Deciding between cTrader vs MetaTrader 5 is a critical choice that shapes a trader’s entire market experience. For many, this decision is as important as selecting a regulated forex broker. The right platform can streamline analysis, improve execution speed, and unlock advanced trading strategies, while the wrong one can be a source of constant frustration. This comprehensive comparison dives deep into every facet of the cTrader vs MT5 debate, covering user interface, charting tools, automated trading, fees, and real-world user feedback. We will explore which platform is better suited for different trading styles, helping you make an informed choice that aligns perfectly with your financial goals.

Key Takeaways

- Core Difference: MetaTrader 5 is the industry standard, known for its massive community and extensive library of automated trading bots (Expert Advisors). cTrader is the modern challenger, focusing on a superior user interface, advanced order types, and transparency, often favored by ECN brokers.

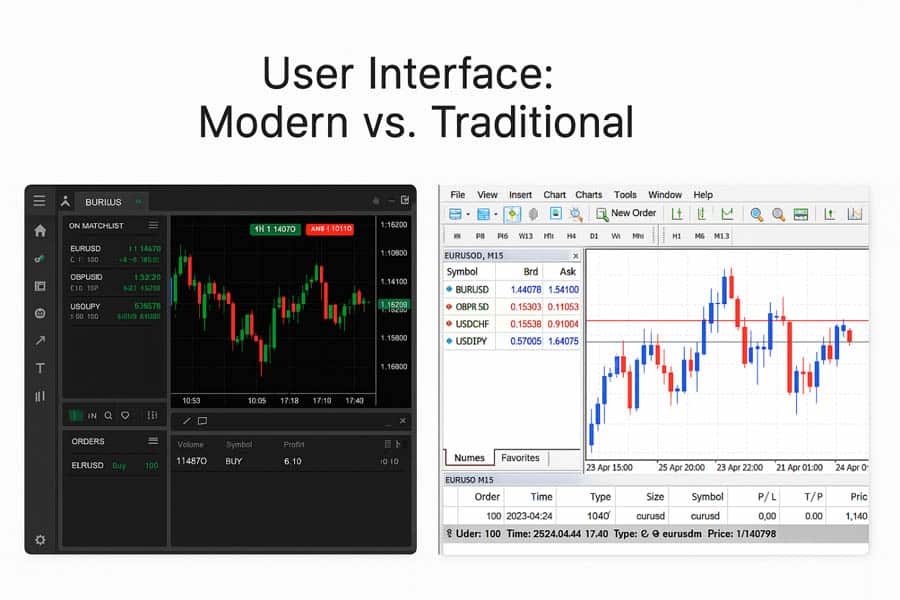

- User Interface: cTrader offers a sleek, intuitive, and modern design that is generally considered more user-friendly for beginners. MT5 has a more traditional, robust interface that, while highly functional, can feel dated and has a steeper learning curve.

- Automated Trading: This is a key battleground in the MT5 vs cTrader debate. MT5 uses the MQL5 language, which has a vast, decades-old ecosystem of developers and ready-made bots. cTrader uses the more universal and powerful C# language, appealing to developers but with a smaller, though growing, community library.

- Charting & Tools: Both platforms offer powerful charting capabilities. MT5 provides more timeframes and technical indicators out of the box. However, cTrader’s charting is often praised for its clean look and feel, alongside unique features like integrated Depth of Market (DoM).

- Broker Availability: MetaTrader 5 is offered by a significantly larger number of brokers worldwide. Finding a cTrader broker is less common, which can limit a trader’s options.

- Best For Whom: MT5 is often the go-to for traders heavily reliant on automated strategies and a large community marketplace. cTrader is ideal for discretionary traders who prioritize a modern user experience, advanced order functionality, and a transparent ECN trading environment.

