Are you tired of getting whipsawed in choppy markets, entering trades too early only to see them reverse, or jumping on a trend too late? It’s a common frustration that can drain both your capital and your confidence. From my own journey, I can tell you that the cost of trading in a directionless market is steep. This is where finding the right tools through your online forex broker becomes critical.

The solution might just lie in understanding the market’s rhythm—knowing when it’s resting and when it’s ready to move. This is precisely what the Alligator indicator, a creation of the legendary trader Bill Williams, is designed to show you. In this comprehensive guide, we will explore how to use the Alligator indicator in forex to identify strong trends, pinpoint effective entry and exit signals, and master the art of patient trading.

Key Takeaways

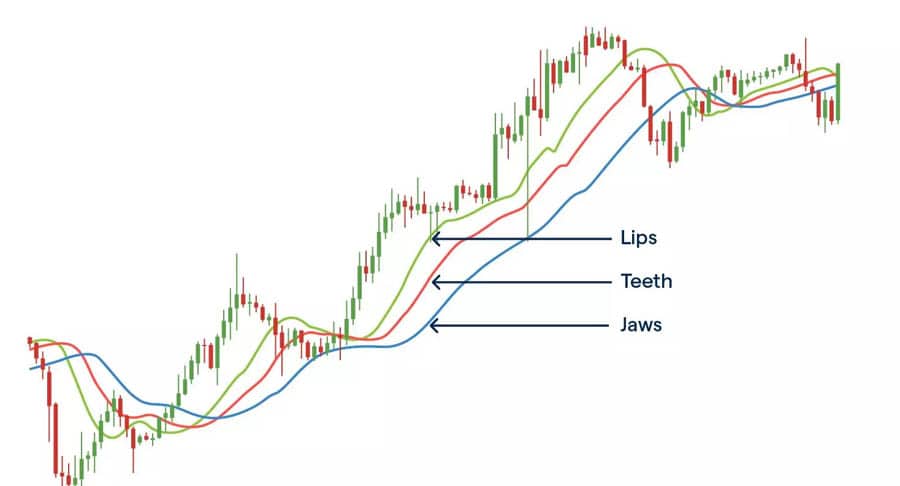

- Indicator Anatomy: The Alligator consists of three smoothed moving averages: the Jaws (blue), the Teeth (red), and the Lips (green).

- Market Phases: The indicator visualizes two primary market states. When the lines are intertwined and tight, the “Alligator is sleeping” in a ranging market—this is a time to stay out.

- Trading Signals: When the lines spread apart and move in parallel, the “Alligator is eating,” signifying a strong trend and a prime opportunity to enter a trade. This is the core of any effective Alligator indicator strategy.

- Trend Direction: In an uptrend, the lines are ordered Green > Red > Blue. In a downtrend, they are ordered Blue > Red > Green.

- Risk Management: The Jaws (blue line) serves as a dynamic level for placing a stop-loss.

- Confirmation is Key: The Alligator works best when its signals are confirmed by price action or other technical indicators.

What is the Alligator Indicator?

The Bill Williams Alligator indicator is a trend-following tool designed to help traders identify the presence, direction, and strength of a market trend. Its primary function is to distinguish between trending periods, which are opportune for trading, and non-trending, choppy periods, where staying on the sidelines is often the wisest, and most profitable, decision. It’s a foundational tool for anyone serious about forex trading with the Alligator indicator.

The genius behind the indicator, Bill Williams, used a powerful analogy to explain its function. He compared the market’s behavior to that of an alligator. Most of the time, the alligator sleeps with its mouth shut. During these long periods of rest, it conserves energy. However, when it wakes up, it is hungry and begins to hunt for its prey.

In trading terms, the “sleeping” alligator represents a sideways, range-bound market where prices fluctuate with no clear direction. This is a dangerous time to trade, as false signals are common. The “hunting” or “eating” alligator signifies a strong, directional trend. As traders, our goal is simple: feed ourselves by trading alongside the hunting alligator and protect our capital by staying away when it is asleep.

