The Ichimoku scalping strategy is a powerful forex trading technique that combines the comprehensive analysis of the Ichimoku Kinko Hyo indicator with short-term, high-frequency trading methods. This strategy allows traders to identify and capitalize on quick price movements in the forex market, potentially leading to increased profits and trading efficiency. By mastering the Ichimoku scalping strategy with the support of a regulated forex broker, traders can enhance their ability to spot high-probability trading opportunities and make informed decisions in rapidly changing market conditions.

The ichimoku scalping strategy works by leveraging the multiple components of the Ichimoku Cloud system to generate precise entry and exit signals for short-term trades. This approach is particularly effective because it provides a holistic view of market trends, momentum, and potential support and resistance levels, all within a single indicator. By focusing on these key elements, traders can execute quick, targeted trades with a higher degree of confidence and accuracy.

In this comprehensive guide, we’ll explore the ins and outs of the ichimoku scalping strategy, breaking down its core principles and providing practical tips for implementation. Whether you’re a seasoned forex trader looking to diversify your techniques or a newcomer eager to learn a powerful trading method, this article will equip you with the knowledge and tools needed to effectively utilize the ichimoku scalping strategy in your trading endeavors.

We’ll cover everything from the basics of the Ichimoku Kinko Hyo indicator to advanced scalping techniques, risk management strategies, and common pitfalls to avoid. By the end of this guide, you’ll have a solid understanding of how to apply the ichimoku scalping strategy to potentially boost your forex trading performance and achieve your financial goals.

So, if you’re ready to take your forex trading to the next level and harness the power of the ichimoku scalping strategy, let’s dive in and discover the 7 proven secrets that can help you master this dynamic and potentially profitable trading approach.

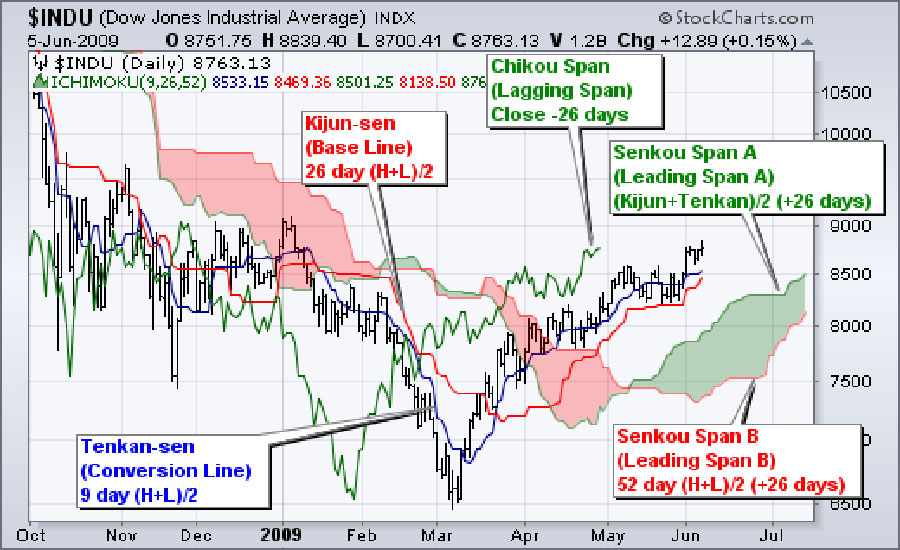

Understanding the Ichimoku Kinko Hyo Indicator

What is the Ichimoku Kinko Hyo?

The Ichimoku Kinko Hyo, often simply called “Ichimoku,” is a versatile technical analysis tool developed by Japanese journalist Goichi Hosoda in the late 1930s. This powerful indicator provides a comprehensive view of market dynamics, offering insights into trend direction, momentum, and potential support and resistance levels. The term “Ichimoku Kinko Hyo” translates to “one-glance equilibrium chart,” emphasizing its ability to provide multiple data points in a single view.

Key Components of the Ichimoku Cloud

To effectively use the ichimoku scalping strategy, it’s essential to understand the five key components of the Ichimoku Cloud:

- Tenkan-sen (Conversion Line): A short-term momentum indicator calculated as the midpoint of the highest high and lowest low over the past 9 periods.

- Kijun-sen (Base Line): A medium-term momentum indicator calculated as the midpoint of the highest high and lowest low over the past 26 periods.

- Senkou Span A (Leading Span A): Forms one edge of the Ichimoku Cloud, calculated as the midpoint of the Tenkan-sen and Kijun-sen, plotted 26 periods ahead.

