In the ever-evolving landscape of Forex trading, the ability to decipher market movements with precision can be the determining factor between a successful trading strategy and a losing one. Among the many advanced concepts that traders employ to gain an edge, ICT volume imbalance stands out as a powerful tool for predicting price action and optimizing trade execution. For those trading with an online forex broker or a regulated forex broker, mastering the concept of ICT volume imbalance can significantly elevate their trading performance.

ICT volume imbalance refers to the gaps in price action where no trading activity has occurred, leading to the formation of what is known as a micro fair value gap. These imbalances arise from various factors, such as the market closing over the weekend or sudden, unexpected events that trigger rapid price movements in one direction. The market often revisits these imbalanced areas, using them as crucial support and resistance levels that influence future price behavior. This article delves into the intricacies of ICT volume imbalance, explains its significance in Forex trading, and provides actionable strategies to leverage this concept for improved trading outcomes.

Understanding ICT Volume Imbalance

What is ICT Volume Imbalance?

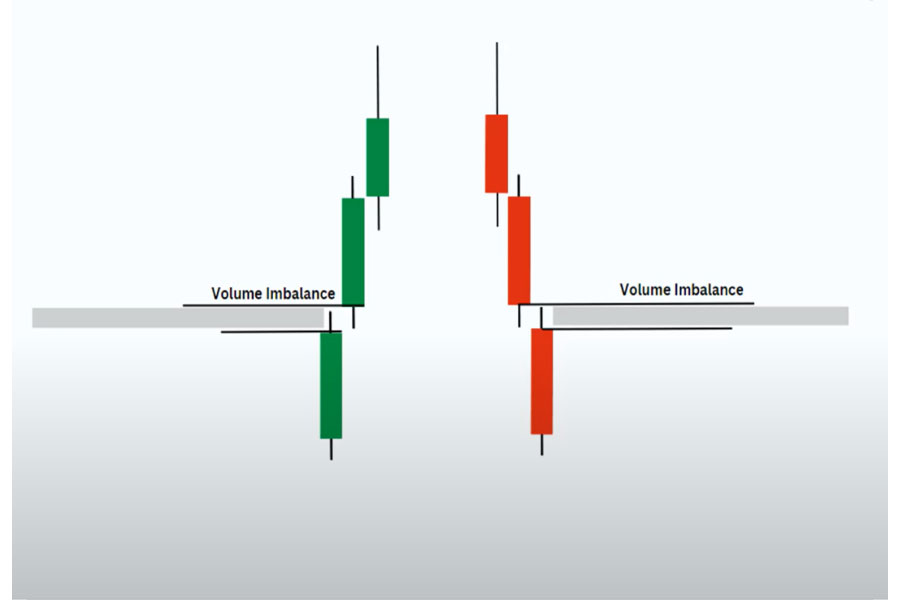

ICT (Inner Circle Trader) volume imbalance occurs when there is a distinct separation between the bodies of two consecutive candles on a trading chart, with no overlap between them. While the wicks of these candles may intersect, the candle bodies themselves do not touch. This separation represents a gap in the price action, signaling that the market did not efficiently offer the price to the marketplace between these two points, thus creating a micro fair value gap.

These gaps, known as volume imbalances, can be attributed to various market conditions. For instance, the market may close for the weekend and reopen with a gap due to new information or developments that occurred during the closure. Alternatively, sudden and unexpected market events—such as economic announcements, geopolitical developments, or large institutional trades—can lead to rapid movements in price, creating volume imbalances.

Volume imbalances play a critical role in market behavior. They act like magnets, attracting the price back to reprice the area before moving away, either in favor of or against the trader. Understanding how these imbalances form and how they can influence future price movements is key to developing a robust trading strategy.

The Mechanics of ICT Volume Imbalance

The formation of ICT volume imbalances results in what is known as a liquidity void—an area on the chart where no trading activity has taken place. This void is essentially a gap that the market needs to fill or rebalance, and it often serves as a significant reference point for future price action. The mechanics of how these imbalances work are crucial for traders looking to capitalize on them:

