Mastering ICT daily profiles is essential for consistent success in Forex trading. ICT daily profiles are meticulously crafted trading templates that outline specific market behaviors during particular trading sessions or under certain conditions. Developed by the Inner Circle Trader, these profiles serve as a blueprint for traders, enabling them to predict market trends, identify optimal entry and exit points, and avoid common trading pitfalls. These profiles, including the Classic Buy Day and London Swing to Z Day, offer traders precise strategies to anticipate market movements, make informed decisions, and effectively manage risks. In this comprehensive guide, we will explore these daily profiles in detail, providing actionable insights to help you navigate the complexities of the Forex market and achieve consistent trading success. Partnering with a trusted forex broker can further enhance your ability to implement these strategies effectively.

Understanding ICT Daily Profiles

What Are ICT Daily Profiles?

ICT daily profiles are meticulously crafted trading templates designed to outline and predict specific market behaviors during particular trading sessions or under certain market conditions. These profiles are the brainchild of the Inner Circle Trader (ICT), a well-respected figure in the trading community known for his deep insights into market mechanics and price action.

The primary purpose of ICT daily profiles is to provide traders with a structured approach to navigating the Forex market. Unlike generic trading strategies, these profiles are highly specific, focusing on the timing, price levels, and expected movements within a trading day. By understanding and applying these profiles, traders can anticipate market trends with greater accuracy, identify optimal entry and exit points, and avoid common pitfalls that often lead to losses.

Importance of ICT Daily Profiles in Forex Trading

- Precision Trading: ICT profiles offer traders a high level of precision by providing clear guidelines on when and how to enter and exit trades based on historical market patterns.

- Risk Management: By following these profiles, traders can better manage their exposure to risk, ensuring they protect their capital while maximizing their potential gains.

- Consistency: These profiles foster consistency in trading decisions, reducing emotional responses and promoting disciplined trading practices.

- Market Understanding: ICT profiles help traders gain a deeper understanding of market dynamics, allowing them to make informed decisions and stay ahead of the market trends.

