Choosing between ICT Trading Breaker Blocks and Order Blocks can significantly influence your trading success, depending on your strategy and market conditions. ICT Trading Breaker Blocks are specifically designed to identify potential reversal points by analyzing significant price movements and structural shifts, making them highly effective for traders looking to capitalize on sharp price changes. On the other hand, Order Blocks focus on pinpointing key entry zones based on historical price action, which can help in identifying areas where price is likely to resume its trend.

When working with a regulated forex broker or any online forex broker, understanding these concepts becomes crucial. Breaker Blocks are particularly useful in volatile markets where quick and decisive movements are observed, while Order Blocks are more beneficial in trending markets where historical levels provide valuable insights for trade entries. This comprehensive guide will delve into the intricacies of both ICT Trading Breaker Blocks and Order Blocks, offering a detailed comparison to help you decide which method aligns best with your trading strategy. By the end of this article, you’ll be equipped with the knowledge to enhance your trading decisions and make the most of your trading opportunities.

What are ICT Trading Breaker Blocks and Order Blocks?

In trading, especially in Forex, traders often look for patterns or blocks that indicate potential price reversals or continuations. Two such concepts that have gained popularity are ICT Trading Breaker Blocks and Order Blocks.

Understanding Order Blocks

Order Blocks are zones on a chart where large financial institutions, such as banks, place their buy or sell orders. These blocks represent areas where significant trading activity has taken place, leading to the creation of strong support or resistance levels. Order Blocks are typically used by traders to identify potential entry and exit points. They are based on the idea that prices tend to return to these blocks, offering traders an opportunity to enter the market at favorable levels.

Order Blocks are essential for traders who want to align their strategies with the actions of institutional players, as they provide insight into where these big players are likely to buy or sell.

What is an ICT Trading Breaker Block?

ICT (Inner Circle Trader) Breaker Blocks are a more advanced concept used in trading. Unlike Order Blocks, which focus on where large orders have been placed, Breaker Blocks are concerned with the point at which a previous support level has been broken and turned into resistance, or vice versa. This concept is based on the idea that when a price level fails to hold, it becomes a key area of interest, often leading to significant price movements.

ICT Trading Breaker Blocks are used by traders who are looking to capitalize on market reversals and want to enter trades at points where the market structure has shifted.

Understanding Bullish and Bearish Breaker Blocks

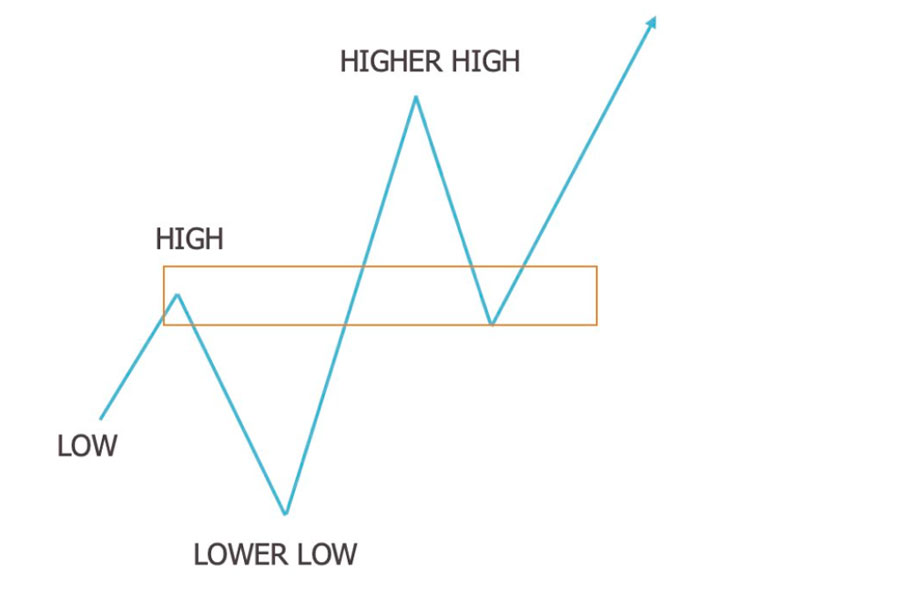

Bullish Breaker Block

A Bullish Breaker Block is identified within a bullish range or an up-close candle at the most recent swing high before an old low is violated. It becomes valid when stops are taken below a previous low, and the price breaks above the swing high that contains the breaker candle.