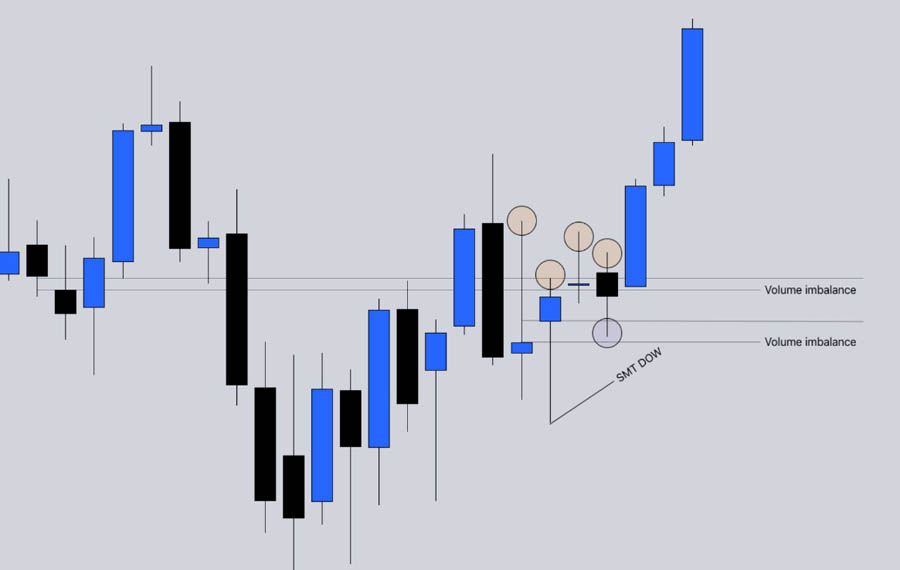

- Volume Imbalance as Support and Resistance: Volume imbalances can act as true support and resistance levels in the market. For example, if a volume imbalance serves as a support level, the price may revisit this area and then move upwards. Conversely, if it serves as resistance, the price may struggle to break through and could potentially reverse, leading to a downward movement.

- Entries and Draw on Liquidity (DOL): Traders can utilize volume imbalances as entry points by treating them as micro fair value gaps (FvGs). Once these gaps are filled, they can reinforce the market’s support or resistance levels. Additionally, volume imbalances can draw price towards them (DOL), providing a clear target for price movement, which is particularly useful for setting up trades.

- Impact of Candle Formation: A volume imbalance typically occurs when there is aggressive buying or selling pressure, causing the price to gap between two consecutive candles. In a bullish scenario, the first candle closes, and the second candle opens higher, creating a gap between the close of the first candle and the open of the second. This gap indicates a shift in market sentiment and the potential for continued price movement in the same direction.

Read More: Mastering ICT Market Structure

Why ICT Volume Imbalance Matters in Forex Trading

ICT volume imbalance is not merely a visual gap on a chart; it represents a deeper understanding of market dynamics that can significantly influence trading decisions. Here’s why mastering this concept is essential for Forex traders:

- Predicting Market Reversals: Volume imbalances often precede market reversals, acting as a precursor to changes in trend direction. These imbalances draw the price back to key levels before the market either continues its current trend or reverses. Recognizing these imbalances allows traders to anticipate potential turning points and adjust their strategies to take advantage of these movements.

- Enhancing Trade Timing: By identifying volume imbalances, traders can fine-tune their entry and exit points, timing their trades to coincide with moments when the market is likely to move in their favor. This improved timing can result in better trade execution and higher profitability.

- Supporting Risk Management: Volume imbalances offer clear levels for setting stop-loss orders. When a trade moves against a trader’s position, these imbalances can provide logical exit points, minimizing potential losses and enhancing overall risk management.

Strategies for Trading ICT Volume Imbalance

Incorporating ICT volume imbalance into your trading strategy requires a comprehensive approach that combines this concept with other technical analysis tools and a deep understanding of market conditions. Below are several strategies to effectively trade ICT volume imbalances:

1. Trading Volume Imbalances as Micro Fair Value Gaps (FVGs)

Volume imbalances can be treated as micro fair value gaps, where the market is likely to return to fill the gap before continuing its trend. Here’s how to trade them:

- Identify Volume Imbalances: Utilize your trading platform to identify areas on the chart where there is a noticeable gap between the bodies of two consecutive candles. These gaps represent potential volume imbalances.

- Set Entries at the Imbalance: Place your entry orders at the volume imbalance, anticipating that the price will return to this level before moving in the desired direction. For instance, if a bullish volume imbalance is identified, a buy order can be placed at the lower boundary of the gap.

- Support and Resistance After the Fill: Once the gap is filled, the volume imbalance can serve as a new support or resistance level. Adjust your stop-loss and take-profit levels accordingly, using the filled imbalance as a reference point.