Introduction to Trading Platforms

A trading platform is a software application provided by brokers to their clients for managing and executing market positions. It’s the bridge between a trader and the complex world of financial markets, including forex, stocks, and commodities. The importance of choosing the right platform cannot be overstated. It directly impacts everything from the quality of your market analysis to the speed of your trade executions and the overall cost of trading. A well-suited platform acts as a powerful ally, while a poorly chosen one can be a significant handicap, making the cTrader vs MetaTrader 5 decision a fundamental step for any serious trader.

cTrader vs MetaTrader 5: Quick Comparison

To understand the core differences at a glance, a side-by-side summary is essential. This table breaks down the main features of the cTrader vs MT5 matchup, giving you a quick reference for what each platform excels at before we dive into the detailed analysis.

| Feature | MetaTrader 5 (MT5) | cTrader |

| User Interface | Traditional, highly functional, somewhat dated | Modern, intuitive, clean, and user-friendly |

| Best For | Algorithmic traders, users needing a huge library of bots | Discretionary traders, beginners, ECN traders |

| Automated Trading | MQL5 language, vast Expert Advisor (EA) marketplace | C# language, growing cBot library, open API |

| Charting | 21 timeframes, 38 built-in indicators, extensive drawing tools | 9 chart types, 54 timeframes (tick, standard, Heikin Ashi), 70+ indicators |

| Order Execution | Supports various models (NDD, DD), fast execution | Primarily designed for ECN/STP environments, advanced order protection |

| Copy Trading | Integrated via MQL5 community signals | Built-in feature (cTrader Copy), more transparent fee structure |

| Broker Availability | Extremely widespread; the industry standard | Limited but growing number of supporting brokers |

| Mobile App | Full-featured app for iOS and Android | Sleek, highly-rated app with cloud sync |

MetaTrader 5 Overview

Developed by MetaQuotes Software, MetaTrader 5 was released in 2010 as the successor to the immensely popular MetaTrader 4. While its adoption was initially slow, MT5 has now established itself as a multi-asset powerhouse. Its core strength lies in its versatility and its unparalleled ecosystem for automated trading. It’s designed to be a one-stop shop for traders, supporting a vast range of instruments from forex and futures to stocks and options. The user base is enormous, consisting of everyone from retail beginners to large financial institutions, making it the most recognized platform in the online trading industry. The debate of cTrader vs MetaTrader 5 often begins with acknowledging MT5’s dominant market position.

cTrader Overview

cTrader was launched by Spotware Systems in 2011 with a clear intention: to create a platform that put traders first. It was built from the ground up to operate in a true Non-Dealing Desk (NDD) environment, offering direct market access (DMA) and ensuring a more transparent trading process. Its key differentiator has always been its modern, uncluttered user interface and its focus on advanced order capabilities and execution quality. cTrader caters heavily to forex and CFD traders and is often the platform of choice for brokers who want to showcase their ECN/STP credentials. While its user base is smaller than MT5’s, it has a fiercely loyal following, particularly among discerning discretionary traders who value design and transparency.

Read More: MetaTrader 4 vs MetaTrader 5

ctrader vs mt5: User Interface

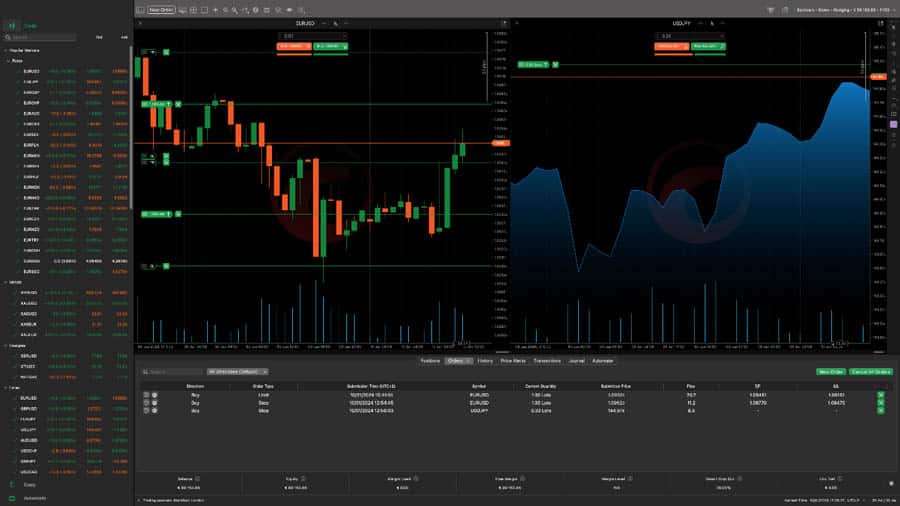

The user interface (UI) is where the most immediate and striking differences between the platforms emerge. It’s a central point in the cTrader vs MT5 discussion, as it directly impacts usability and workflow efficiency. The choice here often comes down to a preference between a classic, function-over-form layout and a modern, aesthetically pleasing design.