- Senkou Span B (Leading Span B): Forms the other edge of the Ichimoku Cloud, calculated as the midpoint of the highest high and lowest low over the past 52 periods, plotted 26 periods ahead.

- Chikou Span (Lagging Span): Used to confirm trends and identify potential reversals, it’s the current closing price plotted 26 periods behind.

Understanding these components and their interactions is crucial for mastering the ichimoku scalping strategy.

The Ichimoku Scalping Strategy Explained

Combining Ichimoku with Scalping Techniques

The ichimoku scalping strategy leverages the multi-dimensional insights of the Ichimoku Kinko Hyo indicator to identify high-probability, short-term trading opportunities. By focusing on quick, small profits, traders can potentially increase their overall trading frequency and profitability.

This strategy is particularly effective because it combines the comprehensive market view provided by the Ichimoku Cloud with the fast-paced nature of scalping. Traders can use the various Ichimoku components to confirm trend direction, identify potential reversal points, and pinpoint optimal entry and exit levels for their scalping trades.

7 Proven Secrets for Successful Ichimoku Scalping

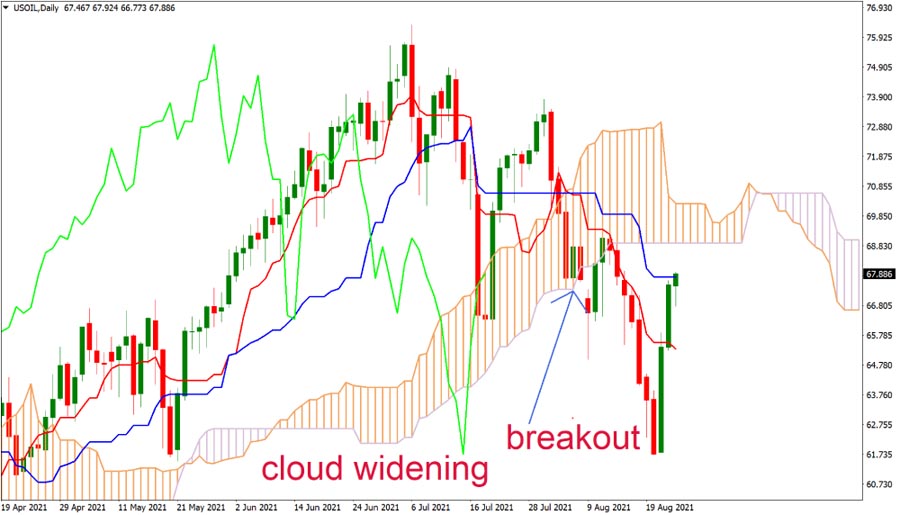

- Master the Kumo (Cloud) Breakout: The Kumo, or Cloud, is a key feature of the Ichimoku system. In the ichimoku scalping strategy, traders look for price action breaking above or below the Cloud to identify potential scalping opportunities. Example: If the price breaks above the Cloud, it signals a potential bullish trend. Scalpers might enter a long position just as the price closes above the Cloud, with a target of 10-20 pips and a stop loss just below the Cloud.

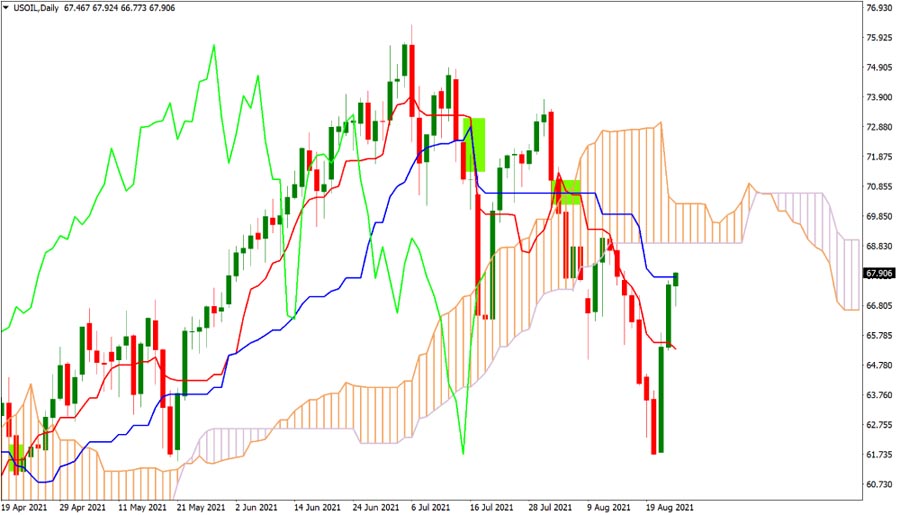

- Utilize the Tenkan-sen/Kijun-sen Cross: When the Tenkan-sen (faster line) crosses above the Kijun-sen (slower line), it may signal a bullish scalping opportunity, while a downward cross could indicate a bearish setup. Example: If the Tenkan-sen crosses above the Kijun-sen while the price is above the Cloud, enter a long position. Set a target of 15-25 pips and a stop loss below the Kijun-sen.

