In the intricate world of forex trading, identifying inducement is a skill that separates the novices from the pros. But what exactly is inducement in forex? Inducement, often labeled as IND or IDM on charts, is a specific area or point that incentivizes traders to buy or sell. In the Smart Money Concept (SMC), it’s the catalyst that prompts most traders to buy after the breakdown of a previous high or sell after the breakdown of a previous low. Learning how to identify inducement in forex is crucial for protecting your investments and maximizing profits. This comprehensive guide will reveal seven proven strategies to spot market manipulation and empower you to navigate the complex waters of currency trading with confidence and precision.

Understanding Forex Inducement: The Hidden Force Behind Price Movements

Before diving into the strategies, it’s essential to grasp the concept of inducement fully. In forex trading, inducement is more than just a price point; it’s a psychological trigger expertly crafted by institutional traders or “smart money” to create false price movements. These movements are designed to lure retail traders into unfavorable positions, often resulting in significant losses.

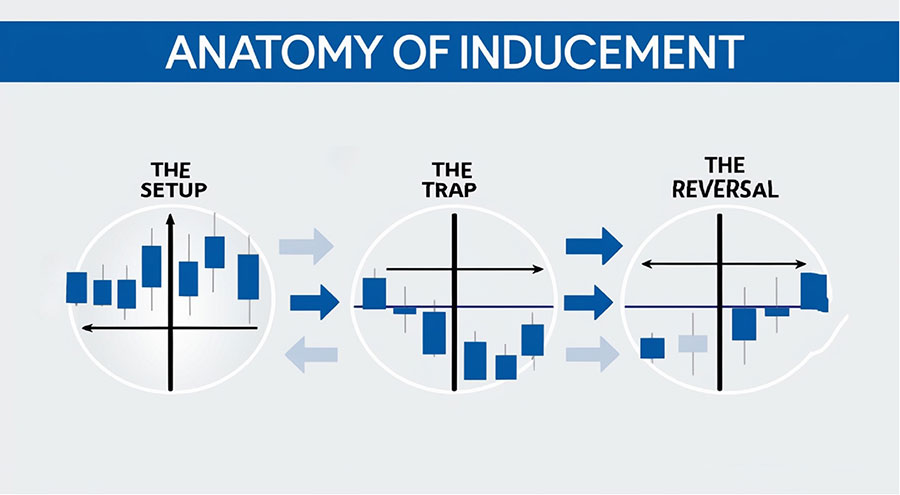

The Anatomy of Inducement

Inducement typically consists of several key elements:

- The Setup: A period of price consolidation or apparent trend

- The Trap: A sudden, sharp move in one direction

- The Reversal: A quick and often violent move in the opposite direction

Understanding this structure is crucial for identifying potential inducement scenarios before they unfold.

The Impact of Inducement on Traders

Inducement can have devastating effects on unprepared traders:

- Premature stop-loss triggers leading to unnecessary losses

- False breakouts enticing traders into losing positions

- Emotional decision-making due to increased market volatility

- Overtrading in an attempt to recover losses

- Loss of confidence in trading strategies and analysis

By learning to identify these tactics, you can avoid common pitfalls and make more informed trading decisions.

7 Proven Strategies to Identify Inducement in Forex

1. Master Price Action Patterns

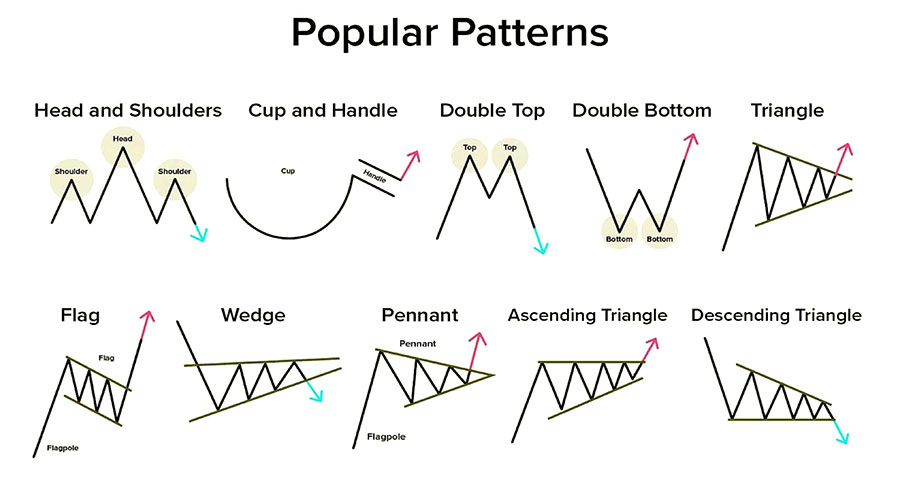

One of the most effective ways to spot inducement is by studying price action patterns. Look for:

