Hey there, fellow trader. If you’re here, chances are you’ve dived into the world of Smart Money Concepts (SMC) and realized one thing: finding those perfect Order Blocks and Fair Value Gaps can feel like a full-time job. The search for the best order block and fvg indicator isn’t just about pretty boxes on a chart; it’s a quest for clarity, efficiency, and a real edge. Let’s be honest, the market is packed with tools all claiming to be the one, which can be overwhelming.

This guide is different. Think of me as a trading buddy who has spent countless hours testing these tools. We’re going to cut through the noise together. This is a complete buyer’s guide—we’ll break down what really matters in an indicator, do a head-to-head comparison of the top players, and then build a solid, actionable strategy around your chosen tool. By the end, you won’t just know which indicator is good; you’ll know which one is the perfect fit for you and your approach with your trusted regulated forex broker.

Key Takeaways

- Think Like an Investor: Your goal isn’t to find a magic indicator, but to choose the best tool for your personal trading style, budget, and platform. This is a strategic investment in your process.

- We’ll Compare the Best: To help you choose, we’ll dive deep into five top-tier indicators, including premium options like Lux Algo and community favorites like SMC by LudoGH68, comparing them feature by feature.

- Strategy is Your Foundation: Remember, the best order block and fvg indicator is a high-performance assistant. It doesn’t replace a solid trading plan built on market structure, liquidity, and disciplined risk management.

- Confirmation is Your Shield: This is a golden rule. Never, ever enter a trade just because price hits a zone. We’ll show you how to wait for that critical price action confirmation that protects your capital.

- No Repainting, Ever: Any indicator that redraws its past signals is fundamentally broken and untrustworthy. All the tools we review are non-repainting.

The Search for the Best Indicator

The core idea of SMC is beautifully simple: follow the “smart money.” We look for their footprints—those explosive moves that leave behind clues like Order Blocks (OBs) and Fair Value Gaps (FVGs). Manually identifying these, especially when you’re scanning multiple pairs and timeframes, is a recipe for eye strain and, worse, inconsistency. This is where a great indicator becomes indispensable.

A Quick, Practical Refresher: OBs and FVGs

- Order Block (OB): In simple terms, it’s the last opposing candle before a powerful, structure-breaking impulse. It’s the launchpad. When price returns here, we anticipate a reaction.

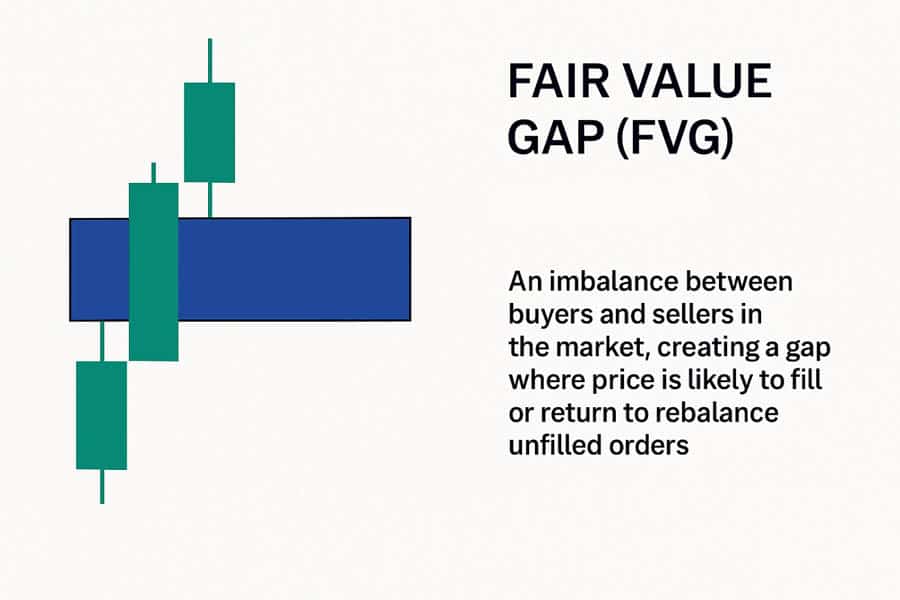

- Fair Value Gap (FVG): Think of this as a vacuum or an imbalance. It’s a three-candle pattern where price shot up or down so fast it left a gap in the market. Price is often drawn back into these gaps to “rebalance” before continuing its journey.