- Leverage the Chikou Span: Use the Lagging Span to confirm trend strength and potential reversals, enhancing your scalping precision. Example: If the Chikou Span is above the price from 26 periods ago and above the Cloud, it confirms an uptrend. This can be used to validate long scalping trades.

- Focus on Confluence Zones: Identify areas where multiple Ichimoku components align to pinpoint high-probability scalping entry points. Example: A strong buy signal might occur when the price is above the Cloud, the Tenkan-sen crosses above the Kijun-sen, and the Chikou Span is above the price and the Cloud.

- Implement Tight Stop Losses: Given the fast-paced nature of scalping, use narrow stop losses to protect your capital while maximizing profit potential. Example: Place stop losses just below the nearest support level, which could be the bottom of the Cloud or the Kijun-sen.

- Embrace the Power of Time Frames: Combine multiple time frames to confirm scalping signals and improve trade timing. Example: Use the 15-minute chart for trend direction and the 5-minute chart for precise entry and exit points.

- Practice Proper Risk Management: Adhere to strict risk-to-reward ratios and position sizing guidelines to ensure long-term scalping success. Example: Risk no more than 1% of your account on any single trade and aim for a minimum risk-to-reward ratio of 1:1.5.

Read More: Algo Scalping Strategy

Setting Up Your Ichimoku Scalping Strategy

Choosing the Right Time Frame

For effective ichimoku scalping, focus on shorter time frames such as the 1-minute, 5-minute, or 15-minute charts. These time frames provide the quick price action necessary for successful scalping while still offering enough detail for accurate analysis.

When selecting your time frame, consider the following:

- 1-minute chart: Suitable for ultra-short-term scalping, but may generate more false signals

- 5-minute chart: A popular choice, offering a balance between speed and signal reliability

- 15-minute chart: Provides a broader view, useful for confirming trends on lower time frames

Many successful ichimoku scalpers use a combination of time frames. For example, you might use the 15-minute chart to identify the overall trend, the 5-minute chart for entry signals, and the 1-minute chart for precise exit timing.

Optimizing Ichimoku Settings for Scalping

While the default Ichimoku settings (9, 26, 52) work well for longer-term analysis, scalpers may benefit from adjusting these parameters to better suit short-term trading. Consider experimenting with settings like (7, 22, 44) or (5, 20, 60) to find the optimal configuration for your scalping style.

Here’s a guide to adjusting your settings:

- Decrease the first value (Tenkan-sen) to make it more responsive to recent price action

- Adjust the second value (Kijun-sen) to align with your average trade duration

- Modify the third value (Senkou Span B) to reflect the overall trend length you’re targeting

Remember, there’s no one-size-fits-all solution. The best settings will depend on your trading style, the currency pairs you’re trading, and current market conditions.

Read More: audusd scalping strategy

Identifying High-Probability Scalping Setups

Look for situations where multiple Ichimoku components align to confirm a potential scalping opportunity. For example, a strong scalping setup might include:

- Price breaking above/below the Kumo (Cloud)

- Tenkan-sen crossing the Kijun-sen in the same direction

- Chikou Span confirming the trend

- Price action near a key support or resistance level

Let’s break down a specific example:

Imagine you’re watching the EUR/USD pair on a 5-minute chart. You notice the following:

- The price has just broken above the Kumo

- The Tenkan-sen has crossed above the Kijun-sen

- The Chikou Span is above the price from 26 periods ago

- The current price is testing the recent swing high, which could act as resistance

This confluence of factors suggests a potential long scalping opportunity. You could enter a buy trade with a target of 10-15 pips and a stop loss just below the Kijun-sen.

Executing Ichimoku Scalping Trades

Entry Strategies

- Kumo Breakout Entry: Enter a trade when price convincingly breaks above or below the Ichimoku Cloud, confirming with other components. Example: If the price breaks above the Cloud on the 5-minute chart, wait for a retest of the Cloud’s upper boundary. If the price bounces off this level, enter a long position with a target of 15 pips and a stop loss 5 pips below the entry.

