A breakout trading strategy is a widely utilized approach in financial markets, especially in forex trading, where traders seek to capitalize on significant price movements that occur when an asset breaks through established support or resistance levels. This strategy involves monitoring price charts and identifying these key levels, which serve as psychological barriers for traders. When the price breaks above resistance or below support, it often signals a potential continuation of the trend, presenting an opportunity for traders to enter the market and ride the momentum.

Understanding breakout trading is essential for anyone looking to engage effectively in the forex market. By leveraging this strategy, traders can make informed decisions that maximize their chances of success. In particular, for traders focusing on forex, working with a regulated forex broker is crucial, as it ensures that they have access to reliable trading platforms and safe transaction processes.

In this article, we will delve deeper into the components of a successful breakout trading strategy, examining the critical techniques, indicators, and best practices that can enhance your trading performance. Whether you are a novice trader or looking to refine your existing strategy, this comprehensive guide will provide you with valuable insights and actionable steps to implement breakout trading effectively.

Introduction to Breakout Trading Strategy

Definition of Breakout Trading

Breakout trading is a strategy that focuses on identifying key price levels where an asset’s price has historically struggled to move beyond. When the price breaks through these levels, it often leads to increased volatility and momentum, offering traders opportunities to enter positions aligned with the new trend. The breakout trading strategy is particularly favored for its ability to generate strong risk-to-reward ratios, as it allows traders to enter trades at the beginning of new trends.

Breakout trading is defined by its focus on key price levels where the asset’s price has historically faced resistance or support.

Read More: 5 EMA Swing Trading Strategy

Why Traders Use Breakout Strategies

Traders utilize breakout trading strategies for several reasons:

- Profit Potential: Breakouts can lead to substantial price movements, allowing traders to capitalize on trends early.

- Market Clarity: Breakouts provide clear entry and exit signals based on technical analysis, reducing ambiguity in trading decisions.

- Momentum Trading: Traders can ride the momentum generated by breakouts, which often results in larger price swings.

- Applicability to Various Markets: Whether you are dealing with stocks, commodities, or forex markets, breakout strategies work across different asset classes. In forex, a breakout forex trading strategy often involves significant price movements caused by macroeconomic events or news releases, providing ample trading opportunities.

Traders employ breakout strategies to harness profit potential, clarity in market signals, momentum trading, and adaptability across various asset classes.

By understanding and implementing breakout strategies, traders can enhance their ability to navigate volatile markets effectively.

How Breakouts Occur

Understanding Support and Resistance Levels

Support and resistance levels are fundamental concepts in technical analysis. They form the backbone of the breakout trading strategy:

- Support: This is a price level where buying interest is strong enough to prevent the price from falling further. When a price breaks through a support level, it signals a potential downtrend or bearish breakout.

- Resistance: Conversely, resistance is where selling pressure overcomes buying interest, preventing the price from rising. A price that breaches a resistance level indicates the onset of an uptrend or bullish breakout.

Support and resistance levels are foundational elements that dictate the effectiveness of breakout trading strategies.

When prices break through these levels, it often indicates a shift in market sentiment that can lead to significant price movements. The breaking of these critical levels generates momentum that traders aim to capture through breakout trading strategies.

Types of Market Conditions for Breakouts

Breakouts can occur under various market conditions. Identifying the type of market structure you’re trading in helps improve the accuracy of your trades. Common patterns include:

- Channels: Price movements within parallel lines create channels. A breakout occurs when prices move outside these boundaries.

- Triangles: Triangular formations (ascending, descending, symmetrical) indicate consolidation before a breakout.

- Flags and Pennants: These patterns represent brief pauses in a trend before a continuation breakout occurs.

- Rectangles: Consolidation patterns that lead to a breakout when the price moves beyond the rectangle boundaries.

Recognizing market structures such as channels, triangles, flags, pennants, and rectangles enhances the accuracy of breakout trading.

By recognizing these market conditions, traders can anticipate potential breakout opportunities, enhancing the success rate of their breakout trading strategy.

