Finding the best regulated forex brokers is the single most important step to keeping your trading funds safe. A regulated forex broker operates under the watch of a financial authority, which creates a secure trading environment. This article breaks down the top regulated forex brokers for 2025, explains what forex regulation means for your safety, outlines the roles of key regulators, and shows you how to confirm a broker’s license to protect your investment.

Best Regulated Forex Brokers in 2025

Choosing a broker from a solid regulated forex brokers list is a critical move for any trader. Regulation means a broker must follow strict financial rules, providing a layer of safety that unregulated firms lack. From years of trading, I can tell you that the confidence that comes with using one of the top regulated forex brokers is invaluable. This section reviews the best forex brokers with regulation, selected for their strong oversight and excellent trading conditions. The best regulated forex brokers include:

- Opofinance – Top Rated Regulated Broker Option

- IC Markets – ASIC & CySEC Regulated | Low Spread

- Pepperstone – FCA & ASIC | High-Speed Execution

- AvaTrade – Multiple Regulations | Beginner Friendly

- XM – Trusted Broker | CySEC Licensed

- FXTM – FSCA & FCA | Local Deposit Options

- IG Markets – FCA Regulated | Top-Tier Reliability

Next, we will look into each of these brokers to help you select the most trusted regulated forex brokers for your specific trading style.

Opofinance – Top Rated Regulated Broker Option

Opofinance is making a name for itself among the best regulated forex brokers by offering a flexible trading setup. The company holds multiple licenses, including from the Financial Sector Conduct Authority (FSCA) in South Africa (License No. 54594) and the Seychelles Financial Services Authority (FSA). While it has claimed an ASIC license in the past, its primary active licenses provide a regulated framework for international clients.

This broker gives traders access to over 350 instruments and supports the industry-standard MT4 and MT5 platforms. It also offers cTrader and its own OpoTrade platform, appealing to a wider range of traders. Its social trading feature is a great asset, making it one of the best regulated forex brokers for beginners wanting to learn from others.

IC Markets – ASIC & CySEC Regulated | Low Spread

IC Markets is widely known as one of the top regulated forex brokers, especially for traders who need low costs and fast execution. With regulation from both the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), it provides a high level of trading security. My personal tests with its Raw Spread account confirmed its reputation for exceptionally tight spreads, often starting at 0.0 pips. This makes it one of the best regulated forex brokers with low spreads. The broker’s deep liquidity and minimal slippage are ideal for automated trading systems and scalpers. The solid regulatory oversight from ASIC and CySEC makes it one of the most trusted regulated forex brokers available.

Pepperstone – FCA & ASIC | High-Speed Execution

Pepperstone is another excellent choice on any regulated forex brokers list, licensed by the UK’s Financial Conduct Authority (FCA) and Australia’s ASIC. This top-tier regulation gives traders immense confidence in their fund’s safety. Pepperstone is famous for its fast execution speeds, a must-have for active day traders. It supports MT4, MT5, and cTrader, catering to various trading styles. My experience with their Razor account showed highly competitive ECN-like conditions with minimal spreads and a clear commission fee. This mix of speed, low cost, and strong oversight makes it one of the best FCA regulated forex brokers and best ASIC regulated forex brokers.

AvaTrade – Multiple Regulations | Beginner Friendly

AvaTrade stands out as one of the best regulated forex brokers for beginners, thanks to its easy-to-use platforms and deep educational content. The broker holds licenses in multiple regions, including from the Central Bank of Ireland, ASIC in Australia, and the FSCA in South Africa. This global regulation ensures a secure environment for regulated forex brokers accepting international clients. AvaTrade’s fixed spreads appeal to new traders who value cost predictability. Its proprietary AvaTradeGO and AvaOptions platforms are intuitive additions to the standard MT4/MT5 suite. Risk management tools like AvaProtect further solidify its status as one of the most reliable regulated brokers in 2025 for newcomers.

XM – Trusted Broker | CySEC Licensed

XM has earned its reputation as a trusted online forex broker, regulated by CySEC in Cyprus and ASIC in Australia. This broad regulatory footprint allows it to serve traders worldwide. XM is often praised among the best regulated forex brokers for its client-first approach, featuring low minimum deposits and multiple account types. The broker focuses on the MT4 and MT5 platforms, providing a stable and familiar trading environment. XM also invests heavily in trader education through frequent webinars and market analysis, making it a fixture on any credible regulated forex brokers list.

