In the dynamic world of forex trading, success often hinges on having a reliable and effective strategy. Enter the Daily Bias Trading Strategy – a powerful approach that has gained significant traction among both novice and experienced traders. This comprehensive guide will delve deep into the intricacies of this broker for forex trading strategy, exploring how it leverages daily market biases to generate consistent profits.

The Daily Bias Trading Strategy focuses on identifying and capitalizing on the overall directional bias of the market on a given day. By analyzing key technical and fundamental factors, traders can determine whether the market has a bullish, bearish, or neutral bias. This insight then informs their trading decisions, allowing them to align their positions with the prevailing market sentiment.

Throughout this article, we’ll explore the core principles of daily trading bias, examine how to effectively implement this strategy in the forex market, and discuss ways to optimize your approach for maximum profitability. Whether you’re new to forex trading or looking to refine your existing techniques, mastering the Daily Bias Trading Strategy can be a game-changer in your quest for consistent returns.

Understanding Daily Bias in Forex Trading

At its core, daily bias in forex trading refers to the overall directional tendency of a currency pair within a given trading day. This bias is influenced by a variety of factors, including:

- Economic Indicators: Major economic releases, such as GDP reports, employment data, and inflation figures, can significantly impact currency valuations and set the tone for daily market movements.

- Central Bank Decisions: Monetary policy announcements, interest rate decisions, and statements from central bank officials can trigger substantial market reactions and shape the daily bias.

- Geopolitical Events: Global news, political developments, and international relations can have far-reaching effects on currency markets, influencing trader sentiment and market direction.

- Technical Analysis: Chart patterns, support and resistance levels, trend lines, and other technical indicators can provide valuable insights into potential market biases.

- Market Sentiment: Overall trader sentiment, which can be gauged through various sentiment indicators and positioning data, plays a crucial role in determining daily bias.

- Global Risk Appetite: The general risk sentiment in global financial markets can impact currency pairs, especially those considered safe-haven currencies versus riskier assets.

Understanding these factors and how they interplay is crucial for traders looking to accurately determine and capitalize on daily market biases.

Read More: Identify liquidity in forex

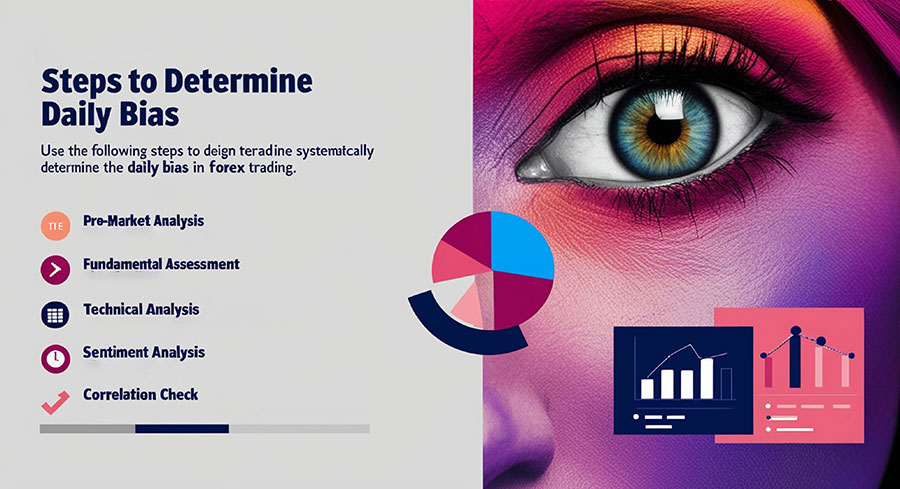

Steps to Determine Daily Bias

Identifying the daily bias in forex trading requires a systematic approach. Here’s a step-by-step guide to help you determine the daily bias:

