Successfully passing a prop firm challenge is a significant achievement, but the real test begins when you need to manage a funded account. This is where discipline, strategy, and a professional mindset separate fleeting success from long-term profitability.

For traders looking to partner with a reliable online forex broker, understanding these principles is paramount. This playbook provides a comprehensive guide on how to not only protect your funded account but also to scale it effectively, secure consistent payouts, and manage the complexities of multiple accounts. We will cover everything from the crucial first week to advanced capital management and the psychological fortitude required for success.

Key Takeaways

- Secure a 1% profit early to withdraw your refund and trade with “house money,” removing emotional pressure.

- Implement strict funded account risk management by risking no more than 0.8% per trade and capping daily losses at half the prop firm’s limit.

- Scale your position size by 25% only after locking in a new equity high and withdraw 50% of new profits bi-weekly to ensure account longevity.

- When you manage multiple funded accounts, rotate between them instead of copying trades to reduce cumulative risk.

- Develop a professional routine with pre-market checklists, mid-day resets, and weekly performance reviews to maintain discipline and a winning edge.

Nail the Fast Refund (Day 1–7)

The first week with your funded account is a critical period that sets the tone for your entire trading journey. The primary objective is to secure your initial refund. This not only returns your initial investment but, more importantly, it provides a powerful psychological boost. Once your own capital is safe, you can approach the market with a clearer, less emotional perspective, knowing you are now trading with the firm’s money.

Bank 1% First

Your immediate goal should be to bank a modest 1% profit. This single percentage point is often the trigger for prop firms to process your fee refund. Achieving this early win removes the immense emotional pressure of trying to recover your challenge fee. It’s a small, tangible target that is achievable without taking undue risks. Focus on high-probability setups and be patient. This isn’t about hitting a home run; it’s about getting on base and securing your stake.

Trade Only Your A-Setups

In this initial phase, selectivity is your greatest ally. You’ve proven you can trade by passing the challenge; now, it’s about demonstrating you can trade profitably under real-world conditions. Stick exclusively to your A-setups—the trade configurations you know inside and out, the ones that have consistently delivered results in your backtesting and challenge phases. Avoid the temptation to trade out of boredom or to chase marginal opportunities. During this first week, it’s also wise to steer clear of major news events. The volatility spikes can be unpredictable and may lead to slippage or unexpected losses that can jeopardize your account before you’ve even found your footing.

Cap Daily Loss at ½ of Account’s Daily Max

One of the quickest ways to lose a funded account is to hit the daily drawdown limit. To create a buffer against this, implement a personal daily loss limit that is half of the official limit set by the prop firm. For instance, if the firm’s daily loss limit is 5%, your personal limit should be 2.5%.

This conservative approach provides a crucial safety net, preventing a single bad day from turning into a catastrophic one. It forces you to be more disciplined and to step away from the screen when things aren’t going your way, which is a hallmark of professional trading and a key component of learning How to Manage a Funded Account effectively.

Read More: Risk management principles for both novice and advanced traders

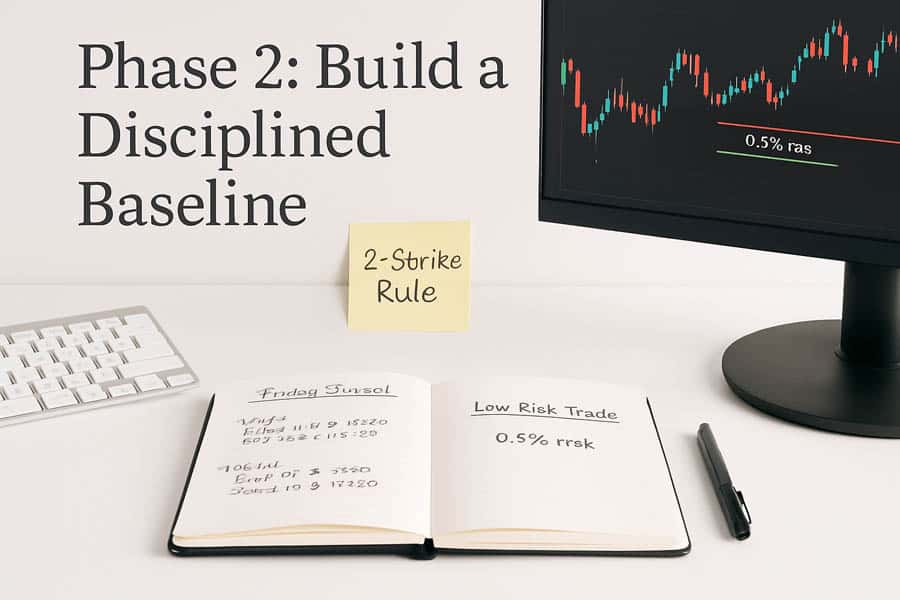

Build a Zero-Stress Baseline (Week 2–4)

