In the dynamic world of forex trading, understanding and capitalizing on trend reversals is crucial for success. One powerful technique that has gained significant traction among traders is the ICT (Inner Circle Trader) trend reversal strategy. This comprehensive guide will delve deep into the intricacies of ICT trend reversal, providing you with the knowledge and tools to enhance your forex trading skills. By mastering ICT trend reversal techniques, you can potentially improve your trading accuracy and profitability in the forex market. Whether you’re a novice trader or an experienced professional seeking to refine your skills, this article will equip you with valuable insights to navigate the complexities of trend reversals. As you explore these strategies, consider partnering with a reputable online forex broker to execute your trades effectively.

What is ICT Trend Reversal?

ICT trend reversal is a sophisticated trading approach developed by the Inner Circle Trader. This method focuses on identifying potential trend reversals in the forex market by analyzing price action, market structure, and institutional order flow. The core principle of ICT trend reversal is to anticipate and capitalize on significant shifts in market direction before they become apparent to the majority of traders.

Key Components of ICT Trend Reversal

- Market Structure Analysis: Understanding the current market structure is fundamental to ICT trend reversal. This involves identifying higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend.

- Order Flow: ICT trend reversal places significant emphasis on institutional order flow. By analyzing large-scale buying or selling pressure, traders can gauge potential trend changes.

- Price Action: Observing candlestick patterns and price behaviors at key levels helps traders identify potential reversal points.

- Supply and Demand Zones: Recognizing areas of significant supply and demand is crucial for anticipating trend reversals.

- Liquidity Pools: ICT trend reversal focuses on identifying areas where large amounts of liquidity reside, as these are often targets for institutional traders.

Read More: Master The ICT Market Structure Break (MSB)

The Importance of ICT Trend Reversal in Forex Trading

Mastering ICT trend reversal can provide several advantages to forex traders:

- Early Entry Opportunities: By identifying potential reversals before they fully materialize, traders can enter positions at favorable prices.

- Risk Management: Understanding trend reversals allows for better stop-loss placement and risk management.

- Improved Trade Selection: ICT trend reversal techniques help traders filter out low-probability setups and focus on high-quality trade opportunities.

- Market Context: This approach provides a deeper understanding of market dynamics and institutional behavior.

- Versatility: ICT trend reversal principles can be applied across various timeframes and currency pairs.

Eight Key ICT Trend Reversal Scenarios

Based on the ICT methodology, there are eight specific scenarios that can be effectively traded with consistency:

1. Trading Previous Day’s Highs

This scenario involves looking for opportunities where the market blows out the previous day’s high, raids the buy stops, and then reverses to trade lower. Traders should pay attention to specific criteria that increase the likelihood of a successful reversal:

- Look for instances where the market approaches the previous day’s high with momentum.

- Observe the price action as it breaches the high – a quick spike followed by immediate rejection can be a strong reversal signal.

- Consider the overall market context and any higher timeframe levels that may influence the reversal.

2. Trading Previous Day’s Lows

Similar to the previous scenario, this involves seeking opportunities where the market trades below the previous day’s low, raids the sell stops, and then reverses to move higher. Key points to consider:

- Watch for a strong push below the previous day’s low, especially if it occurs with high volume.

- Look for signs of buying pressure emerging as soon as the low is breached.

- Consider any support levels or demand zones that may coincide with the previous day’s low.

3. Intra-Week Highs

This scenario focuses on trading reversals when the market moves above the highest high made so far in the week, raids buy stops, and then reverses. Traders should:

- Pay attention to the timing of the move – intra-week highs breached later in the week may have a higher probability of reversal.

- Look for overextended moves that may be ripe for a pullback.

- Consider the weekly market structure and any significant levels on higher timeframes.

4. Intra-Week Lows

This involves looking for opportunities when the market trades below the lowest low of the week, raids sell stops, and then reverses. Key considerations include:

- Assess the strength of the downward move leading to the new low.

- Look for signs of buying interest emerging as the new low is made.

- Consider the overall weekly trend and any potential support levels nearby.

5. Intermediate-Term Highs

Trading reversals when the market moves above a high from a previous week or earlier, raids buy stops, and then reverses. This scenario requires:

- A thorough analysis of the higher timeframe market structure.

- Consideration of any significant resistance levels or supply zones near the intermediate-term high.

- Patience, as these setups may take longer to develop but can offer larger moves.

6. Intermediate-Term Lows

Seeking opportunities when the market trades below a low from a previous week or earlier, raids sell stops, and then reverses. Traders should:

- Analyze the broader market context on higher timeframes.

- Look for signs of accumulation or buying pressure as the intermediate-term low is approached.

