Ready to elevate your forex trading? Discover the best trading platforms for forex, perfect for beginners and seasoned traders alike.

In the competitive realm of forex trading, selecting the best trading platform for forex is pivotal to achieving trading success. Whether you’re a novice seeking a best trading platform for beginners forex or an experienced trader in search of advanced tools, the right platform can significantly enhance your trading experience. This comprehensive guide delves into the top trading platforms for Forex, providing valuable insights and addressing common questions to help you make an informed decision. By the end of this article, you’ll be equipped with the knowledge to choose the ideal forex broker that aligns with your trading objectives and strategies.

Key Factors to Consider When Choosing a Forex Platform

Selecting the best trading platform for forex involves evaluating several critical factors to ensure it aligns with your trading style and objectives. Here are the key elements to consider:

User Interface and Ease of Use

A clean, intuitive user interface (UI) is essential for efficient trading. Platforms should be easy to navigate, with customizable layouts that allow you to tailor the workspace to your preferences. An accessible UI reduces the learning curve, especially for beginners, and enhances overall trading efficiency.

Range of Trading Instruments Offered

The variety of trading instruments available on a platform can significantly impact your trading strategies. Look for platforms that offer a wide range of forex pairs, as well as other assets like commodities, indices, cryptocurrencies, and stocks. A diverse selection allows for better portfolio diversification and more trading opportunities.

Read More: Long Term Forex Trading Strategy

Fees and Commissions

Understanding the fee structure is crucial to managing your trading costs effectively. Compare spreads, commissions, and any additional fees such as withdrawal or inactivity charges across different platforms. Transparent pricing ensures you can calculate your potential returns accurately without unexpected costs eating into your profits.

Customer Support and Educational Resources

Reliable customer support can be a lifesaver when you encounter issues or have questions about the platform. Additionally, robust educational resources like tutorials, webinars, and articles are invaluable for both beginners and advanced traders looking to enhance their skills and knowledge.

Security Features

Security should be a top priority when choosing a trading platform. Ensure the platform employs encryption technologies, two-factor authentication (2FA), and is regulated by reputable authorities such as the ASIC, FCA, or CFTC. These measures protect your personal information and funds from potential threats.

Essential Features to Look for in the Best Trading Platforms for Forex

When selecting the best trading platform for forex, consider the following essential features:

- User Interface (UI): A clean, intuitive interface enhances trading efficiency and reduces the learning curve.

- Charting and Analysis Tools: Comprehensive technical analysis tools are crucial for making informed trading decisions.

- Execution Speed: Fast and reliable trade execution minimizes slippage and ensures timely order fulfillment.

- Security and Regulation: Ensure the platform is regulated by reputable authorities to safeguard your investments.

- Customer Support: Responsive and knowledgeable customer support can assist in resolving issues promptly.

- Educational Resources: Access to tutorials, webinars, and articles can help enhance your trading skills.

- Mobile Compatibility: A robust mobile app allows you to trade on the go without compromising functionality.

Top 10 Best Trading Platforms for Forex

Sorted by popularity and user satisfaction, here are the top 10 trading platforms for forex:

1. MetaTrader 5 (MT5)

MetaTrader 5 stands out as a versatile platform offering advanced charting tools and automated trading capabilities.

Key Features:

- Advanced Charting: Multiple timeframes and extensive technical indicators.

- Automated Trading: Supports Expert Advisors (EAs) for algorithmic trading.

- Market Depth: Provides detailed market depth information.

- Multi-Asset Support: Trade forex, stocks, commodities, and more.

Why It’s the Best: MT5’s comprehensive features cater to both beginners and professional traders, making it a top choice for those seeking a reliable and feature-rich forex trading platform.

