Imagine the thrill of pinpointing fleeting price movements, swiftly entering and exiting trades to accumulate profits within mere seconds. The 1-minute chart presents this exhilarating possibility, a playground for nimble traders. But navigating this rapid-fire environment demands precision and the right arsenal of tools. Are you prepared to uncover the pivotal strategy for conquering this fast-paced arena, transforming fleeting moments into tangible gains?

The quest for the best MACD settings for a 1-minute chart is a common pursuit among active traders. While the standard (12, 26, 9) settings serve as a foundational starting point, achieving optimal performance in the hyper-sensitive realm of 1-minute trading often necessitates a recalibration, a shortening of the lookback periods.

This comprehensive guide delves deep into the realm of optimal MACD settings for 1-minute trading and the nuances of best MACD settings for scalping 1 minute chart, revealing the secrets to fine-tuning this indispensable indicator for unparalleled accuracy on the shortest of timeframes. For those seeking a dependable broker for forex trading to implement these high-precision strategies, a thorough understanding of your indicator settings becomes absolutely paramount. We will explore how to leverage the MACD indicator settings for 1 minute timeframe to gain a competitive edge.

What is MACD?

The Moving Average Convergence Divergence (MACD) stands as a cornerstone in the world of technical analysis, a powerful momentum indicator that unveils shifts in the strength, direction, momentum, and longevity of a trend in an asset’s price. Conceived by Gerald Appel in the late 1970s, the MACD has become an indispensable tool for traders across diverse markets, offering valuable insights into potential trading opportunities.

Definition and Components of MACD

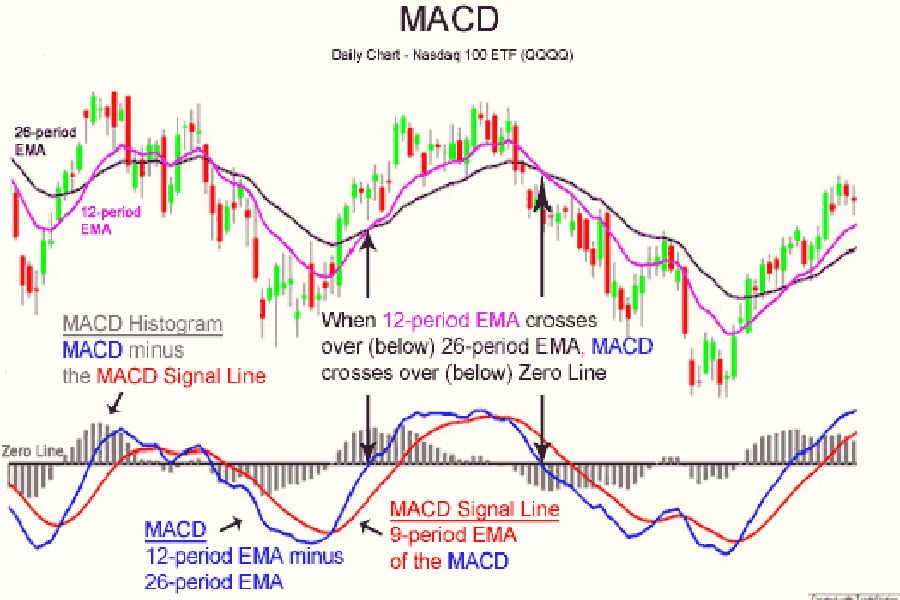

At its core, the MACD is comprised of three key components, each playing a vital role in its functionality:

- MACD Line: This line represents the dynamic relationship between two Exponential Moving Averages (EMAs) of an asset’s price. Typically, it’s calculated by subtracting a longer-period EMA (commonly 26 periods) from a shorter-period EMA (commonly 12 periods). This difference highlights the divergence and convergence of these moving averages.

- Signal Line: The signal line is essentially a smoothed version of the MACD line. It’s calculated as an EMA of the MACD line itself, with a common setting of 9 periods. This line acts as a trigger, generating potential buy and sell signals when it interacts with the MACD line.

- Histogram: The histogram provides a visual representation of the distance between the MACD line and the signal line. When the MACD line resides above the signal line, the histogram bars appear above the zero line, indicating positive momentum. Conversely, when the MACD line is below the signal line, the histogram bars fall below the zero line, signaling negative momentum. The height of these bars reflects the strength of the prevailing momentum.

