Are you tired of guessing market direction and missing out on profitable trades? Do you crave a trading strategy that aligns with the moves of institutional giants, the so-called “smart money”? Imagine having a secret weapon that unveils the true intentions of the market, allowing you to trade with precision and confidence.

This isn’t just a pipe dream. The key to unlocking this level of market insight lies in understanding a powerful concept known as Break of Structure (BOS) in Smart Money Concept (SMC) trading. Mastering BOS is like learning to read the market’s hidden language, enabling you to identify high-probability trading opportunities and significantly improve your trading outcomes. For traders seeking a reliable forex broker to implement these strategies, choosing a well-regulated option is crucial.

In this comprehensive guide, we will demystify BOS in Smart Money Concept, revealing its crucial role in identifying trend continuation and aligning your trades with the smart money flow. Whether you are a seasoned trader or just starting your journey, understanding BOS is an indispensable skill for navigating the complexities of the financial markets. Ready to elevate your trading game and trade like the institutions? Let’s dive in and unlock the power of Break of Structure.

Understanding Break of Structure (BOS)

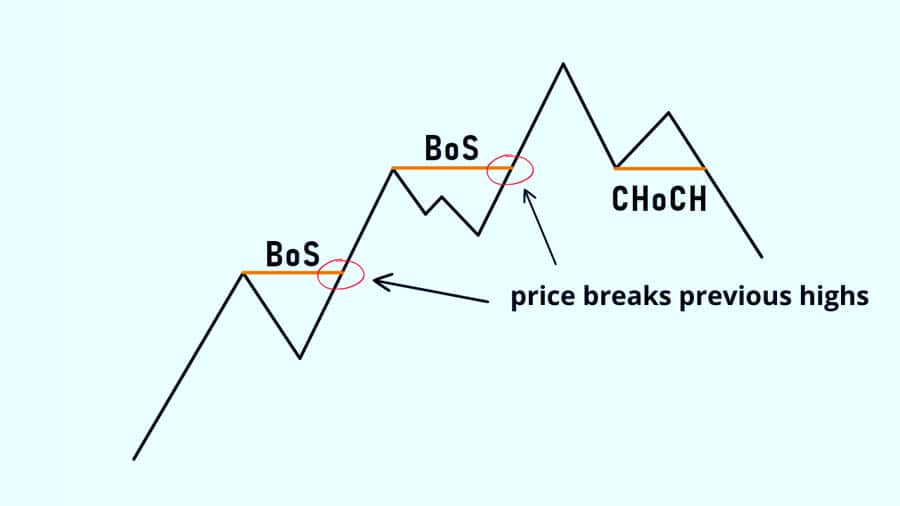

At its core, Break of Structure (BOS) is a fundamental concept within the Smart Money Concept (SMC) trading methodology. It serves as a critical signal indicating the continuation of an existing market trend. Think of BOS as the market confirming its direction, providing traders with a high-probability indication that the current trend is likely to persist. For those looking to trade forex using this concept, finding a suitable broker for forex trading is an important first step.

