Backtesting in forex trading is the process of applying a trading strategy to historical market data to determine how it would have performed in the past. This practice allows traders to simulate trades using specific entry and exit rules, technical indicators, and other criteria without risking actual capital. By doing so, traders working with a regulated forex broker can evaluate the potential effectiveness of their strategies and make informed decisions before implementing them in live trading environments.

Importance of Backtesting in Forex Trading

Evaluating Strategy Effectiveness

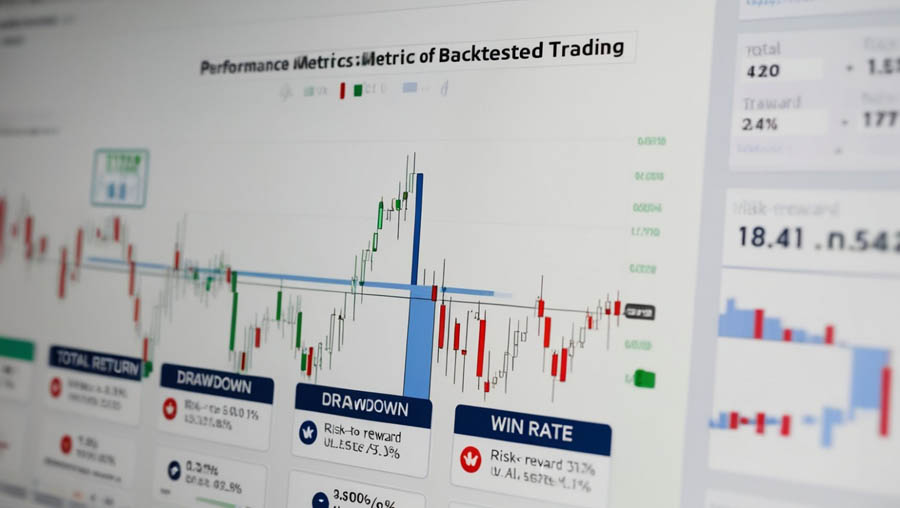

Backtesting a trading strategy is crucial for objectively assessing its effectiveness. By analyzing historical data, traders evaluate metrics like win rate, total return, drawdown, and risk-to-reward ratio. This process determines the strategy’s potential profitability and sustainability across diverse market conditions.

Identifying Weaknesses in Strategy

Backtesting helps pinpoint strategy weaknesses through analysis of performance dips. This critical review highlights areas needing adjustment or enhancement, bolstering the strategy’s overall robustness and adaptability.

Building Confidence

Successful backtesting instills confidence by showcasing historical performance. This psychological reassurance is vital for adhering to trading rules amid market volatility or drawdowns, promoting disciplined decision-making and mitigating emotional biases in live trading.

Components of a Backtesting Process

Historical Data

High-quality historical data is the foundation of effective backtesting. This data should include price information, volume, and other relevant market variables over a significant period. The accuracy and comprehensiveness of the historical data directly impact the reliability of the backtesting results. Traders should use reputable data sources to ensure that their backtesting analysis is based on accurate and representative market information.

Trading Platform

Choosing the right trading platform is essential for conducting backtesting. Various platforms offer different features, data sources, and analytical tools. Popular platforms for backtesting a trading strategy in forex include MetaTrader, TradingView, and NinjaTrader. These platforms allow traders to apply their strategies to historical data, execute simulated trades, and analyze the results comprehensively.

Read More: High Reward Low Risk Forex Trading Strategies

Backtesting Techniques and Methodologies

Simple Backtesting

Simple backtesting involves applying a trading strategy to historical data without considering complexities like transaction costs, slippage, or varying market conditions. While useful for initial evaluation and trend identification, it may not fully reflect real-world trading nuances.

Advanced Backtesting

Advanced backtesting integrates factors such as transaction costs, slippage, and diverse market conditions. This approach employs sophisticated software to simulate trades more realistically, offering a comprehensive assessment of strategy performance. It helps identify potential issues overlooked in simple backtesting, enhancing strategy robustness.

Common Pitfalls in Backtesting

Overfitting the Strategy

Overfitting occurs when a strategy is overly optimized for historical data, leading to poor performance in live trading due to noise rather than genuine market patterns. Traders should prioritize simplicity and adaptability to avoid this pitfall.

Ignoring Slippage and Transaction Costs

Slippage and transaction costs significantly affect strategy profitability but are often disregarded in backtesting. Integrating these factors into simulations ensures more accurate performance expectations and realistic trading outcomes.

