Are you struggling to consistently profit in the forex market? The ICT Market Structure Break (MSB) strategy is the answer you’ve been searching for. This powerful approach, developed by the Inner Circle Trader (ICT), is a game-changing method for identifying trend reversals and capitalizing on high-probability trade setups in the forex market. By mastering the ICT MSB, you can significantly improve your trading accuracy and potentially boost your profits.

The ICT Market Structure Break (MSB) is not just another indicator or fleeting trading fad. It’s a comprehensive framework for understanding price action and market dynamics at a deeper level. This strategy allows traders to:

- Identify potential trend reversals before they occur

- Enter trades at optimal price levels

- Manage risk more effectively

- Capitalize on institutional order flow

As you embark on this journey to trading mastery, partnering with a reputable online forex broker is crucial for implementing these advanced techniques effectively. The right broker will provide you with the necessary tools, resources, and market access to fully leverage the power of the ICT MSB strategy.

In this comprehensive guide, we’ll break down the ICT Market Structure Break (MSB) into easy-to-understand components. You’ll learn how to identify key market structures, recognize potential reversal points, and execute trades with confidence. Whether you’re a novice trader looking to establish a solid foundation or an experienced professional seeking to refine your skills, this guide will equip you with the knowledge to transform your trading performance using the ICT MSB strategy.

Let’s dive in and unlock the secrets of successful forex trading with the ICT Market Structure Break (MSB).

Understanding Market Structure

Before we dive into the specifics of the market structure break, it’s crucial to grasp the fundamental concept of market structure in forex trading.

What is Market Structure?

Market structure refers to the simple price action patterns or movements of price in the market in specific patterns. Price consistently moves in particular patterns by creating support and resistance points and forming swing highs and swing lows. It’s essential to understand that the market moves in three primary ways: uptrend, downtrend, and sideways.

Market Structure in an Uptrend

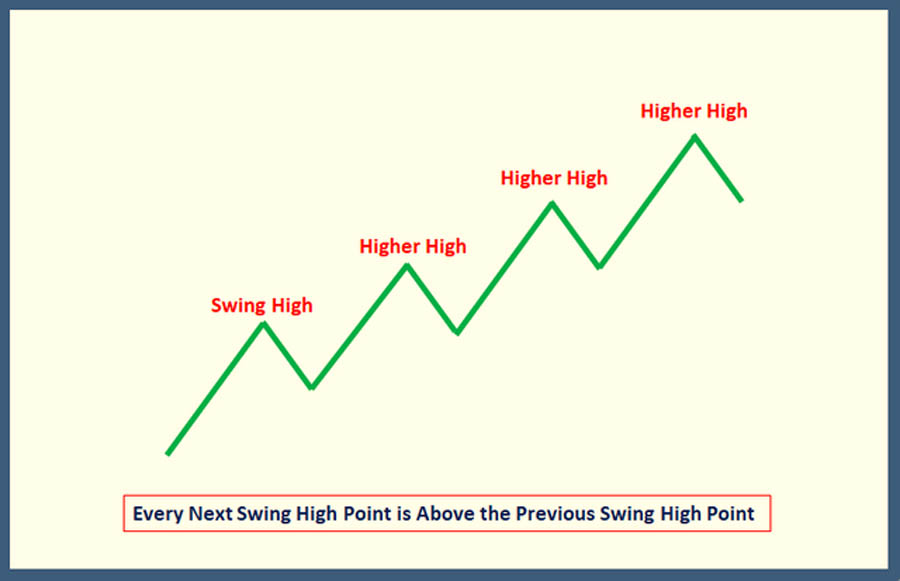

In an uptrend market structure, you’ll observe a series of swing highs and lows where each subsequent swing high and low is higher than the previous ones. Essentially, you’ll see price moving in an upward zig-zag pattern. This creates a staircase-like structure as the market climbs higher.