FXTM – FSCA & FCA | Local Deposit Options

ForexTime (FXTM) is a well-known broker licensed by respected authorities, including the UK’s FCA and South Africa’s FSCA. This dual regulation places it among the most trusted regulated forex brokers, particularly for traders in Europe and Africa. A standout feature of FXTM is its availability of local deposit methods in many countries, simplifying the funding process. The broker offers various account types, from micro accounts for beginners to ECN accounts for professionals. FXTM’s combination of strong regulation, flexible accounts, and localized service makes it a top choice for regulated forex brokers accepting international clients.

IG Markets – FCA Regulated | Top-Tier Reliability

As one of the industry’s pioneers, IG Markets sets the standard for trading security. Regulated by premier authorities worldwide, including the FCA in the UK and ASIC in Australia, IG delivers unmatched trust. It offers access to over 17,000 markets, giving traders endless opportunities. The broker’s proprietary platform is advanced yet user-friendly, and it also supports MT4. In practice, the platform’s reliability and the company’s transparent operations are top-notch. For traders who prioritize safety above all else, IG is undeniably one of the best regulated forex brokers available.

What is a Regulated Broker?

A regulated forex broker is a firm licensed and monitored by a financial oversight body. This supervision ensures the broker operates fairly and ethically. Opting for the best regulated forex brokers is not just a preference; it’s a necessity for secure trading. A financial authority license forces the broker to comply with strict rules on capital reserves, client fund management, and business conduct. This is the clear line that separates a legitimate online forex broker from a risky one and forms the bedrock of trading security.

Definition of Forex Regulation

Forex regulation consists of the rules and guidelines that forex brokers are required to follow. These rules are enforced by financial authorities in the jurisdictions where brokers operate. The main goal of forex regulation is to shield investors from scams and unethical behavior. It mandates that brokers act with transparency, hold enough capital to process withdrawals, and ensure a fair trading environment. When a broker appears on a regulated forex brokers list, it means they have met these high standards set by an entity like the FCA or ASIC.

Role of Regulatory Bodies in Investor Security

Regulatory bodies act as the protectors of investor security in the forex market. They perform regular audits to confirm that brokers are meeting financial standards. A key rule is the use of segregated accounts, compelling brokers to keep client deposits separate from their own company funds. This protects your money if the broker goes out of business. Furthermore, top-tier regulators like the FCA (UK) require brokers to join compensation schemes, which can repay traders up to a certain limit if a broker fails. These safeguards are why the best forex brokers with regulation are the safest choice.

Difference Between Regulated and Unregulated Brokers

The distinction between regulated vs unregulated brokers is critical and directly impacts your capital. Regulated brokers are legally bound to be upfront about their fees, execution methods, and any conflicts of interest. They also provide official channels for resolving disputes. Unregulated brokers, however, answer to no one. They have no obligation to protect your funds, and there’s no authority to hold them accountable. Over the years, I’ve seen countless traders lose everything to unregulated firms. This is why choosing from the most trusted regulated forex brokers is the only logical choice.

Why Choosing a Regulated Broker is Crucial?

Deciding to trade with a regulated online forex broker is the most important choice you’ll make. The high leverage or big bonuses offered by unregulated firms might seem attractive, but the risks are far too great. A financial authority license provides a safety net against the most common dangers in the forex market. It’s the foundation for a secure and long-term trading career. The best regulated forex brokers not only provide this security but also tend to offer superior trading conditions, as their business model depends on earning client trust over the long run.

Prevention of Fraud and Financial Misconduct

The main reason to select from a list of top regulated forex brokers is to avoid fraud. Regulatory bodies levy heavy fines and sanctions on brokers engaging in deceptive practices, such as manipulating prices or blocking withdrawals. This oversight serves as a strong deterrent. Unregulated brokers can act without consequences, leaving their victims with no legal options. The best regulated forex brokers for 2025 are those with spotless regulatory histories, proving their dedication to fair practices.

Assurance of Fund Protection and Segregated Accounts

One of the most vital protections offered by the best forex brokers with regulation is the requirement for segregated accounts. This practice means your deposits are held in a bank account completely separate from the broker’s operational funds. This separation is crucial because it prevents the broker from using your money to pay its own expenses or debts. If the broker were to fail, your funds would be safe and returnable. This is a non-negotiable feature of all trusted forex brokers.