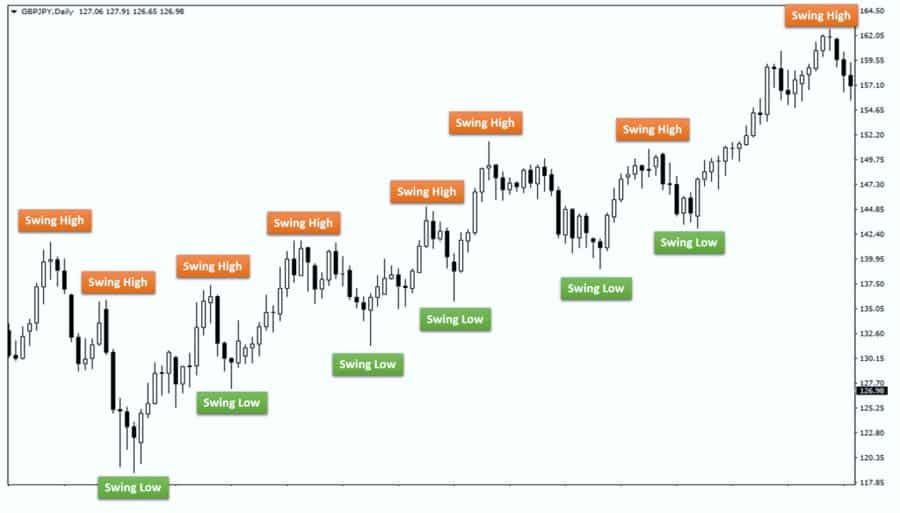

To truly grasp BOS, it’s essential to understand its role in market structure. Financial markets, whether it’s forex, stocks, or cryptocurrencies, move in trends. These trends are characterized by swings – highs and lows that create the visual structure we see on price charts. BOS occurs when price decisively breaks through a significant swing high in an uptrend or a significant swing low in a downtrend. This break signifies that the momentum is still in favor of the current trend. Many traders utilize a regulated forex broker to ensure their trading activities are conducted within a secure and compliant environment.

Defining BOS: The Engine of Trend Continuation

In simple terms, a Break of Structure happens when the price moves beyond a previous significant swing point, confirming the ongoing trend. It’s a validation signal that the market is continuing its established trajectory. Without BOS, it becomes challenging to confidently determine if a trend is still in play or if it’s about to reverse. Understanding BOS in SMC is crucial for any trader aiming to interpret market movements effectively.

BOS is not just any price movement; it’s a decisive break. This means the price action should convincingly move past the swing point, showing strength and momentum. A weak or hesitant break might be a false signal and could lead to misinterpretations. When selecting a broker for forex, consider platforms that offer robust charting tools to accurately identify BOS.

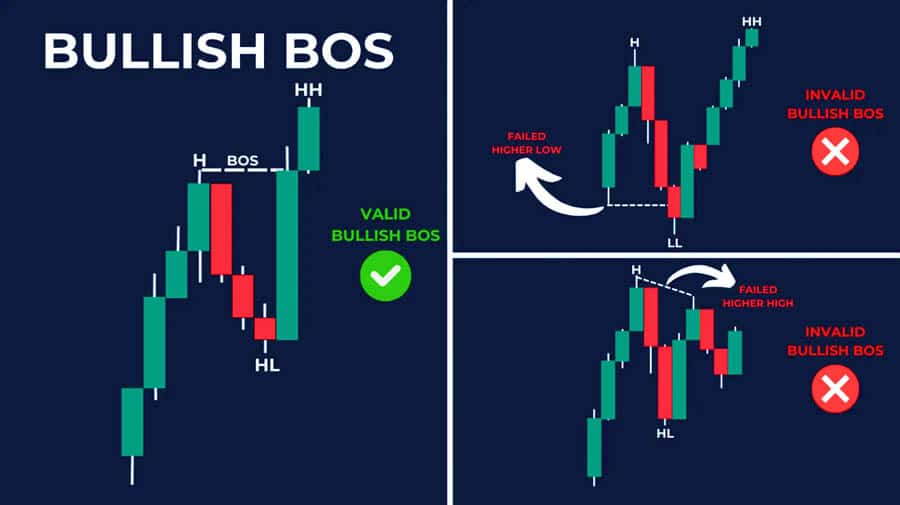

Bullish BOS: Riding the Uptrend Wave

In a bullish trend, characterized by rising prices, a bullish BOS is your confirmation signal. It occurs after the market forms a higher low and then proceeds to break above the previous higher high. This concept of BOS in Smart Money Concept is vital for identifying buying opportunities.

Imagine an ascending staircase pattern on your chart. Each step up represents a higher high, and each brief pause before the next step is a higher low. When the price decisively breaks above the most recent higher high, that’s your bullish BOS. This signifies that buyers are still in control, pushing prices upwards, and the uptrend is likely to continue. For traders using an online forex broker, recognizing bullish BOS can lead to profitable long positions.

