Are you looking to elevate your gold trading strategy and pinpoint those crucial profitable entry and exit points? The Moving Average Convergence Divergence (MACD) indicator is a fundamental tool for any trader, but identifying the best MACD settings for gold can be the key to unlocking its full potential within your macd gold strategy. This article provides an in-depth exploration of optimizing your MACD specifically for the unique dynamics of the gold market, empowering you to make more informed decisions and potentially amplify your returns with a robust macd gold strategy.

We’ll examine various MACD settings for gold, discuss their advantages and disadvantages in the context of a macd gold strategy, and equip you with the knowledge to tailor your approach for both short-term and long-term gold trading as part of your macd gold strategy. If you’re seeking a competitive edge in the gold market and want to harness the power of technical analysis within your macd gold strategy, understanding and implementing the right MACD settings for gold is paramount. For those seeking a reliable platform to execute their macd gold strategy, exploring options with a regulated forex broker can be a crucial step.

Understanding MACD for Gold

Gold, often considered a safe-haven asset, displays distinct price movements influenced by a complex array of factors, from global economic shifts to geopolitical uncertainties. Effectively navigating these fluctuations requires robust analytical tools, and the MACD stands out as a versatile and widely used indicator in developing a sound macd gold strategy.

What’s the MACD?

The Moving Average Convergence Divergence (MACD) is a momentum indicator that follows trends and illustrates the relationship between two moving averages of an asset’s price. Developed by Gerald Appel, it assists traders in identifying potential buy and sell signals by highlighting shifts in the strength, direction, momentum, and duration of a trend, forming the basis of many macd gold strategy approaches. Essentially, it visually represents the convergence and divergence of these moving averages, offering insights into potential shifts in market sentiment, a key element in any macd gold strategy.

Why MACD for Gold Trading?

In the dynamic arena of gold trading, identifying trends early and accurately is crucial for a successful macd gold strategy. The MACD offers several key benefits for gold traders looking to implement a macd gold strategy:

- Identifying Gold Trends: It helps pinpoint the prevailing trend (uptrend or downtrend) in gold prices, a fundamental aspect of any macd gold strategy.

- Assessing Gold Momentum: It gauges the strength of the current trend, indicating whether it’s gaining or losing momentum, a vital consideration in a macd gold strategy.

- Spotting Potential Gold Reversals: Divergence between the MACD and price action can signal potential trend reversals in gold, a valuable signal within a macd gold strategy.

- Pinpointing Gold Entry/Exit Points: Crossovers of the MACD line and the signal line can provide potential entry and exit signals for gold trades, forming the core of many macd gold strategy implementations.

By understanding and effectively utilizing the MACD, gold traders can gain a significant advantage in interpreting market movements and making more informed gold trading decisions as part of their macd gold strategy.

Read More: MACD Indicator in Forex Trading

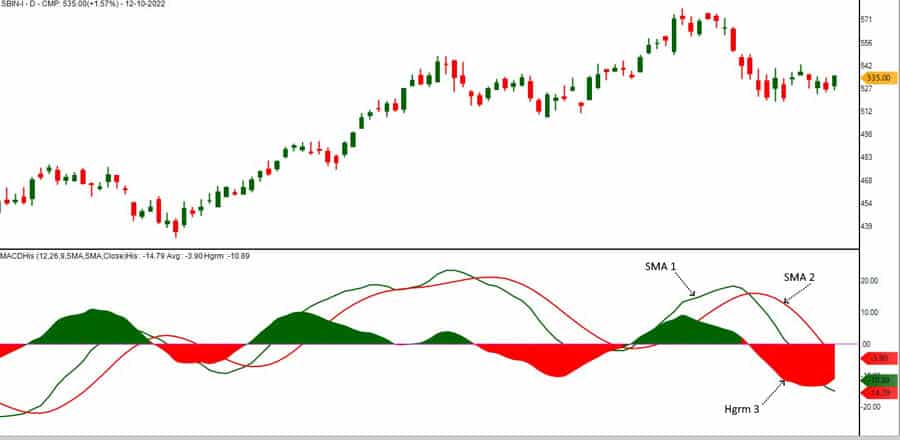

Decoding MACD Components in Gold

To effectively utilize the MACD for gold trading, a solid grasp of its core components is essential for building a reliable macd gold strategy. The indicator comprises three key elements: the MACD line, the signal line, and the histogram.

MACD Line, Signal Line, and Histogram

- MACD Line: This line is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. It represents the faster-moving average, reacting more swiftly to recent price changes in gold, a crucial element in a responsive macd gold strategy.