Transparency in Pricing and Trade Execution

Transparency is another major advantage of using a regulated forex broker. Regulators demand that brokers clearly state their pricing, including spreads, commissions, and overnight fees. This allows traders to accurately forecast their trading costs. Additionally, these bodies monitor how trades are executed to ensure fairness. The best regulated forex brokers with low spreads are often those that offer direct market access (ECN/STP), passing on raw market prices without interference. This transparency builds trust and ensures your trades are filled at fair prices.

Top Global Regulatory Authorities

Knowing the different regulatory bodies is essential for picking the most reliable regulated brokers for 2025. Not all regulators have the same level of authority; they differ in their strictness, investor protection measures, and enforcement power. The best regulated forex brokers are usually licensed by one or more of the top-tier agencies. Getting to know bodies like the FCA (UK), ASIC (Australia), and CySEC (Cyprus) will help you make a smarter decision and improve your trading security.

FCA (UK) – Europe’s Strongest Regulator

The Financial Conduct Authority (FCA) in the United Kingdom is seen as one of the world’s toughest and most respected regulators. Brokers under FCA oversight must meet the highest standards for financial transparency and client safety. A key feature of FCA regulation is the Financial Services Compensation Scheme (FSCS), which protects client deposits up to £85,000 if a broker fails. This makes the best FCA regulated forex brokers an incredibly safe choice for traders.

ASIC (Australia) – Focus on Customer Protection

The Australian Securities and Investments Commission (ASIC) is another elite regulator known for its strong emphasis on consumer protection. ASIC-regulated brokers must keep client funds in segregated accounts at top Australian banks. They are also required to maintain significant capital reserves and operate transparently. While ASIC doesn’t have a compensation fund like the FCA, its strict rules and enforcement create a very secure environment. Many traders view the best ASIC regulated forex brokers as among the most trusted in the world.

CySEC (Cyprus) – Popular Among International Brokers

The Cyprus Securities and Exchange Commission (CySEC) is a key regulator within the European Union. Because Cyprus is an EU member, CySEC’s rules align with the MiFID II directive, standardizing financial regulations across the bloc. This allows CySEC-regulated brokers to serve clients throughout Europe. CySEC mandates that brokers join the Investor Compensation Fund (ICF), protecting client funds up to €20,000. Many top regulated forex brokers choose CySEC for its well-regarded regulatory framework, making it a hub for international firms.

NFA / CFTC (USA) – Strictest Market Rules

The National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) regulate the forex market in the United States. The US regulatory system is the most stringent globally. Rules include a leverage cap of 50:1, a “first-in, first-out” (FIFO) trade-closing rule, and a ban on hedging. While restrictive, these measures are designed for maximum investor protection. Only a select few brokers are licensed to operate in the US, but they are among the most trusted regulated forex brokers worldwide.

FSCA (South Africa) – Popular Choice in the Region

The Financial Sector Conduct Authority (FSCA) is the main financial regulator in South Africa. The FSCA has been tightening its oversight, making it an increasingly credible authority. Many international brokers obtain an FSCA license to serve clients in Africa and the Middle East better. While its protections might not match those of the FCA or ASIC, choosing an FSCA-regulated broker offers far more security than using an unregulated one. It is a key regulator for regulated forex brokers accepting international clients from these regions.

Features of a Credible Regulated Broker

Spotting a credible online forex broker on a regulated forex brokers list requires looking beyond the license itself. The most trusted regulated forex brokers share several key traits that prove their dedication to transparency and client safety. From my experience, checking these details helps avoid problems later. A truly reliable broker is not just regulated; it proudly displays its credentials and makes them easy to verify, giving clients complete confidence.

Full Transparency of License and Number

A legitimate regulated forex broker always shows its license details clearly on its website, typically in the footer. This information should include the regulator’s name and the specific license number. Vague claims like “we are regulated” are red flags. The best forex brokers with regulation provide this information without making you search for it. This transparency is the first sign of a trustworthy broker.

Ability to Verify License on the Regulator’s Website

This is a crucial step that you should never skip. After finding the broker’s license number, you must check it on the official website of the regulatory body. All major regulators, including the FCA (UK), ASIC, and CySEC, have a public database of authorized firms. You can search for the broker by name or license number to confirm their license is valid and that the website address on record matches the one you are on. This ensures you are not dealing with a fraudulent clone firm.

Negative Balance Protection Policy

Negative balance protection is a vital safety net offered by many of the most reliable regulated brokers for 2025. This policy guarantees that you cannot lose more money than your account balance. During extreme market swings, it’s possible for an account to go into a negative balance. With this protection, the broker absorbs that loss, resetting your account to zero. Regulated brokers with negative balance protection, especially those under FCA and CySEC rules, must offer this feature, adding a critical layer of risk management.