Key characteristics of an uptrend market structure:

- Higher highs

- Higher lows

- Overall price direction moving upwards

Market Structure in a Downtrend

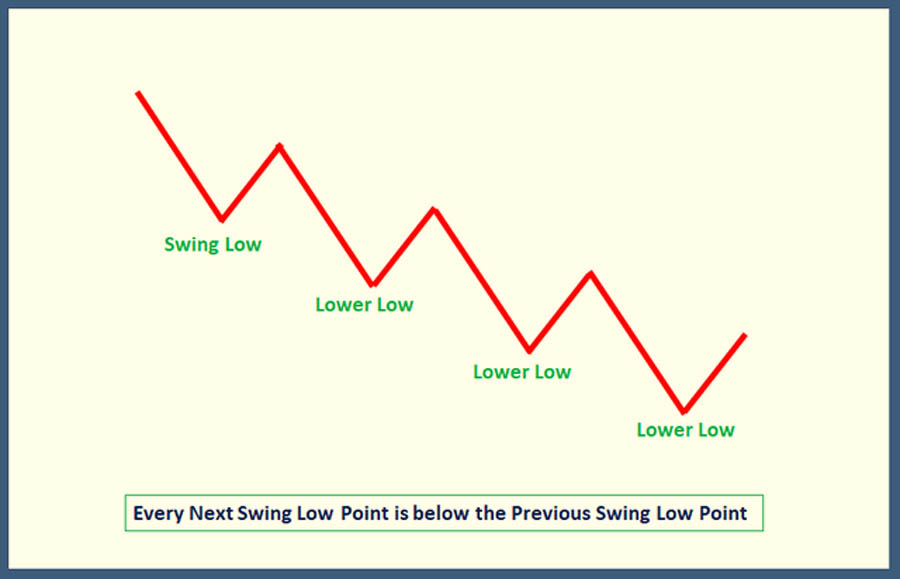

Conversely, in a downtrend market structure, you’ll notice a series of swing lows and highs where each subsequent swing low and high is lower than the previous ones. The price moves in a downward zig-zag pattern, creating a descending staircase-like structure.

Key characteristics of a downtrend market structure:

- Lower lows

- Lower highs

- Overall price direction moving downwards

Read More: Mastering ICT Market Structure

The Concept of Higher Highs, Lower Highs, Lower Lows, and Higher Lows

Understanding these key terms is crucial for mastering the ICT market structure break strategy. Let’s break them down:

Higher High

A higher high is a swing point in an uptrend that forms higher than the previous swing high. To confirm a new higher high, wait for at least 2-3 candles to close above the previous swing high point.

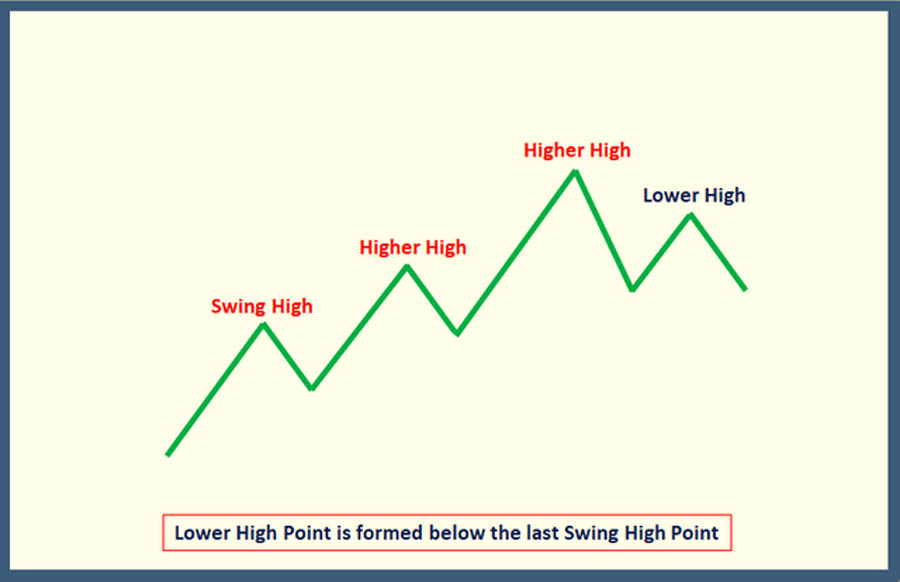

Lower High

A lower high signals a potential reversal in an uptrend. It’s a swing high point that forms at the top of an uptrend but fails to break the previous swing high, instead forming lower than the previous peak.

