The forex market operates 24 hours a day, but not all trading hours are created equal. Among the most dynamic and influential periods is the New York session. This session, which runs from 8 AM to 5 PM EST, is renowned for its high liquidity, substantial trading volume, and significant price movements. Understanding the best currency pairs to trade in the New York session can provide traders with a strategic edge. By focusing on the most active pairs and leveraging the unique characteristics of this trading period, traders can optimize their strategies for better results. To ensure safe and efficient trading during this high-volatility period, partnering with a regulated forex broker is crucial, as it offers the necessary security and regulatory compliance for your trades. In this article, we will explore the top currency pairs to trade during the New York session, the impact of US economic data, and how to tailor your trading strategy for maximum effectiveness.

The New York Session: Powerhouse of Forex Trading

The New York trading session is a powerhouse in the world of forex trading, renowned for its high liquidity and substantial trading volume. This session runs from 8 AM to 5 PM EST, and its significance cannot be overstated. As one of the major trading hubs, it plays a pivotal role in the global forex market. Traders from all over the world converge during this time to engage in intense trading activity, making it a critical period for anyone involved in forex trading.

Overlap with the European Markets

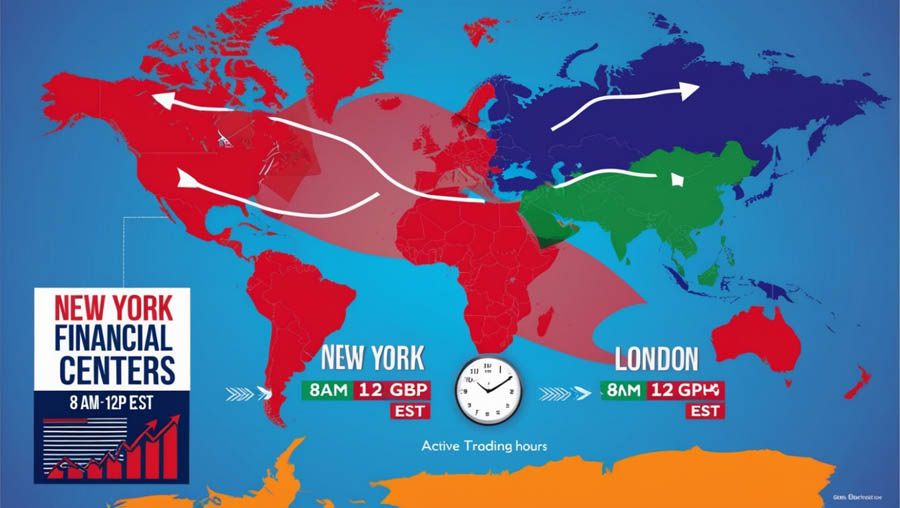

One of the unique aspects of the New York session is its overlap with the European markets, particularly the London session. This overlap occurs from 8 AM to 12 PM EST, creating a period of heightened trading activity and volatility. During this time, both the European and American markets are open, leading to a surge in trading volume and liquidity. This overlap is often considered the most volatile and liquid time in the forex market, providing traders with numerous opportunities to capitalize on price movements.

Read More: Best Currency Pairs to Trade in London Session

High Liquidity and Trading Volume

The New York session is characterized by high liquidity, which is essential for traders seeking to enter and exit positions without significant price slippage. High liquidity ensures that there is a large number of buyers and sellers in the market, which helps in maintaining tight spreads. Tight spreads are crucial for traders as they reduce the cost of trading. The substantial trading volume during the New York session also means that there are more opportunities to find profitable trades.

Influence of US Economic Data

Another defining feature of the New York session is the influence of US economic data. Key economic indicators such as interest rates, inflation reports, employment data, and GDP figures are often released during this session. These data releases can cause significant price movements in currency pairs involving the US dollar. For instance, the Non-Farm Payrolls (NFP) report, which is released monthly, can lead to sharp price swings in USD pairs. Traders need to stay informed about these releases and be prepared to react quickly to the resulting volatility.

Impact on Major Currency Pairs

The New York session is particularly influential for major currency pairs, especially those involving the US dollar. Pairs like EUR/USD, GBP/USD, USD/JPY, and USD/CHF see substantial trading activity during this session. The high volume of trades in these pairs leads to significant price movements, providing traders with opportunities to profit from the volatility. The dominance of the US dollar in global trade and finance further amplifies the impact of the New York session on these pairs.

