Understanding Forex Market Hours is crucial for traders aiming to maximize their trading performance and capitalize on market opportunities. This article delves into the intricacies of forex trading sessions, strategies for different market hours, the impact of economic events, and essential tools for managing your trading activities effectively. Whether you are working with a broker for forex trading, understanding these elements can significantly enhance your trading success.

Introduction to Forex Market Hours

The forex market operates 24 hours a day, five days a week, providing traders with unparalleled flexibility. Unlike traditional financial markets, the forex market does not have a centralized exchange, and trading takes place over-the-counter (OTC) through a global network of banks, brokers, and financial institutions. The continuous nature of the forex market is segmented into major trading sessions: Asian, London, and North American.

Importance of Forex Market Hours

Forex market hours significantly impact trading activities, including liquidity, volatility, and pricing. Different sessions exhibit distinct characteristics, and understanding these can help traders align their strategies to optimize their trading outcomes.

Major Forex Trading Sessions

The forex market is primarily divided into three major trading sessions: Asian, London, and North American. Each session has its unique features and trading opportunities.

Asian Session

The Asian session kicks off the global forex market week, opening at 23:00 GMT on Sunday. Major trading centers in this session include Tokyo, Hong Kong, and Singapore.

Characteristics:

- Generally low volatility compared to other sessions.

- Best suited for trading currency pairs involving JPY, AUD, and NZD.

- Key economic events from Japan, Australia, and China can influence market movements.

London Session

The London session is one of the most active and significant trading periods, opening at 07:00 GMT and closing at 16:00 GMT. London is the financial hub of Europe, and this session overlaps with both the Asian and North American sessions, creating substantial market activity.

Characteristics:

- High liquidity and volatility, particularly during the overlap with the North American session.

- Major currency pairs like EUR/USD, GBP/USD, and USD/CHF are actively traded.

- Key economic events from the UK and Eurozone can drive market movements.

North American Session

The North American session starts at 12:00 GMT and ends at 21:00 GMT, with New York being the primary trading center. This session is known for its high volatility, especially during the overlap with the London session.

Characteristics:

- High liquidity, with major market movements often driven by economic news releases.

- Active trading in pairs like USD/CAD, USD/JPY, and EUR/USD.

- Significant impact from US economic data and corporate earnings reports.

Strategies for Different Market Sessions

Different market sessions offer varied trading environments, necessitating tailored strategies for each. By understanding the unique characteristics of each session, traders can optimize their strategies to maximize profits and minimize risks. Below is an in-depth exploration of effective strategies for the Asian, London, and North American sessions, with detailed examples and advanced techniques.

Asian Session Strategies

The Asian session, particularly dominated by the Tokyo market, is characterized by lower volatility compared to the London and North American sessions. This environment requires strategies that capitalize on stable price movements and the unique dynamics of the session.

Range Trading

Range Trading is a common strategy during the Asian session due to its lower volatility.

- Exploit Low Volatility: Traders identify support and resistance levels where the price tends to bounce within a specific range. This is particularly useful as prices often consolidate during this session.

- Suitable Pairs: USD/JPY and AUD/USD are particularly well-suited for range trading during this session due to their steady behavior.

- Indicators: Tools like the Relative Strength Index (RSI) and Bollinger Bands can help identify overbought and oversold conditions within the range, providing entry and exit points.

Example of a Range Trading Strategy:

- Scenario: The USD/JPY pair is trading within a well-defined range during the Asian session.

- Strategy: The trader sets buy orders near the support level and sell orders near the resistance level.

- Execution: As the price oscillates within the range, the trader executes multiple profitable trades by buying at support and selling at resistance. For instance, if the support is at 110.00 and resistance at 110.50, the trader might buy at 110.10 and sell at 110.40, repeatedly as the price moves between these levels.

News Trading involves taking positions based on economic releases and news events from Asia-Pacific countries.

- Monitor Economic Releases: Key economic indicators such as GDP, unemployment rates, and interest rate decisions can significantly impact currency pairs during the Asian session.

- Trade Immediate Reactions: Traders capitalize on the immediate market reactions to these news events. For example, a surprise interest rate cut by the Bank of Japan could lead to a sharp decline in the JPY.