The Role of Backtesting in Developing a Trading Strategy

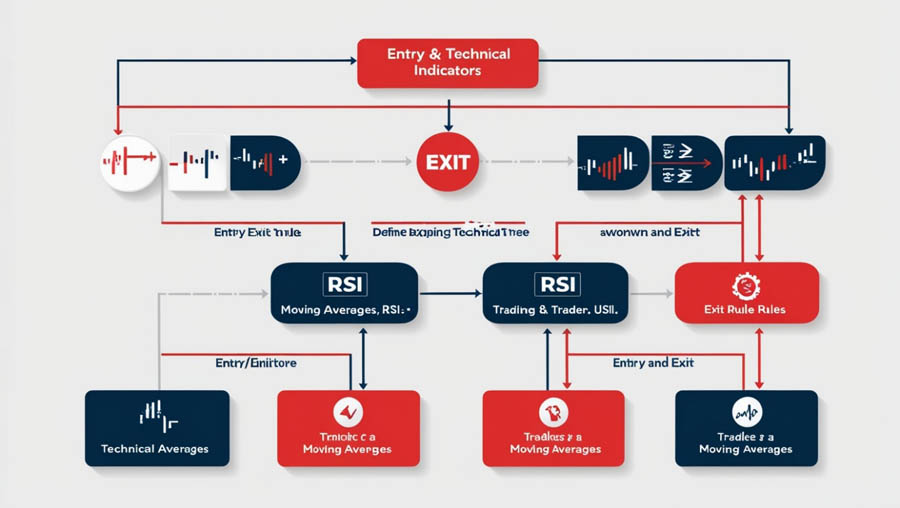

Backtesting plays a pivotal role in developing and refining trading strategies. By providing an objective assessment of a strategy’s performance, it helps traders make informed decisions about its viability. Moreover, backtesting enables traders to experiment with different variables, such as entry and exit rules, technical indicators, and risk management techniques. This iterative process allows traders to optimize their strategies for better performance and adapt them to changing market conditions.

The Backtesting Process

Choosing a Backtesting Platform

Selecting the right backtesting platform is crucial for accurate evaluation of trading strategies in forex. Consider these factors when choosing a platform:

Data Sources Ensure the platform provides access to high-quality historical data from reputable sources, including price information, volume, and relevant market variables. Comprehensive data coverage across various market conditions enhances the reliability of backtesting results.

Historical Data Selection Choose a platform that allows access to extensive historical data suitable for your trading strategy. This is vital for testing strategies across different market conditions and timeframes, supporting robust strategy assessment.

Platforms like MetaTrader, TradingView, and NinjaTrader are popular choices, offering diverse features to cater to different trading styles and analytical needs.

Defining Your Trading Strategy

A well-defined trading strategy is essential for accurate backtesting in forex trading. Here’s how to articulate a strategy that ensures clarity and consistency:

Entry/Exit Rules Clearly specify conditions for entering and exiting trades based on price action, technical indicators, or chart patterns. Define exit criteria such as profit targets, stop-loss levels, or signal confirmations to maintain consistency and evaluate strategy performance.

Indicators Identify key technical indicators like moving averages, RSI, MACD, and Bollinger Bands. State indicator parameters such as period lengths or signal thresholds to accurately reflect your trading strategy in backtesting.

Applying the Strategy to Historical Data

Once your trading strategy is clearly defined, the next step is to apply it to historical market data. This involves executing simulated trades based on your predefined rules and recording the outcomes. Most backtesting platforms offer tools to automate this process, ensuring accuracy and efficiency.

Simulation Process

The simulation process involves running the trading strategy against historical data and generating a detailed record of all trades, including entry and exit points, profits, losses, and performance metrics. The goal is to replicate the conditions and decisions you would make in live trading as closely as possible.

Execution Accuracy

To ensure the accuracy of the simulation, consider factors such as order execution speed, slippage, and transaction costs. These elements can significantly impact the performance of a trading strategy in live markets and should be accounted for in the backtest. Some advanced platforms allow you to customize these parameters to better reflect real-world trading conditions.

Read More: How to Make Consistent Profits in Forex Trading

Analyzing Backtesting Results

Analyzing the results of your backtesting is crucial for understanding the performance of your trading strategy. This analysis involves evaluating various performance metrics to determine the strategy’s effectiveness and identifying areas for improvement.

Performance Metrics

Key performance metrics to evaluate include:

- Total Return: The overall profit or loss generated by the strategy during the backtested period.

- Drawdown: The peak-to-trough decline during a specific period. This helps evaluate the risk associated with the strategy.

- Win Rate: The percentage of successful trades out of the total number of trades. A higher win rate indicates a more reliable strategy.

- Risk-to-Reward Ratio: A measure of the potential reward compared to the risk taken. A higher ratio indicates a more favorable trade-off.

- Sharpe Ratio: A measure of risk-adjusted return. It helps assess the efficiency of the strategy in generating returns relative to its risk.