The Real Goal: Automating for Peak Efficiency

The true purpose of using an indicator is to outsource the heavy lifting. Its job is to apply a consistent set of rules to find these zones 100% of the time, so you don’t have to. This frees up your most valuable asset: your mental energy. Instead of hunting for setups, you can focus on qualifying them. Is this FVG in a premium or discount market? Is this OB likely to be swept for liquidity? This is where the real money is made, and a good indicator gets you there faster.

The Ultimate Checklist: How to Judge Any Indicator

Before we get to the contenders, let’s establish our evaluation criteria. This is the checklist I personally use, and it will empower you to judge any tool you find, making this knowledge evergreen.

Accuracy and Visual Clarity

Does the indicator draw zones precisely where they should be? More importantly, is the chart still readable? Your chart should be a clean workspace, not a chaotic mess. The best order block and fvg indicator presents information in a way that helps, not hinders, your decision-making.

Customization and Control

You need to be able to tweak the indicator to fit your specific strategy. Can you adjust the sensitivity for detecting structure breaks? Can you change colors to differentiate between bullish and bearish zones, or mitigated and unmitigated ones? Control is key.

Performance (The Non-Negotiable No-Repainting Rule)

This is simple: if an indicator repaints—meaning its past signals change or disappear—it’s useless. It’s a deal-breaker. All the indicators we’ll discuss pass this test. Additionally, a well-coded indicator shouldn’t slow down your trading platform.

Depth of Features

Does it just draw boxes, or does it offer a full suite of SMC tools? Look for things like automated Break of Structure (BOS) and Change of Character (CHoCH) labeling, liquidity markings (equal highs/lows), and premium/discount zone overlays. An all-in-one tool can be a massive time-saver.

Read More: Best Smart Money Indicator

The Contenders: 5 Top Order Block and FVG Indicators

Alright, let’s get to the main event. I’ve put these five through their paces. Here’s the honest breakdown of each one.

1. Lux Algo Premium

Platform: TradingView

How to Access: Premium Subscription

To get this indicator, you need to purchase a subscription directly from the Lux Algo website. After your purchase, they grant your TradingView username access to their exclusive, invite-only indicators.

The Lowdown: Let’s start with the heavyweight champion of premium indicators. Lux Algo has built a reputation for creating institutional-grade tools, and their SMC package is their crown jewel. It’s a comprehensive, all-in-one suite designed to be the only SMC indicator you’ll ever need.

Why It Makes the List: It’s flawless in its execution. The visualization is incredibly clean, the logic is non-repainting, and the customization is second to none. Features like predictive ranges and an institutional activity tracker go beyond simple OB/FVG plotting. The active development and professional support mean you’re investing in a tool that constantly evolves.

Things to Consider: It’s a premium tool with a recurring subscription cost. For a beginner, the sheer number of features can be overwhelming at first and requires some configuration to simplify the chart.

Best For: The serious, committed trader who sees their tools as a crucial business investment and wants the most powerful, fully-supported option on the market.

2. SMC Structures and FVG by LudoGH68

Platform: TradingView

How to Access: Free

This is a community script. Simply open the “Indicators” tab on TradingView, search for ” SMC Structures and FVG,” and add it to your chart. Ensure you’re selecting the one with a high number of likes/users to get the most trusted version.

The Lowdown: This indicator is a legend in the TradingView community for a reason. It’s the embodiment of the “less is more” philosophy. It focuses on doing one job—plotting clean, accurate Order Blocks and Fair Value Gaps—and it does that job perfectly.

Why It Makes the List: It’s the gold standard for free, minimalist indicators. It’s incredibly lightweight, meaning it won’t slow down your chart, and its simplicity is its greatest strength. It gives you exactly what you need with zero clutter, allowing price action to be the star of the show. It proves that the best order block and fvg indicator doesn’t need to cost a penny.

