The single most crucial question for traders adopting Inner Circle Trader methodologies is: what are the best pairs to trade with ICT? Based on liquidity, volatility, and setup reliability, the top pairs are EUR/USD, GBP/USD, USD/JPY, and XAU/USD. These instruments consistently respect ICT concepts like Kill Zones and Fair Value Gaps, offering predictable price action. Finding the right online forex broker is the first step, but pairing their platform with the right currency is where strategy comes alive. This guide provides an experience-based deep dive into why these pairs excel, how to select the right one for your style, and which specific ICT setups work best for each.

| Pair | Session Strength | Liquidity | Best ICT Setups |

|---|---|---|---|

| EUR/USD | London/NY | Very High | Silver Bullet, OTE, FVG |

| GBP/USD | London/NY | High | Asian Range Break, OTE |

| USD/JPY | Tokyo/N.Y. | High | Reversal, Breakout, OB |

| XAU/USD | N.Y. | High | Liquidity Sweep, FVG |

| USD/CAD | N.Y./Commodities | Medium | NY Kill Zone, OTE |

| AUD/USD | Asia/London | Medium | FVG, Order Block |

Key Takeaways

- Focus on Majors: The best pairs to trade with ICT are overwhelmingly the major forex pairs like EUR/USD and GBP/USD due to their high liquidity, low spreads, and predictable behavior during key trading sessions.

- Session is Everything: ICT strategies are time-based. The London and New York Kill Zones are paramount for pairs like EUR/USD, GBP/USD, and XAU/USD. Trading these pairs outside their active sessions leads to poor results.

- Pair-Setup Synergy: Not all setups work equally on all pairs. The Silver Bullet is highly effective on EUR/USD and indices, while Asian Range sweeps are a classic GBP/USD play. Matching the setup to the pair’s personality is critical.

- Liquidity is King: ICT concepts rely on institutional order flow. High liquidity ensures that setups like Fair Value Gaps (FVG) and Order Blocks (OB) form cleanly and are more likely to be respected. This makes finding the best pairs for ICT trading a search for liquidity.

- Risk Management on Volatile Pairs: Pairs like XAU/USD (Gold) and GBP/USD offer explosive moves perfect for ICT, but their volatility requires meticulous risk management. While they are some of the best forex pairs for ICT, they are less forgiving.

Best Pairs to Trade with ICT

When you’re building a trading plan around the powerful concepts of ICT, your first and most impactful decision is your choice of instrument. The entire methodology is built on the predictable footprints left by “smart money” in the most liquid markets. This automatically narrows our focus. The consensus among seasoned ICT traders is clear: a select few pairs consistently deliver the high-probability setups we’re looking for. These are the workhorses of any ICT-focused portfolio.

- EUR/USD (The Standard): The most liquid pair globally, making it the top choice and one of the best pairs to trade with ICT. It provides clean, textbook setups, especially during the London and New York session overlap.

- GBP/USD (The Sprinter): Known for its volatility, “Cable” offers aggressive and clean moves, particularly during the London Kill Zone. It’s ideal for traders who have mastered Asian Range analysis.

- XAU/USD (Gold): A powerhouse during the New York session. Its tendency for sharp liquidity sweeps and large Fair Value Gaps makes it a favorite for experienced ICT traders, though it demands respect due to its volatility.

- USD/JPY (The Technician): This pair shines during the Tokyo and New York sessions. It’s known for respecting key daily and weekly levels, offering clear reversal and breakout patterns. Many traders consider it one of the best forex pairs for ICT due to its clean structure.

A Quick Guide to ICT Setups

Before diving into why certain pairs are superior for ICT, it’s essential to have a firm grasp of the core setups. These concepts are not just patterns; they are a lens through which to view market mechanics. Their effectiveness is directly tied to the liquidity and volatility of the instrument you trade. Understanding which are the best pairs to trade with ICT begins with understanding the tools themselves.

