Are you ready to transform your trading game? The Evening Star Candlestick Pattern is a game-changer for traders who want to stay ahead of market trends. As one of the most reliable bearish reversal patterns, it helps traders identify when an uptrend is about to reverse, signaling an ideal time to exit long positions or initiate short trades.

Picture this: You’re analyzing a strong uptrend, and suddenly, a pattern appears that signals a potential turning point. Would you act on it?

In this article, we’ll uncover the Evening Star Candlestick Pattern meaning, its structure, practical trading strategies, and how to integrate it into your technical analysis toolkit. Whether you’re a beginner or an experienced trader using a regulated forex broker, this guide will provide actionable insights to maximize your trading success.

Let’s dive deep into understanding this powerful tool and how it can revolutionize the way you trade.

Overview of Candlestick Patterns in Technical Analysis

Candlestick patterns are essential in technical analysis because they visually represent market sentiment and potential future price movements. They encapsulate the relationship between buyers and sellers within a specific timeframe.

Why Candlestick Patterns Matter

- Market Insights: They provide clues about market direction.

- Trend Reversals: Patterns like the Evening Star highlight when trends are losing momentum.

- Universal Application: Effective across all markets—forex, stocks, and commodities.

For traders aiming to refine their strategies, understanding formations like the Evening Star Candlestick Pattern example is a crucial step toward profitability.

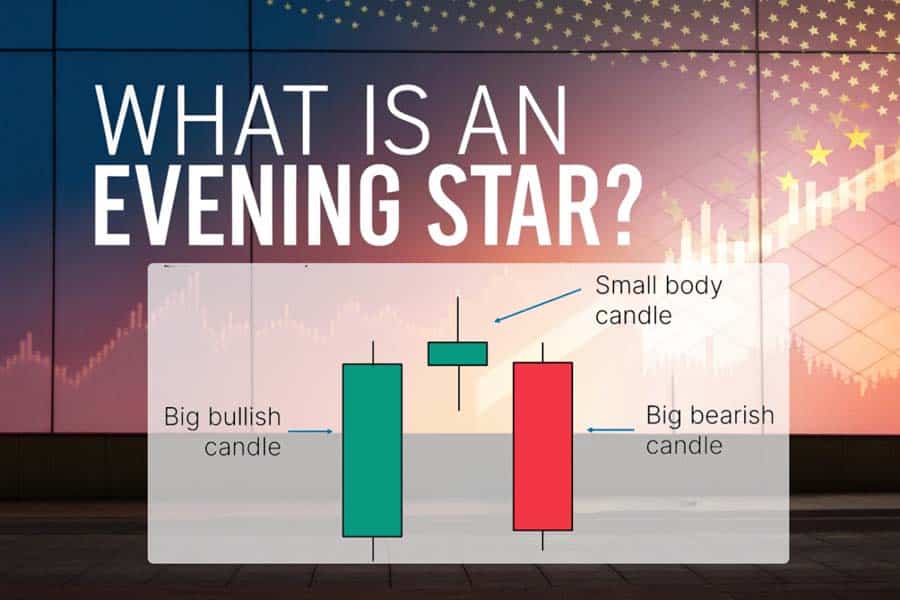

What Is an Evening Star?

Definition and Importance in Trading

Discover the significance of the Evening Star Candlestick Pattern in trading.

The Evening Star Candlestick Pattern is a bearish reversal pattern that marks the end of an uptrend. It consists of three candles, each contributing to the overall signal:

- First Candle: A strong bullish candle, indicating the continuation of the uptrend.

- Second Candle: A small-bodied or doji candle, reflecting indecision in the market.

- Third Candle: A large bearish candle, confirming the reversal.

This pattern is especially potent when it appears near key resistance levels or after a prolonged uptrend, signaling that sellers are gaining control over the market.

Read More: Shooting Star Candlestick Pattern

Structure of the Evening Star Candlestick Pattern

The Evening Star Candlestick Pattern is a powerful bearish reversal pattern that typically signals the end of an uptrend. This pattern consists of three distinct candlesticks that work together to provide a clear indication of a trend change. Let’s break down the individual components of the Evening Star pattern for better clarity.