Things to Consider: It’s not an all-in-one solution. You won’t get features like advanced liquidity plotting or session ranges. You’re getting a specialized tool, not a full suite.

Best For: Traders of all levels who value a clean chart and want a reliable, no-nonsense tool for identifying core SMC zones.

3. SMC Hybrid by Captain_Trading_LAB

Platform: TradingView

How to Access: Free

Just like LudoGH68’s indicator, this is a free community script. Go to the “Indicators” library on TradingView and search for “ SMC Hybrid.” Add the most popular version to your chart.

The Lowdown: If you are a dedicated student of The Inner Circle Trader (ICT) methodology, this is your holy grail. It’s not just an OB/FVG indicator; it’s designed to plot the entire, nuanced vocabulary of ICT concepts directly onto your chart.

Why It Makes the List: Its fidelity to the source material is unmatched. It accurately identifies not just OBs and FVGs, but also Breaker Blocks, Mitigation Blocks, Liquidity Voids, and Silver Bullets. It allows a true ICT practitioner to see the market exactly as their methodology dictates, with incredible precision.

Things to Consider: This indicator is not for the uninitiated. If you aren’t familiar with ICT’s terminology, your chart will become an intimidating and confusing mess of acronyms. It has a steep learning curve.

Best For: The ICT purist. Full stop. If you trade with this specific methodology, this is the tool for you.

4. Smart Money Concepts Probability (SMC) by Zeiierman

Platform: TradingView

How to Access: Free

Another fantastic free community script. Search for “Smart Money Concepts (SMC) by Zeiierman” in the TradingView Indicators library and add it. It has gained massive popularity for its quality.

The Lowdown: This indicator has become a major contender in the free space, offering a feature set that rivals some premium tools. It strikes a fantastic balance between providing comprehensive information and maintaining visual clarity.

Why It Makes the List: It’s an incredible value proposition. It cleanly plots OBs, FVGs, and structure breaks, but also includes excellent visualization for premium/discount zones and session ranges. The on-chart labels are intuitive, making it easier to understand the market narrative at a glance. It’s a perfect “one-up” from a more basic indicator like LudoGH68’s without being overwhelming.

Things to Consider: Because it has more features, you’ll want to spend a few minutes in the settings to customize it and turn off anything you don’t personally use to keep your chart clean.

Best For: The trader who wants a comprehensive, all-in-one experience without the premium price tag. It’s arguably the best free “all-rounder” available right now.

5. Advanced Order Blocks

Platform: MetaTrader 5 (MT5)

How to Access: Paid (Purchase or Rent)

This type of indicator is found on the official MQL5 Marketplace. From your MT5 terminal, open the “Market” tab, search for “Advanced Order Blocks” or “SMC,” and you will find several highly-rated, non-repainting options from reputable developers. You can usually buy it outright or rent it monthly.

The Lowdown: We had to include a top-tier option for the millions of traders on MetaTrader. While TradingView has more community options, the MQL5 marketplace has excellent, professional-grade tools if you know where to look. “Advanced Order Blocks” is representative of the best-in-class, fully-featured SMC indicators for MT5.

Why It Makes the List: It brings much-needed SMC functionality to the MT5 platform. These indicators are coded to be non-repainting and often include crucial features like multi-timeframe dashboards and push notification alerts directly to your phone—a huge advantage of the MetaTrader ecosystem.

Things to Consider: The best ones are not free. You are paying for reliability and features within the MT5 environment. The user interface for settings might be less graphical than on TradingView, but it is just as powerful.

Best For: The serious trader who is dedicated to the MT5 platform and needs a professional, reliable SMC tool with mobile alert capabilities.

