Imagine this: You’re a forex trader, heart racing as you watch the EUR/USD currency pair tick up and down. Every pip matters, and whether you end a trading day in the green or red often hinges on one understated factor—your broker’s spread. In forex, the spread is the gap between the buy (bid) and sell (ask) price of a currency pair, and it’s your first cost to overcome when opening a position. If that spread is too high, you begin each trade in a deficit, effectively shrinking any potential profit from the get-go.

This scenario can be incredibly stressful—especially for scalpers, day traders, and anyone chasing razor-thin margins. A spread difference of just 0.5 pips may seem insignificant at a glance, but execute 50 or 100 trades, and those tiny increments can multiply into a hefty sum. What’s worse, some brokers lure you with “zero spreads” only to bury you under hidden commissions. Others may offer appealing deals yet lack proper regulation, leaving your funds exposed to potential risks. If you’ve ever found yourself frustrated by ballooning costs or anxious about a broker’s credibility, you’re not alone.

The good news is that you don’t have to settle for high fees or questionable regulatory oversight. By focusing on the best forex broker with lowest spread, you can dramatically reduce trading costs while maintaining a sense of security and trust. This extensive guide reveals the five leading brokers offering the tightest spreads in 2025—starting with the cost champion, Opofinance. You’ll uncover each broker’s unique blend of regulatory background, platform options, and additional perks, giving you a clear roadmap to cheaper and more efficient forex trading. Ready to elevate your trading game and keep more of your hard-earned profits? Read on to discover how to slash your spread-related costs, amplify your profit potential, and trade smarter than ever before.

Understanding Low Spreads

In simplest terms, the spread is the difference between the bid and ask price for a currency pair. If EUR/USD’s bid price is 1.1000 while its ask price is 1.1002, the spread is 0.0002—or two pips. Whether you’re a short-term scalper or a long-term position trader, spreads add to the cost of each transaction. The lower the spread, the faster you break even when opening a new position, and the larger the chunk of profit you keep when that trade moves in your favor.

The High-Frequency Factor

Many traders enter and exit positions multiple times a day. If you fit that description, you’re likely sensitive to even minor cost differences per trade. Paying an extra 0.3 or 0.5 pips on 30 trades daily can inflate your monthly costs significantly. Over weeks, months, or years, that “tiny difference” piles up, eroding your .

The Big-Picture Cost of Trading

Spreads are closely tied to other fee components:

- Commissions: Some brokers offer raw, near-zero spreads but charge a fixed commission per lot. In many cases, this commission can still be cheaper overall than a higher spread with zero commissions—but it needs careful calculation.

- Swaps/Overnight Fees: If you hold positions overnight, you may incur swap fees. A broker with the tightest spreads isn’t automatically cheapest if it charges substantially higher swaps.

- Hidden Fees: Occasional inactivity fees, withdrawal charges, or even deposit fees can creep into your net trading costs if you’re not vigilant.

Why Low Spreads Are a Win-Win

- Cost Efficiency: Minimal spreads free up capital you might otherwise lose to transaction costs.

- Better Risk/Reward Ratio: You can optimize risk/reward setups more effectively when your trades start closer to break-even.

- Scalping Feasibility: Strategies involving tiny profit targets rely heavily on near-zero spreads to remain viable.

In the fast-paced, high-stakes realm of forex, every decimal point matters. By seeking out a broker with lowest spread, you position yourself for stronger profit margins and a more sustainable trading strategy.