Explore the significance of each candle in the Evening Star pattern.

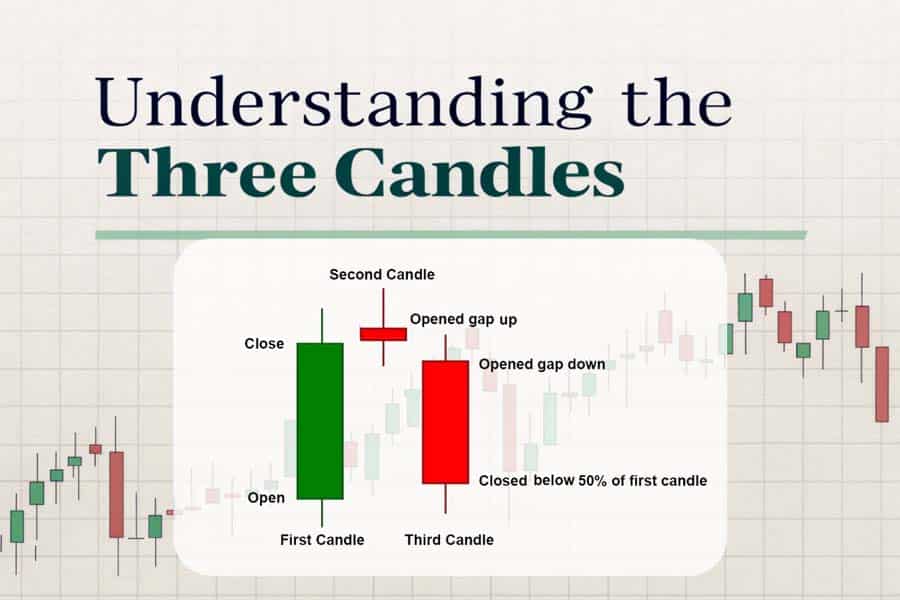

Breakdown of the Three Candles

1. First Candle: Large Bullish Candle

The first candle in the Evening Star Candlestick Pattern is a large bullish candle. This candle represents strong buying pressure, confirming the prevailing uptrend. The bullish nature of this candle suggests that buyers have been in control and that market sentiment is positive.

- Key Insights:

- The first candle typically closes near its high, indicating that buyers have pushed prices higher with strong momentum.

- The larger the body of this first candle, the stronger the initial bullish sentiment, making the reversal even more significant when it occurs.

In the context of a rising market, this large bullish candle sets the stage for a potential reversal, as it signals the peak of the uptrend.

2. Second Candle: Small-Bodied or Doji Candle

The second candle is the pivotal moment in the Evening Star pattern. This candle is often small and can take various forms, such as a Doji, Spinning Top, or a small-bodied candle. It indicates market indecision, where neither buyers nor sellers can gain full control. This indecision highlights the exhaustion of the prevailing bullish momentum and signals a potential shift.

- Key Insights:

- A Doji in this position is particularly significant, as it indicates heightened uncertainty in the market. Traders are unsure whether the uptrend will continue or reverse.

- The small size of this candle suggests a momentary equilibrium between buyers and sellers, marking a pause before the market decides on its next direction.

The appearance of a Doji increases the reliability of the reversal signal, making the Evening Star pattern even more potent.

3. Third Candle: Large Bearish Candle

The third candle in the Evening Star Candlestick Pattern is a large bearish candle that confirms the reversal. This bearish candle closes below the midpoint of the first candle, indicating that sellers have taken control of the market and the uptrend has ended.

- Key Insights:

- A large bearish candle with a wide range signals strong selling pressure. This confirms the shift from bullish to bearish sentiment, marking the start of a potential downtrend.

- Higher trading volume often accompanies this bearish candle, further reinforcing the strength of the reversal and the shift in market sentiment.

This large bearish candle acts as confirmation of the Evening Star pattern, giving traders a clear signal to act on the emerging downtrend.

Evening Star Doji Pattern

When the second candle in the Evening Star pattern is specifically a Doji, it becomes known as the Evening Star Doji Pattern. This variation is particularly powerful because it highlights even greater indecision in the market, often leading to sharper reversals.