- Risk Management: Use tight stop-loss orders to protect against unexpected market movements, as news events can lead to rapid price changes.

Example of News Trading Strategy:

- Scenario: The Reserve Bank of Australia (RBA) is set to announce its interest rate decision.

- Strategy: The trader anticipates a rate cut based on economic indicators and positions short on the AUD/USD.

- Execution: Upon the RBA’s announcement of the rate cut, the AUD/USD drops, allowing the trader to capture the move. The trader sets a stop-loss slightly above the entry point to manage risk.

Liquidity Target Trading

Liquidity Target Trading focuses on capturing price movements during periods of increased liquidity within the Asian session.

- Identify Liquidity Targets: Using historical data, traders can pinpoint periods when liquidity spikes, such as the overlap with the Sydney and Tokyo sessions.

- Execution: Place trades targeting these liquidity spikes to capture potential price movements. Historical analysis can reveal specific times when liquidity tends to increase, providing a basis for strategy.

- Risk Management: Employ stop-loss and take-profit orders to manage risk effectively, as liquidity spikes can lead to sharp price movements.

Example of Liquidity Target Trading:

- Scenario: Historical data shows a liquidity spike in the USD/JPY pair at 01:00 GMT during the Tokyo session.

- Strategy: The trader sets a buy order at a historically significant support level, anticipating a liquidity-driven move upward.

- Execution: As liquidity increases at the expected time, the price rises, triggering the buy order and resulting in a profitable trade.

London Session Strategies

The London session is known for its high volatility and liquidity, making it a prime time for various trading strategies.

Breakout Trading

Breakout Trading leverages the increased volatility to trade breakouts from established ranges.

- Utilize Increased Volatility: As the London session opens, volatility often spikes, leading to breakout opportunities. This is particularly true for pairs like EUR/USD and GBP/USD.

- Focus on Pairs: EUR/USD and GBP/USD are ideal for breakout trading during this session due to their high liquidity and frequent price movements.

- Indicators: Tools such as Moving Average Convergence Divergence (MACD) and Bollinger Bands can help identify breakout points.

Example of a Breakout Trading Strategy:

- Scenario: The EUR/USD pair is consolidating ahead of the London session opening.

- Strategy: The trader places pending buy and sell orders above and below the consolidation range, anticipating a breakout.

- Execution: As the London session opens, increased volatility leads to a breakout, triggering one of the pending orders and resulting in a profitable trade. For instance, if the consolidation range is between 1.1200 and 1.1250, the trader places buy orders at 1.1260 and sell orders at 1.1190.

Trend Following

Trend Following strategies involve identifying strong trends formed during the Asian session and riding them through the London session.

- Identify Trends: Use tools like trend lines, moving averages, and the Average Directional Index (ADX) to confirm trends.

- Execution: Enter trades in the direction of the established trend, using trailing stop-loss orders to lock in profits. For example, if the GBP/USD shows a strong upward trend during the Asian session, the trader might enter a long position at the start of the London session and use a trailing stop to maximize gains.

- Indicators: Trend-following indicators like the Moving Average (MA) crossover, ADX, and Parabolic SAR can help confirm the strength and direction of the trend.

Example of Trend Following Strategy:

- Scenario: The GBP/USD pair exhibits a strong upward trend during the Asian session.

- Strategy: The trader enters a long position at the beginning of the London session, using a 20-period moving average to identify entry points.

- Execution: The trader sets a trailing stop to follow the trend, adjusting the stop-loss as the price increases to lock in profits.

Session Highs and Lows as Liquidity Targets

Using Session Highs and Lows as Liquidity Targets can be particularly effective during the London session.

- Identify Highs and Lows: Mark the highs and lows of previous sessions to set liquidity targets.

- Pending Orders: Place pending orders near these levels to capitalize on potential breakouts or reversals. This approach is beneficial when the price approaches key support or resistance levels established in prior sessions.

- Risk Management: Set stop-loss orders just beyond these levels to manage risk.

Example of Session Highs and Lows Strategy:

- Scenario: The previous session’s high for the EUR/USD pair is 1.1300 and the low is 1.1250.

- Strategy: The trader places a buy order at 1.1310 and a sell order at 1.1240, anticipating a breakout in either direction.