For example, if you observe a price chart forming a series of higher highs and higher lows, and then the price surges past the last established higher high with strong bullish candles, you have witnessed a bullish BOS. This is a powerful signal to look for buying opportunities, aligning with the prevailing uptrend.

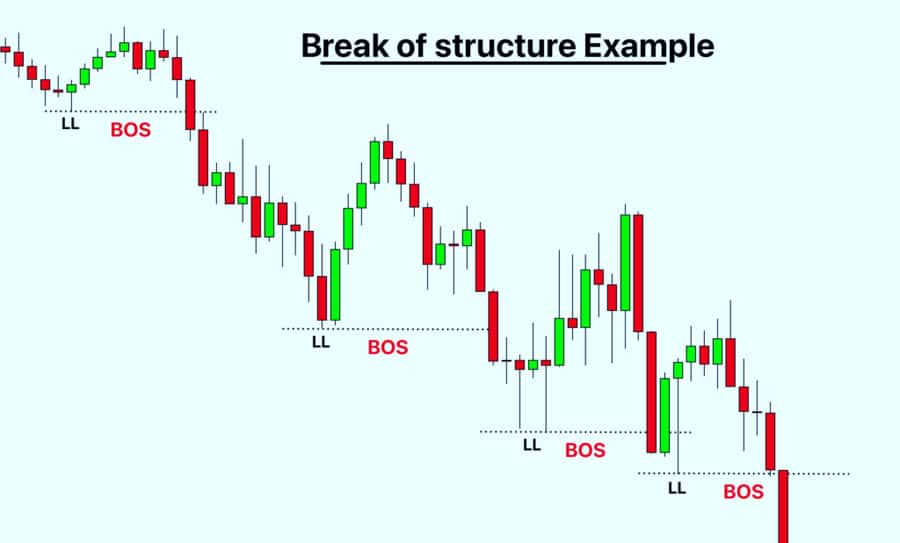

Bearish BOS: Navigating the Downtrend Descent

Conversely, in a bearish trend, where prices are falling, a bearish BOS signals the continuation of the downward momentum. It forms after the market establishes a lower high and then breaks below the previous lower low. Understanding bearish BOS in Smart Money Concept is key to profiting from downtrends.

Think of a descending staircase pattern. Each step down is a lower low, and each brief rally before the next step down is a lower high. When the price forcefully breaks below the most recent lower low, that’s your bearish BOS. This indicates that sellers remain dominant, driving prices lower, and the downtrend is expected to persist.

For instance, if you see a price chart forming a sequence of lower highs and lower lows, and then the price plunges below the last lower low with strong bearish candles, you have identified a bearish BOS. This is a strong signal to consider selling opportunities, trading in harmony with the ongoing downtrend.

Identifying BOS in Market Trends: Sharpening Your Market Vision

Effective Break of Structure recognition is crucial for Smart Money Concept trading. Context within market structure is key. Hone BOS identification across scenarios. Mastering BOS in SMC identification is fundamental to SMC trading.

Recognizing BOS in Various Timeframes: Multi-Dimensional Analysis

Market structure and BOS span timeframes. Analyze price action across multiple timeframes for comprehensive understanding. Higher timeframes (daily, 4-hour) show overall trends; lower (1-hour, 15-minute) offer granular entries. Analyzing BOS in Smart Money Concept across timeframes improves accuracy.

- Higher Timeframe BOS: Confirms dominant trend. Daily bullish BOS signals strong long-term uptrend, crucial for trading bias.

- Lower Timeframe BOS: Refines entries within higher timeframe trends. 1-hour bullish BOS in a daily uptrend provides precise long entry.

Multi-timeframe BOS analysis provides informed, accurate decisions, filtering noise and highlighting significant shifts. For regulated forex broker users, multi-timeframe analysis is standard.

Significance of Strong and Weak Swing Points: Distinguishing the Real Deal

Swing points vary in significance for market structure and BOS validity. Differentiating strong and weak swing points avoids false signals. Accurate Break of Structure in Smart Money Concept identification requires strong swing point distinction.