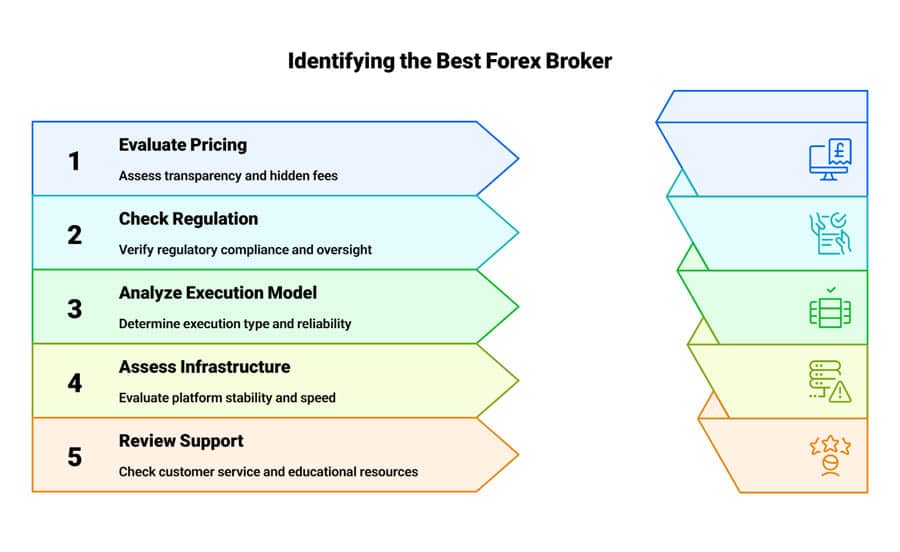

Key Criteria for Identifying the Best Forex Broker With Lowest Spread

When hunting for the best forex broker with lowest spread, it’s not enough to glance at an advertised 0.0 pip spread. Brokers might display their “best case” spread scenarios that only appear during peak market hours—or may even charge hidden fees. To truly separate top contenders from the hype, consider these critical factors:

- Transparent Pricing

- Real vs. Promotional Spreads: Look at average or typical spreads posted across different trading sessions. Spreads that appear only briefly during low-volatility times might not be representative of your real trading costs.

- Commission Disclosure: If a broker offers raw or zero spreads, confirm whether a commission is charged per trade or per lot—and read the fine print to avoid surprises.

- Regulatory Oversight

- Tier-1 Regulators: Licenses from ASIC (Australia), FCA (UK), CySEC (Cyprus), or NFA (US) often indicate high regulatory standards. These authorities typically require brokers to maintain segregated client accounts and adhere to strict reporting guidelines.

- Offshore Entities: Some brokers operate under the oversight of authorities in Seychelles, Mauritius, or other jurisdictions. While not necessarily inferior, the level of investor protection may differ from top-tier bodies.

- Execution Model

- ECN/STP (No-Dealing Desk): Often equated with raw spreads since orders route directly to liquidity providers. While you get tighter pricing, you’ll likely pay a separate commission.

- Market Maker (Dealing Desk): May offer a spread-only structure. However, spreads can be wider, and there’s a risk of re-quotes or price manipulation if the broker acts as your counterparty.

- Trading Infrastructure

- Platform Options: MT4, MT5, cTrader, and proprietary solutions each have unique strengths. If you favor automated trading via Expert Advisors (EAs), ensure your broker’s platform is compatible.

- Server Stability and Speed: Low spreads don’t mean much if you’re constantly facing slippage or disconnections. Look for brokers known for reliable uptime and minimal latency.

- Support and Resources

- Customer Service: A broker may have epic spreads, but slow or unhelpful support can quickly sour your experience—especially in a crisis.

- Educational Materials: For newer traders, a library of webinars, tutorials, and market analysis can be invaluable.

- Additional Tools and AI Services: Some brokers go above and beyond by offering AI-powered market analyzers or social trading platforms that allow for a more versatile approach.

- Overall Reputation

- User Reviews and Forums: While not always objective, feedback from actual traders can highlight real-world experiences with a broker’s spreads, platform stability, and ethics.

- Age and Track Record: Newer brokers may still be building credibility, while established names often have a paper trail of performance and compliance.

By blending cost considerations with operational transparency and regulatory safeguards, you can pinpoint a broker that not only offers the lowest spreads but also preserves a secure, supportive trading environment.

Our Top 5 Picks for 2025: In-Depth Reviews

Ready for the details? Below is a deep dive into five standout choices for the best forex broker with lowest spread in 2025. These brokers consistently provide tight pricing, but each caters to different priorities—regulation, technology, or user-friendliness.

1. Opofinance: The King of Near-Zero Spreads

Opofinance has emerged as a frontrunner in cost-effective forex trading, earning it a spot at the top of our list. Although it’s regulated by the FSA in Seychelles (license SD124), it also offers ASIC-regulated solutions for traders seeking a higher level of security. Founded by industry veterans, Opofinance aims to marry ultra-tight spreads with advanced technology, making it especially appealing to scalpers and frequent traders.

Spread and Commission Structure

- Near-Zero Spreads: On the ECN PRO account, traders often see spreads as low as 0.0–0.2 pips on pairs like EUR/USD.

- Commission: At $4 per lot , this ranks among the cheapest in the market. Over 50 or 100 monthly lots, the savings can be substantial compared to competitors charging $6 or more.

Trading Platforms

- MT4 & MT5: The classic duo for those who prefer reliability and a massive library of indicators and Expert Advisors.

- cTrader: A favorite for traders wanting more transparent pricing and advanced algorithmic trading features.

- OpoTrade: A proprietary platform designed for a user-friendly experience, offering streamlined navigation and direct access to key trading tools.

