Are you ready to unlock a powerful forex reversal signal that can significantly enhance your trading strategy? The Dark Cloud Cover Candlestick Pattern is one of the most effective and reliable indicators that traders use to predict potential market trend reversals, particularly when the market is transitioning from a bullish (upward) trend to a bearish (downward) one. This pattern is a key component of technical analysis and provides traders with a valuable tool to spot market turning points before they fully unfold.

For forex traders looking for reliable technical analysis tools, the Dark Cloud Cover pattern serves as a strong signal of potential market shifts, helping you to anticipate when the prevailing bullish momentum is starting to fade and when bearish forces may be taking over. Understanding how to recognize and interpret this pattern gives you a distinct edge in spotting market tops, where the price is likely to reverse and begin moving downward. In essence, learning how to identify the Dark Cloud Cover candlestick pattern can allow you to capitalize on profitable trading opportunities, by strategically positioning yourself for entry and exit points in the market.

In this comprehensive guide, we will explore every essential aspect of the Dark Cloud Cover candlestick pattern, from its core structure and the psychology behind it, to the most effective trading strategies that will help you leverage its potential in the forex market. We will take a deep dive into how to recognize this pattern, when to use it in your trading, and why it is considered one of the most reliable reversal signals available to traders. Additionally, we will explain how this pattern can be applied to various forex pairs and timeframes to maximize your trading success.

By the end of this guide, you’ll not only understand how the Dark Cloud Cover pattern works but also how to integrate it into your overall trading strategy to spot high-probability reversal setups. So, if you’re working with a regulated forex broker or a trusted forex trading broker, and you’re looking to refine your trading skills to predict market reversals with precision, keep reading as we unlock the full potential of this powerful candlestick pattern.

What Is the Dark Cloud Cover Candlestick Pattern?

The Dark Cloud Cover Candlestick Pattern is a well-regarded bearish reversal signal in technical analysis and a vital tool for traders, especially in the forex market. This pattern typically forms after a sustained uptrend, suggesting that the market is transitioning from bullish to bearish momentum. The Dark Cloud Cover is a two-candle pattern, which gives traders a clear indication of potential price reversals, signaling that the market may soon shift direction.

Learn about the Dark Cloud Cover pattern, a key indicator of market reversals.

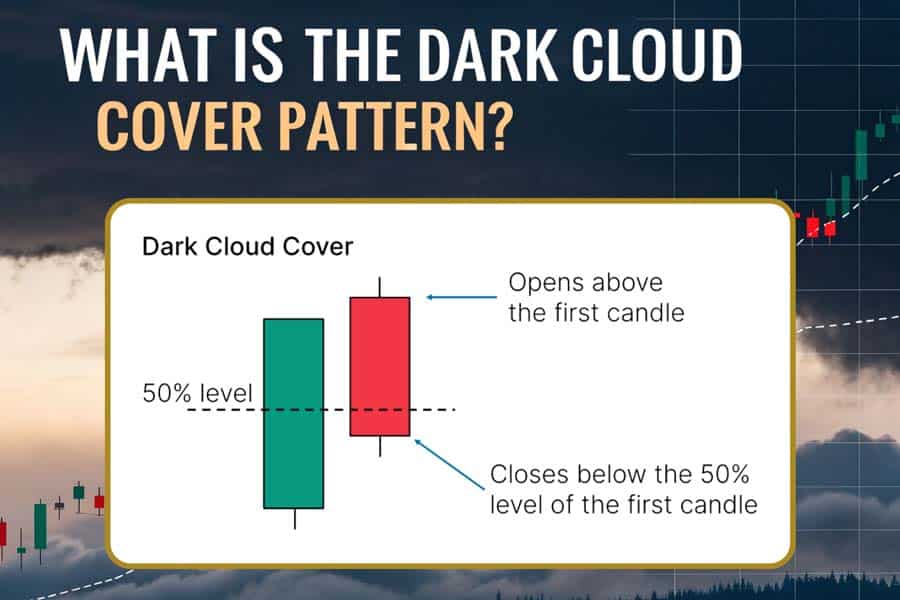

The structure of the Dark Cloud Cover pattern is as follows:

- First Candlestick (Bullish Candle): The first candlestick in the pattern is a large bullish candle, marked by significant upward movement in the price, representing the peak of the uptrend. This candle is often accompanied by high trading volume, reinforcing the strength of the prevailing bullish sentiment. Traders interpret this as an indication that the bulls are in control, and the market is currently in an uptrend.