Key Elements of a Bullish Breaker Block:

- Low – High – Lower Low – Higher High: These elements are crucial in identifying a Bullish Breaker Block.

- The Higher High: This is the most critical element, as the closure above indicates that the price wants to continue higher.

- The Lower Low: This is equally important as it represents a stop run, which suggests that the price will move higher.

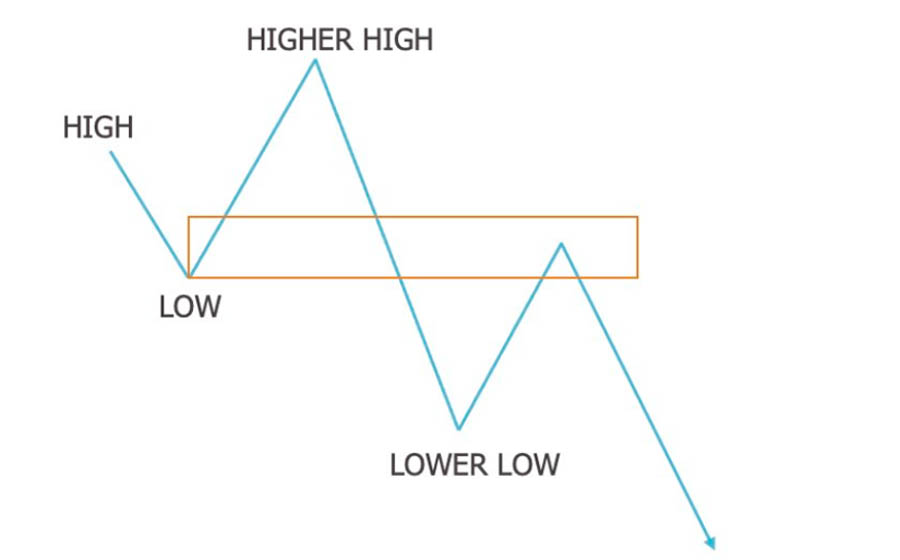

Bearish Breaker Block

On the other hand, a Bearish Breaker Block occurs in a bearish range or down-close candle at the most recent swing low before an old high is violated. It becomes valid when stops are taken above a previous high, and the price breaks below the swing low that contains the breaker candle.

Key Elements of a Bearish Breaker Block:

- High – Low – Higher High – Lower Low: These elements are essential in identifying a Bearish Breaker Block.

- The Higher High: This represents a stop run and suggests that the price will move lower.

- The Lower Low: The closure below this level indicates that the price wants to continue lower.

Understanding these key elements in Bullish and Bearish Breaker Blocks can help traders accurately identify potential reversal points and improve their trading decisions.

Key Differences Between ICT Trading Breaker Blocks and Order Blocks

The primary difference between these two concepts lies in their application. Order Blocks are used to identify zones where large market participants have placed their orders, while Breaker Blocks are used to identify areas where a price level has failed and reversed its role from support to resistance, or vice versa. Understanding these differences can help traders choose the right strategy based on their trading goals.

Read More: ICT Breaker Block Vs Mitigation Block

How to Use ICT Trading Breaker Blocks in Your Trading Strategy

ICT Trading Breaker Blocks can be a powerful tool when used correctly. Here’s a step-by-step guide on how to incorporate them into your trading strategy:

1. Identify a Breaker Block

The first step is to identify a Breaker Block on your chart. Look for a strong price movement that has broken through a previous support or resistance level. This area is now considered a Breaker Block, and it’s where you should focus your attention.