The 3 Lines: Jaws, Teeth, and Lips

The indicator is composed of three lines, which are essentially moving averages calculated in a specific way and projected into the future. This “shifting” is what helps the Alligator lead price action rather than just lag behind it. It uses Smoothed Moving Averages (SMMA), which give more weight to recent prices without dropping older ones, creating a much smoother line than a simple or exponential moving average. This smoothness is key to the indicator’s character, helping to filter out minor market noise.

The Jaws (Blue Line)

The Jaws represents the slowest component and is considered the Alligator’s balance line. It signifies the long-term trend. Think of it as the market’s center of gravity over a longer period. When price is above the Jaws, it suggests a long-term bullish sentiment, and when it’s below, it points to a bearish sentiment. Its calculation is a 13-period SMMA that is then shifted 8 bars into the future.

The Teeth (Red Line)

The Teeth is the intermediate line, acting as a midpoint between the fast and slow components. It provides a more immediate sense of the prevailing trend than the Jaws. One of the classic strategies I learned early on was to use the Teeth as a trailing stop for more aggressive positions, as it tracks the trend more closely than the Jaws. It is an 8-period SMMA, shifted 5 bars into the future.

The Lips (Green Line)

The Lips is the fastest and most sensitive line of the three. It is the first to react to changes in price, often being the first to cross the other lines when a trend is about to begin or end. Think of it as the leading edge of the Alligator’s mouth opening or closing. It is calculated using a 5-period SMMA, shifted 3 bars into the future.

A clear chart from a trading platform like MetaTrader 5 shows the Alligator indicator applied to a currency pair like EUR/USD. The blue line is labeled “Jaws (13, 8)”, the red line is labeled “Teeth (8, 5)”, and the green line is labeled “Lips (5, 3)”. The lines are shown during a clear trend to illustrate their separation.

Read More: Forex Trading Tools

How to Read the Alligator: Sleeping to Hunting

Understanding the interplay between the three lines is fundamental to mastering how to read the Alligator indicator. The market is always in one of three states, as defined by the Alligator, and learning to identify them is a game-changer.

Phase 1: The Alligator is Sleeping

When you see the three lines (Jaws, Teeth, and Lips) tangled together, moving sideways with little to no separation, the Alligator is sleeping. This visual represents a range-bound or consolidating market. Bill Williams was adamant that the longer the Alligator sleeps, the hungrier it will be when it awakens. This phase is a signal for patience. Trying to force trades here is one of the quickest ways to suffer losses from market chop. It’s a time for observation, not action.

Phase 2: The Alligator is Awakening

The awakening phase begins as the sleeping lines start to diverge. Typically, the fastest line, the Lips (green), will begin to cross over or under the slower lines. This is the first hint that a breakout from the range is imminent and a new trend may be forming. While it’s not yet a confirmed signal to enter, it is the moment to pay close attention, as the market is transitioning from rest to activity.

Phase 3: The Alligator is Eating (Strong Trend)

This is the phase we are all waiting for. The Alligator is “eating” or “hunting” when the three lines are wide apart and moving in parallel, pointing clearly up or down. The space between the lines indicates the strength of the trend; the wider the space, the stronger the momentum. This is the prime environment for entering and holding a trade. Your job is to ride the trend for as long as the Alligator’s mouth stays open and the lines remain separated. These are the strongest Alligator indicator signals.

A screenshot of a forex chart displaying two distinct market phases. The left side of the chart shows the “Sleeping” phase, with the blue, red, and green lines tightly intertwined and moving horizontally. An arrow then points to the right side of the chart, labeled “Eating Phase (Uptrend),” where the lines have separated widely and are moving upwards in the correct order (green on top, then red, then blue).

Read More: Moving Average Indicator in Forex

A Step-by-Step Guide: Trading with the Alligator

Now let’s translate this theory into a practical, step-by-step approach for executing trades. This framework is the heart of learning how to use the Alligator indicator in forex for consistent results.

Step 1: Setting Up the Indicator

Adding the Alligator indicator to your charts is straightforward on most trading platforms. On MetaTrader 4/5 or TradingView, you can find it in the “Bill Williams” section of the indicators library. For the vast majority of strategies, especially for beginners, the default Alligator indicator settings of (13, 8, 5) for the Jaws, Teeth, and Lips, respectively, are highly effective. These are the settings recommended by Williams himself and work well on timeframes from the 1-hour (H1) chart upwards.