- Second Candlestick (Bearish Candle): The second candlestick is a bearish candle, which opens above the first candle’s closing price, but closes below its midpoint. This is a critical aspect of the pattern. The fact that it closes below the midpoint of the preceding bullish candle signals that the sellers are starting to overpower the bulls. This shift in momentum is a clear sign of a potential reversal, where the market may soon experience a downtrend.

The Dark Cloud Cover is often seen as a reliable bearish reversal pattern in various financial markets, including the forex market. Traders use it to spot potential trend changes and to position themselves accordingly, either by entering short positions or exiting long positions before the market turns against them.

Read More: Harami Candlestick Pattern

Why Is the Dark Cloud Cover Pattern Important?

The significance of the Dark Cloud Cover pattern lies in its ability to forecast market reversals, which is essential for traders who want to capitalize on turning points. Understanding this pattern allows traders to spot the transition from a bullish market to a bearish one before it fully materializes, giving them ample time to enter short positions or exit long positions.

For traders using technical analysis, the Dark Cloud Cover pattern is a reliable signal to act upon, especially when combined with other market indicators like volume and trend lines. Recognizing it can help you avoid riding a losing trend and position yourself for greater profits.

Structure of the Dark Cloud Cover Candlestick Pattern

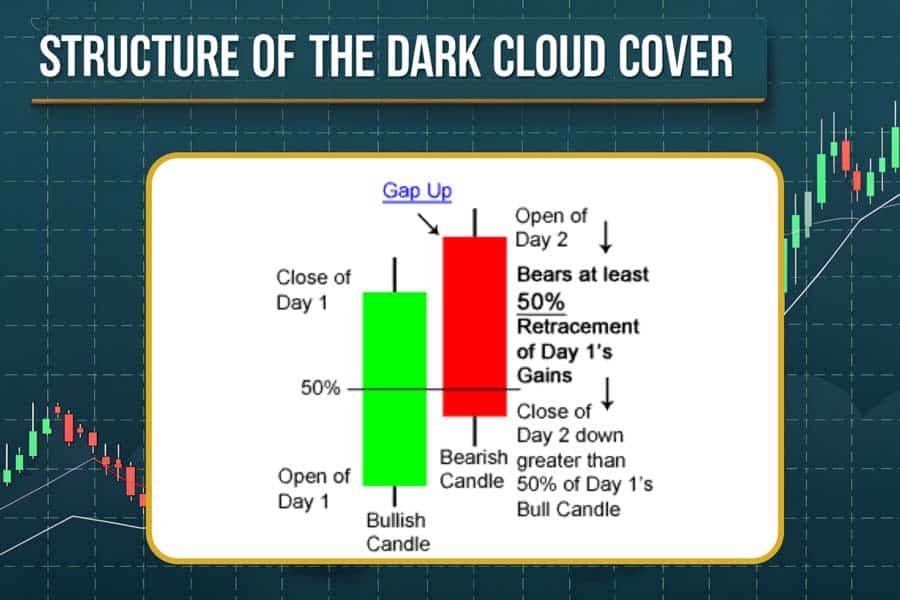

To effectively trade the Dark Cloud Cover Candlestick Pattern, it is essential to understand its structure in detail. This two-candle pattern signals a shift in market momentum, often marking a potential bearish reversal after an uptrend. Let’s break down the role each candlestick plays in forming this powerful reversal signal.

Explore the essential components that make up the Dark Cloud Cover pattern.

First Candlestick: The Strong Bullish Candle

The first candlestick in the Dark Cloud Cover pattern is a large bullish candle that marks the end of an uptrend. This candle plays a vital role in establishing the bullish sentiment that precedes the potential reversal. Here’s a closer look at what makes the first candlestick so important:

- Shows Buying Dominance: The bullish candle demonstrates strong buying pressure throughout the trading session, as the price moves higher. The long body of this candle reflects that the buyers were in control, pushing the price upwards.