Detailed Analysis

In addition to evaluating performance metrics, perform a detailed analysis of the backtesting results. Look for patterns and trends in the data, such as periods of consistent gains or losses. Identify specific market conditions under which the strategy performed well or poorly. This detailed analysis can provide valuable insights into the strengths and weaknesses of the strategy, informing adjustments and refinements.

Optimizing the Strategy

After analyzing the backtesting results, use the insights gained to optimize your trading strategy. This may involve adjusting entry and exit rules, fine-tuning indicator parameters, or incorporating additional risk management techniques. The goal is to enhance the strategy’s performance and robustness, making it more adaptable to different market conditions.

Iterative Process

Optimization is an iterative process that involves continuous testing and refinement. After making adjustments to the strategy, re-run the backtest to evaluate the impact of the changes. This process of testing, analyzing, and refining should be repeated until the strategy consistently performs well across a range of market conditions.

Validating the Strategy

Before implementing the optimized strategy in live trading, validate its effectiveness through additional testing. This can involve forward testing, paper trading, or walk-forward optimization to ensure the strategy remains robust and reliable in real-world conditions.

Forward Testing

Forward testing involves applying the strategy to a new set of historical data that was not used in the initial backtest. This helps ensure that the strategy is not overfitted to the original data set and can perform well in different market conditions.

Paper Trading

Paper trading, or simulated trading, involves using a trading platform to place hypothetical trades in real-time market conditions. This allows traders to test their strategies in a live environment without risking capital, providing additional insights into the strategy’s performance.

Walk-Forward Optimization

Walk-forward optimization involves dividing historical data into segments and testing the strategy on rolling periods. This technique helps identify how well a strategy adapts to changing market conditions, offering a more dynamic approach to backtesting. By continuously optimizing the strategy based on recent data, traders can enhance its robustness and adaptability.

Limitations of Backtesting in Forex Trading

Backtesting is a valuable tool for forex traders, but it comes with several limitations that traders should be aware of to avoid potential pitfalls:

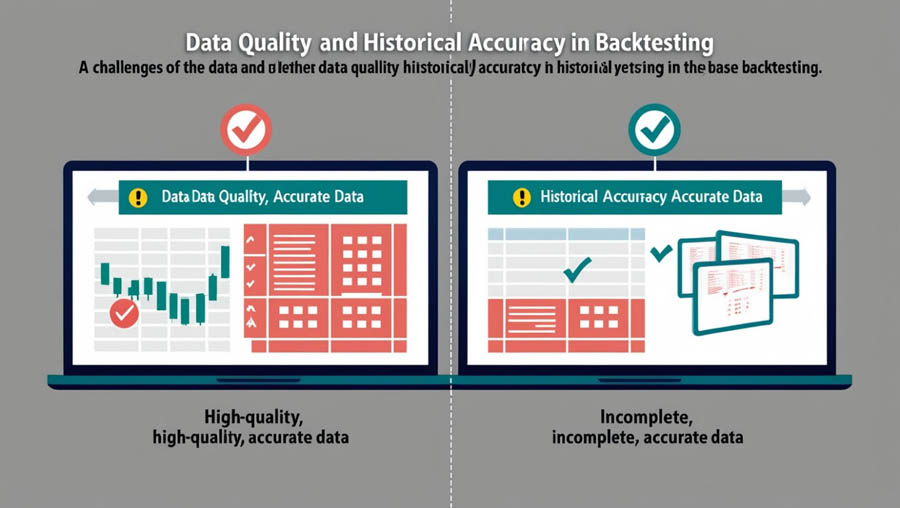

Data Quality and Historical Accuracy The reliability of backtesting results heavily depends on the quality and accuracy of historical data. Inaccurate or incomplete data can lead to misleading conclusions about strategy effectiveness, emphasizing the need for high-quality data from reputable sources.

Representativeness of Data Backtesting results may not accurately reflect a strategy’s performance across different market conditions if the historical data set is limited or fails to capture diverse market environments. This can lead to over-optimistic expectations and underperformance in live trading scenarios.

Impact of Slippage and Transaction Costs Factors like slippage and transaction costs, often overlooked in backtesting, can significantly affect trading results. Ignoring these costs can lead to overestimated profitability and the implementation of strategies that may not be viable in real-world trading conditions.

Past Performance Not Indicative of Future Results Market dynamics evolve over time due to economic events, geopolitical factors, and changes in sentiment, making past performance an imperfect predictor of future outcomes. Traders must adapt strategies to changing market conditions rather than relying solely on historical data.

Survivorship Bias Backtesting may suffer from survivorship bias if only successful strategies or assets are considered, neglecting those that failed or were removed from the market. Including a comprehensive range of assets in backtesting data helps mitigate this bias and provides a more realistic assessment of strategy performance.