Read More: Fair value gap

Comparison Table: OB & FVG Indicators Head-to-Head

I know what you’re looking for when you search for the “best” anything—you want to see how they stack up side-by-side. So, here it is. This table cuts to the chase to help you decide which is the best order block and fvg indicator for you.

| Indicator | Primary Platform | Key Features | Pricing Model | Best For | Our Rating |

| Lux Algo Premium | TradingView | All-in-one suite, HTF zones, advanced alerts, pro visuals, active support | Subscription | The serious trader wanting a complete, supported solution | 4.8 / 5 |

| SMC Structures and FVG by LudoGH68 | TradingView | Full ICT concept plotting (breakers, voids), high precision | Free (mostly) | The dedicated ICT student and purist | 4.5 / 5 |

| SMC Hybrid by Captain_Trading_LAB | TradingView | Clean OB/FVG plotting, lightweight, simple, non-repainting | Free | The minimalist trader who values performance and clarity | 4.3 / 5 |

| Smart Money Concepts Probability (SMC) by Zeiierman | TradingView | Excellent visuals, premium/discount zones, dashboards | Free (mostly) | The visual trader wanting rich features without the cost | 4.4 / 5 |

| Smart Money Concepts – The Dux | TradingView | Advanced liquidity plotting, inducement, sessions | Subscription | The liquidity-focused advanced trader | 4.6 / 5 |

A Practical Trading Strategy using OB & FVG Indicators

Okay, you’ve picked your tool. Now, let’s build the engine. An indicator is useless without a repeatable process. Here’s a simple but robust framework to integrate your new tool.

Step 1: Define the Higher Timeframe (HTF) Narrative

Before anything else, zoom out. Look at the Daily and H4 charts. What is the big picture? Is the market making higher highs and higher lows (bullish), or lower lows and lower highs (bearish)? This is your guiding light. You want to be trading with this current, not against it.

Step 2: Identify the POI with Your Indicator

After you see a clear Break of Structure (BOS) in the direction of your trend, let your indicator do its work. It will automatically highlight the Order Block or FVG that launched that move. This becomes your Point of Interest (POI). I always prioritize fresh, unmitigated zones that led to a very strong, obvious break.

Step 3: Wait for Lower Timeframe (LTF) Confirmation (The Money Step)

This is the step that separates pros from amateurs. I cannot stress this enough: do not just place a limit order at the POI. That is gambling. When price enters your H4 POI, drop down to the M15 or M5. Watch the price action. You’re waiting for the LTF trend to align with your HTF idea. For a bullish setup, you want to see the LTF shift from making lower lows to breaking a recent lower high. This is your confirmation CHoCH, your green light that buyers are stepping in.

Step 4: Execute with Precision (Entry, Stop, Target)

Once you get your confirmation, it’s time to act.

- Entry: Enter on the candle that confirms the LTF shift.

- Stop-Loss: Place it logically. For a long, it goes just below the low of the HTF Order Block. This is your defined risk. Don’t guess.

- Target: Where is the price likely headed? Aim for a clear, opposing liquidity pool, like a major HTF swing high. Always ensure your potential reward is at least twice your risk (1:2 R:R or better).

Read More: Identify Order Blocks in Forex

Common Mistakes in using OB & FVG Indicators

Having the best order block and fvg indicator on your charts is exciting, but it also opens the door to a new set of potential mistakes. Trust me, I’ve made some of these myself and I’ve seen countless traders fall into these traps. Being aware of them is half the battle.

Mistake #1: Blindly Trusting the Zones

This is the most common pitfall by a long shot. A trader gets their new indicator, sees a freshly printed Order Block, and immediately places a limit order with their stop loss below it, then walks away. This is not a strategy; it’s gambling. The indicator’s zone is an area of interest, not a guaranteed reversal point. It’s screaming, “Hey, pay attention here!” not “Hey, risk your money now!”

How to Avoid It: Never forget the golden rule we discussed: always wait for lower timeframe confirmation. The zone is where you start watching; the confirmation is your signal to act.

Mistake #2: Ignoring the Higher Timeframe Narrative

You find a picture-perfect M15 bullish Order Block. It’s clean, unmitigated, and created an FVG. You take the trade, and it gets run over like it wasn’t even there. You zoom out and see the Daily chart is in a brutal, free-falling downtrend. You were trying to catch a falling knife. A low-timeframe setup against the high-timeframe current is a low-probability trade, no matter how good it looks.

How to Avoid It: Start every single analysis on the Daily and H4 charts. The HTF trend is the boss. Your job is to trade in the same direction it’s going.

