In the ever-evolving world of financial markets, mastering ICT Liquidity Pool dynamics is crucial for any trader aiming to succeed. An ICT Liquidity Pool refers to specific areas on a price chart where liquidity—either buy-side or sell-side—is concentrated. These pools represent price levels where large institutional traders, often facilitated by a reliable forex broker, place their orders, making them key areas of interest for predicting market reversals and continuations. Understanding ICT Liquidity Pools allows traders to anticipate where the market is likely to move next, providing a strategic advantage in both bullish and bearish conditions.

ICT Liquidity Pool Trading involves identifying these liquidity-rich zones and using them to make informed trading decisions. By recognizing where liquidity accumulates, traders can enter and exit trades with greater precision, reducing risk and increasing the likelihood of profitable outcomes. This guide will delve into the intricacies of ICT Liquidity Pools, explore how they influence market movements, and provide actionable strategies for effectively trading within these pools.

By the end of this article, you’ll be well-equipped to identify ICT Liquidity Pools, understand their significance, and leverage them in your trading strategy to achieve consistent success in the financial markets.

What Are ICT Liquidity Pools?

Understanding the Basics of ICT Liquidity Pools

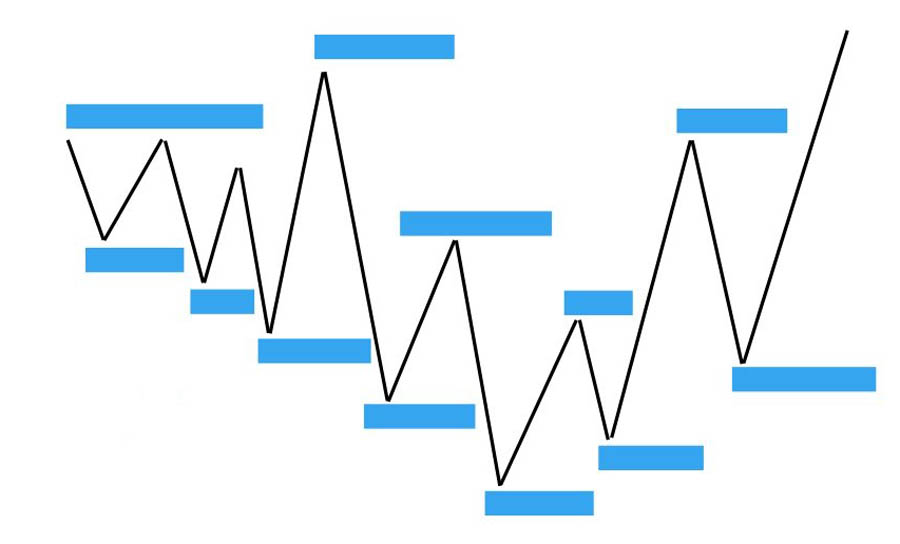

An ICT Liquidity Pool is a key concept in trading that refers to price levels where a large number of buy or sell orders are concentrated. These pools are formed at significant highs and lows on a chart, where institutional traders place their large orders, creating the necessary liquidity for substantial market movements. In essence, an ICT Liquidity Pool acts as a magnet, attracting price action to these levels and often leading to reversals or sharp price movements.

For traders, identifying these liquidity pools is essential. ICT Liquidity Pools serve as indicators of where the market is likely to reverse or continue its trend. For example, in a rising market, a liquidity pool might form above a previous high, where large sell orders are placed. When the price reaches this pool, it might reverse as these sell orders are executed, providing an opportunity for traders to enter short positions.