How MACD Works: Calculation and Interpretation

The magic of the MACD lies in its ability to highlight the convergence and divergence of the two EMAs. When the shorter-term EMA, being more sensitive to recent price changes, begins to move above the longer-term EMA, it suggests a building upward momentum. This is reflected in the MACD line moving above the zero line. Conversely, when the shorter-term EMA dips below the longer-term EMA, it signals increasing downward momentum, causing the MACD line to descend below zero.

Crossovers between the MACD line and the signal line are often interpreted as potential trading signals by astute traders. A bullish crossover materializes when the MACD line crosses above the signal line, hinting at a potential buying opportunity as upward momentum gains traction. Conversely, a bearish crossover occurs when the MACD line crosses below the signal line, suggesting a potential selling opportunity as downward momentum intensifies. The histogram serves as a valuable visual aid, providing a clear indication of the strength and momentum behind these crossovers.

Role of MACD in Identifying Trends, Momentum, and Reversals

The MACD is a versatile indicator, playing a crucial role in various aspects of technical analysis:

- Trend Identification: The MACD line above zero suggests an uptrend; below zero suggests a downtrend.

- Momentum Measurement: The histogram shows the momentum strength. Expanding bars indicate increasing momentum.

- Reversal Spotting: Divergence between price action and the MACD can signal potential trend reversals. Bullish divergence occurs when price makes lower lows, but MACD makes higher lows. Bearish divergence is when price makes higher highs, but MACD makes lower highs.

Read More: MACD Indicator in Forex Trading

Why Use MACD on 1-Minute Charts?

The allure of the 1-minute chart lies in its capacity to capture the most granular price fluctuations, making it a favored tool among scalpers and those engaged in high-frequency trading strategies. The rapid pace of this timeframe presents both unique opportunities and specific challenges when utilizing indicators like the MACD.

Advantages of 1-Minute Charts for Scalping and High-Frequency Trading

The 1-minute chart offers several compelling advantages for traders focused on capturing small, rapid profits:

- Abundant Trading Opportunities: The sheer volume of price movements within each minute on this timeframe translates into a multitude of potential entry and exit points. This constant flux provides numerous opportunities to capitalize on short-term price discrepancies.

- Precise Entry and Exit Points: The fine-grained detail of the 1-minute chart allows for the placement of tighter stop-loss orders, minimizing potential losses, and more precise entry points, maximizing the potential for profit on each trade.

- Immediate Feedback Loop: Traders operating on this timeframe receive almost instantaneous feedback on their trading decisions. This rapid feedback allows for quick adjustments to strategies and a more agile approach to the market.

Challenges of Using MACD on 1-Minute Charts

While the 1-minute chart offers enticing possibilities, it also presents specific hurdles when employing the MACD:

- Increased Noise and False Signals: The rapid and often erratic price fluctuations inherent in the 1-minute chart can generate significant “noise,” leading to a higher frequency of false signals from indicators like the MACD. These false signals can lead to premature entries or exits, eroding potential profits.

- Whipsaws and Volatility: Sudden and sharp reversals in price, often referred to as “whipsaws,” are a common occurrence on such short timeframes. These volatile swings can trigger MACD signals that quickly become invalid, leading to losses if not managed carefully.

- Demands Rapid Decision-Making: Trading on the 1-minute chart necessitates swift analysis and lightning-fast execution. The pace can be overwhelming for novice traders or those who prefer a more deliberate approach.

To overcome these challenges, combine the MACD with other indicators to filter false signals and confirm trading opportunities. Using support and resistance, price action, or the RSI can improve signal accuracy..

