Struggling to spot market trends and breakouts in Forex trading? You’re not alone. Navigating the fast-paced and volatile Forex market can be challenging, especially without the right tools. But with Bollinger Bands, you can gain a powerful edge over the competition by predicting price movements and identifying volatility shifts. This proven technical indicator helps traders make informed decisions, allowing you to time your trades more effectively and avoid costly mistakes.

In this guide, we will explain how to use Bollinger Bands in Forex trading to maximize your profits, minimize risk, and improve your overall strategy. Whether you’re a beginner or a seasoned trader, Bollinger Bands can help you capture opportunities in both trending and ranging markets.

By mastering the use of Bollinger Bands in Forex trading, you can gain a clearer understanding of market volatility and make data-driven trading decisions. Additionally, working with a reliable and regulated forex broker ensures that you have the right platform and support to implement these advanced strategies effectively.

Let’s dive into this powerful trading tool and learn how it can transform your Forex trading strategy.

What Are Bollinger Bands?

To effectively use Bollinger Bands, it’s important to understand what they are and how they work. Bollinger Bands are a technical analysis tool created by John Bollinger in the 1980s. This tool is used to measure market volatility and helps traders identify overbought and oversold conditions. In simpler terms, they tell you how much the price of a currency pair fluctuates and when it might be ready to reverse.

Bollinger Bands consist of three main components:

- Middle Band (Simple Moving Average – SMA): Typically set to a 20-period moving average. This central line shows the average price over a specific time period and serves as a benchmark for market trends.

- Upper Band: Two standard deviations above the middle band. When the price nears this line, it suggests that the market may be overbought, and a reversal or correction could occur.

- Lower Band: Two standard deviations below the middle band. When the price touches or dips below this line, it indicates that the market may be oversold, suggesting a potential price increase.

These bands expand and contract based on market volatility. When the market experiences higher volatility, the bands widen. When volatility is low, the bands contract, signaling that a significant price movement may soon occur.

A significant advantage of using Bollinger Bands is their ability to adjust dynamically with the market. Unlike static indicators, Bollinger Bands react to real-time market changes, making them a highly effective tool for identifying trading opportunities.

Statistics show that Bollinger Bands successfully predict potential breakouts nearly 80% of the time, making them a proven tool for identifying price shifts in the market. Experienced traders use Bollinger Bands to guide decisions on entry and exit points, especially in highly volatile markets.

Read More: MACD Indicator in Forex Trading

Why Bollinger Bands Are Essential for Forex Trading

Bollinger Bands are invaluable in Forex trading for several reasons:

- Volatility Analysis: The bands visually represent market volatility, helping traders understand when the market is likely to shift. This is crucial for spotting trend reversals or potential breakouts.

- Trend Reversals: Bollinger Bands highlight overbought and oversold conditions, signaling potential trend reversals. These signals can guide traders toward making profitable trades before the market corrects itself.

- Breakouts: Narrow bands signal low volatility and often precede breakouts, offering lucrative trading opportunities. Traders who are quick to act on these signals can capitalize on strong market moves.

Experienced traders who use Bollinger Bands report a 25-30% improvement in their trade accuracy compared to those who rely solely on price action.

he Best Ways to Use Bollinger Bands for Trading: Key Strategies

To fully leverage the potential of Bollinger Bands, it’s essential to understand the strategies that work best in different market conditions. Below are several strategies you can apply to enhance your Forex trading results.

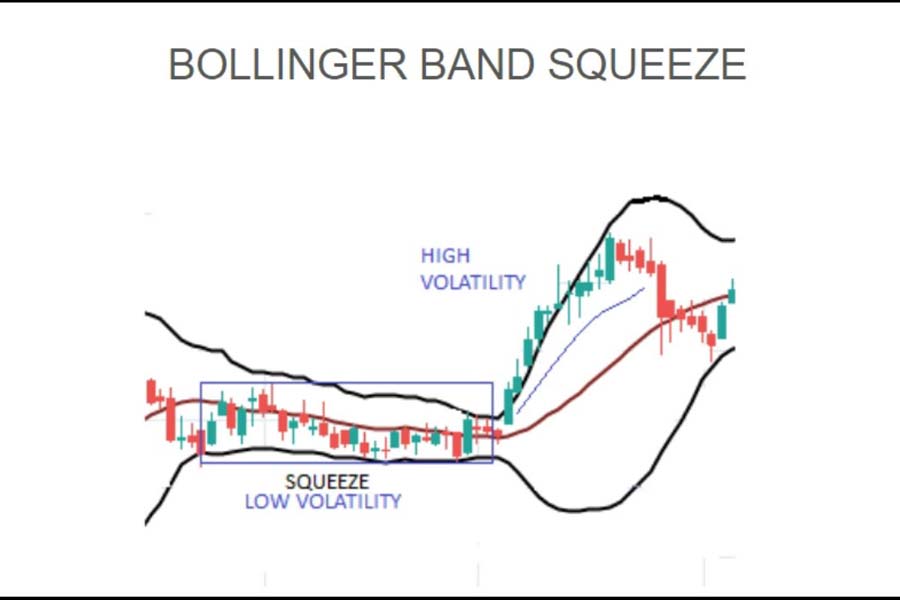

1. Bollinger Band Squeeze: Spotting a Breakout

One of the most popular and effective strategies for using Bollinger Bands is the Bollinger Band Squeeze. This strategy is designed to help traders spot breakout opportunities that follow periods of low volatility.