Layout and Navigation

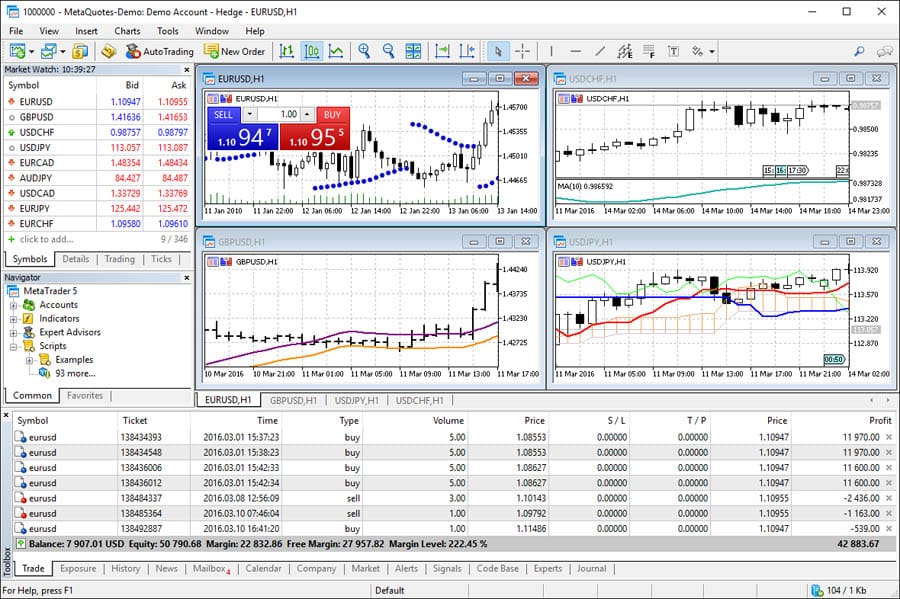

MetaTrader 5 features a traditional and highly customizable layout that has remained largely unchanged for years. It typically consists of four main windows: Market Watch, Navigator, Chart Window, and Terminal. While it feels robust and packed with information, new users often describe it as cluttered and intimidating. Its navigation is powerful but requires a learning curve. In contrast, cTrader’s interface is frequently praised for being clean, modern, and intuitive from the moment you open it. Its layout is more streamlined, with a logical flow that makes finding tools and features straightforward, even for absolute beginners.

Customization and Experience

Both platforms offer significant customization. MT5 allows traders to arrange windows, save profiles, and create templates extensively. cTrader also provides flexible workspace options, detachable charts, and various themes. Where cTrader shines is in its multi-chart experience and cloud-based functionality. Workspaces and settings are saved to the cloud and synced across all devices (desktop, web, and mobile) seamlessly. The mobile experience in the metatrader 5 vs ctrader comparison is another win for cTrader, with its app often feeling more like a native, modern financial app than a port of a desktop program.

Charting Tools & Technical Analysis

For technical traders, charting is the heart of a platform. The ability to analyze price action effectively with a comprehensive set of tools is non-negotiable. Both MT5 and cTrader deliver exceptional charting packages, but they cater to slightly different analytical styles and preferences.

Chart Styles and Timeframes

MetaTrader 5 is a beast when it comes to timeframes, offering 21 distinct periods, ranging from one-minute to one-month charts. This granularity is a significant advantage for traders who employ multi-timeframe analysis. It includes the standard line, bar, and candlestick charts. cTrader, on the other hand, offers more chart types, including Tick charts, Renko, and Range bars, which are invaluable for scalpers and short-term traders. It boasts an impressive 54 timeframes when combining its standard and non-standard options, giving traders incredible flexibility in how they view market data. The MT5 vs cTrader charting debate highlights MT5’s timeframe variety against cTrader’s chart type diversity.

Read More: what is mt5

Indicators and Drawing Objects

Out of the box, MT5 comes loaded with 38 technical indicators and 44 graphical objects, providing a solid foundation for any analyst. However, its true power comes from the thousands of free and paid custom indicators available in the MQL5 marketplace. cTrader includes over 70 built-in indicators and a wide array of drawing tools. While its community library is smaller, the quality of the available tools is generally high. A key feature in cTrader is the ability to see order volumes directly on the chart, a level of transparency that MT5 does not offer natively.

