Forex trading, the global marketplace for currency exchange, offers vast opportunities for profit. Traders are often lured by the promise of high rewards with minimal risk. However, the inherent volatility and unpredictability of the forex market mean that managing expectations is crucial. Working with an online forex broker can help traders navigate these challenges. This article delves into the realities of high reward, low risk forex trading strategies, emphasizing the importance of risk management and disciplined trading to achieve long-term success.

The Misconception of High Reward-Low Risk

Unrealistic Expectations in Forex Trading

The allure of high reward-low risk forex trading strategies captivates many aspiring traders. However, this concept often leads to unrealistic expectations. Achieving consistent high rewards with minimal risk in forex trading is challenging due to the inherent characteristics of the forex market.

Market Realities in Forex Trading

The forex market is vast and highly liquid, with daily trading volumes exceeding $6 trillion. Operating 24 hours a day across multiple time zones, it reacts swiftly to economic data, geopolitical events, and shifts in market sentiment.

Volatility and Risk:

- Nature of Volatility: Currency prices can fluctuate significantly over short periods due to market dynamics.

- Opportunity and Risk: Major economic announcements can trigger rapid price swings, offering profit opportunities but also exposing traders to potential losses.

Retail Trader Statistics:

- According to ESMA, a significant majority of retail forex traders (74-89%) incur losses, highlighting the challenge of balancing rewards with risks in forex trading.

Influence of Market Dynamics:

- Factors Affecting Volatility: Include interest rates, inflation, political stability, and economic performance.

- Impact Examples: Interest rate hikes strengthen currencies; political instability can lead to sharp declines.

Navigating Market Dynamics:

- Traders must grasp the dual nature of volatility—providing opportunities for profit while simultaneously increasing the risk of losses.

The Myth of Foolproof Strategies

Many new traders enter the forex market with the belief that a foolproof strategy exists—one that guarantees profits and minimizes losses. However, no strategy can eliminate risk entirely. Even the most successful traders experience losses, and the key to long-term success lies in effective risk management and a disciplined approach.

The Importance of Flexibility

Successful trading strategies must be adaptable to changing market conditions. For instance, a strategy that works well in a trending market may fail in a range-bound or highly volatile market. Traders must continuously evaluate and adjust their strategies to remain effective. Relying solely on a single approach without flexibility can lead to significant losses

Read More: Forex Diversification Strategies

Risk-Reward Ratio vs. Win Rate

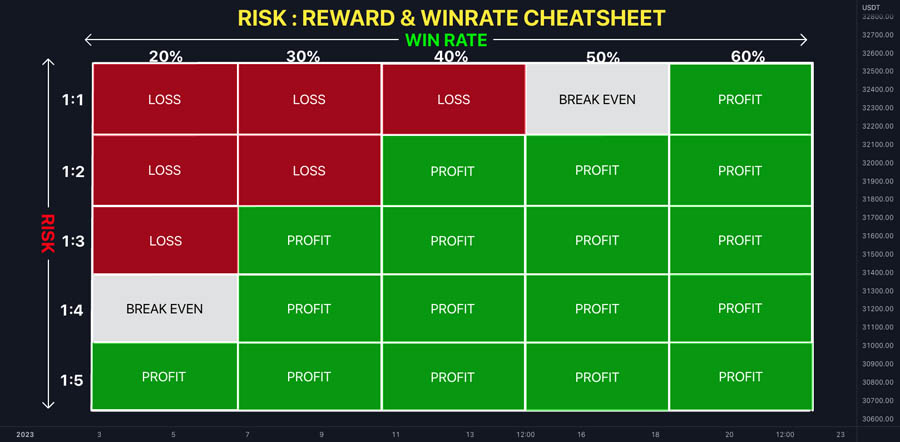

Understanding the relationship between the risk-reward ratio and the win rate is essential for successful forex trading. These two metrics are fundamental in evaluating the effectiveness of a trading strategy and determining its overall profitability.

What is the Risk-Reward Ratio?

The risk-reward ratio (RRR) is a measure of the potential profit relative to the potential loss for a given trade. It helps traders assess whether a trade is worth taking based on the expected returns versus the risk involved.

Calculating the Risk-Reward Ratio

To calculate the RRR, divide the potential profit of a trade by the potential loss. For instance, if a trader sets a target profit of 60 pips and a stop-loss of 20 pips, the RRR is 60/20, which equals 3:1. This means that for every pip risked, the trader expects to gain three pips.