- Tenkan-sen/Kijun-sen Cross Entry: Initiate a position when the Tenkan-sen crosses the Kijun-sen, especially if price is above the Kumo for bullish trades or below for bearish trades. Example: When the Tenkan-sen crosses above the Kijun-sen on the 15-minute chart, switch to the 5-minute chart and wait for a pullback to the Tenkan-sen. Enter a long position if the price bounces off the Tenkan-sen, with a target of 20 pips and a stop loss just below the Kijun-sen.

- Support/Resistance Bounce: Look for price reactions at key Ichimoku levels (e.g., Tenkan-sen, Kijun-sen, or Kumo edges) for potential scalping entries. Example: If the price is in an uptrend and pulls back to the Kijun-sen on the 5-minute chart, enter a long position if a bullish candlestick pattern forms at this level. Set a target of 12-15 pips and a stop loss 5 pips below the Kijun-sen.

Exit Strategies

- Fixed Pip Target: Set a predetermined profit target (e.g., 10-20 pips) for each scalping trade. Example: For a EUR/USD scalp trade, you might set a fixed target of 15 pips. If your entry is at 1.1000, your take-profit order would be at 1.1015.

- Ichimoku Level Exit: Close the trade when price reaches a key Ichimoku level in the opposite direction of your trade. Example: In a long trade, you might exit when the price touches the Tenkan-sen of the opposite color (bearish Tenkan-sen). This dynamic exit strategy adapts to changing market conditions.

- Trailing Stop: Use a trailing stop based on the Tenkan-sen or Kijun-sen to lock in profits as the trade moves in your favor. Example: In a long trade, move your stop loss to break-even once the price moves 10 pips in your favor. Then, trail your stop loss below each subsequent Tenkan-sen as the price advances.

Risk Management in Ichimoku Scalping

Setting Appropriate Stop Losses

When scalping with the Ichimoku strategy, it’s crucial to use tight stop losses to minimize potential losses. Consider placing stops:

- Just beyond the opposite side of the Kumo

- Below/above recent swing lows/highs

- Using a fixed pip value (e.g., 5-10 pips)

Example: If you enter a long trade based on a Kumo breakout, place your stop loss 2-3 pips below the bottom of the Kumo. This allows for some price fluctuation while still protecting your capital if the breakout fails.

Position Sizing and Risk-to-Reward Ratios

Proper position sizing is essential for long-term scalping success. Aim to risk no more than 1-2% of your trading account on any single scalping trade. Additionally, strive for a minimum risk-to-reward ratio of 1:1.5 or higher to ensure profitability over time.

Example calculation:

- Account size: $10,000

- Maximum risk per trade: 1% = $100

- Stop loss: 10 pips

- Trade size calculation: $100 / (10 pips * pip value)

If you’re trading EUR/USD with a pip value of $10 per standard lot, your position size would be 1 mini lot (0.1 standard lot).

Read More: adx scalping strategy

Advanced Ichimoku Scalping Techniques

Incorporating Additional Indicators

While the Ichimoku Kinko Hyo is a powerful standalone tool, combining it with other indicators can enhance your scalping strategy. Consider incorporating:

- Relative Strength Index (RSI): Use RSI to confirm overbought/oversold conditions and potential reversals. Example: Only take long scalping trades when the RSI is above 50 and rising, confirming the bullish momentum suggested by the Ichimoku components.

- Bollinger Bands: Combine Bollinger Bands with Ichimoku to identify potential breakout or mean reversion opportunities. Example: Look for situations where price breaks above both the Kumo and the upper Bollinger Band for strong bullish scalping opportunities.

- Volume Indicators: Use volume to confirm the strength of Ichimoku signals and potential trend reversals. Example: A Kumo breakout accompanied by higher-than-average volume provides a stronger confirmation for a scalping entry.

Trading Multiple Currency Pairs

Diversify your ichimoku scalping strategy by applying it to multiple currency pairs. Focus on pairs with tight spreads and high liquidity, such as EUR/USD, GBP/USD, and USD/JPY, to maximize your scalping potential.

Tips for multi-pair scalping:

- Monitor correlation between pairs to avoid overexposure to similar market movements

- Use a multi-chart layout to keep track of several pairs simultaneously

- Consider automation or algorithmic trading to manage multiple pairs effectively

Adapting to Market Conditions

Flexibility is key in successful ichimoku scalping. Be prepared to adjust your strategy based on prevailing market conditions:

- During trending markets, focus on Kumo breakouts and Tenkan-sen/Kijun-sen crosses

- In ranging markets, look for bounces off key Ichimoku levels and Kumo support/resistance

- During high volatility, consider widening your stop losses and taking profits more quickly

Example: In a strong trend, you might hold trades longer, using the Kijun-sen as a trailing stop instead of taking quick profits. Conversely, in choppy markets, you might reduce your position size and tighten your profit targets to adapt to the increased uncertainty.

