Navigating the Forex Trading Tax in Indonesia can feel like a complex part of your trading journey, but it’s more straightforward than you might imagine. Yes, any profit you make from trading currencies through an online forex broker is taxable. These profits are classified as income and are subject to Indonesia’s progressive tax rates. This guide is designed to be your go-to resource for 2025, walking you through the essential tax rates, showing you exactly how to report your income, explaining how to handle deductions, and ensuring you remain fully compliant. Let’s break it down and demystify your tax obligations once and for all.

Disclaimer: The information provided in this article is for educational and informational purposes only. It does not constitute financial, legal, or tax advice. Tax laws and regulations are subject to change and interpretation. We strongly recommend consulting with a qualified tax professional in Indonesia to address your specific financial situation.

Key Takeaways: A Snapshot of Forex Tax

Before we dive deep, here’s a quick overview of the most critical aspects of the Forex Trading Tax in Indonesia. This table gives you the essential facts at a glance.

| Aspect | Key Details |

|---|---|

| Is forex trading legal? | Yes; regulated by BAPPEBTI and the Ministry of Finance. |

| Is it taxable? | Yes; profits are subject to progressive income tax. |

| Tax rates (individuals, 2025) | 5%–35% based on annual income brackets. |

| Tax year | 1 January – 31 December; reporting deadline is 31 March of the following year. |

| Tax authorities | Directorate General of Taxes (DJP). |

| Deductions | Limited. Losses can only offset forex gains in the same year, not other income sources. |

| Penalties for non-compliance | Administrative fines, high interest on unpaid taxes, and potential criminal charges for evasion. |

| Key reporting requirement | Declare all net forex profits in your annual personal income tax return (SPT Tahunan). |

Essential Facts & 2025 Updates

As a trader, your focus is on the markets, but understanding the regulatory environment is just as crucial for long-term success. The foundation of the Forex Trading Tax in Indonesia lies in the country’s income tax law, most recently harmonized under Law No. 7 of 2021 concerning the Harmonization of Tax Regulations (UU HPP). This law solidified the progressive tax brackets that apply to all individual income, including your trading profits. For 2025 and heading into 2025, these are the rates you need to know. The key is to remember that your forex profit is added to your other income (like a salary) to determine your final tax bracket.

Here are the official 2025 personal income tax brackets (Article 17) that determine your forex trading income tax Indonesia:

- 5% on annual taxable income up to IDR 60 million.

- 15% on annual taxable income from IDR 60 million up to IDR 250 million.

- 25% on annual taxable income from IDR 250 million up to IDR 500 million.

- 30% on annual taxable income from IDR 500 million up to IDR 5 billion.

- 35% on annual taxable income above IDR 5 billion.

Quick Answers to Key Questions

Is forex trading taxable in Indonesia?

Absolutely. All profits derived from forex trading are considered taxable income by the Directorate General of Taxes (DJP).

At what rate is it taxed?

It’s taxed using the progressive income tax rates, ranging from 5% to 35%, depending on your total annual income.

What is the reporting deadline?

The deadline for filing your annual tax return (SPT Tahunan) is March 31 of the year following the tax year.

Who Must Pay: Traders & Residency

The rules for the Forex Trading Tax in Indonesia apply based on your tax residency status, not your citizenship. This is a critical distinction that many traders, especially expatriates, need to understand. If you are considered an Indonesian tax resident, you are liable for tax on your worldwide income. This means profits from a broker based in Singapore, Australia, or Cyprus are just as taxable as those from a local, BAPPEBTI-regulated broker.

Individual vs. Corporate Traders

The vast majority of retail traders in Indonesia operate as individuals. In this case, your net forex profits are simply added to your other sources of income and taxed at the progressive rates listed earlier. It’s a straightforward, albeit layered, calculation. However, some professional, high-volume traders may choose to establish a legal entity (a PT, or Perseroan Terbatas) for their trading activities. For a corporation, the tax structure is different. Corporate income, including trading profits, is typically subject to a flat corporate income tax rate, which currently stands at 22%. This path involves more complex accounting and legal setup but can offer certain structural advantages for very large-scale operations. For the purpose of this guide, we will focus on individual traders, as this applies to over 99% of the trading community.