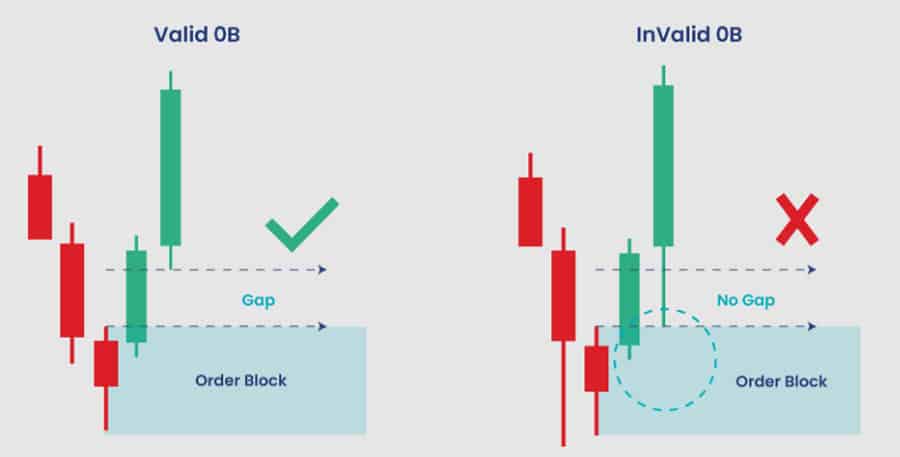

Order Blocks (OB)

An Order Block represents a specific price candle where large institutions likely placed significant orders. In a bullish scenario, it’s the last down candle before a strong move up. In a bearish scenario, it’s the last up candle before a sharp move down. These are institutional footprints indicating likely areas of reversal or strong continuation. Price will often return to these zones to mitigate those orders, providing a high-probability entry point.

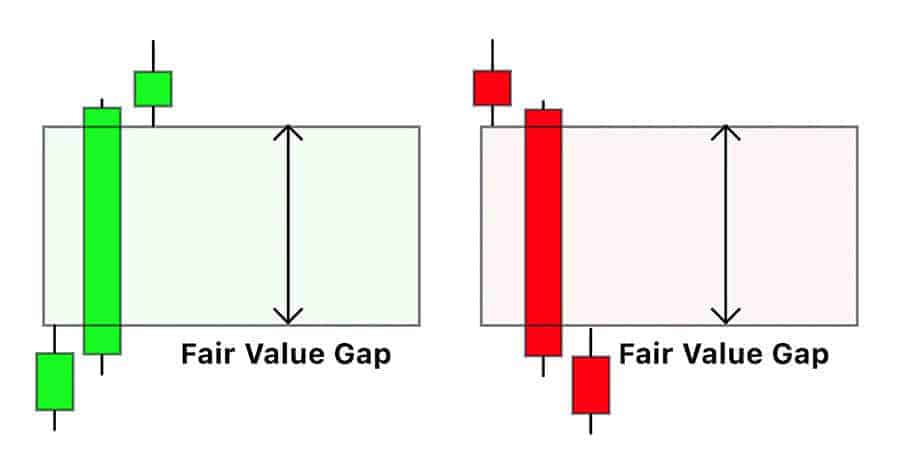

Fair Value Gaps (FVG)

Also known as a price imbalance, an FVG is a three-candle pattern where there is a gap between the first candle’s high and the third candle’s low (or vice versa). This signifies an inefficient, aggressive move that the market algorithm (as per ICT theory) will often seek to “rebalance.” Traders target these gaps for entries or as profit targets, expecting price to return and fill the inefficiency.