Common Pitfalls and How to Avoid Them

- Overtrading: Resist the urge to take every potential setup. Focus on high-probability trades that meet all your criteria. Solution: Develop a clear checklist of conditions that must be met before entering a trade. Only take trades that satisfy all criteria.

- Ignoring the Bigger Picture: While scalping focuses on short-term movements, always be aware of larger trends and key support/resistance levels. Solution: Regularly zoom out to higher time frames (e.g., 1-hour or 4-hour charts) to understand the broader market context.

- Neglecting Risk Management: Stick to your predetermined risk parameters, even during winning streaks. Solution: Use a trading journal to track your adherence to risk management rules and hold yourself accountable.

- Emotional Trading: Maintain discipline and avoid revenge trading or overconfidence after a string of successful scalps. Solution: Implement a rule-based trading system and consider using automation to remove emotions from your trading decisions.

- Failing to Adapt: Regularly review and adjust your ichimoku scalping strategy to stay aligned with changing market conditions. Solution: Conduct weekly or monthly reviews of your trading performance and market analysis to identify necessary adjustments to your strategy.

OpoFinance Services: Your Trusted Partner in Forex Trading

When it comes to executing your ichimoku scalping strategy with precision and confidence, choosing the right forex broker is paramount. Look no further than OpoFinance, an ASIC-regulated broker that offers a comprehensive suite of trading tools and services tailored to meet the needs of both novice and experienced traders.

OpoFinance stands out from the crowd with its cutting-edge trading platform, competitive spreads, and lightning-fast execution speeds – all essential elements for successful scalping. Their commitment to regulatory compliance ensures that your funds are always secure, giving you peace of mind as you navigate the fast-paced world of forex scalping.

One of OpoFinance’s standout features is its innovative social trading service, which allows you to connect with and learn from seasoned traders. This unique offering can be particularly valuable for those looking to refine their ichimoku scalping techniques or gain insights into new trading strategies.

By choosing OpoFinance as your forex broker, you’re not just gaining access to the markets – you’re partnering with a trusted ally dedicated to helping you achieve your trading goals.

Conclusion

Mastering the ichimoku scalping strategy opens up a world of opportunities for forex traders seeking to capitalize on short-term price movements. By combining the powerful insights of the Ichimoku Kinko Hyo indicator with proven scalping techniques, you can potentially enhance your trading precision and boost your overall profitability.

Remember, success in ichimoku scalping requires dedication, practice, and continuous learning. Start by thoroughly understanding the Ichimoku components and their interactions. Then, gradually implement the strategies and techniques outlined in this guide, always prioritizing proper risk management and emotional discipline.

As you refine your ichimoku scalping skills, don’t hesitate to experiment with different time frames, currency pairs, and complementary indicators to find the approach that works best for your trading style. With persistence and the right tools at your disposal, you’ll be well on your way to becoming a proficient ichimoku scalper in the dynamic world of forex trading.

How does the ichimoku scalping strategy differ from traditional scalping methods?

The ichimoku scalping strategy combines the multi-dimensional insights of the Ichimoku Kinko Hyo indicator with conventional scalping techniques. Unlike traditional scalping methods that may rely solely on price action or simple moving averages, the ichimoku approach provides a more comprehensive view of market dynamics. It offers information on trend direction, momentum, and potential support/resistance levels all in one indicator, allowing for more informed and potentially higher-probability scalping decisions.

Can the ichimoku scalping strategy be applied to cryptocurrencies or other financial markets?

Yes, the ichimoku scalping strategy can be adapted for use in cryptocurrency markets and other financial instruments like stocks or commodities. However, it’s important to note that the effectiveness may vary depending on the specific characteristics of each market. Cryptocurrencies, for instance, often exhibit higher volatility and lower liquidity compared to forex, which may require adjustments to your scalping parameters and risk management approach. Always thoroughly backtest and practice the strategy in your chosen market before committing real capital.

How can I optimize my ichimoku scalping strategy for automation or algorithmic trading?

To optimize your ichimoku scalping strategy for automation or algorithmic trading, start by clearly defining your entry and exit rules based on specific Ichimoku component interactions. This might include quantifiable conditions like Kumo breakouts, Tenkan-sen/Kijun-sen crosses, or price action relative to the Cloud. Next, incorporate precise risk management parameters, such as fixed pip targets and stop-loss levels. Consider adding filters to avoid trading during major news events or low-liquidity periods. Finally, implement a robust backtesting framework to evaluate and refine your strategy across various market conditions before deploying it in a live trading environment.