- Strong Swing Points: Significant highs/lows holding or causing price reactions, confirming trend continuation. They represent institutional order areas.

- Weak Swing Points: Minor highs/lows easily broken, unreliable for BOS, often causing false signals. Focus on strong points for genuine breaks.

Identify strong swing points where price reversed, consolidated, or reacted strongly. These levels are defended and significant when broken. When using an online forex broker platform, practice strong swing point identification.

Conclusive Move Past Significant Swing Points: Confirmation is Key

Valid Break of Structure needs a conclusive move past significant swing points, showing strength, not just touching or wicking. Confirmation is vital for BOS in Smart Money Concept.

- Strong Body Close: Candles closing decisively beyond swing points confirm BOS. Bullish BOS: body above swing high; bearish BOS: body below swing low.

- Increased Volume: BOS ideally has increased volume, suggesting strong participation and reliable signals.

- Avoid Wicks and False Breaks: Wicks or brief excursions beyond swing points are false breaks, not valid BOS. Wait for decisive breaks with strong body closes.

Confirmation is paramount for BOS. Avoid premature breaks. Patience and conclusive price action improve BOS accuracy and trade probability.

BOS vs. Change of Character (ChoCH): Decoding Market Shifts

Break of Structure (BOS) signals trend continuation; Change of Character (ChoCH) signals potential reversal. Distinguishing BOS and ChoCH is vital for adapting trading strategies. Confusing them leads to misinterpretations and errors. The difference between Break of Structure vs Change of Character is critical in SMC trading.

BOS: The Banner of Trend Continuation

BOS marks continuing trends, confirming prevailing momentum and trend persistence. Bullish BOS reinforces uptrends; bearish BOS solidifies downtrends. Recognizing BOS in SMC as continuation is fundamental.

BOS signals staying with trends. In trend-aligned trades, BOS strengthens conviction to hold or add. For new trades, BOS offers high-probability setups in trend direction.

ChoCH: The Harbinger of Potential Trend Reversal

Change of Character (ChoCH) signals potential trend weakening and reversal. ChoCH occurs when price breaks significant swing points against the trend. Understanding Break of Structure vs Change of Character helps anticipate shifts.

- Bullish ChoCH: In downtrends, price breaks above a recent lower high, suggesting seller weakness and potential uptrend reversal.

- Bearish ChoCH: In uptrends, price breaks below a recent higher low, suggesting buyer weakness and potential downtrend reversal.

ChoCH is an early trend shift warning, not a guaranteed reversal, but signals weakening trends and increased reversal probability. Be cautious trading with the old trend; look for opportunities in the opposite direction.

Trading Strategies Utilizing BOS: Actionable Steps to Profitability

Understanding Break of Structure (BOS) is only half the battle. The real power of BOS lies in its application within a robust trading strategy. Here’s a step-by-step approach to effectively utilize BOS in your trading. A well-defined strategy is essential for trading BOS in Smart Money Concept effectively.

Step 1: Trend Identification – Setting the Stage

Before looking for BOS, you must first identify the prevailing market trend. This is the foundation of any successful BOS-based strategy. Use higher timeframes (daily, 4-hour) to determine the overall trend direction. Trend identification is the first step in trading Break of Structure in Smart Money Concept.

- Uptrend: Look for a series of higher highs and higher lows.

- Downtrend: Look for a series of lower highs and lower lows.

- Range-Bound/Sideways: If neither of the above is clearly defined, the market might be in a range. BOS strategies are generally less effective in range-bound markets.

Once you’ve identified the trend direction on a higher timeframe, you can then focus on lower timeframes to look for BOS signals aligned with that trend. Trading in the direction of the dominant trend significantly increases your probability of success.

Step 2: Entry Points – Precision Timing After BOS

After identifying a BOS in the direction of the trend, the next step is to find optimal entry points. Waiting for a pullback or retracement after a BOS can provide better risk-to-reward ratios. Tools like Fibonacci retracement can be invaluable in identifying potential entry levels. Precise entry points are crucial for maximizing profits when trading BOS in smc.