- Execution: As the price approaches these levels during the London session, one of the orders is triggered, leading to a potential profitable trade.

London Kill Zone

The London Kill Zone is a critical period from 7:00 GMT to 10:00 GMT, characterized by heightened volatility.

- Focus on High Volatility: This period often sees significant price movements, making it ideal for short-term trading strategies. Traders can capitalize on the overlap between the London and European market openings.

- Execution: Use fast-paced trading strategies such as scalping and breakout trading during this period to take advantage of the increased volatility.

Read More: Major Currency Pairs in Forex

Example of London Kill Zone Strategy:

- Scenario: During the London Kill Zone, the GBP/USD pair shows increased activity and volatility.

- Strategy: The trader uses a 5-minute chart to identify quick price movements and sets buy and sell orders based on short-term support and resistance levels.

- Execution: The trader capitalizes on rapid price changes, executing multiple trades within the Kill Zone to accumulate profits.

North American Session Strategies

The North American session, particularly the New York market, is marked by high volatility and significant market movements due to economic data releases and overlap with the London session.

Scalping

Scalping is a strategy that involves capitalizing on quick, small price movements during high volatility periods.

- Capitalize on Quick Movements: Scalpers take advantage of the rapid price changes during the North American session, often holding positions for only a few minutes.

- Ideal Pairs: Active markets like USD/CAD and EUR/USD are suitable for scalping due to their high liquidity and frequent price movements.

- Indicators: Tools like Moving Averages, RSI, and MACD can help identify short-term trading opportunities.

Example of a Scalping Strategy:

- Scenario: The USD/CAD pair exhibits high volatility during the North American session.

- Strategy: The trader uses a 1-minute chart to identify short-term price movements and places multiple trades to capture small profits.

- Execution: By rapidly entering and exiting trades, the trader accumulates significant profits over a short period. For instance, the trader might buy at 1.2500 and sell at 1.2505 multiple times within an hour.

Swing Trading

Swing Trading involves taking advantage of larger price swings over several hours or days, often influenced by economic data releases.

- Larger Price Swings: Swing traders capitalize on more significant price movements, holding positions longer than scalpers but shorter than trend followers.

- Economic Data Releases: Economic indicators such as Non-Farm Payrolls (NFP), GDP, and interest rate decisions can cause substantial price swings, providing opportunities for swing traders.

- Indicators: Tools like Fibonacci retracement, Moving Averages, and RSI can help identify potential entry and exit points.

Example of a Swing Trading Strategy:

- Scenario: The Non-Farm Payrolls (NFP) report is due for release, and significant price movement is expected.

- Strategy: The trader analyzes historical data to predict the impact of the report and positions accordingly.

- Execution: Upon release, if the report shows better-than-expected job growth, the trader might go long on the USD/JPY pair, anticipating a strong upward movement.

Session Highs and Lows as Liquidity Targets

Similar to the London session, using Session Highs and Lows as Liquidity Targets can be particularly effective during the North American session.

- Identify Highs and Lows: Use the highs and lows of previous sessions to set liquidity targets, especially during high-impact news events.

- Pending Orders: Place pending orders near these levels to capitalize on potential breakouts or reversals.

- Risk Management: Set stop-loss orders just beyond these levels to manage risk.

Example of Session Highs and Lows Strategy:

- Scenario: The previous session’s high for the USD/JPY pair is 110.50 and the low is 110.00.

- Strategy: The trader places a buy order at 110.60 and a sell order at 109.90, anticipating a breakout in either direction.

- Execution: As the price approaches these levels during the North American session, one of the orders is triggered, leading to a potential profitable trade.

New York Kill Zone

The New York Kill Zone is a period from 12:00 GMT to 15:00 GMT, characterized by high activity and significant trading opportunities.

- Focus on High Activity: This period often sees major price movements, particularly around the release of U.S. economic data.

- Execution: Use strategies like breakout trading and scalping during this period to take advantage of the heightened activity.

Example of New York Kill Zone Strategy:

- Scenario: During the New York Kill Zone, the EUR/USD pair shows increased volatility.

- Strategy: The trader uses a 5-minute chart to identify potential breakout points and sets buy and sell orders based on short-term support and resistance levels.