External vs. Internal Liquidity: A Deeper Dive

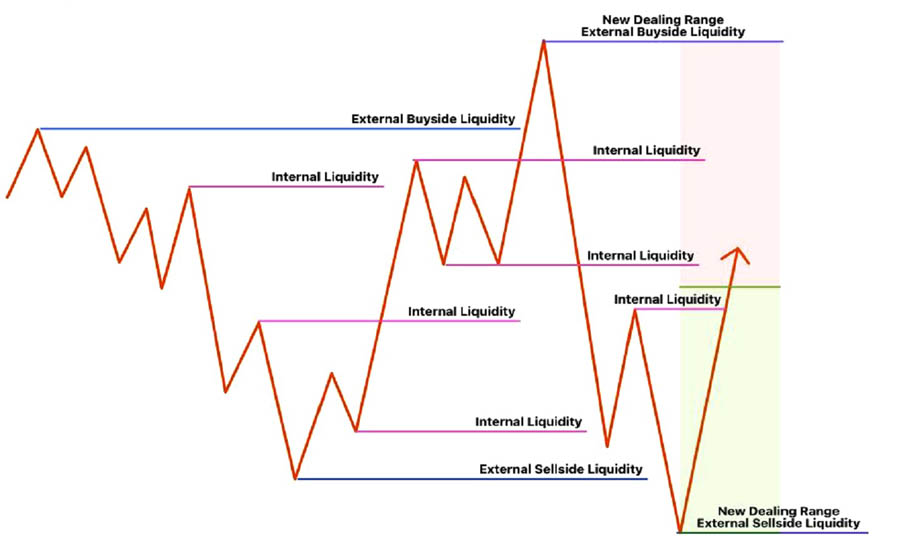

Liquidity within the market can be divided into External Liquidity and Internal Liquidity, both of which are crucial in understanding the overall market structure and dynamics.

- External Liquidity: Refers to liquidity outside the current trading range, such as buy-side liquidity above range highs and sell-side liquidity below range lows. These areas often attract significant market interest, leading to liquidity runs where the price seeks out these pools to execute large institutional orders. Understanding external liquidity helps traders anticipate potential price targets and market movements.

- Internal Liquidity: Refers to liquidity found within the current trading range, including institutional references like order blocks, fair value gaps, and volume imbalances. Internal liquidity is essential for understanding the market’s internal structure, providing traders with key levels for potential entry and exit points.

Buy-Side vs. Sell-Side Liquidity: Key Concepts

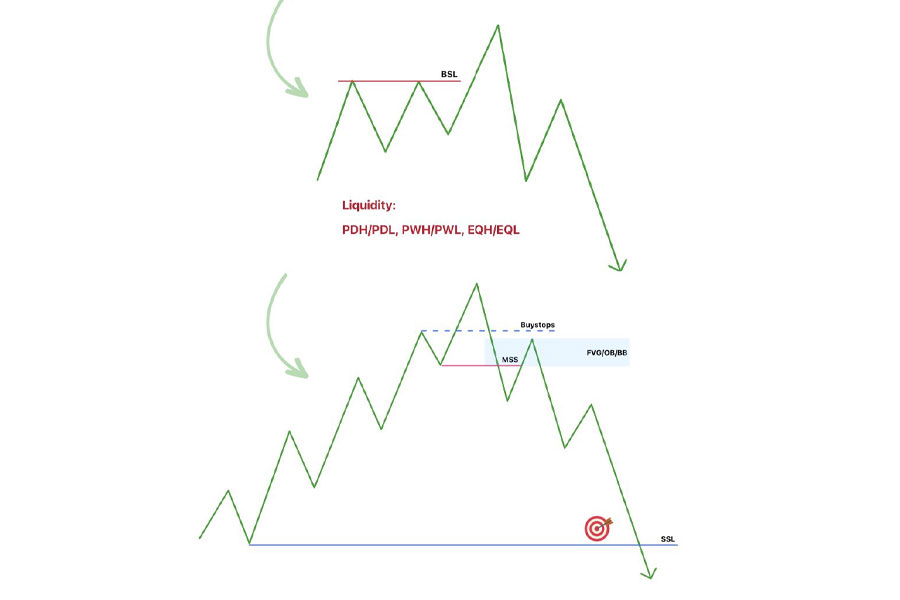

Buy-Side Liquidity (BSL)

Buy-Side Liquidity refers to the accumulation of buy orders above the current market price. These orders create liquidity pools that attract institutional sell orders, often leading to price reversals or retracements. In ICT Liquidity Pool trading, identifying buy-side liquidity helps traders anticipate where the market might face resistance and prepare for potential reversals.

