Finding the best forex brokers for MT4 requires looking at regulation, execution speed, and trading costs. The ideal online forex broker provides a smooth MetaTrader 4 experience with low spreads and reliable performance. This article examines the top 8 mt4 forex brokers for 2025, covering their regulatory status, account features, and what makes them unique. We will also cover how to choose the right broker for forex trading and explain why the MT4 platform remains a top choice for traders globally.

Top 8 Best Forex Brokers for MT4 in 2025

Choosing a broker is a trader’s most important decision. While MetaTrader 4 provides the software, the broker provides the trading conditions. The quality of these conditions—defined by execution speed, spreads, regulation, and support—directly affects your trading results. A great mt4 forex broker enhances the platform’s power, while a poor one can undermine a solid strategy. Below, we review some of the industry’s leading forex brokers with the mt4 platform.

- Opofinance

- IC Markets

- Pepperstone

- XM

- Exness

- FXTM

- AvaTrade

- RoboForex

Opofinance

Opofinance positions itself as a modern and technologically advanced online forex broker, regulated by ASIC. Their MT4 offering is designed to provide a comprehensive trading experience by integrating innovative tools with a secure environment. They provide access to not only MT4 and MT5 but also cTrader and their proprietary OpoTrade app, giving traders ample choice

. A standout feature is their suite of AI tools, including an AI Market Analyzer and an AI Coach, which aim to assist traders in making more informed decisions. For those interested in community-based trading, Opofinance supports both social and prop trading. Their payment system is flexible, accommodating traditional methods as well as crypto payments with zero fees, making it one of the more versatile forex brokers with the mt4 platform.

IC Markets – Best ECN MT4 Broker

IC Markets is widely recognized as one of the best forex brokers for mt4, especially for traders seeking a true ECN environment. Their primary strength is offering raw spreads from a deep liquidity pool, resulting in very low trading costs on major pairs. The EUR/USD spread, for example, can be as low as 0.0 pips, with a transparent commission structure.

Their servers, located in the Equinix NY4 data center, ensure low-latency execution, which minimizes slippage—a critical factor for scalpers and automated traders. As one of the top regulated mt4 forex brokers, IC Markets holds licenses from ASIC and CySEC, ensuring a secure trading framework. They enhance the standard MetaTrader 4 platform with over 20 exclusive trading tools, providing added value for technical traders.

Pepperstone – Fast Execution & Advanced Tools

Pepperstone is frequently named a best mt4 forex broker due to its exceptional execution speed and advanced trading tools. Their infrastructure is built for high performance, making them a top pick for algorithmic traders and those who trade during high-volatility news events. They offer two main account types on their MT4 platform: a commission-free Standard account with wider spreads and a Razor account with raw ECN spreads plus commission.

This flexibility serves both beginners and experienced traders. A key advantage is their “Smart Trader Tools” package for MT4, which includes advanced indicators and trade management tools not found on the basic platform. As a broker for forex trading regulated by the FCA and ASIC, Pepperstone guarantees a high level of client fund protection.

XM – Best for Beginners and Education

XM is one of the best mt4 brokers for beginners, thanks to its focus on education and accessible trading conditions. With a low minimum deposit of just $5 for its Micro and Standard accounts, the platform is open to new traders with minimal starting capital. XM provides extensive educational resources, including daily webinars and platform tutorials. Their Micro accounts are particularly valuable for risk management, allowing beginners to trade in micro-lots and test strategies with very small position sizes. XM maintains a strict policy of no requotes and no order rejections, which helps build trader confidence. This commitment makes them one of the most trusted forex brokers with the mt4 platform.

Exness – Flexible Leverage & Instant Withdrawal

Exness has established itself as a leading mt4 forex broker by offering highly flexible trading conditions, especially concerning leverage and withdrawals. They provide very high leverage options for eligible clients, which allows for greater capital efficiency for experienced traders. However, their standout feature is an instant withdrawal system that often processes funds to e-wallets within seconds. This level of speed and access to funds is rare in the industry. Exness offers multiple account types on MetaTrader 4, including Standard and Pro accounts with tight spreads. As a well-regarded online forex broker, Exness is regulated by multiple authorities, including CySEC and the FCA, ensuring a transparent and secure trading environment.

FXTM – Regulated Broker with Local Payment Options

FXTM (ForexTime) is a globally recognized broker for forex that is popular for its localized services and strong regulatory framework. Regulated by the FCA and other authorities, they provide a reliable MetaTrader 4 experience. A key benefit of FXTM is its wide range of payment options, which includes local bank transfers in many countries, simplifying the deposit and withdrawal process for international traders. FXTM offers various MT4 account types, such as the Micro account for beginners and the Advantage account for traders seeking lower spreads. Their comprehensive educational resources make them a solid choice for traders at all skill levels, solidifying their status as one of the dependable regulated mt4 forex brokers.