- Fibonacci Retracement: After a bullish BOS, draw Fibonacci retracement levels from the swing low to the swing high that caused the BOS. Look for potential entry points at key Fibonacci levels (e.g., 38.2%, 50%, 61.8%) as price retraces after the BOS. Similarly, for a bearish BOS, draw Fibonacci retracement from the swing high to the swing low and look for entry points on the retracement.

- Order Blocks: Identify order blocks (areas of institutional accumulation or distribution) near Fibonacci retracement levels. These areas can act as strong support or resistance and provide high-probability entry zones after a BOS.

- Confirmation Candlesticks: Wait for confirmation candlesticks (e.g., bullish engulfing patterns after a bullish BOS, bearish engulfing patterns after a bearish BOS) at your chosen entry level to further validate your entry.

Patience is key when waiting for optimal entry points after a BOS. Don’t chase the market immediately after the break. Allow price to retrace to a favorable level before entering your trade. A patient approach to entry is vital when trading Break of Structure in Smart Money Concept.

Step 3: Stop Loss Placement – Risk Management is Paramount

Effective risk management is non-negotiable in trading. Proper stop loss placement is crucial for protecting your capital and limiting potential losses. When trading BOS setups, place your stop loss strategically near recent swing points. Risk management through stop loss placement is essential when trading BOS in Smart Money Concept.

- Below Swing Low (Bullish BOS): For long positions after a bullish BOS, place your stop loss slightly below the swing low that preceded the BOS. This level represents a critical support area, and a break below it would invalidate the bullish setup.

- Above Swing High (Bearish BOS): For short positions after a bearish BOS, place your stop loss slightly above the swing high that preceded the BOS. This level acts as a key resistance area, and a break above it would negate the bearish setup.

- Adjust Stop Loss as Price Moves: As the trade progresses in your favor, consider trailing your stop loss to lock in profits and further reduce risk. You can trail your stop loss to subsequent swing lows in an uptrend or swing highs in a downtrend.

Always determine your stop loss level before entering a trade. Never risk more than a small percentage of your trading capital on any single trade (e.g., 1-2%). Disciplined stop loss placement is a hallmark of successful BOS in SMC trading.

Step 4: Take Profit Targets – Defining Your Exit Strategy

Having clear take profit targets is as important as having well-defined entry and stop loss levels. Take profit targets should be based on market structure and potential areas of resistance (for long positions) or support (for short positions). Defining take profit targets is crucial for a complete strategy for trading Break of Structure in Smart Money Concept.

- Next Significant Swing High/Low: A common approach is to target the next significant swing high in an uptrend or the next significant swing low in a downtrend as your initial take profit target. These levels represent natural areas where price might encounter resistance or support.

- Fibonacci Extensions: Use Fibonacci extensions to project potential take profit levels beyond the initial swing target. Fibonacci extension levels (e.g., 161.8%, 261.8%) can provide targets for trades with strong momentum.

- Risk-to-Reward Ratio: Aim for a favorable risk-to-reward ratio (e.g., 1:2, 1:3 or higher). This means your potential profit should be at least twice or three times your potential risk (distance to stop loss). A good risk-to-reward ratio is essential for long-term profitability.

- Partial Profit Taking: Consider taking partial profits at intermediate levels to secure gains and reduce risk. You can close a portion of your position at the first target and let the remaining portion run towards higher targets.

Having a well-defined take profit strategy ensures that you capitalize on profitable trades and don’t let winning positions turn into losers. A clear exit strategy is as important as entry when trading BOS in Smart Money Concept.

Pro Tips for Advanced Traders: Elevating Your BOS Mastery

For traders looking to refine their Break of Structure (BOS) trading and take it to the next level, here are some advanced pro tips. Advanced techniques can further enhance your mastery of BOS in smc.

- Combine BOS with Order Flow Analysis: Integrate BOS with order flow analysis to gain deeper insights into market dynamics. Look for BOS confirmations alongside order flow signals that support the trend continuation. For example, in a bullish BOS, look for increasing buying pressure in order flow data.