- Pre-Market Analysis:

o Review economic calendars for upcoming high-impact events

o Analyze recent price action and identify key technical levels

o Check for any significant news or developments overnight - Fundamental Assessment:

o Evaluate the latest economic data releases and their implications

o Consider ongoing geopolitical events and their potential market impact

o Assess central bank policies and any recent statements from officials - Technical Analysis:

o Examine daily and higher timeframe charts to identify overall trends

o Locate key support and resistance levels

o Analyze popular technical indicators (e.g., moving averages, RSI, MACD) - Sentiment Analysis:

o Review market sentiment indicators and positioning data

o Consider the Commitment of Traders (COT) report for institutional positioning

o Gauge retail sentiment through available data from brokers or sentiment surveys - Correlation Check:

o Assess correlations with related currency pairs or financial instruments

o Consider the performance of stock markets, commodities, and bond yields - Synthesize Information:

o Weigh the collected information to form an overall bias (bullish, bearish, or neutral)

o Consider the strength of the bias based on the confluence of factors - Continuous Monitoring:

o Stay alert for intraday developments that might alter the initial bias

o Be prepared to reassess and adjust your bias as new information emerges

By following these steps diligently, traders can develop a well-informed daily bias that serves as a foundation for their trading decisions.

Implementing the Daily Bias Trading Strategy

Once you’ve determined your daily bias, the next step is to implement it effectively in your trading. Here’s how to put the Daily Bias Trading Strategy into action:

- Align Your Trades with the Bias:

- Look for trade setups that correspond with your identified bias

- For a bullish bias, focus on buying opportunities or long positions

- For a bearish bias, seek selling opportunities or short positions

- In a neutral bias, consider range-bound trading strategies

- Use Multiple Timeframes:

- Confirm the daily bias on higher timeframes (e.g., 4-hour, daily charts)

- Use lower timeframes (e.g., 1-hour, 15-minute charts) for precise entry points

- Set Appropriate Stop Losses:

- Place stop losses at levels that would invalidate your bias

- Consider using wider stops for stronger biases to accommodate market volatility

- Define Clear Profit Targets:

- Set realistic profit targets based on key technical levels and potential market moves

- Consider using trailing stops to protect profits as the market moves in your favor

- Manage Position Sizes:

- Adjust your position sizes based on the strength of your bias and risk tolerance

- Consider scaling into positions for stronger biases

- Monitor and Adjust:

- Continuously monitor market conditions and be ready to adjust your strategy

- Be prepared to close positions or reverse your bias if market conditions change significantly

- Use Confirmation Signals:

- Look for additional technical or fundamental confirmation before entering trades

- Consider using price action patterns, candlestick formations, or indicator signals as entry triggers

- Practice Patience:

- Wait for high-probability setups that align with your daily bias

- Avoid forcing trades if clear opportunities don’t present themselves

- Keep a Trading Journal:

- Record your daily bias, trade rationale, and outcomes

- Use this information to refine your strategy over time

By following these implementation guidelines, traders can effectively translate their daily bias into actionable trading decisions, increasing their chances of success in the forex market.

Read More: Identify Order Blocks in Forex

Advantages of Daily Bias Trading

The Daily Bias Trading Strategy offers several key advantages that make it an attractive approach for forex traders:

- Improved Focus and Discipline: By establishing a clear directional bias each day, traders can avoid the temptation of overtrading or taking random positions. This focused approach helps maintain discipline and reduces impulsive decision-making.

- Enhanced Risk Management: Having a predetermined bias allows traders to set more appropriate stop-loss and take-profit levels. This structured approach to risk management can help protect capital and optimize potential returns.

- Alignment with Market Forces: Trading in the direction of the overall market bias increases the probability of successful trades. By “going with the flow,” traders can potentially benefit from stronger market movements and trends.

- Flexibility and Adaptability: The Daily Bias Strategy can be applied to various timeframes and adapted to different trading styles. Whether you’re a day trader or a swing trader, you can incorporate daily bias analysis into your approach.

- Comprehensive Market Analysis: The process of determining daily bias encourages traders to consider multiple factors, including fundamental, technical, and sentiment analysis. This holistic approach can lead to more informed trading decisions.

- Reduced Emotional Trading: By establishing a bias before the trading day begins, traders are less likely to make emotional decisions based on short-term market fluctuations. This can help maintain a more rational and consistent trading approach.

- Improved Trade Selection: With a clear bias in mind, traders can more easily identify high-probability trade setups that align with their overall market view. This selective approach can lead to better trade quality and potentially higher win rates.

- Continuous Learning and Improvement: The daily process of analyzing markets and forming a bias provides ongoing learning opportunities. Traders can refine their analytical skills and market understanding over time.