After securing your refund, the next phase is about establishing a sustainable trading routine that minimizes stress and maximizes consistency. This is where you lay the foundation for long-term success by implementing robust risk management protocols and disciplined trading habits. The goal is to create a baseline of profitability that you can build upon in the coming months. This is a crucial step when you want to manage a funded account for the long haul.

Fixed Fractional Risk: 0.25 – 0.8% Per Trade

The cornerstone of effective funded account risk management is a fixed fractional risk model. By risking a small, consistent percentage of your account on each trade—ideally between 0.25% and 0.8%—you create a significant buffer against a string of losses. For example, with a 0.25% risk per trade, you would need to lose 40 consecutive trades to blow a 10% drawdown limit. This approach keeps you in the game even during inevitable losing streaks and prevents the emotional decision-making that often accompanies larger, more volatile risk-taking. It’s a systematic way to ensure your survival and give your trading edge the time it needs to play out.

Two-Strike Rule: Stop Trading After 2 Wins or 2 Losses

Overtraining is a common pitfall for funded traders, often driven by greed after a couple of wins or the desire to “revenge trade” after a couple of losses. The “two-strike” rule is a simple yet powerful way to combat this. The rule is straightforward: stop trading for the day after two consecutive winning trades or two consecutive losing trades.

Hitting your profit target with two good trades means you’ve had a successful day; there’s no need to push your luck and risk giving back your gains. Conversely, two consecutive losses are a clear signal that you may not be in sync with the market. Stepping away prevents you from digging a deeper hole and allows you to come back the next day with a fresh perspective.

Journal Screenshots + Emotions Immediately Post-Session

A detailed trading journal is your personal performance coach. To make it as effective as possible, you need to be diligent about your record-keeping. Immediately after each trading session, take screenshots of your charts for every trade you took, annotating your entry, exit, and stop-loss levels. Just as importantly, write down the emotions you experienced during the trade. Were you anxious, confident, fearful, or greedy?

This practice allows you to conduct regular pattern audits, not just of your technical strategy but also of your psychological tendencies. Over time, you’ll identify a wealth of information about what works, what doesn’t, and the emotional triggers that impact your performance. This is a non-negotiable for anyone serious about mastering How to Manage a Funded Account.

Advanced Capital Management Tactics

Once you’ve established a consistent baseline, you can begin to incorporate more advanced capital management techniques. These strategies are designed to protect your account during drawdowns, optimize your risk exposure, and smooth out your equity curve. This is where you transition from simply preserving your account to actively growing it in a smart, controlled manner.

Equity Curve “Volatility Stops”

Just as you use stop-losses to protect individual trades, you can use “equity curve stops” to protect your overall account. This involves monitoring your equity curve and adjusting your position size based on its performance. A simple yet effective rule is to drop your trade size by 50% after three consecutive losses. This acts as a circuit breaker, significantly reducing your risk exposure during a losing streak and protecting your funded status. Once you have a winning trade, you can return to your standard position size. This dynamic approach to risk ensures that you are aggressive when you are trading well and defensive when you are not, a key principle of professional capital management.

Correlation Filter: Max 2 Positions in Same Currency/Sector

Many traders inadvertently take on excessive risk by opening multiple positions in highly correlated assets. For example, being long on both EUR/USD and GBP/USD is often a doubled-down bet on dollar weakness. To avoid these “cluster hits,” implement a correlation filter. A good rule of thumb is to have no more than two open positions in the same currency or sector at any given time. This forces you to diversify your risk and prevents a single market move from wiping out a significant portion of your gains. It’s a sophisticated approach to funded account risk management that many retail traders overlook.