2. Confirm the Breaker Block

Once you’ve identified a potential Breaker Block, you need to confirm it. This can be done by observing the price action around this level. If the price retests this area and fails to break back through it, the Breaker Block is confirmed.

3. Enter the Trade

After confirming the Breaker Block, you can enter a trade in the direction of the breakout. For example, if the price breaks through a support level and then retests it as resistance, you would enter a short trade. Conversely, if a resistance level is broken and then retested as support, you would enter a long trade.

4. Set Your Stop Loss

Setting a stop loss is crucial when trading with Breaker Blocks. Place your stop loss just above or below the Breaker Block, depending on the direction of your trade. This will help protect your capital in case the trade doesn’t go as planned.

5. Take Profit

Finally, set your take profit level at a reasonable distance from the Breaker Block. This could be at the next major support or resistance level or based on your risk-reward ratio.

Using ICT Trading Breaker Blocks can provide traders with high-probability trade setups, especially in volatile markets where reversals are common.

The Advantages of Using Order Blocks

Order Blocks, while simpler than Breaker Blocks, offer several advantages:

1. Clear Entry and Exit Points

Order Blocks provide clear entry and exit points based on the actions of large market participants. This can help traders align their strategies with institutional players, increasing the likelihood of successful trades.

2. High Accuracy

Since Order Blocks are based on actual market orders, they tend to be highly accurate. Prices often return to these blocks, providing traders with multiple opportunities to enter or exit trades.

3. Suitable for All Market Conditions

Order Blocks can be used in any market condition, whether trending or ranging. This makes them a versatile tool for traders of all skill levels.

By focusing on Order Blocks, traders can develop a strategy that is both reliable and easy to implement, making it ideal for those who prefer a straightforward approach to trading.

ICT Trading Breaker Blocks vs. Order Blocks: Which One Should You Use?

Choosing between ICT Trading Breaker Blocks and Order Blocks depends on your trading style, market conditions, and risk tolerance. Both strategies have unique advantages and can be effective in different scenarios. Here’s a closer look at how to decide which one is best for you.

Read More: Unleash The Power Of Fair Value Gap And Order Block Strategy Confluence

1. Trading Style and Experience Level

- ICT Trading Breaker Blocks: Best for experienced traders who enjoy detailed chart analysis and advanced concepts. This strategy requires a deep understanding of market structure and price action, making it ideal for those who can quickly identify and act on key levels.

- Order Blocks: Suitable for traders of all experience levels, including beginners. Order Blocks focus on identifying areas where institutional players have placed significant orders, creating strong support or resistance zones. This strategy is straightforward and relies on visible patterns, making it easier to apply.

2. Market Conditions

- ICT Trading Breaker Blocks: Highly effective in volatile markets where sharp reversals and breakouts occur frequently. This strategy is great for identifying high-probability entry points during rapid market shifts.

- Order Blocks: Versatile and effective across various market conditions, particularly in trending markets. Order Blocks allow you to enter trades with broader market momentum, increasing the likelihood of success.

3. Risk Tolerance and Time Commitment

- ICT Trading Breaker Blocks: Requires active monitoring and quick decision-making, making it suitable for traders with higher risk tolerance and the ability to dedicate more time to market analysis.

- Order Blocks: Offers more predictability and can be used in a more relaxed trading approach. This strategy is ideal for those with lower risk tolerance or traders who prefer a hands-off approach.

4. Long-Term vs. Short-Term Trading Goals

- ICT Trading Breaker Blocks: Ideal for short-term trading goals, such as day trading or scalping. This strategy capitalizes on quick market reversals, making it suitable for traders seeking rapid gains.

- Order Blocks: Better suited for long-term trading strategies like swing or position trading. Order Blocks focus on key levels of institutional activity, providing reliable entry and exit points over longer timeframes.