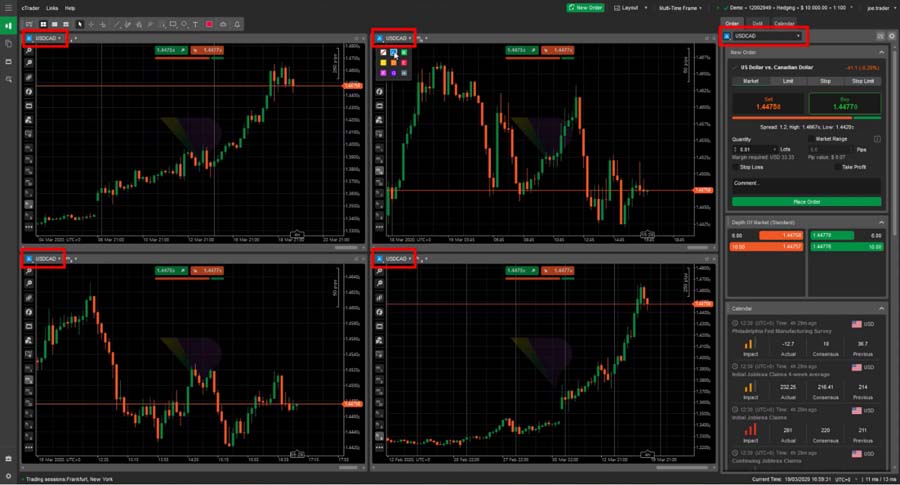

2. cTrader

cTrader is renowned for its intuitive interface and advanced trading functionalities, ideal for active traders.

Key Features:

- User-Friendly Interface: Clean and customizable layout.

- Advanced Order Types: Includes multiple order types for precise trading.

- Algorithmic Trading: Supports cAlgo for automated strategies.

- Level II Pricing: Provides transparent market depth.

Why It’s the Best: cTrader offers a seamless trading experience with its robust features and transparent pricing, making it perfect for traders who demand precision and efficiency.

3. NinjaTrader

NinjaTrader is a powerful platform favored by traders who prioritize technical analysis and customizability.

Key Features:

- Custom Indicators: Extensive library of technical indicators.

- Automated Trading: Advanced algorithmic trading capabilities.

- Simulation Mode: Practice trading without financial risk.

- Third-Party Integrations: Connects with various data feeds and brokers.

Why It’s the Best: Its high degree of customization and advanced analytical tools make NinjaTrader a preferred choice for traders focused on technical strategies.

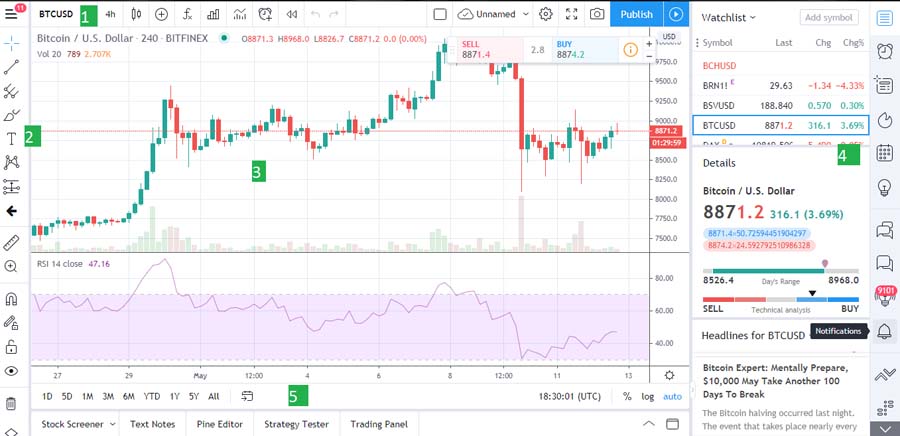

4. TradingView

TradingView offers exceptional charting capabilities and a vibrant community, ideal for collaborative traders.

Key Features:

- Interactive Charts: Highly customizable and interactive charting tools.

- Social Community: Share and discuss trading ideas with other traders.

- Script Language (Pine): Create custom indicators and strategies.

- Multi-Device Access: Accessible via web, desktop, and mobile.

Why It’s the Best: TradingView’s blend of powerful charting tools and a supportive community makes it an excellent platform for traders who value both analysis and collaboration.