Strategic Diversification: Pair an Intraday System with a Swing Book

Another way to smooth your equity curve is to diversify your trading strategies. If you primarily focus on intraday trading, consider adding a swing trading system to your portfolio. Intraday and swing strategies often have different performance cycles. Your intraday system might thrive in volatile markets, while your swing system performs better in trending environments. By combining the two, the profits from one can help offset the drawdowns of the other, leading to a more stable and consistent overall return. This approach to How to Manage a Funded Account demonstrates a mature and professional understanding of portfolio management.

Read More: how much do prop firm traders make

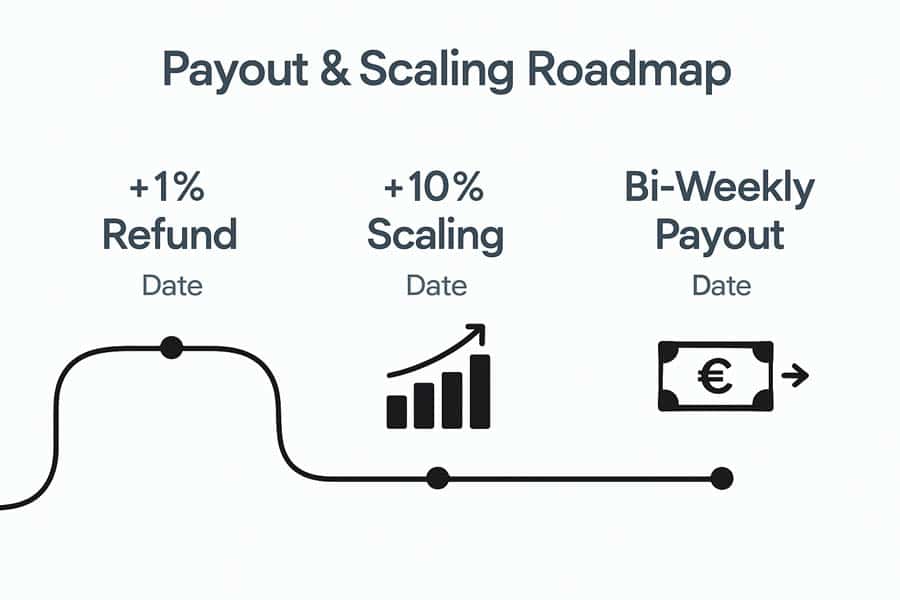

Payout & Scaling Roadmap

A clear roadmap for taking payouts and scaling your account is essential for long-term success. This plan should be systematic and based on performance milestones, not on emotion. Having a structured approach to this aspect of your trading will help you compound your profits safely and ensure the longevity of your account.

| Milestone | Target | Action | Why |

| Refund Secured | +1% | Withdraw full refund; leave profits untouched | Emotionally free trading |

| First Scale-Up | +10% net | Increase position size by 25% only after new equity high is locked | Compounds safely |

| Ongoing Payouts | Every 2 weeks | Withdraw 50% of new profits, retain 50% as cushion | Account longevity |

Managing Multiple Funded Accounts

As you become more proficient, you may decide to manage multiple funded accounts to increase your income potential. However, this comes with its own set of challenges and requires a strategic approach to avoid compounding risk. It is a key step in scaling a funded trading account.

Rotate, Don’t Copy

A common mistake traders make is to use a trade copier to execute the same trade across all their accounts simultaneously. While this seems efficient, it can be catastrophic if the trade goes against you, as all your accounts will suffer a loss at the same time. A much safer approach is to rotate between your accounts. Trade one account until you reach a target of 1-2% profit, then “park” it and move on to the next one. This method reduces your cumulative risk and ensures that a single bad trade doesn’t impact your entire portfolio. It’s a more patient and sustainable way to manage multiple funded accounts.

Purpose Tagging

Assigning a specific purpose to each of your funded accounts can also be a powerful organizational tool. For example, you could designate “Account A” for your low-risk swing trading strategy and “Account B” for your higher-conviction intraday setups. This “purpose tagging” helps you to maintain clarity and focus, and it allows you to tailor your risk parameters to the specific strategy being deployed on each account. It also provides a clear framework for performance analysis, as you can easily track which strategies are performing best.