- Consider any long-term support levels or demand zones that may influence the reversal.

7. New York Session Reversals

Identifying potential reversals during the New York trading session, often in conjunction with higher timeframe premium or discount arrays. Key points:

- Understand that New York session is typically a continuation of the London session unless specific conditions are met.

- Look for price to trade into higher timeframe discount or premium arrays at the New York open.

- Consider the impact of economic news releases during the New York session.

8. London Close Reversals

Trading potential reversals around the London market close, particularly on large range days or when price reaches significant levels. Traders should:

- Pay attention to days where the average daily range has been exceeded.

- Look for potential retracements of 20-30% of the daily range during London close.

- Consider the interaction between London close and New York afternoon trading.

Read More: ICT Internal And External Range Liquidity

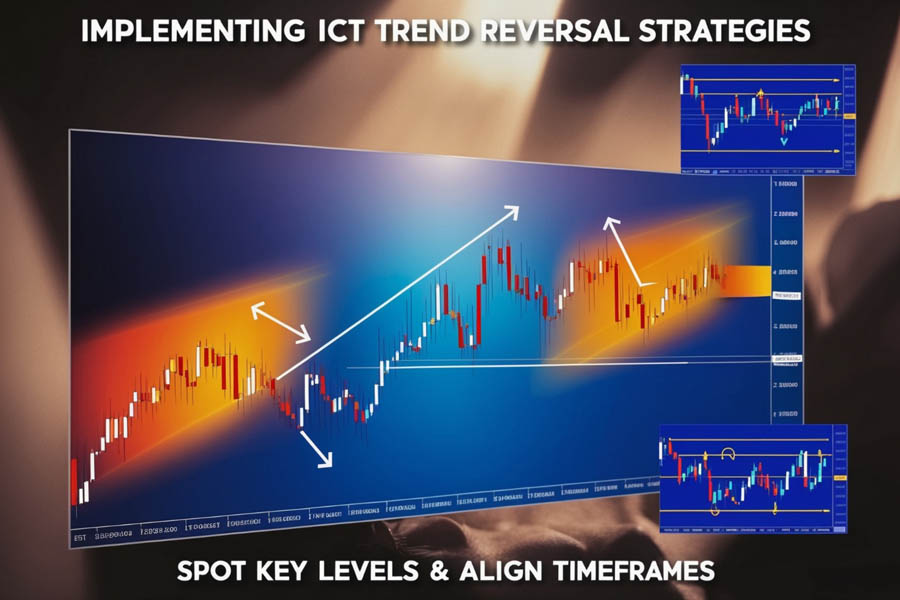

Implementing ICT Trend Reversal Strategies

Context and Market Structure

The key to successfully implementing ICT trend reversal strategies lies in understanding the context and market structure. It’s not simply about selling at old highs or buying at old lows. Traders must consider:

- The overall trend on higher timeframes

- The presence of premium or discount arrays

- The purpose behind price movements (e.g., liquidity raids, stop hunts)

- The storyline or narrative driving current market conditions

Developing this contextual awareness takes time and practice. Traders should regularly review charts across multiple timeframes, making notes of significant levels, trends, and potential reversal zones.

Liquidity Pools and Order Flow

ICT trend reversal places significant emphasis on identifying and trading around liquidity pools:

- Look for areas where stop losses are likely to accumulate (e.g., above recent highs or below recent lows)

- Anticipate potential raids on these liquidity pools by institutional traders

- Be prepared to enter trades as price reverses after these liquidity raids

Understanding order flow is crucial. Traders should develop the ability to read the market and identify when large players are likely to enter or exit positions. This skill comes with experience and careful observation of price action around key levels.

Higher Timeframe Alignments

Successful ICT trend reversal trades often align with higher timeframe structures:

- Use weekly templates to understand the broader market context

- Identify premium and discount arrays on higher timeframes (daily, weekly)

- Look for reversals that coincide with these significant levels

Traders should develop a systematic approach to analyzing higher timeframes, starting with the weekly chart and working down to lower timeframes. This top-down analysis helps ensure that trades are taken in the direction of the dominant trend.

