Are you fed up with slippage draining your hard-earned scalping gains? Tired of brokers seemingly stacked against your rapid-fire trading strategies? Picture this: you identify the perfect scalping opportunity, you’re ready to jump in, but your broker’s slow order fills and expanding spreads sabotage a potential win. This scenario plagues countless forex scalpers who simply picked the wrong broker.

The reality is, not all brokers can keep pace with scalpers’ speed and precision requirements. Wide spreads, sluggish execution, and restrictions on scalping quickly erode profits. You need a specialized, regulated forex broker built for scalping—a supportive partner rather than an obstacle. In short, you’re here to figure out which broker is best for scalping, or more specifically, to locate the best forex broker for scalping so you can lock in consistent performance and profitability.

The solution? Choose a brokerage that fully embraces scalping and has the regulatory backing to prove it. This guide will walk you through the crucial qualities of a scalper-friendly broker and introduce you to top choices, spotlighting Opofinance, an ASIC-regulated forex broker that’s rapidly gaining favor among scalpers. For many high-frequency traders, Opofinance emerges as the best forex broker for scalping currently on the market.

What is Scalping in Forex?

Forex scalping is a high-energy trading approach that aims to profit from swift, small price movements. Think of scalpers as market ninjas—darting in and out of trades within seconds or minutes, hoping to rack up a series of small, frequent wins every trading session. Because each trade targets modest gains, scalpers rely heavily on speed, making the choice of forex broker and platform absolutely pivotal.

Key Characteristics of Scalping:

- Ultra-Short-Term Focus: Trades are held for extremely brief durations, often lasting mere seconds to a few minutes.

- High-Frequency Trading: Scalpers execute a large volume of trades per day, sometimes hundreds or even thousands, requiring a broker for forex that can handle the volume.

- Micro Profit Targets: Each trade aims for a small profit, often just a few pips. The cumulative effect of these small gains is what generates overall profitability.

- Razor-Tight Spreads are Essential: Since profits are small, wide spreads can quickly devour potential gains and even lead to losses.

- Leverage is Often Employed: To amplify small price movements, scalpers often utilize higher leverage, which also magnifies risk.

Pros of Scalping:

- Potential for Rapid Profits: Scalping can generate profits quickly, offering immediate gratification and frequent trading opportunities.

- Less Exposure to Market Volatility: Short trade durations reduce exposure to overnight risk and unexpected market swings.

- Adaptable to Various Market Conditions: Scalping can be effective in both trending and ranging markets, capitalizing on short-term volatility.

Cons of Scalping:

- Intensely Demanding and Stressful: Requires unwavering concentration, rapid decision-making, and constant market monitoring.

- Elevated Transaction Costs: Frequent trading leads to higher commission and spread costs, necessitating exceptionally tight spreads to be profitable.

- Significant Time Commitment Required: Scalping is a time-intensive activity, often demanding near full-time dedication and focus.

- Emotionally Taxing: The fast-paced nature and potential for rapid losses can be emotionally challenging, requiring strong emotional control.