Importance of a Favorable RRR

A favorable RRR, typically greater than 1:1, is crucial because it ensures that the potential rewards justify the risks. Traders often aim for RRRs of 2:1 or 3:1, which means they expect to make twice or three times the amount they are risking. This approach helps in achieving overall profitability even if the win rate is not very high.

Understanding the Win Rate

The win rate is the percentage of trades that result in a profit. It indicates how often a trader successfully executes a profitable trade.

Evaluating the Win Rate

A high win rate is desirable, but it does not guarantee profitability. It’s important to consider the RRR in conjunction with the win rate. A high win rate with a poor RRR can still lead to losses, while a moderate win rate with a good RRR can result in profits.

Read More: Most Effective Forex Trading Indicators

Balancing Risk-Reward Ratio and Win Rate

The interplay between the RRR and the win rate determines the overall success of a trading strategy. Traders need to find a balance that aligns with their trading style and risk tolerance.

Finding the Right Balance

The ideal balance between the RRR and the win rate depends on the trader’s strategy and market conditions. Some strategies, like scalping, may require a higher win rate with lower RRR, while others, like trend following, might operate with a lower win rate but higher RRR.

Risk-Reward Ratio in Practice

Implementing a favorable RRR requires careful planning and discipline. Traders should:

- Set Clear Targets: Define clear profit targets and stop-loss levels before entering a trade.

- Stick to the Plan: Avoid adjusting targets and stops based on emotions or short-term market movements.

- Use Risk Management Tools: Utilize tools such as stop-loss orders and trailing stops to manage risk effectively.

Win Rate in Practice

Maintaining a consistent win rate involves:

- Refining Strategies: Continuously refine trading strategies based on performance and market conditions.

- Backtesting: Test strategies on historical data to identify patterns and improve accuracy.

- Staying Disciplined: Follow the trading plan without deviating due to emotional impulses.

Balancing Risk and Reward in Forex Trading

Achieving success in forex trading requires a balanced approach to managing risk and reward, integrating both the risk-reward ratio (RRR) and win rate into trading strategies. This holistic approach ensures profitability and sustainability over the long term through disciplined trading practices and realistic expectations.

Strategies for Balancing Risk and Reward:

- Implementing Techniques: Use various tools and techniques to manage risk and optimize potential profits.

- Disciplined Trading Practices: Adhere to a structured trading plan that incorporates realistic goals and risk management strategies.

- Optimizing Entries and Exits: Utilize technical analysis and market indicators to identify strategic entry and exit points.

- Continuous Evaluation: Regularly review and adjust trading strategies based on performance analysis and market conditions.

- Psychological Discipline: Maintain emotional control and discipline to avoid impulsive decisions driven by fear or greed.

Emphasizing Risk Management

Risk management forms the cornerstone of successful trading strategies. Effective risk management is essential to mitigate potential losses, even amidst promising trading opportunities.

Concept of Risk-to-Reward Ratio (RRR):

- Definition: RRR measures potential profit relative to potential loss in a trade.

- Importance: Ensures that potential rewards justify risks taken.

- Example: A 1:3 RRR means for every dollar risked, potential reward is three dollars.

- Benefits: Helps maintain profitability with a lower win rate.

Stop-Loss Orders:

- Function: Automatically close trades at predetermined levels to limit losses.

- Strategic Placement: Set at levels accounting for market volatility and price movements.

- Avoidance: Place not too close to entry to prevent premature exits from normal market fluctuations.

- Risk Mitigation: Avoid setting too far, which may increase potential losses.

Read More: How to Make Consistent Profits in Forex Trading

Position Sizing

Proper position sizing is essential to risk management. It involves determining the amount of capital to allocate to each trade based on the trader’s risk tolerance and account size.

Calculating Position Size

Traders can calculate position size using a fixed percentage of their account balance. For example, if a trader is willing to risk 2% of their $10,000 account on a single trade, they can risk up to $200. If their stop-loss is set at 50 pips, they can calculate the appropriate position size in lots to ensure they don’t exceed the $200 risk limit.