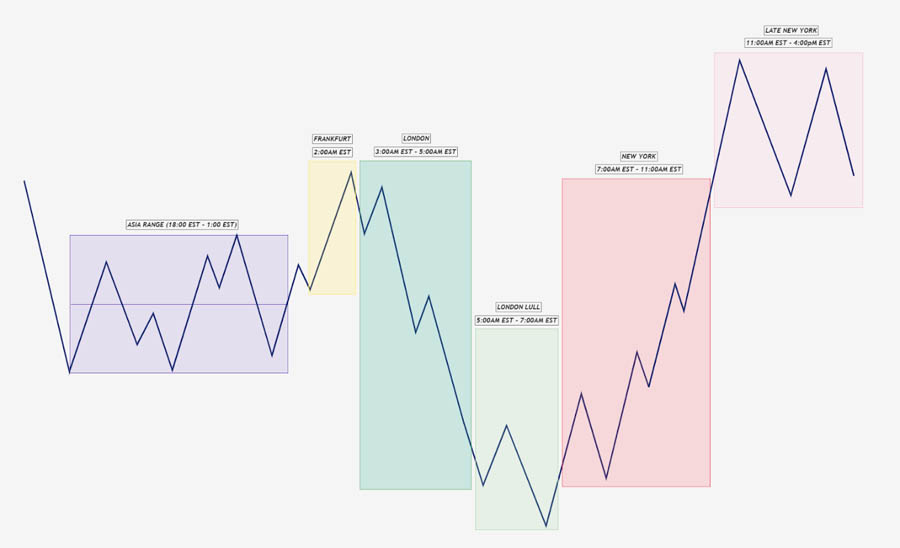

Intraday Trading Opportunities

ICT trend reversal concepts can be applied to intraday trading, particularly around key session times:

- New York session reversals

- London close reversals

- Scalping opportunities during large range days

Intraday traders should pay close attention to the average daily range and look for opportunities when this range is exceeded. The London close, in particular, can offer excellent scalping opportunities on days with large price movements.

Multiple Timeframe Analysis

Incorporate analysis across multiple timeframes to improve trade selection:

- Use higher timeframes to identify the overall trend and key levels

- Drop down to lower timeframes to fine-tune entries and exits

- Ensure that your trades align with the higher timeframe structure

Developing a systematic approach to multiple timeframe analysis is crucial. Traders should have a clear process for moving between timeframes and integrating information from each level into their decision-making process.

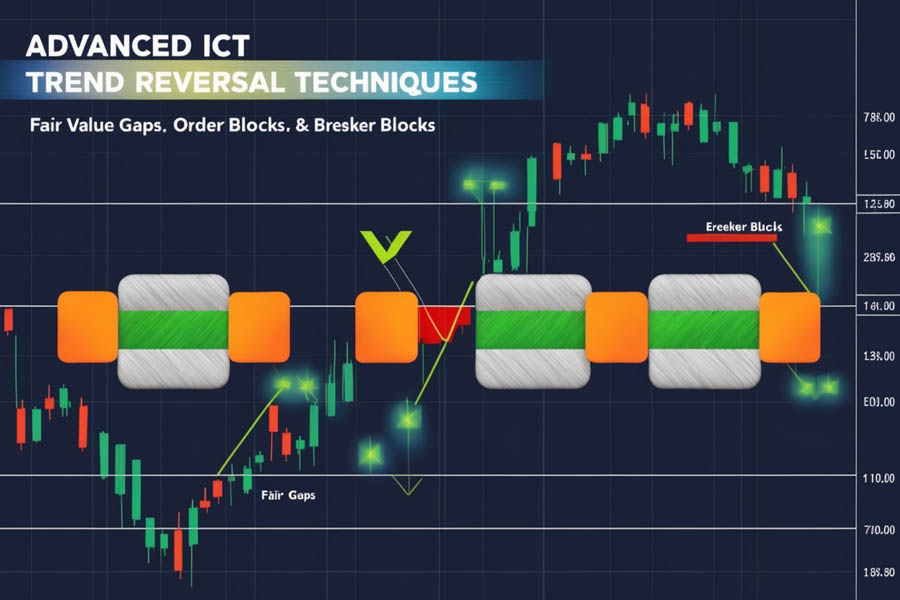

Advanced ICT Trend Reversal Techniques

Fair Value Gaps

Fair Value Gaps (FVGs) are areas on the chart where price has moved rapidly, leaving an imbalance. To trade using FVGs:

- Identify gaps between the closing price of one candle and the opening price of the next

- Look for price to return to these gaps, as they often act as magnets for price action

- Use FVGs in conjunction with other ICT concepts for confirmation

FVGs can be particularly useful in identifying potential reversal points, especially when they align with other significant levels or ICT concepts.

Order Blocks

Order blocks are areas on the chart where significant buying or selling activity occurred, often leading to trend reversals. To identify order blocks:

- Look for strong momentum candles that precede a reversal

- The area just before the strong move is considered the order block

- These zones often act as support or resistance in future price action

Trading order blocks requires patience and discipline. Traders should wait for price to return to these areas and look for confirmation before entering trades.