Strategic Trading During the New York Session

To make the most of the trading opportunities during the New York session, traders should develop a strategic approach. This involves staying informed about scheduled economic releases and understanding their potential impact on the market. Traders should also consider the overlap with the European session and the increased volatility during this period. Using technical analysis tools to identify key support and resistance levels can also help traders make informed decisions.

Dominant Dollars: US Dollar Pairs Take Center Stage

EUR/USD (Euro vs. US Dollar)

The EUR/USD pair is the most traded currency pair in the forex market. Its popularity stems from the economic strength of both the Eurozone and the United States. The New York session sees a high volume of EUR/USD trades, making it a prime choice for traders looking for liquidity and tight spreads.

Advantages:

- High liquidity and tight spreads.

- Significant price movements during the New York session.

- Reacts strongly to US and Eurozone economic data.

GBP/USD (British Pound vs. US Dollar)

The GBP/USD pair, also known as “Cable,” is another major pair that attracts substantial trading activity during the New York session. The British pound’s volatility, combined with the US dollar’s stability, offers traders potential for significant gains.

Advantages:

- High volatility, providing opportunities for large price swings.

- Significant impact from both UK and US economic data.

- Ideal for traders looking to capitalize on quick market movements.

USD/JPY (US Dollar vs. Japanese Yen)

The USD/JPY pair is heavily influenced by US economic data, making it a favorite during the New York session. The pair is known for its stability and predictable movements, making it suitable for both novice and experienced traders.

Advantages:

- High liquidity and moderate volatility.

- Influenced by US economic releases and Japanese monetary policy.

- Suitable for various trading strategies, including scalping and swing trading.

USD/CHF (US Dollar vs. Swiss Franc)

The USD/CHF pair, often referred to as the “Swissie,” is a popular choice during the New York session. The Swiss franc is known for its safe-haven status, and the pair tends to react to global economic events and risk sentiment.

Advantages:

- High liquidity during the New York session.

- Reacts to both US economic data and global risk sentiment.

- Suitable for traders looking for stable, predictable price movements.

Capitalizing on US Economic Data

US economic data releases are crucial during the New York session. Key economic indicators such as interest rates, inflation reports, employment data, and GDP figures can cause significant price movements in USD pairs. Traders need to stay informed about the economic calendar and be prepared for potential volatility.

Impactful US Economic Indicators:

- Non-Farm Payrolls (NFP): Released monthly, this report can cause sharp price movements in USD pairs.

- Federal Reserve Interest Rate Decisions: Changes in interest rates or forward guidance from the Fed can significantly impact the USD.

- Consumer Price Index (CPI): A key measure of inflation, which can influence the Fed’s monetary policy decisions.

By understanding and anticipating these economic releases, traders can develop strategies to capitalize on the resulting market movements.

Looking Beyond Majors: Alternative Options

While major currency pairs dominate the New York session, traders can also explore minor and exotic pairs for additional opportunities. These pairs can offer unique advantages but come with increased risk due to lower liquidity and higher spreads.

Read More: What Are Major Currency Pairs?

