What makes currencies rise and fall? One of the biggest drivers is how interest rates affect forex market trends. When central banks raise or lower interest rates, they influence currency demand, inflation, and economic stability—causing sharp price movements in forex trading.

Many traders overlook the impact of interest rates, focusing only on price action. This can lead to poor trade timing, missed opportunities, or unexpected losses when central banks make policy shifts.

Imagine holding a long position on EUR/USD right before the Federal Reserve unexpectedly raises rates. The U.S. dollar surges, and your trade moves against you. Without understanding rate dynamics, you could miss profitable carry trades or get caught in sudden volatility.

Mastering how does interest rates affect forex trading allows you to predict trends, time entries more effectively, and avoid unnecessary risks. By tracking central bank decisions and economic indicators, you can align your strategy with interest rate cycles for better trading outcomes. A regulated forex broker provides the tools, security, and execution speed necessary to capitalize on these rate-driven moves.

In this guide, we’ll explore why interest rates matter, how they shape forex markets, and practical strategies to trade rate shifts profitably. Let’s dive in.

The Influence of Interest Rates on Currency Value

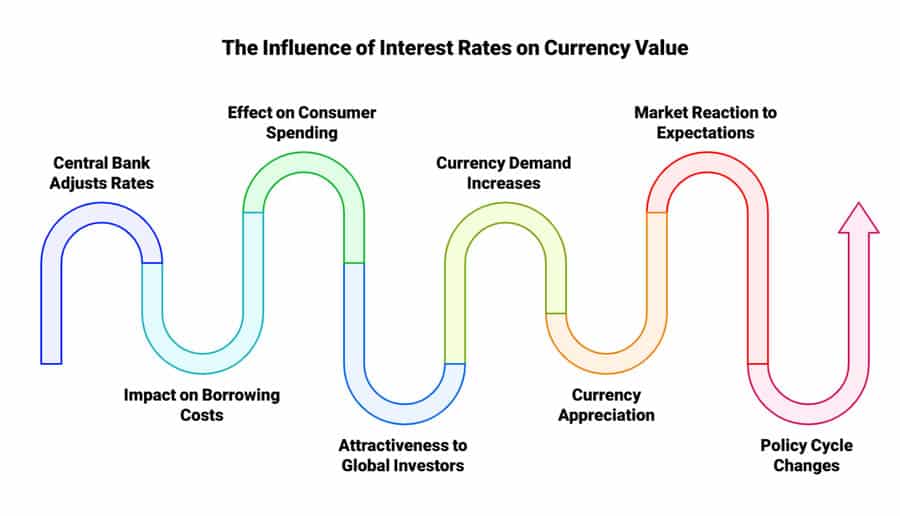

Interest rates function as a country’s monetary policy cornerstone. When a central bank adjusts its benchmark rate, it sets off a chain reaction throughout its economy. In the forex market, this policy decision can suddenly tilt the balance in favor of one currency over another.

Understanding the “Price of Money”

One of the most fundamental aspects of how interest rates affect forex market momentum is tied to the concept of money’s “price.” A rate hike makes borrowing more expensive, usually slowing consumer spending and business investment. Conversely, higher yields can attract global investors looking to earn more on bonds, certificates of deposit, or savings accounts in that currency. The result: increased demand for that currency and often an appreciation in its exchange rate.

On the other end, a rate cut reduces borrowing costs, attempting to spur economic growth and manage deflationary pressures. Although it encourages local borrowers, it can also prompt foreign investors to seek higher returns elsewhere, weakening that currency in the process.

Impact of Expectations

Sometimes, the market reacts more strongly to what traders believe will happen than to what’s already occurred. If a central bank like the European Central Bank (ECB) signals an upcoming rate hike, traders might begin buying euros weeks in advance. This pricing in of expectations can lead to immediate euro strength—even before the official announcement. Similarly, rumors of a dovish tilt may cause a currency to drop well ahead of an actual rate cut.

When it comes to how does interest rates affect forex trading decisions, staying on top of forward guidance and market speculation is just as crucial as reading the official rate statements. Markets abhor uncertainty, and any surprise can cause explosive price movements that reward those who have planned accordingly.

Monetary Policy Cycles

Central banks usually operate in policy cycles—either tightening (raising rates) or easing (lowering rates) to manage inflation and growth. For example, if the Bank of England raises rates repeatedly over six months, traders may view the British pound as a strong currency relative to counterparts that maintain low rates. If global conditions shift, however—maybe inflation drops or a recession looms—that same central bank could pivot, reversing its monetary stance.