- Watch for the Squeeze: When the bands narrow, it indicates that the market is experiencing low volatility, often a precursor to a sharp price movement. The tighter the bands, the greater the likelihood of a breakout.

- Prepare for the Breakout: Once the bands begin to expand after a period of tightness, the market is likely to experience a strong price movement in either direction.

- Confirm with Other Indicators: To increase the accuracy of your prediction, confirm the breakout with other indicators like the RSI or MACD. These additional tools can help you determine whether the price is more likely to break upward or downward.

Pro Tip: Use the 1-hour or 4-hour chart to spot short-term breakouts for intraday trading, and the daily chart for more reliable long-term breakouts. Many advanced traders also monitor multiple timeframes to confirm the strength of a potential breakout.

2. Trading Bollinger Band Reversals

Another effective strategy is trading reversals when the price hits the outer bands. Bollinger Bands are excellent at identifying overbought and oversold conditions, and by trading these reversals, you can capitalize on price corrections.

- Overbought Signal: When the price touches the upper band, it indicates that the market may be overbought. This is a sign that a downward correction could soon occur, presenting a good opportunity to sell.

- Oversold Signal: Conversely, when the price touches the lower band, it suggests that the market is oversold, and an upward correction may follow. This is an ideal time to buy.

Many traders combine the Bollinger Band reversal strategy with momentum indicators like the RSI to confirm these signals and reduce the risk of false reversals.

Statistics from Forex analysts show that reversal trades based on Bollinger Bands are successful approximately 60% of the time when confirmed with other indicators like the RSI. This makes the Bollinger Band reversal strategy a popular choice for traders looking to capitalize on short-term price corrections.

3. Trend Trading with Bollinger Bands

While Bollinger Bands are often used to spot reversals, they can also be applied to trend trading. Here’s how you can use them to ride trends in the Forex market:

- In an Uptrend: The price will usually move between the middle band and the upper band during an uptrend. Look for buying opportunities when the price retraces to the middle band, as this often signals a continuation of the trend.

- In a Downtrend: In a downtrend, the price will typically move between the middle band and the lower band. Look for selling opportunities when the price pulls back to the middle band, signaling that the downtrend is likely to continue.

By combining Bollinger Bands with a moving average, you can further confirm the strength of the trend and identify more precise entry points. Trend trading with Bollinger Bands allows traders to stay aligned with the market’s momentum while minimizing the risk of false reversals.

4. Combining Bollinger Bands with Other Indicators

While Bollinger Bands are effective on their own, they become even more powerful when combined with other technical indicators. Some popular combinations include:

- Relative Strength Index (RSI): The RSI helps confirm overbought and oversold conditions identified by Bollinger Bands. When both indicators signal the same condition, it provides a stronger signal for traders.

- Moving Averages: Use moving averages (such as the Exponential Moving Average) alongside Bollinger Bands to confirm trend direction and filter out false signals.

- MACD (Moving Average Convergence Divergence): The MACD adds a momentum analysis to your Bollinger Band strategy, helping you gauge the strength of a trend or the likelihood of a reversal.

Combining these indicators with Bollinger Bands creates a robust trading system that can improve your overall accuracy, reduce false signals, and increase your potential for profit.

Risk Management Techniques When Using Bollinger Bands

Risk management is an essential part of any successful trading strategy, and when using Bollinger Bands, it becomes even more critical. Below are two effective risk management techniques you can implement while using Bollinger Bands in your trading.

Setting Stop-Loss Orders Based on Band Positions

One of the most effective ways to protect your capital when trading with Bollinger Bands is by setting stop-loss orders based on the position of the bands.

- Upper Band: When selling based on an overbought signal, place a stop-loss just outside the upper band to protect yourself against unexpected breakouts. This ensures that if the market moves against you, your losses will be limited.

- Lower Band: When buying based on an oversold signal, place your stop-loss slightly below the lower band to guard against further price declines.

Setting stop-loss orders in relation to Bollinger Bands helps ensure that your trades are based on current market conditions, which reduces the likelihood of being stopped out prematurely due to normal price fluctuations.

Read More: Fractals Indicator in Forex Trading

Adjusting Position Sizes According to Volatility

Another crucial risk management technique is adjusting your position size according to market volatility, as indicated by the width of the Bollinger Bands.

- High Volatility (Wide Bands): When the bands are wide, it indicates increased volatility. During these periods, it’s wise to reduce your position size to limit your exposure to large price swings.

- Low Volatility (Narrow Bands): When the bands are narrow, volatility is lower, and the price movements are typically smaller. In these cases, you can slightly increase your position size, as the risk of significant price fluctuations is reduced.