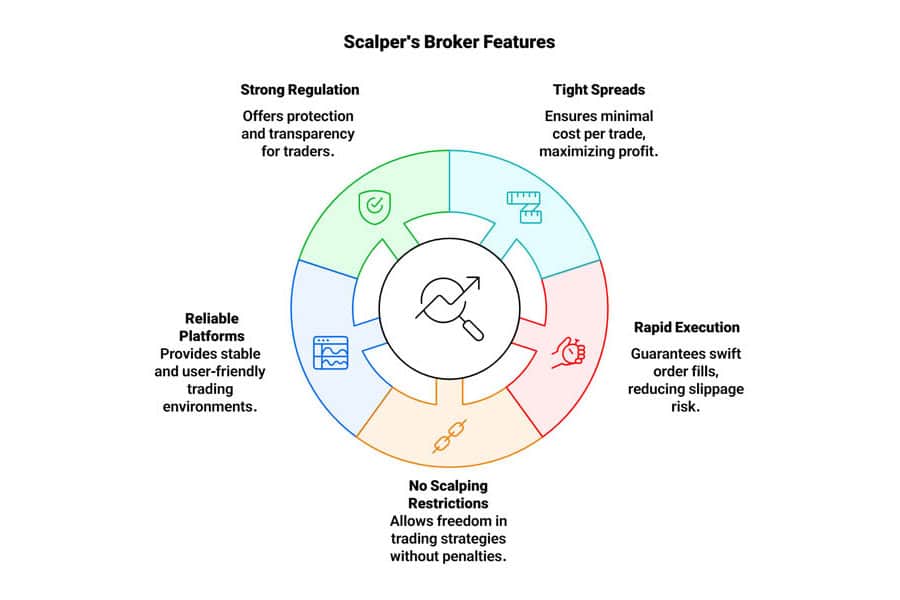

Scalper’s Checklist: Essential Broker Features

Succeeding as a scalper means partnering with an online forex broker that fosters an environment of speed, low costs, and reliability. When evaluating which broker is best for scalping, zero in on the following attributes:

- Tight Spreads and Low Commissions

Every pip matters in scalping. High spreads or steep fees directly cut into profits. The best forex broker for scalping typically offers near-zero spreads on major pairs and transparent, minimal commissions. ECN (Electronic Communication Network) or Raw Spread accounts often prove optimal, charging a small commission instead of padding the spread.

- Rapid Execution Speeds

Scalpers need near-instant order fills; even a millisecond delay can lead to slippage, where your final fill price deviates from the intended quote. Slippage can singlehandedly wipe out a scalper’s edge. Seek brokers that invest in advanced trading infrastructures ensuring swift, accurate execution. - No Scalping Restrictions

Some market maker brokers discourage scalping or even ban it outright. Others might widen spreads without warning or enact punitive measures against short-term strategies. A reputable, regulated forex broker that welcomes scalping will state explicitly that short-term trading is not only allowed but encouraged. - Dependable Trading Platform

A stable, user-friendly platform like MetaTrader 4 (MT4), MetaTrader 5 (MT5), or cTrader is a non-negotiable for scalpers. These platforms offer robust charting, rapid trade execution, and the option to automate strategies via Expert Advisors. The best forex broker for scalping ensures continuous platform stability and minimal downtime. - Strong Regulatory Compliance

Always opt for a broker regulated by a top-tier authority such as ASIC (Australia), FCA (UK), or CySEC (Cyprus). Strong regulatory oversight mandates financial transparency, client fund segregation, and fair dealing—critical safeguards when entrusting your capital to a broker.

Top Forex Brokers for Scalping: A Deep Dive

Now, let’s explore some of the leading contenders vying for the title of “best forex broker for scalping,” carefully evaluating them against the crucial features we’ve just discussed. Each of these brokers offers a compelling proposition for scalpers, but understanding their nuances is key to finding the perfect fit for your individual trading style and needs.

Opofinance – ASIC Regulation for Superior Scalping

Opofinance has quickly risen as a premier choice among scalpers, bolstered by ASIC regulation that cements its standing as an industry leader. Here’s why many scalpers rank Opofinance as the best forex broker for scalping:

Strength of Regulation

Opofinance holds an ASIC license (AFSL 402043), reflecting rigorous compliance standards. ASIC regulation obligates best practices, periodic audits, and strict fund protection, offering scalpers peace of mind. Opofinance also operates under Seychelles FSA (license SD124) and is a verified member of The Financial Commission for additional dispute resolution.

Competitive Trading Costs

- Razor-Thin Spreads: On the ECN Pro account, spreads can start as low as 0.0 pips, enabling scalpers to exploit the slightest market movements.

- Low Commissions: Commissions begin at just $4 per lot, maximizing profitability for high-frequency traders.

Ultra-Fast Execution

Opofinance has invested heavily in cutting-edge technology for lightning-fast order fills, drastically reducing slippage. Speed is critical for scalpers, and Opofinance’s infrastructure consistently garners praise for real-world performance.

Robust Platform Options

Traders can choose from MT4, MT5, cTrader, or a Web Terminal:

- MT4 & MT5: Industry-standard for reliability, automation via EAs, and comprehensive charting.

- cTrader: Beloved by scalpers for its transparency, advanced depth-of-market data, and superior order execution.

- Web Terminal: Trade from any web browser with no software installation required.

Scalping-Friendly Environment

Opofinance imposes zero restrictions on high-frequency or short-term strategies. Scalpers can trade freely without fear of sudden spread widening or other hidden penalties.

Advanced Tools & Education

Opofinance offers:

- AI-Driven Trading Tools: Real-time analytics, personalized coaching, and AI support.