When multiple major economies move in sync (e.g., a global tightening cycle), cross-currency flows can intensify. A popular currency pair might become more volatile as traders worldwide adjust to the synchronized rate changes. Watching the interplay of these cycles explains much about how interest rates affect forex market liquidity and direction.

Read More: The Impact of Central Bank Interventions in Forex

Beyond Interest Rates: Additional Forex Drivers

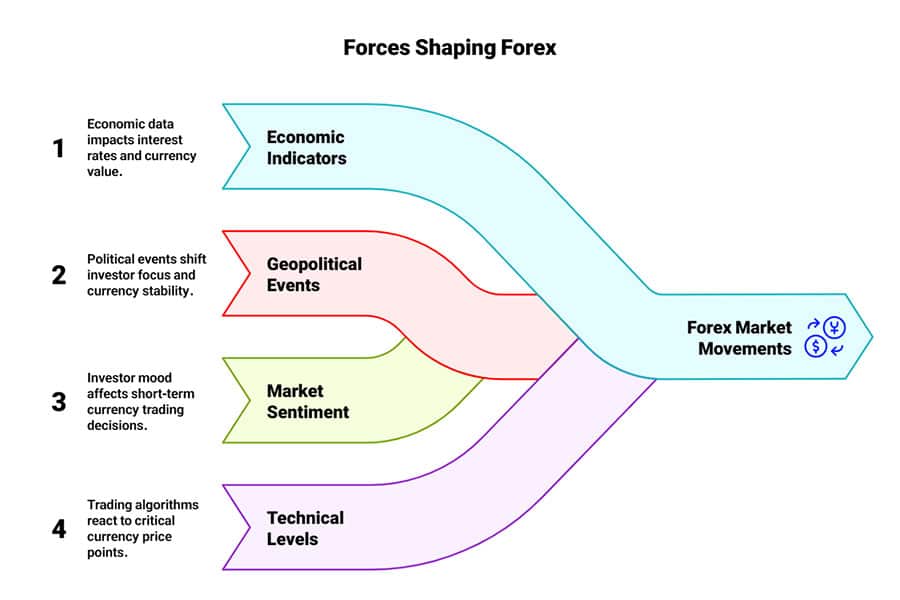

Interest rates are a potent driver, but no single factor rules the entire forex market. Economic indicators, geopolitical events, and overall market sentiment layer on top of rate policy, amplifying or attenuating currency movements.

Inflation, Jobs, and GDP

Inflation often informs interest rate decisions. A spike in inflation might push a central bank toward hiking rates more aggressively, while tame inflation could give policymakers room to stay dovish. Employment figures, like U.S. Non-Farm Payrolls or the UK’s employment change data, can also hint at whether the economy is overheating (potentially requiring higher rates) or slowing (potentially requiring cuts).

Gross Domestic Product (GDP) ties these threads together, reflecting overall economic health. A strong GDP trend typically signals robust economic performance, prompting higher rates. A shrinking GDP can put downward pressure on rates. By tracking these indicators, you’ll gain deeper insight into how does interest rates affect forex trading across different regions.

Geopolitical Influence and Risk Sentiment

Events like political unrest, trade disputes, or major policy changes can override traditional rate logic. During crises, investors might flee high-yield currencies in favor of safe-haven assets like the Japanese yen or the Swiss franc. Even if Japan has near-zero or negative interest rates, the yen can appreciate simply because traders view it as a reliable store of value in turbulent times.

Risk sentiment—a collective mood about whether market conditions are “risk-on” or “risk-off”—often supersedes interest rate differentials, particularly in the short term. Learning to gauge sentiment helps you avoid surprises when major geopolitical events or global market downturns trigger abrupt capital flight into or out of certain currencies.

Market Psychology and Technical Levels

Beyond the fundamentals, market psychology plays a substantial role. Traders, especially large institutional ones, can jump in or out of positions en masse based on perceived signals. If a currency pair nears a critical technical level right before a rate announcement, automated trading algorithms might activate, creating sudden spikes or dips.

This interplay highlights the complexity of how interest rates affect forex market movements. Even if your fundamental thesis is solid—expecting a rate-driven bullish move—technical or sentiment factors can temporarily push the pair in the opposite direction.

Read More: The Role of Central Bank in Forex Trading

How Does Interest Rates Affect Forex Trading Strategies?

Knowing the mechanics is one thing; leveraging them for real-world trading is another. The interplay of interest rate policies with other economic factors shapes short-term trades, long-term positions, and everything in between.