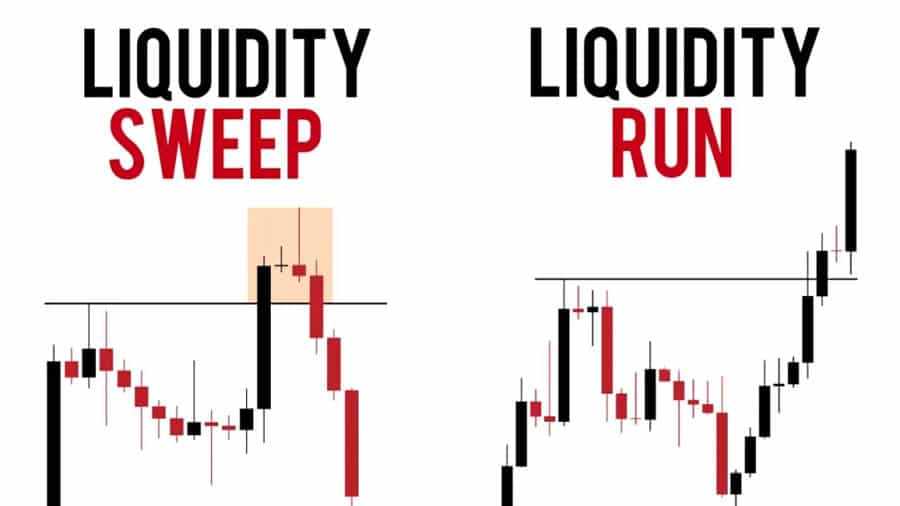

Liquidity Sweeps

This is a foundational concept. The market is engineered to run on liquidity. A liquidity sweep (or “stop hunt”) is a deliberate price move designed to trigger stop-loss orders resting above recent highs or below recent lows. Once this liquidity is captured, the market often reverses sharply. Identifying where this liquidity rests is key to anticipating major market turns.

Optimal Trade Entry (OTE)

The OTE is a precise entry technique using the Fibonacci tool. After a significant price swing, traders look for a retracement into a specific “sweet spot” between the 62% and 79% Fibonacci levels. This zone represents an optimal point to enter a trade in the direction of the original impulse, offering a high reward-to-risk ratio.

Silver Bullet

This is a specific, time-based strategy that targets high-probability moves within designated one-hour windows, known as “Kill Zones.” The setup typically involves waiting for a liquidity sweep followed by a market structure shift and an entry within a resulting Fair Value Gap. It’s designed for quick, precise, and high-momentum plays, making the choice of the best pairs for ICT trading absolutely critical for its success.

What Makes a ‘Best Pair’ for ICT?

Not all pairs are created equal in the world of ICT. A pair might trend beautifully on a daily chart but offer chaotic, unpredictable price action during the specific hours an ICT trader is active. The criteria for what makes the best pairs to trade with ICT are strict and non-negotiable. They revolve around time, liquidity, and clarity of structure. Trying to force ICT concepts onto illiquid or erratic pairs is a recipe for frustration and failure. The methodology is designed for specific market conditions, and our job is to find the instruments that consistently provide them.

Best ICT Trading Times (Kill Zones)

ICT is not a 24/7 strategy; it is a time-sensitive methodology. The highest probability setups occur during specific windows of volatility known as “Kill Zones.” Trading outside these windows is like fishing in a barren pond. Your chosen pair must be active during your trading session.

- London Kill Zone (2:00 AM – 5:00 AM EST): This is the epicenter of volatility for major pairs. It’s when the trading day truly begins, with massive volume flowing in from European institutions. This session is where the best forex pairs for ICT, like EUR/USD and GBP/USD, truly shine. They form clean structures and offer classic setups as the session high or low is established.

- New York Kill Zone (7:00 AM – 10:00 AM EST): This window is essential for any USD-denominated pair. It includes the London close and the New York open, creating a surge of liquidity and often powerful, directional moves. It is the prime time for XAU/USD, USD/CAD, and is also a critical session for EUR/USD and GBP/USD, often providing reversals or continuations of the London move.

- Asian Kill Zone (8:00 PM – 12:00 AM EST): While generally less volatile for majors, this session is crucial for pairs like AUD/USD and USD/JPY. The key play here is often the formation of the “Asian Range,” a consolidation box whose highs and lows become prime liquidity targets for the subsequent London session.

Core Selection Criteria

Beyond being active in a Kill Zone, the ideal ICT pair must possess several key characteristics. These factors ensure that the setups you see are reliable and that your execution is clean. This is the checklist I run through when considering a new instrument.

- High Liquidity: This is the most important factor. High liquidity means more participants, tighter spreads, and smoother price action. It ensures that concepts like Order Blocks and FVGs are the result of genuine institutional flow, not random spikes in a thin market. Major pairs are the obvious choice here.

- Session Volatility: The pair must not only be liquid but also move with intent during the Kill Zones. We need volatility to create the impulses and retracements that form ICT setups. A pair that flatlines during the New York Kill Zone is useless to an ICT trader active at that time.

- Low Spreads: Many ICT strategies, especially the Silver Bullet or FVG entries, require precision and tight stop losses. A high spread can stop you out of a valid trade before it even has a chance to move in your favor. This is another reason why major pairs are considered the best pairs for ICT trading.