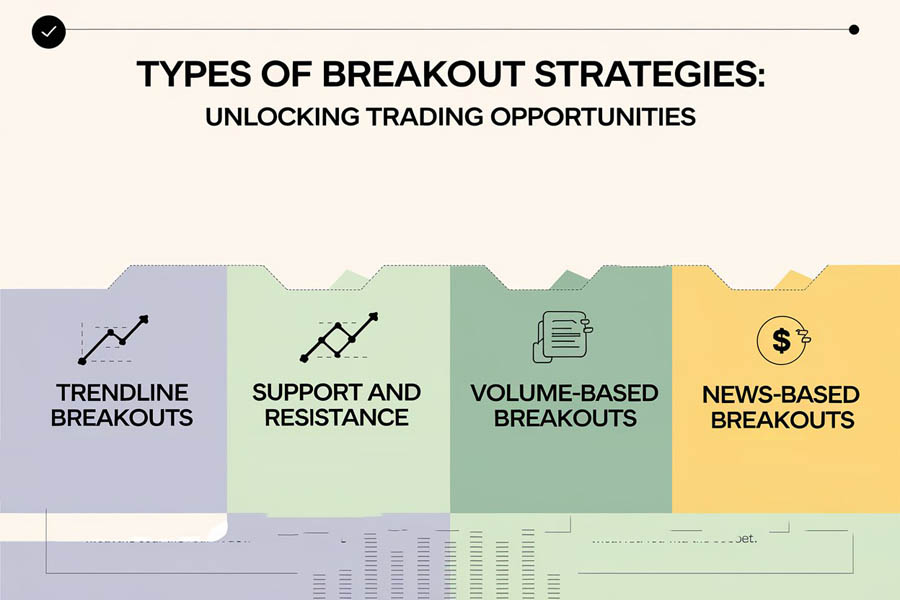

Types of Breakout Strategies

Momentum Breakouts

Momentum breakouts focus on entering trades immediately after a breakout occurs. Traders look for rapid price movements that signal strong buying or selling interest. These strategies work well in markets with high volatility, such as forex, where a breakout forex trading strategy can capitalize on sharp, news-driven price movements.

Continuation Patterns

Continuation patterns such as head and shoulders, wedges, or flags indicate that the prevailing trend is likely to continue after a brief consolidation period. Traders look for breakouts from these patterns to confirm their positions, expecting the trend to persist for an extended period.

Reversal Breakouts

Reversal breakouts occur when prices break through support or resistance levels after an established trend. This signals a potential change in direction, prompting traders to enter positions opposite to the previous trend. Reversal patterns are often found near the top or bottom of a market cycle.

Choosing the right type of breakout trading strategy depends on individual trading styles and market conditions. For instance, traders in the forex market may prefer a breakout forex trading strategy that captures reversals triggered by geopolitical events or interest rate changes.

Read More: Pivot Point Swing Trading Strategy

Identifying a Breakout Opportunity

Technical Analysis: Support & Resistance

Technical analysis plays a crucial role in identifying breakout opportunities. Traders analyze historical price data to determine key support and resistance levels. Identifying these levels is crucial because they often act as psychological barriers, dictating the behavior of the market.

Volume Indicators and Confirmation

Volume is an essential indicator in breakout trading. An increase in volume during a breakout confirms its validity. Traders often look for volume spikes as confirmation signals before entering trades. In forex markets, volume may not be as easily measurable, but liquidity and volatility during breakouts can act as substitutes.

Common False Breakouts (Fakeouts) and How to Avoid Them

False breakouts occur when prices briefly move beyond support or resistance levels but quickly reverse back. This phenomenon, also known as a “fakeout,” can trap traders into losing trades. To avoid fakeouts:

- Wait for Confirmation: Ensure that there is sufficient volume supporting the breakout before entering a trade.

- Use Multiple Indicators: Combine various technical indicators (like moving averages, RSI, or MACD) for added confirmation.

Being aware of false breakouts can help traders make more informed decisions, ensuring they don’t fall into common traps associated with breakout trading strategies.

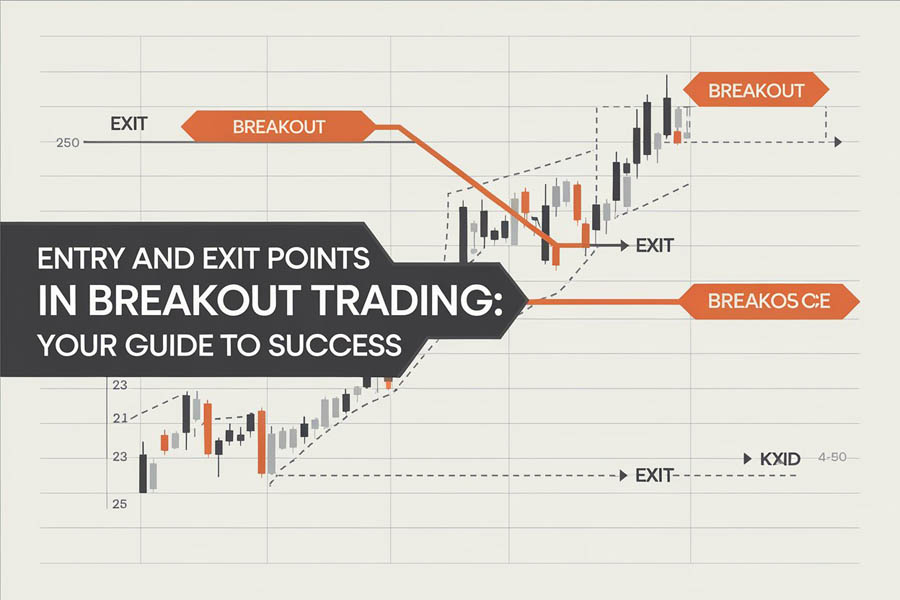

Entry and Exit Points in Breakout Trading

How to Enter a Long or Short Position

To enter a long position during a bullish breakout:

- Identify key resistance levels.