- Significant Upward Movement: The price action during this candle should indicate considerable upward momentum. It should show a clear trend continuation as the market moves in favor of the bulls, reaching a high point in the current uptrend.

- Establishes Bullish Sentiment: A strong bullish candle that closes at or near its highest price of the day provides a solid foundation for the Dark Cloud Cover pattern. This bullish sentiment is necessary for the pattern to signal a reversal. The bigger the body of the bullish candle, the stronger the upward movement and market sentiment, making it a more effective reversal signal when the second candle forms.

However, it’s crucial to note that a weak or small bullish candle reduces the reliability of the pattern. A small candle or one with little upward movement fails to signal the same level of buying dominance, undermining the potential of the Dark Cloud Cover as a reversal pattern.

For the Dark Cloud Cover pattern to be effective, the first candlestick needs to clearly mark the peak of the uptrend, as this establishes the foundation for the potential reversal. Without a strong bullish candle, the market sentiment may not be fully bullish, and the pattern may lose its predictive power.

Read More: Engulfing Candlestick Pattern

Second Candlestick: The Bearish Candle

The second candlestick in the Dark Cloud Cover pattern is a bearish candle that follows the strong bullish candle. This candle represents a shift from buying dominance to selling pressure, signaling the start of a potential trend reversal. Here are the key characteristics of the second candlestick:

- Opens Above the First Candle’s Close: The second candlestick opens above the closing price of the first bullish candle, indicating that the uptrend is still intact at the start of the new session. However, the crucial element comes in the following price action.

- Closes Below the Midpoint of the First Candle: This is the most significant feature of the Dark Cloud Cover pattern. The second candle must close below the midpoint of the first bullish candle, signaling that selling pressure has taken over. This shift in market sentiment is a clear indication that the bears are beginning to gain control after the bullish phase.

- A Signal of Reversal: The fact that the bearish candle closes below the midpoint of the previous bullish candle shows that the buying pressure has been exhausted. It signals that the market is now ready for a potential downtrend, as sellers are taking over and pushing the price lower. The bearish candlestick doesn’t need to fully engulf the first candle’s body, but the close below the midpoint is crucial for identifying a possible trend reversal.

It is important to remember that the second candlestick does not need to fully engulf the first candle, unlike other reversal patterns like the Engulfing Pattern. The key requirement for a valid Dark Cloud Cover is that the second candlestick closes below the midpoint of the first candlestick, confirming the shift in momentum from bullish to bearish.

Together, these two candles create a strong bearish reversal signal that traders can use to predict the possibility of a price decline. When seen after an uptrend, the Dark Cloud Cover pattern suggests that the market may soon start moving in the opposite direction, presenting an opportunity to enter short positions.

Market Psychology Behind the Dark Cloud Cover Pattern

Understanding the market psychology behind the Dark Cloud Cover Candlestick Pattern can help traders make more informed decisions when using it in their strategy. The pattern represents the emotional shift from optimism to fear or pessimism, which is often what triggers a market reversal.

Understand the emotional shifts that drive market reversals with the Dark Cloud Cover.

How the Bulls Lose Control

In a bullish market, the first candle demonstrates strong buying interest, which pushes prices to new highs. However, as the market reaches a peak, traders start to question the sustainability of the uptrend, leading to profit-taking and a shift in sentiment.

The second candlestick is where this shift is visible. The bearish candle indicates that the buying pressure has weakened, and sellers are beginning to dominate. This reversal in sentiment often sets the stage for a downtrend, with prices continuing to fall as bearish momentum takes over.

The Role of Psychological Resistance

The Dark Cloud Cover pattern often forms at psychological resistance levels. After a strong uptrend, the market reaches a point where traders expect the trend to reverse, such as at a key price level, a trendline, or a Fibonacci retracement level. This pattern forms when market participants realize that the buying pressure is unsustainable, and they begin to sell, triggering a bearish reversal.

How to Trade Using the Dark Cloud Cover Pattern

Trading the Dark Cloud Cover Candlestick Pattern successfully requires a structured approach that incorporates not only pattern recognition but also effective risk management and confirmation techniques. In this section, we will guide you through actionable steps that will help you capitalize on this powerful bearish reversal signal in the forex market.