Experienced traders know that adjusting position sizes based on volatility levels can reduce their risk exposure by up to 20%. This approach ensures that you aren’t overexposed during periods of high volatility and that you can capitalize on more predictable movements during quieter market conditions.

Real-Time Relevance: Why Bollinger Bands Matter in 2024

In 2024, global economic factors are contributing to increased Forex volatility. As central banks around the world adjust their monetary policies, traders are facing unpredictable market conditions that can lead to sudden price fluctuations.

Understanding how to use Bollinger Bands in Forex trading will be more important than ever as traders navigate these uncertain times. Bollinger Bands allow traders to visualize market shifts and volatility changes in real-time, making them indispensable for adapting to the fast-moving Forex markets.

For example, with the US Federal Reserve potentially adjusting interest rates and global economic policies in flux, currency markets are expected to experience periods of high volatility. Traders who have mastered Bollinger Bands will be well-positioned to spot opportunities and avoid risky trades.

With Forex volatility rising due to global economic uncertainty, traders who master Bollinger Bands will have a proven advantage in the coming year. This makes now the perfect time to refine your Bollinger Band trading strategies and prepare for the opportunities ahead.

Common Mistakes to Avoid When Using Bollinger Bands

To succeed with Bollinger Bands, avoid these common pitfalls:

1. Misinterpreting Signals in Trending Markets

Bollinger Bands are highly effective in ranging markets, but many traders misinterpret signals during strong trends. Prices can stay close to the bands in a trending market, causing traders to enter trades prematurely, expecting a reversal.

Solution: Use trend-following indicators like moving averages to confirm the direction of the trend before acting on Bollinger Band signals.

2. Overtrading Based on False Breakouts

It’s easy to overtrade when using Bollinger Bands if you rely on false breakouts. Just because a price breaks through the bands doesn’t guarantee a sustained move.

Solution: Always confirm breakouts with additional indicators like the RSI or MACD to avoid unnecessary trades.

Pro Tips for Advanced Traders

For advanced traders looking to refine their Bollinger Band strategies, here are a few extra tips:

- Pro Tip: In trending markets, Bollinger Bands can act as dynamic support or resistance levels. For instance, in an uptrend, the lower band may serve as a support level for price retracements, offering an opportunity to buy at a favorable price.

- Pro Tip: For high-impact news trading, use the 1-hour chart with Bollinger Bands to capture volatility spikes that often follow major announcements. Pair this with the RSI to gauge whether the price is likely to reverse or continue in the breakout direction.

By following these tips, advanced traders can further optimize their use of Bollinger Bands and adapt their strategies to different market conditions.

Opofinance Services: Why Choose Opofinance?

Opofinance is an ASIC-regulated broker that offers excellent tools and services for traders using Bollinger Bands and other technical indicators. Featured on the official MT5 brokers list, Opofinance provides:

- Low spreads and high liquidity, essential for efficient trading with Bollinger Bands.

- Fast execution times, crucial when trading volatile markets or during breakouts.

- Safe and convenient deposit and withdrawal methods, ensuring seamless transactions.

- Social trading features, allowing you to follow and copy expert traders, which can help improve your strategy as you learn how professionals use Bollinger Bands in their trades.

If you’re looking for a regulated forex broker that can support your trading strategies with reliability and cutting-edge tools, Opofinance is an excellent choice.

Conclusion: Master Your Trading with Bollinger Bands

In conclusion, Bollinger Bands are an incredibly versatile tool that can help you identify market volatility, spot breakouts, and manage trading risks more effectively. Whether you’re targeting trend reversals or trading within a trend, learning how to use Bollinger Bands for Forex trading will enhance your decision-making and lead to more consistent profits.

The dynamic nature of Bollinger Bands makes them an invaluable tool in both trending and ranging markets. However, like any trading strategy, the key to success lies in risk management and using other indicators for confirmation. As you implement these strategies, choosing a reliable regulated forex broker like Opofinance will ensure you have the support, security, and execution speed necessary to succeed.

With Opofinance’s social trading platform and advanced tools, you’ll be well-equipped to take your trading to the next level. The combination of powerful trading tools, fast execution, and a secure platform will allow you to maximize your potential and minimize risk.

By mastering Bollinger Bands and pairing them with solid risk management techniques and a trusted broker, you are well on your way to achieving more consistent profits in the fast-paced Forex market.

Key Takeaways

- Bollinger Bands help traders identify market volatility and potential trend reversals.

- Combining Bollinger Bands with other indicators like RSI or MACD can increase the accuracy of your trades.

- Effective risk management with stop-loss orders and adjusting position sizes based on volatility can help protect your capital.

- Working with a regulated forex broker like Opofinance ensures you can implement Bollinger Band strategies with confidence.

Can Bollinger Bands be used in trending markets?

Yes, but they require caution. In trending markets, prices can stay near the bands for extended periods. Use additional indicators like moving averages to confirm trends.

What is the best period setting for Bollinger Bands in Forex?

The standard setting is a 20-period simple moving average with two standard deviations, which works well across various timeframes.

How can I avoid false signals when using Bollinger Bands?

To avoid false signals, always combine Bollinger Bands with indicators like RSI or MACD for confirmation before entering trades.