Step 2: Identifying Trading Signals (Entry Points)

The core Alligator indicator signals are generated when the Alligator awakens and starts to eat. The key is to wait for a clear confirmation before jumping in.

Bullish Signal (Buy)

A buy signal occurs when the market transitions from a sleeping phase to an uptrend. The sequence is crucial:

- The lines, once intertwined, begin to separate and move upwards.

- The green line (Lips) crosses above the red (Teeth) and blue (Jaws) lines.

- A confirmed entry signal appears when the price moves decisively above all three lines, and the lines are stacked in the correct bullish order: Green > Red > Blue. The Alligator’s mouth is open and angled upwards.

A chart showing a clear Buy signal on a currency pair. The Alligator lines are shown moving from a sleeping phase to an eating phase upwards. An arrow marks the candle that breaks above all three open lines, with the text “Bullish Entry Point” next to it.

Bearish Signal (Sell)

A sell signal is the mirror image of a buy signal, indicating a transition to a downtrend.

- After a period of consolidation, the lines start to separate and point downwards.

- The green line (Lips) crosses below the other two lines.

- A confirmed sell signal is triggered when the price moves below all three lines, and the lines are ordered correctly for a downtrend: Blue > Red > Green. The Alligator’s mouth is open and facing down.

A chart displaying a clear Sell signal. The Alligator lines are separating downwards after a period of consolidation. An arrow points to the candle that breaks below all three lines, labeled “Bearish Entry Point.”

Step 3: Setting Your Stop-Loss and Take-Profit (Exit Points)

Knowing when to enter is only half the battle; effective Alligator indicator entry exit signals require a clear plan for managing risk and taking profits. A trade without an exit plan is just a hope.

Stop-Loss

The Alligator indicator provides an excellent dynamic guide for placing your stop-loss. A common and effective technique is to use the Alligator’s Jaws (the blue line) as your protection level. For a buy trade, place your initial stop-loss just below the blue Jaws line. For a sell trade, place it just above the blue Jaws line. As the trend progresses and the Jaws line moves in your favor, you can trail your stop-loss along with it, locking in profits while giving the trade room to breathe.

Take-Profit

Determining when to exit a profitable trade can be done in a few ways:

- The Alligator Goes to Sleep: The most logical exit signal is when the lines begin to converge and cross again. When the fast green line crosses back over the red line, it signals that momentum is fading. This is your cue to take profits.

- Price Action Signals: Look for strong reversal candles or patterns that form against your position, such as a large engulfing candle or a head and shoulders pattern.

- Fixed Risk-Reward Ratio: Before entering, determine a risk-reward ratio, such as 1:2 or 1:3. Once the price reaches your pre-determined profit target, you exit the trade, no questions asked. This enforces discipline.

Advanced Strategy: Combining the Alligator with Other Indicators

While powerful, the Alligator shouldn’t be used in a vacuum. A great Alligator indicator strategy often involves a confirmation tool. From my experience, a mistake that cost me dearly early on was taking every Alligator signal without a secondary filter. Adding one more layer of confirmation can dramatically increase your win rate.

Alligator + Fractals

Bill Williams designed Fractals to work in tandem with the Alligator. Fractals are simple five-bar patterns identifying potential support and resistance. The strategy is simple: wait for the Alligator’s mouth to open, then use a fractal break as your entry trigger. For a buy, once the Alligator’s mouth is open and pointing up, wait for an upward fractal to form. Enter when the price breaks above that fractal high. This confirms the bullish momentum is real.

A chart showing both the Alligator and Fractals indicators. An uptrend is identified by the Alligator. An upward fractal is highlighted above the red line. An arrow points to the subsequent candle that breaks this fractal’s high, with the text “Entry Confirmed by Fractal Break.”