Lower Low

In a downtrend, a lower low is a swing point that forms lower than the previous swing low. Similar to higher highs, wait for 2-3 candles to close below the previous swing low to confirm a new lower low.

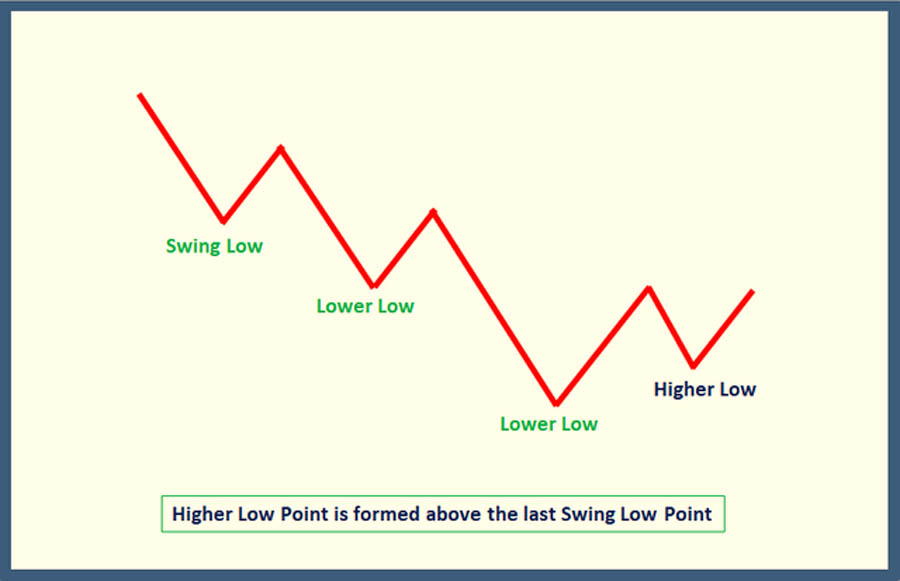

Higher Low

A higher low indicates a potential reversal in a downtrend. It’s a swing low point that forms at the bottom of a downtrend but fails to break the previous swing low, instead forming above it.

Identifying Trend Reversals with Market Structure Breaks

The ICT market structure break strategy allows traders to identify potential trend reversals early. Here’s how to spot these opportunities:

Identifying Uptrend Reversal

To identify an uptrend reversal, look for the following:

- Formation of a lower high at the top of an uptrend

- Mark the neckline of the market structure

- Wait for a clear break of the neckline

When these conditions are met, it’s a strong indication that the trend may reverse from that point.

Identifying Downtrend Reversal

For a downtrend reversal, look for:

- Formation of a higher low at the bottom of a downtrend

- Mark the neckline of the market structure

- Wait for a clear break of the neckline

When these conditions are fulfilled, it suggests a potential trend reversal to the upside.

Trade Entry Criteria for the ICT Market Structure Break Strategy

Establishing clear rules for trade entry is crucial for any successful trading strategy. Here are the entry criteria for both buy and sell positions using the ICT market structure break approach:

Buy Entry Criteria

- The market should be in a downtrend (can be short-term, depending on your chosen timeframe)