AvaTrade – Best for Copy Trading and Security

AvaTrade is one of the best forex brokers for mt4, known for its strong security and excellent copy trading features. Regulated across multiple continents by bodies like the Central Bank of Ireland and ASIC, AvaTrade offers a highly secure trading environment. Their MT4 platform integrates smoothly with leading third-party copy trading platforms like DupliTrade and ZuluTrade, making it ideal for traders who want to replicate the strategies of professionals. They also offer a unique risk management tool called AvaProtect™, which allows traders to hedge specific trades against losses for a small fee. This combination of robust regulation and support for mt4 brokers with copy trading makes AvaTrade a compelling choice.

RoboForex – Best MT4 Broker for Automated Trading

RoboForex is a top choice for traders who focus on automated strategies, making it the best forex broker for metatrader 4 for this purpose. The broker supports algorithmic trading by offering free Virtual Private Server (VPS) services to clients who meet certain criteria. A VPS is essential for running Expert Advisors (EAs) 24/7 without interruption. RoboForex provides several MT4 account types, including Pro-Standard and ECN accounts, suitable for different automated strategies. Their competitive execution speeds are crucial for EA performance. Regulated by the IFSC and a member of The Financial Commission, they offer a secure environment, making RoboForex a standout mt4 forex broker for systematic traders.

How to Choose the Best Forex Broker for MT4

Selecting the best forex broker for metatrader 4 is about more than just marketing claims. It involves a careful review of key factors that define a broker’s reliability, costs, and overall quality of service. A trader’s success depends just as much on the broker’s infrastructure as on their trading strategy. Every element, from regulation to execution speed, shapes the trading experience. Here is a straightforward guide to help you choose the right broker for forex trading.

Checking Regulation and Licensing

Regulation is the most important factor. A broker’s license is the foundation of its credibility. Top-tier regulators like the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC) enforce strict rules. These rules often include segregating client funds and providing negative balance protection. Before opening an account, always confirm a broker’s license on the regulator’s official website. Choosing regulated mt4 forex brokers is essential for protecting yourself from fraud and ensuring fair trading conditions.

Comparing Spreads and Commissions

Trading costs directly affect your profits. These costs mainly consist of spreads and commissions. Some brokers offer commission-free trading by building their fees into wider spreads, which is common with Standard accounts. Other brokers, such as ECN types, provide very low spreads but charge a fixed commission per trade. To find mt4 brokers with low spreads, you must compare the total cost. A broker advertising “zero spreads” might have high commissions that make it more expensive than a broker with a 0.6 pip spread and no commission. Always check the average spreads for the currency pairs you trade most often.

MT4 Server Speed and Order Execution

A broker’s technology determines how fast and reliably your trades are executed. The best forex brokers for mt4 use high-performance servers, often located in major financial data centers. This reduces latency and results in faster execution with less slippage. Slippage is the difference between the price you expect and the price you get, and it can reduce profits. A good broker should execute trades quickly (under 100 milliseconds is ideal) and have very few requotes. A good way to test this is by using a demo account during a major news event to see how the platform performs under pressure.

Available Account Types

A good broker offers different account types to suit various trading styles and capital levels. The three most common types are:

- Standard Account: Usually commission-free with slightly wider spreads. It’s a good choice for beginners.

- ECN Account: Offers raw market spreads with a fixed commission. This is preferred by scalpers and algorithmic traders.

- Micro Account: Allows trading in very small units (micro-lots), perfect for beginners practicing risk management with minimal capital.

The best mt4 forex broker will provide clear details on each account, helping you choose one that aligns with your strategy.

Customer Support and 24/7 Service

Reliable customer support is a sign of a professional brokerage. Since trading occurs 24/5, problems can happen at any time. Look for a broker that offers support through live chat, phone, and email during the trading week. The quality of support is just as important. Are the support agents knowledgeable? Quick resolution of a technical issue or a question about a withdrawal is crucial. You can test a broker’s live chat response time before funding an account to get a sense of their service quality.

International Deposit and Withdrawal Options

A global online forex broker should offer various secure and convenient payment methods. Standard options include bank transfers and credit/debit cards, but leading brokers also support e-wallets like Skrill and Neteller. The speed and cost of transactions are also important. The best forex brokers for mt4 often process deposits instantly and withdrawals within 24 hours with zero fees. Transparency about any third-party charges is another sign of a reputable broker.