Sell-Side Liquidity (SSL)

Sell-Side Liquidity refers to the accumulation of sell orders below the current market price. These orders create sell-side liquidity pools, where institutional buy orders may be executed, leading to potential price reversals upward. Recognizing sell-side liquidity is crucial for traders looking to enter long positions, as it indicates areas where the market might find support.

The Role of ICT Liquidity Pools in Market Movements

ICT Liquidity Pools and Market Reversals

ICT Liquidity Pools play a pivotal role in determining market reversals. Before any significant price movement, the market often sweeps through liquidity pools, gathering the necessary orders to fuel the next move. These liquidity sweeps are critical indicators of where the market is likely to go next, making them essential for traders to identify.

Understanding how ICT Liquidity Pools influence market behavior allows traders to anticipate potential reversals and position themselves accordingly. For example, if the market is in an uptrend and reaches a buy-side liquidity pool, a reversal might occur as institutional traders execute sell orders into this liquidity, leading to a downward price movement.

Draw on Liquidity (DOL): Identifying Key Opportunities

Identifying the Draw on Liquidity (DOL) is essential for effective ICT Liquidity Pool trading. The DOL can be identified by analyzing key levels such as Previous Week High/Low (PWH/PWL) or session highs and lows from major trading sessions. These levels often attract significant liquidity, providing clues about where the price is likely to move next.

By understanding the DOL, traders can better anticipate market movements and position themselves to take advantage of these opportunities. Following the DOL helps traders stay ahead of the market, increasing their chances of success.

Read more: Mastering ICT Liquidity Pool Trading

HRLR and LRLR: Understanding Resistance Levels

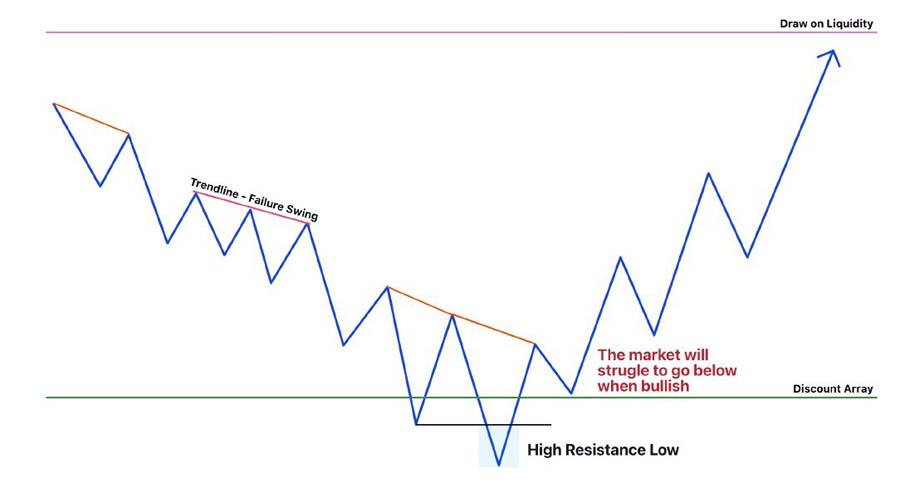

HRLR (High Resistance Liquidity Run) and LRLR (Low Resistance Liquidity Run) are critical concepts in ICT Liquidity Pool trading that help traders understand where the market might encounter resistance or face smooth movement.

- HRLR (High Resistance Liquidity Run): Refers to areas where the market encounters significant resistance. A low that runs a previous low and rejects is termed a High Resistance Low, while a high that runs a previous high and rejects is a High Resistance High. These areas often indicate potential reversals, where the market is likely to face resistance.

- LRLR (Low Resistance Liquidity Run): Refers to areas where the market is likely to move smoothly with little resistance. A bearish failure swing, where a high fails to take out the previous high, indicates low resistance on the bearish side, while a bullish failure swing, where a low fails to take out the previous low, indicates low resistance on the bullish side. Understanding these concepts helps traders position themselves more effectively in the market.