- Price should form a higher low after a series of lower lows

- Mark the neckline after the higher low is formed

- Wait for a clear bullish candle to break through and close above the neckline

- Enter the buy trade just above the market structure break

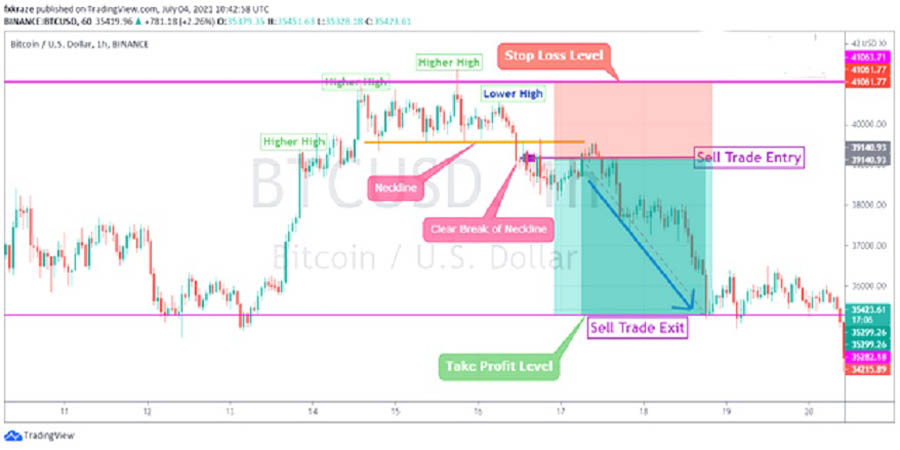

Sell Entry Criteria

- The market should be in an uptrend (can be short-term, depending on your chosen timeframe)

- Price should form a lower high after a series of higher highs

- Mark the neckline after the lower high is formed

- Wait for a clear bearish candle to break through and close below the neckline

- Enter the sell trade just below the market structure break

Trade Exit Criteria for the ICT Market Structure Break Strategy

Knowing when to exit a trade is just as important as knowing when to enter. Let’s explore the exit criteria for both losing and winning trades:

Trade Exit Criteria When in Loss

- Set a stop loss level in case the trade moves against you

- For sell trades, place the stop loss above the lower high point

- For buy trades, place the stop loss below the higher low point

- Exit the trade if price crosses the stop loss level, as this invalidates the setup

Trade Exit Criteria When in Profit

- Set a take profit level for when the trade moves in your favor

- Aim for at least a 1:1 risk-to-reward ratio (RR)

- Consider setting take profits at a 1:2 RR for more experienced traders

- Exit the trade when price hits your predetermined take profit level

Read More: The ICT Market Structure Shift Is Transforming Trading Strategies

Advanced Techniques for Trading ICT Market Structure Breaks

Once you’ve mastered the basics, you can employ more sophisticated techniques to enhance your trading strategy:

1. Combining Market Structure Breaks with Order Blocks

Order blocks often coincide with significant market structure levels. By identifying order blocks near structure breaks, you can:

- Increase the probability of successful trades

- Find high-risk/reward ratio setups

- Anticipate potential price reactions with greater accuracy

2. Utilizing Fair Value Gaps in Conjunction with Structure Breaks

Fair Value Gaps (FVGs) can provide additional confirmation for market structure breaks:

- Look for FVGs that align with the direction of the structure break

- Use FVGs as potential targets for price movement after a break

- Consider entering trades when price returns to fill an FVG near a broken structure level

3. Incorporating Multiple Timeframe Analysis

To gain a more comprehensive view of market structure:

- Analyze higher timeframes to identify major structure levels

- Use lower timeframes to fine-tune entries and exits

- Look for alignment of structure breaks across multiple timeframes for stronger signals

Common Pitfalls and How to Avoid Them

While the ICT market structure break strategy is powerful, it’s not without challenges. Here are some common mistakes traders make and how to avoid them:

- Jumping the gun: Avoid entering trades before the structure break is confirmed. Wait for a convincing close beyond the structure level.

- Ignoring the bigger picture: Always consider the overall market context and higher timeframe structure.

- Overtrading: Not every structure break is a valid trading opportunity. Be selective and patient.

- Neglecting risk management: Always use appropriate stop losses and position sizing, regardless of how confident you are in a setup.

- Failing to adapt: Market conditions change, and what works in one market environment may not work in another. Be prepared to adjust your approach as needed.