Client Fund Safety Measures

In addition to segregated accounts, the best regulated forex brokers take extra steps to secure client funds. This often includes partnering with major international banks to hold client deposits and, in places like the UK, participating in investor compensation funds. These measures create a strong safety net for your money. When assessing a broker, always examine the details of their fund safety policies. The most trusted regulated forex brokers are always open about these measures, as they are a core part of their service.

Comparison Table of Regulated Brokers

To provide a quick overview of some top regulated forex brokers, the table below summarizes their main features. This data is current for 2025 and serves as a useful reference for your own research.

| Broker | Country | Regulator | Account Type | Max Leverage | Min. Deposit | Trust Score |

| IC Markets | Australia | ASIC, CySEC, FSA | Standard, Raw Spread | 1:500 | $200 | 9.5/10 |

| Pepperstone | Australia | FCA, ASIC, CySEC | Standard, Razor | 1:200 (Retail) | $0 | 9.7/10 |

| AvaTrade | Ireland | CBI, ASIC, FSCA | Retail, Professional | 1:400 | $100 | 9.3/10 |

| XM | Cyprus | CySEC, ASIC, FSC | Micro, Standard, Zero | 1:1000 | $5 | 9.1/10 |

| FXTM | Cyprus | FCA, CySEC, FSCA | Advantage, Advantage Plus | 1:2000 | $200 | 9.0/10 |

| IG Markets | UK | FCA, ASIC, NFA | CFD Account, DMA | 1:200 | $250 | 9.8/10 |

Pros and Cons of Regulated Forex Brokers

Although the advantages of using a regulated forex broker are clear, it’s helpful to see the full picture. The strict rules that regulators enforce can sometimes lead to limitations not found with unregulated firms. However, any experienced trader knows these limitations are a small trade-off for the security that comes with using the best forex brokers with regulation. Understanding both the benefits and drawbacks helps you set the right expectations.

Pros

- Fund Security: This is the biggest plus. Features like segregated accounts and investor compensation funds, offered by the best regulated forex brokers, provide a strong defense for your money.

- Transparency: Regulated brokers must be clear about their fees, execution methods, and any conflicts of interest, which creates a fairer trading environment for everyone.

- Guaranteed Withdrawals: A regulated online forex broker must process valid withdrawal requests in a timely manner. Not doing so can lead to serious penalties from the regulator.

Cons

- Bonus Restrictions: Top-tier regulators in the EU and UK have banned or heavily restricted trading bonuses and promotions. This is to stop brokers from encouraging risky, excessive trading.

- Strict Rules: The best regulated forex brokers must enforce strict leverage limits and client verification (KYC) processes, which some traders may find cumbersome.

- Country Restrictions: Some of the most trusted regulated forex brokers cannot accept clients from certain countries, like the United States, due to specific national regulations.