How to Trade ICT Liquidity Pools: A Step-by-Step Guide

Step 1: Identify the Market Structure

The first step in trading ICT Liquidity Pools is identifying the market structure. Determine whether the market is in an uptrend or downtrend, as this will guide your trading strategy. In an uptrend, the market is more likely to target buy-side liquidity, while in a downtrend, it’s more likely to target sell-side liquidity.

Step 2: Recognize Key Liquidity Pools

Once the market structure is identified, the next step is recognizing the key ICT Liquidity Pools. These pools are typically found at significant highs and lows on the chart, where large buy or sell orders are likely to accumulate. Higher time frame analysis can help identify these key liquidity zones.

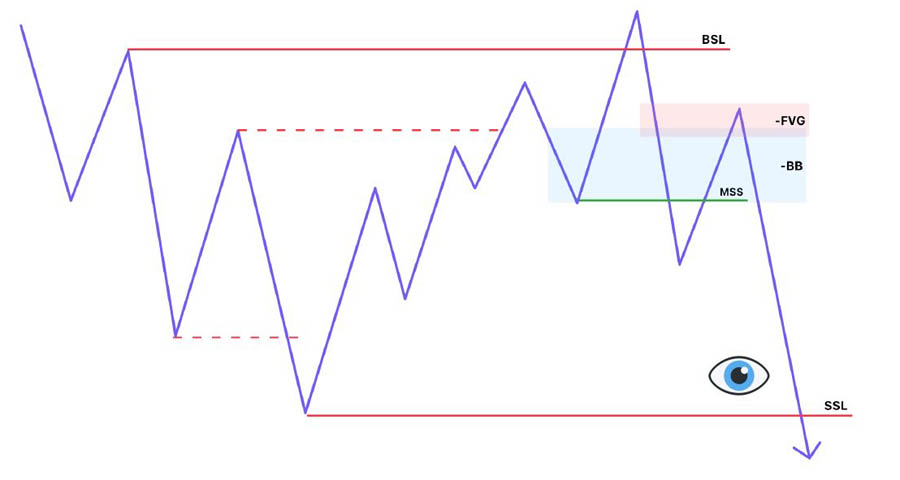

Step 3: Wait for Confirmation

After identifying key ICT Liquidity Pools, the next step is waiting for confirmation before entering a trade. Confirmation typically comes in the form of a Market Structure Shift (MSS) and Displacement on a lower time frame, signaling that the market is reacting to the liquidity pool as expected.

Step 4: Enter the Trade

Once confirmation is obtained, enter the trade at key points such as Order Blocks (OB), Fair Value Gaps (FVG), or Breakers (BB). These points provide high-probability setups, aligning your trades with institutional order flow.

Step 5: Manage Your Trade

Effective trade management is crucial to maximizing profits and minimizing risks. After entering the trade, monitor the market for any signs of reversal or significant resistance. Adjust your stop loss to protect profits as the trade moves in your favor, and be prepared to exit the trade if the market conditions change.

Read more: Mastering ICT Liquidity Pool Trading

Advanced Concepts in ICT Liquidity Pool Trading

External vs. Internal Range Liquidity: A Deeper Understanding

External range liquidity refers to the buy-side liquidity above the range high and sell-side liquidity below the range low in the current trading range. It is associated with liquidity runs that seek to pair orders with pending order liquidity, which is in the form of a liquidity pool. External range liquidity runs can be low resistance or high resistance in nature. As a trader, you want your trades to be in low resistance conditions, meaning you don’t want any resistance in your path of profitability.

On the other hand, Internal Range Liquidity is the liquidity inside the defined range (External Range Liquidity). This could be in the form of any institutional reference that we can use as an entry, such as order blocks, fair value gaps, volume imbalance, and more. Understanding these concepts helps traders to better navigate the complexities of the market and identify the best entry and exit points for their trades.

Market Structure Shift and Displacement: Key Indicators

Market Structure Shift (MSS) and Displacement are critical indicators in ICT Liquidity Pool trading that signal potential reversals and provide confirmation for trade entries. An MSS occurs when the market breaks a significant level of support or resistance, indicating a potential change in the market trend. Displacement refers to a strong price movement that follows an MSS, confirming the market’s new direction.