- Order Flow Clarity: The best pairs have a “memory.” They respect previous session highs and lows, weekly and daily levels, and clearly defined Order Blocks. Their price action tells a story. Exotic or cross pairs often have choppier, less predictable order flow, making them difficult to analyze with ICT principles.

While exotic or minor cross pairs might occasionally present a seemingly perfect setup, their lack of consistent liquidity and wider spreads often lead to erratic behavior. An FVG might form, but price may never return to fill it, or an Order Block may be completely ignored. Sticking to the majors is a rule of thumb that protects your capital and sanity. The search for the best pairs to trade with ICT is fundamentally a search for quality and predictability.

Deep Dive: Top Pairs and ICT Setups

Theory is one thing, but screen time is where the real learning happens. Each pair has a unique personality—a way it moves, reacts to news, and paints its story on the chart. Understanding these nuances is what separates a novice from a professional. Here’s an experience-based breakdown of the best pairs to trade with ICT, focusing on why they work and which setups they offer most reliably. This is the intel that comes from watching these pairs day in and day out.

EUR/USD: The Gold Standard

Why It Ranks #1: There’s a reason virtually every ICT trader starts here. EUR/USD boasts the highest liquidity in the forex market, which translates to incredibly clean price action and low spreads. Its movements during the London and New York Kill Zone overlap are often so textbook it feels like you’re looking at a strategy backtest. This pair is the epitome of what makes the best pairs for ICT trading so effective. It respects key levels and algorithmic signatures with remarkable consistency, making it the perfect canvas for applying core ICT concepts.

Best ICT Setups:

- Silver Bullet: EUR/USD is one of the premier instruments for this setup. The high volume during the 10:00 AM – 11:00 AM EST window frequently delivers classic Silver Bullet scenarios after a sweep of the early session liquidity.

- Optimal Trade Entry (OTE): The pair’s smooth, flowing trends often produce deep, clean retracements into the OTE zone (62%-79% Fib level), especially after a major liquidity grab or market structure shift.

- Fair Value Gaps (FVG): Due to its algorithmic nature, EUR/USD creates and fills FVGs with high fidelity. An FVG created during the London open is a very high-probability target for the New York session.

From years of observation, I’ve found that EUR/USD has an almost magnetic attraction to the highs and lows of the previous day and the previous session (Asia/London). Before a major move, it will almost always reach for one of these liquidity pools. Its Order Blocks, especially on the 1-hour and 4-hour charts, are extremely reliable support and resistance zones. When a clear FVG forms after a sweep of an old high, it’s one of the highest-confidence trades you can take on this pair. It’s the ideal instrument to build a foundation on, truly one of the best forex pairs for ICT.

GBP/USD: The Aggressive Mover

Why Trade It: If EUR/USD is a smooth sedan, GBP/USD (“Cable”) is a muscle car. It’s known for its higher volatility and sharp, decisive moves. This isn’t a pair for the faint of heart, but for a trader who understands liquidity sweeps, it’s a goldmine. The London open is where this pair comes alive, often delivering explosive breakouts from the consolidated Asian Range. This volatility, when harnessed, makes it one of the most profitable and best pairs to trade with ICT.

Best ICT Setups:

- Asian Range Break: This is the classic GBP/USD play. Traders mark the high and low of the Asian session and wait for the London open to violently sweep one side before reversing. This setup is a cornerstone for many Cable traders.

- Order Block Rejection: Because of its sharp moves, GBP/USD leaves behind very clear and respected Order Blocks. When price returns to a 1H or 4H OB, the rejection is often swift and powerful.

- Liquidity Sweeps: Cable loves to hunt stops. It will often push 15-20 pips beyond a clear high or low just to grab liquidity before reversing. A patient trader who waits for the sweep and the subsequent market structure shift will be rewarded.

Don’t be fooled by its aggressive wicks. While it can look chaotic, its respect for weekly highs/lows is phenomenal. It is also highly sensitive to major news events (both UK and US). A high-impact news release during the New York Kill Zone can provide the fuel for a massive, multi-hour trend. My advice is to give this pair a wider stop loss than you would with EUR/USD to account for its volatility. Patience is key; wait for the clear sweep of the Asian range, because a premature entry will likely get you stopped out. The setups are clean, but you have to let them fully form. Its dynamic nature solidifies its place among the best pairs to trade with ICT.