Carry Trades and Position Trading

A classic example of how interest rates affect forex market strategies is the carry trade. Traders borrow in a currency with a low rate—like the Japanese yen—then invest in a currency with a higher rate—like the Australian or New Zealand dollar. The goal is to pocket the interest rate differential, often called “the carry,” and potentially gain from any appreciation in the higher-rate currency.

- Pros: Generate steady income from the rate gap, and possibly earn capital gains if the target currency strengthens.

- Cons: Market sentiment swings can reverse the pair rapidly. A risk-off environment might send investors rushing back into safe havens (e.g., JPY), wiping out the carry trade gains.

- Best Practices: Track monetary policy stances and risk conditions. If global growth falters, carry trades might unravel quickly.

Long-term position traders often track rate cycles, waiting for a central bank’s hawkish pivot to buy a currency that might appreciate over months. Conversely, identifying a bank that’s on the verge of cutting rates could lead to a longer-term short position. This approach demands patience, thorough economic analysis, and robust risk management.

Short-Term News-Based Trading

Day traders or scalpers thrive on volatility. Nothing sparks short-term turmoil in the forex market like unexpected rate decisions or hawkish/dovish comments from central bank officials.

- Pre-Announcement Setup: By studying economic calendars and interest rate forecasts, you can decide if it’s worth taking a position before a big announcement. Tight stop-loss orders are crucial here.

- Post-Announcement Opportunity: Some prefer waiting until after the initial noise settles, then jumping on the residual momentum. If the central bank surprises markets, the trend might persist for hours—or even days.

- Managing Volatility: Spreads can widen dramatically around announcements. Ensure your broker for forex trading offers reliable execution to handle potential slippage.

Blending Fundamentals and Technicals

Combining fundamental knowledge of how interest rates affect forex market direction with technical analysis can yield a balanced approach. For instance, if you expect a hawkish tilt from the Bank of Canada, and USD/CAD is forming a bullish pennant on the charts, that synergy might support a high-probability long position on the Canadian dollar. If the technical pattern confirms your fundamental outlook, you’ll feel more confident entering the trade.

Practical Ways to Monitor Interest Rate Shifts

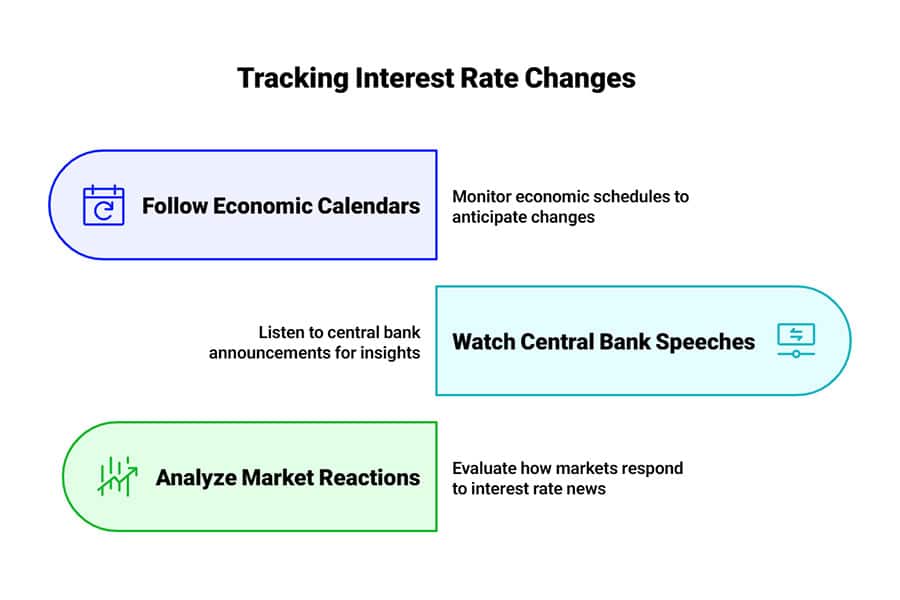

Staying ahead of interest rate changes requires consistent tracking of economic data, central bank speeches, and market indicators. Fortunately, technology provides streamlined paths to stay informed.

Economic Calendars and Newsfeeds

Many online forex broker platforms incorporate economic calendars that list upcoming central bank meetings, GDP releases, CPI data, and more. Mark down key dates—like Federal Reserve announcements or ECB press conferences—and adjust your trading schedule accordingly. Look at the consensus forecast vs. previous data. If a major deviation occurs, volatility often follows.