- BOS in Confluence with Key Levels: Identify BOS that occur in confluence with other key technical levels, such as supply and demand zones, trendlines, or moving averages. Confluence of multiple signals increases the probability of a successful trade.

- Refined Entry Techniques: Explore advanced entry techniques beyond simple Fibonacci retracements. Consider using precision entries based on refined order blocks, imbalance zones, or candlestick patterns at retracement levels after a BOS.

- Dynamic Stop Loss Management: Implement dynamic stop loss management strategies that adapt to evolving market conditions. Consider using volatility-based stop losses (e.g., Average True Range – ATR) or adjusting stop losses based on market structure shifts.

- Multi-Timeframe Confluence: Seek BOS confirmations across multiple timeframes. For example, a bullish BOS on a 1-hour chart that aligns with a bullish BOS on a 4-hour chart provides a stronger signal than a BOS on a single timeframe alone.

- Backtesting and Forward Testing: Rigorous backtesting and forward testing are crucial for validating your BOS trading strategy and optimizing its parameters. Analyze historical data to assess the performance of your strategy and track its performance in live market conditions.

- Psychological Discipline: Mastering BOS trading also requires psychological discipline. Stick to your trading plan, avoid emotional decision-making, and manage your risk consistently. Patience and discipline are key to long-term success.

By incorporating these pro tips into your BOS trading approach, you can enhance your market analysis, improve your trade execution, and increase your overall trading profitability. Advanced traders often refine their approach to Break of Structure in Smart Money Concept with these techniques.

Common Mistakes and How to Avoid Them: Navigating the Pitfalls

Even with a solid understanding of Break of Structure (BOS), traders can fall into common pitfalls that hinder their success. Being aware of these mistakes and learning how to avoid them is crucial for consistent profitability. Avoiding common mistakes is crucial for successful bos in smart money concept trading.

- Mistake 1: Premature Entries Before Confirmation: One of the most frequent errors is entering trades prematurely before a valid BOS is confirmed. Traders might jump in based on a weak break or a mere wick past a swing point.

- Solution: Always wait for a conclusive break with a strong body close beyond the swing point. Look for increased volume to support the break. Patience is key – don’t rush into trades.

- Mistake 2: Ignoring Higher Timeframe Trend: Trading BOS against the higher timeframe trend is a recipe for disaster. Trying to buy in a downtrend or sell in an uptrend significantly reduces your probability of success.

- Solution: Always identify the higher timeframe trend first. Only look for BOS signals that align with the dominant trend direction. Trade with the trend, not against it.

- Mistake 3: Focusing on Weak Swing Points: Mistaking weak swing points for significant levels can lead to false BOS signals. Breaks of minor swing points are often unreliable and can result in whipsaws.

- Solution: Focus on strong swing points that have demonstrated significance in the market. Look for areas where price has previously reversed, consolidated, or reacted strongly.

- Mistake 4: Improper Stop Loss Placement: Placing stop losses too tightly or too far away can be detrimental. Tight stop losses can be triggered prematurely by market noise, while wide stop losses expose you to excessive risk.

- Solution: Place stop losses strategically near recent swing points, as outlined in the trading strategy section. Adjust stop loss placement based on market volatility and your risk tolerance.

- Mistake 5: Lack of Patience and Discipline: Impatience and lack of discipline can derail even the best BOS strategies. Chasing trades, deviating from your trading plan, and emotional decision-making are common pitfalls.

- Solution: Develop a well-defined trading plan and stick to it. Practice patience and wait for high-probability BOS setups to materialize. Manage your emotions and trade with discipline.

- Mistake 6: Over-Leveraging: Using excessive leverage amplifies both profits and losses. Over-leveraging in BOS trading can lead to significant capital losses if trades go against you.

- Solution: Use appropriate leverage levels that are aligned with your risk tolerance and trading capital. Never risk more than a small percentage of your capital on any single trade.

