Oil prices are subject to frequent changes, influenced by a variety of factors that can cause significant economic and geopolitical shifts. Understanding what causes oil prices to fluctuate is essential for businesses, policymakers, and consumers. This article delves into the primary factors driving oil price fluctuations, providing insights into the complex dynamics of the global oil market. For those engaged in global financial markets, such as trading oil futures, choosing a regulated forex broker is crucial to navigate these complexities effectively..

Oil prices are influenced by a myriad of factors, ranging from fundamental supply and demand dynamics to geopolitical events and market speculation. These factors are interconnected, often amplifying each other’s impact, making oil price prediction a complex task.

Supply and Demand Dynamics

Oil prices are primarily driven by the forces of supply and demand. This section explores various aspects of these dynamics, shedding light on how they influence oil price fluctuations.

Global Economic Growth

Economic growth plays a critical role in determining oil demand. During periods of robust economic expansion, industries ramp up production, transportation activity increases, and overall energy consumption rises. This heightened demand for oil can drive prices upward.

Seasonal Trends

Oil demand exhibits seasonal variations, influenced by factors such as travel patterns and heating needs. These seasonal trends can lead to predictable fluctuations in oil prices.

Summer Driving Season

In the United States, the summer driving season, typically from Memorial Day to Labor Day, sees a significant increase in gasoline consumption as millions of Americans take to the roads for vacations. This spike in demand often leads to higher oil prices during the summer months. For example, in the summer of 2018, U.S. gasoline consumption averaged about 9.4 million barrels per day, up from the annual average of 9.2 million barrels per day, contributing to a rise in oil prices.

Winter Heating Demand

Winter brings an increased demand for heating oil, particularly in colder regions like North America and Europe. Harsh winters can exacerbate this demand. For instance, the winter of 2013-2014, known as the “Polar Vortex” winter in the United States, led to a surge in heating oil consumption, driving up prices due to increased demand.

Read More: Mastering the Best Trading Strategy for Crude Oil

Disruptions in Supply

Supply disruptions can have a profound impact on oil prices, often leading to sharp increases due to reduced availability.

Natural Disasters

Natural disasters such as hurricanes, earthquakes, and floods can damage oil production facilities, pipelines, and refineries, disrupting supply chains.

Political Unrest

Political instability in key oil-producing regions can also disrupt supply and drive prices higher.

Actions by OPEC

The Organization of the Petroleum Exporting Countries (OPEC) plays a significant role in managing global oil supply through its production decisions.

Production Quotas

OPEC sets production quotas for its member countries to manage supply and influence prices.

Global Supply and Demand Balance

The balance between global oil supply and demand is a delicate one, influenced by various factors. Overproduction or undersupply can lead to significant price swings.

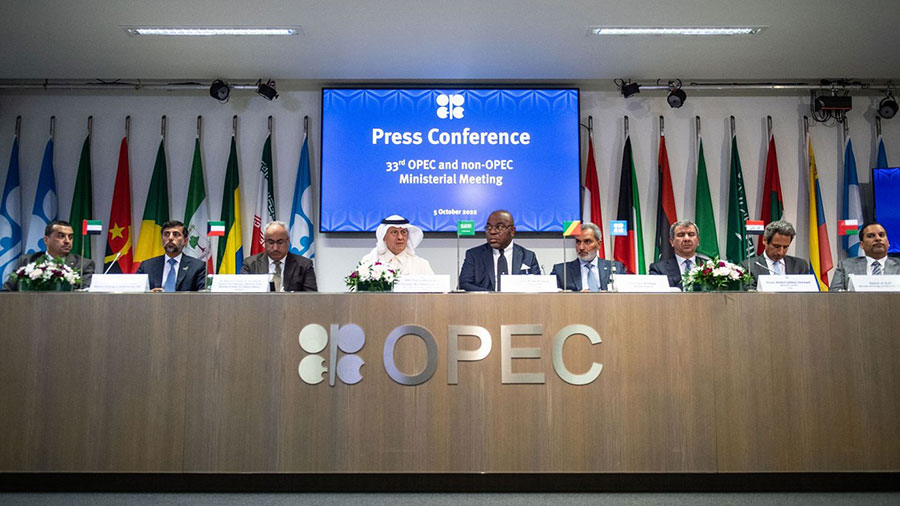

The Role of OPEC

The Organization of the Petroleum Exporting Countries (OPEC) plays a pivotal role in the global oil market. Comprised of 13 member countries, OPEC coordinates and unifies the petroleum policies of its member states, aiming to secure fair and stable prices for petroleum producers. Understanding the role of OPEC in influencing oil prices is crucial for comprehending the broader dynamics of the oil market.

Organization of the Petroleum Exporting Countries

OPEC was established in 1960 by five founding members: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. The organization has since expanded, with additional members joining over the years. OPEC’s primary mission is to coordinate and unify the petroleum policies of its member countries and ensure the stabilization of oil markets. This involves balancing supply and demand to prevent harmful price volatility.

Production Quotas

One of the main tools OPEC uses to influence oil prices is the setting of production quotas. By controlling the amount of oil that member countries produce, OPEC can influence global oil supply and, consequently, oil prices.