Real-time news feeds from reputable outlets (Bloomberg, Reuters, Financial Times) can keep you updated on sudden central bank statements or leaks. Quick access to breaking news helps you act or hedge promptly if markets pivot.

Central Bank Communications

Official statements, meeting minutes, and press conferences offer granular details about a central bank’s outlook. If the Bank of England consistently highlights rising wage growth, it could be a clue that rate hikes are coming sooner than the market expects. Conversely, mention of “transitory inflation” might signal a reluctance to raise rates aggressively, damping the currency’s potential.

Tracking these communications is a core tactic in understanding how does interest rates affect forex trading on both a weekly and monthly basis. Subtle language shifts, like changing “will” to “may,” might signal a pivotal adjustment in policy stance.

Historical Analysis and Yield Curves

Studying historical rate cycles and yield curves reveals patterns in how interest rates affect forex market movements. Yield curves, which plot short-term vs. long-term bond rates, can predict economic turning points. If short-term rates surpass longer-term rates, an inverted yield curve often hints at future economic slowdowns—and the possibility of eventual rate cuts.

Review how different currencies responded during past policy cycles. If the Reserve Bank of Australia embarked on multiple hikes in a robust commodity environment, AUD might have rallied sharply. Look for parallels in current conditions.

Risk Management Around Rate Decisions

Volatility around interest rate events can balloon, offering larger profit swings but also exposing you to bigger potential losses. Having a solid defensive structure is essential.

Stop-Loss Orders and Hedging

Stop-loss orders act as automatic guards. If you anticipate a hawkish rate decision that should lift the U.S. dollar, place a stop-loss at a level that reflects your maximum acceptable risk. If the outcome defies expectations (say, the Fed remains dovish), your stop-loss will activate, curbing losses.

Hedging involves opening offsetting positions to reduce downside. For instance, if you’re bullish on GBP/USD but face uncertainty about a Bank of England rate decision, you might short EUR/GBP as a partial hedge. If the pound weakens broadly, the short EUR/GBP position could mitigate some of your losses.

Position Sizing and Timing

Even if you’re confident in how interest rates affect forex market conditions, risking too much on a single event is perilous. Many seasoned traders limit exposure to 1–2% of their account balance per trade. Around critical announcements, some even scale down to reduce the impact of a market shock.

Another tactic involves timing entries to avoid the most chaotic price spikes. If you believe a central bank will surprise the market, you could open a position earlier with wider stops or wait until the storm subsides before entering based on new trends confirmed by price action.

Emotional Restraint

A highly anticipated rate announcement can inspire overconfidence or fear-based trading. Set clear rules on leverage and decide in advance how you’ll respond if the market moves drastically against you. Refrain from “revenge trading” to recoup losses quickly—a common pitfall when rate decisions defy consensus.

Read More: Inflation Impact on Forex Market

Real-World Examples of Rate Shifts

Practical case studies highlight how interest rates affect forex market trajectories with clarity.

Federal Reserve Tightening Cycle (2017–2019)

During this period, the Federal Reserve gradually raised interest rates, citing strong labor markets and moderate inflation. Traders began buying U.S. dollars even before official announcements, anticipating further hikes.

- Outcome: The USD strengthened against lower-yielding counterparts.

- Market Reaction: Each hike saw diminishing surprises, as the Fed telegraphed its actions clearly.

- Lesson: Strong forward guidance can smooth out volatility but still create directional trends.

Bank of Japan and Negative Rates (2016–Present)

The Bank of Japan’s negative interest rate policy aimed to spur growth and combat deflation. Although negative rates typically weaken a currency, the yen repeatedly gained ground during risk-off episodes as investors viewed it as a safe haven.

- Outcome: The yen’s safe-haven status outweighed its low rate.

- Volatility Factor: Geopolitical crises often led to yen appreciation, defying standard interest rate theory.

- Lesson: Risk sentiment can overpower rate logic in times of global uncertainty.

ECB Rate Hikes Amid Inflation Concerns (2022–2023)

Rising inflation prompted the European Central Bank to signal the end of ultra-low rates. Traders quickly priced in hawkish moves, pushing the euro higher against currencies from economies deemed slower to tighten.

- Outcome: EUR rallied, especially against currencies where the central bank hesitated on hikes.

- Data Dependence: If Eurozone inflation data disappointed, the ECB paused hawkish rhetoric, and the euro saw short-lived dips.

- Lesson: Rate expectations can change rapidly with fresh data, creating frequent trading opportunities.