By being mindful of these common mistakes and actively working to avoid them, you can significantly improve your BOS trading performance and increase your chances of achieving consistent profitability. Avoiding these pitfalls is key to mastering Break of Structure in Smart Money Concept trading.

Opofinance: Your Partner in Smart Money Concept Trading

For effective Smart Money Concept strategies like BOS, choose a reliable, regulated forex broker. Opofinance, an ASIC regulated forex broker, offers a secure, robust trading environment.

Why Choose Opofinance?

- ASIC Regulation: Top-tier regulation ensures security and transparency.

- MT5 Platform: Featured on MT5 brokers list, offering advanced tools for SMC trading.

- Social Trading: Learn from experienced traders, accelerating your SMC learning.

- Safe Deposits/Withdrawals: Seamless, secure transactions.

- Competitive Conditions: Tight spreads, low commissions, fast execution.

Elevate your Smart Money Concept trading with a trusted broker!

Visit opofinance.com to explore services and open an account!

Conclusion: Mastering BOS for Market Mastery

In conclusion, Break of Structure (BOS) is an indispensable concept within the Smart Money Concept (SMC) trading framework. It serves as a powerful signal for trend continuation, providing traders with high-probability trading opportunities aligned with institutional market movements. Mastering BOS in Smart Money Concept is key to market mastery.

By understanding the nuances of bullish and bearish BOS, learning to identify BOS across multiple timeframes, and differentiating BOS from Change of Character (ChoCH), you equip yourself with the essential tools for navigating market structure effectively. Implementing a robust trading strategy that incorporates trend identification, precise entry points, strategic stop loss placement, and well-defined take profit targets is crucial for capitalizing on BOS signals. Understanding Break of Structure vs Change of Character is vital for strategic trading.

Avoiding common mistakes, such as premature entries, ignoring higher timeframe trends, and improper risk management, is equally important for consistent success. By mastering BOS and continuously refining your trading skills, you can unlock a deeper understanding of market dynamics and significantly enhance your trading performance. Consistent practice is essential for mastering BOS in smc.

Remember, mastering BOS is a journey that requires dedication, practice, and continuous learning. Embrace the process, stay disciplined, and you’ll be well on your way to trading with greater confidence and profitability. Dedication is key to mastering Break of Structure in Smart Money Concept.

Key Takeaways: BOS Essentials at a Glance

- Break of Structure (BOS) signals trend continuation in SMC trading.

- Bullish BOS confirms uptrends; bearish BOS confirms downtrends.

- Identify BOS across timeframes for market overview.

- Differentiate BOS from ChoCH (trend reversal signal).

- Use BOS in structured strategies with defined entries, stops, targets.

- Avoid common BOS trading mistakes.

- Practice and refine BOS trading skills.

Can BOS be used in all market conditions, including ranging markets?

While BOS is primarily designed for trending markets, it can be less effective in range-bound or sideways markets. In ranging markets, price action is often choppy and lacks clear directional momentum, leading to more false BOS signals. It’s generally advisable to focus on trading BOS in clearly trending markets for higher probability setups. In ranging markets, consider alternative strategies that are better suited for those conditions.

How do I determine the strength of a BOS signal?

The strength of a BOS signal can be assessed by considering several factors. A strong BOS is typically characterized by a decisive break of a significant swing point with strong body candles, accompanied by increased trading volume. The momentum of the price movement leading up to the BOS and the timeframe on which the BOS occurs also contribute to its strength. BOS signals on higher timeframes generally carry more weight than those on lower timeframes. Confluence with other technical factors, such as key support/resistance levels or order flow signals, can further strengthen a BOS signal.

Is BOS a standalone trading strategy, or should it be combined with other SMC concepts?

While BOS can be traded as a standalone concept, its effectiveness is significantly enhanced when combined with other Smart Money Concept principles. Integrating BOS with concepts like order blocks, liquidity sweeps, and imbalances provides a more holistic and robust trading approach. Combining BOS with order flow analysis can also offer deeper insights into market dynamics and improve trade selection. SMC trading is most powerful when different concepts are used in conjunction to create a confluence of signals, increasing the probability of successful trades.