- Signal Line: This is a 9-period EMA of the MACD line. It acts as a smoother version of the MACD line and helps identify potential buy and sell signals when it crosses the MACD line in the context of gold, providing key triggers in a macd gold strategy.

- Histogram: The histogram visually represents the difference between the MACD line and the signal line. Positive values indicate the MACD line is above the signal line, suggesting bullish momentum in gold, while negative values indicate the MACD line is below the signal line, suggesting bearish momentum in gold. The height of the bars reflects the strength of the momentum, offering visual confirmation within a macd gold strategy.

How MACD Components Interact with Gold Prices

The interplay between these components provides valuable insights into gold price movements, forming the basis of interpreting signals within a macd gold strategy:

- Bullish Gold Signal: When the MACD line crosses above the signal line, it’s generally considered a bullish signal, suggesting a potential buying opportunity as upward momentum in gold is increasing, a key entry point in a macd gold strategy.

- Bearish Gold Signal: When the MACD line crosses below the signal line, it’s generally considered a bearish signal, suggesting a potential selling opportunity as downward momentum in gold is increasing, a potential exit point in a macd gold strategy.

- Strengthening Gold Momentum: Increasing height of the histogram bars (whether positive or negative) indicates strengthening momentum in the respective direction for gold, providing confirmation of trend strength in a macd gold strategy.

- Weakening Gold Momentum: Decreasing height of the histogram bars suggests weakening momentum, potentially signaling a trend reversal in gold, a warning sign to adjust a macd gold strategy.

- Gold Divergence: When the price of gold makes new highs (or lows) but the MACD fails to do so, it can signal a potential weakening of the current trend and a possible reversal in gold, a crucial divergence signal within a macd gold strategy. For instance, if the gold price makes a higher high, but the MACD makes a lower high, this is bearish divergence.

Understanding these interactions allows traders to interpret the signals generated by the MACD and make more informed decisions about their gold trades as part of their overall macd gold strategy.

Read More: what is xauusd in forex

Limitations of Default MACD for Gold

The standard MACD settings, often referred to as the “default” settings, are 12, 26, and 9. These numbers represent the periods used for calculating the EMAs for the MACD line and the signal line. While these settings are widely used across various markets, they may not always be optimal for the specific nuances of gold trading and implementing a successful macd gold strategy.

Standard MACD Settings: 12, 26, 9

- 12-period EMA: This shorter-term EMA reacts quickly to recent price changes in gold, making it sensitive to short-term fluctuations within a macd gold strategy.

- 26-period EMA: This longer-term EMA is slower to react and provides a broader perspective on the gold trend, offering a longer-term context for a macd gold strategy.

- 9-period EMA (Signal Line): This smooths out the MACD line, helping to identify potential crossover signals in gold, providing potential entry and exit triggers for a macd gold strategy.

These default settings are designed to strike a balance between responsiveness and lag, aiming to capture a wide range of trading opportunities, but may not be perfectly suited for every macd gold strategy.

Why Default Settings Might Not Fit Your Gold Strategy

While the default settings can be a good starting point for a macd gold strategy, several factors suggest they might not be the best MACD settings for gold:

- Gold’s Volatility: Gold can experience periods of high volatility and sudden price swings. The default settings might generate too many false signals during these periods, leading to whipsaws and losses in gold trading, potentially hindering a macd gold strategy.

- Unique Gold Price Action: Gold’s price movements are often influenced by macroeconomic factors and investor sentiment, which can lead to different trend durations and momentum characteristics compared to other assets. This necessitates tailored MACD settings for gold to optimize a macd gold strategy.

- Lagging Gold Signals: In fast-moving gold markets, the default settings might produce lagging signals, causing traders to miss early entry or exit points, potentially reducing the effectiveness of a macd gold strategy.

- False Gold Crossovers: The default settings can be prone to generating false crossover signals in gold, especially in choppy or sideways markets, leading to premature entries or exits, which can be detrimental to a macd gold strategy.

Therefore, optimizing the MACD settings for gold specifically can significantly improve the accuracy and reliability of the signals generated, leading to a more robust and profitable macd gold strategy.

Read More: best ema settings for gold

Finding Your Best MACD Settings for Gold

Finding the best MACD settings for gold involves considering your trading style, time horizon, and the prevailing market conditions when developing your macd gold strategy. There’s no one-size-fits-all answer, but certain adjustments can significantly enhance the indicator’s performance for gold and refine your macd gold strategy.