- Educational Resources: Webinars, tutorials, and a comprehensive knowledge base to continuously fine-tune your scalping expertise.

- Social Trading: Copy or learn from adept traders, potentially integrating new techniques into your strategy.

Pepperstone

A well-established broker founded in 2010, Pepperstone boasts strong regulation from ASIC (Australia), FCA (UK), and CySEC (Cyprus), making it a highly trusted regulated forex broker. They handle a massive daily trading volume, demonstrating their scale and reliability.

Features:

- Razor Account: Offers raw spreads starting from 0.0 pips with a commission of $7 per lot.

- Exceptional Execution Speed: Advertises average execution speeds of around 30 milliseconds, among the fastest in the industry.

- Wide Platform Choice: Supports MT4, MT5, cTrader, and TradingView, providing extensive platform flexibility.

Pros:

- Industry-Leading Execution: Renowned for its lightning-fast execution speeds and tight spreads, making it a top contender for the best forex broker for scalping.

- Top-Tier Regulation: Offers peace of mind with regulation from multiple reputable authorities.

Cons:

- Higher Commission: Commission is slightly higher compared to some competitors like Opofinance.

- Variable Support Response: Some users report inconsistent support response times.

IC Markets

IC Markets, established in 2007, is another popular choice, especially among high-volume traders. They are regulated by ASIC, CySEC, and FSA, and are known for their focus on direct market access and competitive pricing, making them a solid choice for a broker for forex trading.

Features:

- Raw Spread Account: Provides raw spreads from 0.0 pips with a commission of $7 per lot.

- Fast Execution: Offers execution speeds around 40 milliseconds, still very competitive for scalping.

- Platform Suite: Supports MT4, MT5, and cTrader, covering the most popular trading platforms.

- Social Trading Features: Offers social trading capabilities, allowing traders to follow and potentially learn from successful scalpers.

Pros:

- Competitive Pricing and Execution: Provides a good balance between cost-effectiveness and reliable execution.

- Social Trading Integration: Offers opportunities for learning and potentially benefiting from experienced traders.

Cons:

- Limited Support in Some Regions: Customer support availability might be less extensive in certain geographical areas.

FP Markets

Operating since 2005, FP Markets is regulated by ASIC, CySEC, and FSCA (South Africa) and offers a vast selection of over 10,000 instruments, appealing to traders seeking portfolio diversification and a comprehensive broker for forex.

Features:

- Raw ECN Account: Offers raw spreads from 0.0 pips with a commission of $6 per side per $100,000 traded.

- Comprehensive Platform Choice: Supports MT4, MT5, cTrader, TradingView, and Iress, providing an unparalleled platform selection.

Pros:

- Competitive Pricing and Extensive Resources: Combines tight spreads with a wealth of trading resources and educational materials.

- Strong Customer Support: Known for its responsive and helpful customer support services.

Cons:

- Potentially Higher Fees on Certain Accounts: Fees may vary depending on the chosen account type.

- Platform Complexity for Beginners: The sheer number of platforms and features could be overwhelming for novice traders.

Exness

Established in 2008 and regulated by FCA (UK) and FSC (Mauritius), Exness serves a large global client base, exceeding 800,000 traders, and is known for its accessibility as an online forex broker.

Features:

- Raw Spread Account: Offers raw spreads from 0.0 pips with a very low commission of $3.5 per side per lot traded.

- Fast Execution: Provides fast execution on MT4, MT5, and their proprietary Exness Trade platform.

- User-Friendly Platforms: Platforms are designed for ease of use and an intuitive trading experience.

Pros:

- Lowest Commissions: Offers some of the lowest commissions in the industry, making it highly attractive for cost-sensitive scalpers.

- User-Friendly Experience: Platforms are designed for both beginners and experienced traders.

- Solid Regulation: Regulated by reputable authorities.

Cons:

- Limited Language Support Options: Language support may be less comprehensive compared to some global brokers.