2. Volume Imbalance as Support and Resistance

Volume imbalances can serve as strong support and resistance levels that the market respects. Here’s how to utilize them in your trading:

- Identify Key Volume Imbalances: Scan the charts for areas where volume imbalances have previously acted as support or resistance. These areas are likely to attract the price again, providing potential trading opportunities.

- Monitor Price Action at the Imbalance: When the price approaches a known volume imbalance, closely observe how it reacts. If the imbalance acts as support, the price may bounce off it and move higher. If it acts as resistance, the price may struggle to break through and could reverse.

- Adjust Your Trading Bias: Depending on how the price interacts with the volume imbalance, you may need to adjust your trading bias. For example, if the price breaks through a support level formed by a volume imbalance, it may signal a shift in market sentiment, prompting a reassessment of your strategy.

Read More: Mastering ICT Liquidity Pool Trading

3. Using Volume Imbalance to Gauge Order Flow

Volume imbalances offer valuable insights into the market’s order flow, helping traders determine whether the market is more likely to move up or down. Here’s how to incorporate this understanding into your trading strategy:

- Analyze Order Flow: Study the direction in which volume imbalances are forming. If they consistently occur at higher price levels (acting as resistance), it suggests that sellers are exerting more pressure, and the market may be poised for a downward movement. Conversely, if they form at lower price levels (acting as support), it indicates that buyers are gaining control, potentially leading to an upward movement.

- Confirm Bias with Volume Imbalance: Before entering a trade, confirm your bias by checking for volume imbalances that align with your expected market direction. For example, if you anticipate a bullish trend, look for volume imbalances that support this upward movement.

- Adjust as Needed: If a volume imbalance is breached (e.g., a candle body closes below a bullish imbalance), it may indicate that your initial bias is no longer valid. In such cases, be prepared to adjust your strategy or exit the trade to mitigate potential losses.

4. Volume Imbalance and Liquidity Voids

Volume imbalances create liquidity voids—gaps where the market has moved rapidly without any trading activity. These voids often become areas of interest for future price movements, offering potential trading opportunities:

- Identify Liquidity Voids: Look for areas on the chart where rapid price movements have created gaps with no trading activity. These are liquidity voids that the market is likely to revisit.

- Use Voids for Target Setting: When setting up your trades, consider targeting the boundaries of liquidity voids, as these are areas the market is likely to revisit. This approach can enhance your take-profit strategy.

- Avoid False Signals: Not all liquidity voids are filled immediately. Use additional technical indicators or price action analysis to confirm that the market is likely to return to a void before placing your trade.

Avoiding Common Mistakes with ICT Volume Imbalance

While ICT volume imbalance is a valuable tool for traders, it is essential to use it correctly to avoid common pitfalls. Here are some mistakes to avoid:

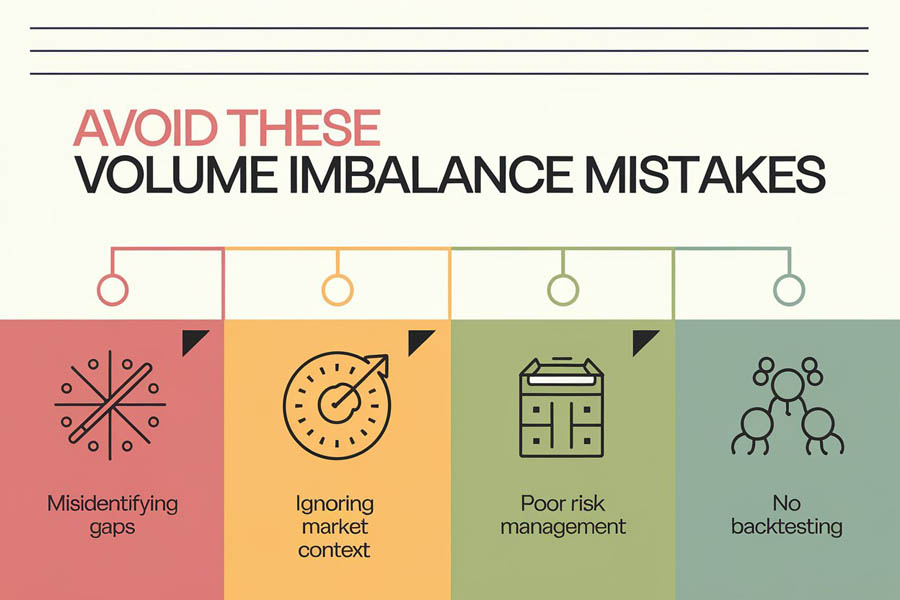

- Ignoring Market Context: Volume imbalances should not be analyzed in isolation. Always consider the broader market context, including trends, economic news, and other technical indicators, to make informed trading decisions.