What is MT4 and Why Traders Prefer It

MetaTrader 4, or MT4, is a cornerstone of the online forex trading world. Even with a successor available, MT4 remains the dominant platform for retail traders. Its lasting appeal comes from its unique mix of simplicity, power, and a massive ecosystem of community-built tools. Understanding why so many traders prefer it explains why finding a top-tier forex broker with the mt4 platform is still a priority for traders everywhere.

Introducing the MetaTrader 4 Software

Released in 2005 by MetaQuotes Software, MetaTrader 4 was built for forex and CFD trading. It gives traders all the tools they need to analyze markets, execute trades, and run automated strategies. The platform is known for being stable, lightweight, and easy to use, making it suitable for beginners while still being powerful enough for professionals. Brokers license the software and connect it to their own servers, which is why the trading experience can differ between one mt4 forex broker and another.

MT4 Advantages for Technical Analysis and EAs

MT4’s main strength is its powerful charting and analysis tools. It includes 30 built-in technical indicators and 31 graphical objects. However, its real power is in customization. The platform’s programming language, MQL4, has allowed a global community to create thousands of custom indicators and scripts. Its most famous feature is its support for Expert Advisors (EAs), which are automated trading systems that can trade on your behalf based on a pre-set strategy. This has made MT4 the leading platform for algorithmic trading in the retail market.

Key Differences Between MT4 and MT5

Although MT5 was intended as an upgrade, it hasn’t replaced MT4 because they serve different purposes.

- Market Access: MT4 was designed for forex and CFDs. MT5 is a multi-asset platform built to also handle stocks and futures on centralized exchanges.

- Programming Language: MT4 uses MQL4, while MT5 uses MQL5. They are not compatible, so EAs and indicators for MT4 won’t work on MT5.

- Analytical Tools: MT5 has more built-in indicators (38 vs. 30) and more timeframes (21 vs. 9).

- Order Types: MT5 supports more pending order types and has a Depth of Market (DOM) function.

For many forex traders who rely on the vast library of existing MT4 tools, the original platform’s simplicity is still preferred. This is why the search for the best forex broker for metatrader 4 continues to be relevant.

Selecting a Reliable Broker for MT4

The MT4 platform’s performance depends entirely on the broker providing it. A reliable broker for forex ensures the platform is connected to high-quality liquidity for accurate prices and fast execution. They also maintain their servers to guarantee uptime and provide knowledgeable support. Choosing the best mt4 forex broker is what turns the standard MT4 software into an effective and powerful trading tool.

Comparison Table – Best MT4 Brokers

This table summarizes the key features of the top-rated forex brokers with mt4 platform reviewed in this article. This comparison helps you quickly identify which online forex broker best fits your trading needs, whether you prioritize low costs, strong regulation, or specific features.

| Broker Name | Country of Registration | Regulation | Minimum Deposit | Spread (EUR/USD) | Leverage | Key Feature |

| Opofinance | Australia | ASIC | $100 | From 0.0 pips | Up to 1:2000 | AI Tools & Prop Trading |

| IC Markets | Australia | ASIC, CySEC | $200 | From 0.0 pips | Up to 1:500 | True ECN Environment |

| Pepperstone | Australia | FCA, ASIC, CySEC | $200 | From 0.0 pips | Up to 1:500 | Fast Execution Speed |

| XM | Cyprus | CySEC, ASIC | $5 | From 0.6 pips | Up to 1:1000 | Excellent for Beginners |

| Exness | Cyprus | FCA, CySEC | $10 | From 0.3 pips | Up to 1:Unlimited | Instant Withdrawals |

| FXTM | Cyprus | FCA, CySEC | $10 | From 0.1 pips | Up to 1:2000 | Localized Payment Methods |

| AvaTrade | Ireland | CBI, ASIC | $100 | From 0.9 pips | Up to 1:400 | Strong Copy Trading Support |

| RoboForex | Belize | IFSC | $10 | From 0.0 pips | Up to 1:2000 | Free VPS for Automated Trading |

