If you’re trading currencies, you’ve likely asked the critical question: “How is forex tax in USA handled?” The answer is not always straightforward, but understanding it is non-negotiable for staying compliant and profitable. In the United States, your forex profits are taxable. The specific tax treatment depends on the type of forex products you trade, with gains typically falling under either Section 988 as ordinary income or the more favorable Section 1256, which offers a blended rate. As an experienced trader, I know that navigating the tax code can feel as complex as analyzing the markets themselves. This guide will demystify the rules set by the IRS, explain your options, and show you how to handle your tax obligations like a professional, whether you’re working with an online forex broker or trading futures.

Key Takeaways

- Taxable Income: Yes, all net profits from forex trading are taxable in the United States. There is no special “forex tax-free” status.

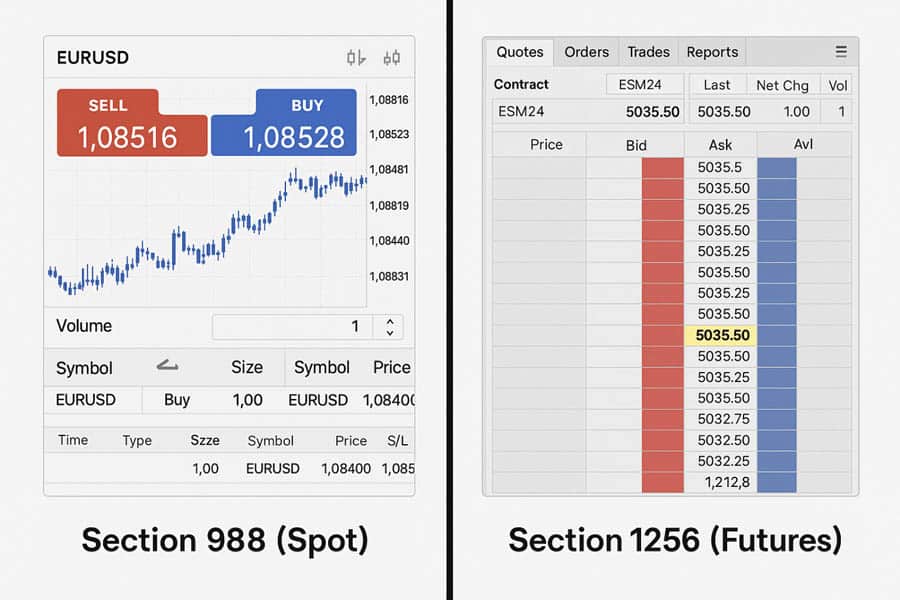

- Two Tax Systems: Your forex gains are taxed under one of two IRS sections. By default, spot forex falls under Section 988 (taxed as ordinary income). Regulated forex futures and options fall under Section 1256, which receives more favorable tax treatment.