5. Psychological Comfort

- ICT Trading Breaker Blocks: Appeals to traders comfortable with quick decision-making and higher risk, enjoying the dynamic nature of rapid market movements.

- Order Blocks: Provides a more measured and predictable approach, offering psychological comfort to traders who prefer steady and reliable strategies.

Ultimately, your choice between ICT Trading Breaker Blocks and Order Blocks should align with your trading goals, experience, and comfort level. Consider testing both strategies in a demo account to determine which suits you best.

Why Choose an ASIC-Regulated Broker for Your Trading?

When trading in the financial markets, it’s essential to choose a broker that is both reliable and regulated. Opofinance is an ASIC-regulated online forex broker that offers traders a secure and transparent trading environment. Here’s why Opofinance stands out:

1. Regulatory Compliance

Opofinance is regulated by ASIC (Australian Securities and Investments Commission), one of the most respected financial regulators in the world. This means that your funds are protected, and the broker operates with the highest standards of transparency and fairness.

2. Low Spreads and Fast Execution

As a leading broker for forex trading, Opofinance offers some of the lowest spreads in the industry, along with fast trade execution. This ensures that you can enter and exit trades at the best possible prices.

3. Social Trading

Opofinance offers a unique social trading platform that allows you to follow and copy the trades of successful traders. This is an excellent option for those who are new to trading or want to diversify their trading strategies.

4. Educational Resources

Opofinance provides a wealth of educational resources, including webinars, tutorials, and trading guides. These resources are designed to help traders of all levels improve their skills and become more successful in the markets.

Choosing an ASIC-regulated broker like Opofinance ensures that you are trading in a secure environment, with access to top-tier trading services and resources.

Read More: Understanding And Trading With ICT Breaker Blocks In Forex

Conclusion

Selecting the right trading strategy is crucial for achieving success in the markets, and both ICT Trading Breaker Blocks and Order Blocks offer distinct advantages based on different trading needs.

ICT Trading Breaker Blocks are ideal for identifying potential reversal points where previous support or resistance levels have failed and reversed. This strategy is especially useful in volatile markets where rapid price shifts occur. It requires a solid understanding of market structure and quick decision-making, making it best suited for experienced traders.

Order Blocks, on the other hand, help traders identify key zones where large institutional players have placed significant orders. These zones often act as strong support or resistance levels, offering clear entry and exit points. Order Blocks are versatile and can be applied in both trending and ranging markets, making them accessible for traders of all levels.

Choosing between these strategies depends on your trading style, experience, and the current market conditions. ICT Trading Breaker Blocks are beneficial for those looking to capitalize on sharp price reversals, while Order Blocks provide a more straightforward approach based on institutional activity.

Regardless of your choice, successful trading relies on disciplined application and effective risk management. Testing both strategies in a demo account can help you determine which aligns best with your goals. Additionally, partnering with a reliable, regulated broker like Opofinance can offer you a secure trading environment and valuable resources to support your trading journey.

In summary, by understanding the unique benefits of ICT Trading Breaker Blocks and Order Blocks, and aligning your strategy with market conditions and personal trading goals, you can enhance your trading effectiveness and work towards achieving consistent success.

What is the main risk when using ICT Trading Breaker Blocks?

The main risk when using ICT Trading Breaker Blocks is misidentifying a Breaker Block. If the price does not respect the Breaker Block and continues in the opposite direction, it can lead to losses. It’s essential to confirm the Breaker Block with strong price action before entering a trade.

Can Order Blocks be used in conjunction with other trading strategies?

Yes, Order Blocks can be combined with other trading strategies, such as trend following or price action trading. Using Order Blocks alongside other strategies can provide additional confirmation and improve the accuracy of your trades.

How can I improve my success rate when trading with Order Blocks?

To improve your success rate with Order Blocks, focus on identifying high-quality Order Blocks that coincide with significant support or resistance levels. Additionally, using multi-timeframe analysis can help you confirm the strength of an Order Block before entering a trade.