Master effective trading strategies using the Dark Cloud Cover candlestick pattern.

1. Identifying the Pattern in the Market

The first step in trading the Dark Cloud Cover pattern is to identify it correctly in the market. Here’s how you can do that:

- Look for a Strong Uptrend: The Dark Cloud Cover pattern typically appears after an extended bullish trend. This means the market should have been rising for a period, showing strong upward momentum.

- Spot the Bullish Candle: The first candlestick in the pattern is a large bullish candle that marks the peak of the uptrend. This candle reflects strong buying activity, and its long body indicates a continuation of bullish sentiment.

- Monitor for the Bearish Candle: After the bullish candle, you need to wait for the second candlestick to form. The bearish candle should:

- Open above the closing price of the bullish candle.

- Close below the midpoint of the bullish candle.

This closing below the midpoint is the critical factor that signals a shift in momentum from bullish to bearish. When you spot this combination of candlesticks, you can confirm that the Dark Cloud Cover pattern is forming.

2. Confirm the Signal

While the Dark Cloud Cover pattern is a powerful reversal signal on its own, confirming the signal with other technical indicators can significantly improve the accuracy of your trade. Here’s how to use confirmation tools:

- Relative Strength Index (RSI): The RSI is a popular momentum oscillator. Before the Dark Cloud Cover pattern forms, check if the RSI is above 70, indicating that the market is overbought. This suggests that the market may be due for a reversal, aligning perfectly with the Dark Cloud Cover signal.

- Moving Averages (MA): Look for the price to be above a key moving average (e.g., the 50-period or 200-period MA). A price reversal from above the moving average strengthens the bearish signal provided by the Dark Cloud Cover pattern. This confirmation helps ensure that the trend is genuinely reversing, not just consolidating.

- Volume: Volume is a critical aspect of any trading strategy. If the bearish candle in the pattern is accompanied by an increase in volume, it indicates stronger selling pressure and reinforces the validity of the pattern. Higher volume signals that the market participants are actively engaging in the sell-off, making the reversal more likely to occur.

Using these confirmatory indicators helps you filter out false signals and improves your chances of a successful trade.

Read More: Shooting Star Candlestick Pattern

3. Entry and Exit Strategies

Once the Dark Cloud Cover pattern is confirmed, the next step is to execute your trade effectively. Here’s how to approach entry and exit:

- Entry Point: The ideal entry point is at the close of the bearish candle. This ensures that the market has fully confirmed the trend reversal. Entering at this point positions you to take advantage of the new downtrend that the Dark Cloud Cover pattern predicts.

- Stop Loss: To protect yourself from unexpected price movements, place a stop-loss order above the high of the second bearish candle. This way, if the market doesn’t reverse and continues the uptrend, your position will be closed at a loss, limiting your risk.

- Take Profit: Set a take-profit level at the next key support level. This support level acts as a price point where the market could find buying interest again. As a rule of thumb, aim for a risk-to-reward ratio of at least 1:2. This means your potential reward (take-profit) should be twice as large as your risk (stop-loss).

This strategy ensures that you can capture the potential downtrend while protecting yourself from unnecessary losses.

4. Risk Management

Effective risk management is crucial when trading any pattern, including the Dark Cloud Cover. Here are some tips to manage your risk effectively:

- Use Stop-Loss Orders: Always use a stop-loss order to limit potential losses. The stop-loss should be placed above the high of the second bearish candle, as explained in the entry strategy. This helps you protect your capital in case the market doesn’t move as expected.

- Position Sizing: Adjust your position size based on your overall portfolio risk tolerance. Never risk more than a small percentage (usually 1-2%) of your trading account balance on a single trade. This will help protect your account from a string of losing trades.

- Risk-to-Reward Ratio: Always calculate the risk-to-reward ratio before entering a trade. A ratio of 1:2 or higher is ideal, meaning that for every unit of risk, your potential reward should be at least two units. This ensures that, even if you have some losing trades, the overall strategy will still be profitable over time.