Pro Tips for Advanced Traders

- Cross-Asset Correlation

Follow how commodities, equities, and bond yields move in response to rate news. A rising USD can pressure gold prices, for example, revealing additional ways how interest rates affect forex market sentiment. - Option Market Signals

Spikes in implied volatility for currency options can indicate markets anticipating major price swings around rate announcements. This insight allows you to time entries more strategically. - Yield Curve Analysis

Short-term vs. long-term yield comparisons help you spot potential recessions or expansions. Anticipating these shifts can give you an edge in identifying hawkish or dovish pivots before they become mainstream news. - Fed Watch Tools

For U.S. traders, the Chicago Mercantile Exchange (CME) FedWatch Tool shows the market’s expectations for Federal Reserve rate actions. Aligning your trades with these forecasts can improve win rates, especially if you foresee a deviation from consensus. - Data Triangulation

Cross-reference multiple reports—like inflation, retail sales, and manufacturing indexes—to confirm the direction of a central bank’s thinking. Consistent data across sectors amplifies a potential policy shift.

Opofinance Services

When you’re ready to leverage how interest rates affect forex market movements, an ASIC-regulated broker like Opofinance can enhance your trading edge:

- Advanced Trading Platforms

Choose from MT4, MT5, cTrader, or OpoTrade to align with your preferred style—be it algorithmic or discretionary analysis. - Innovative AI Tools

Utilize AI Market Analyzer, AI Coach, and AI Support for faster data interpretation, crucial when minutes can make all the difference after a rate decision. - Social & Prop Trading

Compare insights, follow successful traders, or explore proprietary trading opportunities that can scale up your exposure to interest rate trends. - Secure & Flexible Transactions

Rely on safe deposit and withdrawal methods, including crypto, all facilitated at zero fees from Opofinance. - ASIC Regulated

Trade with peace of mind in a transparent environment, guided by a reputable regulatory authority.

Ready to adapt your strategies around rate announcements? Visit opofinance.com and unlock the full potential of how interest rates affect forex market activities, all while enjoying premium trading conditions.

Conclusion

Recognizing how interest rates affect forex market volatility is a turning point in any trader’s journey. Rate hikes, cuts, or even subtle language shifts in central bank communications can spark powerful moves in currency pairs. By keeping tabs on inflation reports, GDP data, and employment figures, you’ll deepen your understanding of how does interest rates affect forex trading across different economic cycles.

However, interest rates don’t exist in a vacuum. Market psychology, geopolitics, and risk sentiment can override standard rate logic. That’s why a blend of fundamental analysis, technical evaluation, and disciplined risk management forms the backbone of a resilient forex strategy. Look beyond immediate headlines, plan trades around significant announcements, and constantly refine your approach as central banks reveal new guidance.

Aligning yourself with a reputable, regulated forex broker and staying informed about upcoming data releases allows you to act confidently when the market shifts. Over time, your ability to predict and react to rate movements will evolve, potentially turning each central bank decision into an opportunity—rather than a gamble. Stay focused, plan thoughtfully, and let interest rates guide you toward smarter currency trades.

Key Takeaways

- Core Currency Driver – Interest rates directly influence capital flows, making them a foundational factor in currency valuation.

- Rate Differentials – Discrepancies in national rates can fuel carry trades, offering both steady yields and potential appreciation.

- Risk Sentiment Matters – Even with strong fundamentals, risk-off markets can override the usual interest rate logic, boosting safe havens like JPY or CHF.

- Plan Around Announcements – Use economic calendars, central bank statements, and risk management tools to anticipate and handle volatility.

- Adapt Constantly – The best forex traders marry macro insights with technical cues and remain flexible as new economic data emerges.

Do central banks coordinate interest rate decisions?

While central banks occasionally move in tandem during global crises, most set policies to meet domestic goals, such as controlling inflation or boosting employment. However, global economic conditions can pressure multiple banks to act similarly—leading to what seems like coordinated rate cycles.

Why do some currencies strengthen despite negative or near-zero interest rates?

Safe-haven status can overshadow yield-based logic. The Japanese yen, for example, often appreciates in times of global fear because investors perceive it as a secure refuge, even though Japan’s rates remain at or below zero.

How does interest rates affect forex trading for day traders vs. long-term investors?

Day traders often focus on immediate volatility around announcements or unexpected rate shifts, aiming for quick profits on short price swings. Long-term investors examine broader rate cycles, employing carry trades or multi-month positions keyed to hawkish or dovish central bank outlooks. Both can capitalize on rate changes, but the specific strategies and risk management differ significantly.