Minor Pairs

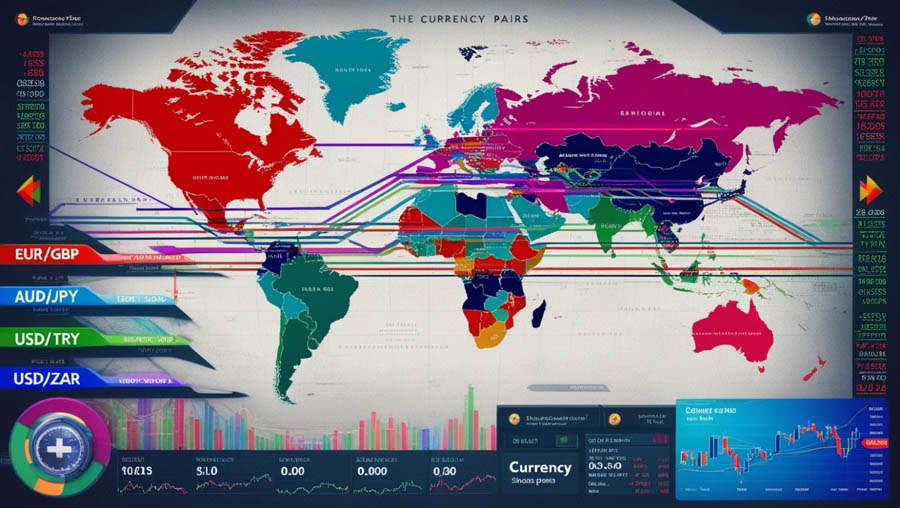

Minor pairs consist of currencies from major economies but do not include the US dollar. Examples include EUR/GBP, AUD/JPY, and EUR/AUD. These pairs can provide good trading opportunities, especially during overlapping trading sessions.

Advantages:

- Opportunities to diversify trading portfolios.

- Potential for significant price movements during session overlaps.

Exotic Pairs

Exotic pairs involve a major currency paired with a currency from a smaller or emerging market. Examples include USD/TRY (US Dollar vs. Turkish Lira) and USD/ZAR (US Dollar vs. South African Rand). While these pairs can offer high volatility and potential for large gains, they also come with higher risks.

Advantages:

- High volatility, offering potential for large price swings.

- Diversification opportunities in emerging markets.

Tailoring Your Strategy: Choosing the Right Pair

Selecting the best currency pairs to trade in the New York session involves more than just focusing on the session’s characteristics. It requires a nuanced approach that takes into account your individual trading goals, risk tolerance, and preferred trading style. Here, we will delve into the key factors that can help you tailor your strategy and choose the right pairs to maximize your trading success.

Individual Trading Goals

Short-Term Trading Goals:

- Aim for quick profits with high volatility and frequent price movements.

- Ideal pairs: EUR/USD, GBP/USD, USD/JPY due to liquidity and responsiveness to news.

- Implement scalping and day trading during the New York session.

Long-Term Trading Goals:

- Prioritize stability and trend consistency.

- Suitable pairs: EUR/USD, USD/JPY for analyzing trends over longer periods.

- Align with position trading and swing trading strategies focusing on broader economic trends.

Risk Tolerance and Preferred Trading Style

High Risk Tolerance:

- Prefer pairs with significant price swings.

- Examples: GBP/USD, USD/JPY for potential large gains.

- Apply aggressive strategies like leveraging and short-term trading.

Low Risk Tolerance:

- Choose pairs with stable price movements.

- Examples: EUR/USD, USD/CHF known for relative stability.

- Employ conservative strategies like long-term holding and minimal leveraging.

Fundamental vs. Technical Analysis Approach

Fundamental Analysis:

- Focus on pairs influenced by economic news and data.

- Reactive pairs: EUR/USD, GBP/USD to US and European economic releases.

- Monitor economic calendar for informed trades.

Technical Analysis:

- Prefer pairs with clear price patterns and reliable technical indicators.

- Examples: USD/JPY, EUR/USD for predictable technical patterns.

- Use charts, trend lines, and technical indicators for trade signals.

Market Conditions and News Events

Economic News:

- USD-related pairs sensitive to US economic data.

- Monitor events like Federal Reserve announcements, Non-Farm Payrolls (NFP).

- Prepare for volatility during major economic releases.

Geopolitical Events:

- Currencies influenced by geopolitical developments.

- Stay updated on trade negotiations, elections, international conflicts.

- Responsive pairs: GBP/USD, USD/CHF due to global influence.

Diversification and Portfolio Management

Diversification Strategies:

- Spread risk across major, minor, and exotic pairs.

- Example: Trade EUR/USD, GBP/USD alongside AUD/JPY, USD/ZAR.

- Balance high-risk pairs with stable options for a resilient portfolio.

Portfolio Management:

- Regularly review and adjust based on performance and market conditions.

- Use risk management tools like stop-loss orders and position sizing.

- Adapt strategy to evolving market conditions for long-term success.

Staying Informed: News and Market Events

Staying informed about news and market events is crucial for successful trading during the New York session. The forex market is highly sensitive to economic news, geopolitical events, and overall market sentiment. By keeping up-to-date with relevant information, traders can anticipate potential market movements and adjust their strategies accordingly. This section will explore the importance of staying informed, the impact of economic news, and how market sentiment and geopolitical events can influence trading decisions.