- Execution: The trader capitalizes on rapid price changes, executing multiple trades within the Kill Zone to accumulate profits.

Read More: Exotic Currency Pairs in Forex

Silver Bullet Strategy

The Silver Bullet Strategy aims to capture high-probability price reversals during the peak of the North American session.

- Identify Key Levels: This strategy involves identifying strong support and resistance levels and waiting for price action confirmation before entering trades.

- Execution: Typically executed between 15:00 GMT and 17:00 GMT, after the New York Kill Zone, this strategy aims to catch price reversals.

- Indicators: Price action patterns such as bullish or bearish engulfing candles, and tools like Fibonacci retracement levels can help confirm entry points.

Example of the Silver Bullet Strategy:

- Scenario: The EUR/USD pair has shown strong movements during the New York session, and a potential reversal is anticipated.

- Strategy: The trader identifies a key resistance level based on prior session highs and waits for price action to confirm a reversal pattern, such as a bearish engulfing candle.

- Execution: Upon confirmation, the trader enters a short position, setting a stop-loss just above the resistance level and a take-profit target based on the next significant support level.

Impact of Economic Events on Market Hours

Economic events significantly impact forex market hours by driving volatility and liquidity. Major announcements, such as interest rate decisions, GDP reports, and employment data, often lead to sharp market movements.

Key Economic Events

Non-Farm Payrolls (NFP) Report (US):

- Released monthly, it significantly impacts USD pairs.

European Central Bank (ECB) Meetings:

- Policy decisions and statements can drive EUR pairs.

Bank of Japan (BoJ) Announcements:

- Influence JPY pairs.

Analysis of High-Impact Economic Events

US Non-Farm Payrolls (NFP):

- Released on the first Friday of each month.

- Measures the number of jobs added or lost in the US economy, excluding the agricultural sector.

- Strongly influences the USD and can cause major movements in related pairs.

European Central Bank (ECB) Meetings:

- Held monthly to discuss monetary policy and interest rates.

- Decisions and statements from these meetings can lead to significant volatility in EUR pairs.

Bank of Japan (BoJ) Announcements:

- Include interest rate decisions and economic outlook reports.

- Impact the JPY and can cause major price movements in related pairs.

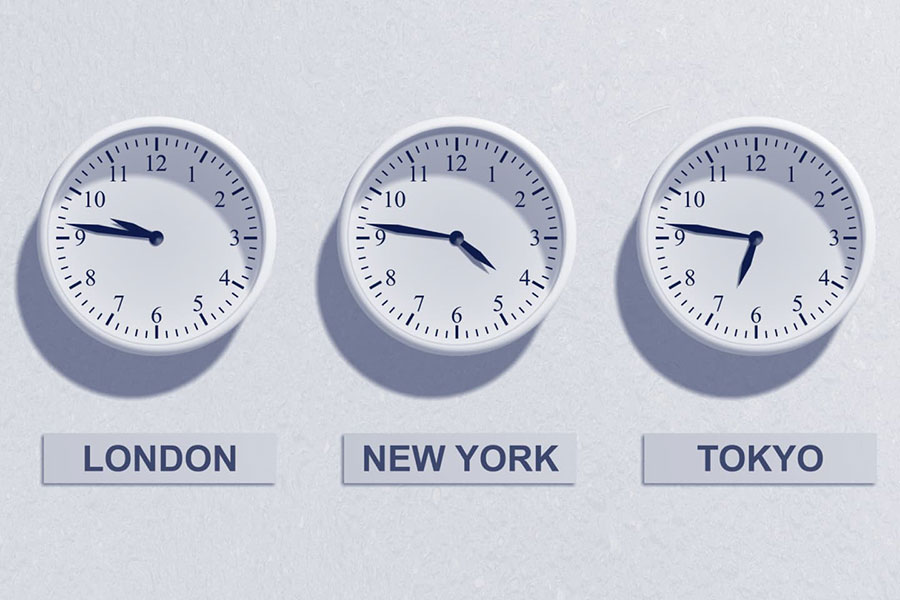

Forex Market Hours and Time Zone Considerations

Forex traders need to consider time zone differences when planning their trading activities. Tools like forex market hours converters and world clocks can help in tracking market openings and closings accurately.