- Why It Matters:

- The Doji indicates a moment of complete equilibrium between buyers and sellers, amplifying the significance of the subsequent bearish reversal.

- The market’s hesitation and indecision at this stage increase the likelihood of a strong price movement once the third bearish candle appears.

The Evening Star Doji Pattern is often viewed as a stronger signal for a trend reversal than a standard Evening Star, as it reflects deeper market uncertainty, which typically results in sharper price action once the reversal begins.

By understanding the components of the Evening Star Candlestick Pattern, traders can better anticipate potential market reversals and use this knowledge to make more informed trading decisions.

Read More: Morning Star Candlestick Pattern

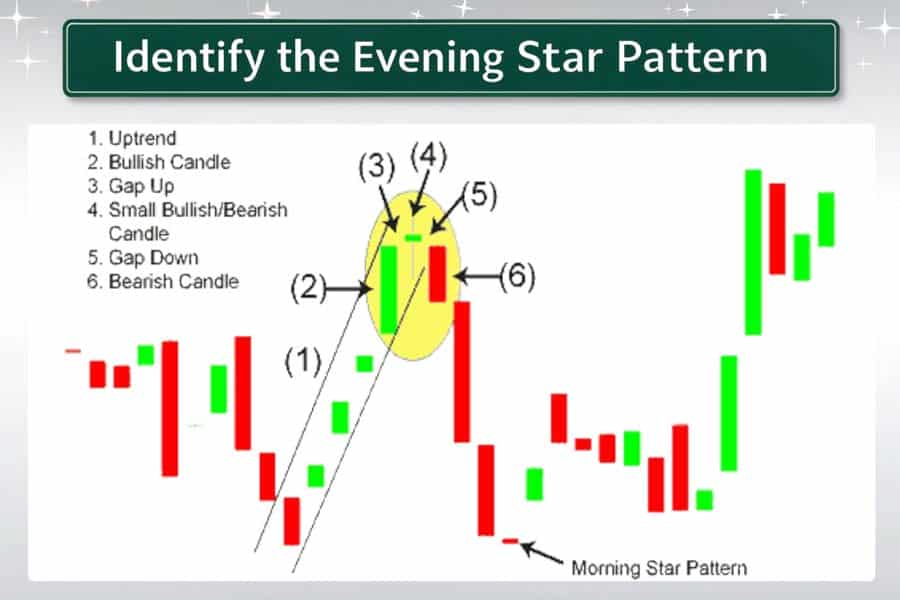

How to Identify an Evening Star Candlestick Pattern

The Evening Star Candlestick Pattern is a classic technical analysis tool used to identify potential trend reversals. It consists of three distinct candles and requires specific conditions to be met for it to be considered a valid signal. Let’s take a closer look at how to identify this powerful bearish pattern and apply it to your trading strategy.

Learn how to spot the Evening Star pattern for effective trading.

Key Characteristics of the Evening Star Candlestick Pattern

To spot an Evening Star, you need to recognize three critical features in the chart. Each of these features plays an important role in the pattern’s predictive power, signaling a potential trend reversal. Here’s what to look for:

- Preceding Uptrend:

- The Evening Star pattern must occur after a clear and strong uptrend. The market needs to be in a bullish phase, as this pattern is specifically a reversal signal that indicates a shift from an uptrend to a potential downtrend.

- Key Insight: If the pattern appears during a period of sideways movement or in the midst of a downtrend, it may not be as reliable as a reversal signal.

- Three-Candle Structure:

- The Evening Star consists of three candles:

- First Candle: A large bullish candle that confirms the market’s strong upward momentum.

- Second Candle: A small-bodied candle (often a Doji or Spinning Top), representing market indecision.

- Third Candle: A large bearish candle that confirms the reversal by closing significantly lower than the midpoint of the first candle.

- Key Insight: All three candles must meet the criteria of size and positioning. If any of these components are missing or altered, the pattern may lose its significance.

- Confirmation:

- The third candle, a large bearish candle, is the confirmation that the uptrend has ended and that the reversal has begun. It should close below the midpoint of the first candle to validate the pattern.

- Key Insight: The larger and more pronounced the bearish candle, the stronger the confirmation of the reversal.