Execution Model and Technology

- ECN Environment: Orders are sent to liquidity providers with minimal intervention, reducing the likelihood of re-quotes.

- High-Speed Servers: For scalpers and algo-traders, a low-latency environment is a must. Opofinance invests in robust server infrastructure to facilitate lightning-fast execution.

Additional Perks

- Innovative AI Tools: AI Market Analyzer, AI Coach, and AI Support allow traders to glean insights from big data, refine strategy performance, and manage queries more efficiently.

- Social & Prop Trading: Join a community of traders to share insights, copy strategies, or even become a funded prop trader under structured programs.

- Payment Flexibility: Deposits and withdrawals are convenient, secure, and come with zero fees from Opofinance—covering a range of methods, including cryptocurrencies.

Pros

- Near-zero spread structure.

- Low commissions.

- Advanced AI-based toolset.

- Several regulated options, including ASIC, which many traders find comforting.

If you’re primarily focused on cost-efficiency and want advanced features like AI analytics, Opofinance stands out as the best forex broker with lowest spread for 2025. Scalpers, day traders, and high-volume enthusiasts will likely find the financial edge they’ve been seeking.

2. FP Markets: Powerhouse of Precision

Founded in 2005, FP Markets is headquartered in Australia and regulated by ASIC, one of the most respected financial authorities globally. This factor alone provides a sense of security for traders worried about broker solvency or unethical practices.

Spreads and Fees

- Raw Account: Advertised spreads often hit 0.0 pips during peak liquidity, especially on EUR/USD and USD/JPY.

- Commission: $3 per side ($6 round trip) per lot. While slightly higher than Opofinance’s structure, it’s still competitive for an ASIC-regulated broker.

Platform Selection

- MT4 and MT5: Access a comprehensive suite of charting tools, automated trading, and thousands of custom indicators.

- cTrader: Known for depth-of-market views, low-latency execution, and advanced order management.

- Iress: An equities-leaning platform that can also handle CFDs, offering robust analytics and research tools.

Execution Quality

- ECN Model: Orders flow to a pool of liquidity providers, facilitating tight pricing.

- Low-Latency Servers: FP Markets invests in co-located data centers, ensuring traders execute quickly and reliably.

Why It’s Not #1

For traders laser-focused on cost, FP Markets’ commission of $6 per round trip is higher than Opofinance’s $4. However, for those who place a premium on ASIC regulation and broad platform variety, this difference might be a worthwhile tradeoff.

Ideal User

- Regulation-Conscious Traders: Those who want near-institutional-level security for their funds.

- Multi-Asset Traders: If you want to dip into CFDs for stocks, commodities, or indices, FP Markets has you covered.

3. Trade Nation: Beginner-Friendly Brilliance

Trade Nation’s main differentiator is simplicity. Founded with the idea that transparent fees and a user-friendly approach help lower the barrier for new forex traders, it quickly gained traction among novices intimidated by more complex ECN or raw-spread models.

Spread and Fee Structure

- Average Spread: Roughly 0.6 pips on EUR/USD, free of commission on standard accounts.

- No Hidden Costs: Trade Nation aims to reduce the confusion by rolling everything into the spread, so you won’t face separate commission or unexpected charges.

Platforms and Ease of Use

- App-Focused Platform: Built for convenience, particularly appealing to traders who rely on smartphones or tablets.

- Limited Advanced Features: If you require advanced order types or high-level analytics, you might find the platform lacking.

Regulatory Environment

- Varies by Region: The broker may operate under different regulators, so always confirm local licensing details.

Pros

- Straightforward pricing that’s easy to calculate.

- No commissions for standard account traders.

- Appealing, streamlined mobile interface.

Cons

- Higher spreads than pure ECN accounts, especially noticeable for scalpers or high-volume traders.

- May not satisfy professional traders needing advanced analytics, algorithmic trading, or deep liquidity pools.

Best For

- Beginners: Those stepping into forex for the first time, wanting a simple cost structure without the complexities of separate commissions and platform intricacies.

- Casual Traders: If you only place a few trades per week or month, the difference in spread won’t significantly hurt your wallet.

4. CMC Markets: The Spread-Slashing Veteran

CMC Markets has been in the retail trading scene for decades, known for innovation and solid regulatory oversight. It’s also frequently lauded for robust research, educational materials, and an advanced proprietary platform.

Spread Model

- Average Spreads: Around 0.61 pips on EUR/USD, which can be competitive for moderate-frequency traders.