The Essential ICT Daily Profiles

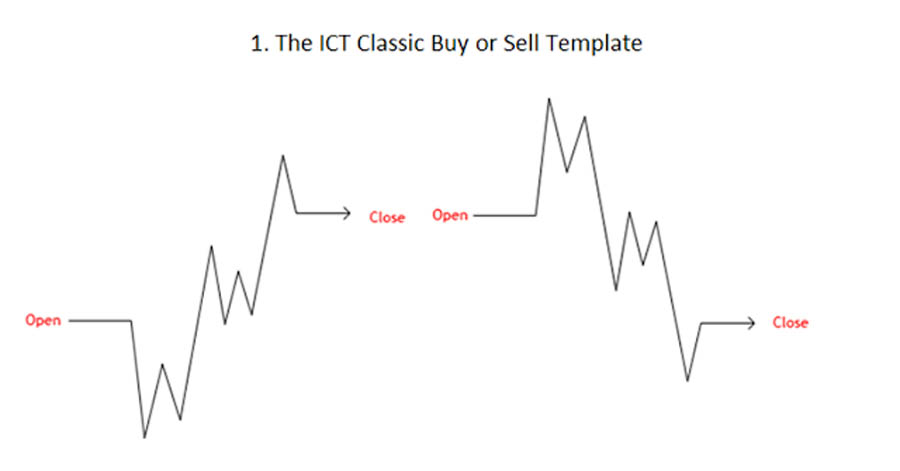

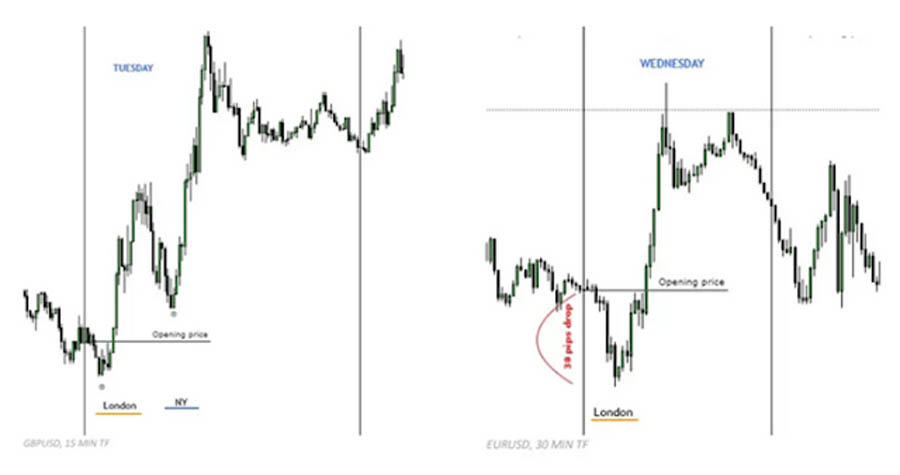

1. The Classic Buy Day or Sell Day Template

The Classic Buy Day or Sell Day Template is a powerful strategy for traders aiming to capture significant market movements, especially during the London session. This template is highly effective on Mondays, Tuesdays, and Wednesdays, when the market typically sets a definitive trend.

Key Strategies:

- Buying Strategy: Always buy when the market dips to a key support level below the opening price, particularly during the London session. If the price starts above the opening price, wait for it to trade below before entering a buy position.

- Selling Strategy: For a sell day, look for the price to trade above the opening price and then drop to a resistance level.

- Timing: The daily range usually lasts for 7 to 8 hours, with the most significant moves occurring within the first few hours of the London session.

- Profit Target: Aim to secure small, consistent profits of 20–30 pips around 12:00 EST.

This template is ideal for traders who can actively monitor the market during the London and New York sessions, where the template’s signals are most reliable.

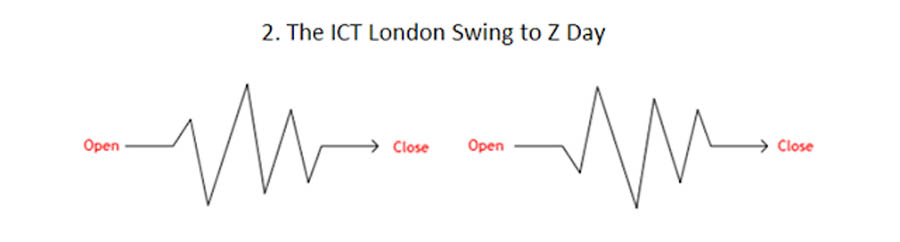

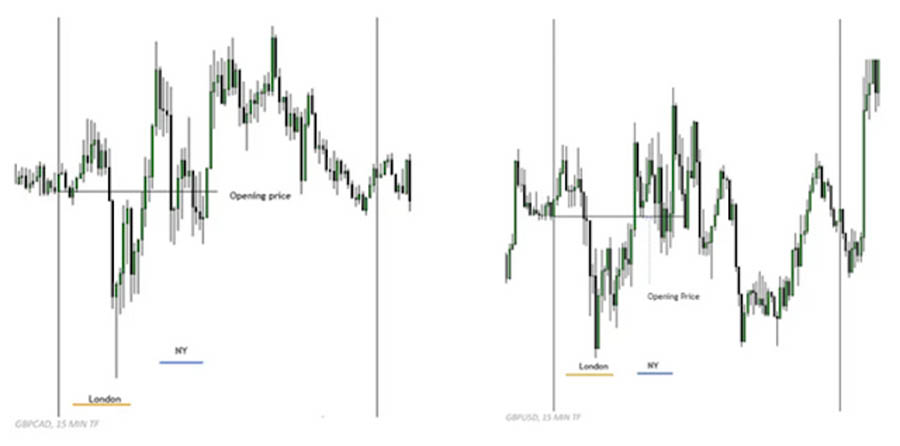

2. The London Swing to Z Day Template

The London Swing to Z Day Template typically appears on Thursdays and is most effective after a strong market move. This setup occurs when the market trend begins to lose momentum and enters a consolidation phase, often following two or three days of significant price action.

Key Strategies:

- Consolidation Phase: After several days of strong market movement, expect the market to pause and consolidate. This template unfolds when the market initially drops below the opening price, rallies above it, and then reverts to a consolidation range.

- Avoiding False Moves: Be cautious during this setup, as the market may initially appear to continue in the direction of the previous trend before settling into consolidation.

- Exit Strategy: Once consolidation is evident, take profits early and avoid looking for continuation trades into the New York session.

This template is perfect for traders who prefer to capitalize on short-term consolidation patterns following significant market movements.