Algorithmic & Automated Trading

Automated trading is arguably the most significant battleground in the cTrader vs MetaTrader 5 comparison. This is where the platforms diverge most in terms of philosophy, technology, and community support. The choice here depends heavily on a trader’s programming skills and their reliance on automated strategies.

Programming Languages: MQL5 vs C#

MetaTrader 5 uses its proprietary language, MetaQuotes Language 5 (MQL5). It’s a C++ based language specifically designed for developing trading robots, indicators, and scripts. While powerful, its main drawback is that it’s only useful within the MetaTrader ecosystem. cTrader utilizes C#, one of the most popular and versatile programming languages in the world. This is a massive advantage for developers, as they can use their existing skills and powerful tools like Visual Studio to create sophisticated trading bots (known as cBots). The learning curve for C# can be steeper for non-programmers, but its capabilities are far greater than MQL5’s.

EAs vs cBots and Backtesting

In MT5, automated strategies are called Expert Advisors (EAs). The platform includes a robust Strategy Tester that allows for multi-threaded backtesting and optimization of EAs against historical data. The ecosystem is its greatest strength; the MQL5 marketplace is the largest in the world for trading bots. cTrader’s bots are called cBots. The platform offers excellent backtesting tools with detailed analytics and a visual representation of trades on the chart. While the cTrader community and marketplace are smaller, they are growing rapidly, driven by the appeal of the C# language. For developers looking for an open and modern environment, cTrader is often the superior choice.

Read More: What is cTrader

Order Execution, Fees, and Transparency

How a platform handles orders and the transparency of its fee structure are critical for profitability. This section examines the core differences in execution models and cost visibility between the two platforms.

Execution Models and Order Types

cTrader was fundamentally built for an ECN/STP (Electronic Communication Network/Straight Through Processing) environment. This means it’s designed to send orders directly to liquidity providers, ensuring no dealing desk intervention. This transparency is a core selling point. It also offers advanced order types not found in MT5, such as Time-Weighted Average Price (TWAP) and Volume-Weighted Average Price (VWAP) orders, alongside sophisticated stop-loss and take-profit settings. MetaTrader 5 is more flexible and can be used by brokers with various execution models, including dealing desks. While it supports market and pending orders, it lacks the advanced protection and complex order types native to cTrader. The cTrader vs MT5 choice often hinges on this desire for ECN purity.

Speed, Costs, and Commissions

Execution speed on both platforms is generally excellent, but cTrader’s focus on direct market access often gives it a perceived edge in low-latency environments. Regarding costs, the platform itself doesn’t determine the fees—the broker does. However, cTrader’s design promotes transparency. It clearly separates the raw spread from the broker’s commission, allowing traders to see exactly what they are paying for each trade. In MT5, the commission is often bundled into the spread, which can make it harder to assess true trading costs. For traders seeking maximum clarity on fees, cTrader is typically the better option.

Supported Assets & Instrument Diversity

The range of available financial instruments is another crucial factor. While the broker ultimately determines which assets are offered, the platform must have the capability to support them. The metatrader 5 vs ctrader comparison reveals two multi-asset platforms with slightly different areas of focus.

Forex, Stocks, Commodities, and More

MetaTrader 5 was designed from the ground up to be a true multi-asset platform, capable of handling both centralized and decentralized markets. This means it can seamlessly support forex, CFDs, stocks, futures, and options all from a single interface. This is one of its primary advantages over its predecessor, MT4. cTrader also supports a wide range of asset classes, including forex and CFDs on indices, commodities, and cryptocurrencies. However, its native support for exchange-traded instruments like stocks and futures is less developed than MT5’s, making MT5 the superior choice for traders seeking the absolute broadest instrument diversity through a single platform.

Depth of Market (DoM)

Both platforms offer Depth of Market data, which shows the available liquidity at different price levels. cTrader, however, integrates it more deeply into its interface and offers three distinct DoM types: Standard DoM, Price DoM, and VWAP DoM. This provides a more comprehensive view of market liquidity, which is especially useful for scalpers and volume traders. MT5’s DoM is functional but less feature-rich, further cementing cTrader’s reputation as the platform for traders who prioritize detailed liquidity analysis.