Overfitting and Curve Fitting Overfitting occurs when a strategy is overly tailored to historical data, capturing noise rather than genuine market patterns. Traders should focus on developing robust strategies that are less susceptible to overfitting and can adapt effectively to varying market conditions.

Incomplete Simulation of Real Market Conditions Backtesting often fails to simulate real-world market impacts, such as trade execution slippage and the influence of large orders on prices. Traders should consider these factors’ potential effects on strategy performance, particularly in high-frequency or large-scale trading scenarios.

Psychological Factors Backtesting cannot replicate the psychological challenges of live trading, such as fear, greed, and stress, which can significantly influence decision-making. Traders must develop emotional resilience and discipline to execute strategies consistently in live trading environments.

Lack of Real-Time Feedback Unlike live trading, backtesting lacks real-time feedback on strategy performance under current market conditions. Combining backtesting with paper trading or demo accounts can provide more dynamic feedback and help refine strategies for real-world implementation.

Read More: Forex Diversification Strategies

Optimizing Your Backtesting Process

Setting Realistic Expectations

It is essential to set realistic expectations for your strategy’s performance. Overestimating potential returns can lead to disappointment and poor decision-making in live trading. Consider the variability in market conditions and the inherent uncertainties in trading when evaluating backtesting results.

Avoiding Overfitting the Strategy

Overfitting occurs when a strategy is too closely tailored to historical data, reducing its generalizability to future market conditions. To avoid overfitting:

- Use a Robust Data Set: Ensure your backtest includes various market conditions, such as bull, bear, and sideways markets.

- Simplify Your Strategy: Avoid overly complex strategies that fit past data perfectly but fail in live markets. Focus on key indicators and rules that are likely to be effective across different market scenarios.

Paper Trading for Live Market Simulation

Paper trading, or simulated trading, involves using a trading platform to place hypothetical trades in real-time market conditions. This allows traders to test their strategies in a live environment without risking capital, providing additional insights into the strategy’s performance.

Advanced Backtesting Techniques

Monte Carlo Simulations

Monte Carlo simulations involve running multiple backtests with randomized variables to stress-test a strategy. This technique helps assess how a strategy performs under different market conditions and levels of volatility, providing a more comprehensive evaluation. By simulating thousands of potential scenarios, traders can gain a deeper understanding of the potential risks and rewards of their strategies.

Walk-Forward Optimization

Walk-forward optimization involves dividing historical data into segments and testing the strategy on rolling periods. This technique helps identify how well a strategy adapts to changing market conditions, offering a more dynamic approach to backtesting. By continuously optimizing the strategy based on recent data, traders can enhance its robustness and adaptability.

Backtesting with Different Market Conditions

Testing your strategy under various market conditions, such as volatile and ranging markets, is crucial for understanding its versatility. This helps ensure that the strategy performs well under different scenarios, improving its robustness. Consider using different time frames and currency pairs to evaluate the strategy’s effectiveness across various contexts.

Conclusion

Backtesting is an invaluable tool for forex traders, offering a way to evaluate and refine trading strategies without risking real capital. By understanding the process, recognizing the limitations, and employing advanced techniques, traders can develop robust strategies that stand the test of time. However, it is essential to combine backtesting with sound risk management practices, other analysis methods, and a disciplined approach to trading. By doing so, traders can enhance their chances of success in the dynamic world of forex trading.

Reference: +

How often should I backtest my trading strategy?

It is recommended to backtest your trading strategy regularly, especially after significant market events or changes in market conditions. This helps ensure your strategy remains effective and up-to-date. Periodic reviews also allow for adjustments based on new market insights.

Can backtesting predict future market performance?

While backtesting can provide valuable insights into a strategy’s historical performance, it cannot predict future market performance with certainty. Market conditions can change, and past performance is not always indicative of future results. Traders should use backtesting as one of many tools in their decision-making process.

What are the best platforms for backtesting trading strategies?

Some popular platforms for backtesting trading strategies include MetaTrader, TradingView, and NinjaTrader. Each platform offers unique features and data sources, so choose one that aligns with your specific needs and preferences. Ensure the platform provides high-quality data and comprehensive analysis tools.

How can I improve the accuracy of my backtesting results?

To improve the accuracy of your backtesting results, use high-quality historical data, account for slippage and transaction costs, and test your strategy under various market conditions. Additionally, avoid overfitting your strategy to historical data and set realistic expectations for its performance. Consider using advanced techniques like Monte Carlo simulations and walk-forward optimization for a more thorough evaluation.

One Response

Hello there! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me. Nonetheless, I’m definitely glad I found it and I’ll be book-marking and checking back frequently!