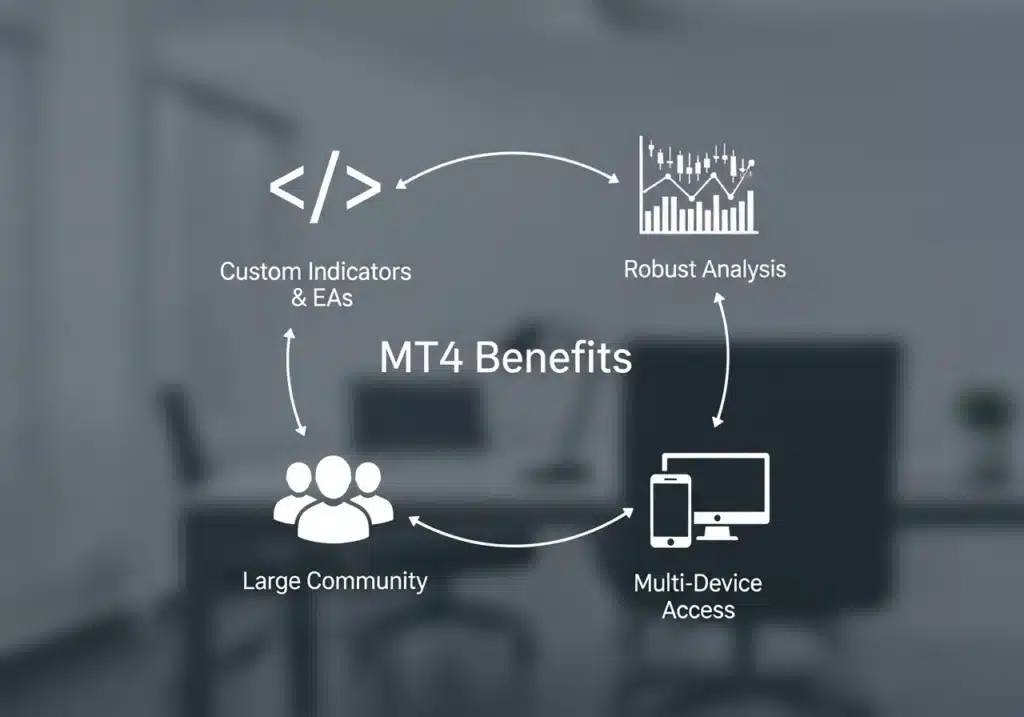

Benefits of Using MT4 for Forex Trading

MetaTrader 4’s continued dominance is due to a feature-rich environment that gives traders flexibility, control, and powerful analytical tools. These advantages are why so many traders search for the best forex brokers for mt4. The platform’s design allows for a highly customized trading experience, suitable for strategies from simple manual trading to complex automated algorithms. Here are some of the main benefits that make MT4 a top choice.

Support for Custom Indicators

While MT4 has 30 built-in technical indicators, its true strength is its open architecture. The MQL4 language lets traders and developers create their own custom indicators. This has resulted in a huge online library with thousands of free and paid indicators available. This level of customization is a major advantage over many proprietary forex trading platforms and allows traders to tailor their analysis to their specific strategies.

Ability to Run Expert Advisors (EAs)

This is MT4’s most defining feature. Expert Advisors (EAs) are programs that automate trading on the MT4 platform. They can be programmed to execute trades when certain technical conditions are met, manage open positions, and close trades without manual intervention. This allows for a hands-off approach to trading, removing emotion from decisions and enabling strategies to run 24/7. Choosing the best mt4 forex broker with fast execution is essential for the success of any EA.

Mobile and Desktop Versions for Fast Trading

MT4 provides a seamless experience across devices. The desktop terminal offers the most powerful environment for analysis and automated trading. The MT4 mobile apps for iOS and Android are also highly functional, with interactive charts and a full set of trading orders. This allows traders to manage their positions from anywhere, ensuring they never miss a market opportunity.

Detailed Charts and Robust Analysis Tools

MT4’s charting package is powerful and user-friendly. Traders can view multiple charts, customize their appearance, and apply numerous indicators and graphical objects. The ability to save chart templates allows for quick and efficient analysis across different instruments. When combined with a broker for forex that provides reliable data feeds, MT4’s charting tools become an essential part of any technical trader’s toolkit.

Tips Before Opening an MT4 Trading Account

Before committing real money, it’s smart to take a few preparatory steps to ensure you choose the right broker for forex trading and are comfortable with the MT4 platform. This initial testing phase can help you avoid costly mistakes. Rushing into a live account without doing your homework is a common error. Here are some practical tips to follow before you start trading with real money.

Testing with a Demo Account

Nearly all of the best forex brokers for mt4 offer a free demo account, which is an invaluable tool. A demo account lets you trade with virtual money in a simulated live market. Use this opportunity to get comfortable with the MT4 interface, practice placing orders, and test your trading strategy without any risk. I recommend spending at least a few weeks on a demo account to build confidence and refine your approach.