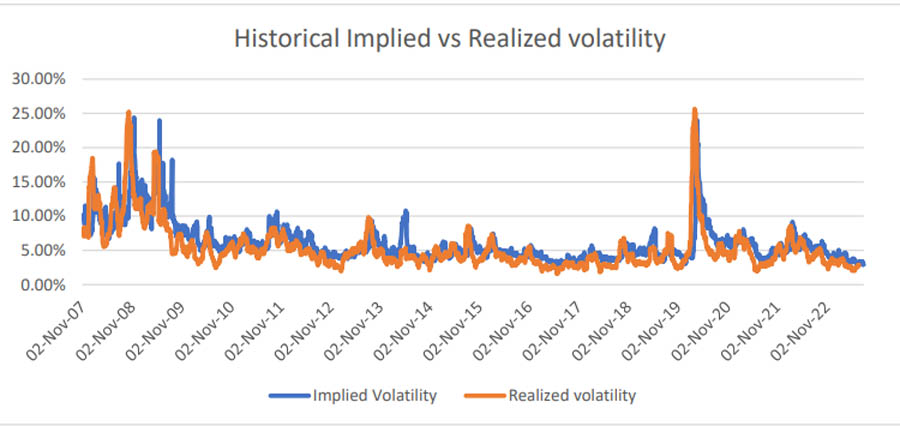

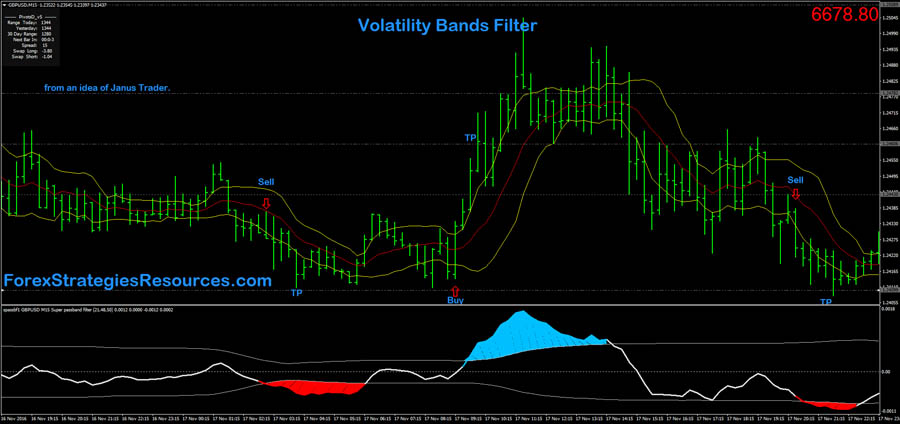

Volatility Filtering

Incorporating volatility filters helps identify calmer market conditions with potentially lower risk and more predictable price movements.

Using Volatility Indicators

Volatility indicators, such as the Average True Range (ATR) or Bollinger Bands, can help traders assess market volatility and adjust their trading strategies accordingly. During periods of high volatility, traders might reduce position sizes or avoid entering new trades.

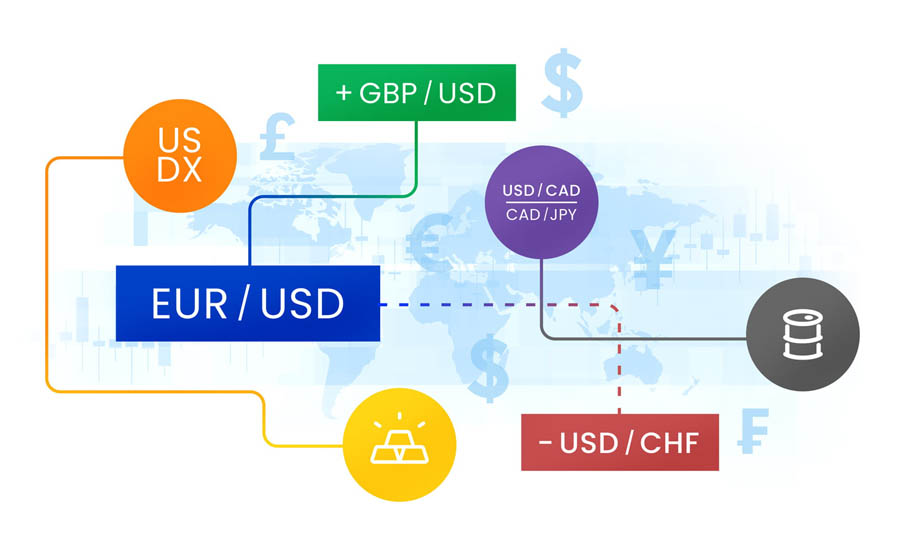

Correlation Analysis

Understanding the correlation between currency pairs can help manage risk by avoiding conflicting trades.

Positive and Negative Correlations

Currency pairs can be positively or negatively correlated. Positively correlated pairs move in the same direction, while negatively correlated pairs move in opposite directions. Traders should avoid taking positions in multiple positively correlated pairs simultaneously, as this increases risk exposure.

Trailing Stops

Trailing stops automatically adjust stop-loss orders as the price moves in favor of the trade, potentially locking in profits and reducing the risk of reversal.