USD/JPY: The Session Specialist

Why Trade It: USD/JPY offers a unique rhythm. It provides high-quality setups during two distinct periods: the Tokyo session and the New York session. As Asia’s most liquid pair, it’s perfect for traders in that time zone. Then, it often becomes highly active again during the NY open as it reacts to US economic data and overall market risk sentiment. This dual-session volatility makes it a versatile candidate for the list of best pairs for ICT trading.

Best ICT Setups:

- Reversal Patterns: USD/JPY is known for its clean reversals at key institutional levels (e.g., 140.000, 145.000). When it approaches such a level, look for classic ICT reversal signatures: a liquidity sweep, a market structure shift, and an FVG entry.

- Kill Zone Breakouts: During the overlap of the Tokyo and London sessions, or during the NY open, this pair can produce powerful breakouts from consolidation. These are often initiated by a news catalyst.

- Order Blocks: Like the other majors, it carves out clean OBs on higher timeframes that act as reliable turning points. A bearish OB formed on a Monday often becomes a key resistance level for the rest of the week.

USD/JPY is highly sensitive to the broader market’s risk-on/risk-off mood and the performance of US Treasury yields. When yields are rising, USD/JPY tends to follow suit. It often respects the daily highs and lows with precision. A very common pattern is for the Tokyo session to set a high or low, and for the New York session to sweep that level and then reverse. This interplay between sessions is what makes it one of the best pairs to trade with ICT for those who understand intermarket relationships.

XAU/USD (Gold): The Volatility King

Why Consider It: Gold isn’t a forex pair, but it’s traded by forex brokers and is a staple for ICT traders. Its appeal is its massive daily range (Average True Range – ATR) and its clean reactions to USD strength or weakness. The New York session, especially the COMEX open at 8:20 AM EST, is when Gold truly ignites. It offers explosive moves that are perfect for aggressive liquidity grab strategies. For the experienced trader, it is arguably one of the best pairs to trade with ICT, period.

Best ICT Setups:

- Liquidity Sweeps: Gold is the king of stop hunts. It will make sharp, V-shaped reversals after sweeping a prominent high or low. These sweeps are often fast and furious, leaving large Fair Value Gaps in their wake.

- Fair Value Gaps (FVG): Because of the speed of its moves, Gold leaves behind large, clean FVGs. These are prime targets for entry. An entry in a 5-minute FVG on Gold can yield hundreds of pips in a single session.

- Order Blocks (OB): Higher timeframe OBs on Gold are incredibly potent. A daily bullish OB can act as a springboard for a multi-day rally.

Risk management is not optional on Gold; it is mandatory. Its volatility can blow up an account in minutes if you are not careful. Use smaller position sizes than you would on forex pairs. I’ve found that Gold has a strong tendency to react to the Dollar Index (DXY). If DXY is sweeping a high and showing signs of reversing, look for Gold to sweep a low and start rallying. This inverse correlation is a powerful confluence to add to your analysis. The sheer power of its moves during the NY Kill Zone solidifies its reputation among the best forex pairs for ICT (even though it’s a metal).

USD/CAD: The Commodity Follower

Why Trade It: Known as the “Loonie,” USD/CAD offers strong volatility during the New York session due to its correlation with oil prices (WTI/Crude) and its close economic ties to the United States. When US or Canadian economic news hits the wires, or when oil makes a significant move, this pair responds. This news-driven liquidity makes it a solid choice for traders who excel during the NY Kill Zone.

Best ICT Setups:

- NY Kill Zone OTEs: The influx of volume during the New York session often creates a clear directional bias. After an initial impulse move, look for a clean retracement to an Optimal Trade Entry (OTE) for a high-probability continuation trade.

- Order Block and FVG Combos: USD/CAD respects the classic combination of an Order Block with a Fair Value Gap inside it. When price returns to test such a zone, it often provides a very precise and reliable entry point.

This pair can be “spiky.” It sometimes has sharp, sudden wicks that can hunt stops before the real move begins. Because of this, I’ve learned to be more patient and wait for a clear market structure shift on a lower timeframe (like the 5m or 15m) before committing to a trade. Always have an eye on the oil charts (WTI). If oil is breaking out to the upside, it’s generally bearish for USD/CAD (as the Canadian dollar strengthens). This intermarket analysis is key to mastering the best pairs to trade with ICT like the Loonie.