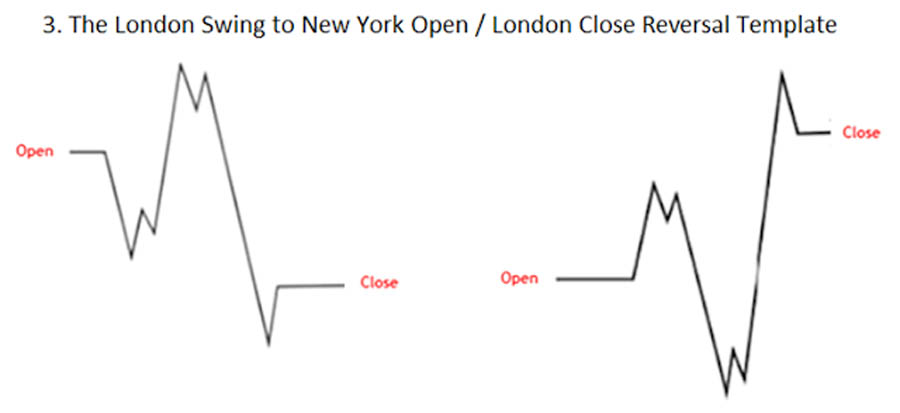

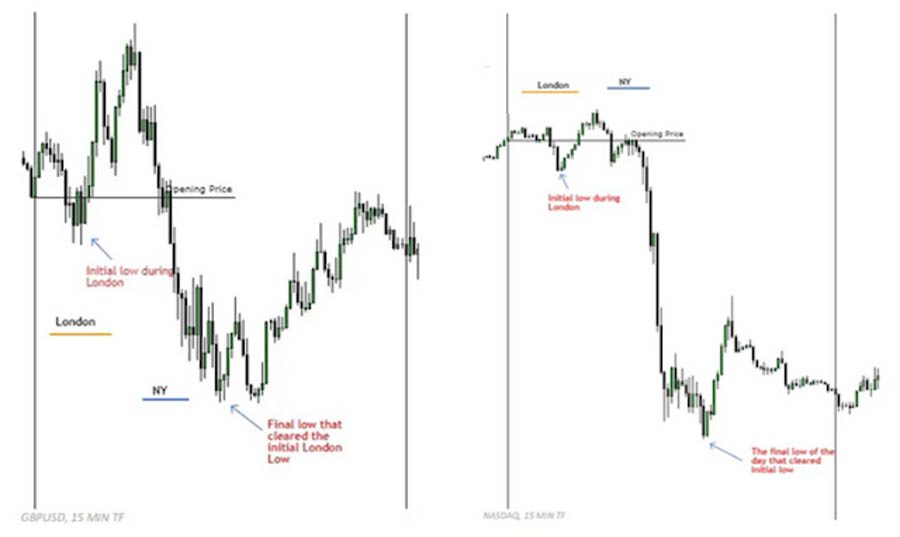

3. The London Swing to New York Open / London Close Reversal Template

The London Swing to New York Open / London Close Reversal Template is a potent setup that signals potential market reversals. This template often begins similarly to the Classic Buy or Sell Day Template but results in a significant reversal during the New York session.

Key Strategies:

- Bullish Reversal: Look for a decline below the opening price during the London session, followed by a rally to a higher time frame Point of Interest (POI) during the New York session.

- Bearish Reversal: For a bearish reversal, the market will initially rally above the opening price before reversing to lower levels during the New York session.

- Visual Patterns: This template often aligns with classic chart patterns, such as an inverted head and shoulders on a higher time frame.

- Timing: Reversals typically consolidate into the next trading day, especially around 18:00 GMT.

This template is particularly effective for identifying key reversal days, allowing traders to position themselves advantageously ahead of significant market movements.

