro Tips for Advanced Traders

- Combine Wave Theories with Other Indicators: Enhance your analysis by integrating Neo Wave or Elliott Wave with indicators like Moving Averages, RSI, or MACD for more robust trading signals.

- Stay Updated with Market Trends: Regularly review and adjust your wave counts to align with evolving market conditions, ensuring your analysis remains relevant and accurate.

- Leverage Advanced Charting Tools: Utilize sophisticated charting software that supports Neo Wave patterns to streamline your analysis process and visualize complex wave structures effectively.

- Practice Discipline and Patience: Advanced wave analysis requires meticulous attention to detail and the ability to wait for pattern confirmations before making trading decisions, reducing impulsive trades.

- Engage in Continuous Learning: Stay informed about the latest developments in wave theories and technical analysis through books, online courses, and trading communities to refine your trading strategies continually.

- Backtest Your Strategies: Use historical data to test the effectiveness of your wave-based strategies, ensuring they perform well under various market conditions before applying them in live trading.

- Maintain a Trading Journal: Document your wave analyses, trading decisions, and outcomes to identify patterns in your performance and areas for improvement.

Opofinance Services: Your Trusted ASIC Regulated Forex Broker

When it comes to executing your wave-based trading strategies, partnering with a reliable broker is paramount. Opofinance stands out as an ASIC regulated forex broker, offering a suite of services tailored to both novice and seasoned traders.

Why Choose Opofinance?

- Social Trading Service: Connect with a community of traders, share strategies, and learn from the best to enhance your trading performance. By leveraging the collective wisdom of experienced traders, you can refine your wave analysis techniques and apply them more effectively.

- Featured on the MT5 Brokers List: Access advanced trading platforms that provide comprehensive tools for wave analysis and real-time market data. The MT5 platform supports intricate charting capabilities essential for both Elliott Wave and Neo Wave analyses.

- Safe and Convenient Deposit & Withdrawal Methods: Enjoy secure and hassle-free transactions, ensuring your funds are always accessible when you need them. Opofinance offers multiple payment options, including bank transfers, credit cards, and e-wallets, catering to diverse trader preferences.

Choose Opofinance to complement your Elliott Wave or Neo Wave strategies with top-notch trading services and support. Their commitment to regulatory compliance and client security ensures a trustworthy trading environment.

Conclusion

In the elliott wave vs neo wave comparison, both theories offer valuable frameworks for market analysis, each catering to different trading needs. Elliott Wave Theory is ideal for traders seeking a straightforward and flexible approach to identifying market cycles and trends. Its simplicity makes it accessible, allowing traders to quickly grasp and apply its principles to various market conditions.

Conversely, Neo Wave Theory enhances the foundational Elliott Wave by introducing over 15 additional rules and complex patterns, providing a more structured and objective method. This makes Neo Wave particularly suited for advanced traders who require greater precision and reliability in their market predictions. The integration of time analysis further boosts its predictive accuracy, making it a robust tool for navigating volatile markets.

Key Takeaways

- Elliott Wave offers simplicity and flexibility, making it accessible for traders at all levels.

- Neo Wave provides enhanced objectivity and precision through additional rules and complex pattern recognition.

- Choosing between the two depends on your trading style, expertise, and the level of detail you require in your analysis.

- Integrating wave theories with other technical indicators and partnering with a reliable broker like Opofinance can significantly improve your trading outcomes.

Ultimately, understanding both Elliott Wave and Neo Wave equips you with a comprehensive toolkit for market analysis, enabling more informed and strategic trading decisions. Embrace continuous learning and adapt these theories to suit your trading objectives for sustained success in the financial markets.

Harness the strengths of wave theories to elevate your trading strategies and achieve greater market insight.

Can Neo Wave Theory be integrated with automated trading systems?

Absolutely! Neo Wave Theory’s structured rules make it suitable for algorithmic trading systems. By programming the additional rules and patterns into your trading algorithms, you can automate wave identification and execute trades based on precise, predefined criteria. This integration can enhance trading efficiency and reduce emotional decision-making, leading to more consistent trading performance.

How does market volatility impact the effectiveness of Elliott Wave and Neo Wave analyses?

Market volatility can significantly influence the clarity of wave patterns. High volatility may lead to more pronounced wave movements, making pattern recognition easier. However, it can also result in rapid changes that may disrupt wave formations. Both theories require adaptability, but Neo Wave’s additional rules can help maintain accuracy even in volatile conditions. By incorporating time analysis, Neo Wave can better account for sudden market shifts, ensuring more reliable wave counts and trading signals during turbulent periods.

What educational resources are available for mastering Neo Wave Theory?

To master Neo Wave Theory, consider the following resources:

Books by Glenn Neely: Comprehensive guides that delve into the intricacies of Neo Wave, providing detailed explanations and practical examples.

Online Courses and Webinars: Interactive sessions conducted by experts in wave analysis, offering structured learning paths and real-time feedback.

Trading Communities and Forums: Engage with fellow traders to exchange insights and practical tips, fostering a collaborative learning environment.

Professional Workshops: Hands-on training sessions that provide in-depth understanding and practical application of Neo Wave principles, often featuring live market analysis and case studies.

Advanced Charting Software Tutorials: Learn to use sophisticated charting tools that support Neo Wave patterns, enhancing your technical analysis capabilities.