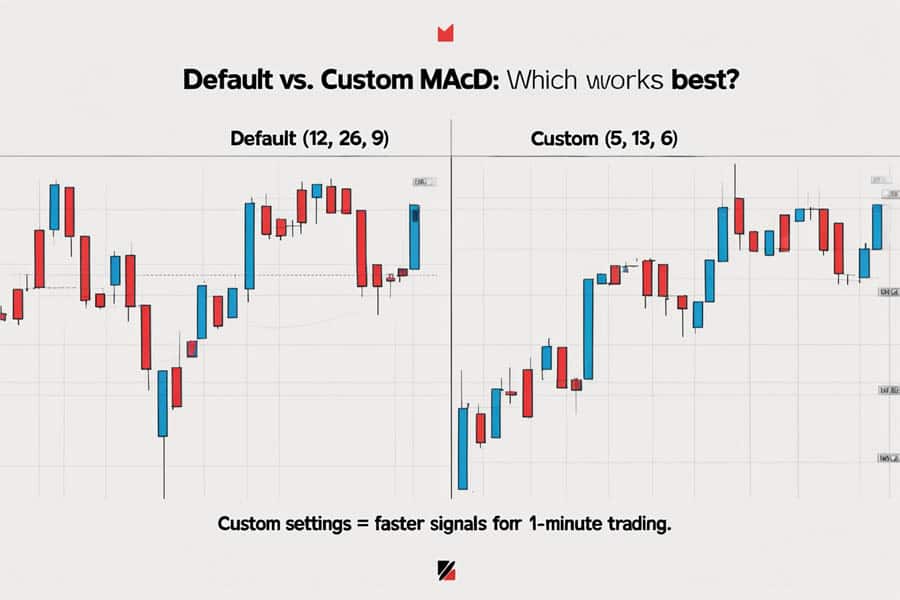

Default MACD Settings vs. Custom Settings

The default MACD settings of 12, 26, and 9 are widely recognized and have proven their effectiveness on longer timeframes, such as daily or hourly charts. However, when it comes to the ultra-short-term nature of the 1-minute chart, these standard settings may not always represent the best macd settings for 1 min chart due to the inherent speed and volatility.

Explanation of Default MACD Settings (12, 26, 9)

Let’s break down the components of the default MACD settings:

- 12-period EMA (Fast Length): This shorter-period Exponential Moving Average is designed to be more responsive to recent price fluctuations, capturing short-term momentum shifts.

- 26-period EMA (Slow Length): This longer-period EMA reacts more slowly to price changes, providing a representation of the longer-term trend.

- 9-period EMA (Signal Line): This EMA of the MACD line itself acts as a smoothing mechanism, generating potential buy and sell signals when it crosses the MACD line.

Read More: Best EMA Settings for 15 Minute Chart

Why Default Settings May Not Be Ideal for 1-Minute Charts

The default MACD settings are inherently designed to identify and track medium-term trends. On the 1-minute chart, where price action is incredibly rapid and often erratic, these settings can exhibit a degree of lag. This lag can result in delayed signals, causing traders to miss out on timely opportunities or, worse, act on information that is no longer relevant. The delay can lead to entering trades after the optimal point or exiting too late, ultimately diminishing potential profits in the fast-paced world of 1-minute trading.

Benefits of Customizing MACD Settings for Short-Term Trading

Tailoring the MACD settings specifically for the 1-minute chart offers several key advantages for short-term traders:

- Increased Sensitivity: By employing shorter lookback periods for the EMAs, the MACD becomes significantly more sensitive to immediate price changes. This heightened sensitivity allows for the quicker identification of short-term momentum shifts, crucial for capitalizing on fleeting opportunities.

- Reduced Lag: Utilizing shorter EMAs enables the MACD to react more swiftly to current market conditions. This reduction in lag translates to more timely signal generation, allowing traders to enter and exit positions closer to optimal points.

- Potential for Noise Reduction (with Careful Selection): While it might seem counterintuitive, carefully chosen shorter settings can, in some instances, help filter out some of the excessive noise that is prevalent on 1-minute charts. The key lies in finding the right balance between sensitivity and signal reliability.

Best MACD Settings for 1-Minute Charts

The pursuit of the absolute best MACD settings for 1 minute chart is an ongoing endeavor, often influenced by individual trading styles, the specific asset being traded, and prevailing market conditions. However, certain settings have gained popularity among traders who frequent the 1-minute timeframe.

Recommended Settings for 1-Minute Charts

Here are a couple of commonly recommended and utilized settings for 1-minute charts:

- 5, 13, 6: This configuration is a favored choice among scalpers due to its significantly heightened sensitivity. The shorter periods make the MACD exceptionally responsive to even the slightest price fluctuations, enabling the rapid identification of short-term momentum shifts. This is often considered a prime candidate for the best macd settings for 1 minute scalping.

- 8, 17, 9: This setting offers a slightly less sensitive approach compared to the 5, 13, 6 configuration. It aims to strike a balance, potentially filtering out some of the extreme noise inherent in the 1-minute chart while still maintaining sufficient responsiveness for effective short-term trading.