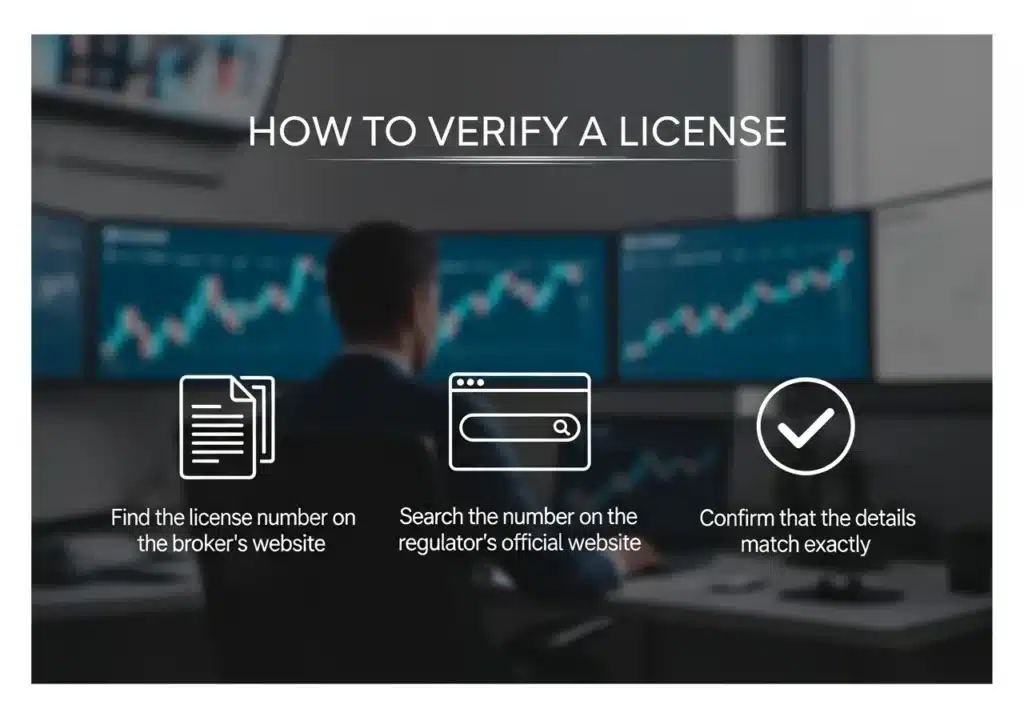

How to Verify a Broker’s License

Confirming a broker’s license is a simple but vital step every trader must take before depositing money. Never rely solely on the information a broker posts on its website. Spending a few minutes on this due diligence can protect you from scams and confirm you are working with one of the top regulated forex brokers. This verification is your personal safety check for ensuring trading security.

Checking on the Regulator’s Official Website

The best way to verify a license is to go straight to the source: the regulator’s official website. For instance, if a broker states it is regulated by the FCA in the UK, you should go to the FCA’s Financial Services Register. Every major regulator maintains a similar online database where you can look up authorized companies. This is the only way to be completely sure of a broker’s status.

Matching the License Number with Broker Information

When you find the broker on the regulator’s website, compare the details carefully. Make sure the license number, company name, and official address match what is on the broker’s site. Most importantly, confirm the website domain listed in the official register is the same one you are visiting. Scammers often create “clone” sites that look like legitimate regulated brokers to trick people.

Reviewing User Feedback and Operational History

While regulation is the top priority, it’s also smart to look into a broker’s history and user reviews. Search for feedback on reputable financial websites and forums. A long track record of positive comments and no major regulatory issues is a good sign of one of the most trusted regulated forex brokers. This qualitative check complements the quantitative license verification and helps you build a full picture of the broker’s dependability.

Opofinance: Trade with an FSCA Regulated Innovator

Opofinance, regulated by the FSCA, delivers a secure and modern trading environment. Access a powerful suite of platforms and innovative tools built to improve your trading performance.

- Advanced Trading Platforms: Select from MT4, MT5, cTrader, and the exclusive OpoTrade platform for a flexible trading experience.

- Innovative AI Tools: Use our AI Market Analyzer, AI Coach, and AI Support to gain an edge and make data-driven decisions.

- Social & Prop Trading: Connect with other traders through Social Trading or test your skills with our Prop Trading program.

- Secure & Flexible Transactions: Benefit from secure deposits and withdrawals, including cryptocurrency payments with zero fees.

Conclusion

Choosing one of the best regulated forex brokers is the most important decision a trader can make in 2025. Regulation provides the necessary structure for fund safety, transparency, and ethical trading practices. By selecting a broker supervised by a respected authority like the FCA, ASIC, or CySEC, you drastically lower your risk of fraud and ensure your money is protected. Always take the time to verify a broker’s license on the official regulator’s website. To trade safely, start with a broker that has a credible license; protecting your funds is always the top priority.

FAQ Section

Which is the best regulated forex broker in 2025?

The “best” broker varies based on a trader’s needs. However, firms like Pepperstone and IG Markets consistently rank among the top regulated forex brokers because of their strong FCA and ASIC regulation, competitive trading conditions, and long-standing trustworthy reputations.

Why is forex regulation important for traders?

Forex regulation is crucial because it forces brokers to follow strict financial rules. This includes keeping client funds separate, providing clear pricing, and maintaining a fair trading environment, all of which protect traders from scams and bad business practices.

What are the major financial authorities regulating forex brokers?

The most prominent, top-tier financial authorities are the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the NFA/CFTC in the United States.

Can regulated brokers offer high leverage?

It depends on the specific regulator. Top-tier regulators such as the FCA and ASIC enforce strict leverage limits (e.g., 30:1 for retail traders) to protect them from taking on too much risk. Brokers regulated by offshore authorities might offer higher leverage but with significantly less investor protection.

How do I know if a forex broker is regulated?

A regulated forex broker will list its license number and regulator on its website. You must then go to that regulator’s official website and use its public search tool to look up the broker by name or license number to confirm its status is legitimate and active.