Importance of Economic News

Economic news releases are among the most significant factors affecting currency prices. These releases provide insights into the health of an economy and can lead to rapid price movements, especially during the New York session when major US economic data is often released.

Key Economic Indicators

Non-Farm Payrolls (NFP):

- Released monthly, this report measures the number of jobs added or lost in the US economy, excluding the farming sector.

- It is a critical indicator of economic health and can cause significant volatility in USD pairs like EUR/USD, GBP/USD, and USD/JPY.

Federal Reserve Interest Rate Decisions:

- The Federal Reserve’s decisions on interest rates can have a profound impact on the US dollar.

- Changes in interest rates or forward guidance can lead to significant price movements in USD pairs.

Consumer Price Index (CPI):

- This measure of inflation reflects changes in the price level of a basket of consumer goods and services.

- High or low inflation rates can influence the Fed’s monetary policy, affecting USD currency pairs.

Gross Domestic Product (GDP):

- GDP measures the total economic output of a country.

- Strong or weak GDP growth can influence market sentiment and impact currency prices, particularly for pairs involving the US dollar.

Impact on Market Sentiment

Market sentiment, driven by economic news and broader geopolitical events, can significantly influence currency prices. Understanding how news affects sentiment can help traders anticipate price movements and adjust their strategies accordingly.

Positive Market Sentiment

When economic data indicates strong growth or stability, market sentiment tends to be positive. This can lead to increased demand for higher-yielding currencies and riskier assets.

Negative Market Sentiment

Conversely, weak economic data or geopolitical uncertainty can lead to negative market sentiment. This can result in a flight to safe-haven assets and currencies.

Geopolitical Events and Their Influence

Geopolitical events can have a profound impact on the forex market, often leading to rapid and unpredictable price movements. Traders need to stay informed about global developments to anticipate potential market reactions.

Trade Negotiations

Trade negotiations between major economies, such as the US and China, can significantly influence currency prices. Positive developments can boost market confidence, while setbacks can lead to uncertainty and volatility.

Political Elections

Political elections can create uncertainty and volatility in the forex market, particularly when the outcome is uncertain or could lead to significant policy changes.

Read More: Forex Market Hours

Natural Disasters and Crises

Natural disasters and crises, such as pandemics or significant geopolitical conflicts, can disrupt markets and lead to rapid shifts in currency prices.

Utilizing News and Analysis Tools

To stay informed and make informed trading decisions, traders should leverage various news and analysis tools. These tools can provide real-time updates, expert analysis, and historical data to help traders understand market trends and potential impacts.

Economic Calendars

Economic calendars list upcoming economic data releases, providing traders with a schedule of important events that could impact the market. By keeping track of these events, traders can prepare for potential volatility and plan their trades accordingly.

News Feeds and Alerts

Real-time news feeds and alerts can help traders stay informed about breaking news and market developments. Subscribing to reliable financial news sources and setting up alerts for key events can ensure traders receive timely information.

Technical and Fundamental Analysis

Combining technical and fundamental analysis can provide a comprehensive view of the market. Technical analysis helps identify price patterns and trends, while fundamental analysis focuses on economic data and news events. Using both approaches can enhance trading strategies and decision-making.

Conclusion

Trading during the New York session offers a wealth of opportunities for forex traders. By focusing on the best currency pairs to trade in the New York session, such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF, traders can take advantage of high liquidity and significant price movements. Additionally, staying informed about US economic data releases and understanding market sentiment are crucial for making informed trading decisions. While major pairs dominate, exploring minor and exotic pairs can provide additional opportunities for those willing to take on higher risks. Ultimately, tailoring your trading strategy to suit your individual goals and risk tolerance will help you navigate the dynamic environment of the New York session successfully.

What are the best times to trade during the New York session?

The best times to trade during the New York session are typically during the overlap with the London session (8 AM to 12 PM EST) and during major US economic data releases. These periods offer the highest liquidity and volatility.

How can I manage risk while trading in the New York session?

To manage risk, traders should use stop-loss orders, position sizing, and diversify their trades across different currency pairs. Staying informed about economic news and using technical analysis can also help in making informed trading decisions.