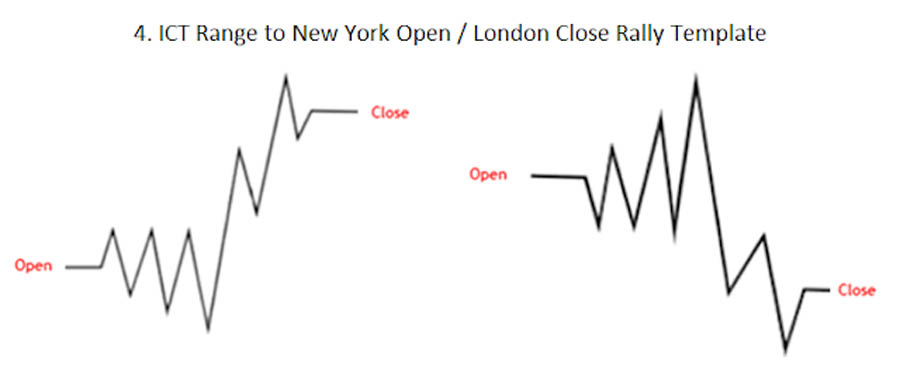

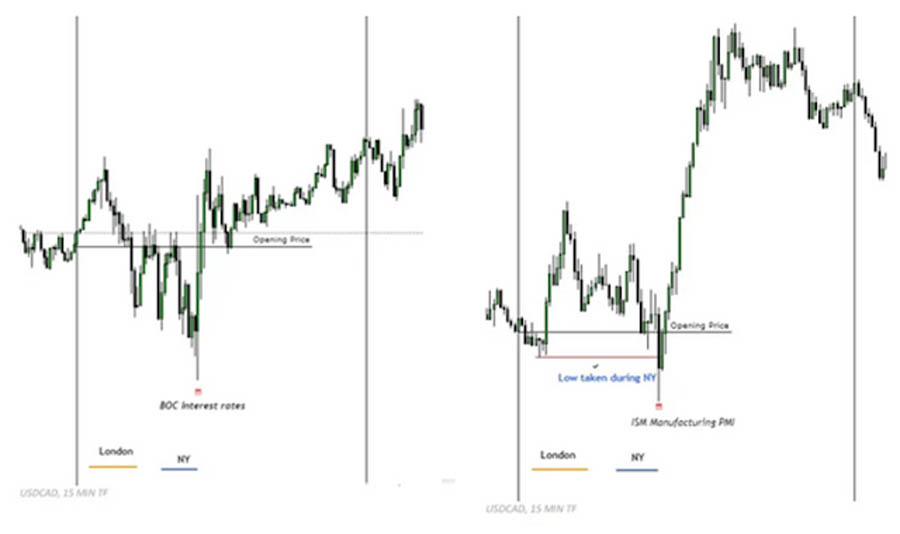

4. The Range to New York Open / London Close Rally Template

The Range to New York Open / London Close Rally Template typically unfolds on days with high-impact news events, such as interest rate announcements or Non-Farm Payroll (NFP) releases. This setup is characterized by price consolidation during the Asian and London sessions, followed by a directional move after the news event.

Key Strategies:

- Pre-News Consolidation: Expect the market to consolidate and clear lows during the London session, setting up for a rally after the news release.

- Cross-Pair Analysis: Monitor cross pairs of the major currency pair you’re trading. For example, if the Dollar is dropping and EUR/USD is consolidating, watch EUR/JPY for buying opportunities.

- Post-News Rally: After the news, expect a strong directional move. Enter trades aligned with the cross pairs’ direction after they hit key support or resistance levels.

This template is valuable for traders who thrive on trading news events, offering clear guidelines for capturing post-news volatility.