Domestic vs. Foreign Brokers

A question I hear constantly is, “If I use a foreign broker, do I still have to pay forex tax Indonesia?” The answer is an unequivocal yes. Indonesian tax law is based on residency. The Directorate General of Taxes (DJP) doesn’t care where your broker is located; they care where you are located. If you are a tax resident, you are legally obligated to report all income, regardless of its source country. In an age of increasing financial transparency and Automatic Exchange of Information (AEOI) agreements between countries, assuming that offshore income is invisible is a risky and outdated strategy. The government’s ability to track international fund flows is growing stronger every year. Therefore, the principles of calculating and reporting your forex trading income tax Indonesia remain the same whether your funds are with a local or international firm.

How Your Profits Are Taxed

Understanding the calculation method is where the theory of Forex Trading Tax in Indonesia meets practice. The first thing to clarify is how forex profits are classified. For individual retail traders, these profits are not treated as “capital gains” in the way stock sales from the IDX might be, which can sometimes have a final tax. Instead, forex profits fall under the category of “Other Income” (Penghasilan Lain-lain) on your tax return. This means you must first calculate your net profit from trading for the entire tax year, and then add that figure to your other income streams to determine your total taxable income.

Calculating Your Taxable Income

The calculation itself is logical. Your taxable forex income is your total annual profit minus your total annual loss from all your trading activities. This is your net trading profit.

Net Trading Profit = (Sum of All Winning Trades) - (Sum of All Losing Trades)

This net figure is what you will report. For example, if you made IDR 200 million in profits but also incurred IDR 80 million in losses throughout the year, your taxable forex income is IDR 120 million. This IDR 120 million is then added to your salary or any other income you have. It’s the combined total that is subject to the progressive tax rates, after deducting the non-taxable income threshold (PTKP).

Practical Tax Calculation Examples

Let’s walk through some real-world scenarios to see how the Forex Trading Tax in Indonesia works. For these examples, we’ll assume the trader is single with no dependents, making them eligible for the PTKP (Non-Taxable Income) of IDR 54 million for the year.

Scenario 1: The Part-Time Trader

- Annual Salary: IDR 100,000,000

- Net Forex Profit: IDR 50,000,000

- Total Income: IDR 150,000,000

- Non-Taxable Income (PTKP): (IDR 54,000,000)

- Total Taxable Income: IDR 96,000,000

Tax Calculation:

- 5% on the first IDR 60,000,000 = IDR 3,000,000

- 15% on the remaining IDR 36,000,000 (96M – 60M) = IDR 5,400,000

- Total Tax Due: IDR 8,400,000

Scenario 2: The Profitable Trader

- Annual Salary: IDR 180,000,000

- Net Forex Profit: IDR 200,000,000

- Total Income: IDR 380,000,000

- Non-Taxable Income (PTKP): (IDR 54,000,000)

- Total Taxable Income: IDR 326,000,000

Tax Calculation:

- 5% on the first IDR 60,000,000 = IDR 3,000,000

- 15% on the next IDR 190,000,000 (250M – 60M) = IDR 28,500,000

- 25% on the remaining IDR 76,000,000 (326M – 250M) = IDR 19,000,000

- Total Tax Due: IDR 50,500,000

Scenario 3: The Full-Time Professional Trader

- Annual Salary: IDR 0 (trading is the only income)

- Net Forex Profit: IDR 700,000,000

- Total Income: IDR 700,000,000

- Non-Taxable Income (PTKP): (IDR 54,000,000)

- Total Taxable Income: IDR 646,000,000

Tax Calculation:

- 5% on the first IDR 60,000,000 = IDR 3,000,000

- 15% on the next IDR 190,000,000 = IDR 28,500,000

- 25% on the next IDR 250,000,000 = IDR 62,500,000

- 30% on the remaining IDR 146,000,000 (646M – 500M) = IDR 43,800,000

- Total Tax Due: IDR 137,800,000

These examples clearly illustrate how profits stack up and push you into higher brackets, making an understanding of the forex tax Indonesia system essential for financial planning.