By waiting for an MSS and Displacement before entering a trade, traders can increase their chances of success and reduce the risk of false breakouts. These indicators are particularly useful in volatile markets, where sudden price movements can lead to significant opportunities.

Read more: Mastering ICT Liquidity Pool Trading

Order Blocks and Fair Value Gaps: Essential Tools for Traders

Order Blocks (OB) and Fair Value Gaps (FVG) are essential tools in ICT Liquidity Pool trading that provide high-probability setups for trade entries. An Order Block is a consolidation area on the chart where large institutional orders have been placed, creating a zone of support or resistance. Fair Value Gaps, on the other hand, refer to price gaps on the chart that indicate an imbalance in supply and demand.

Traders can use Order Blocks and Fair Value Gaps to identify key entry points, aligning their trades with institutional order flow. By entering trades at these points, traders can increase their chances of success and capture significant price movements.

Unlock Your Trading Potential with OpoFinance

Are you ready to take your trading skills to the next level? At OpoFinance, we provide you with the tools, insights, and support you need to master the complexities of ICT Liquidity Pool trading. Whether you’re a seasoned trader or just starting out, our platform is designed to help you navigate the markets with confidence and precision.

Why Choose OpoFinance?

- Advanced Trading Tools: Gain access to cutting-edge trading platforms that allow you to identify and capitalize on ICT Liquidity Pools with ease.

- Expert Guidance: Benefit from the insights of experienced traders and analysts who are committed to helping you succeed.

- Education and Resources: Our comprehensive educational materials cover everything from basic concepts to advanced trading strategies, ensuring you’re always one step ahead.

- Seamless Execution: Enjoy fast and reliable trade execution, giving you the edge you need in today’s fast-paced markets.

- Regulatory Security: Trade with confidence knowing that OpoFinance is ASIC-regulated, ensuring a secure and transparent trading environment.

Read more: Mastering the IPDA Trading Strategy

Start Trading with OpoFinance Today!

Join the community of successful traders who trust OpoFinance to help them achieve their financial goals. Sign up today and discover the difference that expert tools and support can make in your trading journey.

Conclusion: Mastering ICT Liquidity Pool Trading for Consistent Success

In the dynamic world of financial markets, understanding and effectively utilizing ICT Liquidity Pools can significantly enhance your trading strategy. By identifying where liquidity is concentrated—whether on the buy-side or sell-side—you can anticipate market movements, enter and exit trades with precision, and ultimately increase your chances of success.

Throughout this guide, we’ve explored the key concepts behind ICT Liquidity Pools, including the differences between external and internal liquidity, as well as buy-side and sell-side dynamics. We’ve also provided actionable steps to help you navigate these liquidity-rich zones, along with advanced strategies to refine your approach.

As you continue to refine your trading skills, remember that mastering ICT Liquidity Pool trading is not just about understanding the theory but also about applying these concepts in real market conditions. With the right knowledge, tools, and mindset, you can leverage ICT Liquidity Pools to achieve consistent and profitable trading outcomes.

Now, it’s time to put these strategies into practice and start making informed trading decisions that lead to lasting success.

How do ICT Liquidity Pools influence market movements?

ICT Liquidity Pools influence market movements by acting as magnets for price action. These pools are areas where large buy or sell orders are concentrated, attracting price movements as institutional traders execute their orders. By understanding where these liquidity pools are located, traders can anticipate potential reversals and position themselves accordingly.

What is the difference between buy-side and sell-side liquidity?

Buy-side liquidity refers to the accumulation of buy orders above the current market price, while sell-side liquidity refers to the accumulation of sell orders below the current market price. These liquidity pools create areas of interest for institutional traders, often leading to reversals or significant price movements when the market reaches these levels.

How can traders effectively manage their trades in ICT Liquidity Pool trading?

Effective trade management in ICT Liquidity Pool trading involves monitoring the market for signs of reversal or significant resistance after entering a trade. Traders should adjust their stop loss to protect profits as the trade moves in their favor and be prepared to exit the trade if market conditions change. Additionally, traders should use tools like Order Blocks and Fair Value Gaps to identify key entry and exit points.