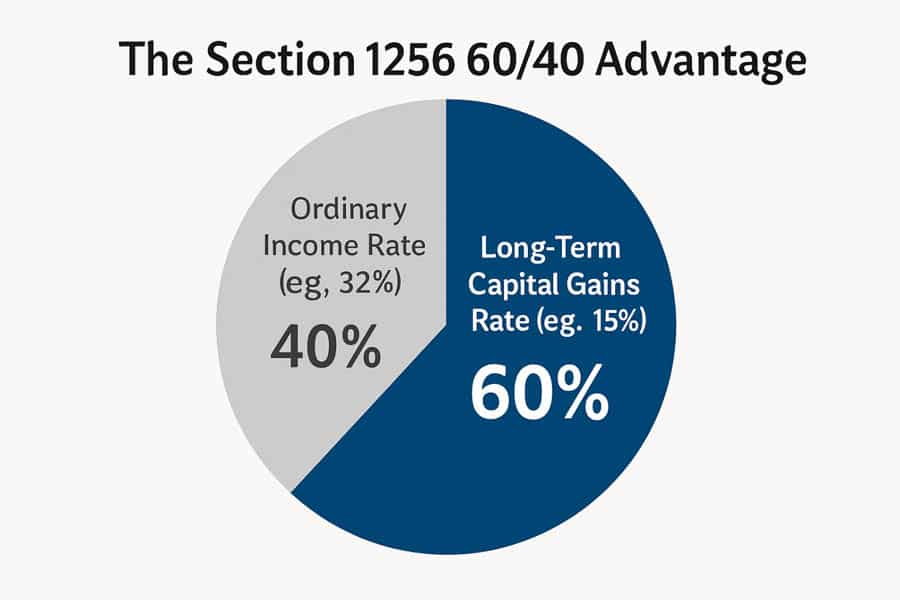

- The 60/40 Advantage: The Section 1256 60/40 rule is a major benefit, taxing 60% of your gains at the lower long-term capital gains rate and 40% at the short-term rate, regardless of how long you held the position. This can significantly reduce your tax bill.

- Election is Key: Most retail spot forex traders can elect to have their trades taxed under Section 1256 instead of Section 988. This election must be made by the first day of the tax year and cannot be easily revoked.

- Deductions Matter: Active traders can claim numerous forex tax deductions to lower their taxable income, including platform fees, data subscriptions, home office expenses, and educational costs.

Final Disclaimer: The information provided in this article is for educational purposes only and is not a substitute for professional tax advice. Tax laws are complex and subject to change. Consult with a qualified CPA or tax attorney to discuss your individual circumstances before making any financial decisions.

Quick Answer: Do You Owe Tax?

Yes, absolutely. If you are a U.S. resident and made a profit from forex trading, you are required to report it and pay taxes. There’s a common myth among new traders that profits aren’t taxable until they are withdrawn from the brokerage account—this is false. The core of understanding forex tax in USA is knowing your profits are taxed based on one of two systems: as ordinary income/loss under Section 988, or as blended capital gains under the highly advantageous Section 1256 60/40 rule.

Spot vs. Futures: Your Tax Bucket

The first step in understanding your tax liability is to identify which tax “bucket” your trading activity falls into. In my experience, this is where most of the confusion around forex tax in America begins. The IRS treats different types of foreign exchange contracts differently.

Your trading style and the specific financial instruments you use determine your default tax classification. Are you trading rolling spot contracts with a retail broker, or are you trading regulated futures on an exchange like the CME? The answer dictates your tax path.

| Feature | Section 988 (Default for Spot Forex) | Section 1256 (Futures & Elected Spot) |

|---|---|---|

| What it is | The default tax rule for most retail spot forex transactions (e.g., trading EUR/USD on a typical retail platform). | Applies to regulated futures contracts, options on futures, and spot traders who make a timely election. |

| Tax Treatment | Gains and losses are treated as ordinary income or loss, similar to your job’s wages. Taxed at your marginal tax rate (up to 37% in 2025). | Gains and losses are split: 60% are taxed at the favorable long-term capital gains rate (0%, 15%, or 20%) and 40% at the short-term rate (your ordinary income rate). |

| Loss Limitation | Ordinary losses can fully offset ordinary income without limit. However, if treated as investment activity, capital loss limitations ($3,000 per year against ordinary income) may apply. | Losses can be carried back three years to offset prior Section 1256 gains, potentially generating a refund. |

| Paperwork | Reported directly on your tax return. Detailed transaction reporting may be required. | Reported on IRS Form 6781, “Gains and Losses From Section 1256 Contracts and Straddles.” |

Trader Scenarios

- Scenario A (Section 988): Jane is a part-time trader using a popular online forex broker to trade spot currency pairs like GBP/JPY. She has not made any special tax elections. At year-end, her net profit is $20,000. This $20,000 will be added to her other income (like her salary) and taxed at her regular marginal income tax rate. This is the standard Section 988 forex treatment.

- Scenario B (Section 1256): Tom trades EUR/USD futures on the Chicago Mercantile Exchange (CME). He also has a $20,000 net profit. His profit is automatically subject to the Section 1256 60/40 rule. He will report this on Form 6781, leading to a much lower effective tax rate than Jane.

How the 60/40 Rule Lowers Your Bill

The Section 1256 60/40 rule is the most powerful tax-saving tool available to U.S. forex traders. It’s a significant advantage because most forex trading is inherently short-term. Without this rule, 100% of your gains would be taxed at the higher short-term capital gains rates, which are the same as your ordinary income tax rates. The rule changes that math entirely.