- Enter just above the resistance level once it’s broken.

For short positions, enter just below support levels during bearish breakouts. The timing of entry is crucial as premature or delayed entries can result in diminished profits or losses.

Read More: vwap swing trading strategy

Timing Your Entry: Confirmation of Breakout

Timing is crucial in breakout trading. Traders should wait for confirmation signals—such as sustained price movement beyond key levels—before executing trades. The best breakout trading strategies often involve a combination of price action, volume, and volatility measures to time entries accurately.

Using Stop-Loss and Take-Profit Orders

Implementing stop-loss orders is vital for managing risk. Place stop-loss orders just below support levels for long trades or above resistance for short trades. Additionally, set take-profit orders at predetermined levels based on historical price movements or technical indicators.

Stop-loss and take-profit levels are especially important in a breakout forex trading strategy, where rapid price changes can trigger significant gains or losses within minutes.

Risk Management in Breakout Trading

Breakout trading is inherently risky due to its reliance on volatile market conditions, making risk management an essential aspect of a successful breakout trading strategy. Traders must implement risk control measures to minimize potential losses, especially when trading in highly unpredictable markets like forex or cryptocurrencies.

Importance of Managing Volatility

Volatility is a key factor in determining the success or failure of a breakout forex trading strategy. While breakouts can lead to significant price movements, high volatility also brings unpredictable swings, which can result in false breakouts or “fakeouts.” Understanding and managing volatility ensures that traders are better prepared for these sudden price movements, helping them adjust their strategies to stay in control.

For instance, during major economic announcements, forex markets often experience spikes in volatility. Traders must be cautious during these periods, as false signals can occur frequently. Monitoring volatility indicators like the Average True Range (ATR) helps traders gauge the level of market turbulence and adjust their positions accordingly.

Mitigating Risk Through Stop-Loss Strategies

One of the most effective ways to manage risk in breakout trading is by using stop-loss orders. These predefined exit points automatically close a trade when the price moves against the trader, limiting potential losses. For instance, in a breakout forex trading strategy, placing a stop-loss order just below the support level in a bullish breakout or above the resistance level in a bearish breakout is common practice.

Using tight stop-losses can protect against fakeouts, while looser stop-losses allow more room for price fluctuations without prematurely exiting a trade. Traders can adjust their stop-loss strategy based on the volatility of the asset and the strength of the breakout.

Retesting Levels: When to Exit Early

After an initial breakout, it’s common for the price to retest the broken support or resistance level. If the price fails to maintain momentum and falls back to the original level, it may indicate that the breakout is losing strength. In such cases, exiting the position early can help secure profits or minimize losses before the price reverses entirely.

Traders often use technical indicators such as the Relative Strength Index (RSI) or Moving Averages to confirm whether a breakout is likely to continue or if it’s time to exit early. Implementing robust risk management strategies, such as monitoring retests, enhances long-term trading success.

Pros and Cons of Breakout Trading

Like any trading strategy, breakout trading comes with its own set of advantages and disadvantages. Understanding these pros and cons helps traders make informed decisions on whether to incorporate breakout strategies into their trading plans.

Advantages

- Higher Volatility: Breakout trading thrives in volatile markets, providing opportunities to capitalize on rapid price swings. This is particularly relevant in markets like forex and cryptocurrencies, where volatility is frequent.

- Clear Entry Signals: Breakout trading relies heavily on technical analysis, offering clear and easily identifiable entry signals. Traders can make quick decisions based on the breach of support or resistance levels, ensuring timely market entries.

Disadvantages

- Risk of Fakeouts: One of the biggest challenges in breakout trading is the risk of false breakouts or fakeouts. If traders enter the market prematurely before confirmation, they can suffer losses when prices reverse shortly after breaking key levels.

- High Monitoring Requirements: To be successful in breakout trading, traders must constantly monitor market conditions and price movements. This can be time-consuming and mentally taxing, especially during volatile periods.

By weighing these pros and cons, traders can develop a more balanced approach to incorporating breakout trading strategies into their broader trading framework.

Popular Breakout Patterns to Trade

Recognizing and trading well-established breakout patterns is key to a successful breakout trading strategy. These patterns help traders anticipate future price movements and guide them in making timely entries and exits.