AUD/USD: The Asian Session Leader

Why Trade It: The “Aussie” is an excellent choice for traders active during the Asian and early London sessions. It’s a commodity currency, heavily influenced by risk sentiment and the price of raw materials. It forms very clean Asian Range consolidations, providing a clear roadmap for the London open liquidity hunt. This makes it a strategic choice for early-risers looking for the best pairs for ICT trading.

Best ICT Setups:

- Asian Range Strategy: As with GBP/USD, this is a bread-and-butter setup. Mark the high and low of the Asian session consolidation. The London Kill Zone will often target one of these levels for a liquidity sweep before heading in the opposite direction.

- Fair Value Gaps (FVG): The Aussie provides clean, well-respected FVGs, especially on the 15-minute and 1-hour charts. These often act as perfect entry points for continuation trades after a trend has been established.

While less liquid than EUR/USD or GBP/USD, its movements are often smoother and less erratic than Cable’s. This can make it a good stepping stone for traders looking to move beyond EUR/USD. Proper risk filtering is crucial; because it’s less liquid, it can sometimes ignore setups if there isn’t a major catalyst. It works exceptionally well when global stock markets are trending strongly, as it’s considered a “risk-on” currency. This correlation is a vital piece of the puzzle for consistently profiting from what many consider one of the best forex pairs for ICT for the Asian session.

How to Find Your Best ICT Pair

Reading about the best pairs to trade with ICT is the first step, but the ultimate goal is to find the one or two pairs that resonate with your specific personality, schedule, and risk tolerance. What works wonders for a London session trader might be useless for someone in Asia. The process of selecting your pair should be systematic and data-driven, not based on a single winning trade. Here is a practical, experience-based process to follow.

Step 1: Align with Your Trading Session

This is the most critical filter. You cannot be a successful ICT trader if you are not available during the Kill Zones. – If you can only trade from 7 AM to 11 AM EST, your focus should be squarely on USD pairs and Gold (EUR/USD, GBP/USD, XAU/USD, USD/CAD). – If you are available from 2 AM to 5 AM EST, the London session is your playground. EUR/USD and GBP/USD are your primary candidates. – If your schedule aligns with the Asian session, USD/JPY and AUD/USD should be at the top of your list.

Step 2: Demo Trade and Track Data

Pick 2-3 of the pairs from the list above that align with your session. For the next month, trade them exclusively on a demo account or with micro-lots on a live account. The goal isn’t to make money; it’s to gather data. Create a simple spreadsheet and track the following for every trade:

- Pair: (e.g., EUR/USD)

- Date and Time:

- ICT Setup: (e.g., Silver Bullet, OTE, OB Rejection)

- Kill Zone: (London, NY, Asia)

- Outcome: (Win, Loss, Break-Even)

- Notes: (e.g., “Clean FVG fill,” “Stopped out by news spike,” “Hesitated on entry”)

Step 3: Analyze Your Hit Rate

After a month, review your data. Don’t just look at the profit and loss. Look for patterns. You might discover that your hit rate on GBP/USD Asian Range sweeps is 70%, but your win rate on XAU/USD Silver Bullets is only 30%. The data will tell you which of the best pairs for ICT trading is actually best for you. You might find that the slower, smoother price action of AUD/USD suits your temperament better than the aggressive moves of GBP/USD, even if both are profitable.

Step 4: Optimize for Execution

Once you’ve narrowed your focus to one or two pairs, it’s time to optimize. Pay close attention to the spread your broker offers on those specific pairs during your active Kill Zone. Analyze your execution—are you experiencing slippage? A pair is only as good as your ability to trade it effectively. This deep focus on a single instrument is how you build mastery and confidence, turning theoretical knowledge about the best pairs to trade with ICT into consistent results.

Pro Insights: Setups That Excel

After thousands of hours of screen time and countless discussions in trading communities, clear patterns emerge. Certain ICT setups just perform better on certain pairs. This isn’t a coincidence; it’s a function of a pair’s unique liquidity profile and participant behavior. Understanding this synergy is a massive edge. If you’re going to specialize, it pays to know where to focus your energy. This is where experience elevates you beyond just knowing the definitions of setups and toward mastering their application on the best pairs to trade with ICT.