Incorporating ICT Market Structure Breaks into Your Trading Plan

To effectively use ICT market structure breaks in your trading:

- Develop a consistent analysis routine: Regularly review charts to identify potential structure breaks.

- Create a trading journal: Document your observations and trades to refine your approach over time.

- Practice patience: The best setups don’t come along every day. Wait for high-probability opportunities.

- Continuously educate yourself: Stay updated on ICT concepts and refine your understanding through study and practice.

- Backtest your strategy: Use historical data to validate and refine your ICT market structure break approach.

The Role of Technology in ICT Trading

Modern trading platforms and tools can significantly enhance your ability to identify and trade ICT market structure breaks:

- Advanced charting software: Look for platforms that offer multi-timeframe analysis and drawing tools for marking structure levels.

- Automated alerts: Set up notifications for potential structure breaks to stay on top of opportunities.

- Backtesting capabilities: Use historical data to test and refine your ICT trading strategies.

- Risk management tools: Utilize position sizing calculators and risk-reward ratio tools to optimize your trades.

OpoFinance Services: Empowering Your ICT Trading Journey

When it comes to implementing advanced trading strategies like the ICT market structure break, having a reliable and feature-rich trading platform is essential. OpoFinance, an ASIC-regulated forex broker, offers a comprehensive suite of services tailored to meet the needs of sophisticated traders.

Why Choose OpoFinance for Your ICT Trading?

- Advanced Trading Platforms: Access state-of-the-art charting tools and multi-timeframe analysis capabilities.

- Competitive Spreads: Maximize your profits with tight spreads on major currency pairs.

- Educational Resources: Benefit from extensive learning materials to enhance your ICT trading skills.

- Social Trading: Leverage the power of community with OpoFinance’s innovative social trading feature, allowing you to follow and learn from successful ICT traders.

- Regulatory Compliance: Trade with peace of mind knowing that OpoFinance is regulated by the Australian Securities and Investments Commission (ASIC).

By choosing OpoFinance as your forex trading partner, you’ll have access to the tools and support needed to effectively implement ICT market structure break strategies and take your trading to the next level.

Read More: Mastering ICT Trend Reversal

Conclusion

Mastering the ICT market structure break can be a game-changer for your forex trading career. By understanding the principles behind this powerful concept and implementing it effectively, you can gain a significant edge in the markets. Remember that success in trading requires continuous learning, practice, and discipline.

As you embark on your journey to master ICT market structure breaks, consider partnering with a reputable broker like OpoFinance to ensure you have the necessary tools and support. With dedication and the right resources, you’ll be well on your way to achieving forex trading dominance.

The ICT market structure break strategy offers a unique perspective on price action and market dynamics. By focusing on key structural elements and institutional order flow, traders can identify high-probability setups and potentially improve their trading performance.

How does the ICT Market Structure Break differ from traditional trend reversal strategies?

The ICT Market Structure Break strategy focuses on identifying specific price action patterns and market structure shifts, rather than relying solely on indicators or chart patterns. It emphasizes the importance of higher lows and lower highs in determining potential trend reversals, providing a more nuanced approach to market analysis. This strategy allows traders to anticipate reversals earlier, potentially leading to better entry points and higher profit potential.

Can the ICT Market Structure Break strategy be applied to all financial markets?

While the ICT Market Structure Break strategy is primarily used in forex trading, its principles can be applied to other financial markets such as stocks, commodities, and cryptocurrencies. However, it’s important to note that market dynamics may vary, and traders should adapt the strategy to suit the specific characteristics of each market. For instance, forex markets tend to trend more strongly than some other markets, which may affect the frequency and reliability of market structure breaks.

How long does it typically take to become proficient in using the ICT Market Structure Break strategy?

The time required to master the ICT Market Structure Break strategy varies depending on individual learning pace and dedication. Generally, traders should expect to spend several months practicing and refining their skills before consistently applying the strategy effectively. Continuous learning, backtesting, and demo trading are essential steps in the learning process. Many successful traders report that it takes 6-12 months of consistent practice to feel truly comfortable and proficient with the strategy.