Execution Speed Testing

While using a demo account, pay attention to the broker’s execution speed, especially during volatile market conditions like a major news release. Although demo execution isn’t always identical to live execution, it can give you a good idea of the broker’s server performance. This test can help you evaluate the technical infrastructure provided by your chosen mt4 forex broker.

Risk Management with Smaller Accounts

When you move to a live account, start with a small amount of capital you are prepared to lose. This minimizes financial risk while you experience the psychological pressures of real trading. Many of the best mt4 brokers for beginners offer Micro accounts, which are perfect for this. They allow you to trade with very small position sizes, helping you practice proper risk management techniques.

Utilizing a VPS for Continuous Trading

If you plan to use an Expert Advisor (EA) for automated trading, a Virtual Private Server (VPS) is highly recommended. A VPS is a remote server that runs 24/7. By installing your MT4 platform on a VPS, you can ensure your EAs are always running, even if your computer is off. Many top forex brokers with the mt4 platform offer free or discounted VPS services to clients who meet certain criteria.

Common Mistakes When Choosing an MT4 Broker

Many traders, especially beginners, make predictable mistakes when selecting a broker. These errors can lead to higher costs, poor performance, and even the loss of capital. Being aware of these common pitfalls is the first step to avoiding them. A methodical decision is always better than one based on flashy marketing. Here are the most common mistakes traders make when choosing an mt4 forex broker.

Choosing a Broker Without Verifying Regulation

This is the biggest mistake a trader can make. Unregulated brokers operate without oversight, exposing you to significant risks, including fraud and difficulty withdrawing funds. Always prioritize regulated mt4 forex brokers licensed by top-tier agencies like the FCA, ASIC, or CySEC. This is the most important check you can make.

Focusing Only on Bonuses While Ignoring Spreads

Welcome bonuses can be tempting, but they should never be the main reason for choosing a broker. Often, brokers offering large bonuses make up for it with wider spreads or hidden fees. High trading costs will quickly eat away at any bonus. Long-term profitability depends on a broker’s core trading conditions, so always analyze the total costs to find genuinely low-cost mt4 brokers with low spreads.

Overlooking Order Execution Speed and Requotes

Execution quality is often underestimated by new traders. A broker with slow execution can cause significant slippage, meaning your trades are filled at a worse price than you expected. Requotes, where the broker offers a new price, can also be a major problem in fast-moving markets. The best forex brokers for mt4 are known for fast, reliable execution with minimal slippage and no requotes.

Experience Superior Trading with Opofinance

Opofinance, a reputable ASIC regulated broker, offers a premium trading environment designed for modern traders. Benefit from a suite of advanced trading platforms and tools that cater to every strategy and skill level.

- Advanced Trading Platforms: Choose from industry-leading platforms including MT4, MT5, cTrader, and the proprietary OpoTrade app.

- Innovative AI Tools: Leverage the power of AI with our Market Analyzer, AI Coach, and instant AI Support to enhance your trading decisions.

- Social & Prop Trading: Engage with the trading community through our Social Trading features or take on the challenge with our Prop Trading program.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Take your trading to the next level with cutting-edge technology and a secure, regulated environment.

Conclusion

Selecting the best forex brokers for mt4 is a critical step for any trader. The right broker offers more than just the MetaTrader 4 platform; they provide a secure, low-cost, and high-performance trading environment. By focusing on regulation, analyzing costs and execution speed, and choosing an account that fits your strategy, you can create a solid foundation for your trading journey. The brokers reviewed here are excellent options for anyone looking for a reliable mt4 forex broker in 2025.

FAQ

Which is the best MT4 forex broker in 2025?

The “best” broker depends on your trading style. For ECN conditions, IC Markets is a top contender. For beginners, XM provides excellent educational support. For fast execution, Pepperstone is highly recommended.

Are all MT4 brokers regulated?

No, not all brokers offering MT4 are regulated. It is extremely important to choose a broker regulated by a reputable authority like the FCA, ASIC, or CySEC to ensure your funds are safe.

What is the difference between MT4 and MT5 brokers?

The main difference is the platform itself. MT5 is a multi-asset platform designed for trading stocks and futures in addition to forex, while MT4 is primarily focused on forex. MT5 also offers more built-in indicators and analytical tools.

How can I test a broker’s MT4 platform before depositing real money?

The best method is to open a free demo account. This allows you to test the platform’s features, charting tools, and order execution speed using virtual funds in a risk-free environment.

Can I use one MT4 account with different brokers?

No, an MT4 account is specific to the broker you opened it with. You cannot use the login credentials from one broker to access the MT4 platform of another.