- Sudden spikes in volume without corresponding news events

- Rapid price reversals, especially after breaking key levels

- Unusual candlestick formations, such as engulfing patterns or dojis at critical points

These patterns often indicate potential manipulation and can serve as warning signs for savvy traders. Pay special attention to:

- Liquidity Grabs: Sharp moves that quickly reverse, often taking out stop losses

- Fakeouts: False breakouts of support or resistance levels

- Traps: Price movements designed to lure traders into unfavorable positions

By becoming proficient in recognizing these patterns, you’ll be better equipped to anticipate and avoid inducement scenarios.

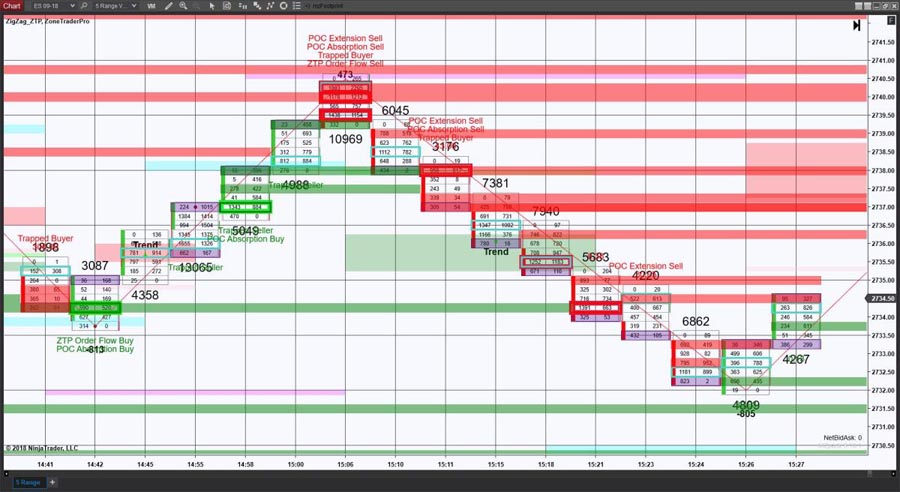

2. Monitor Order Flow with Precision

Understanding order flow is crucial in identifying inducement. Pay attention to:

- Large block trades that appear out of sync with current market sentiment

- Imbalances in buy and sell orders, especially near key levels

- Sudden shifts in market depth that don’t align with technical or fundamental factors

To effectively monitor order flow:

- Use advanced trading platforms that offer order flow analysis tools

- Study time and sales data to identify unusual transaction patterns

- Pay attention to the timing of large orders, especially around key economic releases

By tracking these indicators, you can gain insights into institutional activity and potential manipulation attempts.

3. Utilize Advanced Technical Indicators

Incorporating specialized technical indicators can enhance your ability to spot inducement:

- Order Blocks: Areas on the chart where significant buying or selling pressure has occurred

- Liquidity Pools: Zones where a large number of stop losses or pending orders are clustered

- Smart Money Concepts (SMC) Indicators: Tools designed to visualize institutional trading activity

Some specific indicators to consider include:

- Volume Profile: To identify areas of high and low trading activity

- Market Profile: To understand price acceptance and rejection levels

- Cumulative Delta: To track buying and selling pressure over time

These tools can help you visualize potential areas of manipulation and make more informed trading decisions.