How to Adjust Settings Based on Market Volatility and Asset Class

The optimal MACD settings are not static and may require adjustments based on prevailing market conditions and the specific asset being traded:

- Higher Volatility: In periods of heightened market volatility, characterized by rapid and unpredictable price swings, employing slightly longer periods for the MACD might prove beneficial. This can help to reduce the number of false signals generated by the increased noise. Consider settings like 8, 17, 9 or even slightly longer durations.

- Lower Volatility: Conversely, in markets exhibiting lower volatility and more gradual price movements, shorter periods like 5, 13, 6 can be more effective in capturing the smaller price fluctuations and identifying potential trading opportunities.

- Asset Class Considerations: Different asset classes inherently possess varying levels of volatility. For instance, certain forex pairs are known for their high volatility, while some stocks might exhibit more subdued price action. It’s prudent to adjust your MACD settings to align with the typical volatility characteristics of the specific asset you are trading.

Strategies for Using MACD on 1-Minute Charts

Effectively harnessing the power of the MACD on the 1-minute chart requires a clear understanding and application of specific trading strategies.

MACD Crossover Strategy: Bullish and Bearish Signals

The MACD crossover strategy is a fundamental approach that focuses on the interaction between the MACD line and the signal line:

- Bullish Signal: A bullish crossover occurs when the MACD line crosses above the signal line. This event suggests that upward momentum is gaining strength and can be interpreted as a potential signal to initiate a long position. Confirmation can be sought from the histogram, which should ideally be transitioning from negative to positive.

- Bearish Signal: Conversely, a bearish crossover materializes when the MACD line crosses below the signal line. This indicates increasing downward momentum and can be considered a potential signal to enter a short position. Confirmation can be obtained by observing the histogram turning negative.

Divergence Trading: Identifying Reversals and Continuations

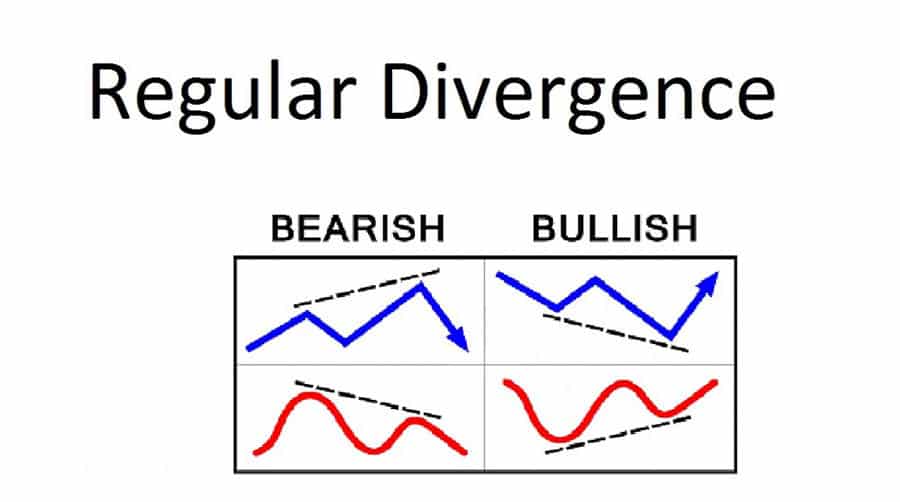

Divergence occurs when the price action of an asset moves in a direction that contradicts the movement of the MACD indicator. This discrepancy can often foreshadow potential trend reversals or continuations.

- Bullish Divergence: Bullish divergence arises when the price of an asset is making lower lows, but the MACD indicator is simultaneously forming higher lows. This divergence suggests that the selling pressure is likely weakening, and a potential upward trend reversal could be imminent. It can also signal a continuation of an existing uptrend after a pullback.

- Bearish Divergence: Bearish divergence occurs when the price is making higher highs, but the MACD indicator is forming lower highs. This discrepancy indicates that the buying pressure is likely diminishing, and a potential downward trend reversal might be on the horizon. It can also signal a continuation of a downtrend after a rally.