Short-Term Gold MACD Settings

For short-term traders, such as day traders or scalpers, who aim to capitalize on smaller price fluctuations in gold as part of their macd gold strategy, more responsive settings are generally preferred. These settings react quickly to price changes, providing timely entry and exit signals for gold trades within a short-term macd gold strategy.

- Faster MACD Settings for Gold (e.g., 8, 17, 9): Reducing the periods for the MACD line (8 and 17) makes it more sensitive to short-term price movements in gold, allowing for quicker identification of opportunities within a macd gold strategy. The signal line (9) can remain the same or be slightly adjusted. This can help capture quick momentum shifts in gold, a key element of a short-term macd gold strategy.

- Considerations for Short-Term Gold Trading: While these settings offer faster signals, they can also generate more false signals, especially in volatile conditions. It’s crucial to combine these MACD settings for gold with other confirmation tools and robust risk management when implementing a short-term macd gold strategy.

Long-Term Gold MACD Settings

Long-term investors and swing traders, who focus on capturing larger trends in gold over weeks or months as part of their macd gold strategy, benefit from settings that filter out short-term noise and provide a clearer picture of the overall gold trend.

- Slower MACD Settings for Gold (e.g., 15, 35, 5): Increasing the periods for the MACD line (15 and 35) makes it less sensitive to short-term fluctuations in gold, focusing on the broader trend, a crucial aspect of a long-term macd gold strategy. A shorter signal line (5) can help identify potential entry points within the larger gold trend, allowing for strategic entries in a long-term macd gold strategy.

- Considerations for Long-Term Gold Trading: These settings will generate fewer signals, but they are likely to be more reliable for identifying significant trend changes in gold, a core principle of a long-term macd gold strategy. Patience is key when using these MACD settings for gold as part of a long-term macd gold strategy.

Customizing Your Gold MACD Strategy

Customizing your MACD settings for gold involves experimentation and understanding the characteristics of the gold market to optimize your macd gold strategy. Here’s a step-by-step approach:

- Define Your Gold Trading Style and Timeframe: Are you a short-term or long-term gold trader? This will guide your initial adjustments to your MACD settings for gold and the development of your macd gold strategy.

- Analyze Historical Gold Price Data: Look at past gold price charts and observe how different MACD settings for gold would have performed during various market conditions (trending, ranging, volatile) to inform your macd gold strategy.

- Experiment with Different Gold MACD Settings: Start with slight variations from the default settings and gradually adjust them. For example, try reducing the periods for short-term gold trading or increasing them for long-term gold trading within your macd gold strategy.

- Backtest Your Gold MACD Settings: Use historical data to test the profitability and reliability of your chosen MACD settings for gold. This will help you identify settings that have historically performed well for gold and refine your macd gold strategy.

- Forward Test Your Gold MACD Settings: Once you have identified promising MACD settings for gold through backtesting, test them in a live trading environment with a small amount of capital or on a demo account to validate your macd gold strategy.

- Continuously Monitor and Adjust Your Gold MACD Settings: The gold market is dynamic, so your optimal MACD settings for gold might need adjustments over time. Regularly review your settings and adapt them to changing market conditions to maintain the effectiveness of your macd gold strategy.

Pro Tip: Consider using different MACD settings for gold on multiple timeframes to gain a more comprehensive view of the market and inform your macd gold strategy. For example, you might use faster settings on a 15-minute chart for intraday gold trading and slower settings on a daily chart for identifying the overall gold trend within your macd gold strategy.

Testing and Optimizing Your Gold MACD Strategy

Simply choosing a set of MACD parameters isn’t enough. Rigorous testing and optimization are crucial to ensure your MACD settings for gold are effective and your macd gold strategy is sound.

Backtesting for Optimal Gold MACD Settings

Backtesting involves applying your chosen MACD settings for gold to historical gold price data to simulate how they would have performed in the past, allowing you to evaluate the effectiveness of your macd gold strategy. This process helps you:

- Evaluate Gold Profitability: Determine if the signals generated by your MACD settings for gold would have led to profitable trades, a key metric for assessing your macd gold strategy.

- Assess Gold Reliability: Identify the frequency of winning and losing signals generated by your MACD settings for gold, providing insights into the consistency of your macd gold strategy.

- Optimize Gold MACD Parameters: Fine-tune the MACD periods to maximize profitability and minimize false signals in gold trading, a crucial step in refining your macd gold strategy.