- Misinterpreting Gaps: Not every gap on the chart qualifies as a volume imbalance. Ensure that the gaps you analyze meet the criteria of having a separation between candle bodies with no overlap before making trading decisions. Understanding the true nature of these gaps is crucial to avoid false signals and ineffective trades.

- Overconfidence in Imbalances: While volume imbalances are a powerful tool, they are not foolproof. It’s important to use them in conjunction with other technical analysis tools and maintain a disciplined approach to trading. Always have a well-defined risk management plan and be prepared to adapt to changing market conditions.

OpoFinance Services: Your Trusted ASIC-Regulated Broker

Selecting a reputable broker is essential for successful Forex trading. OpoFinance stands out as a trusted ASIC-regulated broker, offering a range of services tailored to meet the needs of both novice and experienced traders. Here’s why OpoFinance is a top choice:

- Regulated and Secure: OpoFinance is regulated by the Australian Securities and Investments Commission (ASIC), providing a high level of security and transparency. This regulatory oversight ensures that your funds are protected and that the broker adheres to stringent financial and operational standards.

- Advanced Trading Platforms: OpoFinance offers state-of-the-art trading platforms equipped with sophisticated tools for analyzing ICT volume imbalances. These platforms provide real-time market data, customizable indicators, and advanced charting features, enabling traders to make informed decisions based on precise technical analysis.

- Comprehensive Educational Resources: To support traders in their journey, OpoFinance provides extensive educational resources, including webinars, tutorials, and expert market analysis. These resources are designed to enhance your trading skills and help you leverage concepts like ICT volume imbalance effectively.

- Exceptional Customer Support: With dedicated customer support available 24/5, OpoFinance ensures that assistance is always at hand. Whether you need technical support or have queries about your trading account, their professional team is ready to help.

Read More: Identify Imbalance In Forex

Partner with OpoFinance today to access a secure, regulated trading environment with top-notch tools and resources that can enhance your trading strategy.

Conclusion

Mastering ICT volume imbalance is a crucial component of a successful Forex trading strategy. By understanding and effectively using this concept, traders can gain valuable insights into market dynamics, improve their trade timing, and manage risk more effectively. Volume imbalances offer significant advantages by acting as key support and resistance levels, predicting market reversals, and providing clear targets for trade entries and exits.

Whether you are a seasoned trader or new to the Forex market, incorporating ICT volume imbalance into your trading plan can enhance your ability to navigate market fluctuations and achieve your trading objectives. As you develop your skills and strategies, remember to use volume imbalances in conjunction with other analytical tools and maintain a disciplined approach to risk management.

Choosing the right broker is also essential to your trading success. OpoFinance, with its ASIC regulation, advanced trading platforms, and comprehensive educational resources, offers an excellent environment for traders looking to refine their strategies and achieve their financial goals. Take advantage of these resources and partner with OpoFinance to elevate your trading experience.

Can ICT Volume Imbalance Be Applied to Different Forex Pairs?

Yes, ICT volume imbalance can be applied to various Forex currency pairs. The concept is universal and can be used across different pairs to identify potential support and resistance levels, gauge market sentiment, and refine trading strategies. However, it is important to adjust your analysis based on the specific characteristics and volatility of each currency pair.

How Can I Confirm the Validity of a Volume Imbalance Signal?

To confirm the validity of a volume imbalance signal, consider using additional technical indicators and price action analysis. For example, combining volume imbalance with trend indicators like moving averages or momentum indicators can provide additional confirmation. It’s also useful to analyze the broader market context and look for alignment with your overall trading strategy.

What Are the Best Practices for Incorporating Volume Imbalance into a Trading Strategy?

When incorporating volume imbalance into your trading strategy, follow these best practices:

Combine with Other Tools: Use volume imbalances in conjunction with other technical analysis tools and indicators to enhance your strategy.

Monitor Market Conditions: Consider the broader market environment and news events that may impact price action.

Manage Risk: Always implement proper risk management techniques, including setting stop-loss orders and managing trade sizes.

Backtest Your Strategy: Test your approach using historical data to understand how volume imbalances have performed in different market conditions.