Visual Representation of the Evening Star Pattern

To identify an Evening Star candlestick pattern in a chart, it’s important to monitor the candlestick formation closely, especially in uptrends. Here’s what you should look for:

- The pattern typically appears near the top of an uptrend, often forming a “star” shape due to the small second candle that rests between the first large bullish and the third large bearish candle.

- Key Insight: After the first bullish candle, the small-bodied second candle indicates market indecision. The third bearish candle must close below the midpoint of the first bullish candle, signaling a strong shift in market sentiment.

Example of the Evening Star Pattern

Let’s say the market has been rising steadily. Traders observe the following:

- First Candle: A large bullish candle, closing near its high, indicating strong buying momentum.

- Second Candle: A small candle (a Doji or Spinning Top), signaling indecision as the market pauses.

- Third Candle: A large bearish candle, closing well below the first candle’s midpoint, confirming that the trend is likely to reverse.

When this pattern forms after an uptrend, traders often interpret it as a signal that the market is about to shift from a bullish phase to a bearish phase. The stronger the bearish third candle, the more likely the reversal is to happen.

Read More: Shooting Star Candlestick Pattern

Pro Tip: Use Fibonacci Retracements to Confirm the Reversal Level

One way to further strengthen your analysis of the Evening Star pattern is by applying Fibonacci retracement levels. These levels can help confirm that the reversal is happening at a significant level of price resistance, increasing the reliability of the pattern’s signal.

- How to Use Fibonacci: Apply Fibonacci retracements to the recent uptrend and look for key levels where the third bearish candle closes, such as the 50% or 61.8% retracement level. If the third candle occurs near these levels, it adds more weight to the potential reversal signal.

Trading Strategies Using the Evening Star Pattern

The Evening Star Candlestick Pattern is a powerful tool for identifying market reversals. To maximize its potential, combining it with effective entry and exit strategies, risk management, and additional indicators can significantly improve your trading success.

Maximize your trades with proven strategies using the Evening Star pattern.

Entry and Exit Strategies

1. Entry Point:

- Short Position: Enter when the third candle closes below the midpoint of the first bullish candle. This confirms the bearish reversal.

- Key Insight: Wait for the third candle’s confirmation to avoid entering prematurely.

2. Exit Strategy:

- Support Levels: Set your exit near key support levels, where the price is likely to reverse. Alternatively, use trailing stops to lock in profits.

- Key Insight: Exiting near support or with trailing stops protects gains while allowing for further potential profit.

Stop-Loss Placement

- Position: Place your stop-loss just above the high of the second candle (small-bodied or Doji).

- Key Insight: This minimizes risk by protecting against potential reversals.

Using Additional Indicators

To strengthen your analysis and confirm the Evening Star Pattern, incorporate these indicators:

1. Relative Strength Index (RSI)

- An overbought RSI (above 70) signals a strong bearish reversal.

- Key Insight: RSI confirms whether the market is due for a correction.

2. Moving Averages

- A moving average crossover (e.g., 50-period crossing below the 200-period) can validate the pattern and confirm bearish momentum.

- Key Insight: Moving averages help confirm trend changes after the Evening Star.

3. Volume Analysis

- High volume on the third bearish candle increases the pattern’s reliability, indicating strong selling pressure.

- Key Insight: Volume confirms market conviction and enhances pattern validity.

Combining the Evening Star Candlestick Pattern with other indicators like RSI, moving averages, and volume analysis creates a powerful, well-rounded trading strategy. By carefully managing entry, exit, and stop-loss placement, traders can enhance their success rate and minimize risk.

Strength Assessment of the Evening Star Candlestick Pattern

The Evening Star Candlestick Pattern can vary in its reliability. Not every Evening Star pattern will deliver the same results. Assessing its strength is crucial for making informed trading decisions.

Grading the Pattern

Evaluating the quality of the Evening Star pattern involves analyzing the size and clarity of the candles as well as volume. A more powerful pattern tends to have larger candles, clear price action, and higher trading volume. Here’s how to assess the strength of the pattern:

1. Grade A:

- Large Candles: The first bullish candle is strong, and the third bearish candle is decisive, closing below the midpoint of the first candle.