Let’s break it down with a clear example. The essence of the forex tax in USA for Section 1256 contracts is this blended rate.

Example: $50,000 Profit with the 60/40 Rule

Imagine you made a net profit of $50,000 for the year from trading Section 1256 contracts. Let’s also assume you are in the 32% marginal tax bracket for ordinary income, and your long-term capital gains rate is 15% (the most common rate for 2025).

- Long-Term Portion (60%):

- $50,000 (Total Gain) x 60% = $30,000

- Tax on this portion: $30,000 x 15% (Long-Term Rate) = $4,500

- Short-Term Portion (40%):

- $50,000 (Total Gain) x 40% = $20,000

- Tax on this portion: $20,000 x 32% (Ordinary Rate) = $6,400

- Total Tax Bill:

- $4,500 + $6,400 = $10,900

- Effective Tax Rate:

- ($10,900 / $50,000) = 21.8%

Without the Section 1256 60/40 rule, your entire $50,000 profit would be taxed at your 32% ordinary income rate, resulting in a tax bill of $16,000. By using Section 1256, you saved $5,100 in taxes. This demonstrates the immense value of this specific tax code when managing your forex tax in USA obligations.

Making the Section 988-to-1256 Election

If you’re a spot forex trader, you are likely now asking, “How do I get that lower tax rate?” The good news is the IRS allows you to make an election to treat your Section 988 forex gains and losses under the more favorable Section 1256 rules. This is arguably the single most important tax decision a U.S. spot forex trader can make.

However, you must be proactive. You can’t just decide to use it when you file your taxes. The election must be made internally, in your own records, *before* you place any trades for the tax year. From my experience helping traders, this is a deadline that cannot be missed.

Steps to Make the Election:

- Timing is Crucial: You must make the election by the first day of the tax year. For most people, this is January 1st. If you start trading mid-year, you must make the election on the first day you trade.

- Create an Internal Record: There is no specific IRS form to file to *make* the election itself. Instead, you must document it in your own books and records. A simple signed and dated statement in a document saved on your computer is sufficient.

- Statement Wording: The statement should be clear. Something like: “For the tax year beginning January 1, 2025, I, [Your Name], hereby elect to treat all gains and losses from my trading of Section 988 foreign currency transactions as Section 1256 contracts, pursuant to IRC Sec. 988(a)(1)(B).” Date it and sign it.

- Attach to Tax Return: While you don’t file the election initially, you should attach a copy of this statement to your tax return for the year the election is effective. Your tax preparer will then know to file Form 6781 for your trading activity.

Warning: This election is binding. Once you make it, you generally cannot revoke it without IRS consent, which is rarely granted. This means if you have a large loss year, those losses will be capital losses (subject to the $3,000 annual deduction limit against ordinary income) rather than fully deductible ordinary losses. Carefully consider your trading style and risk tolerance before electing. This is a key aspect of managing your forex tax in America.

Record-Keeping the IRS Expects

The IRS isn’t lenient about sloppy records. As a trader, you are running a business, and you need the documentation to prove it. Proper record-keeping is the foundation of a defensible tax return and is critical for managing your forex tax in USA properly.

Many modern brokers provide year-end tax forms like the 1099-B, which aggregates your gains and losses. For Section 1256 traders, this form will often show the aggregate profit or loss needed for Form 6781. However, I always advise traders not to rely solely on this form. It’s your responsibility to ensure the numbers are correct.

Essential Records to Keep:

- Broker Statements: Download and save all monthly and annual statements from your broker. These are your primary source documents.

- Daily Trade Log (CSV): I can’t stress this enough. Export your detailed transaction history, ideally in a CSV or Excel format. This file should contain every trade, including the currency pair, date and time of entry and exit, position size, and profit/loss. This is your ultimate proof if the IRS ever has questions.

- Election Statement: Keep a digital and physical copy of your Section 988-to-1256 election statement with the date clearly visible.

- Receipts for Expenses: If you plan on taking forex tax deductions, you need receipts for every single one. This includes software subscriptions, data fees, computer hardware, education courses, etc.

You should retain these records for a minimum of three years from the tax filing date, but I personally recommend keeping them for seven years to be completely safe.