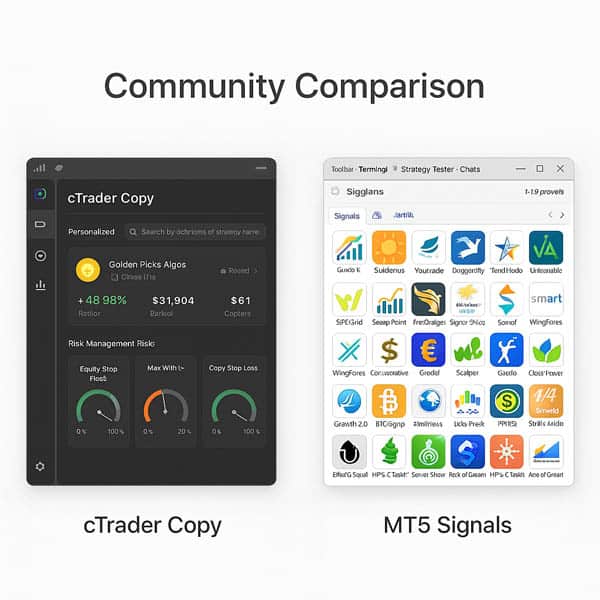

Social & Copy Trading Features

Copy trading allows users to automatically replicate the trades of experienced and successful traders. It has become incredibly popular, and both platforms have integrated robust solutions to cater to this demand.

MT5’s copy trading is offered through its “Signals” service, which is deeply integrated into the MQL5 community platform. Traders can subscribe to thousands of signal providers directly from the platform. The sheer size of the marketplace is its biggest advantage. cTrader’s solution, “cTrader Copy,” is a built-in feature that is often praised for its transparency and advanced risk management tools. It allows investors to set specific equity stop-losses and control their risk more granularly than on MT5. The fee structure is also very clear. In the MT5 vs cTrader social trading race, MT5 wins on quantity, while cTrader wins on quality and transparency.

cTrader vs MT5: Security and Reliability

When real money is on the line, the security and stability of your trading platform are paramount. Both platforms are considered highly secure and reliable, built with institutional-grade infrastructure to ensure high uptime and data protection.

Both cTrader and MetaTrader 5 employ robust encryption protocols to protect user data and financial transactions. Platform stability is excellent on both sides, with crashes or freezes being extremely rare. The key difference in security often comes down to the broker, not the platform itself. It is crucial for traders to choose a well-regulated broker to ensure the safety of their funds. cTrader’s cloud-based infrastructure offers an additional layer of reliability, as all workspace settings and account information are backed up externally, allowing for seamless recovery and cross-device syncing.

Mobile Trading Experience

In today’s fast-paced world, the ability to manage trades on the go is essential. The mobile trading experience is a key consideration in the cTrader vs MetaTrader 5 debate, and here, cTrader often takes the lead.

Both platforms offer full-featured mobile applications for iOS and Android devices, allowing traders to perform analysis, place orders, and manage their accounts from anywhere. The MT5 mobile app is powerful and includes most of the desktop version’s core functionalities. However, its interface can feel less intuitive and slightly dated. The cTrader mobile app, on the other hand, is frequently lauded for its sleek, modern design and superior user experience. It feels like it was designed for mobile-first, with smooth navigation and excellent charting capabilities. The seamless cloud syncing of watchlists, workspaces, and analysis across desktop, web, and mobile gives it a distinct edge for traders who frequently switch between devices.

Community, Support, and Ecosystem

The size and quality of a platform’s community can be a significant resource, providing support, custom tools, and shared knowledge. Here, the long-standing dominance of MetaTrader gives it a substantial advantage.

The MetaTrader community is the largest and most active in the retail trading world. The MQL5 forum is a massive repository of information, tutorials, and expert discussions. The marketplace offers an unparalleled number of free and commercial EAs, indicators, and scripts. This vast ecosystem is one of MT5’s most compelling features. The cTrader community, while smaller, is highly engaged and supportive. The official cTrader forum is actively monitored by Spotware developers, who often respond directly to user queries and feature requests. This direct line to the developers is a unique benefit. Ultimately, the metatrader 5 vs ctrader community comparison is a choice between the massive, sprawling ecosystem of MT5 and the more tight-knit, developer-focused community of cTrader.

User Experiences (Hands-On, Reviews)

Beyond technical specifications, real-world user feedback provides invaluable insight. Forum discussions and reviews reveal a clear pattern: traders choose their platform based on their primary trading style and priorities.