- Clear Reversal: The pattern shows a sharp reversal with high volume, indicating strong market conviction.

- Key Insight: A Grade A Evening Star is the most reliable, offering high-probability trade setups.

2. Grade B:

- Moderate Candles: The candles are not as large or definitive, and the reversal is less clear.

- Some Ambiguity: Volume may not be as high, and the reversal may not be as strong.

- Key Insight: While still useful, a Grade B pattern requires additional confirmation before entering a trade.

3. Grade C:

- Small or Unclear Candles: The candles are small, and the price action may not indicate a strong trend reversal.

- Minimal Confirmation: Little or no supporting volume, making the pattern less reliable.

- Key Insight: Avoid trading Grade C patterns, as they lack the strength needed for a successful reversal.

The strength of an Evening Star Candlestick Pattern plays a significant role in your trading success. Always prioritize Grade A patterns for high-confidence trades, and use additional indicators or confirmations for Grade B patterns. Grade C patterns should be avoided to minimize risk.

Advantages and Limitations of the Evening Star Pattern

The Evening Star Candlestick Pattern is widely recognized for its effectiveness in predicting trend reversals. However, like all patterns, it comes with both advantages and limitations. Understanding these aspects will help you use the pattern more effectively and avoid common mistakes.

Advantages of the Evening Star Pattern

- High Accuracy:

- The Evening Star provides a clear signal for bearish trend reversals, especially when accompanied by strong volume and a decisive third candle. This makes it a reliable pattern for traders aiming to capitalize on market shifts.

- Versatility:

- The pattern is applicable across a wide range of asset classes, including forex, stocks, and commodities. It offers opportunities for traders in different markets, making it a versatile tool for various trading strategies.

- Ease of Use:

- The Evening Star is relatively easy to identify, even for beginner traders. With its three distinct candles, it provides a straightforward visual cue that doesn’t require deep analysis, making it beginner-friendly while still valuable for more experienced traders.

Limitations and Common Mistakes

Despite its effectiveness, the Evening Star pattern has some limitations and is prone to certain common mistakes.

Limitations:

- False Signals in Sideways Markets:

- The Evening Star may produce misleading signals during sideways or consolidating market conditions. In such environments, the pattern’s reliability diminishes, making it essential to confirm with other indicators before acting on it.

- Need for Confirmation:

- For greater accuracy, the Evening Star pattern must be confirmed with additional technical indicators like RSI, moving averages, or volume analysis. Relying solely on the pattern without confirmation can lead to false signals.

Common Mistakes:

- Misidentifying Candles:

- One of the most common errors is misinterpreting the candles that make up the pattern. Subtle variations can lead traders to mistake other patterns (like Dark Cloud Cover) for an Evening Star, leading to incorrect trades.

- Ignoring Market Context:

- Failing to consider the broader market context, such as the prevailing trend strength or overall market conditions, is another pitfall. A pattern formed in a strong uptrend may not be as reliable unless accompanied by broader confirmation signals.

Pro Tip:

Always confirm the Evening Star Candlestick Pattern with other technical tools to increase its reliability. Using indicators like RSI, MACD, or moving averages can significantly reduce the likelihood of false signals and enhance your decision-making process.

The Evening Star Candlestick Pattern offers a highly accurate and versatile signal for trend reversals but requires confirmation to avoid false signals. By understanding its advantages and limitations and using additional technical tools, traders can make better-informed decisions and improve their trading outcomes.

Comparison with Other Candlestick Patterns

Evening Star vs. Morning Star

- Morning Star: Signals bullish reversals at the bottom of a downtrend.

- Evening Star: Indicates bearish reversals at the top of an uptrend.

Differences from Other Bearish Patterns

- Dark Cloud Cover: Partial bearish engulfment.

- Bearish Engulfing: Fully engulfs the previous bullish candle.

The Evening Star Candlestick Pattern remains a preferred choice for its simplicity and accuracy.

Advanced Tips for Traders Using the Evening Star Pattern

Understand both sides of using the Evening Star pattern in your trading strategy.

Advanced traders can refine their strategy with the Evening Star pattern by incorporating more sophisticated techniques for higher accuracy and success. Here are key insights:

1. Use Multiple Time Frames for Confirmation

- Confirm the Evening Star pattern across different time frames. For example, if the pattern forms on a 4-hour chart, check the daily chart for additional validation.