Histogram Analysis: Using Momentum Shifts to Time Entries and Exits

The histogram component of the MACD provides valuable insights into the momentum of the prevailing trend:

- Increasing Histogram: Expanding histogram bars above the zero line signify strengthening bullish momentum, suggesting that the upward trend is gaining traction. Conversely, expanding bars below the zero line indicate increasing bearish momentum, signaling a strengthening downward trend.

- Decreasing Histogram: Shrinking histogram bars above the zero line suggest a weakening of bullish momentum, potentially indicating a loss of upward momentum. Similarly, shrinking bars below the zero line indicate weakening bearish momentum. A crossover of the histogram from negative to positive or vice versa can also serve as a potential signal for a shift in momentum and a possible entry or exit point.

Read More: Best 15 minute forex trading strategy

Combining MACD with Other Indicators

To enhance the reliability of MACD signals, particularly on the noise-prone 1-minute chart, it is highly recommended to combine it with other complementary technical indicators. This confluence of signals can significantly improve the accuracy of your trading decisions.

Pairing MACD with RSI, Bollinger Bands, or Moving Averages

Here are some popular combinations:

- Pairing MACD with RSI: The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements, identifying overbought and oversold conditions. Combining MACD with RSI can provide valuable confirmation. For example, a bullish MACD crossover occurring when the RSI is below 30 (oversold) can present a stronger buy signal. Conversely, a bearish MACD crossover when the RSI is above 70 (overbought) can strengthen a sell signal.

- Pairing MACD with Bollinger Bands: Bollinger Bands are volatility indicators that plot bands above and below a moving average. When the price touches or breaks through the upper band, it suggests overbought conditions, while touching or breaking the lower band suggests oversold conditions. A MACD crossover occurring near the outer bands of the Bollinger Bands can provide high-probability trading signals, especially when aligning with the band’s indication of overbought or oversold conditions.

- Pairing MACD with Moving Averages: Incorporating longer-term moving averages can help to establish the overall trend direction. Traders can then opt to only take MACD crossover signals that align with the prevailing trend identified by the moving average. For instance, if the price is trading above a 200-period moving average (indicating an uptrend), traders might focus solely on bullish MACD crossovers, filtering out potential false bearish signals.

How to Filter False Signals Using Additional Tools

Filtering out false signals is crucial for successful trading on the 1-minute chart. Here are some techniques:

- Look for Confluence: Seek confirmation of MACD signals from multiple indicators or price action patterns. The more confirming signals you have, the higher the probability of the trade being successful.

- Consider Volume: Increased trading volume accompanying a MACD crossover can add validity to the signal, suggesting stronger conviction behind the price movement.

- Analyze Price Action: Pay close attention to candlestick patterns and support/resistance levels. A MACD signal occurring at a key support or resistance level, or coinciding with a specific candlestick pattern, can provide a higher-probability trading opportunity.

Importance of Risk Management in Scalping Strategies

Given the high frequency of trades inherent in scalping strategies on the 1-minute chart, implementing robust risk management protocols is absolutely paramount. Always utilize stop-loss orders to define and limit your potential losses on each trade. Furthermore, carefully determine your risk-reward ratio before entering any trade, ensuring that the potential profit outweighs the risk involved. Proper position sizing is also crucial to avoid significant capital depletion from a series of losing trades.

Common Mistakes to Avoid

Navigating the fast-paced and often unforgiving environment of 1-minute chart trading with the MACD requires awareness of common pitfalls that can lead to losses.

Over-Reliance on MACD Without Confirmation from Other Indicators

One of the most frequent mistakes made by traders, particularly beginners, is relying solely on MACD signals without seeking confirmation from other indicators or analyzing price action. On the volatile 1-minute chart, this approach can be particularly detrimental, leading to numerous false entries and unnecessary losses. Always remember that the MACD is a valuable tool, but it should be used in conjunction with other forms of analysis for optimal results.

Using Overly Sensitive Settings That Generate False Signals

While employing shorter MACD periods can be beneficial for capturing rapid price movements, using excessively short settings can lead to a barrage of false signals. This “noise” can create confusion and induce traders to enter and exit positions prematurely, ultimately eroding their capital. Finding the right balance between sensitivity and signal reliability is key to effective MACD usage on the 1-minute chart.