- Scalability: The Daily Bias Strategy can be applied to multiple currency pairs or even across different financial markets, allowing traders to diversify their approach and potentially increase their opportunities.

- Time Efficiency: By focusing on a daily timeframe, traders can efficiently manage their time while still capturing significant market moves. This can be particularly beneficial for part-time traders or those with limited time for market analysis.

These advantages make the Daily Bias Trading Strategy a valuable tool in any forex trader’s arsenal, providing a structured yet flexible approach to navigating the complex world of currency trading.

Read More: Identify Imbalance in Forex

Challenges and Common Mistakes

Be aware of these potential pitfalls:

- Confirmation Bias: Seeking out information that confirms pre-existing bias.

- Overconfidence: Taking on excessive risk due to a strong bias.

- Inflexibility: Stubbornly sticking to an initial bias despite contrary evidence.

- Overtrading: Taking every trade that seems to align with the bias.

- Neglecting Other Timeframes: Focusing solely on the daily bias without considering other timeframes.

- Ignoring Important Technical Levels: Overlooking key support and resistance levels.

- Overlooking Correlations: Failing to consider correlations between currency pairs.

- Misinterpreting News and Data: Incorrectly analyzing economic data or news events.

- Lack of Patience: Feeling pressured to trade even when ideal setups aren’t present.

- Inadequate Record-Keeping: Failing to keep detailed records of biases and trades.

Tips for Successful Daily Bias Trading

To maximize the effectiveness of your strategy:

- Develop a robust morning routine for market analysis.

- Use a combination of fundamental, technical, and sentiment analysis.

- Start with major currency pairs if new to the strategy.

- Consider different market sessions and their impact.

- Use multiple timeframes in your analysis.

- Implement a scoring system for various factors influencing your bias.

- Stay informed about financial news and economic releases.

- Practice with a demo account before using real capital.

- Be cautious around high-impact economic events.

- Use proper position sizing based on bias strength and market volatility.

- Keep a detailed trading journal and review it regularly.

- Develop a personal system for rating bias strength.

- Be aware of correlations between currency pairs and other instruments.

- Look for trades with multiple confirming factors (confluence).

- Stay flexible and be prepared to change your bias if conditions shift.

Conclusion

The Daily Bias Trading Strategy offers a structured approach to navigating the complex world of forex trading. By systematically analyzing market conditions, establishing a directional bias, and aligning trades with this outlook, traders can enhance their decision-making process and potentially improve their overall profitability.

Success with this strategy requires diligence, flexibility, and a commitment to continuous learning. Traders must be aware of the challenges and common pitfalls associated with this approach and actively work to avoid them.

Remember, no trading strategy is foolproof, and the forex market can be unpredictable. Risk management remains paramount, regardless of how strong your daily bias may be. Always adhere to proper position sizing, use appropriate stop-losses, and be prepared to adjust your approach as market conditions change.

Whether you’re a novice trader looking to establish a reliable methodology or an experienced professional seeking to refine your approach, the Daily Bias Trading Strategy can be a valuable addition to your forex trading toolkit. With dedication, discipline, and consistent application of the principles outlined in this guide, you’ll be well-equipped to navigate the forex markets with greater confidence and consistency.

How does the Daily Bias Strategy perform in highly volatile market conditions?

In highly volatile markets, the Daily Bias Strategy can be particularly useful as it helps traders maintain a clear direction amidst rapid price movements. However, it’s crucial to adjust position sizes and use wider stop-losses to accommodate increased volatility. Traders should also be prepared to reassess their bias more frequently during volatile periods.

Can the Daily Bias Strategy be combined with other trading strategies?

Yes, the Daily Bias Strategy can be effectively combined with other trading approaches. For example, it can be used in conjunction with trend-following strategies, support and resistance trading, or even with certain aspects of price action trading. The key is to ensure that the combined strategies don’t contradict each other and that they complement your overall trading plan.

How long does it typically take to become proficient in using the Daily Bias Trading Strategy?

The time it takes to become proficient varies for each trader, but generally, it can take several months of consistent practice and review to develop a solid grasp of the strategy. Traders should expect to spend time refining their analysis techniques, learning to interpret various market factors, and developing the discipline to stick to their bias. Continuous learning and adaptation are crucial for long-term success with this strategy.