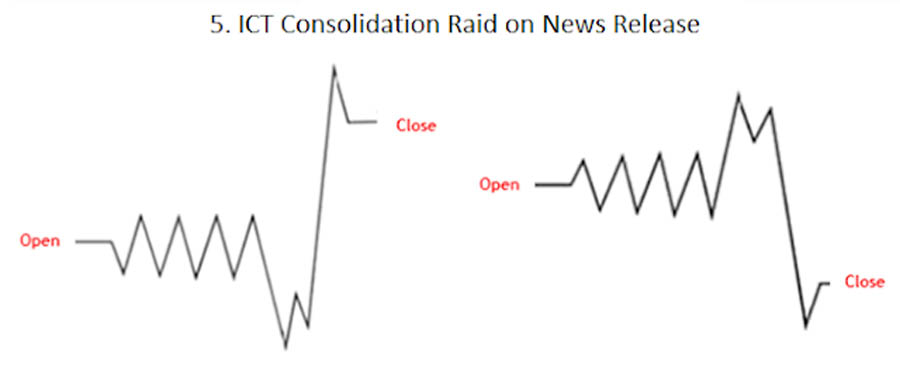

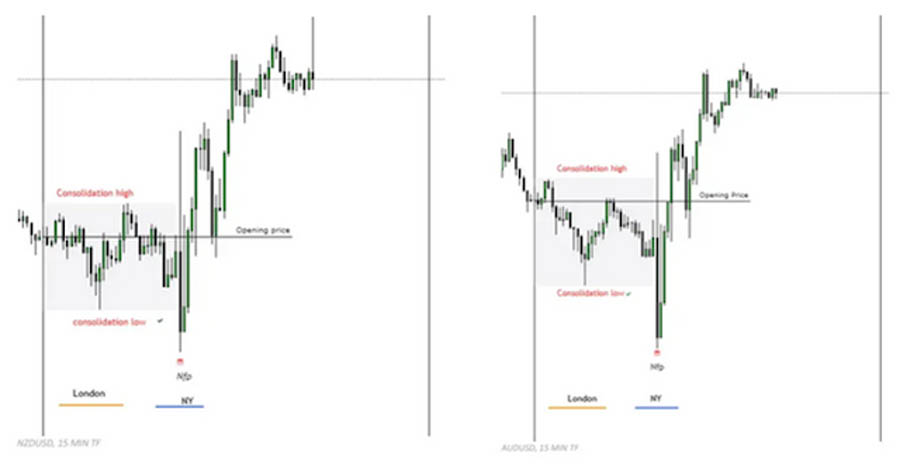

5. The Consolidation Raid on News Release Template

The Consolidation Raid on News Release Template is another strategy for high-impact news days, particularly during the New York session. This template involves the market taking out old highs and lows of prior consolidation levels during or shortly after the news event.

Key Strategies:

- Pre-News Setup: Before the news release, the market will often consolidate, setting up for a raid on stops during the news.

- Post-Raid Reaction: After inducing traders by breaching prior highs or lows, the market will typically move in the true direction of the trend.

- Entry Points: Buy when a low is taken out during consolidation, and sell when a high is breached.

This template is essential for traders looking to exploit market manipulations during high-volatility news events.

Read more: EMA Crossover Magic

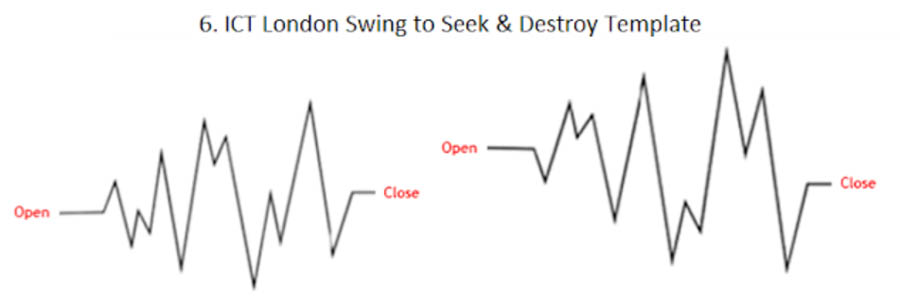

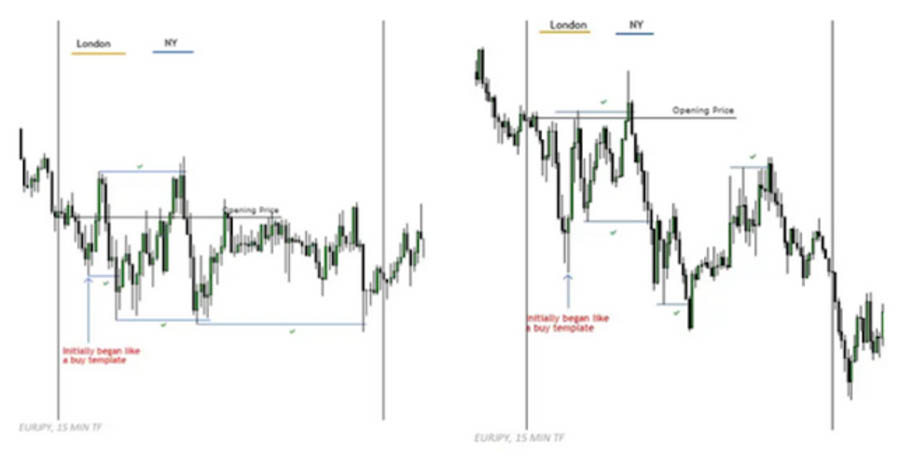

6. The London Swing to Seek & Destroy Template

The London Swing to Seek & Destroy Template is one of the most challenging setups to navigate and often leads to losses if not approached cautiously. This template typically unfolds after a significant price swing, where the market aims to take out both buyers and sellers in a narrow range.