By implementing risk management techniques, you protect your capital and increase the sustainability of your trading approach.

Common Mistakes to Avoid When Trading the Dark Cloud Cover Pattern

Like any candlestick pattern, the Dark Cloud Cover pattern is not foolproof. Traders should be aware of common mistakes that can lead to poor trading decisions.

1. Acting Prematurely

One common mistake is entering the trade too early before the pattern is confirmed. Always wait for the bearish candle to close below the midpoint of the first candle to validate the reversal.

2. Ignoring Broader Market Trends

Traders who focus solely on the Dark Cloud Cover pattern without considering the broader market trend or other indicators may miss important context. Always ensure the pattern aligns with the overall trend and market conditions.

3. Over-Reliance on the Pattern Alone

Relying on the Dark Cloud Cover pattern without considering other tools or analysis techniques can lead to failure. Combine it with other indicators, such as RSI, MACD, or trend lines, to improve the accuracy of your trades.

Opofinance Services: A Trusted ASIC Regulated Broker

If you’re looking for a reliable and secure forex broker, Opofinance is an excellent choice. As an ASIC-regulated broker, Opofinance adheres to the highest standards of safety and regulatory compliance, ensuring that your funds and trading activities are protected. With a strong reputation for trustworthiness and transparency, Opofinance is a go-to broker for traders who want peace of mind while executing their trades.

Here are some key benefits of choosing Opofinance:

- ASIC Regulation: Ensures a secure and compliant trading environment.

- Featured on MT5 Brokers List: Access advanced trading features and powerful tools through the MetaTrader 5 platform.

- Social Trading Services: Follow, copy, and learn from experienced traders with Opofinance’s social trading feature. Enhance your trading strategies by tapping into the expertise of a global community.

- Safe and Convenient Deposits and Withdrawals: Enjoy fast, secure, and convenient payment processing methods, making it easy to manage your trading account and funds.

Ready to elevate your trading experience? Sign up with Opofinance today and gain access to a trusted, regulated, and feature-rich trading platform that supports your success.

Conclusion: Maximize Your Trading with the Dark Cloud Cover Candlestick Pattern

The Dark Cloud Cover Candlestick Pattern is a potent and reliable tool for traders aiming to profit from market reversals. By understanding its structure, confirming it with other technical indicators, and applying a sound trading strategy, you can take advantage of bearish trends in the market and make well-informed decisions. This pattern serves as a reliable signal of potential trend reversals, helping you enter short positions at the right time.

To enhance your trading experience, consider utilizing a reliable and regulated forex broker like Opofinance. With ASIC regulation, a social trading service that allows you to follow successful traders, and safe deposit/withdrawal methods, Opofinance provides a secure, transparent, and professional platform for executing forex trades. This broker ensures you have the right tools and protection to make the most of your trading opportunities.

Key Takeaways

- The Dark Cloud Cover Candlestick Pattern signals a bearish reversal, indicating a potential shift from bullish to bearish momentum in the market.

- Traders should confirm the pattern with other technical indicators, such as RSI, moving averages, and volume, for higher accuracy and better trading decisions.

- Proper risk management is crucial when trading this pattern to avoid large losses and maximize your trading potential.

Can the Dark Cloud Cover pattern be used in all markets?

Yes, the Dark Cloud Cover pattern is effective in various financial markets, including forex, stocks, commodities, and cryptocurrencies. As long as a clear trend reversal is present, the pattern can be used to identify potential shifts from bullish to bearish momentum in any market.

How reliable is the Dark Cloud Cover pattern for predicting reversals?

The Dark Cloud Cover pattern is considered a highly reliable reversal signal when confirmed with other technical indicators. When volume is high and the pattern forms after a strong uptrend, its predictive power is significantly strengthened. The confirmation from tools like the RSI, moving averages, and volume analysis ensures higher accuracy in spotting potential market reversals.

Should I trade the Dark Cloud Cover pattern on all timeframes?

While the Dark Cloud Cover pattern can be identified on any timeframe, it is generally more reliable when observed on higher timeframes, such as 1-hour, 4-hour, or daily charts. These timeframes often show more pronounced trends, making the pattern’s signal more dependable in forecasting trend reversals.