Based on a consensus of professional and community feedback, here’s what consistently works:

- EUR/USD & GBP/USD: These two are the undisputed champions for Optimal Trade Entry (OTE) and Fair Value Gap (FVG) plays during the London and New York sessions. Their high liquidity means retracements are often smooth and predictable, and imbalances are filled with high probability. The algorithm seems to run purest on these pairs.

- XAU/USD (Gold): This is the premier instrument for the Silver Bullet and aggressive Order Block breaks during the New York session. Its tendency for massive, momentum-fueled moves after a liquidity sweep is exactly what the Silver Bullet strategy is designed to capture. When Gold decides to move, it doesn’t look back, making it perfect for these high-impact setups. This is why many pros feel it’s one of the best pairs for ICT trading.

- USD/JPY: This pair excels at liquidity sweeps of daily/weekly highs and lows and subsequent session-end reversals. It will often spend an entire session trending in one direction, only to sweep a key level and aggressively reverse in the final hours. Patient traders who wait for these major turning points find USD/JPY to be one of the most reliable and best forex pairs for ICT.

By aligning the highest-probability setup with the pair that delivers it most cleanly, you stack the odds significantly in your favor. Don’t try to force a Silver Bullet on AUD/USD in the Asian session. Instead, look for the textbook Asian Range sweep on GBP/USD during the London open. This is how you trade smarter, not harder, by focusing on the best pairs to trade with ICT for the specific strategy you are deploying.

Trade with an ASIC-Regulated Broker

Choosing the right pair is only half the battle. Your success also depends on a reliable and innovative regulated forex broker. Opofinance, regulated by ASIC, provides the tools and security you need to trade with confidence.

- Advanced Trading Platforms: Choose from MT4, MT5, cTrader, and the intuitive OpoTrade app to suit your trading style.

- Innovative AI Tools: Gain an edge with our AI Market Analyzer for insights, an AI Coach for personalized guidance, and 24/7 AI Support.

- Social & Prop Trading: Join a community of traders or get funded through our Prop Trading program.

- Secure & Flexible Transactions: Enjoy safe, convenient deposits and withdrawals, including crypto payments with zero fees.

Start Trading with Opofinance Today!

Conclusion

Ultimately, the quest to find the best pairs to trade with ICT leads back to a core group of majors: EUR/USD, GBP/USD, USD/JPY, and XAU/USD. Their superior liquidity, predictable volatility within Kill Zones, and clear respect for ICT’s institutional concepts make them the ideal instruments for this methodology. Your task is not to reinvent the wheel but to align your schedule with the correct pair, master its unique personality, and systematically track your performance. By focusing on one or two of these high-performing pairs, you can move from being a student of the theory to a confident practitioner executing with precision.

What is the most volatile ICT Kill Zone?

The London Kill Zone (2-5 AM EST) is typically the most volatile, especially for GBP pairs. However, the first two hours of the New York Kill Zone (8-10 AM EST) often see the most explosive, news-driven moves, particularly for USD pairs and Gold.

Can I trade stocks or crypto with ICT?

Yes, ICT concepts can be applied to any market with sufficient liquidity and clear institutional footprints. Indices like the S&P 500 (ES) and Nasdaq (NQ) are extremely popular with ICT traders, as are major cryptocurrencies like Bitcoin and Ethereum.

How many pairs should an ICT beginner focus on?

One. A beginner should master a single pair, preferably EUR/USD, for at least 3-6 months. This builds a deep understanding of one pair’s behavior before adding the complexity of another. The goal is mastery, not variety.

Is the Asian session ever good for major pairs?

The primary purpose of the Asian session for ICT traders focusing on EUR/USD or GBP/USD is not to trade, but to observe. The session creates the consolidation (the Asian Range) whose highs and lows become the primary liquidity targets for the more volatile London session.

What’s the best timeframe for identifying the bias?

Per standard ICT teaching, traders should use the Daily and 4-Hour charts to establish the overall directional bias. These higher timeframes show the larger institutional order flow. Entries are then refined on lower timeframes like the 15-minute, 5-minute, or even 1-minute chart.

References: +