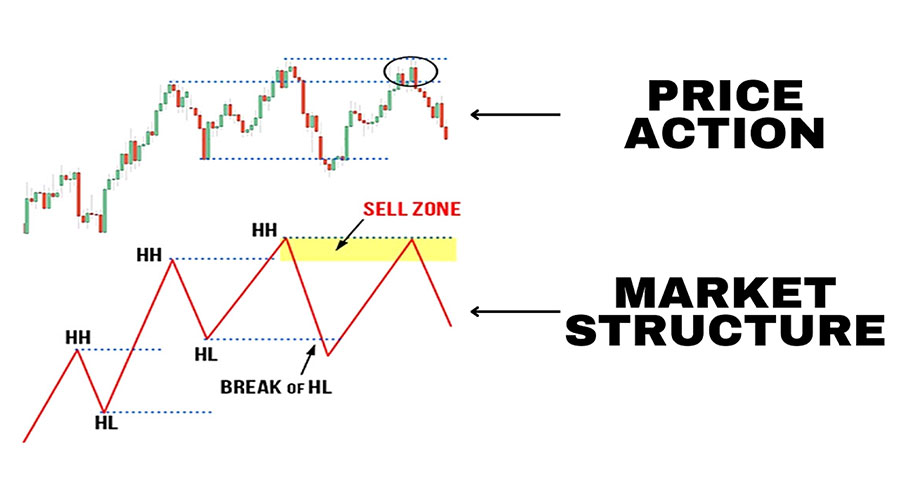

4. Master Market Structure Analysis

A solid understanding of market structure is essential for identifying inducement:

- Recognize key support and resistance levels, including multi-timeframe confluences

- Identify trend lines and chart patterns that may be used to disguise manipulative moves

- Analyze market cycles and timeframes to understand the broader context of price movements

Key aspects of market structure to focus on include:

- Swing Highs and Lows: Major turning points in price action

- Trend Channels: Areas where price tends to move within defined boundaries

- Fibonacci Retracements and Extensions: Key levels where price often reacts

By developing a comprehensive view of market structure, you’ll be better equipped to spot anomalies that may indicate inducement.

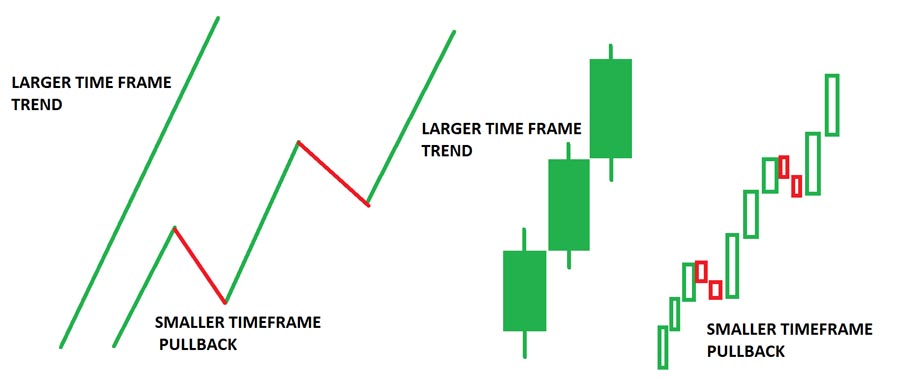

5. Implement Multi-Timeframe Analysis

Don’t rely on a single timeframe when searching for inducement. Instead:

- Compare price action across multiple timeframes to identify divergences

- Look for confluences and conflicts between different time horizons

- Identify key levels on higher timeframes that may influence lower timeframe movements

A recommended approach is to use at least three timeframes:

- Higher Timeframe: For overall trend and major support/resistance

- Intermediate Timeframe: For trade setup and entry

- Lower Timeframe: For precise entry and exit timing

This approach provides a more holistic view of market dynamics and helps you avoid false signals that may be present on a single timeframe.

6. Integrate Fundamental Analysis

While technical analysis is crucial, incorporating fundamental factors can provide additional context for potential inducement:

- Stay informed about major economic releases and their potential impact on currency pairs

- Understand central bank policies and how they might influence market movements

- Monitor geopolitical events that could lead to sudden market shifts

Key fundamental factors to consider:

- Interest rate decisions and monetary policy statements

- Employment reports and inflation data

- Political events and trade agreements

By combining technical and fundamental analysis, you can better anticipate potential inducement scenarios and adjust your trading strategy accordingly.

7. Develop a Psychological Edge

Understanding the psychology behind inducement is crucial for avoiding its traps:

- Recognize common cognitive biases that make traders susceptible to manipulation

- Develop emotional resilience to avoid impulsive decisions during volatile market conditions

- Cultivate patience and discipline to wait for high-probability setups

Psychological strategies to implement:

- Mindfulness Practices: To maintain focus and reduce emotional trading

- Journaling: To track and analyze your decision-making process

- Scenario Planning: To prepare for various market outcomes and reduce stress

By strengthening your mental game, you’ll be less likely to fall victim to inducement tactics and more capable of executing your trading plan with confidence.