Comparison of Top Scalping Brokers: Side-by-Side

To provide a clear and concise comparison, here’s a table highlighting the key features of these top brokers specifically for scalping. This side-by-side view will help you quickly assess and compare their strengths and weaknesses in relation to your scalping needs:

| Broker | Spread (EUR/USD) | Commission | Execution Speed | Platforms | Regulation |

| Opofinance | 0.0 pips | $4 per lot (ECN Pro) | Ultra-fast (lightning-speed, minimal slippage) | MT4, MT5, cTrader, Web Terminal | ASIC (AFSL 402043), Seychelles FSA (SD124), Financial Commission |

| Pepperstone | 0.0 pips | $7 per lot | ~30 ms | MT4, MT5, cTrader, TradingView | ASIC, FCA, CySEC |

| IC Markets | 0.0 pips | $7 per lot | ~40 ms | MT4, MT5, cTrader | ASIC, CySEC, FSA |

| FP Markets | 0.0 pips | $6 per side per $100K | Not specified | MT4, MT5, cTrader, TradingView, Iress | ASIC, CySEC, FSCA |

| Exness | 0.0 pips | $3.5 per side per lot | Extremely fast | MT4, MT5, Exness Trade | FCA, FSC |

Summary of Comparison

- Opofinance: Undeniably the best forex broker for scalping for traders who prioritize a potent combination of ultra-low trading costs, robust ASIC regulatory security, and exceptionally fast order execution. The added layer of trust provided by ASIC regulation makes it an exceptionally compelling choice for discerning scalpers.

- Pepperstone and IC Markets: Remain excellent alternatives for traders who place paramount importance on raw execution speed and the highest levels of global regulatory oversight.

- Exness: Stands out by offering incredibly competitive commission rates, making it a highly attractive option for scalpers who are laser-focused on minimizing transaction costs, although execution specifics may exhibit some variability.

- FP Markets: Provides a comprehensive suite of trading tools and a vast range of instruments, making it a solid choice for traders pursuing more diversified trading strategies, but its platform complexity might be perceived as slightly higher by some users.

For scalpers diligently seeking the optimal balance between affordability, cutting-edge trading tools, and a secure trading environment underpinned by the gold standard of ASIC regulation, Opofinance unequivocally emerges as the leading contender and the best forex broker for scalping available in the market today.

Tips for Successful Scalping: Mastering the Art of the Quick Trade

Choosing the best forex broker for scalping is just the foundational step. Consistent success in scalping demands discipline, a robust strategy, and a refined approach. Here are essential tips to guide you on your scalping journey:

Prioritize Risk Management Above All Else

Scalping inherently involves high leverage and a high frequency of trading, making robust and unwavering risk management absolutely paramount. Always, without exception, use stop-loss orders to rigorously limit your potential losses on every single trade. Before you even consider entering a trade, clearly define your personal risk tolerance and meticulously ensure that you never risk more than a small, pre-determined percentage of your total trading capital on any individual trade. Protecting your capital is the number one priority in the high-stakes world of scalping.

Meticulously Utilize the Right Tools and Indicators

Scalpers are heavily reliant on technical analysis to precisely identify fleeting short-term trading opportunities. Focus your analytical efforts on indicators that are exceptionally responsive to short-term price movements and rapid fluctuations, such as moving averages with short lookback periods, the RSI (Relative Strength Index) for momentum, MACD (Moving Average Convergence Divergence) for trend direction and potential divergences, and volatility indicators like Average True Range (ATR) to gauge market activity. Developing expertise in order flow analysis and utilizing Level 2 market data can further enhance your scalping precision and provide a significant competitive advantage.

Diligently Avoid Common Scalping Mistakes

- Resist Over-trading: Don’t fall into the trap of forcing trades simply for the sake of being active. Exercise patience and selectively wait for only the highest probability setups that perfectly align with your meticulously defined scalping strategy. Quality over quantity is key.

- Eliminate Emotional Trading: Strictly adhere to your well-defined trading plan and consciously avoid impulsive, emotionally driven decisions fueled by fear, greed, or the pressure of the fast-paced scalping environment. Emotional discipline is paramount for consistent profitability.

- Stay Vigilant About News Events: Always be acutely aware of upcoming high-impact economic news releases and geopolitical events. These events can trigger sudden bursts of extreme market volatility, potentially disrupting your scalping strategy and leading to unexpected losses if you’re caught off guard. Adjust your trading activity and risk exposure accordingly around major news announcements.

- Commit to Consistent Practice: Before risking any real capital in the live markets, dedicate significant time to practicing your scalping strategy extensively on a demo account. Demo trading is invaluable for refining your techniques, building confidence, and becoming thoroughly comfortable with the rapid-fire pace and intense demands of the scalping environment.