Several trading platforms offer backtesting tools that allow you to automate this process. When backtesting, consider different market conditions (bullish, bearish, sideways) to ensure your MACD settings for gold are robust and your macd gold strategy is adaptable.

Adjusting Gold MACD Settings for Market Conditions

The gold market is not static. Volatility, trend strength, and market sentiment can change over time. Therefore, it’s crucial to understand that the best MACD settings for gold might not be fixed, and your macd gold strategy may need adjustments.

- Adjusting Gold MACD for Increased Volatility: During periods of high volatility in gold, you might consider using slightly slower settings to filter out noise and reduce false signals, adapting your macd gold strategy to the market conditions.

- Adjusting Gold MACD for Strong Trends: In strong trending gold markets, faster settings might help you capture early entry points, allowing you to capitalize on momentum within your macd gold strategy.

- Adjusting Gold MACD for Sideways Markets: MACD can be less effective in sideways gold markets. Consider using it in conjunction with other indicators or adjusting the settings to be less sensitive, modifying your macd gold strategy accordingly.

Regularly analyzing market conditions and being prepared to adjust your MACD settings for gold accordingly is a sign of a disciplined and adaptable trader with a flexible macd gold strategy.

Opofinance Services

Looking for a reliable and regulated broker to trade gold and implement your MACD strategies? Opofinance, an ASIC-regulated broker officially featured on the MT5 brokers list, offers a robust platform for trading various financial instruments, including gold.

- ASIC Regulation: Trade with confidence knowing Opofinance is regulated by the Australian Securities and Investments Commission (ASIC), a reputable regulatory body.

- MT5 Platform: Access the powerful MetaTrader 5 (MT5) platform, equipped with advanced charting tools and technical indicators, including the MACD.

- Safe and Convenient Deposits and Withdrawals: Enjoy a seamless trading experience with secure and efficient deposit and withdrawal methods.

- Social Trading: Leverage the wisdom of the crowd with Opofinance’s social trading features, allowing you to follow and copy the trades of experienced traders.

Ready to elevate your gold trading? Start trading gold with Opofinance today!

Conclusion

Mastering the MACD indicator and finding the best MACD settings for gold is an ongoing process of learning, testing, and adaptation to refine your macd gold strategy. While there’s no magic formula, understanding the components of the MACD, experimenting with different MACD settings for gold, and combining it with other analysis techniques can significantly enhance your ability to identify profitable trading opportunities in the gold market and execute a successful macd gold strategy.

Remember to tailor your approach to your individual gold trading style and the prevailing market conditions. By diligently applying the principles discussed in this article, you can unlock the power of the MACD and potentially achieve greater success in your gold trading endeavors with a well-defined macd gold strategy.

Key Takeaways for Your MACD Gold Strategy

- The MACD is a valuable momentum indicator for gold trading, helping identify trends and potential reversals, forming the foundation of a macd gold strategy.

- Default MACD settings (12, 26, 9) may not be optimal for the specific characteristics of gold, requiring adjustments for an effective macd gold strategy.

- Short-term gold traders may benefit from faster MACD settings, while long-term traders might prefer slower settings, tailoring the indicator to their macd gold strategy.

- Backtesting and forward testing are crucial for optimizing your MACD settings for gold and validating your macd gold strategy.

- Combining the MACD with other technical indicators can improve the accuracy of your gold trading signals, strengthening your macd gold strategy.

- Avoid common mistakes like ignoring the overall gold trend and over-reliance on crossovers to ensure the effectiveness of your macd gold strategy.

Can I use the same MACD settings for gold as I use for stocks?

While the fundamental principles of MACD remain the same, the optimal MACD settings for gold can differ due to the unique volatility and price action characteristics of gold compared to stocks, necessitating specific optimization for a macd gold strategy. It’s generally recommended to optimize your MACD settings specifically for the gold market through testing and analysis to build an effective macd gold strategy.

How often should I adjust my MACD settings for gold?

There’s no fixed timeframe, but regularly reviewing your MACD settings for gold is advisable, especially when market conditions change significantly, to ensure your macd gold strategy remains aligned with market dynamics. Periods of increased volatility or shifts in trend strength might warrant adjustments to your MACD parameters to maintain their effectiveness in gold trading and the profitability of your macd gold strategy.

Is it possible to have different “best” MACD settings for gold depending on the trading platform I use?

The calculation of the MACD itself is standardized across most trading platforms. However, the visual presentation and the availability of backtesting tools might vary. The core principles of finding optimal MACD settings for gold and developing a sound macd gold strategy remain consistent regardless of the platform.