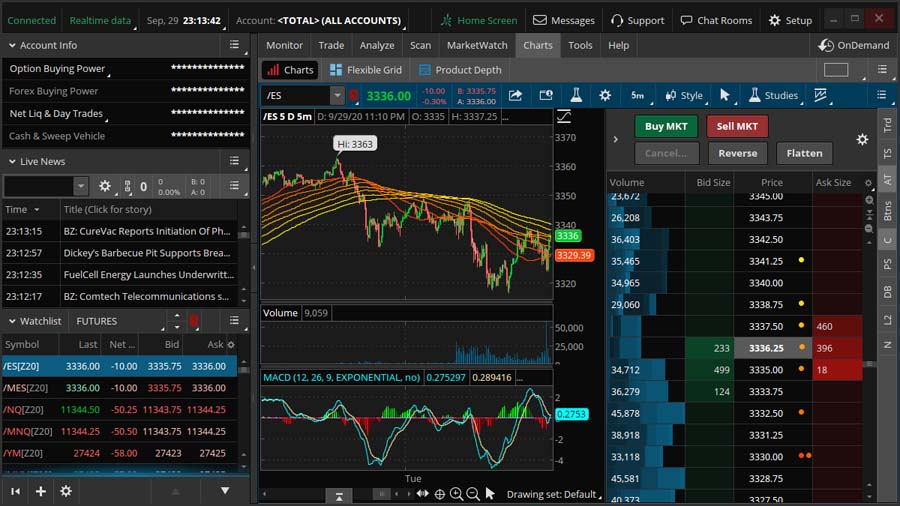

5. Thinkorswim by TD Ameritrade

Thinkorswim provides a comprehensive suite of trading tools and educational resources, perfect for serious traders.

Key Features:

- Advanced Analytics: In-depth market analysis tools.

- Paper Trading: Practice strategies without risking real money.

- Customizable Interface: Tailor the platform to your trading style.

- Extensive Research: Access to a wealth of market research and insights.

Why It’s the Best: Thinkorswim’s extensive toolset and educational resources support traders in developing and executing sophisticated trading strategies.

Read More: Choosing a Forex Broker

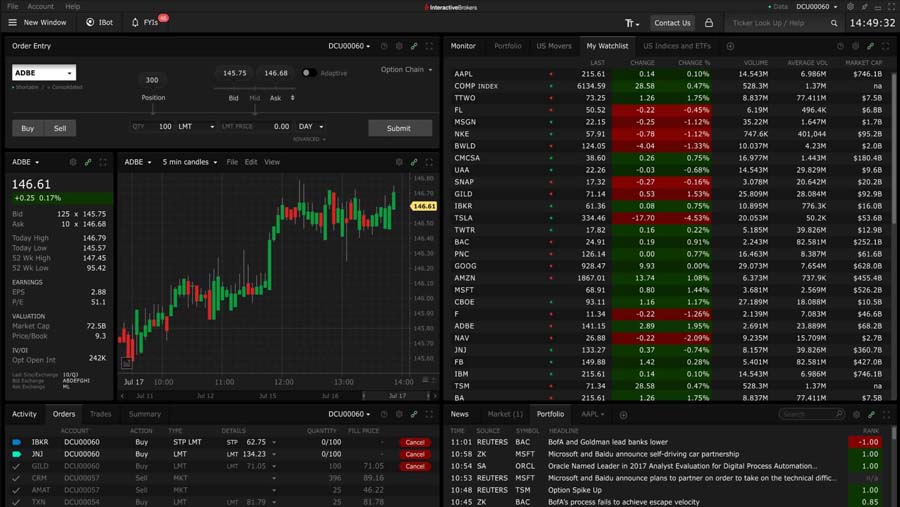

6. Interactive Brokers (IBKR) Trader Workstation

Interactive Brokers’ Trader Workstation is a robust platform designed for professional traders seeking comprehensive market access.

Key Features:

- Global Market Access: Trade in multiple markets worldwide.

- Advanced Order Management: Sophisticated order types and algorithms.

- Risk Management Tools: Extensive tools to manage trading risks.

- API Integration: Connect with various trading applications.

Why It’s the Best: IBKR Trader Workstation’s extensive market access and advanced trading tools cater to professional traders who require comprehensive and reliable trading solutions.