Professional discretionary traders and scalpers frequently praise cTrader for its superior UI/UX, advanced order types, and transparent ECN environment. They value the “feel” of the platform and the detailed DoM data. As one user on a popular forum noted, “Once you get used to cTrader’s clean interface and one-click trading, going back to MT5 feels like a downgrade.” Conversely, traders who rely heavily on algorithmic strategies or who have invested years in the MetaTrader ecosystem are staunch defenders of MT5.

They point to the massive library of EAs and the endless customization possibilities as unbeatable advantages. Many proprietary trading firms have also started offering cTrader as their preferred platform, citing its risk management features and transparency as better suited for their evaluation models.

Key Differences Summarized

To consolidate the extensive comparison of cTrader vs MetaTrader 5, here are the main strengths and drawbacks of each platform in a nutshell. This summary helps to highlight the core trade-offs a user makes when choosing one over the other.

- MetaTrader 5’s Strengths: Unmatched community size, largest marketplace for automated bots (EAs), wider broker availability, and superior support for diverse, exchange-traded assets.

- MetaTrader 5’s Drawbacks: Dated user interface, steeper learning curve for beginners, and a proprietary programming language (MQL5) with no use outside its ecosystem.

- cTrader’s Strengths: Modern and intuitive user interface, superior charting experience, advanced order types and transparency (ideal for ECN), and use of the universal C# programming language.

- cTrader’s Drawbacks: Smaller community and marketplace, much more limited broker selection, and less native support for non-CFD assets like stocks and futures.

Who Should Use cTrader or MetaTrader 5?

The final decision in the cTrader vs MT5 dilemma comes down to individual needs. There is no single “better” platform; there is only the platform that is better for *you*. Here’s a breakdown to help you decide.

You should choose MetaTrader 5 if:

- You want to use automated trading robots (EAs) and need access to the largest possible library.

- You want the widest possible choice of brokers.

- You plan to trade a diverse range of assets, including exchange-traded stocks and futures.

- You are already familiar with the MetaTrader environment (e.g., from MT4).

You should choose cTrader if:

- You are a discretionary trader who values a clean, modern, and intuitive user interface.

- You prioritize a transparent ECN/STP trading environment with clear fee structures.

- You need advanced order types and sophisticated risk management tools.

- You are a developer who prefers to code in the powerful and universal C# language.

Trade with Opofinance

Elevate your trading journey with Opofinance, an ASIC-regulated broker committed to your success. Access the world’s markets through a suite of powerful platforms and cutting-edge tools.

- Advanced Trading Platforms: Choose from industry standards like MT4, MT5, and cTrader, or use our proprietary OpoTrade platform.

- Innovative AI Tools: Gain a competitive edge with our AI Market Analyzer, AI Coach, and 24/7 AI Support.

- Flexible Trading Options: Explore opportunities in Social & Prop Trading to diversify your strategies.

- Secure & Convenient Transactions: Enjoy peace of mind with safe deposits and withdrawals, including crypto payments with zero fees.

Start Trading with Opofinance Today

Final Verdict: ctrader vs mt5

The cTrader vs MetaTrader 5 debate is a classic battle between an established industry giant and a modern, innovative challenger. MetaTrader 5 remains the king of algorithmic trading and broker availability. Its massive ecosystem is a fortress that is hard to assail. However, cTrader has successfully carved out a significant niche by focusing on what many modern traders value most: a superior user experience, transparency, and advanced features for discretionary trading. For the discerning trader of 2025, cTrader represents the future, while MT5 represents unparalleled legacy and reach.

Which is better for a beginner, cTrader or MT5?

cTrader is generally considered better for beginners due to its more intuitive, modern, and user-friendly interface, which makes the initial learning process much smoother.

Can I use MT4 robots on MT5?

No, you cannot. EAs and indicators built for MT4 using the MQL4 language are not compatible with MT5, which uses the MQL5 language. They must be recoded.

Is cTrader really cheaper to trade on?

The platform itself doesn’t set costs, your broker does. However, cTrader’s structure promotes transparency by separating commissions from spreads, which many traders find helps in assessing true costs more easily.

Which platform is more popular with prop firms?

While many prop firms still use MT5, there is a growing trend of firms adopting cTrader. They often cite its advanced risk management features and transparent API as better suited for their evaluation and account management needs.

Do both platforms support hedging?

Yes, both cTrader and MetaTrader 5 support hedging, which allows traders to hold both long and short positions in the same instrument simultaneously.