- This reduces false signals and ensures the reversal is supported across time frames.

2. Combine with Momentum Indicators

- Use RSI or MACD to assess if the market is overbought. A high RSI (>70) strengthens the bearish signal from the Evening Star.

- Combining these indicators ensures you enter trades when the market is primed for a reversal.

3. Use Trendlines and Support/Resistance

- Draw trendlines and identify key support/resistance levels. A break below support alongside the Evening Star strengthens the reversal signal.

- This provides critical context for more accurate entry and exit points.

4. Analyze Volume

- Look for high volume on the third candle, as it confirms market conviction and strengthens the reversal.

- Volume spikes increase the reliability of the Evening Star as a reversal pattern.

5. Use Fibonacci Retracements

- Combine the Evening Star with Fibonacci retracement levels. If the pattern aligns with key levels (like 61.8%), the reversal signal becomes stronger.

- Fibonacci levels highlight areas of support/resistance, reinforcing the signal.

6. Refine Stop-Loss Placement

- Use Average True Range (ATR) for dynamic stop-loss placement, rather than just above the second candle.

- This accounts for market volatility, reducing the chance of being stopped out too early.

7. Consider the Broader Market Trend

- Avoid trading the Evening Star in strong uptrends. Wait for a pullback or consolidation phase for better reliability.

- Aligning the pattern with the broader trend increases its effectiveness.

By integrating these techniques, traders can enhance their chances of success when using the Evening Star Candlestick Pattern.

- Integrate Fibonacci Retracements: Use them to pinpoint optimal entry points after the third candle.

- Analyze Volume Trends: Higher volume confirms the pattern’s strength.

- Trade Across Timeframes: Validate the pattern on higher timeframes for reliability while entering trades on lower timeframes for precision.

Opofinance Services: A Reliable Partner for Traders

Opofinance, an ASIC-regulated broker, offers tools and services to empower your trading journey:

- Social Trading Platform: Follow and replicate strategies of top-performing traders.

- MT5 Broker Listing: Access advanced charting tools and automated trading features.

- Safe Transactions: Enjoy secure and convenient deposit/withdrawal options.

Join Opofinance to take your trading strategies to the next level with the Evening Star Pattern and more!

Conclusion: Why the Evening Star Pattern Matters

The Evening Star Candlestick Pattern is a powerful tool for traders seeking to identify potential trend reversals in the markets. This pattern is particularly useful for those who are looking to capitalize on shifts from bullish to bearish trends. By understanding its structure and how to effectively implement it into a trading strategy, traders can make more informed decisions and increase their chances of success.

What makes the Evening Star pattern so significant is its simplicity and reliability when confirmed with other technical indicators like RSI, MACD, or volume analysis. By using this pattern in conjunction with tools like Fibonacci retracements and key support/resistance levels, traders can significantly enhance their probability of success.

Whether you are new to trading or an experienced professional, the Evening Star provides an easy-to-recognize signal that can help pinpoint critical market turning points. Remember, while the pattern is a powerful indicator, it is always best to combine it with other forms of analysis to ensure that you are making well-rounded, informed trading decisions.

By mastering the Evening Star Candlestick Pattern, traders can refine their strategies, minimize risks, and ultimately improve their trading performance.

Key Takeaways

- The Evening Star Candlestick Pattern is a reliable signal for market reversals.

- It consists of a large bullish candle, a small-bodied second candle, and a large bearish candle.

- Confirm the pattern with additional indicators like RSI and volume.

- Use Opofinance’s tools to enhance your trading strategies effectively.

How can I confirm the Evening Star Pattern for higher accuracy?

Use indicators like RSI, moving averages, and volume analysis to confirm the pattern and reduce the chances of false signals.

Is the Evening Star Pattern effective in all timeframes?

Yes, but higher timeframes provide more reliable signals, while lower timeframes offer more precise entry points.

Can the Evening Star Pattern be combined with other trading strategies?

Absolutely! It works well with Fibonacci levels, trendlines, and support/resistance zones to refine entry and exit points.