OPEC+ Coalition

To enhance its influence, OPEC has formed alliances with other major oil-producing countries, including Russia, forming the OPEC+ coalition. This broader coalition allows for more comprehensive control over global oil supply.

Read More: Geopolitical Impact on Forex Trading

Influence on Market Sentiment

OPEC’s announcements and decisions can significantly influence market sentiment. Traders and investors closely watch OPEC meetings and statements, as they often provide indications of future oil supply levels.

Production Quotas

OPEC sets production quotas for its member countries, which directly impacts global oil supply. When OPEC decides to cut production, it reduces supply, leading to higher prices. Conversely, increasing production can lower prices. For instance, in 2020, OPEC+ (which includes OPEC members and other oil-producing countries like Russia) agreed to significant production cuts in response to the COVID-19 pandemic’s impact on oil demand. This decision helped stabilize oil prices, which had plummeted earlier in the year.

Market Stabilization Efforts

OPEC often steps in to stabilize the market during periods of extreme price volatility. By adjusting production levels, OPEC aims to maintain a balance that supports fair prices for producers while ensuring a stable supply for consumers.

Financial Markets and Speculation

The financial markets and speculative trading play a crucial role in determining oil prices. These elements can lead to significant short-term price volatility, driven by investor sentiment, market psychology, and trading strategies.

Oil Futures Contracts

Oil futures contracts are agreements to buy or sell oil at a predetermined price on a specified date in the future. These contracts are traded on commodities exchanges, such as the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE). Futures contracts are essential tools for hedging against price fluctuations and for speculative trading.

Example: Hedging with Futures Contracts

Oil producers and consumers use futures contracts to hedge against price volatility. For example, an airline company might purchase oil futures to lock in fuel prices and protect against potential price increases. Similarly, an oil producer might sell futures contracts to secure a guaranteed price for their output, mitigating the risk of price drops.

Speculative Trading

Speculative trading involves buying and selling oil futures contracts based on expectations of future price movements. Speculators do not intend to take physical delivery of oil but aim to profit from price changes. Their activities can amplify short-term price volatility.

Impact of Speculative Trading

Speculative trading can lead to rapid price movements in response to news and events. For instance, during the 2008 financial crisis, speculative trading contributed to the sharp rise in oil prices to $147 per barrel in July, followed by a rapid decline to $40 per barrel by December. Traders’ reactions to changing economic conditions, geopolitical events, and market sentiment drove these significant price swings.

Role of Investor Sentiment and Market Psychology

Investor sentiment and market psychology are critical drivers of oil price movements. Positive or negative news can influence traders’ perceptions of future supply and demand, leading to buying or selling activity that impacts prices.

Example: Economic Data Releases

Economic data releases, such as reports on GDP growth, employment figures, and industrial production, can significantly influence investor sentiment. Positive economic data can lead to expectations of increased oil demand, driving prices higher. Conversely, negative data can trigger fears of reduced demand, leading to lower prices. For instance, strong U.S. jobs reports often lead to higher oil prices due to anticipated increased consumption.

Geopolitical Events and Speculation

Geopolitical events can also trigger speculative trading. Tensions in oil-producing regions, changes in trade policies, and other geopolitical developments can lead to rapid price adjustments based on speculators’ expectations.

Example: U.S.-Iran Tensions

In early 2020, heightened tensions between the United States and Iran led to significant volatility in oil prices. Speculators reacted to the potential for supply disruptions in the Middle East, pushing prices higher. Although the situation de-escalated, the period of heightened tension illustrated how geopolitical events can drive speculative trading and impact prices.

Influence of Financial Instruments and Strategies

Various financial instruments and trading strategies can influence oil prices. These include options, exchange-traded funds (ETFs), and algorithmic trading.

Example: Options Trading

Options trading allows investors to bet on future price movements without holding the underlying asset. Call options provide the right to buy oil at a specific price, while put options provide the right to sell. Significant trading in options can influence market sentiment and contribute to price volatility. For instance, a surge in call options trading might indicate bullish sentiment, leading to higher oil prices.

Read More: Trading in Forex

Algorithmic and High-Frequency Trading

Algorithmic and high-frequency trading (HFT) involve using computer algorithms to execute trades at high speeds and volumes. These strategies can contribute to market liquidity but also amplify price movements during periods of high volatility.

Example: Flash Crashes

Flash crashes, where prices drop and recover rapidly within minutes, are often attributed to algorithmic and high-frequency trading. For instance, a sudden drop in oil prices in February 2018, when WTI crude fell by over $2 per barrel within minutes, was partially attributed to algorithmic trading strategies reacting to market signals and triggering a cascade of sell orders.

Other Factors Affecting Oil Prices

Several additional factors influence oil prices, ranging from production costs to geopolitical events. These factors can significantly impact the supply and demand dynamics, leading to price fluctuations. This section explores these influences in detail.

Production Costs

The cost of producing oil varies significantly depending on the region and extraction method. Higher production costs can lead to higher oil prices, as producers need to cover their expenses and achieve profitability.