Mistake #3: Not Understanding the Zone’s Context

Not all Order Blocks are created equal. Some are high-probability reversal points, while others are merely “inducement”—traps set by smart money to entice retail traders into a trade so they can be used as liquidity. An indicator can’t tell the difference; it just sees a candle pattern.

How to Avoid It: Learn to ask “why” this zone exists. Did this Order Block cause a major break of structure? Or is it a weak-looking OB just before a much larger, more obvious liquidity pool? The zones that cause significant market shifts are the ones you want to focus on.

Mistake #4: Poor Risk Management on “Perfect” Setups

The indicator flags a setup that looks like it’s straight out of a textbook. You get a surge of adrenaline and think, “This is the one!” You double your usual position size or use a dangerously tight stop-loss, convinced it can’t fail. This emotional decision-making is a direct path to a blown account.

How to Avoid It: Your risk parameters should be mechanical and non-negotiable. Whether a setup looks “perfect” or just “good,” your risk per trade (e.g., 1% of your account) must remain consistent. The market doesn’t care how you feel about a setup.

Opofinance Services

To execute a sophisticated strategy like the one we’ve discussed, you need a brokerage partner that provides the necessary tools and a secure environment. Opofinance, regulated by ASIC, stands out as a top-tier choice for modern traders.

- Advanced Trading Platforms: Choose the platform that fits your style. Opofinance offers the industry-standard MT4 and MT5, the advanced cTrader for algorithmic traders, and their user-friendly proprietary platform, OpoTrade.

- Innovative AI Tools: Gain a competitive edge with cutting-edge technology. Utilize the AI Market Analyzer for deep insights, the AI Coach to refine your habits, and AI Support for instant assistance.

- Social & Prop Trading: Whether you want to follow experienced traders through social trading or prove your skills and get funded via proprietary trading, Opofinance provides pathways for growth.

- Secure & Flexible Transactions: Fund your account with confidence. Opofinance offers safe and convenient deposit and withdrawal methods, including crypto payments, all with zero transaction fees charged by the broker.

Explore Opofinance Services Today!

Conclusion

So, what’s the verdict on the best order block and fvg indicator? The real answer is… it depends on you. As we’ve seen, the “best” is subjective. It could be the feature-packed Lux Algo if you need an all-in-one powerhouse, or the beautifully simple SMC by LudoGH68 if you value a clean chart. The goal of this guide was to empower you to make that choice with confidence.

But remember, the indicator is just the start. It’s a tool for efficiency, not a crystal ball. Your true, lasting edge will always come from mastering your strategy, having the patience to wait for confirmation, managing your risk like a professional, and staying curious. Choose your tool, integrate it into the framework, and get to work. Happy trading.

Are order block indicators accurate?

Yes, in a technical sense. A quality indicator is extremely accurate at its defined job: identifying specific candle patterns on your chart that meet the rules for an OB or FVG. However, their predictive or “trading” accuracy is a different story. Not every zone will hold, which is why a trader’s strategy and confirmation are what determine profitability.

Do these indicators repaint?

No, a reputable tool will never repaint. All the contenders for the best order block and fvg indicator, including those reviewed here, have non-repainting logic. This means once a zone is drawn, it stays fixed in place. If you ever use an indicator that moves its past signals, stop using it immediately.

Can I find a good free order block and FVG indicator?

Absolutely! The trading community is generous. Indicators like SMC by LudoGH68, ICT Concepts by Sonarlab, and DGT Smart Money Concepts are available for free on TradingView and are powerful enough for full-time professional traders. Don’t assume that “free” means “bad.”

What’s the difference between an order block and a breaker block?

Think of it as a zone’s role-reversal. An order block is a supply/demand zone that is expected to hold. A breaker block is an order block that failed and was broken through. When price returns to this “broken” zone, it’s expected to act as resistance instead of support (or vice-versa). It’s a key concept in SMC.

Do these indicators work for crypto/forex/stocks?

Yes. The beauty of these concepts is that they are based on market structure and price delivery, which are universal. As long as an asset has good liquidity and is charted with candlesticks, these indicators will work just as well on Bitcoin or Tesla as they do on EUR/USD.