Ignoring Market Context and Trading During Low-Liquidity Periods

Failing to consider the broader market context and engaging in trading during periods of low liquidity can significantly impact the reliability of MACD signals. During low-liquidity periods, such as overnight sessions or during major news releases, price movements can become erratic and unpredictable, leading to unreliable signals from technical indicators like the MACD. Always be mindful of the prevailing market conditions and avoid trading during times when liquidity is thin and volatility is high and unpredictable.

Opofinance Services

Are you seeking a trustworthy and regulated online forex broker to implement your refined 1-minute chart MACD strategies? Consider Opofinance, a reputable ASIC-regulated broker officially recognized on the MT5 brokers list.

- ASIC Regulated: Trade with confidence knowing that Opofinance adheres to the stringent regulatory standards set by the Australian Securities and Investments Commission (ASIC), providing a secure and transparent trading environment.

- MT5 Platform: Access the powerful MetaTrader 5 (MT5) platform, renowned for its advanced charting tools, a wide array of technical indicators (including the MACD), and automated trading capabilities.

- Social Trading: Benefit from the insights and strategies of experienced traders through Opofinance’s social trading features. Learn from their approaches and potentially mirror their trades to enhance your own trading journey.

- Safe and Convenient Deposits and Withdrawals: Enjoy a seamless and secure trading experience with a variety of convenient and reliable deposit and withdrawal methods.

Ready to take your 1-minute chart trading to the next level? Explore the opportunities with Opofinance. Visit opofinance.com today to discover more.

Conclusion

Mastering the art of utilizing the MACD on a 1-minute chart is an ongoing process of learning, adaptation, and refinement. While the default settings provide a foundational understanding, customizing them to align with the rapid dynamics of this timeframe is often essential for achieving consistent success. Remember that identifying the best macd settings for scalping 1 minute chart frequently involves employing shorter lookback periods to enhance sensitivity and responsiveness.

Combining the MACD with other complementary indicators, diligently practicing robust risk management techniques, and consistently backtesting your strategies are all integral components of profitable 1-minute chart trading. Embrace a spirit of experimentation, remain adaptable to evolving market conditions, and you will be well-equipped to unlock the inherent potential of this dynamic and fast-paced trading environment. The journey to finding the optimal MACD settings for 1 minute trading is unique to each trader, so continuous learning is key.

Key Takeaways

- Optimizing MACD settings for 1-minute charts is crucial for effectively capturing rapid price fluctuations and capitalizing on short-term opportunities.

- Shorter MACD periods, such as 5, 13, 6 or 8, 17, 9, are generally preferred for the increased sensitivity required in 1-minute trading.

- Combining the MACD with other technical indicators like the RSI or Bollinger Bands is essential for filtering out false signals and improving the accuracy of trading decisions.

- Thoroughly backtesting your chosen MACD settings and trading strategies on historical data is a critical step before deploying them in live trading.

- Implementing robust risk management strategies is paramount when trading on the fast-paced and potentially volatile 1-minute chart.

Can the optimal MACD settings for a 1-minute chart vary depending on the time of day?

Yes, the optimal MACD settings can indeed be influenced by the time of day. During periods of higher trading volume and volatility, such as the overlap between the London and New York trading sessions, you might find that slightly shorter, more sensitive settings work best. Conversely, during quieter periods with lower liquidity, you might consider slightly longer settings to filter out some of the noise. Experimentation and backtesting across different trading sessions can help you identify the most effective settings for various times of the day.

Are there specific MACD settings that are better suited for identifying reversals on a 1-minute chart compared to trend following?

While the core MACD calculation remains the same, traders often focus on specific aspects of the indicator when looking for reversals versus trend-following signals. For identifying potential reversals through divergence, the standard or slightly longer settings might be preferred as they can provide a clearer picture of the divergence developing over a slightly longer timeframe. For trend-following using crossovers, shorter settings can be more responsive to immediate momentum shifts. However, remember that no single setting is definitively “best,” and confirmation from other indicators is always recommended.

Besides adjusting the fast, slow, and signal line periods, are there other ways to customize the MACD for 1-minute chart trading?

While adjusting the periods is the most common method of customization, some trading platforms offer additional options for modifying the MACD. For instance, you might be able to choose different types of moving averages beyond simple EMAs, such as smoothed moving averages or linear weighted moving averages. However, for 1-minute chart trading, sticking with EMA-based MACD and focusing on optimizing the periods is generally the most effective approach. Overcomplicating the settings can sometimes lead to confusion and less reliable signals.