Setting Trailing Stops

Trailing stops can be set as a fixed number of pips or as a percentage of the current price. As the price moves in the trader’s favor, the trailing stop follows at a set distance, securing gains while allowing the trade to continue profiting.

Additional Strategies for Managing Risk

Diversification

Diversifying trades across different currency pairs, timeframes, and trading strategies can help spread risk. By not putting all their capital into a single trade or strategy, traders can mitigate the impact of any single losing trade.

Regular Review and Adjustment

Regularly reviewing and adjusting trading strategies based on performance and changing market conditions is essential for maintaining effectiveness. This continuous improvement process helps traders adapt to new information and market dynamics, ensuring their risk management remains robust.

Trading Strategies with Lower Risk Profiles

Implementing trading strategies with lower risk profiles is crucial for achieving long-term success in forex trading. These strategies emphasize minimizing risk while aiming for consistent, sustainable returns. Below are some of the most effective lower-risk trading strategies, enriched with detailed explanations, and practical tips.

Trend Following Strategies

Trend following strategies capitalize on sustained market movements by trading in the direction of prevailing trends, offering potential high rewards with managed risk.

Identifying Trends:

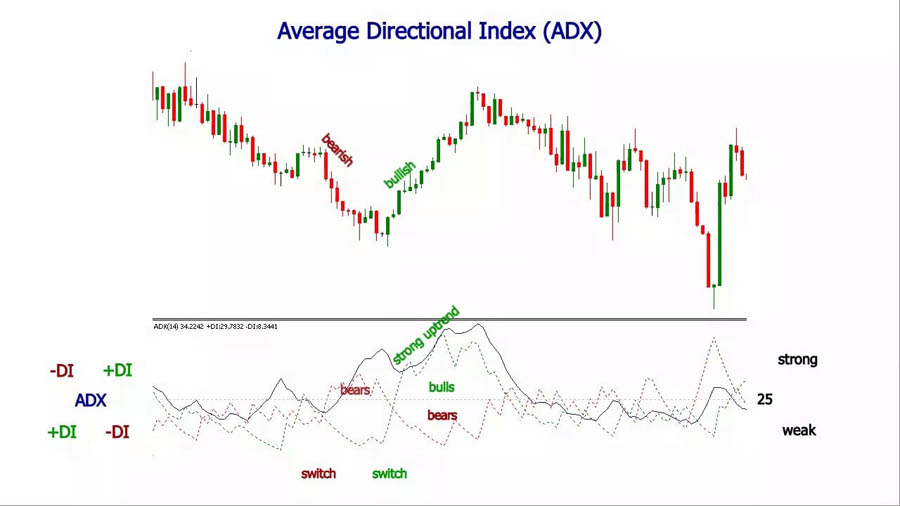

- Tools and Indicators: Traders utilize moving averages, trendlines, and the Average Directional Index (ADX) to identify trends.

- Moving Averages:

- Smooth price data to reveal trend directions.

- Commonly used: 50-day and 200-day for long-term trends, 20-day for short-term trends.

- A bullish trend: Shorter moving average crosses above longer (golden cross).

- A bearish trend: Shorter moving average crosses below longer (death cross).

- Trendlines:

- Connect lows in uptrends and highs in downtrends.

- Validate trend direction visually.

- Uptrend: Price stays above trendline; downtrend: below trendline.

Average Directional Index (ADX)

The ADX measures the strength of a trend. Values above 25 indicate a strong trend, while values below 20 suggest a weak trend or no trend. Traders can use the ADX in combination with other indicators to confirm the trend’s strength before entering a trade.