Reporting Forex Income: A Guide

This is arguably the most important section. Knowing you have to pay tax is one thing; knowing how to do it correctly is another. The process of how to report forex trading profits Indonesia is managed through the DJP Online portal. It requires diligence and good record-keeping, but it is a manageable process once you understand the steps. A common mistake traders make is ignoring this obligation until the last minute, leading to stress and potential errors.

Key Dates and Deadlines

Mark these dates in your calendar. The Indonesian tax system operates on a clear schedule:

- Tax Year: 1 January to 31 December.

- Reporting Deadline: 31 March of the following year for individual taxpayers.

- Payment Deadline: The full amount of underpaid tax must also be paid by 31 March.

Required Documents & Records

From my experience, the key to a stress-free tax season is meticulous record-keeping throughout the year. Don’t wait until March to scramble for documents. The DJP can request supporting evidence during an audit, so you must be prepared. Here’s what you should maintain:

- Broker Statements: Download your monthly and annual statements from your broker. These are your primary proof of profit and loss.

- Trade History Logs: Your trading platform (like MT4/MT5) can export detailed reports of every single trade. Keep these digital files organized.

- Bank Transfer Records: Keep a record of all deposits to and withdrawals from your brokerage accounts. This helps substantiate the flow of funds.

- Personal P&L Spreadsheet: I highly recommend maintaining a simple spreadsheet where you log your net profit or loss weekly or monthly. This makes calculating your year-end total much easier.

Step-by-Step Reporting Process

Here is a simplified guide on how to report forex trading profits Indonesia using the DJP Online system. This assumes you already have a Taxpayer Identification Number (NPWP).

- Get Your EFIN: An Electronic Filing Identification Number (EFIN) is a prerequisite for using DJP Online. You can obtain this by visiting your local tax office (KPP) in person. It’s a one-time process.

- Log into DJP Online: Go to the official website (djponline.pajak.go.id) and log in using your NPWP, password, and security code.

- Choose the Right Form: You will be prompted to file your tax return (e-Filing). For a trader with salary and “other income,” you will typically use the Form 1770 S or 1770. The system often guides you based on a few preliminary questions. Form 1770 is the most comprehensive and is required for anyone with income from a business or “independent work,” which full-time trading can be classified as.

- Declare Forex Profits as “Other Income”: Navigate through the form’s annexes (Lampiran). You are looking for the section on “Income Subject to Non-Final Income Tax.” Specifically, you’ll find a field for “Other Income” (Penghasilan Lainnya). This is where you declare your net profit from forex for the year. There isn’t a specific box labeled “Forex Profit”; you must categorize it here.

- Complete All Sections: Fill out all other required parts of the form, including your salary income (if any), assets, and liabilities. Be thorough and honest. The asset section is where you would declare the balance in your trading account at year-end.

- Review and Submit: The system will automatically calculate your total tax due based on all the income you’ve entered. It will show you how much tax you’ve already paid (e.g., withheld by your employer) and how much you still owe (Pajak Kurang Bayar).

- Pay Your Tax Bill: If you have tax to pay, you must first generate a billing ID (Kode Billing) through the system. You can then use this code to pay the amount due via bank transfer, ATM, mobile banking, or at the post office before the March 31 deadline.

Following this process diligently ensures your compliance with the Forex Trading Tax in Indonesia and provides peace of mind.