Channels

Channels consist of two parallel lines that contain the asset’s price movements. These lines represent support and resistance levels. A breakout occurs when the price breaches either boundary, signaling the start of a new trend. In a bullish breakout, the price breaks above the resistance line, while a bearish breakout happens when the price drops below the support line.

Triangles (Ascending, Descending, Symmetrical)

Triangles are consolidation patterns that indicate a potential breakout is coming.

- Ascending Triangles: These triangles form when resistance remains relatively flat, but the price forms higher lows, signaling a bullish breakout.

- Descending Triangles: The opposite of ascending triangles, these indicate a bearish breakout when the price forms lower highs while the support level remains constant.

- Symmetrical Triangles: This pattern involves converging support and resistance lines, signaling that a breakout could occur in either direction.

Flags and Pennants

Flags and Pennants are continuation patterns that appear after strong price movements, often indicating that the trend will resume after a brief consolidation. Traders watch for price breakouts from these patterns to confirm the continuation of the trend.

Understanding these breakout patterns equips traders with the tools they need to identify profitable opportunities and time their entries for maximum impact.

Breakout Trading Across Different Markets

Breakout trading is versatile and can be applied across various financial markets, including forex, stocks, commodities, and cryptocurrencies. Each market behaves differently during breakouts, and traders should tailor their strategies accordingly.

Forex Breakouts

In the forex market, breakouts frequently occur around major economic news releases or geopolitical events. For example, announcements of interest rate changes or employment data can trigger significant breakouts in currency pairs. A well-timed breakout forex trading strategy can capture these movements and lead to substantial gains.

Stock Market Breakouts

In the stock market, breakouts often occur in response to earnings reports, corporate news, or sector-wide events. Traders use breakout strategies to capture price movements that result from unexpected news or positive earnings surprises.

Breakouts in Commodities and Cryptocurrencies

Commodities like gold, oil, and agricultural products can experience breakouts due to factors like supply chain disruptions or changes in global demand. Similarly, cryptocurrencies are known for their extreme volatility, creating frequent breakout opportunities. Cryptocurrency traders capitalize on these movements, particularly after major events like regulatory changes or technology upgrades.

By understanding how different markets react during breakouts, traders can optimize their strategies for each asset class.

Trade with Confidence at Opofinance!

Unlock the potential of your trading journey with Opofinance, the premier broker designed for traders seeking reliability and growth. Enjoy a seamless trading experience with our ASIC regulation, ensuring that your investments are safe and secure.

- Join the MT5 Brokers List: Experience advanced trading features with the renowned MetaTrader 5 platform. Benefit from robust analytical tools and a user-friendly interface that empowers your trading decisions.

- Engage in Social Trading: Connect with a vibrant community of traders! Utilize our Social Trading services to follow and copy the strategies of successful traders, making it easier for you to learn and grow.

- Safe Deposit and Withdrawal Methods: We prioritize your security! Our platform offers a variety of reliable methods for deposits and withdrawals, ensuring a hassle-free experience every time.

Experience the best in trading with Opofinance, where your success is our priority. Visit us at opofinance.com to start your trading journey today!

Conclusion

Mastering the breakout trading strategy can offer significant profit opportunities by capitalizing on momentum following key price level breaches. By understanding essential concepts such as support and resistance levels, identifying various market conditions, implementing effective risk management techniques, and recognizing popular breakout patterns, traders can enhance their success in both forex and other markets.

As you refine your breakout trading skills, always remember that discipline, patience, and continuous learning are vital components of long-term success in the trading world.

How can I differentiate between a real breakout and a fakeout?

A real breakout typically occurs with strong volume and price momentum, signaling that the market is committed to the new trend direction. Traders can use volume indicators, such as the On-Balance Volume (OBV) or Volume Weighted Average Price (VWAP), to confirm whether a breakout is backed by sufficient market interest. On the other hand, a fakeout often happens with lower volume and weaker price movement, making it more prone to reversal. Waiting for a retest of the breakout level can also help confirm the validity of the breakout before entering a trade.

Should breakout traders only trade during volatile market conditions?

While volatility can create ideal conditions for breakouts due to larger price movements, it’s not always necessary to trade only during periods of high volatility. Many traders prefer to trade during more stable market conditions where breakouts are more predictable. That said, volatile markets tend to provide more opportunities for larger profits, albeit with higher risk. Traders should adapt their strategies based on the market environment, whether it’s high or low volatility.

Is breakout trading suitable for beginners?

Breakout trading can be a challenging strategy for beginners because it requires a good understanding of technical analysis, pattern recognition, and market conditions. However, with proper education and practice, new traders can use simplified breakout strategies. It’s advisable for beginners to start with smaller trades, use stop-loss orders to minimize risks, and focus on learning to identify strong breakout patterns before increasing trade sizes.