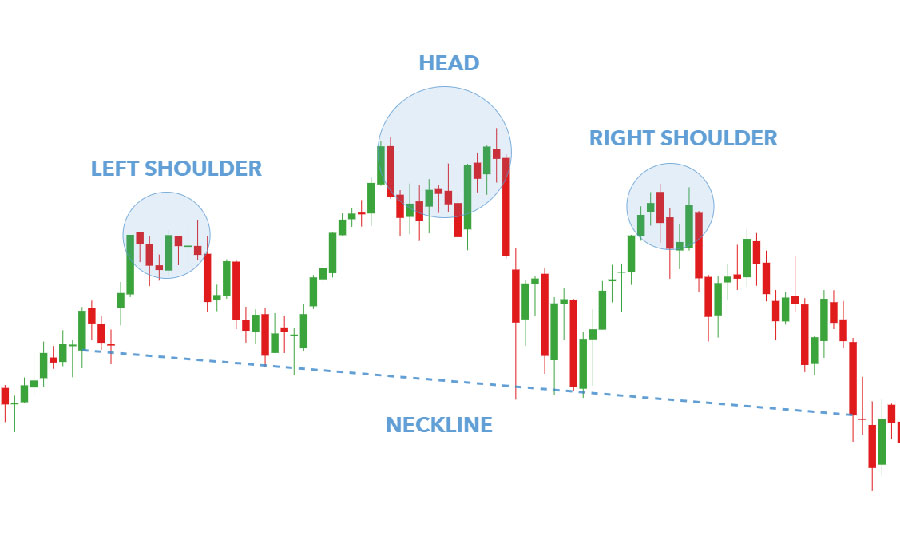

Support and Resistance Trading

Support and resistance trading involves identifying key price levels where the market has historically reversed or paused, offering strategic entry and exit points with favorable risk-reward ratios.

Identifying Support and Resistance Levels:

- Support Levels:

- Support levels are where demand prevents the price from falling further.

- Identified through analysis of historical price data, focusing on previous lows.

- Resistance Levels:

- Resistance levels are where supply prevents the price from rising further.

- Identified through historical price highs, pivot points, and psychological levels.

Price Action Trading

Price action trading involves analyzing raw price movements to identify trading opportunities, focusing on clear entry and exit points without relying on complex indicators.

Key Price Action Patterns:

- Pin Bars:

- Pin bars have long tails and small bodies, signaling rejection of a specific price level.

- A bullish pin bar has a long lower tail, indicating potential upward momentum.

- A bearish pin bar has a long upper tail, suggesting potential downward momentum.

- Inside Bars:

- Inside bars occur when the price range of one bar is entirely within the previous bar’s range, indicating consolidation.

- Traders watch for a breakout from the inside bar to predict the next market direction.

- Engulfing Bars:

- Engulfing bars occur when a bar’s range completely engulfs the previous bar’s range, indicating a strong reversal signal.

- A bullish engulfing bar engulfs a bearish bar, signaling potential upward movement.

- A bearish engulfing bar engulfs a bullish bar, signaling potential downward movement.

The Importance of Lower Risk Strategies in Forex Trading

Implementing lower-risk strategies is vital for sustained success in forex trading. Techniques such as trend following, support and resistance trading, and price action strategies, combined with effective risk management, safeguard capital and promote consistent returns. This disciplined approach minimizes losses and enhances long-term profitability in the dynamic forex market.

Discipline and Emotional Control

Importance of Discipline: Discipline is crucial for forex traders. Adhering to a well-defined trading plan and risk management strategy prevents impulsive decisions that can lead to significant losses. Consistency, even during drawdowns, is key to achieving long-term success.

Developing a Trading Plan:

A comprehensive trading plan should include:

- Trading Goals: Clear and achievable objectives.

- Risk Management Rules: Guidelines for position sizing, stop-loss levels, and risk per trade.

- Entry and Exit Criteria: Specific conditions for entering and exiting trades.

- Review and Adjustment: Regularly review and adjust the plan based on performance and market conditions.

Emotional Control in Forex Trading

Emotions like fear and greed can impair judgment and lead to irrational trading decisions. Traders must develop emotional control to maintain objectivity and focus. Techniques such as mindfulness, journaling, and taking breaks help manage emotions and maintain clarity.

Conclusion: Realistic Expectations and Long-Term Success

Managing expectations is crucial for achieving long-term success in forex trading. While high reward, low risk strategies are appealing, traders must acknowledge the inherent risks and volatility of the market. By focusing on sustainable growth, employing robust risk management techniques, and maintaining discipline, traders can navigate the complexities of the forex market and achieve consistent, profitable results.

What is the difference between a stop-loss order and a trailing stop?

A stop-loss order is a fixed order to sell a security when it reaches a specific price, designed to limit an investor’s loss on a position. A trailing stop, on the other hand, is a dynamic stop-loss that moves with the price as it goes in the trader’s favor, maintaining a set distance from the current price to protect gains and limit losses if the price reverses.

How can I manage emotions effectively while trading?

Managing emotions while trading involves practicing mindfulness techniques, keeping a trading journal to reflect on decisions and emotions, and taking regular breaks to avoid burnout. Additionally, adhering to a well-defined trading plan and risk management strategy can help mitigate the impact of emotions on trading decisions.

What are the benefits of using a demo account before live trading?

Using a demo account allows traders to practice and test their trading strategies in a risk-free environment. It helps in developing trading skills, understanding market dynamics, and building confidence before committing real capital. Demo trading also allows traders to refine their strategies based on simulated performance.