Deductions and Loss Treatment

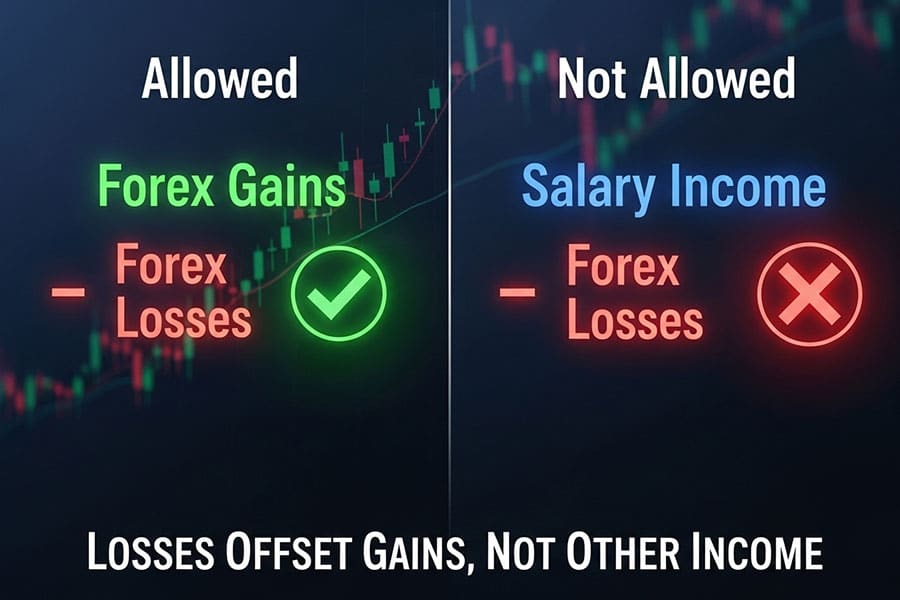

One of the most frequent areas of confusion around the Forex Trading Tax in Indonesia revolves around what can be deducted and, more importantly, how losses are treated. The rules here are quite strict and different from what traders in other countries might be used to.

What Can and Can’t Be Claimed?

For an individual retail trader, there are very few direct “deductions” you can claim against your forex income in the traditional sense, like office supplies or internet costs. Instead, trading-related costs are inherently factored into your net profit calculation. These include:

- Commissions: Brokerage fees for opening and closing trades.

- Spreads: The built-in cost of a trade.

- Swaps/Rollover Fees: Charges for holding positions overnight.

These costs automatically reduce your gross profit. Your broker statement’s final P&L figure already accounts for them. You cannot separately deduct expenses like a new laptop, educational courses, or your home internet bill unless you are operating as a registered business entity, which has different accounting rules.

The Critical Rule on Trading Losses

This is a point that cannot be overstressed. While you can use your trading losses to offset your trading gains within the same tax year, you cannot use your net forex trading losses to reduce your taxable income from other sources.

Let’s be crystal clear with an example:

- Annual Salary: IDR 200,000,000

- Net Forex Loss for the Year: (IDR 50,000,000)

In this situation, your taxable income is still IDR 200,000,000. You cannot subtract the IDR 50 million trading loss from your salary. The loss is essentially “lost” for tax purposes. It cannot be carried forward to offset future forex gains in subsequent years either. This is a significant aspect of the forex tax Indonesia regulations and impacts how you should manage your risk and financial planning.

Smart Tax Strategies for Traders

Being compliant with the Forex Trading Tax in Indonesia is non-negotiable, but there are smart habits and strategies you can adopt to make the process smoother and ensure you are not paying a cent more than you legally owe. This is not about finding loopholes, but about being organized and efficient.

Meticulous, Year-Round Record-Keeping

I’ve mentioned it before, but it’s the single most important strategy. A successful trader is an organized trader. Don’t think of tax preparation as a once-a-year event.

- Use a Dedicated Spreadsheet: Track your daily or weekly P&L. Note down large wins or losses. This gives you a running total and avoids any year-end surprises.

- Create Digital Folders: Create a folder on your computer for each tax year. Every month, save your broker statements and bank transfer receipts into it. When March comes, everything is in one place.

This simple habit transforms tax season from a chaotic scramble into a simple administrative task.

Separate Your Trading Funds

From both a psychological and an accounting perspective, it’s wise to use a separate bank account solely for your trading activities. Deposit funds into this account and use it to fund your brokerage account. When you withdraw profits, transfer them from the broker to this dedicated account first, before moving them to your main spending account. This creates a clean, easily traceable paper trail of your trading cash flow, which is invaluable if the tax office ever has questions. It simplifies the process of verifying your declared forex trading income tax Indonesia.

Know When to Consult a Professional

While this guide covers the fundamentals, there are times when professional help is essential. Consider hiring a certified tax consultant if:

- Your trading profits become your primary or a very significant source of income.

- You are considering setting up a company for your trading activities.

- You have a complex financial situation with multiple international income streams.

- You receive a query or audit notice from the DJP.

The fee for a consultation is a small price to pay for professional assurance and can save you from costly mistakes. A good consultant can provide personalized advice on your specific forex tax Indonesia situation.