Tech Stack: VPS + Trade Copier for Identical Rules Accounts; Manual Rotation for Mixed Rule-Sets

Your technology stack should be tailored to your specific needs. If you have multiple accounts with identical rules, a Virtual Private Server (VPS) and a trade copier can be a viable option, provided you are mindful of the risks. However, if your accounts are from different prop firms with varying rules (e.g., different drawdown limits, time restrictions, or lot size caps), manual rotation is the far safer and more professional approach. This ensures that you are always in compliance with the specific rules of each account and avoids any costly mistakes.

Unified Dashboard Review Every Friday

To effectively manage multiple funded accounts, you need a unified view of your overall performance. At the end of each week, take the time to review a consolidated dashboard that tracks your key performance indicators (KPIs) across all accounts. This should include your net P/L, current drawdown, and any rule breaches. This weekly review provides a high-level perspective on your trading business and allows you to make informed decisions about your strategy for the week ahead.

Read More: How to Pass a Prop Firm Challenge in 2025

Psychology & Routine of a Professional

The technical aspects of trading are only half the battle. To truly succeed as a funded trader, you need to cultivate the psychology and daily routines of a professional. This is what will sustain you through the inevitable ups and downs of the market and keep you performing at your peak.

Morning Pre-Commit Checklist

Before you even think about placing a trade, you should run through a pre-commitment checklist. This should include a scan of the day’s economic news and events, a clear definition of your maximum risk for the day, and a check for any highly correlated assets you might be planning to trade. This simple routine primes your brain for a disciplined trading session and helps you to avoid impulsive decisions.

Mid-Day Reset

One of the biggest challenges for traders is knowing when to stop. After you’ve hit your daily profit target or taken your two losses as per the “two-strike” rule, it’s crucial to step away from your trading desk. Go for a walk, read a book, or do something completely unrelated to the markets. This mid-day reset helps to block the temptation to overtrade and solidifies your profits for the day. It’s a discipline that separates the amateurs from the pros.

Monthly Performance Audit

Just as you review your performance weekly, you should conduct a more in-depth performance audit at the end of each month. This is where you dig into your KPIs, such as your win rate, average risk-to-reward ratio, and expectancy. You should also track the trend of any rule breaches. Are you consistently making the same mistakes? This monthly audit provides the data-driven insights you need to make meaningful improvements to your trading plan.

Burnout Guardrails

Trading is a mentally demanding profession, and burnout is a very real risk. To maintain your edge, you need to build “burnout guardrails” into your routine. This means taking at least one full day off from the markets each week to completely disconnect and recharge. Regular exercise, a healthy diet, and mindfulness practices like meditation can also help you to stay sharp and focused. Remember, your mental capital is just as important as your financial capital.

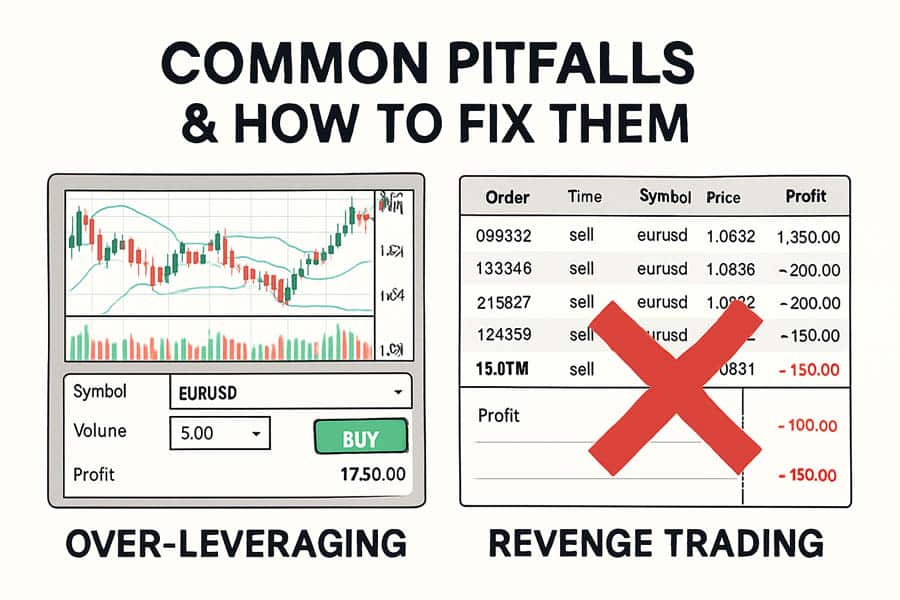

Common Funded-Trader Pitfalls (and Quick Fixes)

Even with the best-laid plans, it’s easy to fall into common traps. Being aware of these pitfalls and having a quick fix at the ready can save you from making costly mistakes and help you understand How to Manage a Funded Account under pressure.