7. OANDA

OANDA offers a reliable and user-friendly platform with strong analytical tools, suitable for both beginners and experienced traders.

Key Features:

- Flexible Trading Options: Supports various order types and trading strategies.

- Comprehensive Analytics: Access to detailed market analysis and reports.

- Mobile Trading: Fully functional mobile app for trading on the go.

- Regulated Broker: Ensures security and trustworthiness.

Why It’s the Best: OANDA’s balanced approach to functionality and ease of use makes it an excellent choice for a wide range of traders, especially those seeking the best trading platform for beginners forex.

8. Saxo Bank’s SaxoTraderGO

SaxoTraderGO is a high-end platform offering a sleek interface and extensive trading tools, ideal for sophisticated traders.

Key Features:

- Intuitive Design: Modern and user-friendly interface.

- Extensive Asset Classes: Trade forex, stocks, CFDs, and more.

- Advanced Order Types: Variety of order types for precise trading.

- Integrated News and Research: Stay updated with real-time news and analysis.

Why It’s the Best: SaxoTraderGO’s sophisticated tools and elegant design cater to traders who seek both functionality and aesthetics in their forex trading platform.

9. FOREX.com

FOREX.com provides a comprehensive trading platform with strong research and educational resources, perfect for traders at all levels.

Key Features:

- Robust Trading Tools: Advanced charting and analysis tools.

- Educational Resources: Extensive materials for trader education.

- Secure Trading Environment: High standards of security and regulation.

- Multi-Platform Support: Access via web, desktop, and mobile.

Why It’s the Best: FOREX.com’s commitment to education and security makes it a trustworthy platform for traders looking to enhance their skills and trade safely.

10. eToro

eToro stands out with its unique social trading features, allowing traders to follow and copy the strategies of successful peers.

Key Features:

- Social Trading: Follow and replicate trades of top investors.

- User-Friendly Interface: Easy to navigate for all experience levels.

- Wide Range of Assets: Trade forex, stocks, cryptocurrencies, and more.

- Regulated Platform: Ensures a safe trading environment.

Why It’s the Best: eToro’s innovative social trading features provide a unique advantage for traders looking to learn from and mimic successful trading strategies.

Comparing Top Trading Platforms

To help you make an informed decision, here’s a comprehensive comparison of the top trading platforms for Forex based on key features:

| Platform | Best For | Key Features | Regulation | Fee Structure | Customer Support |

| MetaTrader 5 (MT5) | Versatile Trading | Advanced charting, automated trading, multi-asset support, market depth | Multiple Authorities | Low spreads, no commissions on some brokers | 24/7 support via chat and email |

| cTrader | Precision Trading | User-friendly interface, advanced order types, market depth, algorithmic trading with cAlgo | Multiple Authorities | Competitive spreads, low commissions | Responsive support team |

| NinjaTrader | Technical Analysis | Custom indicators, algorithmic trading, simulation mode, third-party integrations | Varies by Broker | Variable, depending on broker | Extensive support resources |

| TradingView | Collaborative Trading | Interactive charts, social community, Pine scripts, multi-device access | Not a Broker | Subscription-based for advanced features | Community and support forums |

| Thinkorswim | Comprehensive Tools | Advanced analytics, paper trading, customizable interface, extensive research | SEC, CFTC | No commissions on some trades, variable spreads | 24/7 support via phone and chat |

| IBKR Trader Workstation | Professional Traders | Global market access, advanced order management, risk management tools, API integration | SEC, FCA, ASIC | Low commissions, tiered pricing | Dedicated support for professionals |

| OANDA | Reliable and User-Friendly | Flexible trading options, comprehensive analytics, mobile trading, regulated broker | CFTC, FCA, ASIC | Tight spreads, no minimum deposit | 24/5 multilingual support |

| SaxoTraderGO | Sophisticated Traders | Intuitive design, extensive asset classes, advanced order types, integrated news and research | Multiple Authorities | Competitive spreads, tiered commissions | Premium customer support |

| FOREX.com | All-Level Traders | Robust trading tools, educational resources, secure trading environment, multi-platform support | CFTC, FCA, ASIC | Transparent pricing, low spreads | 24/7 support via phone, chat, and email |

| eToro | Social Traders | Social trading, user-friendly interface, wide range of assets, regulated platform | FCA, CySEC, ASIC | Competitive spreads, copy trading fees | Active support team and community forums |

Pro Tips for Advanced Forex Traders

Maximize your trading potential with these advanced strategies and platform features.