Top 5 Forex Tax Deductions

One of the ways to actively reduce your tax bill is by claiming all legitimate business expenses. If you qualify for Trader Tax Status (TTS), a specific IRS designation we’ll touch on later, you can deduct many expenses. Even if you are classified as an investor, some deductions are still available. Many traders overlook valid forex tax deductions, leaving money on the table.

Here are the top five deductions I see traders miss when preparing their forex tax in USA filings:

- Home Office Deduction: If you have a specific, exclusive area in your home used regularly for your trading business, you can deduct a portion of your rent/mortgage interest, utilities, insurance, and repairs. The simplified method allows a deduction of $5 per square foot, up to 300 square feet.

- Platform and Data Fees: Monthly fees for trading platforms (like a premium version of MT4/MT5), charting software (like TradingView), and professional news or data feeds are fully deductible business expenses.

- Education and Coaching: Money spent on courses, seminars, books, or coaching services to improve your trading skills is a valid educational expense. The key is that it must be to improve skills in your current business (trading), not to prepare you for a new one.

- Proprietary Firm Evaluation Costs: The fees paid to prop firms like FTMO, Topstep, or The Funded Trader for their evaluation challenges are a direct cost of doing business and are generally deductible.

- Technology and Office Supplies: The cost of computers, monitors, a high-speed internet connection, and even a new desk chair can be deducted or depreciated as a business expense.

Filing Checklist for Tax Day 2025

Tax season can be stressful. Having a clear checklist helps ensure you don’t miss anything important. Proper preparation is the key to a smooth filing process for your forex tax in America.

Here’s a simple checklist to guide you through filing your 2024 taxes by the 2025 deadline.

| Task | Deadline | Associated Forms |

|---|---|---|

| Gather all broker 1099s and trade logs. | February/March 2025 | Form 1099-B, Form 1099-MISC (from prop firms) |

| Compile and total all business expenses. | March 2025 | Receipts, bank statements |

| File your tax return (or an extension). | April 15, 2025 | Form 1040, Form 4868 (for extension) |

| File your extended tax return. | October 15, 2025 | Full return (1040, 6781, etc.) |

Key Forms for Forex Traders:

- Form 6781: The central form for anyone using the Section 1256 60/40 rule. You report your total net gain or loss here.

- Form 8949 / Schedule D: Used for reporting capital gains and losses not covered by Section 1256. If you have losses from a Section 1256 election, they flow from Form 6781 to Schedule D to be netted against other capital gains.

- Schedule C: If you qualify for Trader Tax Status (TTS), you will use Schedule C to report your trading business income and claim your forex tax deductions.

Common Mistakes That Trigger an Audit

From my professional standpoint, I’ve seen a few common, unforced errors that can attract unwanted attention from the IRS. Avoiding these simple mistakes is a huge part of managing your forex tax in USA obligations smoothly.

- Misclassifying Income: The most common error is simply not reporting trading income at all, or incorrectly classifying Section 1256 gains as ordinary income (or vice-versa). Ensure you understand the difference between Section 988 forex rules and the Section 1256 60/40 rule.

- Ignoring Mark-to-Market (MTM): Section 1256 contracts are “marked-to-market” at year-end. This means any open positions on December 31st are treated as if they were closed at the market price on that day. You must pay tax on these unrealized gains.

- Sloppy Record-Keeping: As mentioned, not having the documentation to back up your filed numbers is a major red flag. If you are audited and can’t produce trade logs or expense receipts, the IRS will likely disallow your claims.

- Incorrectly Claiming Trader Tax Status (TTS): Claiming TTS to get more deductions when you don’t meet the strict criteria (frequent, regular, and continuous trading as your primary source of income) can lead to an audit and penalties.

Legal Ways to Reduce Forex Taxes

Beyond the Section 1256 election and standard deductions, there are more advanced strategies serious traders can use to optimize their forex tax in USA situation. These often involve setting up a formal business structure.

Trader Tax Status (TTS)

Qualifying for TTS is the holy grail for many active traders. It reclassifies you from an “investor” to a “business” in the eyes of the IRS. To qualify, your trading must be substantial, continuous, and regular. This isn’t for the hobbyist who trades a few times a week.

Benefits of TTS:

- Business Expense Deductions: You can deduct all your expenses on Schedule C, as discussed under forex tax deductions.