Alligator + MACD or RSI (Momentum Oscillators)

Combining the Alligator with an oscillator like the RSI is a classic confirmation technique. The Alligator tells you the trend’s direction, and the RSI tells you its strength. A trend without momentum is like a car running out of gas—it might look like it’s moving, but it’s about to stop. Strategy: Wait for the Alligator to give a buy signal. Before entering, check the RSI. If the RSI is above 50, it confirms bullish momentum, strengthening the signal. For a sell signal, an RSI below 50 provides bearish confirmation.

Common Mistakes to Avoid When Using the Alligator

Learning how to use the Alligator indicator in forex also means learning the traps to avoid. I’ve fallen into all of them at some point, and they can be costly.

- Trading When the Alligator is Sleeping: The number one mistake. The intertwined lines are a clear “stay out” signal. Trying to scalp this chop is a recipe for a thousand small cuts to your account.

- Entering a Trade Too Late: This one is tempting. You see the lines wide apart on the EUR/USD H4 chart, and it looks like a can’t-miss opportunity. But a quick look shows the move has already run 200 pips without a significant pullback. Entering here often means you’re providing the exit liquidity for the traders who got in early.

- Using It on Very Low Timeframes: The Alligator is a trend-following indicator. On timeframes like the 1-minute chart, it will generate a lot of noise. It performs much more reliably on the H1, H4, and Daily charts where trends are more established.

- Relying on It Exclusively: Never use any single indicator as your sole reason for a trade. The Alligator is a map, not a magic crystal ball. Always confirm with price action and market structure.

Opofinance Services

To effectively implement strategies like the Alligator indicator strategy, partnering with a reliable and well-equipped broker is paramount. Opofinance, regulated by the ASIC, offers a robust environment tailored for both new and experienced traders.

- Advanced Trading Platforms: Trade on industry-leading platforms including MT4, MT5, cTrader, and the proprietary OpoTrade. This ensures you can use the Alligator indicator seamlessly.

- Innovative AI Tools: Gain a competitive edge with an AI Market Analyzer, an AI Coach to refine your strategy, and AI-powered support.

- Social & Prop Trading: Engage with a community through Social Trading or test your skills and get funded through their Proprietary Trading program.

- Secure & Flexible Transactions: Experience hassle-free banking with safe deposit and withdrawal methods, including crypto payments, all with zero fees charged by Opofinance.

Elevate Your Trading with Opofinance

Conclusion

The Bill Williams Alligator indicator is more than just a set of lines; it’s a philosophy for navigating the markets. It teaches the invaluable trading virtues of patience and discipline. By learning to recognize when the market is sleeping, you preserve capital for high-probability opportunities. By mastering the Alligator indicator entry exit signals, you can confidently ride strong trends.

The ultimate lesson in how to use the Alligator indicator in forex is to align your actions with the market’s rhythm. Wait for the alligator to wake up, trade in the direction it’s hunting, get out when it goes back to sleep, and repeat. Now, open your demo account and start spotting the sleeping and hunting Alligator for yourself. It’s a skill that, once mastered, will serve you for your entire trading career.

What’s the difference between the Alligator and standard moving averages?

The Alligator uses Smoothed Moving Averages (SMMA) and, most importantly, shifts the calculated lines into the future. This “shifting” helps the indicator lead price action and reduce lag, unlike standard MAs which are purely lagging.

Can the Alligator indicator predict reversals?

The Alligator is primarily a trend-following tool, not a reversal predictor. However, the convergence of its lines (the mouth closing) is a strong signal that a trend is ending, which is often the prerequisite for a potential reversal.

Does the Alligator indicator repaint?

No, the Alligator indicator is a non-repainting tool. Its values are fixed once a candle closes and will not change retroactively, making it a reliable tool for backtesting and live analysis.

Is there a ‘best’ currency pair for the Alligator indicator?

The indicator works best on currency pairs that are known to exhibit strong, sustained trends. Major pairs like EUR/USD, GBP/USD, and trending cross pairs are generally more suitable than pairs that are typically range-bound.

Can I use the Alligator indicator for cryptocurrency trading?

Yes, absolutely. The principles of trend and consolidation apply to all financial markets. The Alligator can be effectively used to identify trends in Bitcoin, Ethereum, and other cryptocurrencies, especially on higher timeframes like the 4-hour and daily charts.