- Leverage Algorithmic Trading: Utilize platforms like MetaTrader 5 and cTrader that support automated trading systems to execute complex strategies without manual intervention.

- Integrate Multiple Data Sources: Enhance your market analysis by integrating various data feeds and third-party tools available on platforms like NinjaTrader and Interactive Brokers.

- Customize Your Trading Environment: Tailor your platform’s interface and tools to suit your trading style. Platforms like SaxoTraderGO offer extensive customization options to optimize your workflow.

- Utilize Advanced Risk Management Tools: Implement sophisticated risk management techniques using the tools provided by platforms like Thinkorswim and Interactive Brokers to protect your investments.

- Engage with Trading Communities: Participate in forums and communities on platforms like TradingView and eToro to exchange insights and strategies with other experienced traders.

Read More: Forex Trading Tools

Opofinance: A Trusted ASIC Regulated Broker

Opofinance stands out as a premier ASIC regulated forex broker, offering a suite of services designed to enhance your trading experience.

Opofinance Services:

- Social Trading: Engage with a community of traders, follow top performers, and replicate their strategies effortlessly.

- Featured on MT5 Brokers List: Benefit from the advanced features and reliability of MetaTrader 5, officially supported by Opofinance.

- Safe and Convenient Deposits and Withdrawals: Enjoy secure and hassle-free transactions with a variety of payment methods tailored to your needs.

Choose Opofinance for a secure, innovative, and user-centric trading experience that empowers you to achieve your financial goals.

Conclusion

Choosing the best trading platform for forex is a pivotal decision that can significantly influence your trading success. With a myriad of options available, it’s essential to assess each platform based on key factors such as user interface, range of trading instruments, fee structures, customer support, and security features. Platforms like MetaTrader 5, cTrader, and Interactive Brokers’ Trader Workstation stand out for their comprehensive features and robust performance, catering to both beginners and seasoned traders.

Additionally, platforms like OANDA and eToro offer user-friendly interfaces and unique features like social trading, making them ideal for those looking to learn and grow in the forex market. For advanced traders, platforms like NinjaTrader and SaxoTraderGO provide the necessary tools and customization options to implement sophisticated trading strategies effectively.

Ultimately, the best trading platform for you will align with your trading style, goals, and preferences, providing the tools and support you need to navigate the complex forex market confidently.

Key Takeaways

- Platform Selection is Crucial: The right trading platform can significantly impact your trading success and efficiency.

- Feature-Rich Platforms Offer Advantages: Advanced tools, automated trading, and comprehensive analytics cater to diverse trading needs.

- Security and Regulation are Non-Negotiable: Always choose platforms regulated by reputable authorities to ensure the safety of your investments.

- Beginner-Friendly Platforms Enhance Learning: User-friendly interfaces and educational resources are essential for novice traders.

- Advanced Traders Benefit from Customization and Automation: Platforms offering high levels of customization and automated trading capabilities support sophisticated trading strategies.

- Social Trading Enhances Learning and Strategy Sharing: Engaging with trading communities can provide valuable insights and collaborative opportunities.

How do I determine which forex trading platform suits my trading style?

Evaluate your trading style by assessing the platform’s features such as charting tools, order types, automation capabilities, and user interface. Consider whether you prefer manual trading or automated strategies, and choose a platform that aligns with your specific needs.

Are there any hidden fees associated with forex trading platforms?

While many platforms offer transparent pricing, it’s essential to review their fee structures carefully. Look out for hidden costs such as withdrawal fees, inactivity fees, or charges for additional services to ensure you understand the total cost of trading.

Can I switch trading platforms without losing my trading history?

Most reputable trading platforms allow you to export your trading history and data. However, the ease of switching depends on the specific platforms involved. It’s advisable to check with both your current and prospective platform to understand the process and ensure a smooth transition.