- Volume Discounts: High-volume traders may qualify for rebates or tighter spreads, so it pays to inquire if you meet certain thresholds.

Platform Versatility

- Next Generation Platform: This proprietary solution includes a wide array of charting tools, pattern recognition software, and custom watchlists.

- MT4: Available for those who prefer a classic interface with automated trading compatibility.

Regulatory Framework

- Multi-Region Regulation: CMC Markets operates under major authorities like FCA (UK) and ASIC (Australia), among others, reinforcing its reputation for reliability and client protection.

Who Thrives Here

- Active Traders: If you trade in high volumes, CMC Markets’ discount programs can slash your trading costs considerably.

- Traders Seeking Research and Education: CMC invests heavily in analytics, market insights, and learning tools.

Trade-Off

- Casual or low-volume traders might see fewer cost benefits compared to more specialized brokers with lower commissions or narrower raw spreads.

5. IC Markets: The Scalper’s Dream

IC Markets is a top pick for those who rely on speed and low spreads—particularly scalpers, high-frequency traders, and robot enthusiasts. Founded in 2007 and headquartered in Australia, it’s known for catering to advanced trading strategies.

Spread & Commission Highlights

- Average Spread: Often near 0.62 pips on EUR/USD in its raw account.

- Commission Structure: Varies by account type, but competitive rates are available once you reach certain volume tiers.

Execution and Server Tech

- ECN Environment: Direct market access ensures minimal dealing desk intervention.

- VPS and Low Latency: Encourages scalpers to host their EAs on Virtual Private Servers for near-instant trade execution.

Regulation and Trust

- ASIC and Others: Alongside ASIC, the broker may hold licenses in other jurisdictions, extending its global reach and providing multiple options to clients.

Best Match

- Algorithmic Traders: If you rely on EAs or custom-coded scripts, the synergy of low spreads and fast infrastructure can boost your system’s performance.

- Volume-Oriented Strategies: High-volume traders can negotiate better conditions or enroll in loyalty programs.

Note

- For smaller accounts or occasional traders, the full benefits of IC Markets’ raw spread structure might not outweigh the costs unless you’re trading enough volume.

Comparison Table: Quick Glance at the Top Contenders

| Broker | Lowest Spread | Commission | Regulation | Platforms |

| Opofinance | ~0.0–0.2 pips (ECN PRO) | $4/lot | FSA Seychelles & ASIC | MT4, MT5, cTrader, OpoTrade |

| FP Markets | 0.0 pips (peak times) | $6/lot (round trip) | ASIC, CySEC | MT4, MT5, cTrader, Iress |

| Trade Nation | ~0.6 pips | None (standard accounts) | Varies by region | Mobile-focused (proprietary platform) |

| CMC Markets | ~0.61 pips | Varies by volume | Multiple (FCA, ASIC, more) | Proprietary platform + MT4 |

| IC Markets | ~0.62 pips | Varies by account volume | ASIC, additional licenses | MT4, MT5, cTrader |

Which One Should You Choose?

- Cost Above All: Opofinance leads with tight spreads and ultra-low commissions.

- Regulatory Strength: FP Markets and CMC Markets excel if you want top-tier oversight.

- Beginner Simplicity: Trade Nation’s easy pricing structure might be your go-to.

- Scalping & High-Speed: IC Markets is built to accommodate algorithmic and rapid-fire trading.

Pro Tips for Advanced Traders

If you’re not a newbie and want to squeeze maximum advantage from a broker with lowest spread, consider these advanced strategies:

- Leverage Peak Liquidity

- Forex markets are most liquid during the London-New York overlap. Spreads typically hit their lowest in these hours. By timing your trades in these windows, you can pay a fraction of what you’d pay in quieter sessions.

- Take Advantage of ECN Accounts

- ECN or STP accounts might charge commissions, but if you’re trading large volumes, you could save in the long run due to narrower spreads. Always calculate your total cost (spread + commission) to find the sweet spot.

- Use VPS for Automated Trading

- If scalping or running high-frequency bots, a VPS located near your broker’s data center minimizes latency. Every millisecond counts when you aim for small, frequent profits.

- Apply Strict Risk Management

- Even if spreads are minimal, leverage magnifies both gains and losses. No broker can protect you from an unbalanced risk strategy, so always employ stop-loss orders and size your positions carefully.

- Regularly Reassess Your Broker

- Brokers can modify their liquidity providers or fee structures over time. Check if your broker still offers the best deal every few months—especially if you’re a high-volume trader.