Over-Leveraging After Payout

After receiving a payout, it’s tempting to feel overconfident and start increasing your leverage. This is a classic mistake that has led to the downfall of many funded traders. The quick fix? After a payout, reinstate your original, conservative lot size for the next 10 trades. This forces you to get back to basics and ensures that you don’t give back all your hard-earned profits in a moment of hubris.

Rule Creep (Forgetting Time Limits, Lot Caps)

As you get comfortable, it’s easy to let the little rules slip. You might forget about a firm’s restrictions on holding trades over the weekend or exceed a lot size cap without realizing it. The simple solution is to print out the prop firm’s rules and keep them on your desk. Highlight the fatal rules—the ones that lead to immediate account termination—in red. This constant visual reminder will help you to stay compliant and protect your account.

Emotional Revenge Trades

A losing trade can be frustrating, but an emotional revenge trade is a guaranteed way to make a bad situation worse. The fix for this is a mandatory cool-off period. After a losing trade, set a timer for 20 minutes and step away from your screen. This gives you time for the emotional charge to dissipate and allows you to re-approach the market with a clear and rational mind.

Opofinance: Your Partner in Trading Success

For traders seeking a robust and reliable trading environment, Opofinance, an ASIC-regulated forex trading broker, offers a comprehensive suite of tools and services designed to support your journey. Whether you are a novice or an experienced professional, Opofinance provides the resources you need to thrive.

- Advanced Trading Platforms: Choose from a range of industry-leading platforms, including MT4, MT5, cTrader, and the proprietary OpoTrade platform.

- Innovative AI Tools: Gain a competitive edge with our AI Market Analyzer, AI Coach, and AI Support, designed to provide you with data-driven insights and personalized guidance.

- Social & Prop Trading: Join a community of traders and explore our prop trading opportunities to leverage your skills and access greater capital.

- Secure & Flexible Transactions: Enjoy safe and convenient deposits and withdrawals, including crypto payments with zero fees, ensuring that you can manage your funds with ease and confidence.

Discover the Opofinance advantage today!

Conclusion

Mastering How to Manage a Funded Account is a journey that extends far beyond the initial challenge. It requires a blend of disciplined funded account risk management, strategic planning for growth, and the psychological fortitude of a professional. By implementing the strategies outlined in this playbook—from securing your initial refund to a structured plan for scaling a funded trading account—you can build a sustainable and profitable career as a funded trader. Remember that consistency, patience, and a commitment to continuous improvement are your most valuable assets.

Can I trade multiple prop firms at once?

Yes, you can trade for multiple prop firms simultaneously. However, it is crucial to be aware of each firm’s specific rules and to have a clear strategy for managing your risk across all accounts, such as the rotation method described in this article.

What is the best risk per trade for funded accounts?

A conservative risk of 0.25% to 0.8% of your account balance per trade is widely recommended for funded accounts. This small, fixed fractional risk helps to protect your account from significant drawdowns and allows you to withstand losing streaks.

How do I avoid over-leveraging my funded account?

To avoid over-leveraging, it’s essential to stick to a pre-defined risk management plan. After a payout, it’s a good practice to revert to your original, smaller lot sizes for a set number of trades to prevent overconfidence from leading to excessive risk-taking.

What is the best way to track my performance across multiple accounts?

Using a unified dashboard or a trading journal that consolidates your performance across all accounts is the most effective way to track your overall progress. This allows you to monitor key metrics like net P/L, drawdown, and rule compliance in one place.

How can I prevent emotional trading from affecting my funded account?

Implementing a “two-strike” rule (stopping after two wins or two losses) and taking a mandatory cool-off period after a losing trade are effective strategies to prevent emotional decision-making. A consistent pre-market routine also helps to prime your mind for a disciplined trading session.