Tips for Managing Time Zones

Use GMT as a Standard Reference

Most forex trading platforms and economic calendars use GMT.

Adjust Trading Schedule According to Local Time Zones

Align your trading hours with the most active sessions in your region.

Stay Updated with Daylight Saving Time Changes

Be aware of changes in trading hours due to daylight saving time adjustments.

Example of Time Zone Management

Scenario: A trader based in New York wants to trade the London session.

- Strategy: The trader adjusts their schedule to start trading at 3:00 AM EST, corresponding to the 8:00 AM GMT opening of the London session.

- Execution: By aligning their trading hours with the London session, the trader takes advantaasia ge of increased liquidity and volatility.

Best Times to Trade

The best times to trade in the forex market are characterized by high liquidity and volatility, which are crucial for executing trades with optimal pricing and minimal slippage. Here are the key periods considered optimal for trading:

Overlap Sessions

- London-New York Overlap (12:00 GMT to 17:00 GMT)

- Characteristics: This period is highly liquid and volatile as both the London and New York sessions are active simultaneously.

- Currency Pairs: Major pairs like EUR/USD, GBP/USD, and USD/JPY see increased trading volume and tighter spreads.

- Trading Strategies: Traders can capitalize on breakouts and trends during this overlap, making it ideal for day traders and swing traders alike.

- Asian-European Overlap (07:00 GMT to 08:00 GMT)

- Characteristics: Overlaps between the end of the Asian session and the beginning of the London session.

- Currency Pairs: EUR/JPY, EUR/AUD, and GBP/JPY are actively traded.

- Trading Strategies: Focus on trading major European and Asian currencies as the market transitions from the Asian to the European session.

Specific Sessions

- London Session (07:00 GMT to 16:00 GMT)

- Characteristics: The London session is known for its high liquidity and volatility, especially during the first few hours.

- Currency Pairs: EUR/USD, GBP/USD, and USD/CHF are highly active.

- Trading Strategies: Employ breakout and trend-following strategies as market movements can be pronounced due to economic data releases and news from Europe.

- North American Session (12:00 GMT to 21:00 GMT)

- Characteristics: The New York session sees the highest volatility during its overlap with the London session.

- Currency Pairs: USD/CAD, USD/JPY, and EUR/USD are traded actively.

- Trading Strategies: Scalping and trend continuation strategies can be effective during this session, given the rapid price movements driven by economic news from the US.

Worst Times to Trade

Understanding the worst times to trade in the forex market is crucial to avoid periods of low liquidity, wider spreads, and potentially higher trading costs. These times generally coincide with market closures and lower trading activity:

- End of Trading Sessions

- Characteristics: Liquidity starts to decline towards the end of each major trading session.

- Impact: Spreads widen, and price movements become less predictable, increasing the risk of slippage.

- Examples: The last hour of the New York session (20:00 to 21:00 GMT) and the last hour of the Asian session (06:00 to 07:00 GMT) are typically less favorable for trading.

- Weekend Trading (Saturday and Sunday)

- Characteristics: Forex trading is generally closed from 22:00 GMT on Friday until 22:00 GMT on Sunday.

- Impact: Liquidity is extremely low, and spreads are wider, making it challenging to execute trades at favorable prices.

- Considerations: Some brokers offer limited trading options during weekends, mainly involving cryptocurrencies and a few forex pairs, but these are not recommended for most traders due to low liquidity.

Daylight Saving Considerations in Trading Sessions

Daylight saving time (DST) changes impact forex trading hours, shifting the opening and closing times of sessions based on local time zones. Here’s how DST affects trading sessions:

- Impact on Sessions: During DST changes, sessions such as the London and New York sessions may open and close an hour earlier or later in GMT terms.

- Adjusting Trading Hours: Traders should adjust their trading schedules according to GMT and local time changes to ensure they are trading during the most active periods.

- Using Time Zone Converters: Forex market hours converters help traders stay updated with session times across different time zones, essential for planning trades accurately during DST transitions.

Physical and Psychological Effects of Choosing the Right Session for Trading

Choosing the right trading session not only affects trading outcomes but also impacts traders physically and psychologically:

- Physical Effects: Trading during sessions that align with a trader’s local time zone can minimize fatigue and enhance alertness, crucial for making informed trading decisions.