Example: Deepwater Drilling vs. Shale Oil

Deepwater drilling, such as in the Gulf of Mexico or offshore Brazil, involves significant investment in technology, equipment, and safety measures, leading to higher production costs. In contrast, shale oil production, which has surged in the United States, involves hydraulic fracturing and horizontal drilling techniques that can be more cost-effective. However, shale oil production also faces challenges such as rapid depletion rates of wells, requiring continuous investment in new drilling.

Technological Advancements

Advancements in technology can affect oil prices by altering production capabilities and influencing the development of alternative energy sources.

Example: Hydraulic Fracturing and Horizontal Drilling

Technological advancements in hydraulic fracturing and horizontal drilling have revolutionized the oil industry, particularly in the United States. These technologies have unlocked vast reserves of shale oil, significantly increasing supply and contributing to lower global oil prices. The U.S. shale boom transformed the country into a major oil producer, influencing global oil markets and prices.

Geopolitical Events

Geopolitical events, including wars, sanctions, and political instability, can disrupt oil supply and lead to price spikes.

Example: Sanctions on Iran

U.S. sanctions on Iran’s oil industry have significantly impacted global oil supply. In 2018, the U.S. reinstated sanctions on Iran, reducing its oil exports by more than 1 million barrels per day. This reduction in supply contributed to higher oil prices, as other producers struggled to fill the gap left by Iranian oil.

Political Instability

Political instability in oil-producing regions can lead to disruptions in production and exports, affecting global supply and prices.

Example: Venezuelan Crisis

Venezuela, home to some of the world’s largest oil reserves, has faced severe political and economic turmoil. The crisis has led to a collapse in oil production, with output dropping from over 2 million barrels per day in 2016 to less than 1 million barrels per day by 2020. This significant reduction in supply has contributed to fluctuations in global oil prices.

Refining Capacity

The capacity to refine crude oil into usable products such as gasoline, diesel, and jet fuel influences oil prices. Limited refining capacity can create bottlenecks, leading to higher prices for refined products.

Example: U.S. Refining Bottlenecks

The United States, despite being a major oil producer, has faced challenges with refining capacity. During periods of high demand, such as the summer driving season or after natural disasters that damage refineries, the limited refining capacity can lead to higher prices for gasoline and other products. For instance, Hurricane Harvey in 2017 significantly impacted refining capacity along the Gulf Coast, leading to a spike in gasoline prices.

Storage Capacity

Storage capacity also plays a crucial role in oil price dynamics. When storage facilities are full, producers may be forced to reduce output or sell oil at lower prices to clear inventories.

Example: 2020 Oil Price Collapse

In April 2020, as the COVID-19 pandemic led to a sharp drop in oil demand, storage facilities around the world began to fill up. The lack of storage capacity contributed to the unprecedented collapse in oil prices, with WTI crude futures briefly trading at negative prices. This situation highlighted the importance of storage capacity in managing supply and maintaining price stability.

Interest Rates

Interest rates can influence oil prices by affecting the cost of financing for oil producers and the broader economy’s health.

Example: Federal Reserve Rate Hikes

When the Federal Reserve increases interest rates, borrowing costs for oil producers rise. Higher interest rates can lead to reduced investment in new production, limiting supply and potentially driving up prices. Additionally, higher interest rates can slow economic growth, reducing oil demand and exerting downward pressure on prices.

The Interconnectedness of Factors

The factors influencing oil prices are deeply interconnected. For example, geopolitical events can lead to supply disruptions, which in turn affect market sentiment and speculative trading. Similarly, economic growth can drive up demand, leading to higher prices, which then influence production decisions by OPEC and other producers. Understanding these interactions is key to comprehending the complex nature of oil price fluctuations.

Conclusion

Understanding what causes oil prices to fluctuate requires a multifaceted approach, considering various economic, geopolitical, technological, and environmental factors. Businesses and policymakers must stay informed about these influences to make strategic decisions and manage risks effectively. By analyzing the interplay of supply and demand, geopolitical events, technological advancements, market speculation, and natural factors, one can better anticipate and respond to the dynamic nature of oil prices.

How do natural disasters affect oil prices?

Natural disasters can disrupt oil production and refining operations, leading to temporary shortages and price spikes. For instance, hurricanes in the Gulf of Mexico can damage oil platforms and refineries, reducing supply and driving up prices.

What role do currency fluctuations play in oil pricing?

Oil prices are typically denominated in U.S. dollars. Fluctuations in the value of the dollar can impact oil prices. A stronger dollar makes oil more expensive for countries using other currencies, potentially reducing demand and lowering prices. Conversely, a weaker dollar can make oil cheaper for foreign buyers, increasing demand and driving up prices.

How do technological advancements in energy storage impact oil prices?

Advancements in energy storage, such as improved batteries for renewable energy sources, can reduce dependence on oil. As energy storage becomes more efficient and widespread, it may lead to decreased oil demand and lower prices in the long term.

Can government policies influence oil prices?

Yes, government policies can significantly influence oil prices. Policies promoting renewable energy, imposing taxes on carbon emissions, or providing subsidies for alternative energy sources can reduce oil demand. Conversely, policies supporting oil exploration and production can increase supply and influence prices.