Key Strategies:

- Market Caution: This setup is best avoided if you’re unsure of the market’s direction. It often results in an inside day with minimal profit potential.

- Avoid Support/Resistance Traps: Avoid trading pairs already near key support or resistance levels, as the market may either break through or fail to hold these levels.

This template serves as a warning for traders to stay on the sidelines during uncertain market conditions, preserving capital for more favorable setups.

Read more: Mastering ICT Monthly Profiles

Maximizing the Benefits of ICT Daily Profiles

Customizing Your Approach

To maximize the benefits of ICT daily profiles, it’s crucial to tailor your trading strategy to your unique needs. Consider your risk tolerance, trading schedule, and market preferences when choosing which profiles to focus on. By customizing your approach, you can optimize your trading outcomes and build a strategy that aligns with your goals.

Leveraging Technology and Tools

Utilize trading platforms and tools that support ICT principles, such as TradingView for charting and analysis or MetaTrader for executing trades. These tools can help automate certain aspects of your trading, such as setting alerts for key levels and managing risk, ensuring you stay on top of market movements.

Continuous Learning and Adaptation

The Forex market is ever-changing, and so should your approach to trading. Continuously study and adapt your strategies based on new insights, market conditions, and the evolution of ICT methodologies. Engage with the trading community to share ideas and refine your approach, ensuring you stay ahead of the curve.

Read more: Mastering ICT Weekly Profiles

Opofinance Services: Unlock Premium Trading with ASIC-Regulated Brokers

When it comes to Forex trading, the security and reliability of your broker are paramount. Opofinance offers access to ASIC-regulated brokers, ensuring that your trades are executed with the highest level of integrity and compliance. ASIC (Australian Securities and Investments Commission) is renowned for its stringent regulatory standards, providing traders with peace of mind and confidence in their trading activities. With Opofinance, you can explore a wide range of financial products and benefit from expert support, making it an ideal choice for both novice and experienced traders.

Conclusion

Mastering ICT daily profiles is a valuable skill that can significantly enhance your Forex trading success. These meticulously crafted templates provide traders with a clear and structured approach to navigating the complexities of the market. By understanding and applying these profiles, such as the Classic Buy Day and London Swing to Z Day, you can make informed trading decisions, optimize your entry and exit points, and effectively manage risks. The insights and strategies offered by ICT daily profiles are not just tools but valuable assets that can lead to consistent and profitable trading outcomes. As you incorporate these profiles into your trading routine, you’ll find yourself better equipped to anticipate market movements, adapt to changing conditions, and achieve your trading goals with confidence.

How can I identify the best times to use ICT daily profiles?

Identifying the best times to use ICT daily profiles involves understanding the market sessions and the specific conditions each profile addresses. For instance, the Classic Buy or Sell Day Template is most effective during the London session, while the Range to New York Open / London Close Rally Template is ideal on days with significant news releases. By aligning your trading schedule with these templates, you can optimize your trading outcomes.

Can ICT daily profiles be integrated with other trading strategies?

Yes, ICT daily profiles can be integrated with other trading strategies such as swing trading, scalping, or trend following. The key is to use ICT profiles as a framework for understanding market conditions and then applying your preferred strategy within that context. For example, a swing trader might use the London Swing to Z Day Template to identify consolidation periods for entry or exit points.

What are the risks of relying solely on ICT daily profiles?

While ICT daily profiles are powerful tools, relying solely on them without considering other market factors can be risky. For example, unexpected news events or changes in market sentiment can invalidate a profile’s expected outcome. It’s essential to use these profiles in conjunction with thorough market analysis and risk management practices.

How does news impact the effectiveness of ICT daily profiles?

News events can significantly impact the effectiveness of ICT daily profiles, particularly those designed for high-impact news days, such as the Consolidation Raid on News Release Template. Understanding how news affects market volatility and price movements can help traders anticipate when to apply specific profiles and when to stay out of the market.

Where can I learn more about ICT daily profiles?

To deepen your understanding of ICT daily profiles, consider enrolling in courses or joining trading communities that focus on ICT methodologies. There are also numerous online resources, including videos, articles, and webinars, that provide comprehensive insights into these profiles.