Advanced Techniques for Spotting Inducement

Liquidity Analysis

Understanding where liquidity pools are located can help you anticipate potential inducement:

- Identify areas with a high concentration of stop losses

- Look for price levels where limit orders are likely to be placed

- Analyze historical price action to find recurring liquidity zones

Orderblock Identification

Orderblocks are key areas where significant buying or selling pressure has occurred:

- Look for sharp moves followed by a period of consolidation

- Identify the origin of strong trending moves

- Pay attention to how price reacts when revisiting these areas

Wyckoff Method Integration

The Wyckoff Method can provide insights into institutional manipulation:

- Study accumulation and distribution phases

- Identify spring and upthrust patterns that often precede major moves

- Analyze volume in relation to price movements to confirm manipulation

Practical Application: Putting It All Together

To effectively identify inducement in forex, it’s crucial to combine multiple strategies and develop a systematic approach. Here’s a step-by-step guide to implementing what you’ve learned:

- Start with the big picture: Begin your analysis on higher timeframes to understand the overall market context and identify key levels.

- Narrow your focus: Move to lower timeframes to spot potential inducement setups, paying close attention to price action around significant levels.

- Apply technical tools: Use your chosen indicators and analysis techniques to confirm or refute your initial observations.

- Consider fundamentals: Check if any upcoming economic events or news releases could impact your analysis.

- Assess order flow: Look for unusual patterns in buying and selling pressure that might indicate institutional activity.

- Identify potential traps: Be especially vigilant around breakout points and areas where stop losses are likely to be clustered.

- Plan your approach: If you identify a potential inducement scenario, develop a clear plan for how you’ll respond, including entry points, stop losses, and take-profit levels.

- Monitor and adjust: Stay alert as the situation unfolds, be prepared to adapt your plan if new information emerges.

- Review and learn: After each trade, whether successful or not, analyze your decision-making process and look for areas of improvement.

Remember, identifying inducement is as much an art as it is a science. It requires practice, patience, and continuous learning to master.

Conclusion

Mastering the art of identifying inducement in forex is a game-changer for serious traders. By implementing these seven proven strategies and advanced techniques, you’ll be well-equipped to spot market manipulation and make more profitable trading decisions.

Remember, success in forex trading isn’t just about making winning trades; it’s also about protecting yourself from unnecessary losses and developing a sustainable, long-term approach to the markets. By staying vigilant, continuously educating yourself on market dynamics, and refining your skills in identifying inducement, you’ll be better positioned to navigate the complexities of the forex market and achieve lasting success.

Take action today: start incorporating these strategies into your trading routine and watch as your ability to identify inducement in forex improves. Embrace the challenge of outsmarting market manipulation, and let your enhanced skills guide you towards consistent profitability in the exciting world of currency trading. Your trading account – and your future financial success – will thank you for the effort and dedication you put into mastering this crucial aspect of forex trading.

How can retail traders effectively counter institutional inducement?

While it’s challenging to completely avoid the effects of inducement, retail traders can improve their odds by:

Developing a deep understanding of market structure and price action

Implementing robust risk management strategies, including proper position sizing

Avoiding overtrading and maintaining patience for high-probability setups

Continuously educating themselves on market dynamics and manipulation tactics

Using advanced tools and indicators to gain insights into institutional activity

By combining these approaches, traders can make more informed decisions and protect their capital against inducement strategies.

Are there specific currency pairs more prone to inducement?

while inducement can occur in any currency pair, some factors may increase the likelihood of manipulation:

Liquidity: Less liquid pairs may be more susceptible to large price movements

Economic Importance: Major pairs tied to significant economies may experience more institutional activity

Volatility: Highly volatile pairs may provide more opportunities for inducement

It’s important to note that even major pairs can experience inducement, especially during key economic events or periods of low liquidity. Traders should remain vigilant across all currency pairs they trade.

How often should I review my trading strategy to account for inducement?

Regular review and adjustment of your trading strategy are crucial in the ever-changing forex market:

Monthly Review: Assess your approach at least monthly, focusing on how well you’re identifying and responding to potential inducement scenarios

Post-Event Analysis: After significant market events, evaluate your performance and strategy effectiveness

Continuous Learning: Stay updated on new manipulation tactics and adjust your strategy accordingly

Performance Metrics: Track key metrics like win rate and risk-reward ratio to ensure your strategy remains effective

By maintaining a proactive approach to strategy refinement, you can stay ahead of evolving market dynamics and inducement tactics.

One Response

I want learn forex trading for skin 1% to 100% skin