Opofinance Services: Why It’s a Standout Choice

Below is an expanded look at why Opofinance remains a game-changer, offering more than just low spreads:

- ASIC-Regulated Option

- Beyond its FSA Seychelles license, Opofinance also provides an ASIC-regulated framework. This dual regulatory approach is ideal for those wanting tighter oversight and additional consumer protections.

- Advanced Trading Platforms

- MT4, MT5, cTrader, OpoTrade – Each platform offers something unique. Whether you’re a seasoned algorithmic trader or just starting, you’ll find a solution that fits your skill set.

- Innovative AI Tools

- AI Market Analyzer: Uses data-driven intelligence to identify potential trade setups.

- AI Coach: Offers personalized guidance, especially for those refining their strategies.

- AI Support: Speeds up customer assistance, ensuring faster resolutions to common queries.

- Social & Prop Trading

- Copy-Trading: Follow expert traders and mimic their strategies in real-time, which can help novices learn faster.

- Proprietary Trading Programs: Qualify for in-house capital if you demonstrate a consistent track record.

- Secure & Flexible Transactions

- Deposits and withdrawals are hassle-free, supporting multiple payment gateways, including crypto.

- Zero Fees from Opofinance: The broker waives internal charges, so you keep more of what you earn.

- Safe and Convenient

- Client funds typically held in segregated accounts, adding another layer of security.

- Lightning-fast deposits ensure you can act on market opportunities without delay.

- Why Traders Love It

- Low spreads + minimal commissions = robust cost savings for scalpers and day traders.

- AI-driven tools streamline analysis, helping refine trades for better accuracy.

Ready to experience Opofinance’s cost-saving benefits?

Open Your Account at opofinance.com

Conclusion

Choosing the best forex broker with lowest spread isn’t just about finding the tightest quote on EUR/USD; it’s about a holistic package that balances regulatory credibility, cutting-edge technology, transparent fees, and reliable execution. The five brokers spotlighted here each excel in different areas:

- Opofinance stands out for its near-zero spreads and innovative AI tools, offering an incredible deal to scalpers and high-frequency traders.

- FP Markets caters to those prioritizing ASIC oversight, with spreads from 0.0 pips during peak hours.

- Trade Nation is a win for beginners, boasting an easy-to-understand pricing model.

- CMC Markets captures traders who need extensive research tools and multi-region regulation.

- IC Markets remains a top choice for scalpers seeking minimal latency and flexible account tiers.

Although cost is vital, remember that transparency, platform stability, and customer support can be equally important to your success. Spreads can fluctuate based on market conditions, so confirm each broker’s average spread, not just the advertised minimum. Whether you’re new to forex or refining a seasoned approach, the path to optimal profitability starts with aligning your needs—spread tolerance, trade frequency, regulatory requirements—with the right broker.

By researching diligently, testing demo accounts, and adopting robust risk management, you’ll be well on your way to making the most of low spreads in the ever-dynamic forex landscape.

Key Takeaways

- Low Spreads Matter

- Reduced transaction costs can dramatically enhance your overall profitability, especially if you trade frequently.

- Regulation and Trust

- Seek brokers overseen by reputable regulators like ASIC, FCA, or CySEC. Regulation often indicates better fund security and ethical behavior.

- Platform Diversity

- Multi-platform support (MT4, MT5, cTrader, or proprietary options) grants you the flexibility to automate strategies, conduct detailed analysis, or follow live signals.

- Opofinance Shines

- Near-zero spreads, low commissions, AI-driven tools, and a user-friendly environment make Opofinance a prime candidate for cost-conscious traders.

- Stay Vigilant

- Regularly review your broker’s spread data and fee structure to ensure you’re still getting a competitive deal, as conditions can evolve over time.

How do brokers maintain “zero spreads” without hidden catches?

“Zero spread” or “raw spread” accounts usually involve a small per-lot commission that compensates the broker. While the spreads can indeed be close to zero, you must factor in that commission to grasp the total cost. Make sure to compare both spread and commission against brokers offering an all-in spread-only model to see which is truly cheaper for your strategy.

Can I switch between different account types if my trading style changes?

Many brokers allow you to open multiple account types (e.g., a Standard account and an ECN/Raw account) under the same profile. This flexibility can be helpful if you start as a beginner with a spread-only model and later transition to a raw-spread account for more advanced, high-volume trading.

Is it advisable to rely on AI tools and signals for trading decisions?

AI tools and signals can be incredibly useful for identifying patterns or refining strategies, but they’re not infallible. It’s best to combine any AI-driven recommendations with your own analysis, risk management, and market knowledge. Over-reliance on automation without understanding the rationale behind trades can lead to unexpected losses.