Regulation and Safety Considerations

In the often-unregulated world of online finance, trading with a regulated broker is absolutely non-negotiable for safeguarding your financial well-being. Regulation provides a critical framework of rules, oversight, and accountability, specifically designed to protect traders from unethical practices and ensure fair and transparent market conduct. When choosing the best forex broker for scalping, regulation should be your first and foremost consideration.

- The Paramount Importance of Regulated Brokers: Regulated brokers are legally mandated to segregate client funds completely separate from their own operational capital, undergo rigorous and regular audits conducted by independent third-party bodies, and meticulously adhere to stringent capital adequacy requirements. Furthermore, regulated brokers typically provide access to impartial and effective dispute resolution mechanisms, offering a crucial safety net should any issues or disagreements arise.

- How to Verify a Broker’s Regulatory Status with Certainty: Always take the proactive step of independently verifying a broker’s claimed regulatory status directly with the official website of the regulatory body they cite (e.g., ASIC, FCA, CySEC, FSA). Reputable regulators maintain comprehensive online databases and registers where you can easily search for brokers by name or license number and definitively confirm their current license validity and regulatory standing. Don’t rely solely on information presented on the broker’s website – always cross-reference with the official regulator.

- The Unacceptable Risks of Trading with Unregulated Brokers: Unregulated brokers operate entirely outside of any established legal framework designed to protect the interests of traders. Choosing to trade with an unregulated broker exposes you to a dramatically heightened risk of falling victim to fraudulent schemes, market manipulation tactics, and the very real possibility of losing your entire invested capital with virtually no recourse for recovery. The potential for marginal cost savings with an unregulated entity simply cannot justify the immense and unacceptable risks involved.

Conclusion: Your Scalping Broker Awaits

Choosing the best forex broker for scalping can dramatically affect your ability to profit in this fast-paced arena. Opofinance, bolstered by ASIC regulation, plus Pepperstone, IC Markets, FP Markets, and Exness are among the top-tier contenders. Each aligns closely with scalping needs but offers unique advantages.

- If you value low costs, powerful execution, and robust security, Opofinance is an exceptional pick for scalpers.

- Pepperstone and IC Markets shine when speed and broad regulatory oversight are paramount.

- Exness appeals to cost-centric traders, providing the lowest commission rates on the list.

Ultimately, determining which broker is best for scalping is a personal call, shaped by your trading style, capital, platform preference, and risk tolerance. Test several options—especially Opofinance—through demo accounts to ensure the broker’s execution quality and platform features meet your standards. By selecting the right partner, you equip yourself with the essential tools, security, and trading conditions to flourish in the exhilarating world of forex scalping. Always uphold risk management, learn continuously, and trade with discipline to harness this strategy’s potential rewards.

Key Takeaways

- Scalping Demands the Right Broker: Choosing the best forex broker for scalping is crucial for profitability due to the strategy’s reliance on low spreads, fast execution, and no restrictions.

- ASIC Regulation Matters: Opofinance’s ASIC regulation provides a significant layer of security and trust, making it a top choice.

- Low Costs are Essential: Brokers like Opofinance and Exness offer ultra-low spreads and commissions, vital for scalping profitability.

- Execution Speed is King: Pepperstone and IC Markets are renowned for their lightning-fast execution, minimizing slippage.

- Platform Choice is Personal: Top brokers offer MT4, MT5, and cTrader, catering to different preferences.

- Risk Management is Paramount: Always use stop-loss orders and manage your risk diligently when scalping.

- Continuous Learning is Key: Stay updated with market dynamics and refine your scalping strategy continuously.

What is the ideal leverage for scalping forex?

While higher leverage can amplify small price movements, for scalping, it’s crucial to use leverage judiciously. A leverage ratio between 1:100 to 1:200 is often considered suitable, balancing potential gains with manageable risk. Always ensure your risk management strategy aligns with your chosen leverage.

Are there specific currency pairs that are better for scalping?

Major currency pairs like EUR/USD, GBP/USD, and USD/JPY are generally preferred for scalping due to their high liquidity, tight spreads, and consistent volatility. These pairs typically offer the best conditions for executing frequent, short-term trades.

How much capital do I need to start scalping forex?

You can start scalping with a relatively small amount of capital, especially with brokers like Opofinance offering minimum deposits as low as $100. However, the amount of capital you need depends on your risk tolerance, desired profit targets, and the lot sizes you intend to trade. It’s recommended to start with an amount you are comfortable potentially losing while you learn and refine your scalping strategy.