- Psychological Effects: Trading during active sessions with high liquidity and volatility can boost trader confidence and reduce emotional stress associated with trading during low-activity periods.

- Optimizing Performance: By selecting sessions that match their peak concentration and energy levels, traders can optimize their trading performance and achieve better results in the forex market.

Common Mistakes to Avoid When Trading Forex

Understanding common mistakes can help traders avoid pitfalls and improve their trading performance.

Common Mistakes

Trading During Low Liquidity Periods:

- Avoid trading during market close hours when liquidity is low, leading to wider spreads and higher costs.

Ignoring Economic Calendars:

- Failing to keep track of economic events can result in unexpected market movements, affecting open positions.

Overtrading:

- Excessive trading, especially during volatile periods, can lead to significant losses.

Detailed Analysis of Common Mistakes

Trading During Low Liquidity Periods:

- Example: Trading the EUR/USD pair during the last hour of the New York session.

- Impact: Wider spreads and increased slippage can lead to higher transaction costs and potential losses.

Ignoring Economic Calendars:

- Example: Holding a position during a major economic announcement without considering the potential impact.

- Impact: Unexpected market movements can result in significant losses if the market moves against the trader’s position.

Overtrading:

- Example: Placing multiple trades within a short period without a clear strategy.

- Impact: Increased transaction costs and the potential for significant losses due to impulsive trading decisions.

Tools for Managing Forex Trading Hours

Several tools can help traders manage their trading activities effectively.

Forex Market Hours Converters

These tools help traders track market opening and closing times across different time zones.

Economic Calendars

Keep traders informed about upcoming economic events and announcements that can impact the market.

Trading Platforms with Built-In Alerts

Some trading platforms offer built-in alerts for market opening and closing times, helping traders stay on top of their schedules.

Example of Using a Forex Market Hours Converter

- Scenario: A trader based in Sydney wants to trade the New York session.

- Tool: The trader uses a forex market hours converter to determine that the New York session starts at 11:00 PM Sydney time.

- Execution: By using the converter, the trader accurately plans their trading activities around the New York session.

Conclusion:

Understanding Forex Market Hours is essential for successful trading. By leveraging the unique characteristics of different market sessions, traders can optimize their strategies and improve their trading performance. Staying informed about economic events, managing time zones effectively, and using the right tools can further enhance trading outcomes.

Key Takeaways

- Different forex market sessions offer unique trading opportunities and require tailored strategies.

- Economic events can significantly impact market hours and trading conditions.

- Effective time zone management and the use of specialized tools can help traders stay on top of their trading activities.

Final Thoughts

Forex trading requires a comprehensive understanding of market hours and the ability to adapt strategies to different trading sessions. By mastering these aspects, traders can navigate the forex market more effectively and achieve their trading goals.

What is the best time to trade forex for beginners?

Beginners should consider trading during the overlap between the London and North American sessions (12:00 GMT to 17:00 GMT). This period offers high liquidity and volatility, providing ample trading opportunities with tighter spreads and better order execution. Beginners can also benefit from observing market reactions to major economic announcements during this time.

How do daylight saving time changes affect forex trading hours?

Daylight saving time (DST) changes can shift the opening and closing times of forex trading sessions. For example, when the US switches to DST, the New York session opens and closes an hour earlier in GMT terms. Traders should adjust their schedules accordingly and use forex market hours converters to stay updated with the correct trading times.

Can I trade forex on weekends?

Forex trading is generally closed over the weekend, from 22:00 GMT on Friday to 22:00 GMT on Sunday. However, some brokers offer limited trading during this period through their “weekend trading” services, which typically involve cryptocurrencies and select forex pairs. Liquidity and volatility are significantly lower during these times, so weekend trading is not recommended for most traders.

What are the risks of trading during low liquidity periods?

Trading during low liquidity periods, such as late Friday afternoons or holidays, can lead to wider spreads, higher slippage, and increased difficulty in executing large orders. These conditions can result in higher trading costs and potential losses. Traders should avoid low liquidity periods and focus on trading during active market hours for better execution and risk management.

One Response

Very informative post and easy to understand, thanks for sharing