Breaker Blocks

Breaker blocks are significant support or resistance levels that, when broken, often lead to trend reversals. To trade breaker blocks:

- Identify strong support or resistance levels on higher timeframes

- Watch for a break of these levels with conviction

- Look for potential retracements to these broken levels for entry opportunities

Breaker blocks can offer high-probability trade setups, especially when combined with other ICT concepts like order flow analysis and liquidity pool identification.

Expansion and Retracement Swings

Understanding expansion and retracement swings is crucial for ICT trend reversal trading:

- During expansion swings, look for smaller retracements that create opportunities to trade previous day’s lows or highs

- In opposing expansion swings, seek retracements that offer chances to trade reversals at previous day’s highs or lows

Traders should develop the ability to identify the current market phase (expansion or retracement) and adjust their strategy accordingly.

Weekly Templates and Market Structure

The ICT approach emphasizes the use of weekly templates and understanding current market structure:

- Study and apply the weekly templates provided in the ICT mentorship

- Use these templates to anticipate potential continuation or reversal scenarios

- Combine template analysis with other ICT concepts for more robust trading decisions

Developing proficiency with weekly templates takes time and practice. Traders should regularly review and refine their understanding of these templates as market conditions evolve.

Common Pitfalls and How to Avoid Them

- Over-trading: Avoid the temptation to trade every potential reversal. Focus on high-probability setups with multiple confirming factors.

- Ignoring the Higher Timeframe: Always consider the higher timeframe context to ensure your trades align with the broader market structure.

- Lack of Patience: ICT trend reversal setups may take time to develop. Avoid premature entries and wait for clear confirmation.

- Neglecting Risk Management: Always use proper position sizing and stop-loss placement, regardless of how confident you are in a setup.

- Emotional Trading: Stick to your trading plan and avoid making impulsive decisions based on emotions.

- Failing to Adapt: Market conditions change. Be prepared to adjust your approach as needed and continuously refine your skills.

- Overlooking Confluence: The most powerful setups often occur when multiple ICT concepts align. Look for these high-probability scenarios.

- Neglecting Practice: Proficiency in ICT trend reversal trading comes with experience. Dedicate time to studying charts and practicing in a demo account.

OpoFinance: A Trusted Partner for ICT Trend Reversal Trading

When implementing ICT trend reversal strategies, having a reliable and regulated forex broker is essential. OpoFinance, an ASIC-regulated broker, offers a comprehensive platform for traders looking to capitalize on trend reversals. With its advanced trading tools, competitive spreads, and robust execution, OpoFinance provides an ideal environment for implementing ICT strategies.

One standout feature of OpoFinance is its social trading service, which allows traders to connect with and learn from experienced practitioners of ICT trend reversal. This collaborative approach can be particularly beneficial for traders looking to refine their skills and gain insights from successful ICT traders.

Read More: Mastering ICT Quarterly Theory

Conclusion

Mastering ICT trend reversal techniques can significantly enhance your forex trading performance. By understanding market structure, order flow, and key concepts like liquidity pools and institutional behavior, you can identify high-probability trading opportunities and manage risk effectively. Remember to combine these strategies with proper risk management and continuous learning to maximize your potential for success in the forex market.

As you continue to develop your ICT trend reversal skills, consider leveraging the resources and platforms offered by regulated brokers like OpoFinance to execute your trades with confidence. With dedication, practice, and the right tools at your disposal, you can harness the power of ICT trend reversal to navigate the forex market more effectively and potentially increase your trading profitability.

The journey to mastering ICT trend reversal is ongoing. Stay curious, remain open to learning, and continuously refine your skills. As you gain experience, you’ll develop an intuitive understanding of market dynamics that will complement your technical analysis. Remember that success in trading comes not just from knowledge, but from consistent application and adaptation to changing market conditions.

How does ICT trend reversal differ from traditional trend reversal techniques?

ICT trend reversal focuses more on institutional order flow and market structure compared to traditional methods. It emphasizes concepts like order blocks, fair value gaps, and liquidity pools, which are not typically central to conventional trend reversal strategies. ICT also places a stronger emphasis on anticipating reversals before they occur, rather than reacting to confirmed reversals.

Can ICT trend reversal be applied to other financial markets besides forex?

Yes, ICT trend reversal principles can be applied to various financial markets, including stocks, commodities, and cryptocurrencies. The core concepts of market structure, order flow, and institutional behavior are relevant across different asset classes. However, traders should be aware of the unique characteristics of each market and adapt their strategies accordingly.

How long does it typically take to become proficient in ICT trend reversal?

The time required to become proficient in ICT trend reversal varies depending on individual factors such as prior trading experience, dedication to learning, and practice. Generally, traders should expect to spend several months to a year studying and practicing ICT concepts before achieving consistent results. Continuous learning and adaptation are key to long-term success with this approach.