Penalties and Enforcement

Ignoring your obligations regarding the Forex Trading Tax in Indonesia is a serious matter with significant consequences. The DJP has been actively modernizing its systems and increasing its enforcement capabilities, particularly concerning digital and international income sources. The days of “what they don’t know won’t hurt me” are over.

Financial Penalties

Failure to report or under-reporting your income can lead to a cascade of financial penalties. These can include:

- Administrative Sanctions: These are fines, often calculated as a percentage of the underpaid tax. These percentages can be high, quickly inflating your tax bill.

- Interest Charges: Late payment of taxes accrues interest for every month it is overdue. The rate is tied to benchmark interest rates and can add up substantially over time.

Legal Consequences

In cases of deliberate and significant tax evasion, the consequences can go beyond financial penalties. The Indonesian tax law provides for criminal charges, which can lead to much larger fines and even imprisonment. While this is typically reserved for the most severe cases, it underscores the importance of honest and timely reporting. Staying compliant is the best way to trade with a clear conscience and focus on the markets, not legal troubles.

The Government’s Digital Focus

It’s important to recognize the current trend. The Indonesian government, like others worldwide, is heavily focused on taxing the digital economy. Through international AEOI agreements and enhanced data analytics, the DJP’s ability to identify discrepancies between declared income and actual wealth (e.g., large fund movements, significant asset purchases) is continuously improving. Assuming that income from an international broker is hidden is no longer a viable or safe assumption. The best approach is always full transparency and compliance with the rules governing the Forex Trading Tax in Indonesia.

Trade with a Trusted, Regulated Broker

Choosing the right broker is the first step to a successful trading career. Opofinance, regulated by ASIC, offers a secure and feature-rich environment for traders of all levels.

- Advanced Trading Platforms: Access the markets with industry-leading platforms like MT4, MT5, cTrader, and the intuitive OpoTrade app.

- Innovative AI Tools: Gain a competitive edge with our AI Market Analyzer for insights, an AI Coach for skill development, and 24/7 AI Support.

- Flexible Trading Options: Explore Social Trading to copy experts or take on the challenge with our Prop Trading program.

- Secure & Convenient Transactions: Enjoy peace of mind with safe deposits and withdrawals, including crypto payment options with zero fees.

Start your trading journey with a broker that puts you first. Explore Opofinance today!

Conclusion

Successfully navigating the Forex Trading Tax in Indonesia is a fundamental pillar of a sustainable trading career. It is not an obstacle to be feared but a responsibility to be managed. By understanding that your profits are taxable income, keeping meticulous records year-round, reporting honestly through the DJP Online portal by the March 31 deadline, and understanding how losses are treated, you can handle your obligations with confidence. Remember, compliance removes stress and allows you to focus fully on what you do best: analyzing the markets and executing your strategy.

Do I pay forex tax if I only use an overseas broker?

Yes. If you are an Indonesian tax resident, you are taxed on your worldwide income. The location of your broker does not change your obligation to report profits and pay the appropriate forex tax Indonesia.

Is there a tax-free allowance specifically for forex trading?

No, there is no specific tax-free amount for forex trading. Your net forex profit is added to your total income, which is then eligible for the general non-taxable income threshold (PTKP) before the progressive rates are applied.

How is forex tax in Indonesia different from crypto tax?

They are treated differently. Forex profits are considered “other income” and are taxed at progressive rates (5%-35%). Crypto transactions are currently subject to their own final tax regime, which includes a small final Income Tax (PPh) and Value Added Tax (PPN) on each transaction, typically collected by the exchange.

Can I pay my final forex tax bill in installments?

Generally, the underpaid tax amount (Kurang Bayar) calculated on your annual return must be paid in full by the March 31 deadline. Tax installments (known as PPh 25) typically apply to those registered as having a regular business income, a status which might apply to professional, full-time traders who should seek advice from a tax consultant.

What should I report if I made a net loss for the year?

If you have a net loss from forex trading for the year, you do not have any forex income to report. You don’t pay tax on it. However, you must still file your annual tax return to report any other income you have, such as a salary. Remember, you cannot deduct the trading loss from your other income.