- No Wash Sale Rule (with MTM election): If you have TTS and make a Mark-to-Market (MTM) election under Section 475(f), the wash sale rule does not apply to your trading business.

- Deductible Home Office: The home office deduction is fully available.

Forming an LLC or S-Corp

Once you have TTS, forming a business entity can unlock further benefits. An LLC (Limited Liability Company) can provide legal protection. Electing for that LLC to be taxed as an S-Corporation can be a powerful tax-saving move.

The main benefit of an S-Corp for a profitable trader is the ability to pay yourself a “reasonable salary” and take the remaining profits as distributions. Only the salary is subject to self-employment taxes (Social Security and Medicare, ~15.3%), while the distributions are not. This can save thousands in taxes. Additionally, an S-Corp can deduct the cost of health insurance premiums for the owner-employee, a deduction not available to sole proprietors.

This is an advanced strategy for handling forex tax in America, and it absolutely requires consultation with a tax professional.

When to Hire a Forex-Savvy CPA

While this guide provides a solid foundation, there are times when DIY tax preparation is a bad idea. The rules for forex tax in USA can be intricate. A small mistake can cost you far more than a CPA’s fee. I always tell traders to consider hiring a professional in these situations:

- You’re Consistently Profitable: If you are generating significant income (e.g., over $50,000 annually), the cost of a CPA who specializes in trader tax is an investment that will likely pay for itself in tax savings.

- You Want to Claim TTS: The criteria for Trader Tax Status are subjective. A CPA can help you determine if you qualify and build the case for it on your tax return.

- You’re Considering an S-Corp: Setting up and managing an S-Corporation involves payroll, compliance, and specific filings. This is not a DIY task.

- You Have Foreign Accounts: If the aggregate value of your foreign financial accounts (including some foreign broker accounts) exceeds $10,000 at any point during the year, you have a separate filing requirement: the FBAR (Report of Foreign Bank and Financial Accounts). The penalties for failing to file are severe.

The complexities of forex tax in USA are manageable, but professional guidance ensures you are compliant and optimized.

Trade with a Regulated and Innovative Broker

Choosing the right broker is as crucial as your tax strategy. Opofinance, regulated by ASIC, offers a robust environment for traders with advanced tools and secure transactions.

- Advanced Trading Platforms: Choose from industry standards like MT4, MT5, and cTrader, or use the proprietary OpoTrade platform.

- Innovative AI Tools: Leverage the power of an AI Market Analyzer, AI Coach, and 24/7 AI Support to enhance your trading decisions.

- Flexible Trading Options: Explore opportunities in Social Trading and Prop Trading to diversify your strategies.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees.

Take your trading to the next level. Explore Opofinance today!

Conclusion

Navigating the world of forex tax in USA doesn’t have to be intimidating. The key is to understand the fundamental choice between Section 988 and Section 1256. For most active spot traders, making the timely election to use the Section 1256 60/40 rule is the most impactful decision you can make, potentially lowering your tax bill significantly. Combine this with meticulous record-keeping and claiming all your eligible forex tax deductions, and you’ll be in a strong position. Remember that your trading profits are taxable income, and proactive planning is the best way to keep more of your hard-earned gains and stay compliant with the IRS. As your trading career grows, don’t hesitate to seek professional advice to optimize your approach to forex tax in America.

Do I pay tax on forex if I don’t withdraw profits?

Yes. You are taxed on your realized gains for the year, regardless of whether the money remains in your trading account or is withdrawn to your bank account. This is a crucial concept for understanding forex tax in USA.

Are forex losses tax deductible in the USA?

Yes. Losses are deductible, but how they are treated depends on your tax classification. Under Section 988, they are ordinary losses. Under Section 1256, they are capital losses, which first offset capital gains, with a maximum of $3,000 per year deductible against ordinary income.

What happens if I forget to make the Section 1256 election on time?

If you miss the deadline (the first day of the tax year), you are stuck with the default Section 988 (ordinary income/loss) treatment for that entire tax year. There is no retroactive relief for missing the election deadline.

Is forex trading tax-free in the USA?

No, there is no scenario in which forex trading profits are tax-free in the United States. All net profits are subject to federal and, in most cases, state income tax. Anyone claiming otherwise is misinformed.